Nucleic Acid Isolation and Purification Market By Product (Kits & Reagents and Instruments (Automatic and Manual)), By Type (DNA Isolation & Purification (Genomic, Plasmid, Viral, and Others) and RNA Isolation & Purification (miRNA, mRNA, Total RNA, and Others)), By Application (Agriculture & Animal Research, Diagnostics, Drug Discovery & Development, Precision Medicine, and Others), By Method (Column-based, Magnetic Beads, Reagent-based, and Others), By End-use (Academic Research Institutes, Contract Research Organizations, Hospitals & Diagnostic Centers, Pharmaceutical & Biotechnology Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136187

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

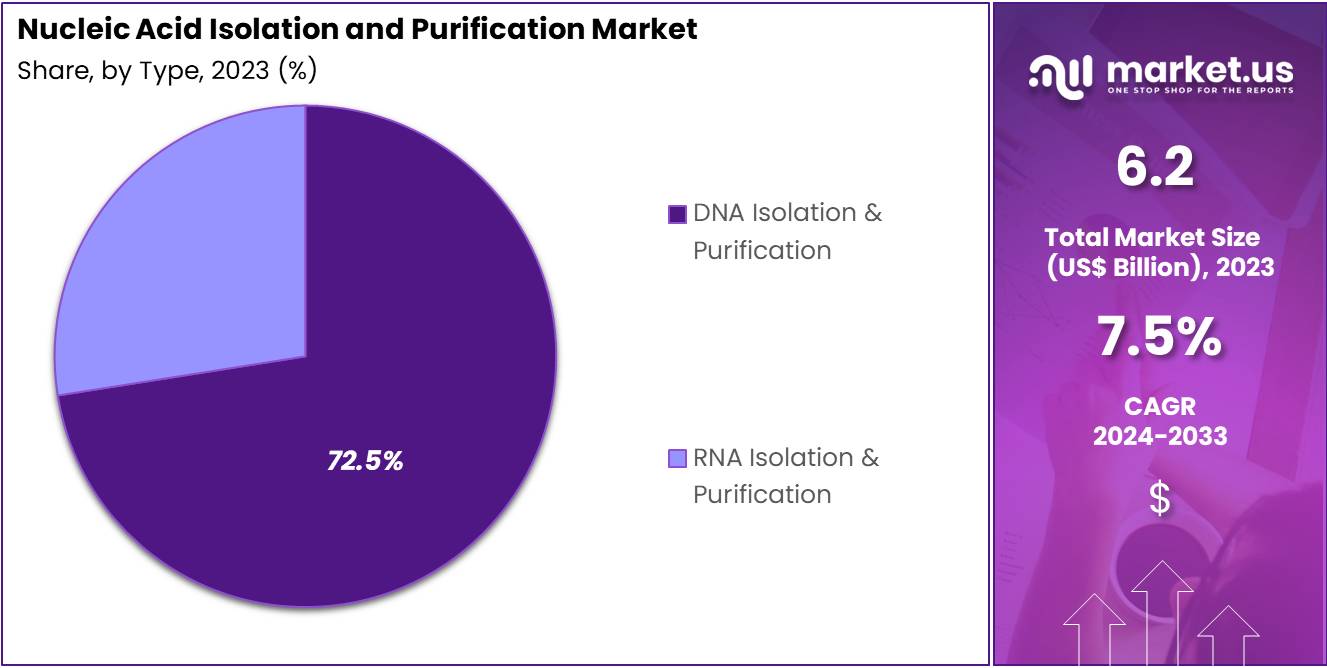

The Nucleic Acid Isolation and Purification Market size is expected to be worth around US$ 15.5 billion by 2033 from US$ 6.2 billion in 2023, growing at a CAGR of 9.6% during the forecast period 2024 to 2033.

Increasing demand for precision in genetic research and diagnostics is driving the growth of the nucleic acid isolation and purification market. These processes are vital for extracting high-quality DNA, RNA, and plasmid DNA from various biological samples, enabling critical applications in genomics, molecular biology, diagnostics, and drug development. As personalized medicine continues to advance, the need for reliable and efficient nucleic acid isolation technologies has surged, particularly in areas such as genetic testing, next-generation sequencing (NGS), and gene editing.

