Automated Cell Counting Market By Product Type (Consumables & Accessories and Instruments (Image-based Cell Counters, Flow Cytometers, and Electrical Impendence Coulter Counters)), By Application (Cell Line development (Biologics Production and Cell & Gene Therapy), Blood Analysis, Stem Cell Research, and Others), By End-use (Hospitals & Diagnostic laboratories, Pharmaceutical & Biotechnology Companies, Research & Academic Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136148

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

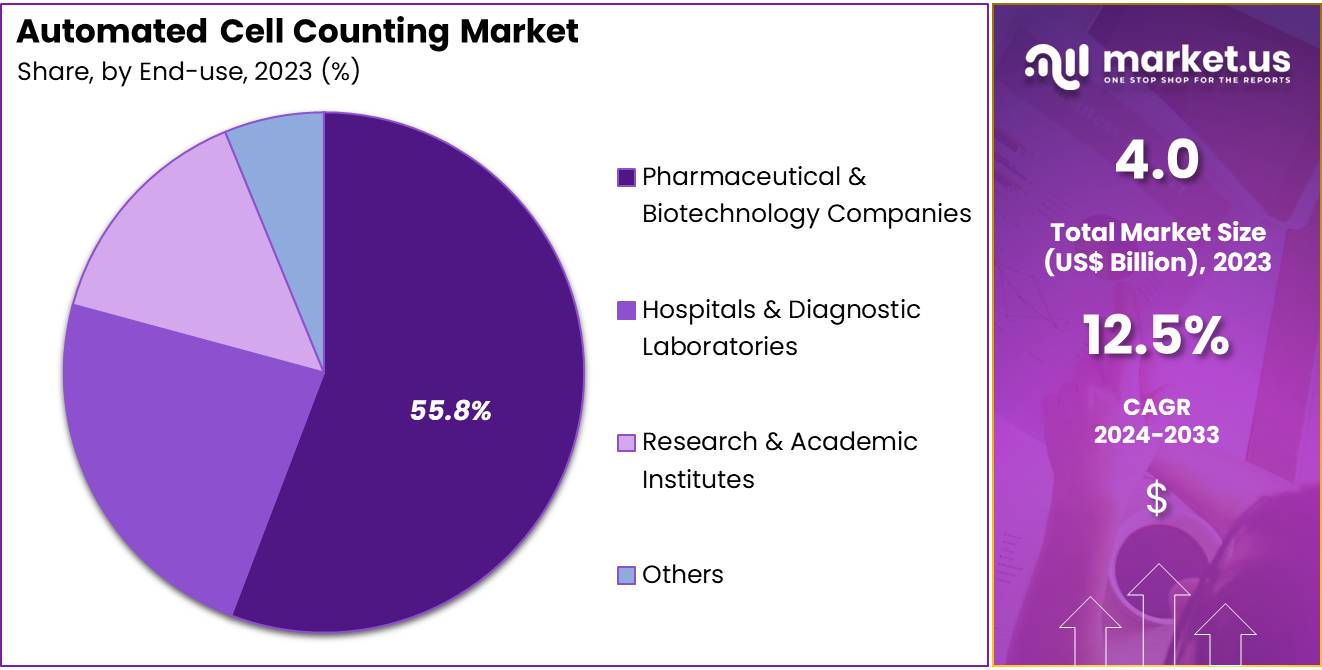

The Global Automated Cell Counting Market size is expected to be worth around US$ 13 Billion by 2033, from US$ 4 Billion in 2023, growing at a CAGR of 12.5% during the forecast period from 2024 to 2033.

Increasing demand for precise and efficient cell analysis in medical research, diagnostics, and pharmaceutical applications is driving the growth of the automated cell counting market. Automated cell counting solutions offer significant advantages over traditional methods, including improved accuracy, high throughput, and reduced human error, making them essential in various applications such as cancer research, drug discovery, and infectious disease diagnostics.

The growing need for rapid and reliable cell counts, especially in fields like oncology and virology, is creating new opportunities. For example, the World Health Organization (WHO) reported that approximately 39 million people globally were living with HIV by the end of 2022, highlighting the continued importance of accurate cell analysis in monitoring immune responses and treatment effectiveness.

