Global Asthma Drugs Market Drug Class (Combination therapies (ICS/LABAs), Long-acting beta agonists (LABAs), Short-acting beta agonists (SABAs), Inhaled corticosteroids (ICS), Oral and intravenous corticosteroids, Leukotriene modifiers, Other drug classes) Product ( Inhalers, Dry Powder, Metered Dose, Soft Mist, Nebulizers) Route of Administration (Oral, Inhaled, Others) By Distribution (Channel, Online Pharmacies, Hospital Pharmacies, Retail Pharmacies, E-Commerce) By End-use, Hospitals & clinics, Ambulatory surgical centers, Homecare settings) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 130279

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

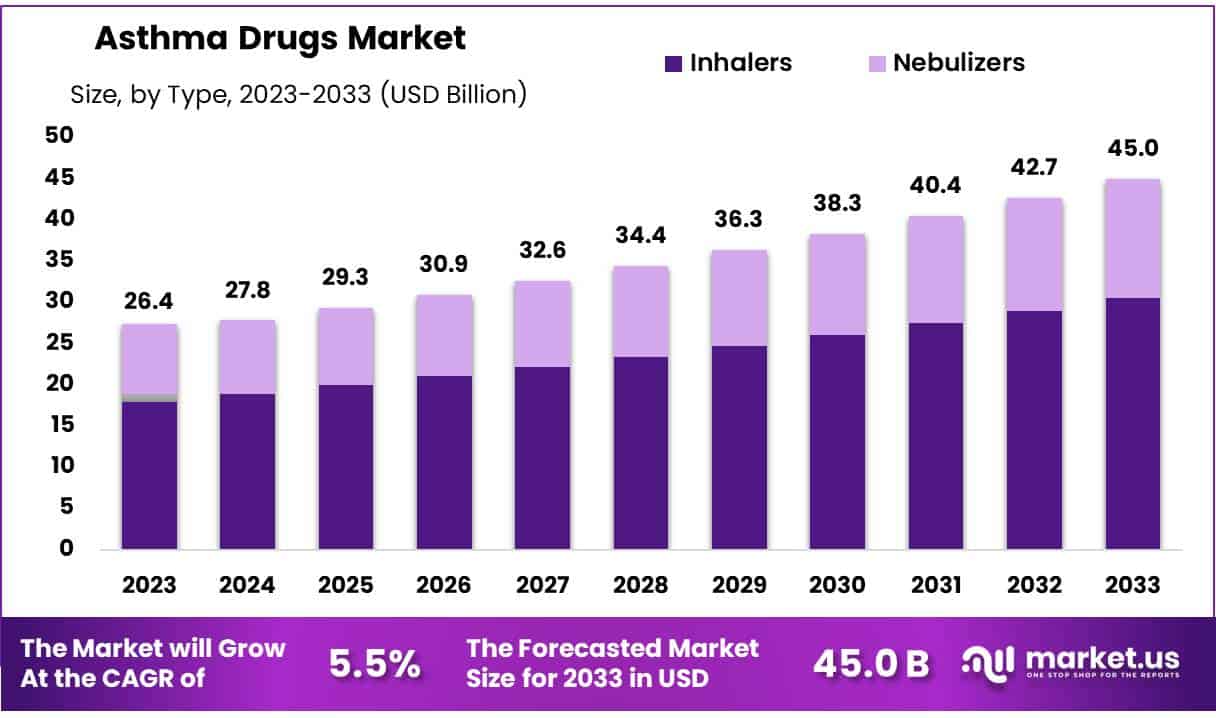

Global Asthma Drugs Market size is expected to be worth around USD 45.0 Billion by 2033 from USD 26.4 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

The global asthma drugs market is experiencing significant growth, driven by increasing asthma prevalence, heightened pollution levels, and enhanced understanding of respiratory disease management. Innovations in therapeutic developments and advances in drug delivery technologies are propelling this market forward. Efforts by governments and healthcare organizations to improve access to asthma diagnosis and treatment further stimulate market expansion. Moreover, a shift towards biologics and personalized medicine is revolutionizing treatment for severe asthma, offering patients advanced therapeutic options and pushing the market dynamics forward.

The rising demand for effective asthma treatments correlates with the global increase in asthma cases, attributed to pollution, lifestyle changes, and genetic factors. Continuous advancements in drug formulations and delivery systems are improving patient outcomes. Biologics, targeting specific molecular pathways, are providing more personalized and effective treatments for severe asthma.

