Global eClinical Solutions Market By Product Type (Cloud-based, Licensed Enterprise, and Web-hosted), By Application (Clinical Trial Management System, Randomization and Trial Supply Management, Electronic Trial Master Files, Electronic Data Capture, Electronic Clinical Outcome Assessment, Clinical Data Management System, and Others), By Development Phase (Phase III, Phase IV, Phase II, and Phase I), By End-User (CROs, Pharma & Biotech Organizations, Medical Device Manufacturers, and Hospitals & Academic Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 100469

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

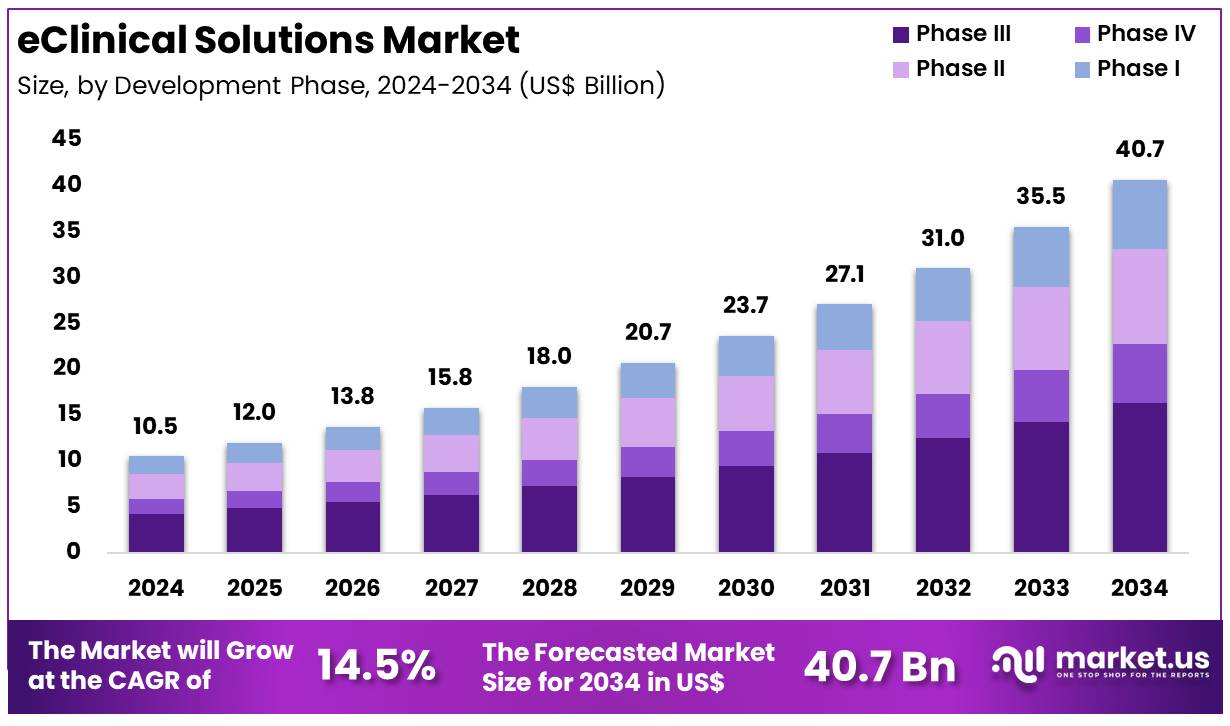

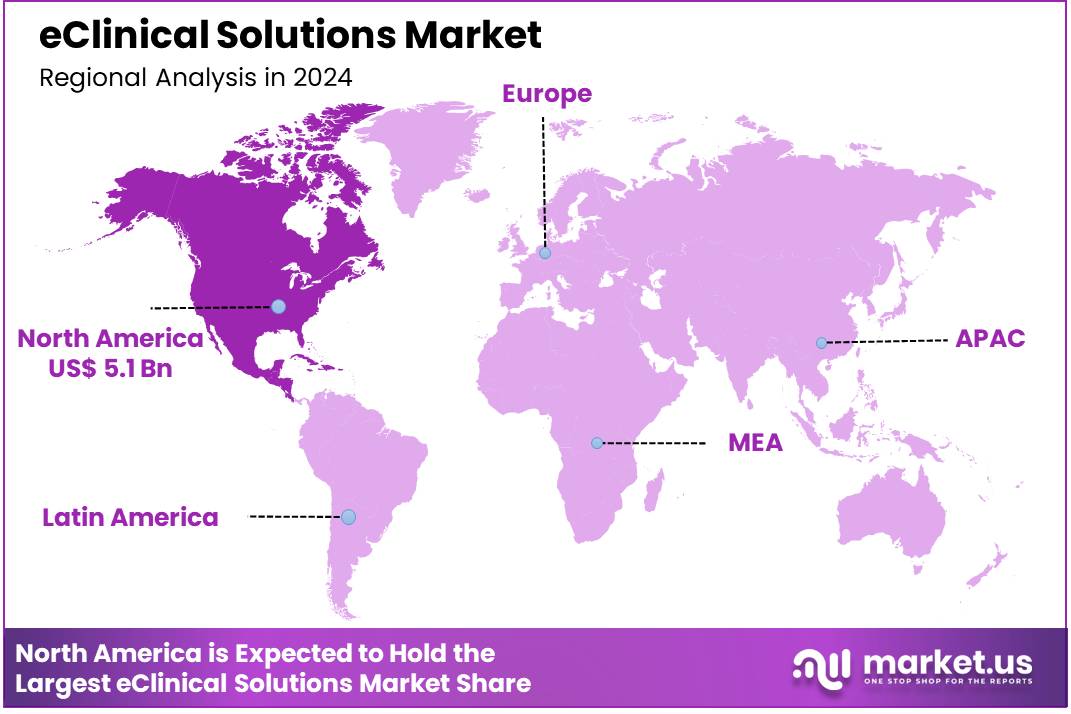

Global EClinical Solutions Market size is expected to be worth around US$ 40.7 Billion by 2034 from US$ 10.5 Billion in 2024, growing at a CAGR of 14.5% during the forecast period 2025 to 2034. North America led the market, achieving over 48.9% share with a revenue of US$ 5.1 Billion.

Increasing complexity in clinical trials and the growing need for data integration and real-time monitoring are driving the expansion of the eClinical solutions market. eClinical solutions streamline various aspects of clinical trials, including data management, patient recruitment, site monitoring, and regulatory compliance. These solutions improve operational efficiency, reduce costs, and enhance the overall quality of trials by providing a comprehensive platform for managing large volumes of clinical data.

The rise in personalized medicine and the increasing focus on rare disease research require more advanced, adaptable clinical trial solutions to handle specialized study designs. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into eClinical solutions has enhanced data analysis, predictive modeling, and decision-making, creating new opportunities for clinical trial sponsors and contract research organizations (CROs). Recent trends show an increasing shift toward cloud-based platforms, which provide scalable, secure, and cost-effective solutions for managing global trials.

In November 2024, RealTime eClinical Solutions expanded its Professional Services to assist clinical research sites, academic medical centers, sponsors, and CROs in fully utilizing its extensive eClinical suite for enhanced research outcomes. This move highlights the growing demand for tailored, comprehensive services that optimize the use of eClinical solutions.

Furthermore, eClinical solutions increasingly support electronic data capture (EDC), clinical trial management systems (CTMS), and electronic patient-reported outcomes (ePRO), improving trial efficiency and regulatory compliance. As the market continues to grow, the demand for end-to-end, integrated eClinical platforms that offer real-time data access and advanced analytics will drive further innovation in the industry.

Key Takeaways

- In 2024, the market for eClinical solutions generated a revenue of US$ 10.5 billion, with a CAGR of 14.5%, and is expected to reach US$ 40.7 billion by the year 2034.

