Global Women’s Health App Market By Type (Fitness & Nutrition, Menstrual Health, Pregnancy Tracking & Postpartum Care, Menopause, Disease Management, Others) By Modality (Smartphone, Tablet, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145923

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

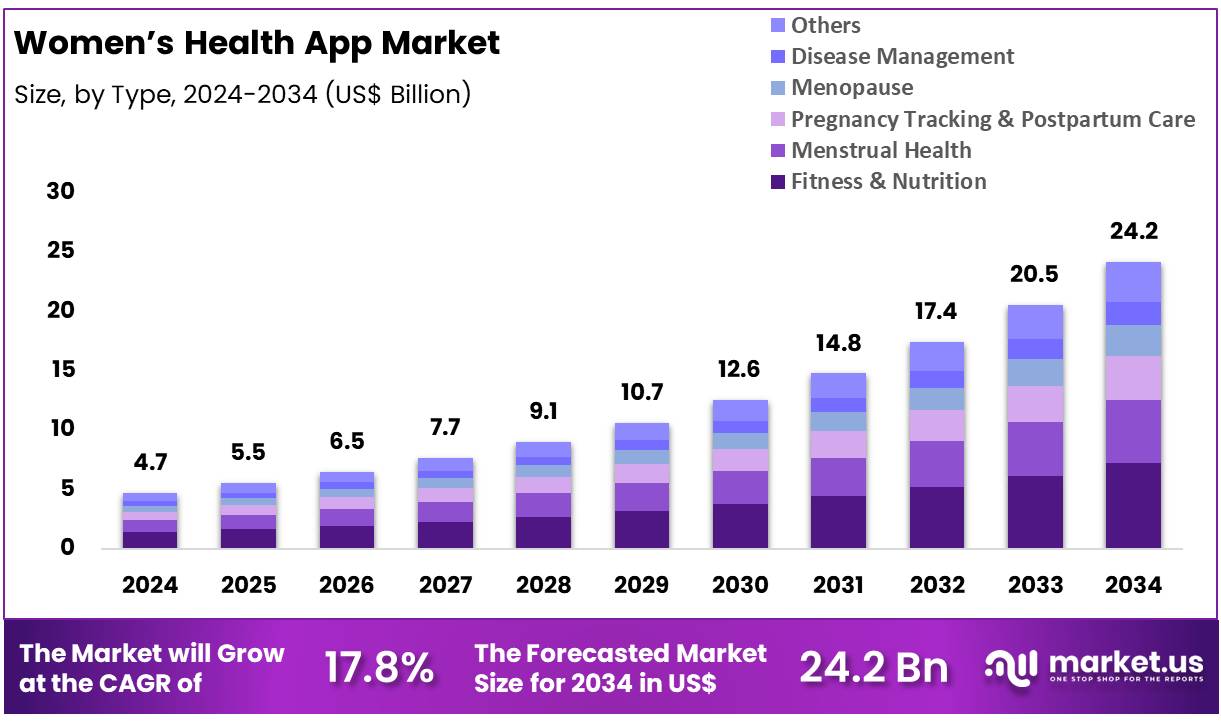

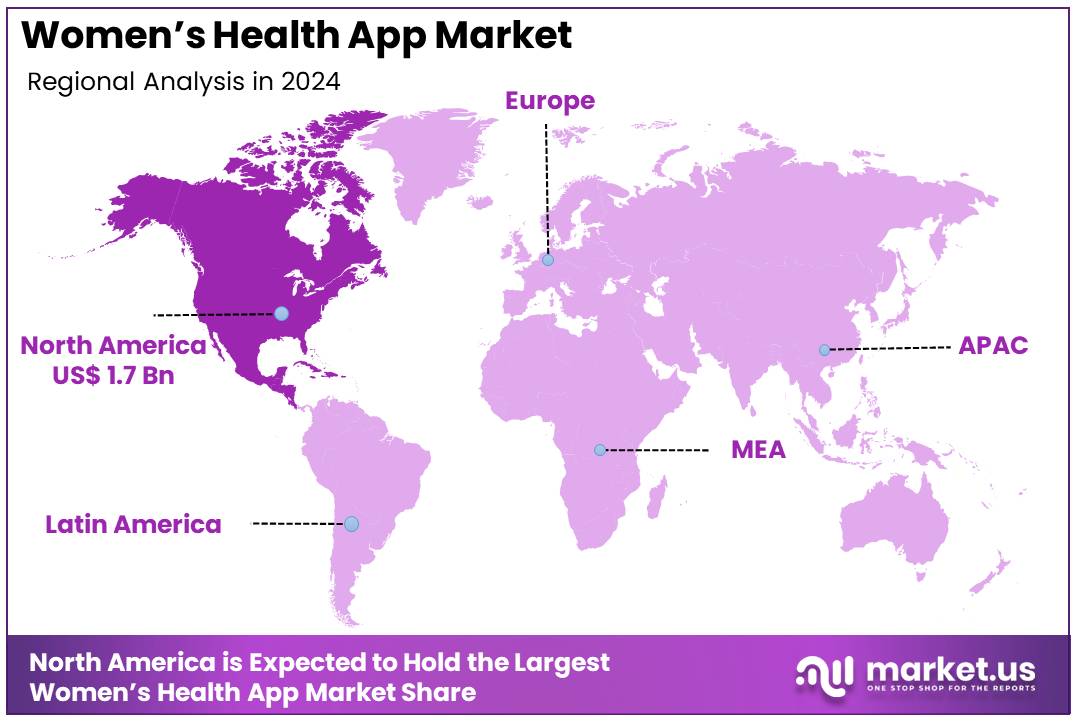

Global Women’s Health App Market size is expected to be worth around US$ 24.2 Billion by 2034 from US$ 4.7 Billion in 2024, growing at a CAGR of 17.8% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 37.2% share with a revenue of US$ 1.7 Billion.

Technological advancements in women’s health are playing a transformative role in addressing the unique and evolving healthcare needs of women worldwide. Women’s health apps have emerged as crucial tools, offering a wide range of features that extend far beyond basic wellness tracking.

These applications now encompass areas such as menstrual health, menopause support, fertility tracking, pregnancy care, mental health, chronic disease management, and even career-life balance through community forums and expert-led guidance.

Among the most promising areas of development is the use of health-focused digital platforms tailored specifically for women. These technologies enhance healthcare accessibility, provide personalized care plans, reduce overall healthcare costs, and improve the quality of care delivered. The integration of artificial intelligence and data analytics allows for more precise health monitoring and early diagnosis of conditions, such as anemia and arthritis, which disproportionately affect women.