Emerging markets such as Asia-Pacific, Latin America, and parts of Africa present significant growth opportunities, fueled by rapid urbanization, increased health awareness, and improving healthcare infrastructure. Additionally, higher disposable incomes and enhanced healthcare access are bolstering market growth in these regions.

The Market Share Analysis offers a detailed and insightful review of the current competitive landscape in the Asthma Drugs Market. This analysis thoroughly assesses vendor contributions by examining key metrics such as revenue generation, customer base, and other essential factors. It provides companies with a deeper understanding of their market positioning and the competitive challenges they face.

The analysis also sheds light on the competitive dynamics within the sector, highlighting trends like market consolidation, dominance, and fragmentation during the study period. Armed with this detailed information, vendors can make more informed strategic decisions and develop effective tactics to secure a competitive advantage in the market.

Key Takeaways

- Market Size: Global Asthma Drugs Market size is expected to be worth around USD 45.0 Billion by 2033 from USD 26.4 Billion in 2023.

- Market Growth: The market growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

- Drug Class Analysis: The long-acting beta agonists (LABAs), accounts approximately 42% of the market share in 2023.

- Product Analysis: In 2023, inhalers emerged as the predominant product category in the Asthma Drugs market, commanding a substantial 67.9% market share.

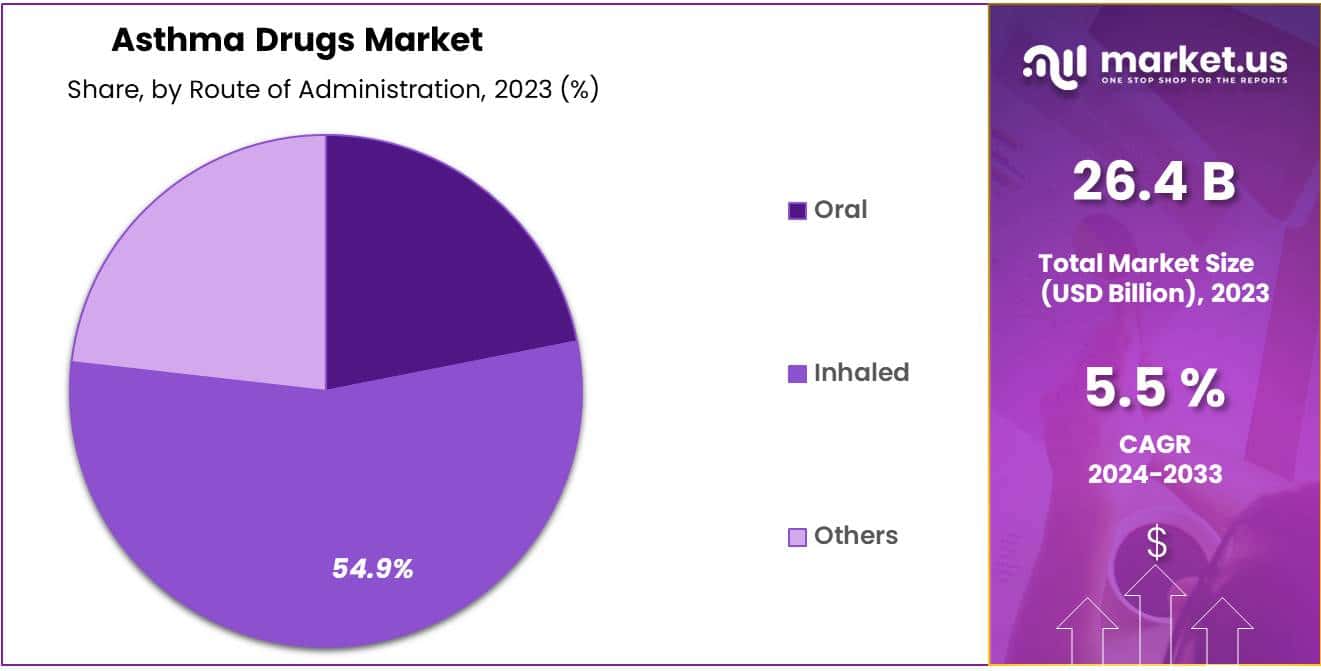

- Route of Administration Analysis: In 2023, the Asthma Drugs market was significantly dominated by inhaled medications, which held a 54.9% market share.

- Distribution Channel Analysis: In 2023, the Asthma Drugs market distribution was prominently led by retail pharmacies, which accounted for 55% of the market share.

