Global Rat and Mouse Model Market By Product Type (Model (Inbred and Outbred) and Service (Cryopreservation, Breeding, Rederivation, Genetic Testing, Quarantine Depending, and Others)), By Application (Cancer, Genetic Diseases, Cardiovascular Diseases, Infectious Diseases, Transplantation, and Others), By End-use (Pharmaceutical & Biotechnology Companies, Contract Research & Manufacturing Organizations, and Academic & Research Facilities), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136565

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

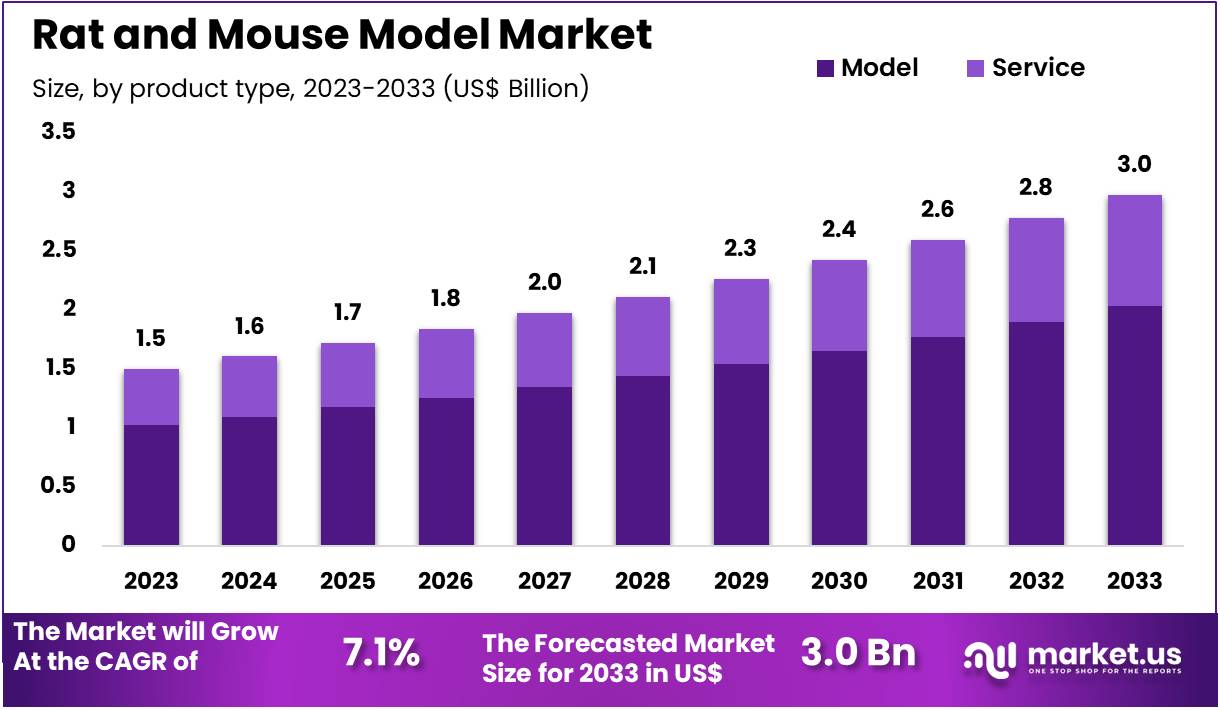

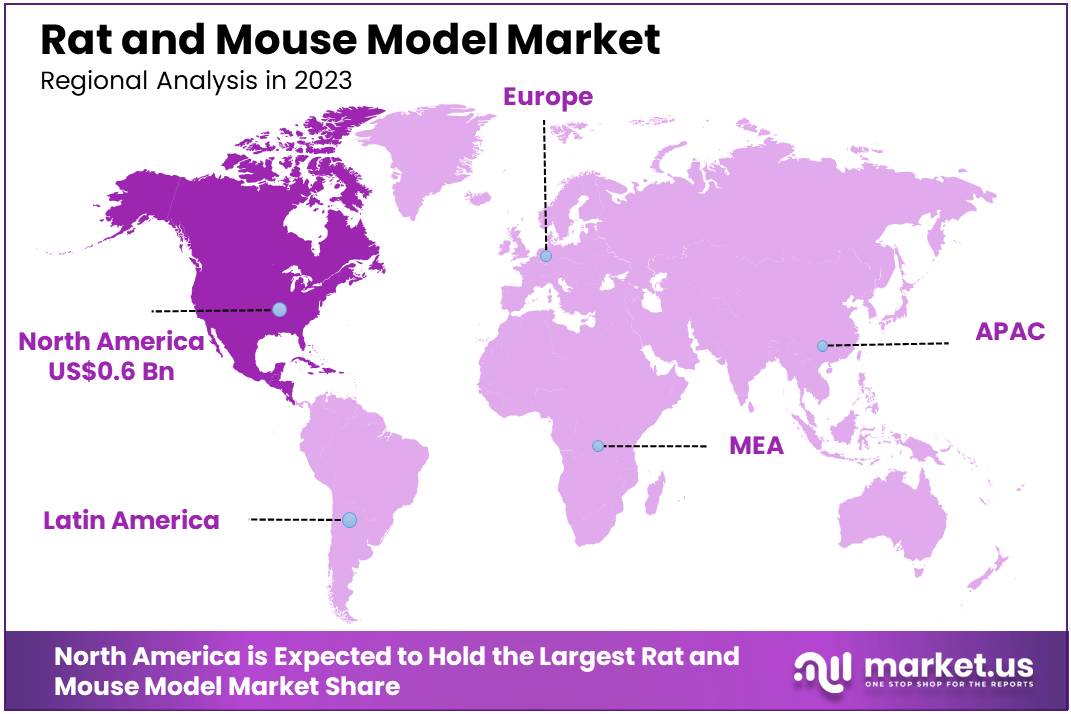

Global Rat and Mouse Model Market size is expected to be worth around US$ 3.0 Billion by 2033 from US$ 1.5 Billion in 2023, growing at a CAGR of 7.1% during the forecast period 2024 to 2033. In 2023, North America led the market, achieving over 38.7% share with a revenue of US$ 0.6 Billion.

Growing demand for more accurate and reliable preclinical research models is driving the expansion of the rat and mouse model market. These models are indispensable in various applications, including drug discovery, genetic research, disease modeling, and testing the efficacy and safety of new treatments. Researchers widely use rats and mice to study complex diseases such as cancer, diabetes, neurological disorders, and cardiovascular conditions.

The continuous advancement in genetic engineering has created new opportunities for more precise models, including genetically modified rats and mice, which mimic human diseases more closely. In November 2023, NASA announced the development of a housing complex for mice and rats aboard the International Space Station, demonstrating the increasing interest in these models for space-related research.

The Rodent Research Facility aims to enhance understanding of how space conditions affect mammalian biology, creating new opportunities for scientific breakthroughs. Additionally, the market is benefiting from trends such as the rise in contract research organizations (CROs) offering rat and mouse model testing services, providing more accessibility and cost-effective solutions for pharmaceutical and biotechnology companies.

The shift toward personalized medicine also drives demand for models that reflect specific genetic backgrounds, enabling more tailored therapeutic approaches. These developments indicate a strong growth trajectory for the rat and mouse model market.

Key Takeaways

- In 2023, the market for Rat and Mouse Model generated a revenue of US$ 1.5 billion, with a CAGR of 7.1%, and is expected to reach US$ 3.0 billion by the year 2033.

- The product type segment is divided into model and service, with model taking the lead in 2023 with a market share of 68.2%.

- Considering application, the market is divided into cancer, genetic diseases, cardiovascular diseases, infectious diseases, transplantation, and others. Among these, cancer held a significant share of 55.6%.

