Medical Document Management Systems Market By Products (Solutions (Standalone Medical Document Management Solutions (Electronic Document Management Software and Document Scanning Software), Integrated Medical Document Management Solutions), Services (Medical Record Scanning and Management Services, Product Support Services (Training & Education Services, Maintenance, Support, and Optimization Services, and Implementation & Integration Services))), By Applications (Patient Medical Records Management, Patient Billing Documents Management, and Admission & Registration Document Management), By Mode of Delivery (On-Premise, Web-Based, and Cloud-Based), By End-Users (Hospitals & Clinics, Nursing Homes/Assisted Living Facilities/Long-Term Care, Healthcare Payers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144001

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

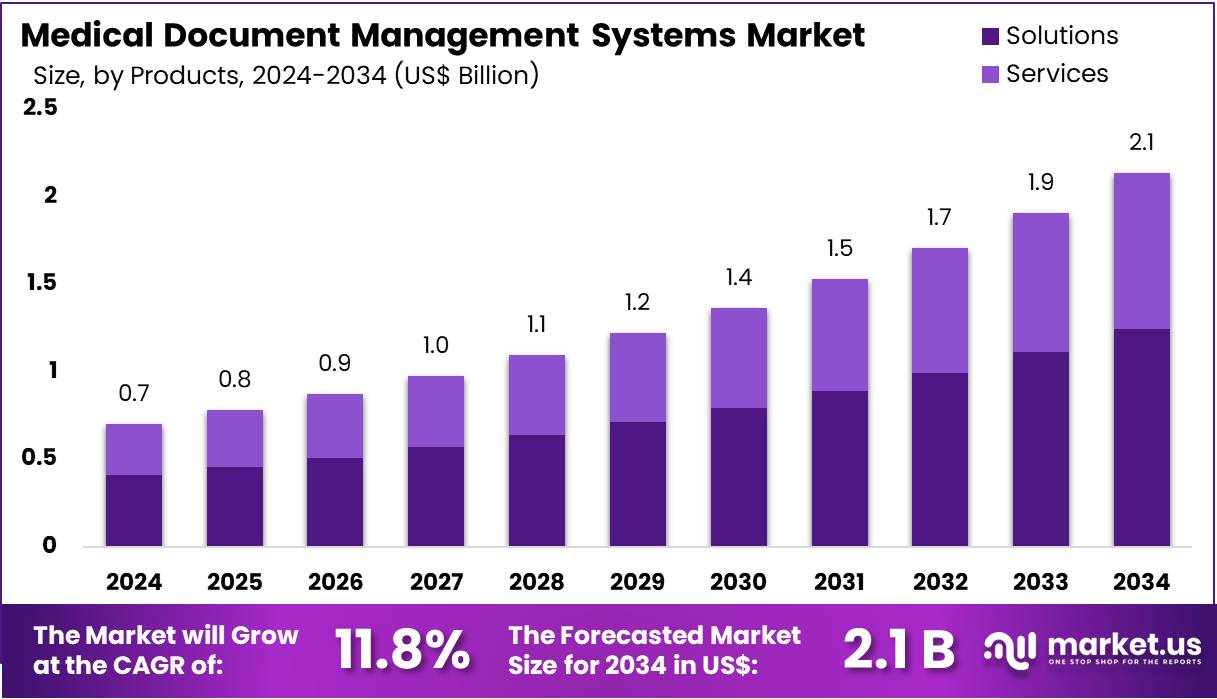

The Global Medical Document Management Systems Market size is expected to be worth around US$ 2.1 Billion by 2034, from US$ 0.7 Billion in 2024, growing at a CAGR of 11.8% during the forecast period from 2025 to 2034.

Increasing reliance on digital solutions in healthcare is driving the growth of the medical document management systems market. These systems are crucial for organizing, storing, and accessing medical documents such as patient records, imaging results, and treatment histories. The demand for streamlined workflows, improved patient care, and compliance with regulations has fueled the adoption of these systems. In April 2023, Microsoft Corporation and Epic Systems Corporation announced a strategic partnership to integrate artificial intelligence into electronic health records (EHR). This collaboration aims to enhance the efficiency of data processing, improve decision-making, and optimize patient care.

The integration of AI into document management systems will enable faster access to accurate information, supporting clinicians in making informed decisions. Furthermore, the increasing shift toward electronic health records, the need for secure data management, and the growing importance of interoperability between healthcare systems present opportunities for growth. As healthcare providers increasingly embrace AI and automation, medical document management systems will continue to evolve, enhancing operational efficiency, and improving patient outcomes.