The trend toward personalized medicine and the increasing focus on cell-based therapies further fuel market expansion as automated cell counting technologies are used for cell culture, stem cell research, and gene therapy applications. Recent innovations in the field include the integration of artificial intelligence and machine learning to enhance the speed and precision of cell counting processes.

Furthermore, the development of compact and user-friendly devices that offer multi-parameter analysis is opening up new opportunities for point-of-care applications, making automated cell counting accessible to a broader range of healthcare settings.

Key Takeaways

- In 2023, the market for Automated Cell Counting generated a revenue of US$ 4 billion, with a CAGR of 12.5%, and is expected to reach US$ 13 billion by the year 2033.

- The product type segment is divided into consumables & accessories and instruments, with consumables & accessories taking the lead in 2023 with a market share of 67.4%.

- Considering application, the market is divided into cell line development, blood analysis, stem cell research, and others. Among these, cell line development held a significant share of 49.5%.

- Furthermore, concerning the end-use segment, the market is segregated into hospitals & diagnostic laboratories, pharmaceutical & biotechnology companies, research & academic institutes, and others. The pharmaceutical & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 55.8% in the Automated Cell Counting market.

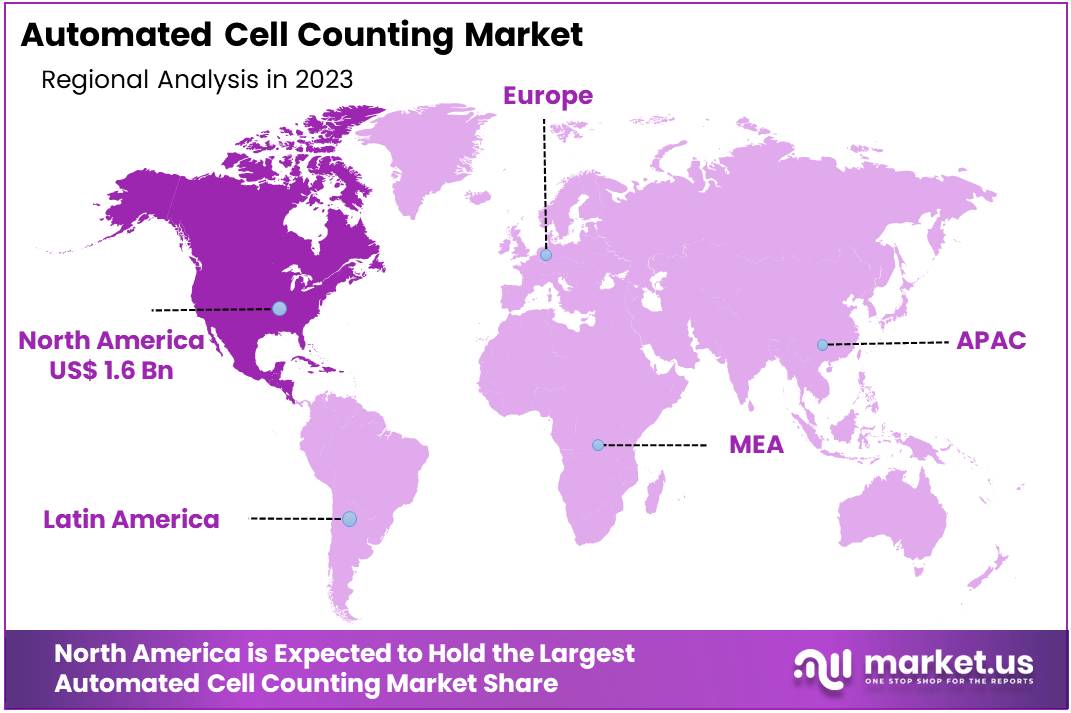

- North America led the market by securing a market share of 39.8% in 2023.

Product Type Analysis

The consumables & accessories segment led in 2023, claiming a market share of 67.4% owing to the increasing demand for supporting products like reagents, filters, and counting slides, which are essential for the efficient operation of automated systems. These consumables are expected to witness rising adoption due to their critical role in maintaining the accuracy and functionality of automated cell counting instruments.

