Global Over-the-Counter Analgesic Market By Type of Drug (Acetaminophen, Nonsteroidal Anti-inflammatory Drugs (NSAIDs), Salicylates, Others) By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 118622

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

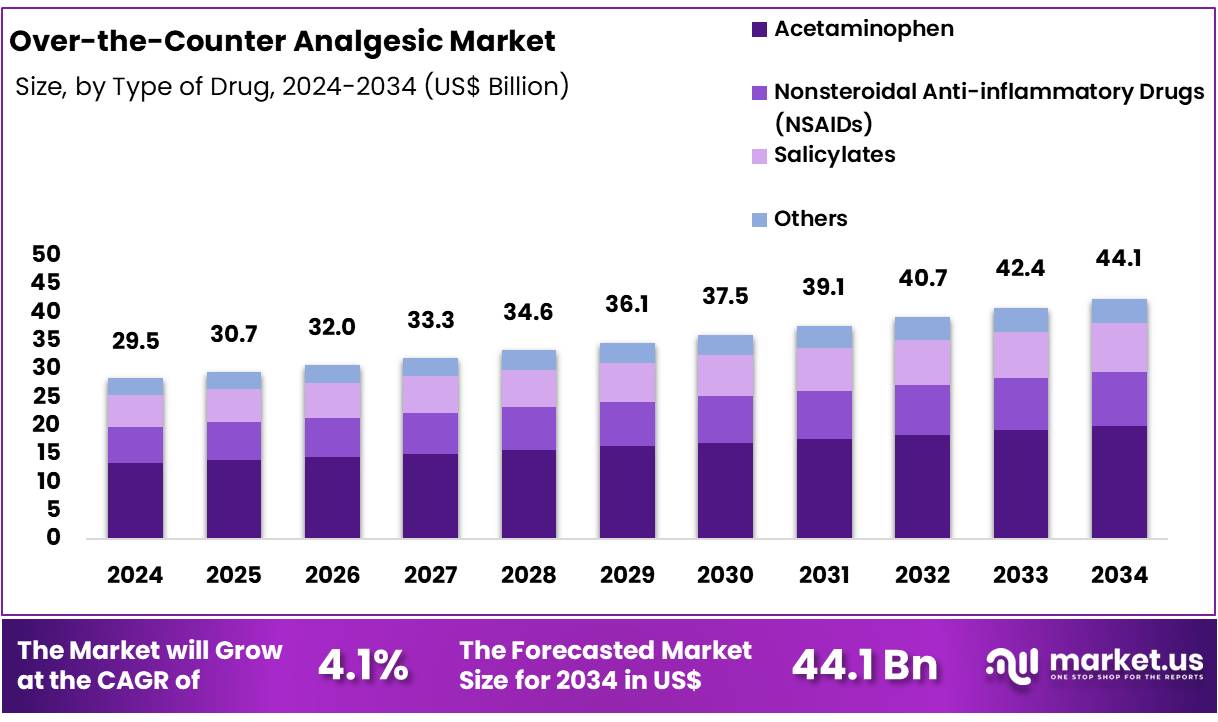

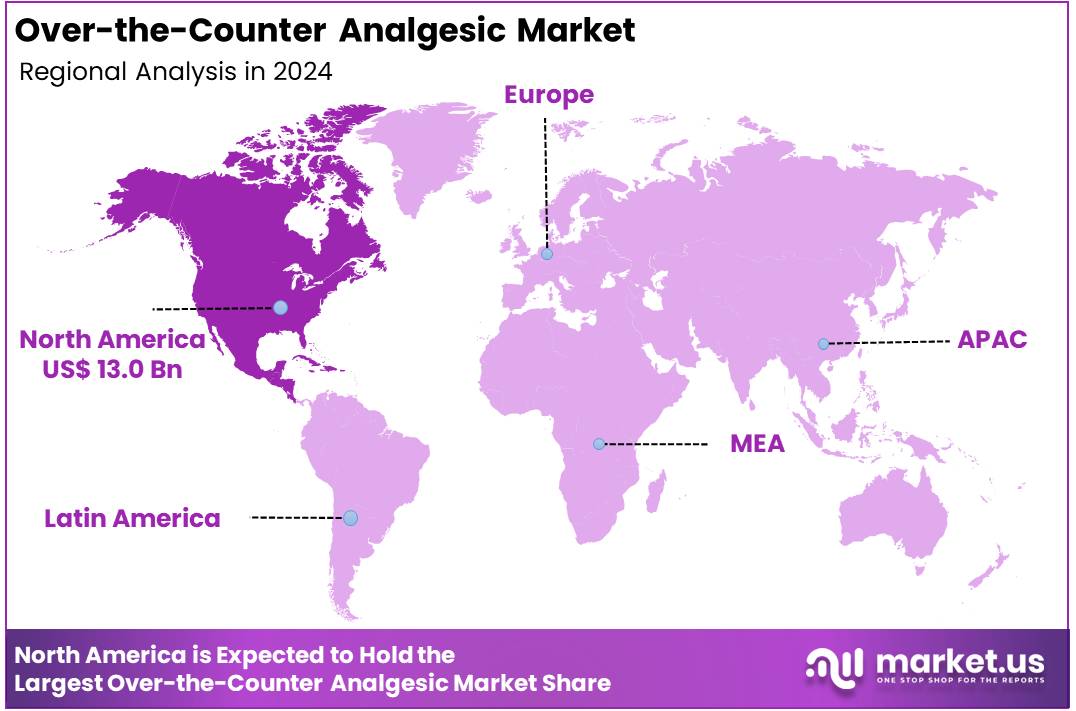

Global Over-the-Counter Analgesic Market size is expected to be worth around US$ 44.1 Billion by 2034 from US$ 29.8 Billion in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 44.4% share with a revenue of US$ 13.0 Billion.

The global Over-The-Counter Analgesics market includes all the types of medication used to relieve pain that are available for purchase without a prescription from a medical practitioner. It is a dynamic sector operating in the healthcare industry, with a prominent presence due to its wide customer base, which includes those seeking rapid pain relief. The products in the over-the-counter analgesics market include NSAIDs (such as aspirin and ibuprofen), acetaminophen, salicylates and others.

Analgesic medication is sold as tablets, capsules, liquid, and is also available in other forms, for example, creams or patches. Factors such as increasing prevalence of chronic conditions, for example, arthritis and headaches, and shifting consumer preference for self-medication assist in accelerating market expansion. Furthermore, the easy accessibility of OTC analgesics drives market growth.

The innovative nature of the market translates to introduction of new and more effective products. Manufacturers focus continually on enhancing the quality, safety and efficacy of analgesic products. Thus, one of the main trends observed in the market is the development of innovative formulations and delivery methods. Furthermore, the integration of digital technologies enables production of medication with much ease, which has presented the market with innumerable opportunities. Conversely, complex regulatory processes and increasing rivalry in the market act as hindrances to the growth of the market.

- According to a BMC Public Health study, around 20% of adults worldwide are estimated to experience pain, with approximately 10% receiving new diagnoses of chronic pain annually.

- According to a research published in the British Journal of Anaesthesia, the impact of chronic pain is increasing on a global scale, with 1.9 billion individuals affected by recurring tension-type headaches, representing the most prevalent symptomatic chronic condition.

Key Takeaways

- Market Size: Global Over-the-Counter Analgesic Market size is expected to be worth around US$ 44.1 Billion by 2034 from US$ 29.8 Billion in 2024.

- Market Growth: The market growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

- Type Of Drug Analysis: The acetaminophen segment dominates with a 45.4% market share.