- End-Use Analysis: In 2023, homecare settings dominated the Asthma Drugs market with a 45.9% market share.

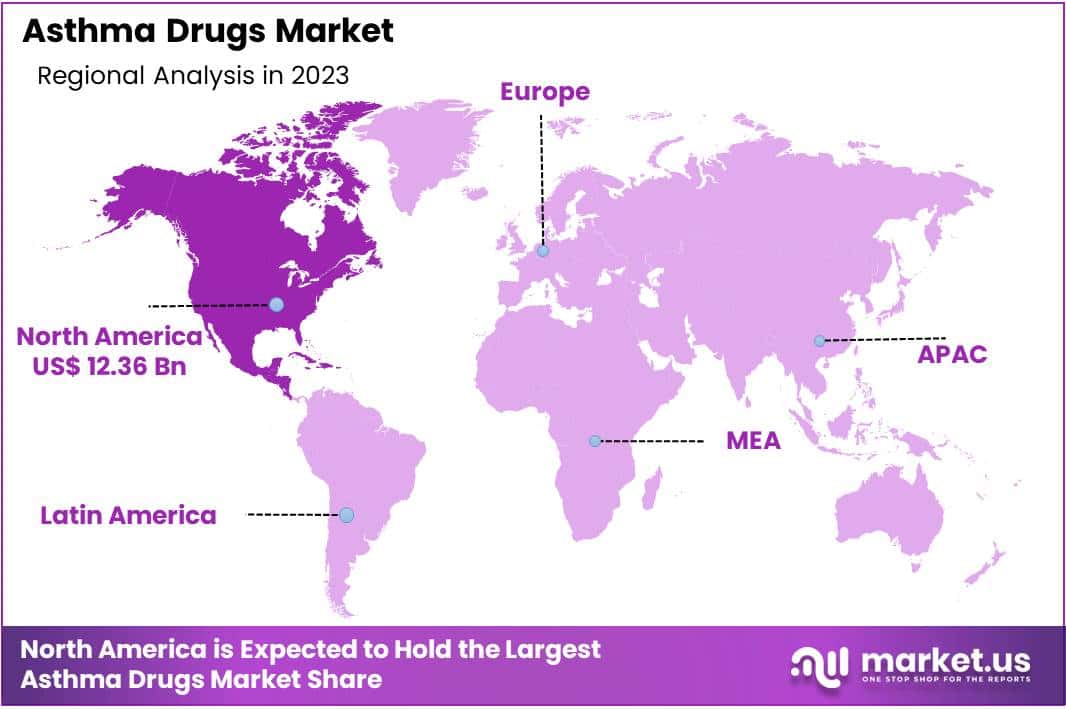

- Regional Analysis: In 2023, North America retained a dominant position in the Asthma Drugs market, securing a substantial 46.9% market share.

Drug Class Analysis

In the 2023 Asthma Drugs market, combination therapies, specifically inhaled corticosteroids (ICS) with long-acting beta agonists (LABAs), dominated with a significant market share. This segment accounted for approximately 42% of the market, driven by their efficacy in controlling asthma symptoms and reducing exacerbations. Long-acting beta agonists (LABAs) alone accounted for around 15%, while short-acting beta agonists (SABAs), primarily used for quick relief of acute symptoms, represented about 12% of the market.

Inhaled corticosteroids (ICS), crucial for ongoing asthma management, held a share of 18%. Oral and intravenous corticosteroids, used for managing severe asthma episodes, captured about 5% of the market. Leukotriene modifiers, another important class for long-term control, accounted for 7%.

The Other drug classes, which include newer biologics and emerging novel therapies, made up the remaining 1%, reflecting ongoing research and development efforts aimed at targeting specific pathways in asthma pathophysiology. This detailed segmentation underscores the prevalent reliance on combination therapies for effective asthma management in the 2023 market landscape.

Product Analysis

In 2023, inhalers emerged as the predominant product category in the Asthma Drugs market, commanding a substantial 67.9% market share. This dominance is attributed to their convenience, effectiveness, and innovations in delivery technologies. Within the inhaler segment, dry powder inhalers (DPIs) were particularly popular, favored for their ease of use and ability to deliver medication directly to the lungs efficiently. Metered dose inhalers (MDIs), another key sub-category, continued to be widely used due to their portability and precision in dosing.