Key Takeaways

- In 2024, the market for Medical Document Management Systems generated a revenue of US$ 0.7 billion, with a CAGR of 11.8%, and is expected to reach US$ 2.1 billion by the year 2034.

- The products segment is divided into solutions and services, with solutions taking the lead in 2024 with a market share of 58.2%.

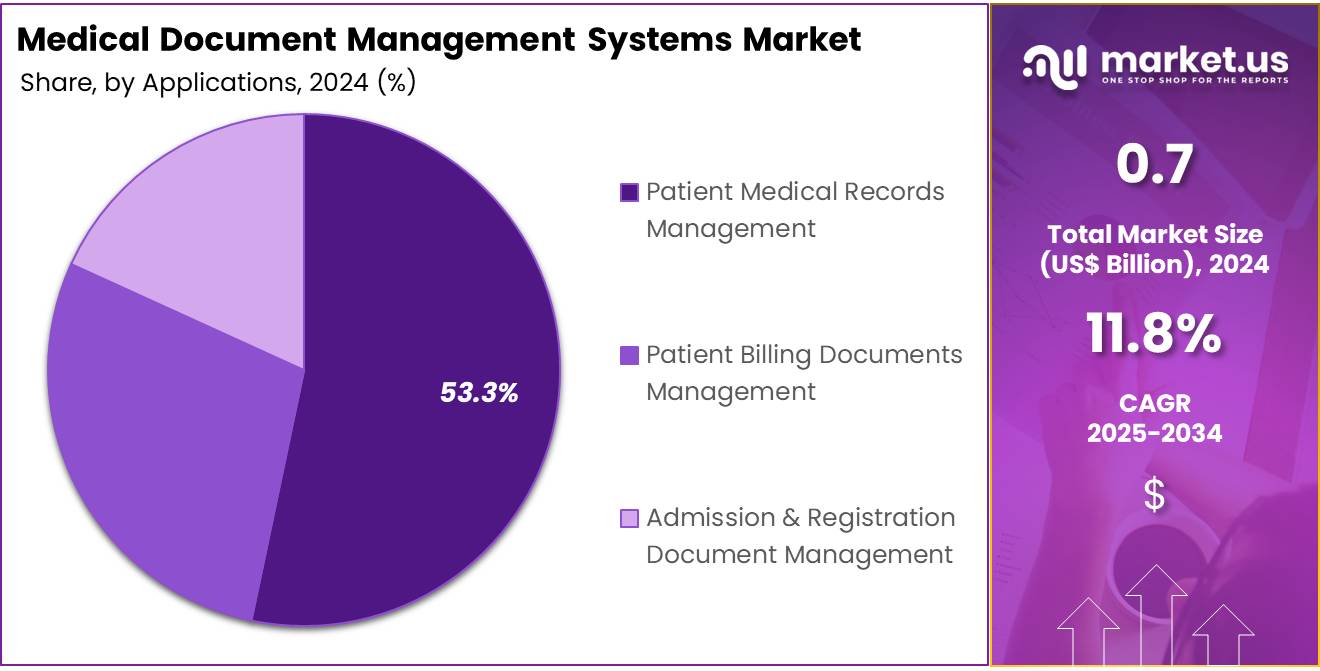

- Considering applications, the market is divided into patient medical records management, patient billing documents management, and admission & registration document management. Among these, patient medical records management held a significant share of 53.3%.

- Furthermore, concerning the mode of delivery segment, the market is segregated into on-premise, web-based, and cloud-based. The cloud-based sector stands out as the dominant player, holding the largest revenue share of 63.5% in the Medical Document Management Systems market.

- The end-users segment is segregated into hospitals & clinics, nursing homes/assisted living facilities/long-term care, healthcare payers, and others, with the hospitals & clinics segment leading the market, holding a revenue share of 52.8%.

