Global Clinical Biomarker Testing Market By Services (Biomarker Assay Development & Validation, Flow Cytometry and Others) By Applications (Drug Discovery, Nutrigenomics, Toxicology Testing, Personalized Medicine and Functional Genomics) By Disease Types (Cancer, Metabolism, Infectious Disease, Cardiology, Neurology and Immunological Disease) By End-user (Pharmaceutical and Biotechnology Companies, Diagnostic Tool Companies, Healthcare IT/Big Data Companies, Clinical Laboratories, Academic and Research Institutes and CROS) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 84784

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Маrkеt Overview

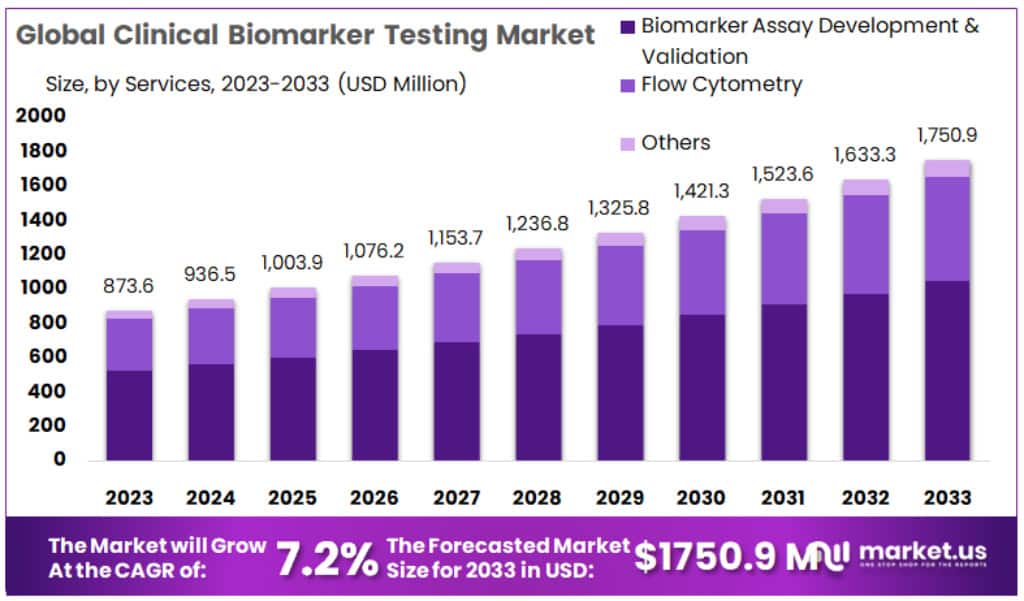

The Global Clinical Biomarker Testing Market size is expected to be worth around USD 1750.9 Million by 2033 from USD 873.6 Million in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

Clinical biomarker testing is a lab test that evaluates whether blood protein levels are too low, too high, or in a normal range. Biomarkers can be used to diagnose and monitor patients with diseases such as cancer and heart disease. The tests measure substances in the blood that may be elevated or decreased when an illness has been detected.

Clinical biomarker testing is often used to help diagnose diseases. More than just identifying the presence of a condition, biomarker tests can also provide information on the severity and progression of a disease.

Key Takeaways

- Market Size: Clinical Biomarker Testing Market size is expected to be worth around USD 1750.9 Million by 2033 from USD 873.6 Million in 2023

- Market Growth: The market growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

- Services Analysis: Biomarker Assay Development & Validation held a dominant market position, capturing more than a 59.5% share in 2023.