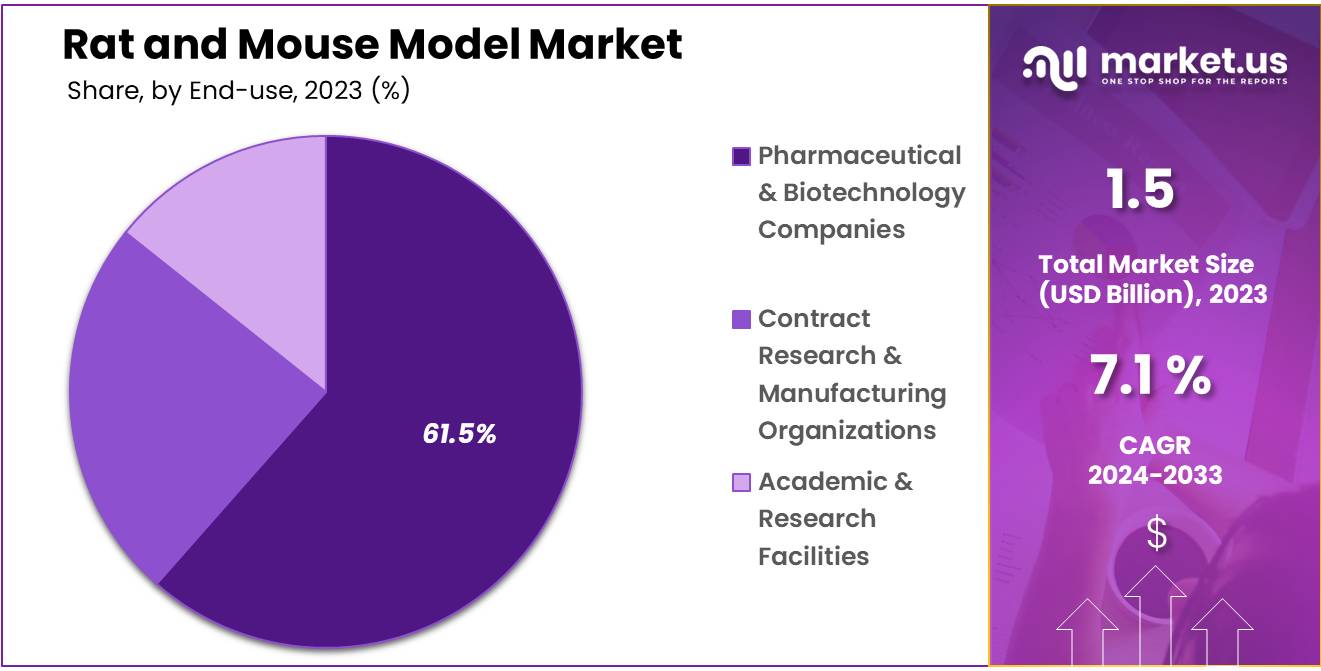

- Furthermore, concerning the end-use segment, the market is segregated into pharmaceutical & biotechnology companies, contract research & manufacturing organizations, and academic & research facilities. The pharmaceutical & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 61.5% in the Rat and Mouse Model market.

- North America led the market by securing a market share of 38.7% in 2023.

Product Type Analysis

The model segment led in 2023, claiming a market share of 68.2% as the demand for more advanced and accurate research tools increases. Researchers are anticipated to continue relying on these animal models to mimic human physiology in drug discovery, toxicology testing, and disease research. The growth of this segment is likely driven by the increasing use of genetically modified rats and mice, which provide more precise models for studying human diseases.

Furthermore, advancements in model development, including the creation of models for specific genetic mutations and disease pathways, are projected to enhance the value of rat and mouse models in various research applications.

With the growing focus on personalized medicine and targeted therapies, the model segment is expected to expand, offering better insights into human health and improving drug development processes. Additionally, the increased investment in biomedical research is projected to contribute to the overall growth of this segment.

Application Analysis

The cancer held a significant share of 55.6% as cancer research continues to be a major focus of scientific inquiry. These animal models are anticipated to play a critical role in cancer research by helping researchers study tumor development, cancer progression, and therapeutic interventions. The rising incidence of cancer worldwide is likely to drive the demand for more effective preclinical testing models, with rat and mouse models providing an accurate representation of human cancer biology.

The increasing focus on immuno-oncology and personalized treatments is expected to further contribute to the growth of this segment. Researchers are anticipated to use these models to test novel therapies and drug candidates, helping to accelerate the development of cancer treatments. As regulatory requirements for cancer drug testing become more stringent, the need for robust preclinical models is projected to grow, thus expanding the cancer segment.

End-use Analysis

The pharmaceutical & biotechnology companies segment had a tremendous growth rate, with a revenue share of 61.5% as these companies continue to invest in preclinical research to develop new therapies. These companies are likely to rely heavily on animal models for testing the efficacy and safety of drug candidates before moving to human clinical trials.

The increasing number of biotechnology innovations, particularly in areas like gene therapy, immunotherapy, and biologics, is projected to drive the demand for customized rat and mouse models that can replicate specific disease conditions. Pharmaceutical and biotechnology companies are anticipated to use these models to accelerate drug discovery, improve therapeutic outcomes, and reduce the time required for clinical trials.

Additionally, as regulatory pressures intensify, these companies are expected to expand their use of animal models to ensure compliance with safety and efficacy standards. The continuous advancement of genetic engineering techniques and model creation is likely to support this growth, providing companies with more accurate tools for research and development.

Key Market Segments

Product Type

- Model

- Inbred

- Outbred

- Service

- Cryopreservation

- Breeding

- Rederivation

- Genetic Testing

- Quarantine depending

- Others

Application

- Cancer

- Genetic Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Transplantation

- Others

End-use

- Pharmaceutical & Biotechnology Companies

- Contract Research & Manufacturing Organizations

- Academic & Research Facilities

Drivers

Rise in scientific procedures involving live animals is driving the rat and mouse model market

Growing scientific procedures involving live animals significantly drive the rat and mouse model market by increasing the demand for reliable and reproducible experimental models. In 2022, the United Kingdom recorded 2.76 million scientific procedures involving live animals, with 1.51 million operations conducted for experimental purposes and 1.25 million for the creation and breeding of genetically altered (GA) animals.

