Global Grain Alcohol Market Size, Share, And Business Benefits By Source (Sugarcane, Grains, Fruits, Others), By Type (Ethanol, Polyols), By Functionality (Preservative, Coloring / Flavoring Agent, Coatings, Others), By Application (Beverages, Food, Pharmaceutical and Health care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153714

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

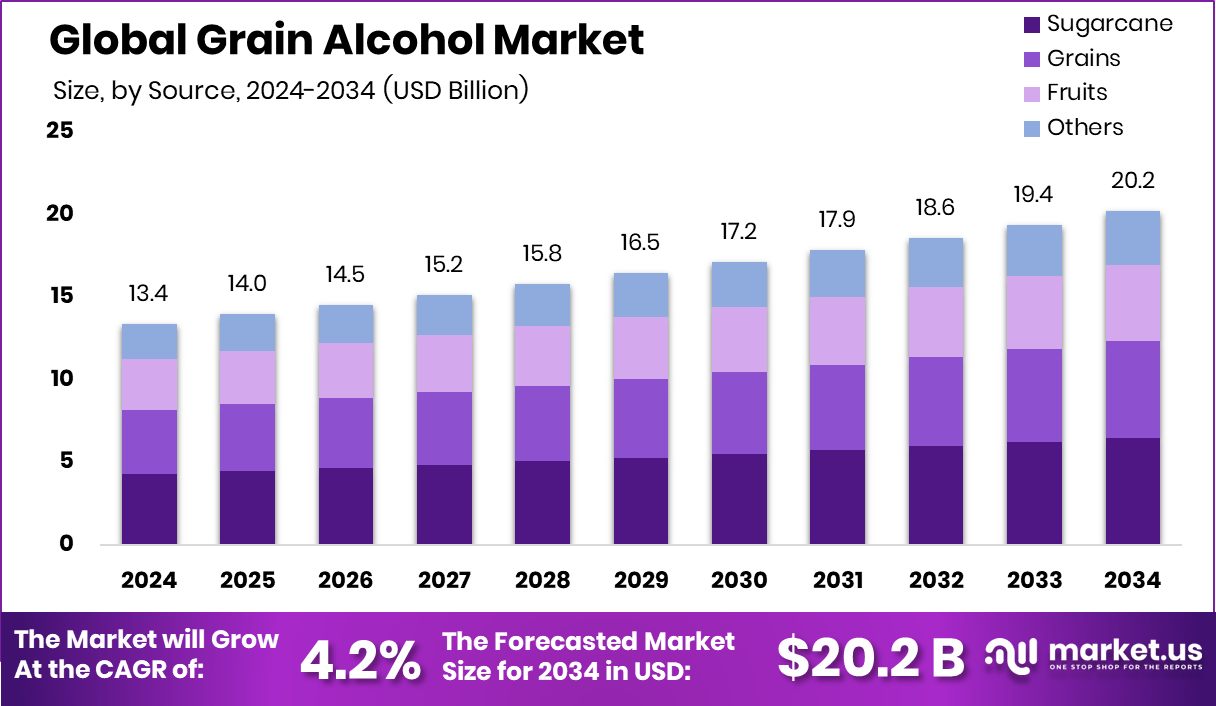

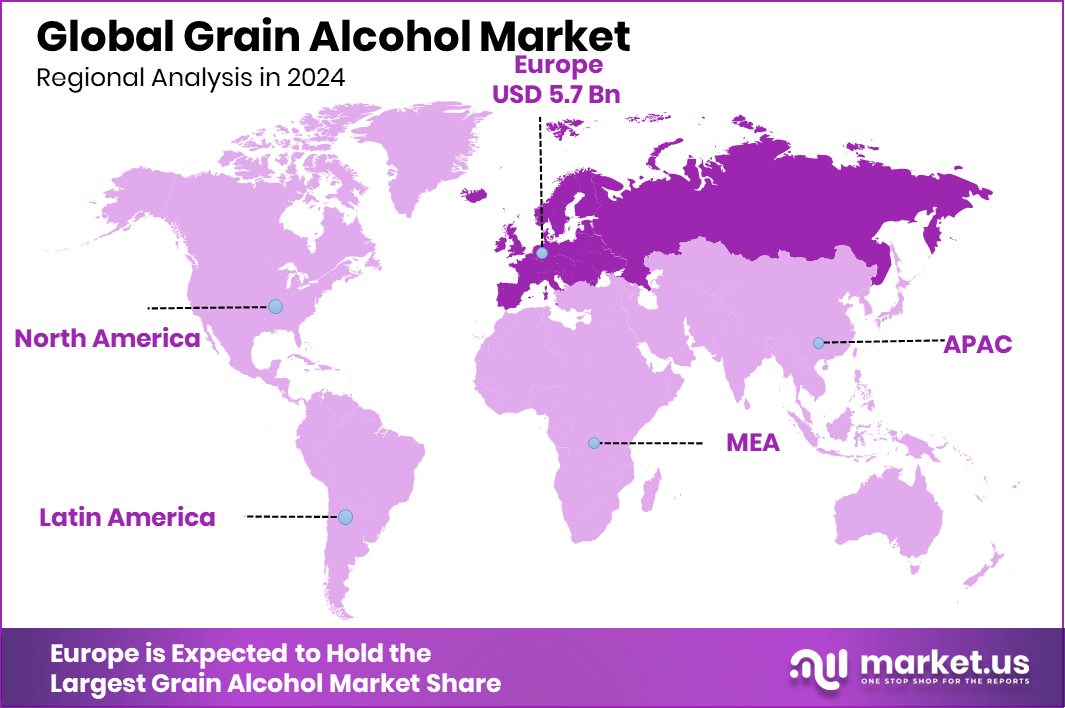

The Global Grain Alcohol Market is expected to be worth around USD 20.2 billion by 2034, up from USD 13.4 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034. Europe’s grain alcohol market stood at 42.9%, generating USD 5.7 billion in revenue.

Grain alcohol, also known as ethyl alcohol or ethanol, is a highly purified form of alcohol derived from the fermentation and distillation of grains such as corn, wheat, rye, or barley. It is a clear, volatile, and flammable liquid with high alcohol content, usually around 95% or more. Due to its purity and versatility, grain alcohol is widely used in various applications, including food processing, beverages, pharmaceuticals, personal care, and industrial products.

The grain alcohol market encompasses the production, distribution, and consumption of ethanol made specifically from grain sources. It is driven by its broad application range across food-grade and industrial uses. In the food and beverage sector, it is used as a key ingredient in flavor extracts, spirits, and sanitizing products. Meanwhile, in industrial settings, it functions as a solvent, fuel additive, and disinfectant.

Growth factors include the rising preference for bio-based solvents and clean-label products. The global shift toward reducing reliance on synthetic chemicals and petroleum-based alternatives is increasing demand for naturally derived ethanol. Additionally, grain alcohol’s biodegradability and low toxicity make it suitable for eco-conscious product formulations. The government has approved the allocation of 2.8 million tonnes of surplus rice for ethanol production at a subsidised rate.

Demand is notably increasing in the pharmaceutical and personal care industries. It is widely used in the formulation of hand sanitizers, antiseptics, and tinctures. Following recent health awareness and hygiene concerns, consumption has significantly grown. Its role in the extraction of botanical ingredients and use in herbal tinctures also supports consistent demand in natural medicine. Nevada-based Lincolnway Energy is setting up a grain-to-alcohol system, supported by a $1 million federal grant.

Key Takeaways

- The Global Grain Alcohol Market is expected to be worth around USD 20.2 billion by 2034, up from USD 13.4 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034.

- In the Grain Alcohol Market, sugarcane accounts for a 29.3% share as a key raw material.