The rise of biopharmaceuticals is significantly impacting the market, particularly in the development and purification of nucleic acids for therapeutic uses. This trend underscores the growing importance of nucleic acid purification in the pharmaceutical industry. Companies are increasingly focusing on enhancing their production capabilities to meet the rising demand.

In February 2023, Agilent Technologies, Inc. demonstrated this trend by collaborating with Fluor Corporation’s Advanced Technologies & Life Sciences division. This partnership aims to expand Agilent’s oligonucleotide therapeutics manufacturing facility in Colorado. This expansion highlights the critical role of advanced manufacturing processes in the biopharmaceutical sector.

Recent trends show that automation is becoming a key feature in nucleic acid isolation systems, allowing for higher throughput and more reproducible results. Additionally, the market is witnessing innovation in purification kits and reagents that offer improved efficiency, scalability, and cost-effectiveness. The growing emphasis on genomic research, coupled with advances in CRISPR and RNA-based therapeutics, presents ample opportunities for market expansion. These developments make nucleic acid isolation and purification technologies more critical in the evolving landscape of life sciences.

Key Takeaways

- In 2023, the market for Nucleic Acid Isolation and Purification generated a revenue of US$ 6.2 billion, with a CAGR of 9.6%, and is expected to reach US$ 15.5 billion by the year 2033.

- The product segment is divided into kits & reagents and instruments, with kits & reagents taking the lead in 2023 with a market share of 62.3%.

- Considering type, the market is divided into DNA isolation & purification and RNA isolation & purification. Among these, DNA isolation & purification held a significant share of 72.5%.

- Furthermore, concerning the application segment, the market is segregated into agriculture & animal research, diagnostics, drug discovery & development, precision medicine, and others. The diagnostics sector stands out as the dominant player, holding the largest revenue share of 48.6% in the Nucleic Acid Isolation and Purification market.

- The method segment is segregated into column-based, magnetic beads, reagent-based, and others, with the magnetic beads segment leading the market, holding a revenue share of 59.2%.

- The end-use segment is segregated into academic research institutes, contract research organizations, hospitals & diagnostic centers, pharmaceutical & biotechnology companies, and others, with the hospitals & diagnostic centers segment leading the market, holding a revenue share of 51.8%.