- The product type segment is divided into cloud-based, licensed enterprise, and web-hosted, with cloud-based taking the lead in 2023 with a market share of 58.2%.

- Considering application, the market is divided into clinical trial management system, randomization and trial supply management, electronic trial master files, electronic data capture, electronic clinical outcome assessment, and clinical data management system. Among these, clinical trial management system held a significant share of 39.5%.

- Furthermore, concerning the development phase segment, the market is segregated into phase III, phase IV, phase II, and phase I. The phase III sector stands out as the dominant player, holding the largest revenue share of 40.2% in the eClinical solutions market.

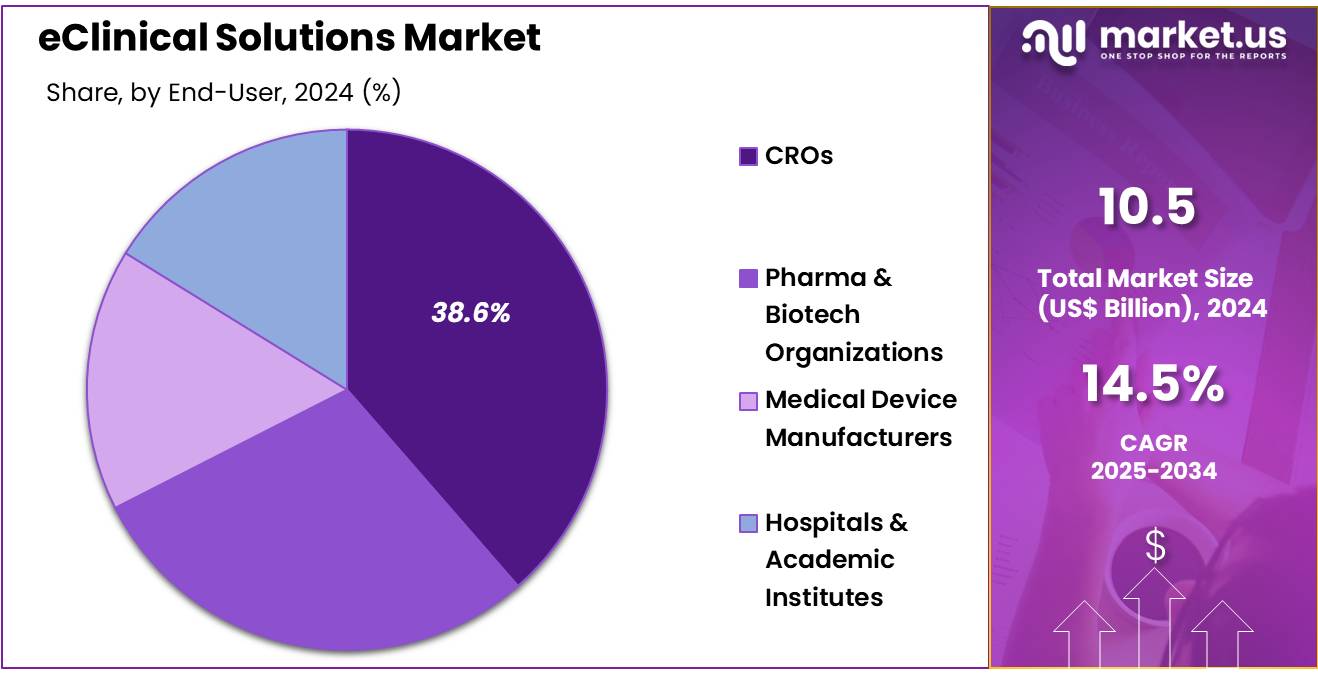

- The end-user segment is segregated into CROs, pharma & biotech organizations, medical device manufacturers, and hospitals & academic institutes, with the CROs segment leading the market, holding a revenue share of 38.6%.

- North America led the market by securing a market share of 48.9% in 2023.

