Healthcare Information Systems Market Analysis By Application (Revenue Cycle Management, Hospital Information System, Electronic Health Record, Electronic Medical Record, Real-time Healthcare, Patient Engagement Solution, Others), By Deployment (Web-based, On-premises, Cloud-based), By Component (Hardware, Software and Systems, Services), By End-user (Hospitals, Diagnostic Centers, Academic and Research Institutes), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 13077

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

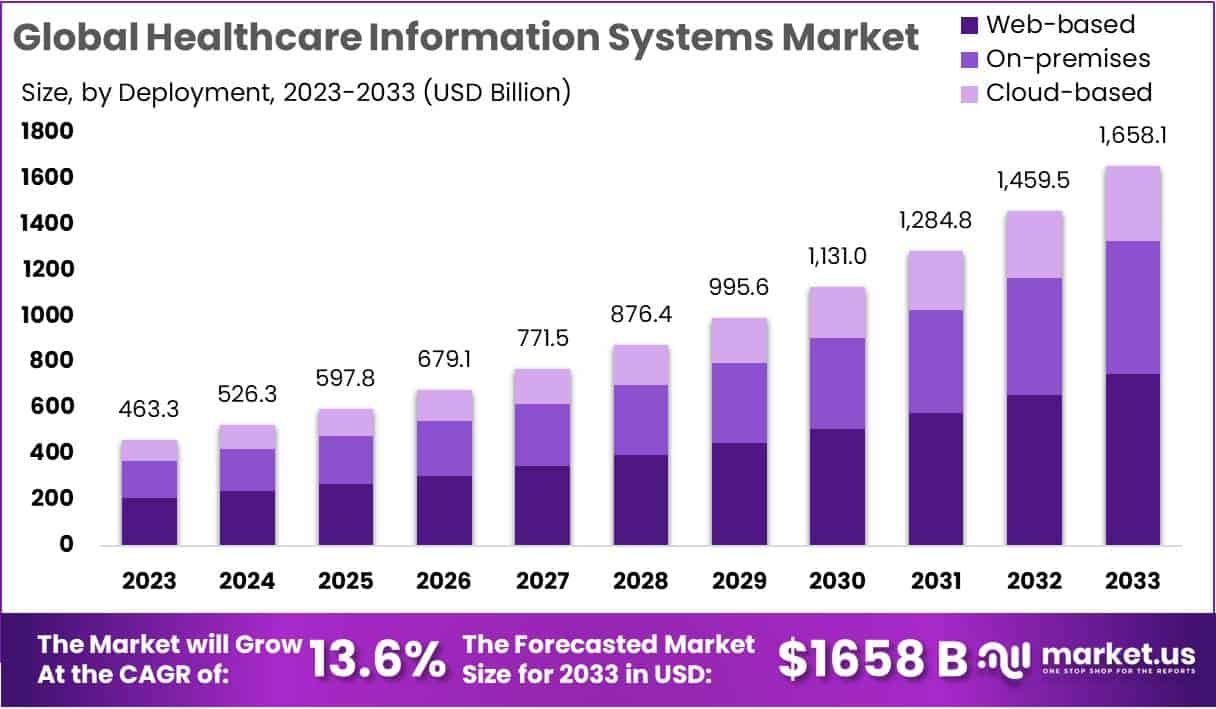

The Global Healthcare Information Systems Market Size is expected to be worth around US$ 1658.1 Billion by 2033, from US$ 463.3 Billion in 2023, growing at a CAGR of 13.6% during the forecast period from 2024 to 2033.

Healthcare information systems are integral to modern medical practices, designed to collect, store, manage, analyze, and transmit healthcare data. These systems encompass a range of technologies aimed at improving patient outcomes, enhancing workflow efficiency, and reducing operational costs. Notable components include Electronic Health Records (EHRs), which digitize patient histories and treatment data, and Clinical Decision Support Systems (CDSS) that aid in patient diagnosis and treatment planning. Additionally, systems such as Computerized Provider Order Entry (CPOE) streamline medication and test ordering processes, demonstrating the broad utility of these technologies in healthcare settings.