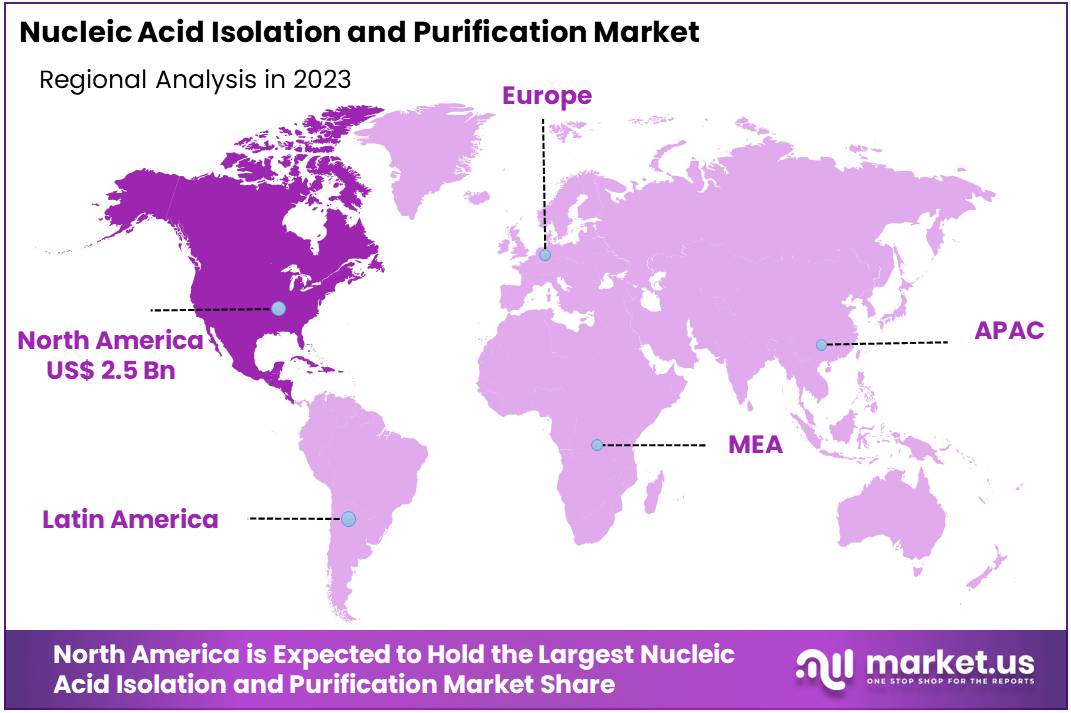

- North America led the market by securing a market share of 39.6% in 2023.

Product Analysis

The kits & reagents segment led in 2023, claiming a market share of 62.3% owing to the increasing demand for user-friendly, cost-effective solutions in laboratories and clinical settings. These products are expected to see strong adoption, especially as research and diagnostic labs require fast, efficient, and reliable nucleic acid extraction methods.

Kits and reagents offer the advantage of ease of use, high reproducibility, and minimal preparation time, which makes them ideal for a variety of applications, including gene sequencing, diagnostics, and molecular biology research. The growing focus on personalized medicine and the increasing number of genetic testing procedures are likely to drive the demand for these products. Furthermore, the continued advancements in biotechnology and molecular biology are anticipated to spur innovation in nucleic acid extraction kits, making them more versatile and precise, further supporting the growth of this segment.

Type Analysis

The DNA isolation & purification held a significant share of 72.5% due to the increasing importance of DNA analysis in various scientific and medical applications. DNA isolation is anticipated to remain a critical step in genetic research, diagnostics, and forensic studies. The growing prevalence of genetic disorders and the expansion of genetic testing are likely to increase the demand for efficient DNA isolation and purification methods.

Furthermore, advancements in DNA extraction technologies, including improved kits and reagents, are projected to enhance the accuracy, yield, and speed of DNA isolation, which is expected to support the growth of this segment. As personalized medicine continues to gain momentum, the demand for high-quality DNA samples for precision medicine applications is likely to drive further adoption of DNA isolation and purification techniques.

Application Analysis

The diagnostics segment experienced significant growth, achieving a revenue share of 48.6% due to the expanding reliance on molecular diagnostics for disease detection and monitoring. The surge in infectious diseases, genetic disorders, and cancers is propelling the demand for nucleic acid-based diagnostic tests. This trend is bolstered by the increasing adoption of personalized medicine and targeted therapies, which necessitate precise molecular diagnostics to be effective.

Advancements in PCR technology and next-generation sequencing are set to elevate the need for high-quality nucleic acid extraction methods in diagnostic applications. The rising number of genetic testing laboratories and diagnostic centers that offer these services is anticipated to further drive the demand for nucleic acid isolation and purification products. This development supports the ongoing growth of the diagnostics segment, making it a critical area of focus in the industry.

Method Analysis

The magnetic beads segment grew at a substantial rate, generating a revenue portion of 59.2% due to the advantages magnetic beads offer in the isolation process. This method is projected to gain popularity due to its high efficiency, reproducibility, and ease of use compared to traditional column-based methods. Magnetic beads are likely to become the preferred choice in clinical diagnostics, drug discovery, and research applications because they allow for rapid and highly specific isolation of nucleic acids.

The growing demand for automated workflows in laboratories, along with the need for scalable and high-throughput solutions, is anticipated to further fuel the adoption of magnetic bead-based methods. Additionally, the ability to adapt magnetic bead-based systems to various sample types and the increasing availability of specialized kits for different applications are projected to drive growth in this segment.