Product Type Analysis

Cloud-based eClinical solutions hold a dominant share of 58.2% in the market. This growth is expected to continue as cloud technology offers scalability, cost-efficiency, and ease of access, making it highly appealing for the clinical trials industry. Healthcare organizations and research institutions are increasingly adopting cloud-based solutions for data management, collaboration, and data security. The flexibility of cloud-based platforms allows users to access clinical data remotely, streamlining communication and coordination across different trial locations.

The rising demand for digital solutions in clinical trials, especially in the wake of the COVID-19 pandemic, has further propelled the adoption of cloud-based systems. Furthermore, the ability to integrate cloud-based solutions with other healthcare IT systems, such as electronic health records (EHR) and clinical trial management systems, is anticipated to drive market growth. The growing emphasis on reducing operational costs and improving trial efficiency is likely to support the continued growth of cloud-based eClinical solutions in the coming years.

Application Analysis

The clinical trial management system (CTMS) holds a significant share of 39.5% in the eClinical solutions market. This growth is expected to continue as clinical trial management becomes more complex, requiring software solutions that can track every phase of a trial, from planning to execution and monitoring. CTMS platforms are widely used by contract research organizations (CROs), pharmaceutical companies, and academic institutions to streamline trial workflows, improve data accuracy, and ensure regulatory compliance.

The increasing complexity of clinical trials, combined with the need for real-time data sharing and efficient resource management, is projected to drive the demand for CTMS solutions. Additionally, the integration of CTMS with other eClinical solutions, such as electronic data capture and clinical data management systems, is expected to enhance the overall efficiency of clinical trials. As global clinical trials continue to increase in number, the CTMS segment is anticipated to maintain its dominant position in the market.

Development Phase Analysis

Phase III trials represent a dominant share of 40.2% in the eClinical solutions market. This phase is critical as it involves large-scale testing of drugs or therapies to assess their effectiveness and safety, leading to regulatory approval. The increasing number of new drugs and therapies undergoing phase III trials is expected to drive the demand for eClinical solutions that can efficiently manage trial data, monitor patient progress, and ensure compliance with regulations.

As pharmaceutical companies and CROs strive to accelerate time-to-market for new treatments, the need for advanced solutions to manage large datasets, track patient outcomes, and streamline communication is projected to grow significantly. Additionally, the growing emphasis on precision medicine, which requires more complex trials and detailed data analysis, is likely to drive further adoption of eClinical solutions in phase III trials. The market for eClinical solutions in phase III trials is anticipated to grow as the demand for faster and more accurate trials increases globally.

End-User Analysis

Contract research organizations (CROs) dominate the end-user segment, holding 38.6% of the market share. This growth is expected to continue as pharmaceutical and biotechnology companies increasingly outsource clinical trial operations to CROs to reduce costs, accelerate trial timelines, and access specialized expertise. CROs are particularly well-positioned to benefit from the adoption of eClinical solutions as they require efficient systems for managing clinical trial data, patient recruitment, regulatory compliance, and trial monitoring.

As clinical trials become more globalized, CROs are expected to rely heavily on eClinical solutions to manage trials across multiple countries and jurisdictions. Additionally, the increasing trend of personalized medicine, which requires more precise and data-intensive trials, is likely to drive further adoption of eClinical technologies. As the need for high-quality clinical trials continues to rise, CROs are projected to remain key drivers in the eClinical solutions market.

Key Market Segments

By Product Type

- Cloud-based

- Licensed Enterprise

- Web-hosted

By Application

- Clinical Trial Management System

- Randomization and Trial Supply Management

- Electronic Trial Master Files

- Electronic Data Capture

- Electronic Clinical Outcome Assessment

- Clinical Data Management System

- Others

By Development Phase

- Phase III

- Phase IV

- Phase II

- Phase I

By End-User

- CROs

- Pharma & Biotech Organizations

- Medical Device Manufacturers

- Hospitals & Academic Institutes

Drivers

Increasing Number and Complexity of Clinical Trials are Driving the Market

The increasing number and growing complexity of clinical trials, particularly for novel treatments in oncology and rare diseases, are significant drivers propelling the eClinical solutions market. Modern clinical trials require the collection and management of vast quantities of data from various sources, including electronic health records, wearable devices, and patient-reported outcomes. Manual processes are inefficient, prone to error, and cannot keep pace with the demands of these complex studies, leading to delays and increased costs. eClinical solutions automate and streamline these workflows, improving data accuracy and accelerating trial timelines.