The continuous advancements in cell counting technology and the growing use of automated systems in research and clinical laboratories are anticipated to fuel the need for consumables and accessories. Additionally, the regular replacement and replenishment of these consumables in high-throughput environments will likely contribute to the growth of this segment.

The expanding focus on precision medicine and personalized healthcare, which requires regular and accurate cell analysis, is projected to further increase the demand for these supporting products. As more pharmaceutical and biotechnology companies incorporate automated cell counting into their workflows, the consumables and accessories segment is expected to benefit from their increasing reliance on these tools.

Application Analysis

The cell line development held a significant share of 49.5% due to the increasing importance of cell lines in drug development and biotechnology research. The demand for high-quality, reproducible cell lines in pharmaceutical research is projected to increase as companies focus on developing new therapies, particularly for cancer and genetic disorders.

Automated cell counting plays a crucial role in the cell line development process, helping researchers maintain consistent cell growth, optimize culture conditions, and track cell proliferation. The growing emphasis on biologics and cell-based therapies is likely to further boost the demand for automated systems that provide precise and reliable cell counting.

Additionally, the advancement of stem cell research, which relies heavily on cell line development, is expected to contribute significantly to this segment’s growth. The adoption of automated cell counting in cell line characterization and the increasing focus on improving cell culture efficiency are projected to drive substantial growth in this application segment.

End-use Analysis

The pharmaceutical & biotechnology companies segment had a tremendous growth rate, with a revenue share of 55.8% owing to the increasing reliance on automated systems for drug development, quality control, and clinical research. These companies are expected to integrate automated cell counting into their workflows to enhance efficiency, reduce human error, and ensure more accurate and reproducible results in cell analysis.

The rising prevalence of chronic diseases and the growing focus on biologics, gene therapies, and personalized medicine are anticipated to drive the need for advanced cell counting solutions in pharmaceutical and biotechnology research. As these companies expand their R&D capabilities to develop novel therapeutics, the demand for automated systems that offer precise cell counting and analysis is likely to increase.

Furthermore, regulatory pressures for accurate, consistent cell measurements in drug development and production are expected to push pharmaceutical and biotechnology companies towards adopting these automated solutions, leading to substantial growth in this segment.

Key Market Segments

By Product Type

- Consumables & Accessories

- Instruments

- Image-based Cell Counters

- Flow Cytometers

- Electrical Impendence Coulter Counters

By Application

- Cell Line development

- Biologics Production

- Cell & Gene Therapy

- Blood Analysis

- Stem Cell Research

- Others

By End-use

- Hospitals & Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Research & Academic Institutes

- Others

Drivers

Growing Prevalence Of Diabetes And Cancer

Growing prevalence of diabetes and cancer significantly drives the automated cell counting market by increasing the demand for precise and efficient diagnostic tools. According to the World Health Organization (WHO), diabetes accounted for 1.5 million deaths globally in 2021, while cancer was responsible for 10 million deaths during the same period. These alarming statistics highlight the urgent need for accurate cell counting in disease diagnosis, monitoring, and treatment planning.

Automated systems offer high accuracy and reproducibility, essential for detecting abnormal cell counts and ensuring timely medical interventions. Healthcare providers are expected to adopt these technologies to improve diagnostic workflows, reduce manual errors, and enhance patient outcomes. Furthermore, the rising incidence of these chronic diseases drives research and development efforts to innovate more advanced counting solutions.

The integration of technologies such as flow cytometry and image analysis allows for detailed cellular analysis, crucial for personalized medicine approaches. Additionally, the scalability and efficiency of automated systems meet the growing laboratory demands, facilitating faster turnaround times for test results. As medical institutions strive to manage the increasing caseloads effectively, the adoption of these solutions is projected to rise.

This trend not only supports clinical accuracy but also optimizes resource allocation within healthcare facilities, further fueling market growth. Moreover, the push towards digitalization in healthcare encourages the implementation of automated technologies, ensuring that the sector keeps pace with global health challenges.

Restraints

High Complexity Of Technology

A significant restraint in the automated cell counting market is the high complexity of the underlying technology. Implementing advanced counting systems requires substantial technical expertise, which can be a barrier for many healthcare facilities. The sophisticated nature of these systems necessitates specialized training for laboratory personnel, increasing the operational costs and time required for effective utilization.