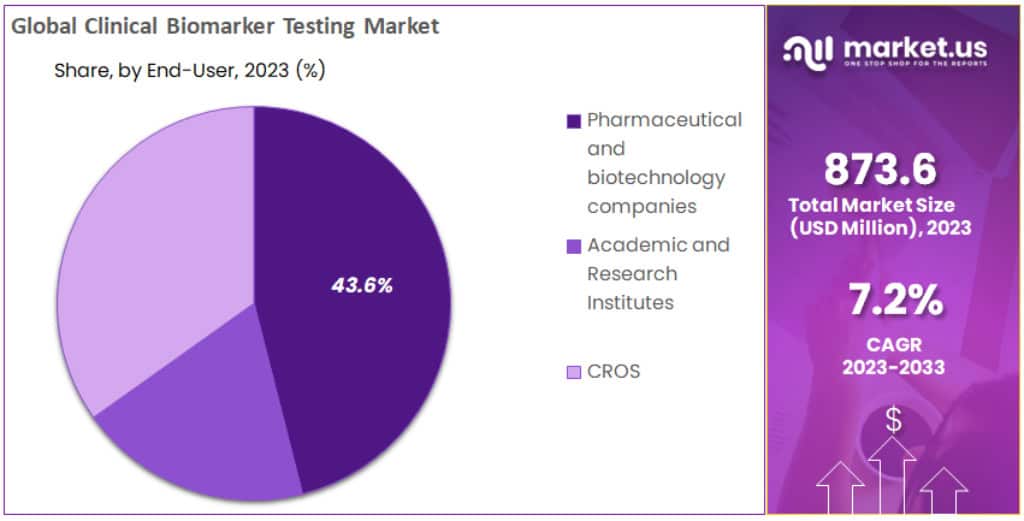

- End-Use Analysis: pharmaceutical and biotechnology companies held a dominant market position, capturing more than a 43.6% share in 2023

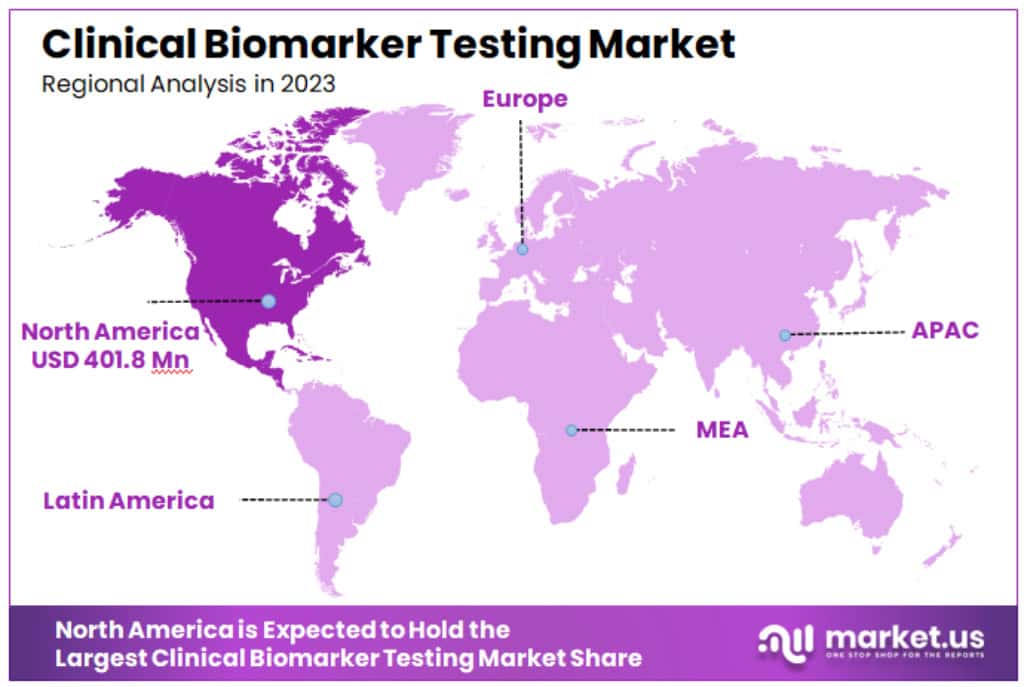

- Regional Analysis: North America: Dominating the market, North America holds a commanding 46% share, translating to a value of USD 401.8 million in 2023.

- Technological Advancements: Advances in genomics, proteomics, and bioinformatics are driving improvements in biomarker discovery and validation, enhancing the accuracy and efficiency of tests.

- High Investment in R&D: Significant investments are being made in research and development to identify new biomarkers and develop reliable, cost-effective testing methods.

- Partnerships and Collaborations: Strategic collaborations between pharmaceutical companies, biotech firms, and diagnostic laboratories are crucial for advancing biomarker research and clinical applications.

- Market Barriers: Despite rapid growth, barriers such as high costs associated with biomarker development and testing, and the need for high specificity and sensitivity in tests, remain challenges.

Services Analysis

In 2023, Biomarker Assay Development & Validation held a dominant market position, capturing more than a 59.5% share. This segment plays a crucial role in clinical biomarker testing by focusing on the development and validation of specific biomarker assays. These assays are essential for accurately detecting and measuring biomarkers in clinical samples, aiding in disease diagnosis and monitoring.