- Ethanol dominates the Grain Alcohol Market by type, capturing a substantial 71.9% of the market.

- Preservative functionality leads in the Grain Alcohol Market, holding a 44.7% share in total use.

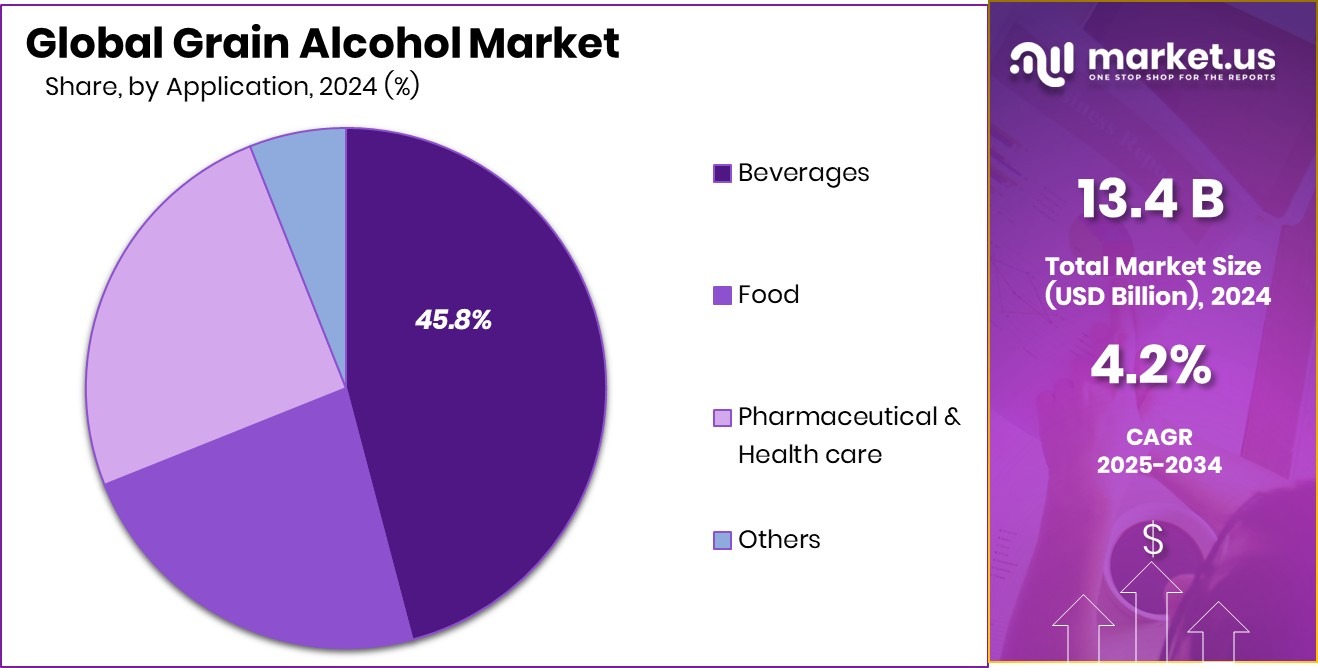

- Beverages remain the top application segment in the Grain Alcohol Market, contributing 45.8% of total demand.

- Grain alcohol demand in Europe reached USD 5.7 billion, covering 42.9 of % market.

By Source Analysis

Sugarcane holds a 29.3% share of the grain alcohol market production.

In 2024, Sugarcane held a dominant market position in the By Source segment of the Grain Alcohol Market, with a 29.3% share. This leading position can be attributed to sugarcane’s high fermentable sugar content, which allows for efficient ethanol production with relatively low processing costs.

The natural abundance and renewability of sugarcane, particularly in tropical and subtropical regions, have further supported its preference as a key feedstock in grain alcohol manufacturing. The conversion of sugarcane to alcohol involves fewer processing steps compared to grains like corn or wheat, making it a cost-effective and energy-efficient option for producers.