Anemia remains a major global health concern, especially among women of reproductive age. According to the World Health Organization (WHO), 29.9% of women aged 15–49 years—nearly half a billion—were affected by anemia in 2023. In response to such needs, Hearst UK launched the Women’s Health UK app in December 2023.

This initiative, developed as part of its Women’s Health Collective membership, delivers expert-led training programs, evidence-based wellness content, and the latest health updates. With contributions from globally recognized health professionals and leading UK writers, the app aims to support women in achieving optimal health and fitness across all life stages.

In addition, the rising incidence of chronic conditions like arthritis among women is driving further innovation in digital health. Preventive health tech is gaining momentum. For instance, the DigiPrevent project, funded in October 2022 with a grant of USD 3.43 million from EIT Health, is focused on developing digital tools to prevent the onset of rheumatoid arthritis. Spearheaded by researchers from Sweden’s Karolinska Institutet, the project exemplifies how early intervention through digital means can help in delaying or even preventing disease onset.

As the landscape of women’s health continues to evolve, the expansion of smart, user-friendly, and scientifically-backed digital solutions will be key to addressing both everyday wellness needs and long-term health conditions. The women’s health app market is expected to witness significant growth, driven by increased health awareness, digital literacy, and a broader global focus on gender-specific healthcare innovation.