This surge in scientific research necessitates the use of rat and mouse models to study disease mechanisms, drug efficacy, and safety profiles. Researchers prefer these models due to their genetic similarity to humans, short breeding cycles, and well-characterized genomes, making them ideal for high-throughput studies and genetic manipulation.

The rising focus on biomedical research, including the development of new therapies for chronic diseases, drives the adoption of these animal models. Additionally, advancements in genetic engineering techniques, such as CRISPR-Cas9, enable the creation of more precise and relevant models, enhancing their utility in scientific studies. The increasing allocation of funds towards biomedical research projects further supports the growth of the market.

Moreover, the global emphasis on improving healthcare outcomes and accelerating drug discovery processes contributes to the sustained demand for rat and mouse models. As scientific endeavors expand, the market is anticipated to grow, driven by the continuous need for advanced and reliable animal models in research and development.

Restraints

Growing ethical concerns are restraining the rat and mouse model market

Growing ethical concerns significantly restrain the rat and mouse model market by raising opposition to the use of live animals in scientific research. Animal welfare organizations and advocacy groups increasingly demand the reduction, refinement, and replacement (the 3Rs) of animal models in research, urging scientists to adopt alternative methods such as in vitro testing and computer modeling.

Public awareness and ethical debates about the treatment and rights of laboratory animals have led to stricter regulations and oversight on animal experimentation, increasing the operational costs and administrative burdens for research institutions. These ethical constraints can delay research projects and limit the scope of studies, as obtaining necessary approvals becomes more challenging.

Additionally, the financial implications of implementing higher welfare standards and investing in alternative technologies can be prohibitive, especially for smaller research facilities. The pressure to adhere to ethical guidelines may also divert funding away from traditional animal model research towards the development of alternative methods.

As a result, these growing ethical concerns create barriers to the widespread adoption and continued use of rat and mouse models, thereby restraining market growth. The industry’s need to balance scientific advancement with ethical responsibility poses a significant challenge, potentially slowing the pace of research and limiting the market’s expansion.

Opportunities

Increase in R&D activities is creating opportunities for the rat and mouse model market

Increasing research and development activities create substantial opportunities for the rat and mouse model market by fostering the creation of more sophisticated and specialized animal models. A review article published in October 2021 highlighted the development of a series of knockout rat models for drug metabolism and pharmacokinetics (DMPK) studies, utilizing the CRISPR-Cas9 gene-editing method.

These advanced models offer invaluable tools for pharmacological research, allowing scientists to study gene functions and disease pathways with greater precision. Enhanced R&D efforts focus on improving the genetic accuracy and physiological relevance of these models, making them indispensable for preclinical testing and personalized medicine initiatives.

Moreover, the collaboration between academic institutions and biotechnology firms accelerates the innovation cycle, leading to the introduction of next-generation animal models that better mimic human diseases. The continuous investment in R&D also supports the development of models for emerging health challenges, such as infectious diseases and rare genetic disorders, broadening the applications and market reach of rat and mouse models.

Additionally, advancements in phenotyping and imaging technologies integrated with these models provide deeper insights into disease mechanisms and treatment effects, enhancing their research value. As R&D activities intensify, the market is projected to benefit from the increased demand for these high-quality, genetically engineered models, driving overall market growth and supporting scientific breakthroughs in various medical fields.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly shape the rat and mouse model market. On the positive side, the growing investment in biomedical research, particularly in drug development, accelerates the demand for animal models. The increasing need for effective treatments for various diseases, such as cancer and neurological disorders, also drives growth. Economic growth in emerging markets, coupled with expanded healthcare access, supports market expansion.

However, economic recessions may limit research funding, hindering the market’s growth. Geopolitical tensions and trade restrictions could disrupt the availability of necessary animal breeds and research materials, affecting the production of reliable models.

Additionally, the tightening of regulations surrounding animal testing in some regions poses challenges to the industry. Despite these challenges, the market is expected to thrive, driven by technological advancements in breeding, genetic modifications, and ethical standards in animal research.

Latest Trends

Integration of AI Driving the Rat and Mouse Model Market:

Increasing integration of artificial intelligence (AI) is driving significant advancements in the rat and mouse model market. AI technologies are expected to enhance the precision and efficiency of preclinical research by analyzing complex data and improving model simulation accuracy.