Flow Cytometry is another significant service segment in the Clinical Biomarker Testing Market. It offers a valuable tool for analyzing and quantifying biomarkers at the cellular level. Flow cytometry allows for the identification of specific biomarkers on individual cells, making it particularly useful in fields like immunology and oncology.

Other services in the market also contribute to the overall landscape of clinical biomarker testing. These services encompass various techniques and methodologies that support biomarker analysis, including molecular diagnostics, immunoassays, and mass spectrometry, among others. These services cater to specific research and diagnostic needs, further diversifying the clinical biomarker testing market.

End-user Analysis

In 2023, the clinical biomarker testing market was significantly influenced by its diverse end-user segments. Leading the way, pharmaceutical and biotechnology companies held a dominant market position, capturing more than a 43.6% share. This segment’s strong performance is attributed to the increasing investment in drug development and personalized medicine, where biomarkers play a pivotal role in tailoring treatments to individual patient needs.

Diagnostic tool companies also made a substantial impact on the market. These companies are at the forefront of developing innovative diagnostic kits and platforms, which are crucial for the effective detection and monitoring of various diseases. Their contribution is particularly notable in the areas of cancer, cardiovascular diseases, and infectious diseases, where early and accurate diagnosis is key.

Healthcare IT/Big Data companies are another key segment, leveraging the power of data analytics and artificial intelligence to revolutionize biomarker testing. They offer solutions that enhance the precision and efficiency of biomarker analysis, thereby supporting better decision-making in clinical settings.

Clinical laboratories have also seen significant growth, driven by the expanding demand for advanced diagnostic services. They provide essential testing services that aid in the early detection, diagnosis, and monitoring of diseases, making them a crucial component of the healthcare system.

Academic and research institutes play a vital role in the advancement of biomarker testing technologies. These institutions are the breeding ground for innovative research and discoveries in the field of biomarkers, contributing to the development of new diagnostic methods and therapeutic strategies.

Lastly, Contract Research Organizations (CROs) are instrumental in facilitating clinical trials and research projects that involve biomarker testing. They provide specialized services that help pharmaceutical and biotech companies to efficiently conduct studies, contributing to the overall growth of the clinical biomarker testing market.

Key Market Segments

Based on Services

- Biomarker Assay Development & Validation

- Flow Cytometry

- Others

Based on Disease Types

- Cancer

- Metabolism

- Infectious Disease

- Cardiology

- Neurology

- Immunological Disease

Based on Applications

- Drug Discovery

- Nutrigenomics

- Toxicology Testing

- Personalized Medicine

- Functional Genomics

Based on End-Users

- Pharmaceutical and biotechnology companies

- Diagnostic Tool Companies

- Healthcare IT/Big Data Companies

- Clinical Laboratories

- Academic and Research Institutes

- CROS

Drivers

- Cancer Burden: Biomarkers are crucial in the fight against cancer. They aid in early detection, precise diagnosis, and monitoring, which is key when the disease is more treatable. Blood tests and liquid biopsies are examples of biomarker-based screenings that detect specific cancer-related biomarkers. Biomarkers also predict a patient’s response to treatments like targeted drugs or immunotherapies.

- Investment in Biomarker Research: There’s a growing investment in biomarker research, driven by scientific advancements and a deeper understanding of their potential. This investment, from pharmaceuticals to research institutes, is fueling innovations in early detection, accurate diagnosis, and efficient treatment, spurring market growth.

- Advancements in Genomics and Proteomics: Progress in genomics and proteomics has enhanced our understanding of disease mechanisms and the identification of clinically significant biomarkers. Technologies like next-generation sequencing (NGS) enable rapid and cost-effective genome sequencing, leading to the discovery of new potential biomarkers.

- Demand for Personalized Medicine: Biomarkers are becoming increasingly important in personalized medicine. They help in selecting appropriate treatments and dosages, and predicting therapeutic responses. This trend towards personalized treatment is driving market growth.

Opportunities

- Biomarkers in Clinical Trials: The use of biomarkers in clinical trials is growing, changing how research is conducted. They provide valuable insights into disease biology and patient response to treatments, which is crucial for pharmaceutical companies to develop new drugs efficiently and cost-effectively.