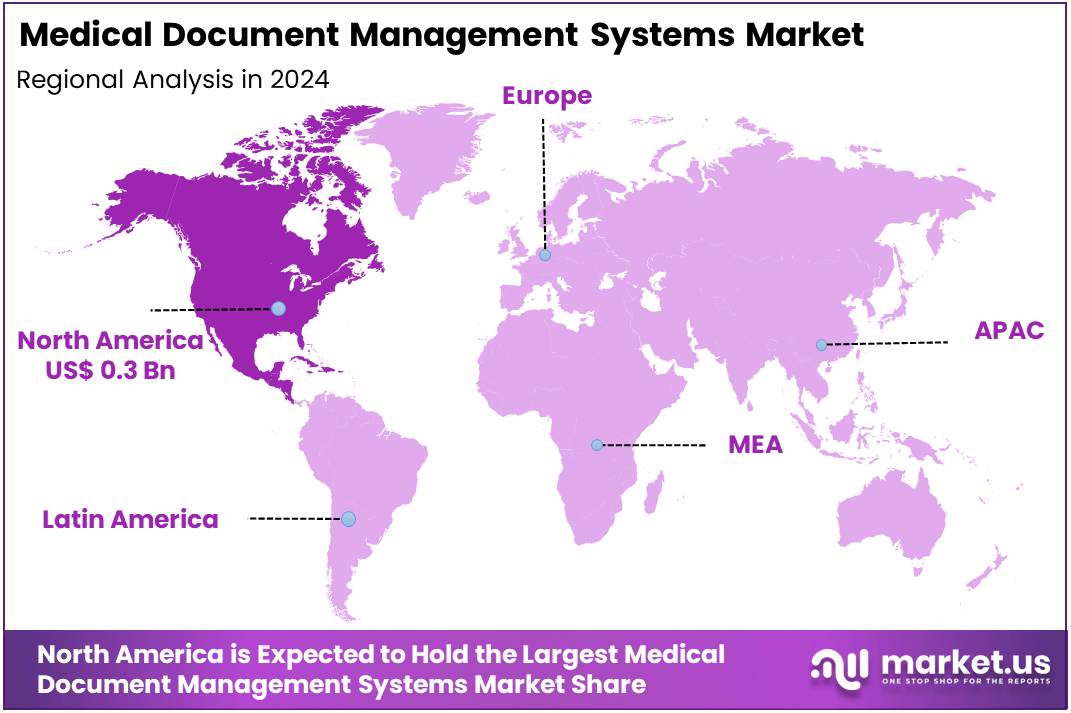

- North America led the market by securing a market share of 44.4% in 2024.

Products Analysis

The solutions segment led in 2024, claiming a market share of 58.2% as healthcare organizations increasingly recognize the need for efficient document handling and storage. Solutions, which include a combination of software and services, help streamline document workflows, reduce human error, and ensure compliance with healthcare regulations.

The rising demand for secure, accessible, and easily retrievable patient records is likely to drive the growth of this segment. Furthermore, the continued advancement of digital health initiatives and the integration of AI for document processing are anticipated to propel the adoption of comprehensive solutions, positioning the segment for robust expansion in the coming years.

Applications Analysis

The patient medical records management held a significant share of 53.3% due to the increasing need for accurate and easily accessible patient data. Efficient management of patient medical records is essential for improving patient care, enhancing treatment outcomes, and ensuring compliance with data privacy regulations.

As healthcare systems shift toward digital health technologies, the demand for integrated systems that can manage patient records across various platforms is likely to increase. This segment’s growth is also supported by the rising adoption of electronic health records (EHR) systems, which streamline documentation processes and facilitate collaboration among healthcare providers.

Mode of Delivery Analysis

The cloud-based segment had a tremendous growth rate, with a revenue share of 63.5% owing to the increasing preference for cloud solutions in healthcare. Cloud-based document management systems offer advantages such as scalability, remote access, and reduced IT infrastructure costs.

With the growing demand for real-time collaboration, secure data storage, and compliance with data privacy regulations, cloud-based systems are anticipated to become the preferred option for many healthcare organizations. The flexibility and cost-effectiveness of cloud-based solutions are likely to drive their adoption, making this segment a key growth area in the medical document management systems market.

End-Users Analysis

The hospitals & clinics segment grew at a substantial rate, generating a revenue portion of 52.8% as healthcare facilities continue to digitize their operations and improve the management of patient data. Hospitals and clinics are key consumers of document management systems due to the large volume of patient records they manage daily.

As healthcare providers focus on improving patient care and operational efficiency, the demand for secure and efficient document management solutions is expected to rise. Additionally, the regulatory pressure for maintaining accurate records, combined with the shift toward value-based care, is likely to further fuel the growth of this segment in the medical document management systems market.