According to data from ClinicalTrials.gov, a service of the US National Library of Medicine, the number of registered studies has consistently grown. The database reported an increase from 399,474 studies at the end of 2022 to 477,208 at the end of 2023, and a further increase to 520,885 by the end of 2024. This consistent increase in the number of trials globally underscores the sustained demand for robust digital platforms to manage research.

The complexity and high costs associated with manual data management in a growing number of trials compel pharmaceutical companies and Contract Research Organizations (CROs) to adopt eClinical platforms to enhance efficiency and maintain data integrity, thereby driving market expansion.

Restraints

Data Security Concerns and Interoperability Issues are Restraining the Market

Concerns over data security and the persistent challenges of interoperability between disparate systems pose a significant restraint on the eClinical solutions market. These platforms handle highly sensitive patient data, and any breach could lead to severe financial penalties and reputational damage for pharmaceutical companies. The threat of cyberattacks, including ransomware and unauthorized access, is a major barrier to adoption, particularly among smaller organizations that may lack robust cybersecurity infrastructure.

The US Department of Health and Human Services (HHS) Office for Civil Rights (OCR) regularly reports on these breaches, highlighting the vulnerability of the healthcare sector. The HIPAA Journal’s report in January 2025 noted that the number of records exposed in healthcare data breaches has increased dramatically, with 275 million records breached in 2024, a notable increase from the 168 million records breached in 2023 and 57 million in 2022.

This persistent risk makes organizations cautious about transitioning to cloud-based or integrated eClinical systems. Additionally, legacy systems used by many research sites are often incompatible with modern eClinical platforms, creating data silos and integration challenges that hinder the seamless flow of information, thereby slowing down the widespread adoption of comprehensive digital solutions.

Opportunities

Focus on Decentralized Clinical Trials is Creating Growth Opportunities

The growing focus on Decentralized Clinical Trials (DCTs) represents a significant growth opportunity for the eClinical solutions market. DCTs utilize technology to conduct some or all trial-related activities remotely, reducing the need for patients to travel to a physical site. This model improves patient recruitment and retention, especially in therapeutic areas with geographically dispersed patient populations, such as rare diseases. The shift towards DCTs requires a suite of sophisticated eClinical solutions, including electronic consent (eConsent), remote patient monitoring (ePRO), and telemedicine platforms, to facilitate remote data collection and communication. This transformation is driven by regulatory support.

In September 2024, the US Food and Drug Administration (FDA) issued a final guidance document on conducting clinical trials with decentralized elements, providing clarity and recommendations for the industry. This guidance, which encourages the use of remote tools and technologies, validates the DCT model and gives sponsors the confidence to invest in the necessary eClinical infrastructure. As a result, the demand for integrated platforms that can seamlessly manage both site-based and remote data is creating a new wave of growth, enabling more patient-centric and efficient clinical research.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic shifts, including persistent inflation and varying levels of R&D investment, influence the eClinical solutions market by affecting the operational costs of technology providers and the capital expenditure budgets of pharmaceutical companies. The development and maintenance of sophisticated eClinical platforms require significant investment in specialized labor, cloud computing infrastructure, and cybersecurity, all of which are susceptible to inflationary pressures.

This can increase the cost of doing business for software vendors. However, a significant driver of this market is the pharmaceutical industry’s need to control escalating clinical trial costs and accelerate time-to-market. A June 2025 report from the World Health Organization noted that, after a temporary decline, global health spending is on a path to reach US$10.6 trillion by 2027, indicating sustained long-term investment.

