Global Drug Repurposing Market By Type Of Approach (Disease-centric ,Target-centric ,Drug-centric) Therapeutic Area (Same Therapeutic Area,Different Therapeutic Area) By Drug Molecules (Biologics ,Small Molecule) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 25213

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

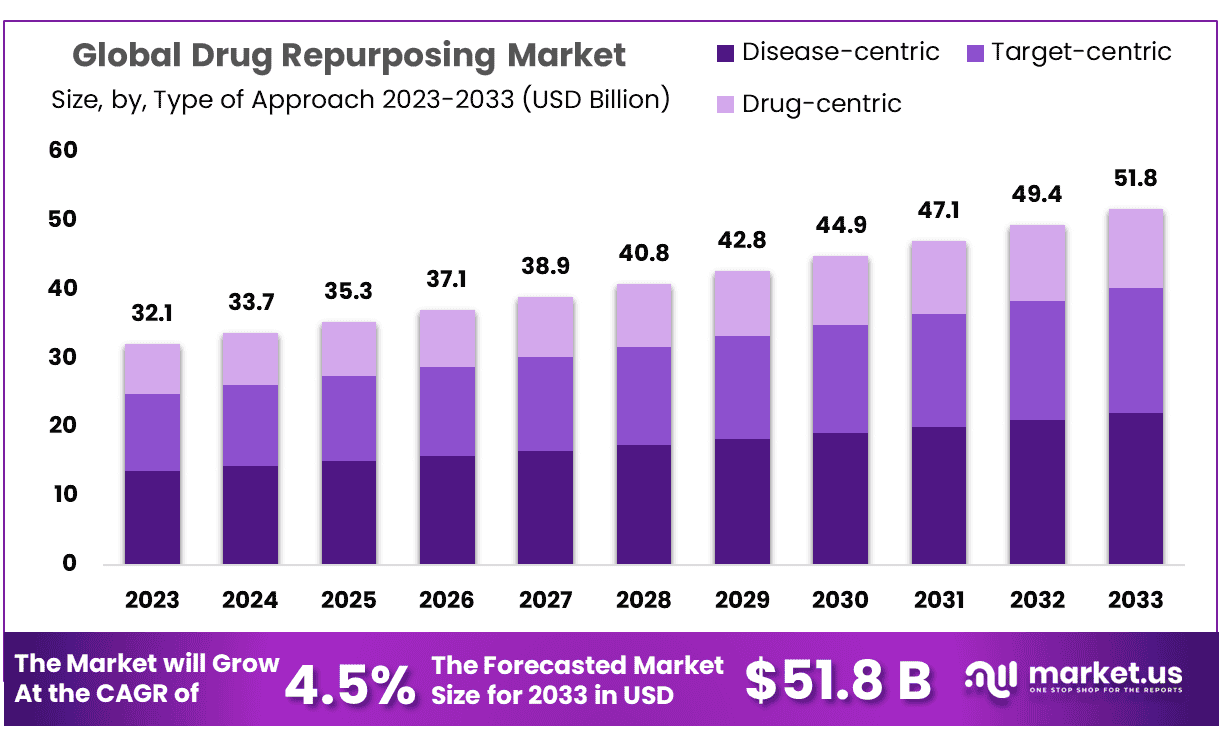

The Global Drug Repurposing Market size is expected to be worth around USD 51.8 Billion by 2033 from USD 32.1 Billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2024 to 2033.

Drug Repurposing (DR) is the process of identifying new medical uses or pharmacological indications for old or existing licensed drugs. Drug repurposing is also known as drug repositioning, drug rescuing, drug recycling, drug re-tasking, drug reprofiling, drug redirection, and therapeutic switching. It involves establishing new therapeutic uses for known drugs, including approved, discontinued, obsolete and experimental drugs.

Repurposed drugs are considered cost-effective and time-efficient alternatives when compared to new drugs that are under development. Some of the most successful and well-known drugs that have emerged through the DR method are sildenafil, minoxidil, aspirin, valproic acid, and methotrexate among others.

In the context of oncology, DR refers to the reuse of non-cancer drugs to treat malignant tumors, rather than opt for new drugs to solve symptoms associated with existing cancer treatments. For cancer indications, the main goal of re-purposing treatment is greater efficacy owing to the need to promptly treat cancer patients. Drug reuse processes can be seen as a response to the decline in oncology drug development productivity/activity, as a strategy to shorten overall development time, and as a source of low-cost treatments to meet the surge in the unmet needs of cancer patients.