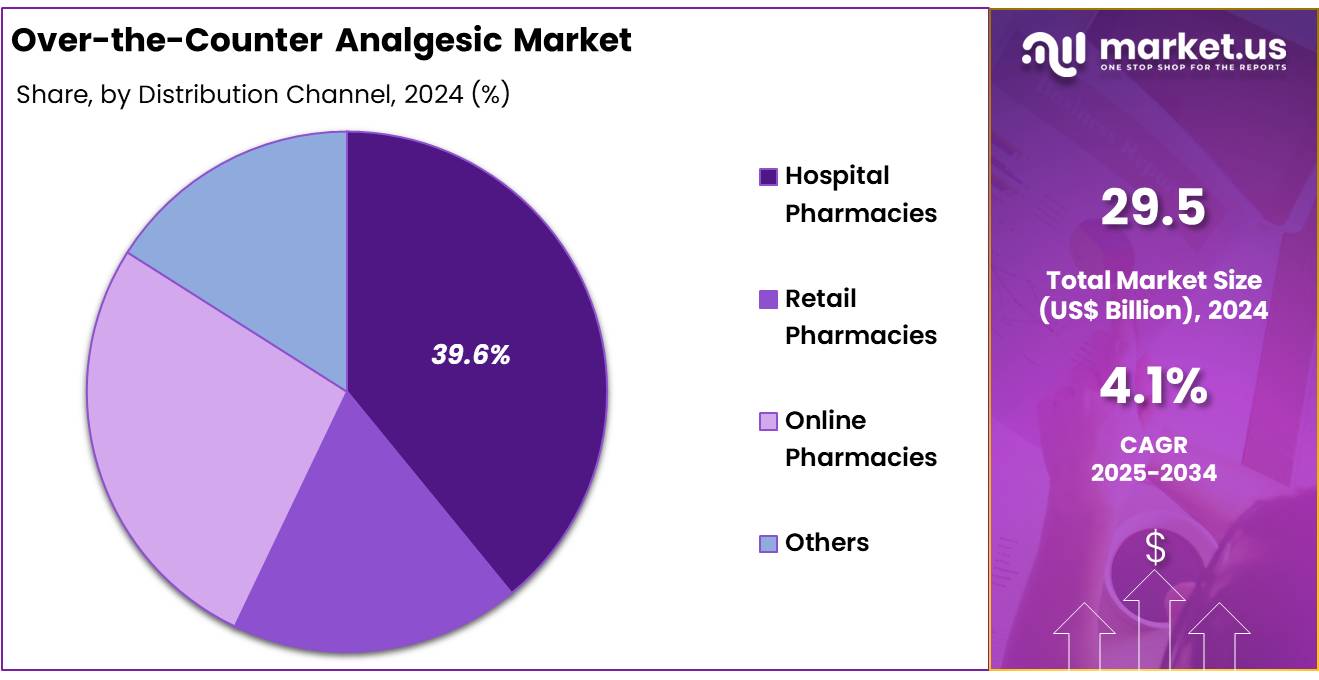

- Distribution Channel: The retail pharmacies segment was dominated by a 39.6 % share in 2024.

- Regional Analysis: In 2024, North America led the market, achieving over 44.4% share with a revenue of US$ 13.0 Billion.

- Consumer Trends: Growing preference for self-medication and increasing availability of OTC analgesics in e-commerce platforms boost market demand.

- Regulatory Landscape: Stringent regulations by healthcare authorities ensure the safety and efficacy of OTC analgesics.

- Challenges: Side effects associated with prolonged use and increasing competition from alternative pain relief therapies pose challenges to market growth.

Type Of Drug Analysis

The Over-the-Counter (OTC) analgesic market is segmented by drug type into acetaminophen, nonsteroidal anti-inflammatory drugs (NSAIDs), salicylates and other analgesics. The acetaminophen segment dominates with a 45.4% market share, owing to its established efficacy in pain relief and fever reduction and widespread recommendation by health authorities.

NSAIDs account for roughly 38.6% of the market and are favored for their anti-inflammatory benefits in conditions such as arthritis and muscle sprains; this segment’s growth can be attributed to increasing prevalence of chronic musculoskeletal disorders and broader consumer awareness of NSAID formulations (e.g., ibuprofen and naproxen).

Salicylates hold approximately 9.8% of the market, driven by long-standing use of aspirin in cardiovascular prophylaxis and analgesia, although some decline has been noted due to gastrointestinal side-effect concerns.

The remaining 6.2% comprises other analgesic types such as combination products and herbal remedies where innovation in formulation and consumer preference for “natural” options are stimulating niche growth. Overall, segmentation dynamics are shaped by clinical guidelines, safety profiles, and evolving patient preferences for targeted pain-management solutions.

Distribution Channel Analysis

The Over-the-Counter analgesic market’s distribution channel segmentation is composed of retail pharmacies, online pharmacies and other channels. The retail pharmacies segment was dominated by a 39.6 % share in 2024, supported by extensive pharmacy networks, pharmacist recommendations and in-store promotional activities.

The online pharmacies channel has been expanding rapidly, driven by rising consumer preference for e-commerce and home delivery it accounted for approximately 32.4 % of total sales in 2024. This growth can be attributed to increased internet penetration, subscription-based medication services and digital marketing initiatives that have enhanced convenience.

The remaining 28.0 % share is held by other channels such as supermarkets, convenience stores, drugstore chains and specialty health retailers which has been bolstered by omnichannel retail strategies and private label product offerings.