Pharmacy and Radiology Information Systems specifically manage medication data and imaging processes, respectively. These specialized tools ensure efficient inventory management, appointment scheduling, and accurate result reporting. Similarly, Laboratory Information Systems (LIS) optimize test processing and specimen handling, integrating seamlessly with medical lab equipment. The goal of these systems is to fortify healthcare delivery with precision and efficiency, proving indispensable in routine medical operations.

The healthcare information systems market is witnessing significant growth, driven by the demand for streamlined healthcare operations and advanced technology integration. Key players such as Cerner Corporation and Epic Systems Corporation are at the forefront, enhancing system capabilities and user experiences. Emerging trends focus on interoperability and telehealth integration, addressing the evolving needs of healthcare providers and patients alike. However, challenges such as data privacy and system interoperability remain, requiring continuous innovation and regulatory compliance to ensure secure and effective operation.

Regulatory frameworks, including standards like HIPAA, play a crucial role in shaping the healthcare information systems market. These regulations mandate stringent data security and privacy measures, guiding system development and implementation across healthcare settings. As the market expands globally, the emphasis on adhering to these standards becomes even more critical, ensuring that patient data is handled with the utmost confidentiality and integrity.

The healthcare information systems are transforming the landscape of medical care delivery. By enhancing data management and supporting clinical decision-making, these systems contribute significantly to the efficiency and effectiveness of healthcare services. As technology advances, the integration of new functionalities will likely continue, promising further improvements in healthcare outcomes and operational workflows. The ongoing collaboration between technology developers, healthcare providers, and regulatory bodies is essential to address existing challenges and harness the full potential of healthcare information systems.

Key Takeaways

- Market Growth: The Healthcare Information Systems Market is projected to reach US$ 1658.1 billion by 2033, with a robust CAGR of 13.6% from 2024 to 2033.

- Web-Based Deployment: Leading with 45.1% market share, web-based systems are favored for their accessibility, user-friendly nature, and efficient workflow.