Cancer is a major health disorder, whose prominence is expected to increase in the coming years and is a leading cause of death worldwide. The limitations of immunotherapy and the emergence of drug resistance are elements that have compromised the prognosis of cancer patients, resulting in the search for effective, alternative treatments.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size: Drug Repurposing Market size is expected to be worth around USD 51.8 Billion by 2033 from USD 32.1 Billion in 2023.

- Market Growth: The market growing at a CAGR of 4.5% during the forecast period from 2024 to 2033.

- Type Of Approach: In drug repurposing market disease-centric accounts for 42.6% market share in 2023.

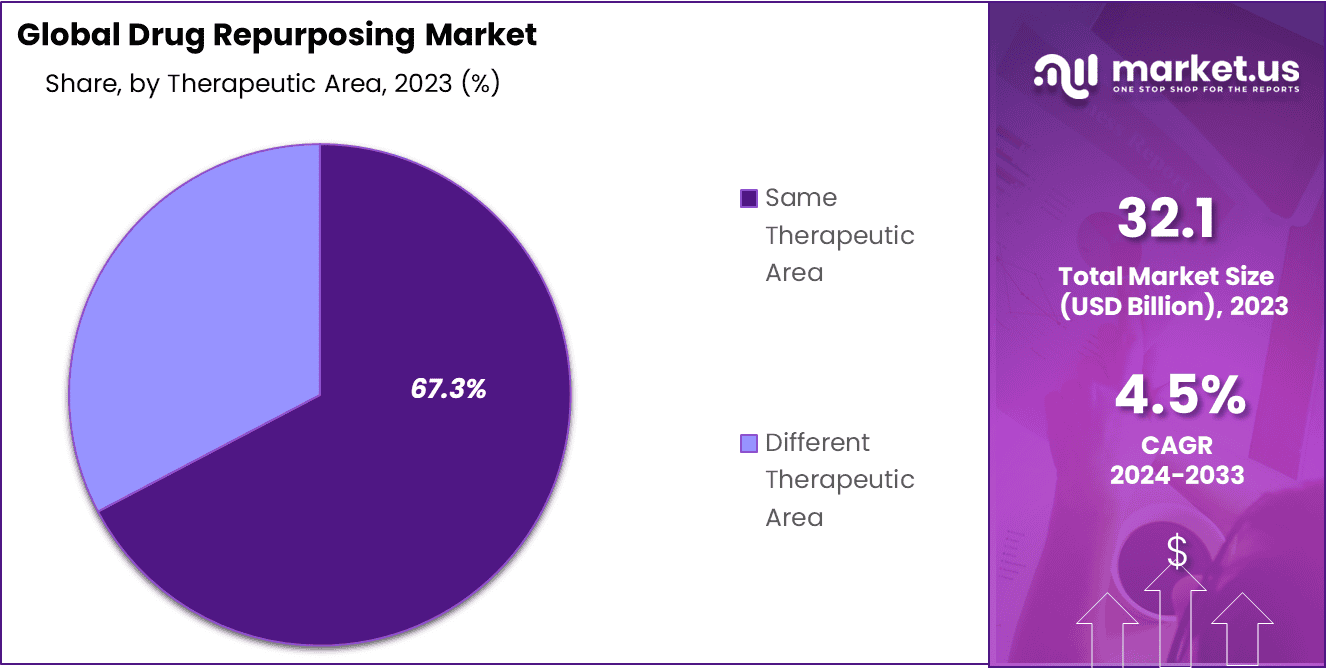

- Therapeutic Area: Same therapeutic area dominant 67.3% market share and increasing in the future.

- Drug Molecules: Biologics accounting for an overwhelming 61.5% share.