Soft mist inhalers (SMIs) also contributed significantly to the market, appreciated for their lower velocity and longer spray duration, which enhance drug deposition in the lungs. Nebulizers, though less portable than inhalers, remained essential for patients requiring large doses of medication or those with difficulties in using handheld inhalers, particularly among pediatric and elderly populations. This detailed breakdown underscores the critical role of advanced inhalation devices in managing asthma effectively in 2023.

Route of Administration Analysis

In 2023, the Asthma Drugs market was significantly dominated by inhaled medications, which held a 54.9% market share. This preference for inhaled routes is primarily due to the direct delivery of drugs to the lungs, resulting in faster and more targeted effects with reduced systemic side effects compared to other routes. Inhaled asthma medications, such as bronchodilators and corticosteroids, are fundamental in both the control of chronic symptoms and the management of acute asthma episodes.

Oral medications also play a critical role in asthma management, especially for systemic treatment and for patients who may not tolerate inhaled therapies well. These include leukotriene modifiers, systemic corticosteroids, and newer biologic agents designed to target specific inflammatory components of asthma.

Other routes of administration, although less common, include intravenous options used in severe cases requiring hospitalization. These treatments are vital for managing acute exacerbations and providing rapid relief from life-threatening symptoms. The diverse administration routes reflect the complex nature of asthma treatment, catering to varying patient needs and conditions in 2023.

Distribution Channel Analysis

In 2023, the Asthma Drugs market distribution was prominently led by retail pharmacies, which accounted for 55% of the market share. Retail pharmacies remain a primary channel due to their accessibility and the personal service they offer, including patient counseling and drug management advice. Hospital pharmacies held the second-largest share at 25%, serving primarily in-patient needs and providing immediate access to asthma medications for emergency and acute care.

Online pharmacies and e-commerce platforms collectively accounted for 20% of the market. These channels have seen a significant increase in patronage due to the convenience and often lower costs they offer, alongside the added benefit of direct home deliveries which are particularly appealing to chronic patients managing conditions like asthma. The growth in digital platform usage reflects a broader trend towards online shopping and healthcare management, especially in a post-pandemic landscape where consumers increasingly favor contactless transactions.

End-use Analysis

In 2023, homecare settings dominated the Asthma Drugs market with a 45.9% market share, underscoring a significant shift towards patient-centered care environments. This trend highlights the growing preference for managing asthma from the comfort of one’s home, facilitated by advancements in portable inhalation devices and remote health monitoring technologies. Homecare offers patients not only convenience but also a sense of autonomy in managing their condition.

Hospitals and clinics accounted for 35% of the market, remaining essential for the diagnosis, treatment, and management of severe asthma cases. These facilities are critical for administering acute care and for initial patient education post-diagnosis.

Ambulatory surgical centers (ASCs) contributed 19.1% to the market. Although a smaller segment, ASCs are increasingly utilized for more complex asthma interventions that require outpatient procedures. Their use reflects an ongoing expansion in the capacity to provide specialized respiratory care in a more cost-effective setting compared to traditional hospitals. This distribution among various end-uses illustrates the comprehensive approach to asthma treatment across different healthcare environments in 2023.

Key Market Segments

Drug Class

- Combination therapies (ICS/LABAs)

- Long-acting beta agonists (LABAs)

- Short-acting beta agonists (SABAs)

- Inhaled corticosteroids (ICS)

- Oral and intravenous corticosteroids

- Leukotriene modifiers

- Other drug classes

Product

- Inhalers

- Dry Powder

- Metered Dose

- Soft Mist

- Nebulizers

Route of Administration

- Oral

- Inhaled

- Others

By Distribution Channel

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

- E-Commerce

By End-use

- Hospitals & clinics

- Ambulatory surgical centers

- Homecare settings

Market Driver

Rising Asthma Incidence

The escalation in asthma prevalence globally serves as a primary market driver for Asthma Drugs. This condition now affects a significant portion of both adults and children worldwide. Contributing factors include urbanization and its impact on air quality, along with genetic factors.

The growing need for effective asthma management has spurred robust research and development efforts, leading to innovative treatments that aim to enhance patient health outcomes.

Market Trend

Advancement Towards Biologic Therapies

A pivotal trend within the Asthma Drugs Market is the shift toward biologic therapies. These advanced treatments are tailored to target specific inflammatory cells and pathways involved in asthma, offering solutions for patients unresponsive to traditional medications.

This trend is fueled by the broader movement towards personalized medicine and a deeper understanding of asthma’s biological mechanisms, which are facilitating the development and adoption of highly effective biologic treatments.