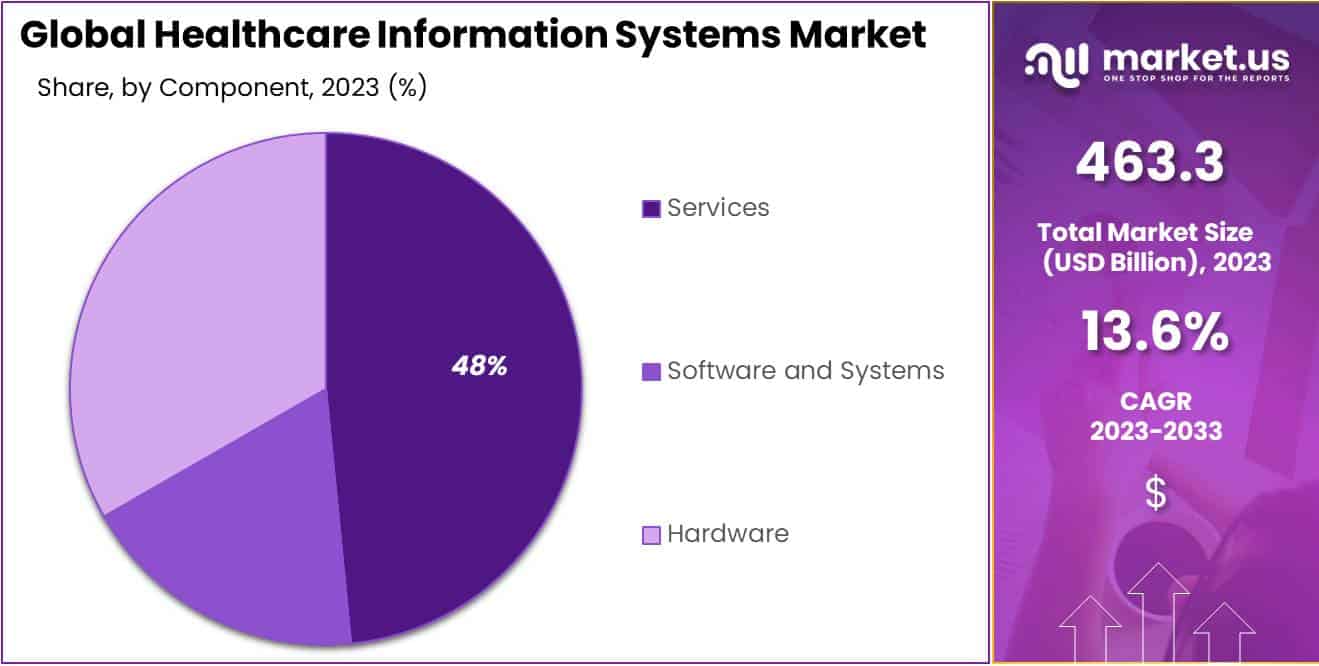

- Services Frontrunner: The Services segment claims 48% market share, offering vital solutions such as implementation, training, support, and consulting.

- Hospital Dominance: Hospitals lead as end-users with a substantial 77.4% market share, emphasizing the pivotal role of advanced information systems in healthcare.

- Drivers of Growth: Factors such as digital transformation, data analytics, and government initiatives fuel market expansion, addressing critical healthcare needs.

- Cloud-Based Trends: The adoption of cloud-based solutions is a prevailing trend, offering scalability, flexibility, and cost-effectiveness for healthcare providers.

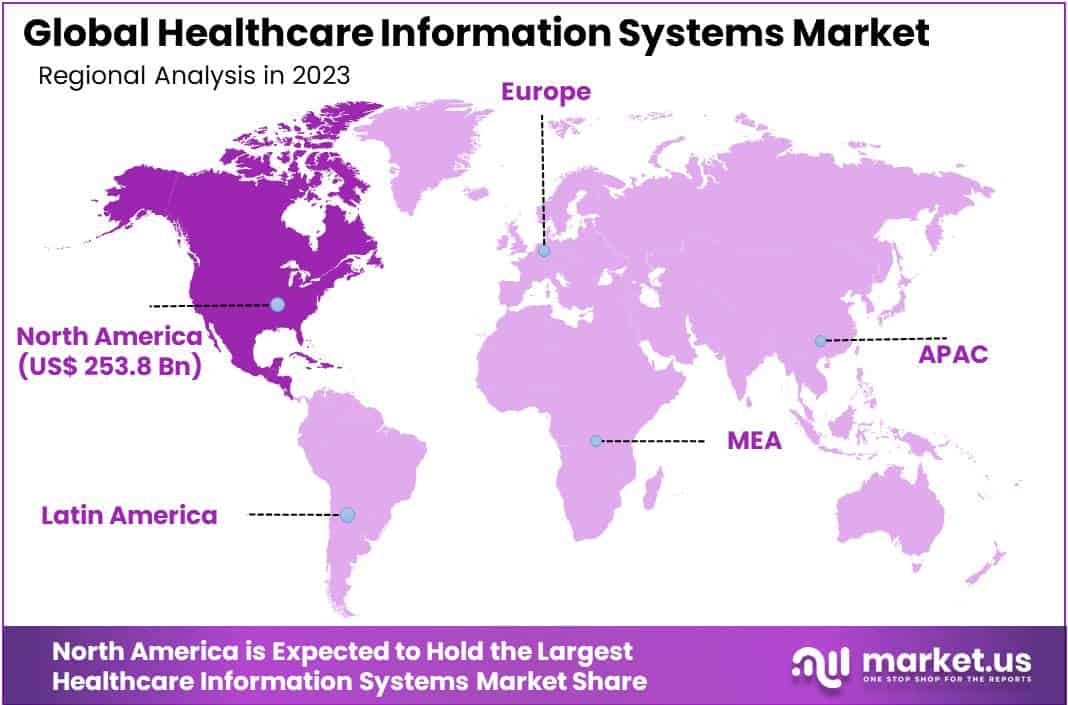

- North American Influence: North America commands a strong market position, holding 54.8% market share in 2023, driven by technological advancements and innovation.