- Point-of-Care Testing (POCT) Demand: Biomarkers are key in POCT, providing rapid and convenient diagnostics. The integration of biomarkers in portable devices or rapid diagnostic kits offers immediate results, presenting a significant opportunity for market expansion.

Restraints

- Complexity and Variability: Biomarkers’ complexity and variability pose challenges in development, validation, and clinical application. Each biomarker type requires specific detection methods and handling procedures, adding to the complexity.

- Regulatory Framework: Biomarker-based diagnostics often need regulatory approval, which varies depending on their intended use. The FDA in the U.S., along with other international bodies, oversees this process, which can be lengthy and intricate.

Challenges

- Reimbursement for Tests: Getting reimbursement coverage for biomarker tests is challenging. It requires evidence of clinical value and cost-effectiveness, which can be time-consuming and expensive to gather, especially for new biomarkers.

- Cost of Biomarker Discovery: Discovering a biomarker can be costly, depending on the study’s scope, disease complexity, and available resources. Establishing and maintaining the necessary research infrastructure involves significant financial investments.

Market Trends

- The global biomarker testing services market, valued at USD 1750.9 Million in 2023, is projected to grow at a CAGR of 7.2% from 2023 to 2033. This growth is attributed to the increasing demand for clinical biomarker testing in various applications like drug discovery, nutrigenomics, and personalized medicine. The market’s expansion is bolstered by new discoveries and technological advancements in biomarker research. With ongoing R&D leading to novel biomarkers and their growing application in clinical studies, the market is poised for substantial growth in the coming years.

Regional Analysis

North America: Dominating the market, North America holds a commanding 46% share, translating to a value of USD 401.8 million in 2023. This dominance is fueled by the presence of major market players, cutting-edge healthcare infrastructure, and heightened awareness about the importance of biomarker testing. However, the region’s stringent regulatory environment, while ensuring test quality and reliability, can pose entry barriers for new entrants.

Europe: Europe stands as the second-largest market, buoyed by a growing awareness of biomarker testing, strong economies in Western Europe, and supportive government initiatives in Eastern Europe. The European market is characterized by regional disparities, with Western Europe leading in market maturity, while Eastern Europe is rapidly catching up. One of the challenges in Europe is the diversity of reimbursement policies across different countries, which can create a fragmented market landscape.

Asia Pacific: This region is poised for the most rapid growth. With a large and growing population, rising disposable incomes, and an increasing prevalence of chronic diseases, the Asia Pacific market is expanding swiftly. The market value for Asia Pacific stands at USD 156.6 million. India and China, with their supportive governmental policies, are spearheading the development and research in biomarkers. However, the region faces challenges like limited access to advanced healthcare facilities and skilled professionals in some areas.

Key Regions

- North America

-

- The US

- Canada

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Mexico

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Market Key Players

- Abbott Laboratories

- Bio Agilytix Labs

- Eurofins Scientific

- SGS SA

- Charles River Laboratories

- Labcorp Drug Development

- Thermo Fisher Scientific Inc. (PPD, Inc.)

- ICON Plc

- IQVIA

- Syneos Health

- Intertek Group Plc

- Adaptive Biotechnologies

- Becton Dickinson

- Bio-Rad Laboratories

- Agilent Technologies

- Hologic

- Merck and Co.

- Danaher Corporation

- AbbVie Inc.

- Others.

Recent Developments

Technological Advancements

- October 2023: Agilent Technologies released a new system called Bravo, which helps test a lot of samples quickly for biomarker analysis in clinical trials. This is especially helpful for studies that need to test many samples at once.

- November 2023: Bio-Rad Laboratories introduced a new tool, the QXD, which can test for different disease markers at the same time. This makes it easier and more accurate to detect various diseases.

- October 2023: Adaptive Biotechnologies and Illumina teamed up to work on a new way to test for minimal residual disease (MRD) in cancer patients using next-generation sequencing (NGS). This could lead to better tracking and treatment of cancer.

Regulatory Approvals & Reimbursements

- November 2023: The US FDA approved a new test by Roche, the AVENIO ctDNA, for checking minimal residual disease in breast cancer patients. This is a big step in using liquid biopsies to guide treatment.

- October 2023: The European Medicines Agency said yes to Thermo Fisher Scientific’s Oncomine Dx TargetRNA assay. This test helps understand the genes in cancer, which can guide personalized treatment.