End-use Analysis

The hospitals & diagnostic centers segment grew at a substantial rate, generating a revenue portion of 51.8% due to the increasing adoption of molecular diagnostics for disease detection and monitoring in clinical settings. Hospitals and diagnostic centers are expected to invest more in advanced technologies, including nucleic acid isolation and purification systems, to improve the accuracy and speed of diagnostic results.

The rising prevalence of chronic and infectious diseases, such as cancer, genetic disorders, and viral infections, is likely to drive the demand for nucleic acid-based diagnostic tests. Furthermore, as healthcare systems focus on personalized medicine and precision therapies, hospitals and diagnostic centers are anticipated to expand their use of molecular diagnostic tools, increasing the demand for reliable and efficient nucleic acid isolation methods. This segment is projected to benefit from the growing number of genetic testing services offered by hospitals and diagnostic centers worldwide.

Key Market Segments

By Product

- Kits & Reagents

- Instruments

- Automatic

- Manual

By Type

- DNA Isolation & Purification

- Genomic

- Plasmid

- Viral

- Others

- RNA Isolation & Purification

- miRNA

- mRNA

- Total RNA

- Others

By Application

- Agriculture & Animal Research

- Diagnostics

- Drug Discovery & Development

- Precision Medicine

- Others

By Method

- Column-based

- Magnetic Beads

- Reagent-based

- Others

By End-use

- Academic Research Institutes

- Contract Research Organizations

- Hospitals & Diagnostic Centers

- Pharmaceutical & Biotechnology Companies

- Others

Drivers

Increasing Demand For Automated And Advanced Instruments Is Driving The Market

Increasing demand for automated and advanced instruments significantly drives the nucleic acid isolation and purification market by enhancing the efficiency and accuracy of genetic research and diagnostic procedures. In August 2023, Gold Standard Diagnostics (GSD) introduced the iMAGo PREDigest kit, which expanded its comprehensive DNA isolation portfolio.

This kit offers both automated (iMAGo Food) and manual (GeneSpin) solutions, complete with pre- and post-treatment options for challenging sample matrices. Automation of these processes reduces manual labor, minimizes human error, and accelerates throughput, making it highly attractive for laboratories handling large volumes of samples.

Advanced instruments provide consistent and high-quality results, crucial for applications such as clinical diagnostics, research, and forensic analysis. Additionally, the ability to efficiently process diverse and complex samples expands the scope of genetic applications, driving further market growth. The integration of user-friendly interfaces and sophisticated software in these instruments enables seamless operation and data management, enhancing overall productivity.

Laboratories are expected to continue investing in these technologies to stay competitive and meet the rising demand for precise genetic analysis. Furthermore, the scalability of automated systems supports the growth of high-throughput environments, accommodating the increasing number of genetic studies and personalized medicine initiatives.

As the pharmaceutical and biotechnology sectors expand, the reliance on automated and advanced nucleic acid isolation tools is projected to increase, thereby fueling the market’s expansion. Continuous innovation in instrument design and functionality ensures that the market remains dynamic and responsive to evolving scientific needs.

Restraints

Growing Complexity Of Regulatory Compliance Is Restraining The Market

A significant restraint in the nucleic acid isolation and purification market is the growing complexity of regulatory compliance. As genetic testing and research activities expand, regulatory bodies impose stricter standards to ensure the accuracy and reliability of nucleic acid isolation processes. Laboratories must adhere to stringent guidelines regarding quality control, data integrity, and laboratory practices, which can increase operational costs and administrative burdens.

The need for continuous monitoring and validation of automated systems adds to the complexity, requiring specialized knowledge and resources that smaller institutions may lack. Additionally, navigating the diverse regulatory landscapes across different regions can delay the adoption of new technologies and hinder market growth.

Compliance with regulations such as the Clinical Laboratory Improvement Amendments (CLIA) in the United States or the General Data Protection Regulation (GDPR) in Europe necessitates significant investments in infrastructure and training. The high costs associated with meeting these regulatory requirements can deter investment in advanced nucleic acid isolation technologies, limiting market penetration.