Additionally, integrating automated solutions with existing laboratory information systems often involves complex configuration and customization, further complicating the adoption process. Maintenance and calibration of these high-tech instruments also present ongoing challenges, requiring regular professional service and support.

Smaller laboratories and healthcare providers may find it difficult to justify the investment due to limited budgets and resources, limiting the market penetration of these technologies. Moreover, the rapid pace of technological advancements can render existing systems obsolete quickly, compelling continuous investment in upgrades and new models.

This technological complexity not only increases the initial and operational costs but also affects the overall accessibility of automated cell counting solutions. As a result, the high complexity associated with these systems restrains widespread adoption and slows down market growth, particularly in regions with limited technical infrastructure.

Opportunities

Increasing R&D Activities Is Creating Opportunities

Increasing research and development activities create substantial opportunities for the automated cell counting market by fostering innovation and the introduction of advanced technologies. In March 2023, UCLA’s Stem Cell Research and the Eli & Edythe Broad Center for Regenerative Medicine secured over USD 5.7 million in funding from the California Institute for Regenerative Medicine to advance stem cell-based solutions for cancer treatment and addressing intellectual disabilities.

These investments drive the development of more sophisticated counting systems capable of handling complex analyses required in cutting-edge medical research. Enhanced R&D efforts lead to the creation of more accurate, efficient, and user-friendly automated counters, meeting the evolving needs of healthcare professionals and researchers.

Furthermore, collaboration between academic institutions and industry players accelerates the innovation cycle, resulting in the commercialization of breakthrough technologies. The integration of artificial intelligence and machine learning in counting systems, a focus of ongoing research, promises to improve data analysis and predictive capabilities.

Additionally, R&D activities focused on miniaturization and portability make automated systems more accessible to diverse healthcare settings, including remote and resource-limited environments. As research continues to push the boundaries of what automated counting can achieve, the market is anticipated to experience significant growth driven by these technological advancements. Increased funding and supportive policies for medical research further bolster the potential for market expansion, enabling the development of next-generation counting solutions that enhance diagnostic precision and efficiency.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a significant influence on the automated cell counting market. On the positive side, the increasing demand for advanced medical research, biotechnology, and pharmaceutical development fuels the adoption of automated cell counters. Economic growth, especially in emerging markets, provides healthcare institutions with more resources to invest in sophisticated laboratory equipment.

However, economic downturns can lead to budget cuts, delaying investments in high-cost technology. Geopolitical factors such as trade regulations and international healthcare policies can disrupt the supply chain for essential components, raising costs. Additionally, regulatory uncertainties surrounding healthcare devices and technology can pose challenges.

Despite these concerns, the growing focus on precision medicine, research in oncology, and drug development is expected to propel market growth, with innovation continuing to drive the sector forward.

Trends

Surge in Launch of Hi-tech and Sophisticated Cell Counters Driving the Market

Rising interest in high-tech and sophisticated cell counters is accelerating the growth of the automated cell counting market. Advances in cell counting technology are expected to improve the accuracy, efficiency, and throughput of laboratory operations. The demand for devices that offer higher precision, faster results, and user-friendly interfaces is increasing across research, clinical, and pharmaceutical settings.

In August 2022, DeNovix Inc. launched two specialized nuclei counting applications for its CellDrop Automated Cell Counters, designed to differentiate isolated nuclei and intact cells from debris effectively. These innovations are anticipated to drive further interest in automated systems, offering researchers more powerful tools to support advanced studies. As the need for more accurate diagnostics and cell analysis increases, the market is projected to continue expanding in response to technological advancements.

Regional Analysis

North America is leading the Automated Cell Counting Market

North America dominated the market with the highest revenue share of 39.8% owing to increasing demand from the biotechnology and pharmaceutical sectors. The rise in research activities related to cell biology, immunology, and drug development has spurred the adoption of automated cell counting technologies, as they offer enhanced accuracy, efficiency, and reproducibility compared to traditional manual methods.