- November 2023: China’s health authorities decided to cover more costs for liquid biopsy cancer tests. This means more people in the Asia Pacific region can access these tests.

Mergers and Acquisitions

- October 2023: Charles River Laboratories bought BioAgilytix Labs, which makes them stronger in lab testing and developing new biomarker tests.

- November 2023: Danaher Corporation bought Syneos Health for $9.6 billion. They plan to be a top company in drug development services with a focus on biomarkers.

Clinical Trials & Research

- October 2023: IQVIA started a big clinical trial to test a new blood marker that might predict Alzheimer’s disease.

- November 2023: A study in Nature Medicine found a new protein marker that could tell if lung cancer treatments are working. This could lead to more personalized treatments for patients.

Report Scope

Report Features Description Market Value (2023) USD 873.6 Million Forecast Revenue (2033) USD 1750.9 Million CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Services (Biomarker Assay Development & Validation, Flow Cytometry and Others) By Applications (Drug Discovery, Nutrigenomics, Toxicology Testing, Personalized Medicine and Functional Genomics) By Disease Types (Cancer, Metabolism, Infectious Disease, Cardiology, Neurology and Immunological Disease) By End-user (Pharmaceutical and Biotechnology Companies, Diagnostic Tool Companies, Healthcare IT/Big Data Companies, Clinical Laboratories, Academic and Research Institutes and CROS) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbott Laboratories, Bio Agilytix Labs, Eurofins Scientific, SGS SA, Charles River Laboratories, Labcorp Drug Development, Thermo Fisher Scientific Inc. (PPD, Inc.), ICON Plc, IQVIA, Syneos Health, Intertek Group Plc, Adaptive Biotechnologies, Becton Dickinson, Bio-Rad Laboratories, Agilent Technologies, Hologic, Merck and Co., Danaher Corporation, AbbVie Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are clinical biomarkers?Clinical biomarkers are biological molecules found in blood, other body fluids, or tissues that indicate a normal or abnormal process, or a condition or disease. They are used in clinical research and patient care to diagnose diseases, predict disease progression, and monitor treatment responses.

How big is the Clinical Biomarker Testing Market?The global Clinical Biomarker Testing Market size was estimated at USD 873.6 Million in 2023 and is expected to reach USD 1750.9 Million in 2033.

What is the Clinical Biomarker Testing Market growth?The global Clinical Biomarker Testing Market is expected to grow at a compound annual growth rate of 7.2%. From 2024 To 2033

Who are the key companies/players in the Clinical Biomarker Testing Market?Some of the key players in the Clinical Biomarker Testing Markets are Abbott Laboratories, Bio Agilytix Labs, Eurofins Scientific, SGS SA, Charles River Laboratories, Labcorp Drug Development, Thermo Fisher Scientific Inc. (PPD, Inc.), ICON Plc, IQVIA, Syneos Health, Intertek Group Plc, Adaptive Biotechnologies, Becton Dickinson, Bio-Rad Laboratories, Agilent Technologies, Hologic, Merck and Co., Danaher Corporation, AbbVie Inc., and Other Key Players.

What is the importance of clinical biomarker testing?Clinical biomarker testing is crucial for early disease detection, diagnosis, and personalized treatment plans. It helps in identifying specific biomarkers associated with diseases, enabling targeted therapies and improving patient outcomes.

Which industries primarily use clinical biomarker testing?The pharmaceutical, biotechnology, and healthcare industries are the primary users of clinical biomarker testing. It is extensively used in drug development, clinical trials, and personalized medicine.

How does clinical biomarker testing impact patient care?Clinical biomarker testing enables personalized treatment plans, improving the efficacy and safety of therapies. It aids in early disease detection, timely intervention, and continuous monitoring, leading to better patient outcomes and reduced healthcare costs.

Clinical Biomarker Testing МаrkеtPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Clinical Biomarker Testing МаrkеtPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Bio Agilytix Labs

- Eurofins Scientific

- SGS SA

- Charles River Laboratories

- Labcorp Drug Development

- Thermo Fisher Scientific Inc. (PPD, Inc.)

- ICON Plc

- IQVIA

- Syneos Health

- Intertek Group Plc

- Adaptive Biotechnologies

- Becton Dickinson

- Bio-Rad Laboratories

- Agilent Technologies

- Hologic

- Merck and Co.

- Danaher Corporation

- AbbVie Inc.

- Others.