Key Market Segments

By Products

- Solutions

- Standalone Medical Document Management Solutions

- Electronic Document Management Software

- Document Scanning Software

- Integrated Medical document Management Solutions

- Standalone Medical Document Management Solutions

- Services

- Medical Record Scanning and Management Services

- Product Support Services

- Training & Education Services

- Maintenance, Support, and Optimization Services

- Implementation & Integration Services

By Applications

- Patient Medical Records Management

- Patient Billing Documents Management

- Admission & Registration Document Management

By Mode of Delivery

- On-Premise

- Web-Based

- Cloud-Based

By End-Users

- Hospitals & Clinics

- Nursing Homes/Assisted Living Facilities/Long-Term Care

- Healthcare Payers

- Others

Drivers

Increasing Adoption of Electronic Health Records (EHRs) is Driving the Market

The growing adoption of electronic health records (EHRs) is a major driver for the medical document management systems market. Healthcare providers are increasingly transitioning from paper-based records to digital systems to improve efficiency, accuracy, and patient care. In 2022, the US Department of Health and Human Services reported that over 90% of hospitals in the US had adopted EHR systems, creating a significant demand for document management solutions.

Companies like Epic Systems and Cerner have seen a steady rise in sales of their software, driven by the need for seamless data integration and secure storage. This trend is expected to continue into 2024, as healthcare facilities worldwide prioritize digitization to comply with regulatory standards and enhance operational efficiency.

Restraints

High Implementation Costs are Restraining the Market

The high implementation costs of medical document management systems act as a significant restraint. These systems require substantial upfront investment in software, hardware, and staff training, which can be a barrier for smaller healthcare facilities. A survey by the Healthcare Information and Management Systems Society (HIMSS) found that cost remains a primary reason for delayed adoption among small clinics.

Companies like McKesson and Allscripts have acknowledged these challenges, offering flexible pricing models to make their systems more accessible. Despite these efforts, the high initial investment remains a limiting factor, particularly in resource-constrained settings.

Opportunities

Expansion in Telehealth Services is Creating Growth Opportunities

The rapid expansion of telehealth services presents significant growth opportunities for the medical document management systems market. As telehealth adoption grows, healthcare providers require robust systems to manage and share patient records securely and efficiently. Companies like NextGen Healthcare and Greenway Health have introduced document management solutions tailored for telehealth applications, catering to this growing demand.

This trend is particularly prominent in rural and underserved areas, where telehealth bridges the gap in healthcare access. As telehealth continues to evolve, the demand for advanced document management solutions is expected to rise significantly.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the medical document management systems market. Economic growth in emerging markets, such as India and Brazil, has increased healthcare spending, driving demand for advanced digital solutions. However, rising inflation and supply chain disruptions, exacerbated by geopolitical tensions, have led to increased production costs and delayed software deployments.

For instance, the Russia-Ukraine conflict disrupted the supply of critical IT components, impacting software developers globally. On the positive side, government initiatives in North America and Europe, such as increased funding for healthcare digitization, have created new opportunities. Despite challenges, the market remains resilient, with technological advancements and strategic collaborations ensuring sustained growth.

Trends

Integration of AI and Automation is a Recent Trend

The integration of artificial intelligence (AI) and automation with document management systems is a prominent trend in the market. AI-powered systems enhance efficiency by automating tasks such as data entry, document classification, and retrieval. Companies like Nuance Communications and 3M Health Information Systems have launched AI-driven platforms that streamline administrative workflows and reduce manual errors.

This trend aligns with the broader adoption of AI in healthcare, as providers seek to improve operational efficiency and patient outcomes. Manufacturers are increasingly focusing on developing systems that seamlessly integrate with AI platforms, reshaping the market and meeting the evolving needs of healthcare professionals.

Regional Analysis

North America is leading the Medical Document Management Systems Market

North America dominated the market with the highest revenue share of 44.4% owing to the increasing adoption of electronic health records (EHRs), regulatory requirements for data security, and the need for efficient healthcare workflows. The US Centers for Medicare & Medicaid Services (CMS) reported a rise in EHR adoption among healthcare providers in 2023, as part of efforts to streamline patient data management and improve care coordination.

The US Department of Health and Human Services (HHS) allocated funding in 2022 to enhance health information technology infrastructure, including investments in document management solutions. Additionally, the Canadian Institute for Health Information (CIHI) noted an increase in the use of digital health tools in 2023, with a focus on secure document storage and retrieval.