Regional variations were also observed online channels were particularly strong in urban areas and among younger demographics, whereas retail pharmacies retained dominance in rural regions and older consumer segments. Overall, distribution dynamics are being shaped by digital transformation, channel diversification and evolving consumer purchasing behaviors.

Key Market Segments

By Type of Drug

- Acetaminophen

- Nonsteroidal Anti-inflammatory Drugs (NSAIDs)

- Salicylates

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Drivers

Increasing Prevalence of Chronic Pain Conditions

The rising incidence of chronic pain conditions such as arthritis and musculoskeletal pain remains one of the primary drivers for the global OTC Analgesics market. Such conditions make it extremely difficult to perform day-to-day activities, which has severe consequences on the quality of life, along with the mental health of individuals. Chronic pain is highly persistent and patients may experience discomfort for years. With the aging populations and changing lifestyle habits, the prevalence of such conditions is expected to increase.

A study in the Lancet Rheumatology journal predicts that by 2050, almost 1 billion people will be affected by osteoarthritis while 15% of individuals aged 30 and above are affected by osteoarthritis currently. As a consequence, pharmaceutical firms are focusing on the development of effective and fast-acting formulas to ensure favourable patient outcomes.

Consumer Preference to Self-Medication

With the easy access to healthcare information and medication, the consumer preference is shifting to self-medication. individuals with minor ailments often self-mediate out of convenience as well. This shifting preference is attributed to factors such as busy lifestyles, restricted access to healthcare, a desire for cost-effective pain management measures, and long wait times at healthcare facilities.

OTC analgesics are made available to consumers without any prescription prerequisite, and are highly accessible through a variety of distribution channels. This accessibility fuels market growth.

Restraints

Complex Regulatory Processes

Regulatory product approvals, labelling requirements and clinical trials are often tedious and time consuming. Similar to the pharmaceutical industry, the market for over the counter analgesics is highly regulated, with a strict protocol in place for product launches. Authorities such as the United States Food and Drug Administration (FDA) and the European Medicines Agency (EMA) govern the market by imposing strict guidelines on OTC analgesics, in order to maintain a standard of safety, efficacy and quality.

Any proposed OTC analgesic must meet the requirements of the governing authority of the market. This may lead to prolonged time-to-market and increased production costs for manufacturers, which often discourages small firms and start-ups from entering the market. Established players also suffer from such stringent regulatory environment.

Opportunities

The market for over the counter analgesics is rife with opportunities, due to evolving consumer needs, technological advancements in healthcare, and healthcare trends. One of the main opportunities for the over the counter analgesics market is the potential for innovation and product diversification.

Developing fast-acting medication that offers quick pain relief for acute pain and extended release products for chronic pain presents firms with potential to cater for a wider consumer base. furthermore, treatment avenues such as combination therapies that target multiple pain pathways and innovative drug delivery systems show great potential in terms of meeting patient needs.

Impact of Macroeconomic / Geopolitical Factors

The over the counter analgesics market is impacted by several macroeconomic and geopolitical factors. Macroeconomic factors such as economic growth, inflation rates, and unemployment levels have a considerable effect on consumer behaviour and spending patterns. Economic downturns often result in reduced purchasing power for consumers, which has a negative influence on market growth. Alternatively, increased healthcare expenditure and favourable healthcare policies accelerate market gowth.

Moreover, geopolitical instability impacts trade, raw material sourcing and supply chains, which is reflected in manufacturing costs, ultimately influencing pricing. Thus, macroeconomic and geopolitical factors are integral to the dynamics, growth trajectory, and strategic considerations for industry stakeholders of the OTC analgesics market.

Latest Trends

One of the main trends observed in the market is the increased emphasis on plant-based or herbal products. This is credited to increasing popularity of environmentalism, sustainability, holistic health and veganism. Herbal formulations and plant-based medication have gained popularity in recent years. By introducing herbal, natural or plat-based products manufacturers can respond to this shifting preference while expanding their product portfolios.

Moreover, the use of e-commerce and online retail channels is surging, which is reshaping the market. Digital platforms offer convenience and extensive product ranges to consumers, which allow them compare prices, read reviews and make informed purchases. In order to capture the attention of consumers, firms employ tactics such as digital marketing strategies and telehealth initiatives.