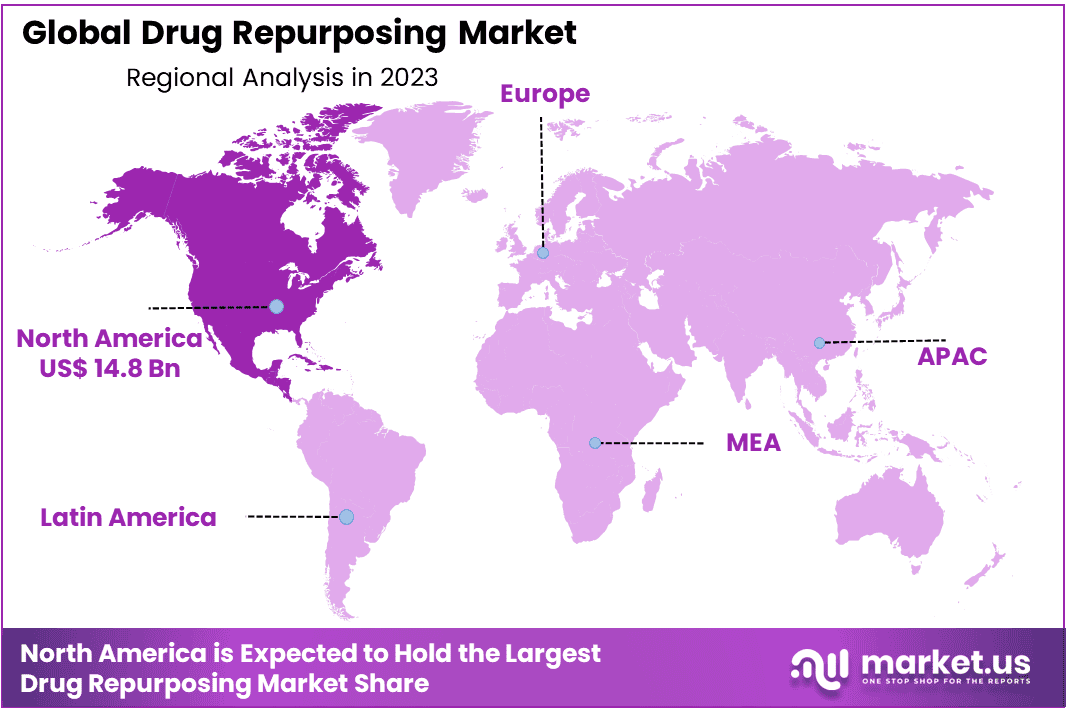

- Regional Analysis: North America dominated the market by 46.3% and holding USD 14.8 Billion market revenue in 2023

- Strategic Approaches: Key players are adopting strategic measures, including product development, geographical expansion, mergers, and acquisitions, to meet the rising demand in the Drug Repurposing market.

- Pandemic Influence: The Drug Repurposing market is expected to maintain strength during the pandemic period due to increased recommendations of supplements and repurposed drugs by healthcare providers worldwide.

Type Of Approach Analysis

In Type Of Approach, three main segments, disease-centric, target-centric and drug-centric approaches to drug repositioning; of these approaches disease-centric accounts for 42.6% market share currently. Repositioning strategies focused on diseases reveal connections between preexisting symptoms and emerging symptoms much quicker and linearly than when applied to targets and drugs alone.

Target-centric strategies are anticipated to experience rapid expansion. This strategy involves linking an existing target medication and its approved indication to new indications, with factors like advancements in computational biology and technology fueling this growth. Furthermore, financial investments for drug repurposing are expected to contribute towards increasing demand for these strategies.

Therapeutic Area Analysis

In the realm of therapeutic areas, the drug repurposing market is divided into the same therapeutic area and different therapeutic area. The report highlights that a dominant 67.3% market share is commanded by repurposing endeavors and accomplishments within the same therapeutic area.

As per the study, drug manufacturers sought to broaden the application within the same therapeutic area—such as exploring a breast cancer treatment for ovarian cancer—for 31% of FDA-approved drugs, demonstrating a notable success rate. The growing popularity of repurposing existing drugs to address different therapeutic areas is attributed to escalating medicine costs and the sluggish pace of drug research and development.

Anticipated to wield substantial influence in the pharmaceutical industry in the near future, these medications are poised to shape the landscape. These factors are foreseen to propel the different therapeutic area segment in the years to come.

Drug Molecules Analysis

By drug molecules segmnets include biologics and small molecules; with biologics accounting for an overwhelming 61.5% share. Biotechnology advances and analytical techniques have contributed greatly to this segment’s rapid expansion; both factors should continue playing their part as its growth accelerates further.

Over the past decade, the rapid expansion of biologics-based drugs and the rising participation by companies has contributed to its surge in growth. Biologics offer several advantages over small molecules as medications; unlike their non-target effects that often require non-specific solutions like small molecules, biologics feature greater specificity with regards to target specificity allowing side effects that bolster therapeutic results more quickly than usual.

These factors are expected to fuel the biologics segment over the coming years. Meanwhile, demand for small molecules should increase due to their ability to treat various conditions due to their small size and unique physicochemical properties.