In June 2024, researchers developed a virtual rat with an AI-driven brain to explore how real rats control their movements. The AI was trained using data from live rats and replicated their actions in a physics simulator, achieving results closely mirroring actual neuronal activations. This breakthrough is anticipated to revolutionize neurology and robotic control systems, offering new possibilities for drug testing and behavioral studies.

AI’s role in refining animal models is projected to enhance research outcomes, making studies more accurate, cost-effective, and ethical. As AI technologies continue to evolve, their application to animal model research is likely to drive the market forward with increased innovation.

Regional Analysis

North America is leading the Rat and Mouse Model Market

North America dominated the market with the highest revenue share of 38.7% owing to advancements in biomedical research and an increasing demand for more accurate and human-relevant preclinical testing models. As the biopharmaceutical industry continues to expand, these models play a crucial role in drug discovery, toxicology testing, and disease modeling.

The growing focus on personalized medicine and immunotherapies has further spurred the adoption of genetically engineered rat and mouse models, which provide more precise insights into human disease mechanisms. A key development in this regard was achieved by scientists at The University of Texas Health Science Center in San Antonio in July 2024, when they created a humanized mouse model with a human immune system and gut microbiota, which is expected to significantly advance immunotherapy development.

The increasing need for reliable models for studying chronic diseases, including cancer, neurological disorders, and metabolic diseases, has further contributed to the market’s growth. Additionally, rising investments in research and development and a favorable regulatory environment in North America have fueled the demand for advanced rodent models in preclinical studies, ensuring continued market expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing investments in biomedical research and the rapid expansion of the pharmaceutical and biotechnology sectors. As the region focuses on improving healthcare outcomes and reducing reliance on animal testing, demand for high-quality and more human-relevant animal models is likely to rise.

Countries like China, India, and Japan are projected to increase their research efforts in areas such as cancer, infectious diseases, and neurodegenerative conditions, fueling the need for advanced rodent models in preclinical studies. The growing adoption of genetically modified rat and mouse models for studying complex diseases and the rising focus on precision medicine are expected to further propel the market.

Additionally, government initiatives and funding to enhance research infrastructure in the region are anticipated to drive market growth. The demand for reliable disease models in drug discovery and development, coupled with the increasing number of clinical trials, will likely contribute to the sustained growth of the rat and mouse model market in Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the rat and mouse model market focus on strategies like developing genetically modified strains to support advanced research in oncology, neuroscience, and metabolic disorders. Companies enhance their service offerings by integrating advanced phenotyping and imaging technologies, improving the efficiency of preclinical studies.

Partnerships with academic institutions and pharmaceutical companies drive innovation and expand their client base. Expanding geographically into regions with growing research activities and strengthening distribution networks also support growth. Emphasis on ethical breeding practices and compliance with animal welfare regulations helps maintain industry credibility.

Charles River Laboratories International, Inc. is a leading provider in the rat and mouse model market, offering a wide range of strains and services for drug discovery and preclinical research. The company combines expertise in breeding and research services with advanced technologies to deliver comprehensive solutions. Charles River maintains a global presence, supporting clients in biotechnology, pharmaceutical, and academic sectors with a focus on quality and innovation.

Top Key Players

Recent Developments

- In January 2024, SMOC leveraged its expert gene editing team and years of independent research to establish U-HuDTMbase, a comprehensive resource library of therapeutic target-humanized mouse models designed to meet diverse research needs in humanized mice studies.

- In December 2022, Biocytogen Pharmaceuticals (Beijing) Co., Ltd. officially introduced RenNano, a fully human heavy-chain antibody platform. RenNano joins RenMab and RenLite as the third member of the RenMice family, further advancing the company’s capabilities in antibody development.

Report Scope

Report Features Description Market Value (2023) US$ 1.5 billion Forecast Revenue (2033) US$ 3.0 billion CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Model (Inbred and Outbred) and Service (Cryopreservation, Breeding, Rederivation, Genetic Testing, Quarantine Depending, and Others)), By Application (Cancer, Genetic Diseases, Cardiovascular Diseases, Infectious Diseases, Transplantation, and Others), By End-use (Pharmaceutical & Biotechnology Companies, Contract Research & Manufacturing Organizations, and Academic & Research Facilities) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape POSTECH, Nortis, MIMETAS, Lonza, InSphero, IISc, Epithelix, ATTC Global, and AlveoliX AG. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- POSTECH

- Nortis

- MIMETAS

- Lonza

- InSphero

- IISc

- Epithelix

- ATTC Global

- AlveoliX AG