Moreover, sugarcane-based alcohol is recognized for its lower carbon footprint, aligning with sustainability goals across industries. This has made it particularly favorable in regions with green energy policies and biofuel mandates. The consistent availability of sugarcane and well-established agricultural infrastructure also ensures a stable supply chain for manufacturers relying on this source.

With growing emphasis on renewable raw materials in both industrial and food-grade alcohol applications, sugarcane’s dominance is expected to remain strong. Its widespread use across sectors such as beverage production, biofuel blending, and pharmaceutical formulations reinforces its market leadership within the source segment of grain alcohol.

By Type Analysis

Ethanol type dominates with 71.9% in the grain alcohol category.

In 2024, Ethanol held a dominant market position in the By Type segment of the Grain Alcohol Market, with a 71.9% share. This significant share reflects ethanol’s widespread acceptance as a versatile and high-purity alcohol used across a broad spectrum of industries.

Its dominance is largely supported by its established role in food-grade applications such as flavor extracts, alcoholic beverages, and preservatives. Additionally, ethanol is extensively utilized in personal care products, pharmaceutical formulations, and sanitizing agents due to its disinfectant properties and safety profile.

The high share can also be linked to the growing demand for bio-based solvents and sustainable raw materials. Ethanol, particularly when derived from grain sources, is favored for its natural origin and compatibility with clean-label product trends. Furthermore, its regulatory approval for use in consumable and topical products strengthens its presence in health-sensitive sectors.

Ethanol’s ability to act as a solvent, carrier, and active ingredient in multiple formulations makes it a critical component for manufacturers seeking functional, safe, and renewable inputs. As industries continue shifting toward environmentally friendly solutions and bio-based ingredients, ethanol’s leadership in the type segment of the grain alcohol market is expected to remain robust, underpinned by strong demand and broad application versatility.

By Functionality Analysis

Preservative function leads with 44.7% usage in applications.

In 2024, Preservative held a dominant market position in the By Functionality segment of the Grain Alcohol Market, with a 44.7% share. This leadership is primarily driven by grain alcohol’s effectiveness in inhibiting microbial growth, thereby extending the shelf life of various food and beverage products.

As consumer demand for natural and clean-label preservatives continues to rise, grain alcohol is increasingly preferred over synthetic additives, especially in processed foods, confectionery, sauces, and ready-to-drink beverages.

Its antimicrobial properties make it suitable for maintaining product safety and freshness without altering taste or quality. This has made it a key ingredient in both industrial-scale and artisanal food production. In addition, its volatility ensures that it evaporates easily, leaving behind no residue—another reason for its wide use in preservative applications. The growing need for stable shelf life in global food distribution chains has further supported its demand in this role.

Grain alcohol’s natural origin and regulatory acceptance as a food-grade substance have helped solidify its position in this functionality segment. As producers seek effective, natural preservation methods that align with regulatory standards and consumer expectations, grain alcohol’s use as a preservative remains a key growth area within the market.

By Application Analysis

Beverages account for 45.8% of total grain alcohol demand.

In 2024, Beverages held a dominant market position in the By Application segment of the Grain Alcohol Market, with a 45.8% share. This strong position is primarily due to the extensive use of grain alcohol as a core ingredient in the production of alcoholic beverages such as vodka, gin, whiskey, and liqueurs. Its high purity, neutral flavor, and consistent quality make it ideal for beverage manufacturers seeking reliable inputs for large-scale and craft alcohol production.

The dominance of this segment is also supported by sustained global demand for premium and flavored alcoholic drinks, particularly in regions with a growing middle-class population and changing lifestyle preferences. Grain alcohol’s versatility allows it to be used in various beverage categories, catering to a wide range of consumer tastes. Additionally, the trend toward natural and locally sourced ingredients has further boosted the use of grain-derived ethanol in the beverage industry.