This stable financial environment, combined with the pressing need for efficiency gains, creates a strong incentive for pharmaceutical companies to invest in eClinical solutions as a strategic tool to improve productivity and mitigate the impact of rising R&D expenses. The demand for solutions that can reduce overall trial costs by improving efficiency and data quality drives market resilience even in periods of economic volatility.

Evolving US trade policies, including the implementation of tariffs on technology imports, are shaping the eClinical solutions market by influencing the costs of essential hardware and cloud computing infrastructure. While eClinical solutions are primarily software, they rely on a robust digital foundation, including servers and networking equipment, many of which are manufactured internationally. Tariffs on these components can increase the operational costs for both software developers and the data centers that host cloud-based eClinical platforms.

For example, a report in April 2025 noted that the costs for data center construction have risen, partly due to higher prices on materials like steel, aluminum, and electrical components, which are subject to tariffs. This rise in input costs may lead to higher prices for eClinical services, potentially impacting the budgets of clinical trial sponsors. Conversely, these trade dynamics are also compelling companies to diversify their supply chains and explore domestic or nearshore manufacturing.

This shift fosters a more resilient and secure technology ecosystem. The need for compliant and secure data handling for patient information encourages providers to invest in platforms that are not only efficient but also resilient to geopolitical risks, ultimately strengthening the market in the long term.

Latest Trends

Integration of AI and Machine Learning for Trial Operations is a Recent Trend

A prominent trend in the eClinical solutions market in 2024 and 2025 is the rapid integration of artificial intelligence (AI) and machine learning (ML) to optimize various aspects of clinical trial operations. AI is no longer a theoretical concept but is being actively deployed to address real-world challenges, such as patient recruitment, site selection, and data analysis. These advanced technologies can analyze vast datasets to identify suitable patients more efficiently, predict which clinical sites will be the most effective, and automate a number of administrative tasks, reducing manual effort and accelerating trial timelines.

For example, AI-driven solutions are being used to automate the extraction of key information from clinical trial protocols to populate other systems, reducing data entry errors and speeding up study planning. According to a DIA Global Forum article published in January 2025, one quarter of site respondents and 16% of sponsors/CROs cited staffing issues as a key area needing improvement, with technology-based efficiency being the primary solution.

The implementation of AI helps to mitigate these shortages by automating labor-intensive tasks and allowing staff to focus on more complex, value-added activities. This practical and targeted deployment of AI is moving beyond hype to deliver tangible benefits in efficiency, quality, and performance across the entire clinical trial lifecycle.

Regional Analysis

North America is leading the EClinical Solutions Market

North America dominated the market with the highest revenue share of 48.9% owing to the increasing complexity of clinical trials and the continuous rise in pharmaceutical research and development (R&D) investments across the region. As drug development becomes more intricate, involving specialized patient populations and sophisticated data requirements, pharmaceutical companies and Contract Research Organizations (CROs) increasingly rely on advanced digital platforms for efficient trial management. This includes solutions for electronic data capture (EDC), clinical trial management systems (CTMS), and electronic patient-reported outcomes (ePRO).

The US Food and Drug Administration (FDA) approved 50 new drugs in 2024, a figure that matches the average over the past six years (2018–2023), according to analyses of FDA data, underscoring the consistent demand for robust eClinical tools to bring new therapies to market. Notably, the proportion of biologics among these approvals reached 32% in 2024, compared to a 28% average in previous years, signifying a shift towards more complex molecules that necessitate precise digital oversight.

Major eClinical solution providers have reported substantial financial performance reflecting this demand. Veeva Systems, for instance, a prominent vendor in the life sciences cloud sector, reported total revenues of US$2,363.7 million for its Fiscal Year 2024 (ended January 31, 2024), representing a 10% increase year-over-year. This robust growth showcases the continued investment by North American biopharmaceutical companies in advanced digital infrastructure to streamline their clinical research operations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the region’s burgeoning pharmaceutical and biotechnology industries, increasing R&D activities, and supportive government initiatives aimed at modernizing clinical research infrastructure. Many countries in Asia Pacific, including China, India, Japan, and South Korea, are actively attracting global clinical trials due to their large and diverse patient populations, which can accelerate patient recruitment.