Furthermore, the rapid pace of technological advancements may outstrip the ability of regulatory frameworks to keep up, creating uncertainty and reluctance among potential adopters. These factors collectively restrain the market by imposing barriers to entry and increasing the financial and operational burdens on market participants.

Opportunities

Rise In Investments By Key Players Is Creating Opportunities For The Market

Rising investments by key players create substantial opportunities for the nucleic acid isolation and purification market by fostering innovation and expanding manufacturing capabilities. In January 2023, Agilent Technologies revealed a plan to invest USD 725 million to expand its manufacturing capability for therapeutic nucleic acids. This significant investment enables Agilent to enhance its production capacity, develop new technologies, and improve the efficiency of its purification processes.

Increased funding allows companies to accelerate research and development efforts, leading to the creation of more advanced and reliable solutions tailored to meet the evolving needs of the biotechnology and pharmaceutical industries. Investments also support the scaling of operations to accommodate the growing demand for therapeutic nucleic acids used in gene therapy, personalized medicine, and advanced diagnostics.

Moreover, such financial commitments enable key players to explore new markets and enhance their global presence, driving further market expansion. The availability of capital for innovation ensures that companies can stay ahead of technological advancements, offering state-of-the-art solutions that improve the quality and throughput of nucleic acid isolation.

Additionally, strategic partnerships and acquisitions funded by these investments can lead to the integration of complementary technologies, enhancing the overall value proposition of purification systems. As key players continue to invest heavily in this sector, the market is anticipated to benefit from increased product offerings, improved technological capabilities, and greater accessibility to cutting-edge purification tools, thereby driving sustained growth and market leadership.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a significant role in shaping the nucleic acid isolation and purification market. On the positive side, the growing demand for genetic research, diagnostics, and biotechnology innovations drives market expansion. Increased healthcare spending and rising investments in genomic research, particularly in personalized medicine, contribute to the adoption of advanced purification technologies.

However, economic recessions or budget constraints in healthcare systems may lead to reduced research funding and slower growth in the sector. Geopolitical factors such as trade barriers, import-export restrictions, or political instability in certain regions can disrupt the supply chain for essential reagents and consumables.

Additionally, varying regulatory frameworks across countries can introduce challenges in the standardization of practices. Despite these challenges, advancements in automation and the ongoing need for genomic research are expected to sustain market growth, creating opportunities for innovation and expanding market potential.

Trends

Surge in Mergers and Acquisitions Driving the Nucleic Acid Isolation and Purification Market

Increasing mergers and acquisitions are fueling growth in the nucleic acid isolation and purification market. High levels of consolidation in the sector are expected to enhance product portfolios and improve operational efficiencies, leading to more competitive pricing and technological advancements. Companies are likely to seek strategic acquisitions to strengthen their research and manufacturing capabilities.

In November 2023, LGC Biosearch Technologies acquired PolyDesign, a producer of solid support embedded frits for DNA/RNA oligonucleotide purification and synthesis. This acquisition is anticipated to bolster LGC’s Nucleic Acid Chemistry offerings and expand its reach in the growing genomics market. The trend of mergers and acquisitions is projected to continue, offering new opportunities for companies to leverage synergies and accelerate innovation in nucleic acid purification technologies.

Regional Analysis

North America is leading the Nucleic Acid Isolation and Purification Market

North America dominated the market with the highest revenue share of 39.6% owing to the expanding demand for precision medicine and advances in molecular diagnostics. The increasing prevalence of chronic diseases, coupled with the rising focus on personalized therapies, has amplified the need for accurate and efficient nucleic acid isolation and purification methods.

In particular, the demand for high-quality DNA and RNA extraction kits has surged in research and clinical settings, facilitating applications in genomics, oncology, and infectious diseases. A key development in this space occurred in August 2023, when CD Bioparticles launched its DNA Extraction and Purification Kits, designed to offer reliable and rapid isolation of various DNA types, including plasmid, tissue, and cell-free DNA.