One notable development in January 2023 was the launch of the Omni Pro 12 by Axion BioSystems, which provides automated solutions for multiple users and supports live-cell imaging applications. The product’s ability to streamline workflows in labs has been particularly appealing to researchers, contributing to the overall growth of the market.

Moreover, the increasing focus on personalized medicine and cell-based therapies, which require precise and scalable cell counting solutions, has further bolstered the market demand. The need for faster and more reliable results in clinical and preclinical studies has driven pharmaceutical companies to adopt these advanced technologies, ensuring sustained growth in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to advancements in healthcare infrastructure and research. As the region experiences rapid improvements in medical research and biotechnology, the demand for automated cell counting solutions is expected to increase, particularly in countries like China, India, and Japan.

The growing investment in cell therapy and regenerative medicine is likely to drive the need for efficient and accurate cell counting methods. Additionally, the increasing prevalence of chronic diseases and cancer in the region is anticipated to spur the demand for advanced diagnostic tools, further boosting market growth.

Governments’ support for research and development in life sciences and the expansion of clinical trials in emerging markets are estimated to contribute to the market’s expansion. The rising adoption of automation in laboratories, coupled with the growing emphasis on reducing human error and increasing throughput, is likely to drive the uptake of automated cell counting technologies across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the automated cell counting market focus on strategies such as developing advanced imaging and AI-based technologies to improve accuracy and efficiency in cell analysis. Companies expand their product portfolios by offering versatile devices capable of handling various cell types and applications. Strategic collaborations with research institutions and biotechnology firms enable them to drive innovation and cater to evolving market demands.

Investments in user-friendly software and digital integration enhance operational efficiency, while global expansion into emerging markets helps increase their customer base. Emphasis on compliance with stringent regulatory standards ensures their solutions remain competitive and reliable.Thermo Fisher Scientific Inc. is a prominent player in the automated cell counting market, offering advanced instruments like the Countess series.

The company combines cutting-edge imaging technologies with robust software to deliver accurate and fast cell counting solutions. Thermo Fisher focuses on addressing diverse research and clinical needs, supported by its extensive global presence and commitment to innovation.

Top Key Players in the Automated Cell Counting Market

- Sysmex Corporation

- Olympus Corporation

- MERCK KGaA

- HORIBA

- DeNovix Inc.

- Danaher

- Chemometec A/S

- Thermo Fisher Scientific

- Abbott

Recent Developments

- In July 2024: DeNovix Inc. introduced a hepatocyte counting application within the CellDrop software. This innovative tool, powered by a machine learning algorithm, is tailored for precise cell counting. The budget-friendly CellDrop software, accessible to all laboratories, is the first of its kind. By eliminating the need for cartridges or disposable slides, it significantly reduces both costs and plastic waste.

- In October 2023: DeNovix’s CellDrop Automated Cell Counter earned ACT Label certification from My Green Lab, becoming the first automated cell counter to receive this recognition under the program.

- In October 2022: Thermo Fisher Scientific launched innovative closed and automated solutions for cell isolation and bead removal. These advancements aim to enhance cell therapy manufacturing by improving cell purity, isolation efficiency, and target cell recovery, enabling scalability in production processes.

Report Scope

Report Features Description Market Value (2023) US$ 4.0 billion Forecast Revenue (2033) US$ 13.0 billion CAGR (2024-2033) 12.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables & Accessories and Instruments (Image-based Cell Counters, Flow Cytometers, and Electrical Impendence Coulter Counters)), By Application (Cell Line development (Biologics Production and Cell & Gene Therapy), Blood Analysis, Stem Cell Research, and Others), By End-use (Hospitals & Diagnostic laboratories, Pharmaceutical & Biotechnology Companies, Research & Academic Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sysmex Corporation, Olympus Corporation, MERCK KGaA, HORIBA, F. Hoffmann-La Roche Ltd, Danaher, Chemometec A/S, Bio-Rad Laboratories, Inc, and Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automated Cell Counting MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Automated Cell Counting MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Sysmex Corporation

- Olympus Corporation

- MERCK KGaA

- HORIBA

- DeNovix Inc.

- Danaher

- Chemometec A/S

- Thermo Fisher Scientific

- Abbott