Regional Analysis

North America is leading the Over The Counter Analgesics Market

North America remained the leading contributor to the market with a market share of 44.4% in 2023. This is credited to a distinct preference for self-medication, escalating prevalence of chronic pain due to musculoskeletal conditions and sports injuries.

According to John Hopkins Medicine, approximately 30 million children and teenagers in the United States engage in organized sports activities, with over 3.5 million injuries reported annually that result in some disruption of participation. Sports-related injuries account for nearly one-third of all childhood injuries in the country.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia-Pacific region is predicted to experience unmatched growth as the forecast period progresses. This is primarily attributed to aging population and increasing prevalence of chronic pain conditions. According to a research paper in the Indian Journal of Palliative Care, over 19.3% of Indian adults suffer from chronic pain. Furthermore, people from lower economic classes seek cost-effective solutions for pain management, which boosts market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Over-The-Counter analgesic market are characterized by diversified portfolios encompassing various formulations and delivery formats to address broad consumer preferences. Significant investment is directed toward research and development to enhance efficacy and safety profiles, with novel combination therapies and fast acting formats under development.

Extensive global distribution networks are leveraged to ensure product availability across retail pharmacies, online platforms, and alternative channels, supported by strategic partnerships and supply-chain integration. Brand equity is strengthened through consistent marketing campaigns, health-professional endorsements, and patient education programs that emphasize proper usage and benefits.

Compliance with regulatory standards is prioritized to maintain product quality and secure approvals in key markets. Additionally, digital engagement strategies including e-commerce optimization and social-media outreach are being adopted to capture growing online consumer segments. Pricing strategies are optimized to remain competitive.

Top Key Players

- Johnson & Johnson

- Haleon PLC

- Endo International PLC

- Reckitt Benckiser Group PLC

- Sanofi SA

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd

- Viatris Inc.

- Dr. Reddy’s Laboratories Ltd

- Novartis AG

- Bayer AG

- Boehringer Ingelheim International GmbH

Recent Developments

- Bayer AG (June 2024): Bayer AG introduced a new over-the-counter analgesic, Aspirin Ultra, in June 2024. This product features a faster-acting formula, aimed at providing rapid pain relief for headaches and muscle pain.

- Boehringer Ingelheim International GmbH (April 2024): Boehringer Ingelheim acquired PainFree Inc., a company specializing in innovative analgesic formulations. This acquisition is expected to enhance Boehringer’s portfolio of pain management solutions.

- Johnson & Johnson (May 2024): Johnson & Johnson launched Tylenol RapidRelease in May 2024. This new product aims to provide quicker pain relief through advanced capsule technology, targeting common pain areas such as headaches and joint pain.

- Haleon PLC (March 2024): Haleon PLC merged with HealWell Pharmaceuticals in March 2024. This strategic merger aims to strengthen Haleon’s position in the over-the-counter analgesics market by combining expertise and expanding their product range.

- Reckitt Benckiser Group PLC (February 2024): Reckitt Benckiser launched Nurofen ExtraStrength in February 2024, an over-the-counter analgesic designed for more effective pain relief. The product targets severe pain, including migraines and back pain.

- Sun Pharmaceutical Industries Ltd (January 2024): Sun Pharmaceutical Industries acquired QuickRelief Pharma, a company known for its over-the-counter pain relief medications. This acquisition aims to expand Sun Pharma’s analgesics product line and market reach.

Report Scope

Report Features Description Market Value (2023) USD 29.8 Billion Forecast Revenue (2033) USD 44.1 Billion CAGR (2024-2033) 4.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Drug (Acetaminophen, Nonsteroidal Anti-inflammatory Drugs (NSAIDs), Salicylates, Others) By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Johnson & Johnson, Haleon PLC, Endo International PLC, Reckitt Benckiser Group PLC, Sanofi SA, Sun Pharmaceutical Industries Ltd, Teva Pharmaceutical Industries Ltd, Viatris Inc., Dr. Reddy’s Laboratories Ltd, Novartis AG, Bayer AG, Boehringer Ingelheim International GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Over The Counter Analgesics MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Over The Counter Analgesics MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Johnson & Johnson

- Haleon PLC

- Endo International PLC

- Reckitt Benckiser Group PLC

- Sanofi SA

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd

- Viatris Inc.

- Dr. Reddy’s Laboratories Ltd

- Novartis AG

- Bayer AG

- Boehringer Ingelheim International GmbH