*Actual Numbers Might Vary In The Final Report

Market Segment

Type Of Approach

- Disease-centric

- Target-centric

- Drug-centric

Therapeutic Area

- Same Therapeutic Area

- Different Therapeutic Area

Drug Molecules

- Biologics

- Small Molecule

Driving Factors

Cost Efficiency and Time Savings

Drug repurposing provides pharmaceutical companies with an efficient and cost-effective alternative to traditional drug development. While discovering and creating new medications from scratch can take years and be expensive, repurposing existing drugs for new indications takes much less time and money while expediting regulatory approval processes more rapidly – significantly reducing financial strain and speeding treatment to market more swiftly.

Another factor being the complementary policies and incentive-based schemes by respective governments and philanthropic organizations of both developed and developing nations for the purposes of drug development and repurposing, coupled with increasing investments by these governments to improve and strengthen their respective healthcare and medical sectors, are expected to further propel the financial trajectory of this target industry.

Expanded Therapeutic Applications

Repurposing existing drugs for novel therapeutic uses has emerged as an integral component of pharmaceutical innovation. As scientists gain more knowledge about disease molecular mechanisms, they are better able to identify drugs with multiple targets; drug repurposing offers companies opportunities to expand their target patient pool while expanding markets and optimizing utilization of existing pharmaceutical compounds.

Trending Factors

Advancements in Artificial Intelligence (AI) and Bioinformatics

AI and bioinformatics tools have revolutionized drug repurposing. Modern algorithms can analyze vast datasets, such as genomic and proteomic information, to quickly and accurately identify candidates for drug repurposing. This trend increases efficiency and accuracy during drug discovery processes allowing researchers to predict new therapeutic uses more quickly for existing drugs.

Collaborative Initiatives and Open Innovation

Pharmaceutical companies are increasingly engaging in collaborative initiatives and open innovation models to explore drug repurposing opportunities. By sharing data and insights, industry players can collectively identify promising candidates for repurposing, creating a more collaborative and streamlined approach to drug discovery. This trend not only accelerates identification of potentially repurposed medications but also fosters knowledge sharing within scientific communities.

However, the surge in technological advancements such as Deep Learning, Machine Learning (ML), and Artificial Intelligence (AI) for the systematic identification of drug repurposing for polypharmacology, as well as an increase in investments for R&D activities by several governments and prominent industry players towards the development of new medications for cancer treatment are trends being presently observed. These factors are expected to further amplify profit margins for this global market.

Restraints

Intellectual Property Challenges

One significant challenge facing drug repurposing efforts is intellectual property rights. Existing drugs may be protected by patents and navigating their legalities can be complicated when repurposing them for new indications; this may lead to lengthy negotiations, legal disputes or an inability to repurpose certain drugs altogether; ultimately limiting market opportunities.

Financial Incentive Limits

Financial incentives associated with drug repurposing may not be as attractive compared to developing novel drugs, due to a lack of exclusivity rights and generic competition concerns that discourage pharmaceutical companies from investing significant resources into repurposing initiatives; such an impediment could prevent exploration of existing medications for new therapeutic uses.

Opportunities

Rare Diseases and Orphan Drug Development

Drug repurposing presents an attractive solution for rare diseases and orphan indications. Due to the difficulty associated with developing new drugs for these conditions, existing ones with established safety profiles offer an easier and faster route. Governments and regulatory bodies have become more supportive of initiatives targeting rare conditions, creating an ideal setting for drug repurposing in this niche market.

Pandemic Response and Antiviral Drug Development

Repurposing existing drugs to test antiviral properties has become an integral component of pandemic preparedness, providing rapid responses to emerging infectious diseases. The COVID-19 Pandemic provided ample opportunities for this strategy, when repurposed drugs were examined as potential treatments, showing its success at meeting immediate healthcare needs.

Regional Analysis

The global drug repurposing market exhibits geographical fragmentation, encompassing North America, Europe, Latin America, and the Middle East & Africa. Notably, North America dominated the market by 46.3% and holding USD 14.8 Billion market revenue in 2023. Meanwhile, the Asia Pacific region is poised for noteworthy growth, with an anticipated substantial Compound Annual Growth Rate (CAGR) over the forecast period.

In North America, the drug repurposing market is experiencing growth attributed to heightened research and development endeavors focused on repurposing existing drugs. This surge in activity is contributing to the region’s substantial share in the overall market. Furthermore, amid the ongoing pandemic, the drug repurposing market is expected to maintain a robust position. This is primarily driven by the increased endorsement of supplements and repurposed drugs by healthcare providers globally during the pandemic period, further solidifying the market’s significance.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

As compititors in the global Drug Repurposing market, various companies are recognized as key contributors, with their status being determined by factors such as revenue and research and development (R&D) initiatives designed to enhance offerings as well as their regional presence. Companies use strategic measures like product development, geographical expansion, mergers & acquisitions as well as other approaches in order to meet growing demands within this space. Companies employ these tactics in order to successfully meet global drug repurposing market requirements while meeting them head on.