Grain alcohol is also valued in beverage processing for its role in flavor extraction and preservation, contributing to product stability and shelf life. With its strong functional benefits and alignment with evolving consumer preferences, the beverage segment continues to anchor the grain alcohol market, reinforcing its leading position by application.

Key Market Segments

By Source

- Sugarcane

- Grains

- Fruits

- Others

By Type

- Ethanol

- Polyols

By Functionality

- Preservative

- Coloring / Flavoring Agent

- Coatings

- Others

By Application

- Beverages

- Food

- Pharmaceutical and Healthcare

- Others

Driving Factors

Rising Demand for Natural and Sustainable Ingredients

One of the main driving factors for the growth of the grain alcohol market is the increasing demand for natural and sustainable ingredients across various industries. Consumers today are more aware of what goes into their food, beverages, and personal care products. This has created a strong shift toward products made with clean-label and plant-based ingredients.

Grain alcohol, which is derived from natural sources like corn, wheat, or sugarcane, fits well into this trend. It is used as a solvent, preservative, or active ingredient without the need for artificial additives. Its biodegradable and renewable nature makes it an attractive option for eco-conscious manufacturers and consumers, boosting its adoption in food, cosmetics, pharmaceuticals, and industrial applications.

Restraining Factors

Strict Regulations on Production and Alcohol Usage

A major restraining factor in the grain alcohol market is the presence of strict government regulations on alcohol production, usage, and distribution. Since grain alcohol is a highly concentrated form of ethanol, it is closely monitored due to its potential for misuse in both food-grade and industrial applications. Many countries have licensing requirements, heavy taxation, and tight import-export controls on alcohol products, which can create delays and increase costs for manufacturers.

Additionally, labeling standards and safety concerns related to consumption and handling make compliance more complex. These regulatory challenges can limit market expansion, especially for small producers, and may also impact the availability of grain alcohol in certain applications or regions.

Growth Opportunity

Expansion of Biofuel Blending Mandates with Grain Alcohol

One significant growth opportunity in the grain alcohol market lies in the expanding global mandates for blending biofuels with conventional fuels. Governments around the world are increasingly promoting renewable energy sources to decrease reliance on fossil fuels and reduce greenhouse gas emissions. Grain alcohol, especially ethanol derived from corn, sugarcane, or other crops, is widely accepted as a biofuel component.

With rising legislative support for ethanol blending—such as E10 or E20 fuel standards—grain alcohol producers stand to benefit from higher demand in the transportation and energy sectors. This opportunity opens doors for large‑scale alcohol production, infrastructure investment, and strategic partnerships with fuel suppliers.

Latest Trends

Growing Use of Grain Alcohol in Herbal Extracts

A key trend shaping the grain alcohol market is its increasing use in the formulation of herbal and botanical extracts. As demand for natural health remedies, clean-label supplements, and plant-based wellness products grows, manufacturers are turning to grain alcohol as an effective solvent for extracting active compounds from herbs and roots.

Its high purity, food-grade quality, and neutral profile make it ideal for producing tinctures, essential oil bases, and liquid supplements. Consumers are showing greater interest in traditional and alternative medicine, especially in liquid forms that are easy to absorb. This trend is being supported by natural product makers who prefer ethanol derived from renewable sources, offering both performance and clean ingredient labeling without synthetic chemicals.

Regional Analysis

In 2024, Europe held a 42.9% share, valued at USD 5.7 billion.

In 2024, Europe emerged as the leading region in the global grain alcohol market, holding a dominant share of 42.9%, which translates to a market value of USD 5.7 billion. This strong regional presence is supported by the well-established alcoholic beverage industry across countries like Germany, France, and the United Kingdom, where grain alcohol is widely used in the production of spirits, liqueurs, and flavor extracts. The region also demonstrates high demand for natural solvents and preservatives in food and pharmaceutical applications, further contributing to the uptake of grain-derived ethanol.