Key Takeaways

- Market Size: Global Women’s Health App Market size is expected to be worth around US$ 24.2 Billion by 2034 from US$ 4.7 Billion in 2024.

- Market Growth: The market growing at a CAGR of 17.8% during the forecast period from 2025 to 2034.

- Type Analysis: The Fitness & Nutrition segment emerges as the dominant category, capturing a 30.1% market share.

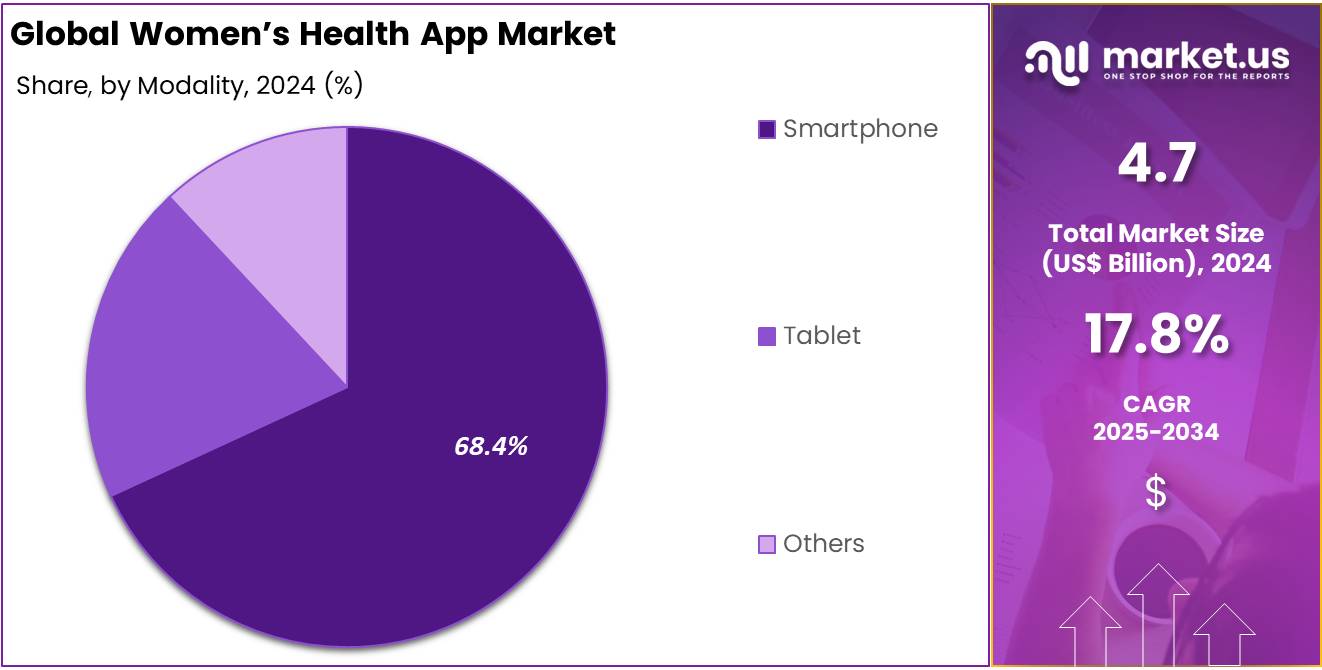

- Modality Analysis: The Smartphone segment dominates the market, commanding a substantial 68.4% share.

- Regional Analysis: In 2024, North America holds a dominant 37.2% share of the global Women’s Health App Market.

Type Analysis

In 2024, the Women’s Health App Market is segmented by type into Menstrual Health, Pregnancy Tracking & Postpartum Care, Menopause, Disease Management, and Others. Among these, the Fitness & Nutrition segment emerges as the dominant category, capturing a 30.1% market share. This growth is primarily driven by the increasing emphasis on preventive healthcare, lifestyle modifications, and wellness-focused digital interventions.