The US Food and Drug Administration (FDA) also emphasized the importance of robust document management systems for compliance with regulatory standards, leading to increased adoption in pharmaceutical and clinical research organizations. These factors, combined with the growing emphasis on data interoperability and patient privacy, have significantly contributed to the expansion of the medical document management systems market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is projected to witness the fastest CAGR in the medical document management systems market. The region’s growth is driven by increasing healthcare digitization, government initiatives, and the rising need for efficient data management. In 2023, the Indian Ministry of Health and Family Welfare (MoHFW) increased funding for digital health initiatives. The focus was on implementing advanced document management solutions in public hospitals. Similarly, the Chinese National Health Commission (NHC) reported higher adoption of health information systems in 2022, particularly in urban healthcare facilities.

Japan and Australia are also making significant investments in healthcare IT infrastructure. In 2023, Japan’s Ministry of Health, Labour, and Welfare (MHLW) allocated funds to deploy secure document management platforms. Meanwhile, Australia’s Department of Health invested in digital health capabilities in 2022. The emphasis was on secure data handling and efficient workflows. These investments, coupled with technological advancements, are expected to drive substantial growth in the Asia Pacific medical document management systems market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the medical document management systems market focus on technological innovation, regulatory compliance, and expanding their service offerings to drive growth. They invest in developing secure, cloud-based platforms that streamline document storage, retrieval, and sharing, enhancing operational efficiency in healthcare organizations. Companies also prioritize integrating artificial intelligence and machine learning to automate document categorization and improve workflow. Strategic partnerships with healthcare providers and software developers help boost product adoption.

Additionally, targeting emerging markets with increasing digital healthcare adoption presents significant opportunities for growth. McKesson Corporation, headquartered in Irving, Texas, is a leading healthcare company providing medical supply chain solutions, healthcare management software, and services. The company offers a robust medical document management solution that helps healthcare organizations securely manage patient records and comply with regulatory standards.

McKesson focuses on innovation by integrating its document management systems with other healthcare technologies, enhancing efficiency and reducing administrative burdens. Through strategic acquisitions and global partnerships, McKesson continues to strengthen its position in the healthcare IT sector.

Recent Developments

- In September 2023, Oracle introduced new generative AI services tailored for healthcare organizations. These services integrate with Oracle’s electronic health record (EHR) solution to minimize manual workloads and enhance operational efficiency within the healthcare sector. By automating administrative processes, this advancement contributes to the industry’s shift toward more data-driven and automated systems, ultimately improving patient care and alleviating the strain on healthcare professionals.

- In April 2023, 3M joined forces with Amazon Web Services (AWS) to integrate their Health Information Systems (HIS) with AWS’s advanced capabilities. This collaboration focuses on advancing 3M’s Modal ambient intelligence, powered by generative AI and machine learning, to improve clinical documentation. By enhancing the way healthcare providers capture and document patient information, this partnership aims to reduce time spent on administrative tasks, improving workflow efficiency and ultimately benefiting patient outcomes.

Top Key Players in the Medical Document Management Systems Market

- Veradigm LLC

- Siemens

- Oracle

- Kofax

- GE Healthcare

- Epic Systems Corporation

- athenahealth, Inc

- 3M

Report Scope

Report Features Description Market Value (2024) US$ 0.7 billion Forecast Revenue (2034) US$ 2.1 billion CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Products (Solutions (Standalone Medical Document Management Solutions (Electronic Document Management Software and Document Scanning Software), Integrated Medical Document Management Solutions), Services (Medical Record Scanning and Management Services, Product Support Services (Training & Education Services, Maintenance, Support, and Optimization Services, and Implementation & Integration Services))), By Applications (Patient Medical Records Management, Patient Billing Documents Management, and Admission & Registration Document Management), By Mode of Delivery (On-Premise, Web-Based, and Cloud-Based), By End-Users (Hospitals & Clinics, Nursing Homes/Assisted Living Facilities/Long-Term Care, Healthcare Payers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Veradigm LLC, Siemens, Oracle, Kofax, GE Healthcare, Epic Systems Corporation, athenahealth, Inc, and 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Document Management Systems MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Document Management Systems MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Veradigm LLC

- Siemens

- Oracle

- Kofax

- GE Healthcare

- Epic Systems Corporation

- athenahealth, Inc

- 3M