Market Restraint

Cost Challenges

The high costs associated with advanced asthma treatments, especially biologics, pose a significant restraint on the Asthma Drugs Market. The complex production and rigorous clinical validation of these drugs lead to higher retail prices, which can limit access, particularly in economically disadvantaged regions. The financial impact of these costs is a considerable barrier, affecting patient access to these potentially life-altering treatments.

Market Opportunity

Growth in Emerging Markets and Digital Innovations

Emerging markets, coupled with digital health innovations, present expansive opportunities for the Asthma Drugs Market. As economies in Asia and Africa grow and urbanize, the incidence of asthma is rising, increasing the demand for treatments.

Furthermore, digital health technologies, such as smart inhalers and mobile applications for asthma management, are poised to transform the market. These tools enhance patient compliance and provide valuable insights through data analytics, driving forward market growth and patient care improvements.

Regional Analysis

In 2023, North America retained a dominant position in the Asthma Drugs market, securing a substantial 46.9% market share. This significant market leadership is primarily driven by the region’s robust healthcare infrastructure and high levels of asthma awareness. The United States plays a crucial role, influenced by substantial healthcare expenditures and continuous investments in asthma research and development. The prevalence of asthma among the North American population also contributes to this dominance.

Additionally, strong regulatory frameworks support the rapid approval and marketing of new asthma medications. These factors collectively ensure that North America remains at the forefront of the global Asthma Drugs market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Asthma Drugs market, the landscape is characterized by a competitive mix of multinational pharmaceutical companies and specialized biotechnology firms. These key players maintain strong positions through extensive product portfolios that encompass a range of advanced inhalers, biologics, and combination therapies. Their commitment to research and development is evident, as they continuously seek to innovate and improve treatment efficacy.

Additionally, strategic alliances, mergers, and acquisitions are prevalent strategies employed to enhance their market presence and access new demographic segments. The robust distribution networks established by these firms ensure that advanced asthma treatments are accessible globally, fostering a dynamic and continuously evolving market environment.

Market Key Players

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Merck & Co., Inc.

- F. Hoffmann-La Roche Ltd

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Sanofi.

- Koninklijke Philips N.V.

- BD

- Covis Pharma

Recent Developments

- Teva Pharmaceutical Industries Ltd. – In March 2023, Teva launched a generic version of a leading asthma inhaler in the U.S., aimed at providing a cost-effective alternative for asthma patients, enhancing accessibility and patient compliance.

- GSK plc – In April 2023, GSK acquired a small biotech firm specializing in advanced biologic treatments for severe asthma, aiming to expand its portfolio in specialty respiratory solutions.

- Merck & Co., Inc. – In May 2023, Merck & Co., Inc. introduced a novel oral asthma medication designed to improve lung function and provide long-term control, targeting a broader range of asthma patients.

- F. Hoffmann -La Roche Ltd – In February 2023, Roche launched a new digital health platform for asthma patients, offering personalized treatment plans and real-time monitoring, aiming to improve outcomes through enhanced patient engagement.

- AstraZeneca – In January 2023, AstraZeneca released a new biologic drug for severe asthma, approved for both adult and pediatric patients, which targets an under-addressed inflammatory pathway.

Report Scope

Report Features Description Market Value (2023) USD 26.4 Billion Forecast Revenue (2033) USD 45.0 Billion CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Drug Class (Combination therapies (ICS/LABAs), Long-acting beta agonists (LABAs), Short-acting beta agonists (SABAs), Inhaled corticosteroids (ICS), Oral and intravenous corticosteroids, Leukotriene modifiers, Other drug classes) Product ( Inhalers, Dry Powder, Metered Dose, Soft Mist, Nebulizers) Route of Administration (Oral, Inhaled, Others) By Distribution (Channel, Online Pharmacies, Hospital Pharmacies, Retail Pharmacies, E-Commerce) By End-use (Hospitals & clinics, Ambulatory surgical centers, Homecare settings) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Teva Pharmaceutical Industries Ltd., GSK plc, Merck & Co., Inc., F. Hoffmann-La Roche Ltd, AstraZeneca, Boehringer Ingelheim International GmbH, Sanofi., Koninklijke Philips N.V., BD, Covis Pharma Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Merck & Co., Inc.

- F. Hoffmann-La Roche Ltd

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Sanofi.

- Koninklijke Philips N.V.

- BD

- Covis Pharma