Fitness & Nutrition features are widely integrated across multiple application types. In Menstrual Health apps, personalized exercise routines and dietary recommendations are used to manage premenstrual symptoms and hormonal balance. Pregnancy Tracking & Postpartum Care apps often include nutrition tracking and physical activity guidance tailored to each trimester, supporting both maternal and infant health outcomes.

Within the Menopause segment, fitness and diet play a vital role in managing symptoms such as weight gain, bone density loss, and cardiovascular risks. Disease Management apps targeting chronic conditions like PCOS, endometriosis, and metabolic disorders incorporate wellness strategies to complement medical treatments.

The surge in consumer demand for holistic health solutions, coupled with advancements in app personalization and integration with wearable devices, has reinforced the leadership of the Fitness & Nutrition segment in 2024. Its comprehensive presence across all segments positions it as a key driver of market expansion.

Modality Analysis

In 2024, the Women’s Health App Market is segmented by modality into Smartphone, Tablet, and Others. Among these, the Smartphone segment dominates the market, commanding a substantial 68.4% share. This significant market position is attributed to the widespread penetration of smartphones, increased affordability, and the growing dependence on mobile platforms for managing personal health.

Smartphones enable continuous and convenient access to a wide range of women’s health applications, including those focused on menstrual health, pregnancy tracking, menopause management, disease monitoring, and fitness and nutrition. Enhanced by real-time data tracking, push notifications, and synchronization with wearable devices, smartphones have become the preferred modality for daily health monitoring. Their user-friendly interfaces, app store accessibility, and integration with digital health ecosystems further strengthen their dominance.

The Tablet segment holds a modest share, primarily used in clinical, educational, or home-care contexts where larger screen size supports detailed tracking and patient education. However, its limited portability restricts widespread adoption.

The Others category, which includes smartwatches, desktops, and web-based platforms, is emerging due to advancements in wearable technology and multi-platform integration, though its current share remains comparatively low.

Key Market Segments

By Type

- Fitness & Nutrition

- Menstrual Health

- Pregnancy Tracking & Postpartum Care

- Menopause

- Disease Management

- Others

By Modality

- Smartphone

- Tablet

- Others

Driver

Rising Adoption of mHealth and Wearable Technologies

The proliferation of smartphones and wearable devices has significantly propelled the adoption of mobile health (mHealth) applications among women. These technologies offer convenient, real-time monitoring of various health parameters, including menstrual cycles, pregnancy progression, and fitness levels. The integration of wearable technology with health apps allows for continuous health tracking, fostering proactive health management.This trend aligns with the increasing demand for personalized healthcare solutions, enabling women to make informed decisions about their health. Moreover, the accessibility of these technologies has democratized health information, making it available to a broader demographic. The synergy between mHealth applications and wearable devices is thus a significant driver in the expansion of the women’s health app market.

Trend

Expansion of FemTech and Personalized Health Solutions

The emergence of FemTech—technology designed to address women’s health issues—has led to a surge in applications focusing on personalized health solutions. These apps offer tailored content and features that cater to individual health needs, such as fertility tracking, menopause management, and mental health support. The personalization of health apps enhances user engagement and adherence to health regimens.Furthermore, the integration of artificial intelligence and machine learning algorithms enables these applications to provide predictive insights and customized recommendations. This trend reflects a broader shift towards individualized healthcare, where technology plays a pivotal role in delivering bespoke health solutions.

Restraint

Privacy and Data Security Concerns

Despite the benefits of health applications, concerns regarding data privacy and security pose significant restraints on market growth. Many health apps collect sensitive personal information, raising issues about data protection and user confidentiality.The lack of standardized regulations and oversight in the digital health space exacerbates these concerns, potentially deterring users from adopting such technologies. Ensuring robust data security measures and transparent privacy policies is crucial to building user trust and facilitating the continued growth of the women’s health app market.