Governments are also implementing policies to streamline regulatory processes and encourage the adoption of digital technologies in healthcare. For example, China’s clinical trial activity rose steadily, peaking at 5,433 trials in 2024, a trend driven by ongoing regulatory reforms and efforts to establish China as a hub for global multicenter studies, which directly fuels the demand for advanced digital solutions.

Dassault Systèmes, the parent company of Medidata, a major eClinical platform provider, reported that its Asia software revenue, representing 26% of total software revenue, increased by 13% in Q2 2022, indicating significant regional momentum for its life sciences segment. This growth highlights the increasing reliance on digital tools for managing complex trials in the region. As countries in Asia Pacific continue to enhance their clinical research capabilities and integrate digital health strategies, the adoption of sophisticated platforms to optimize trial conduct, ensure data quality, and accelerate drug development is likely to intensify.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the eClinical solutions market employ various strategies to drive growth and enhance clinical trial efficiency. They focus on integrating advanced technologies such as artificial intelligence (AI) and machine learning (ML) to optimize trial design, patient recruitment, and data analysis. Companies also prioritize the development of cloud-based platforms, offering scalability, real-time data access, and seamless interoperability with existing electronic health record (EHR) systems.

Strategic partnerships with healthcare providers, research institutions, and technology firms enable these companies to expand their market reach and enhance service offerings. Additionally, they invest in user-friendly interfaces and mobile applications to improve accessibility and user experience. Geographical expansion, particularly in emerging markets, further contributes to their growth trajectory.

One key player, Medidata Solutions, is a global provider of cloud-based solutions for clinical trials. Headquartered in New York, Medidata offers a comprehensive suite of services, including electronic data capture (EDC), clinical trial management systems (CTMS), and analytics platforms. The company focuses on leveraging AI and ML to enhance data-driven decision-making and streamline clinical trial processes. Medidata’s commitment to innovation and collaboration with industry leaders positions it as a significant player in the eClinical solutions market.

Top Key Players

- RealTime eClinical Solutions

- Parexel International Corporation

- Oracle

- ICON plc

- ERT Clinical

- Dassault Systemes

- CRF Health

- Bioclinica

Recent Developments

- In June 2023, ICON plc launched the newest version of its Digital Platform, designed to streamline the integration of site, sponsor, and patient services while ensuring efficient data delivery. This platform is customizable to support various therapeutic areas and study designs, providing comprehensive solutions for clinical trial patient services, including a mobile app, direct data capture for home-based services, eCOA, telehealth consultations, eConsent, and management of digital health technologies.

- In May 2023, eClinical Solutions LLC expanded its machine learning (ML) and artificial intelligence (AI) capabilities within its elluminate IQ platform. These advancements enable data management teams to conduct more efficient and scalable data reviews.

Report Scope

Report Features Description Market Value (2024) US$ 10.5 Billion Forecast Revenue (2034) US$ 40.7 Billion CAGR (2025-2034) 14.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cloud-based, Licensed Enterprise, and Web-hosted), By Application (Clinical Trial Management System, Randomization and Trial Supply Management, Electronic Trial Master Files, Electronic Data Capture, Electronic Clinical Outcome Assessment, Clinical Data Management System, and Others), By Development Phase (Phase III, Phase IV, Phase II, and Phase I), By End-User (CROs, Pharma & Biotech Organizations, Medical Device Manufacturers, and Hospitals & Academic Institutes) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape RealTime eClinical Solutions, Parexel International Corporation, Oracle, ICON plc, ERT Clinical, Dassault Systemes, CRF Health, Bioclinica. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  eClinical Solutions MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

eClinical Solutions MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- RealTime eClinical Solutions

- Parexel International Corporation

- Oracle

- ICON plc

- ERT Clinical

- Dassault Systemes

- CRF Health

- Bioclinica