This innovation supports critical areas like genetic testing and biomarker discovery, significantly contributing to the market’s growth. Additionally, the rise in government and private sector investments in life sciences research has further bolstered the adoption of advanced nucleic acid isolation technologies in North America, ensuring continued market expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to experience the fastest growth in the nucleic acid extraction market, driven by rapid biotechnological advancements and increased focus on healthcare and research. China, India, and Japan are at the forefront, expanding their genomic research, diagnostics, and drug development efforts. The region’s rising cases of genetic disorders, cancer, and infectious diseases further boost the demand for advanced nucleic acid isolation methods.

In July 2023, INOVIQ Limited and Promega Corporation formed a global marketing collaboration to promote Promega’s Nucleic Acid purification systems. This partnership aims to improve the availability of reliable extraction solutions across Asia Pacific. Such collaborations are vital in enhancing regional capabilities in genetic analysis and molecular diagnostics.

The growth of research institutions and pharmaceutical companies in Asia Pacific is expected to accelerate the market. These entities are increasingly adopting efficient technologies to advance research in personalized medicine and molecular diagnostics. Additionally, government initiatives supporting biotechnology research and improving healthcare infrastructure are crucial. These efforts collectively contribute to the market’s expansion, making Asia Pacific a key player in the global arena.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the nucleic acid isolation and purification market focus on strategies such as developing innovative kits and automated systems to streamline workflows and enhance yield accuracy. Companies invest heavily in R&D to introduce solutions tailored for applications in genomics, diagnostics, and drug development.

Collaborations with biotechnology firms and research institutes strengthen their market presence while addressing diverse customer needs. Expansion into emerging regions with growing demand for molecular biology research drives additional growth. Prioritizing compliance with stringent regulatory standards ensures product reliability and maintains customer trust.

Thermo Fisher Scientific Inc. is a prominent player in this market, offering advanced products such as the PureLink and MagMAX systems. The company combines expertise in molecular biology with cutting-edge technology to deliver efficient and reliable solutions for researchers and clinicians. Thermo Fisher leverages its global reach and strong distribution network to serve a wide range of customers, solidifying its leadership position in the industry.

Recent Developments

- In June 2023: Bionano Genomics unveiled the Ionic Purification System, a tool developed for extracting nucleic acids from tumor tissues and formalin-fixed paraffin-embedded (FFPE) samples.

- In December 2023: Thermo Fisher Scientific launched the Thermo Scientific KingFisher Apex Dx and the Applied Biosystems MagMAX Dx Pathogen/Viral NA Isolation Kit, offering automated solutions for isolating and purifying bacterial and viral pathogens from biological samples.

Top Key Players in the Nucleic Acid Isolation and Purification Market

- Thermo Fisher Scientific

- Takara Bio Inc.

- QIAGEN

- Promega Corporation

- New England Biolabs

- LGC Biosearch Technologies

- Alpha Laboratories

- Agilent Technologies

Report Scope

Report Features Description Market Value (2023) US$ 6.2 billion Forecast Revenue (2033) Us$ 15.5 billion CAGR (2024-2033) 9.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Kits & Reagents and Instruments (Automatic and Manual)), By Type (DNA Isolation & Purification (Genomic, Plasmid, Viral, and Others) and RNA Isolation & Purification (miRNA, mRNA, Total RNA, and Others)), By Application (Agriculture & Animal Research, Diagnostics, Drug Discovery & Development, Precision Medicine, and Others), By Method (Column-based, Magnetic Beads, Reagent-based, and Others), By End-use (Academic Research Institutes, Contract Research Organizations, Hospitals & Diagnostic Centers, Pharmaceutical & Biotechnology Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Takara Bio Inc., QIAGEN, Promega Corporation, New England Biolabs, LGC Biosearch Technologies, Alpha Laboratories, and Agilent Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Nucleic Acid Isolation and Purification MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Nucleic Acid Isolation and Purification MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Takara Bio Inc.

- QIAGEN

- Promega Corporation

- New England Biolabs

- LGC Biosearch Technologies

- Alpha Laboratories

- Agilent Technologies