Opportunity

Integration of AI for Enhanced Health Insights

The integration of artificial intelligence (AI) into women’s health applications presents a significant opportunity for market expansion. AI algorithms can analyze vast amounts of health data to provide personalized insights, predictive analytics, and early detection of potential health issues. This technological advancement enables more proactive and preventive healthcare measures, improving health outcomes for women.Moreover, AI-driven applications can offer virtual health assistance, enhancing accessibility to healthcare services, especially in underserved regions. The continued development and integration of AI technologies into health apps are poised to revolutionize women’s healthcare delivery.

Regional Analysis

In 2024, North America holds a dominant 37.2% share of the global Women’s Health App Market. This leadership is attributed to widespread smartphone usage, high digital literacy, and strong healthcare infrastructure. The region benefits from growing awareness around women’s health issues, supported by national campaigns and initiatives from institutions such as the Centers for Disease Control and Prevention (CDC) and Office on Women’s Health (OWH).

Additionally, favorable regulatory frameworks and the rapid adoption of telehealth solutions have contributed to increased usage of mobile health applications. Investments in FemTech startups and collaborations with healthcare providers have further accelerated market penetration. The U.S. and Canada remain key contributors, emphasizing preventive care and personalized health management through digital platforms.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Key players in the Women’s Health App Market are focusing on enhancing user engagement through personalized health tracking, AI-based recommendations, and integration with wearable devices. These companies are continuously investing in product innovation, including features for menstrual health, fertility tracking, pregnancy care, and menopausal support. Strategic collaborations with healthcare providers, digital platforms, and pharmaceutical companies are strengthening their market presence.

Additionally, emphasis is being placed on data privacy, regulatory compliance, and evidence-based content to build trust among users. Many are expanding their reach through multilingual support and geographical localization to address the needs of diverse populations. The competitive landscape is marked by a focus on user-centric design, clinical validation, and interoperability with electronic health records (EHRs).

Market Key Players

- Flo Health, Inc.

- Clue

- Glow, Inc.

- Withings

- Google, Inc

- Fitbit, Inc.

- Natural Cycles USA Corp

- Apple Inc.

- Wildflower Health

- HelloBaby, Inc.

- Ovia Health

- Tia

- LactApp

Recent Developments

- Flo Health, Inc: In July 2024, Flo Health secured over $200 million in a Series C funding round led by General Atlantic, elevating its valuation beyond $1 billion and achieving unicorn status. This investment aims to enhance product development and expand into new health verticals.

- Clue: In September 2024, Clue announced a $7 million investment from Union Square Ventures and Mosaic Ventures. The funding is intended to launch new product features, accelerate growth, and develop in new markets.

- Glow, Inc: In March 2025, Glow merged with Asia Genomics to extend services supporting women from adolescence through menopause, targeting expansion in Southeast Asia, Australia, and New Zealand.

- Withings: In January 2024, Withings announced BeamO, a 4-in-1 health checkup device capable of measuring body temperature, heart, and lung health in under a minute. This innovation aims to enhance at-home health monitoring.

- Fitbit, Inc: In July 2024, Emagine Solutions Technology integrated with Fitbit, allowing pregnant users of Emagine’s The Journey Pregnancy App to monitor their maternal health via Fitbit devices. This collaboration enhances maternal health tracking capabilities.

Report Scope

Report Features Description Market Value (2024) US$ 4.7 Billion Forecast Revenue (2034) US$ 24.2 Billion CAGR (2025-2034) 17.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fitness & Nutrition, Menstrual Health, Pregnancy Tracking & Postpartum Care, Menopause, Disease Management, Others) By Modality (Smartphone, Tablet, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Flo Health, Inc., Clue, Glow, Inc., Withings, Google, Inc, Fitbit, Inc., Natural Cycles USA Corp, Apple Inc., Wildflower Health, HelloBaby, Inc., Ovia Health, Tia, LactApp Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Women’s Health App MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Women’s Health App MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Flo Health, Inc.

- Clue

- Glow, Inc.

- Withings

- Google, Inc

- Fitbit, Inc.

- Natural Cycles USA Corp

- Apple Inc.

- Wildflower Health

- HelloBaby, Inc.

- Ovia Health

- Tia

- LactApp