Market Key Players

- Algernon Pharmaceuticals

- Biovista

- Celentyx Ltd

- ChemBio Discovery, Inc.

- Chord Therapeutics SA

- Excelra

- Fios Genomics

- Lantern Pharma, Inc.

- Novartis AG

- Paradigm Biopharmaceuticals Ltd

- Predictive Oncology

- Segue Therapeutics, LLC

- Sosei Group Corporation

- Teva Pharmaceutical Industries

Recent Developments

- Algernon Pharmaceuticals: Received FDA Fast Track designation for NP-120 for Niemann-Pick Type C disease.

- Biovista: Partnered with Boehringer Ingelheim to leverage its artificial intelligence platform for drug repurposing in oncology.

- Celentyx Ltd: Completed enrollment in Phase 2b trial of CTX-001 (celecoxib) for prevention of Alzheimer’s disease dementia.

- ChemBio Discovery, Inc.: Presented data on repurposing existing drugs for neurodegenerative diseases at the Society for Neuroscience meeting.

- Fios Genomics: Published research in Nature Genetics identifying potential repurposed drugs for treatment of rare diseases.

- Novartis AG: Partnered with two biotech startups to develop repurposed drugs for cancer and neurodegenerative diseases.

Report Scope

Report Features Description Market Value (2023) USD 32.1 Billion Forecast Revenue (2033) USD 51.8 Billion CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type Of Approach-(Disease-centric ,Target-centric ,Drug-centric);Therapeutic Area-(Same Therapeutic Area,Different Therapeutic Area);By Drug Molecules-(Biologics ,Small Molecule) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Algernon Pharmaceuticals,Biovista,Celentyx Ltd,ChemBio Discovery, Inc.,Chord Therapeutics SA,Excelra,Fios Genomics,Lantern Pharma, Inc.,Novartis AG,Paradigm Biopharmaceuticals Ltd,Predictive Oncology,Segue Therapeutics, LLC,Sosei Group Corporation,Teva Pharmaceutical Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Drug Repurposing?Drug repurposing, also known as drug repositioning, involves identifying new therapeutic uses for existing drugs. Instead of developing new drugs from scratch, researchers explore established medications for potential applications in different diseases.

How big is the Drug Repurposing Market?The global Drug Repurposing Market size was estimated at USD 51.8 Billion in 2023 and is expected to reach USD 32.1 Billion in 2033.

What is the Drug Repurposing Market growth?The global Drug Repurposing Market is expected to grow at a compound annual growth rate of 4.5%. From 2024 To 2033

Who are the key companies/players in the Drug Repurposing Market?Some of the key players in the Drug Repurposing Markets are Algernon Pharmaceuticals,Biovista,Celentyx Ltd,ChemBio Discovery, Inc.,Chord Therapeutics SA,Excelra,Fios Genomics,Lantern Pharma, Inc.,Novartis AG,Paradigm Biopharmaceuticals Ltd,Predictive Oncology,Segue Therapeutics, LLC,Sosei Group Corporation,Teva Pharmaceutical Industries

Why is Drug Repurposing Important?Drug repurposing is crucial for its potential to expedite the drug development process, reduce costs, and address unmet medical needs. It allows for the identification of new uses for existing drugs with known safety profiles, streamlining regulatory approval.

How is the Global Market Geographically Distributed?The global Drug Repurposing market is fragmented across regions, including North America, Europe, Latin America, and the Middle East & Africa. North America dominated the market in 2023, while the Asia Pacific region is expected to witness substantial growth.

What Drives the North American Market?The North American market for drug repurposing is primarily driven by increased research and development activities focused on exploring new therapeutic applications for existing drugs.

What Strategies are Key Players Adopting?Key players in the drug repurposing market are adopting strategic approaches such as product development, geographical expansion, mergers, and acquisitions to meet the growing demand globally.

-

-

- Algernon Pharmaceuticals

- Biovista

- Celentyx Ltd

- ChemBio Discovery, Inc.

- Chord Therapeutics SA

- Excelra

- Fios Genomics

- Lantern Pharma, Inc.

- Novartis AG

- Paradigm Biopharmaceuticals Ltd

- Predictive Oncology

- Segue Therapeutics, LLC

- Sosei Group Corporation

- Teva Pharmaceutical Industries