North America remains a significant market, driven by consistent demand from beverage and personal care industries. The region benefits from strong agricultural output and ethanol infrastructure, particularly in the United States. In the Asia Pacific, a growing population, industrialization, and increasing consumption of processed food and alcoholic drinks support steady market expansion.

Meanwhile, Latin America and the Middle East & Africa represent emerging markets, where urbanization and rising awareness of natural ingredients are gradually increasing demand. However, the overall market dominance in 2024 clearly rests with Europe, not only due to its consumption levels but also due to favorable regulatory frameworks and technological advancements in alcohol processing and purification.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ADM continued to strengthen its position in the grain alcohol market through its integrated supply chain and robust grain processing capabilities. As a major producer of corn-based ethanol and industrial-grade grain alcohol, the company leveraged its expansive network of ethanol plants across North America to meet growing global demand for both biofuel and beverage-grade alcohol.

Cargill Inc. maintained its significant role in the grain alcohol industry, focusing on food-grade and pharmaceutical-grade alcohol. The company capitalized on increasing demand for clean-label and high-purity alcohols in beverage and personal care formulations. With vertically integrated grain sourcing and investment in fermentation technologies, Cargill was able to enhance product quality and scalability, especially in North American and European markets.

ChemCeed LLC contributed to the market through its specialty chemical distribution model. The company offered denatured and undenatured grain alcohols to industrial sectors such as coatings, solvents, and cleaning agents. ChemCeed’s value proposition centered on reliable logistics, regulatory compliance, and custom packaging formats, appealing particularly to niche industrial users and mid-scale manufacturers.

Cristalco SAS, a European-based supplier, played a vital role in the production of alcohol derived from sugar beet and grains. With a focus on sustainable practices and high-purity ethanol, Cristalco catered to the beverage, pharmaceutical, and cosmetics industries across Europe.

Top Key Players in the Market

- ADM

- Cargill Inc.

- ChemCeed LLC

- Cristalco SAS

- Diageo plc

- Glacial Grain Spirits LLC

- Grain Processing Corporation

- Greenfield Global Inc.

- Kweichow Moutai Co. Ltd.

- Manildra Group

- MGP Ingredients

- Pernod Ricard SA

- Roquette Frères SA

- Wilmar International Limited

- Wuliangye Yibin Co.

Recent Developments

- In February 2025, Cargill signed an agreement to acquire the remaining 50% stake in SJC Bioenergia, a Brazilian renewable energy firm. This move gives Cargill full control of the company’s operations, which include processing sugarcane and corn into ethanol, corn oil, distillers’ dried grains, and electricity generation.

- In August 2024, ADM entered a joint venture with Farmers Business Network to launch Gradable, a digital platform aimed at expanding sustainable grain sourcing. This initiative supports regenerative agriculture among corn growers and improves traceability for grain used in ethanol production.

Report Scope

Report Features Description Market Value (2024) USD 13.4 Billion Forecast Revenue (2034) USD 20.2 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Sugarcane, Grains, Fruits, Others), By Type (Ethanol, Polyols), By Functionality (Preservative, Coloring / Flavoring Agent, Coatings, Others), By Application (Beverages, Food, Pharmaceutical and Health care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Cargill Inc., ChemCeed LLC, Cristalco SAS, Diageo plc, Glacial Grain Spirits LLC, Grain Processing Corporation, Greenfield Global Inc., Kweichow Moutai Co. Ltd., Manildra Group, MGP Ingredients, Pernod Ricard SA, Roquette Frères SA, Wilmar International Limited, Wuliangye Yibin Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM

- Cargill Inc.

- ChemCeed LLC

- Cristalco SAS

- Diageo plc

- Glacial Grain Spirits LLC

- Grain Processing Corporation

- Greenfield Global Inc.

- Kweichow Moutai Co. Ltd.

- Manildra Group

- MGP Ingredients

- Pernod Ricard SA

- Roquette Frères SA

- Wilmar International Limited

- Wuliangye Yibin Co.