- Asia Pacific Growth: The Asia Pacific is the fastest-growing region, witnessing increased demand for healthcare IT services due to government spending and improved healthcare infrastructure.

- Strategic Developments: Recent acquisitions, such as Teladoc’s purchase of Livongo and Allscripts acquiring Cerner for $28 billion, signify significant consolidation and growth in the healthcare IT sector.

Application Analysis

In 2023, the Revenue Cycle Management (RCM) segment emerged as a frontrunner in the healthcare information systems market, commanding a substantial market share of over 65.8%. This dominance can be attributed to the pivotal role RCM plays in streamlining financial processes within healthcare organizations.

Hospital Information System (HIS) also played a crucial role, contributing significantly to the market landscape. HIS facilitates seamless communication and coordination among various departments within a hospital, aiding in efficient patient care and resource management.

The Electronic Health Record (EHR) and Electronic Medical Record (EMR) segments showcased robust growth, capturing attention due to their transformative impact on digitizing and organizing patient information. EHRs focus on comprehensive health records, while EMRs specifically concentrate on medical data, both enhancing accessibility and accuracy of patient information.

Real-time Healthcare solutions gained momentum, offering instantaneous data updates for timely decision-making. This segment’s agility and responsiveness have become instrumental in improving patient outcomes and operational efficiency for healthcare providers.

Patient Engagement Solutions emerged as a noteworthy segment, reflecting the industry’s increasing emphasis on patient-centric care. These solutions empower patients to actively participate in their healthcare journey, fostering better communication and understanding between healthcare providers and patients.

As the healthcare landscape continues to evolve, other segments within the healthcare information systems market are also gaining traction. These include innovative solutions designed to address specific challenges and enhance overall healthcare delivery.

Deployment Analysis

In 2023, the healthcare information systems market witnessed a notable landscape, with distinct segments playing pivotal roles in shaping the industry’s dynamics. Among these, the web-based deployment emerged as a frontrunner, firmly establishing its dominance by capturing a substantial 45.1% share of the market.

Web-based systems demonstrated a compelling appeal due to their accessibility and user-friendly nature. This deployment method enables healthcare professionals to seamlessly access crucial information from any location with internet connectivity, fostering a more agile and efficient workflow. The ease of implementation and reduced infrastructure demands further contributed to the segment’s robust market position.

On-premises deployment, although a traditional approach, maintained its relevance, holding a steady market share. Organizations preferring heightened control over their healthcare information systems and data security found on-premises solutions to be a stalwart choice. This segment’s strength lies in providing a localized and customizable infrastructure, catering to the specific needs and preferences of healthcare institutions.

Cloud-based deployment, on the other hand, exhibited a burgeoning presence in the healthcare information systems landscape. With a market share reflecting a noteworthy portion, cloud-based systems gained traction due to their scalability, cost-effectiveness, and the ability to facilitate seamless collaboration. The flexibility offered by cloud solutions proved instrumental in accommodating the evolving needs of healthcare organizations, positioning this segment as a promising avenue for future growth.

Component Analysis

In 2023, the Healthcare Information Systems market exhibited a noteworthy landscape with various segments contributing to its dynamic growth. Among these segments, the Services category emerged as a frontrunner, securing a commanding market position by capturing over 48% share.

The Services segment played a pivotal role in shaping the healthcare information systems landscape. Healthcare providers increasingly relied on services to optimize and streamline their information systems, leading to the segment’s dominant position. Services encompassed a range of offerings, including implementation, training, support, and consulting, providing healthcare organizations with comprehensive solutions to enhance their operational efficiency.

The Hardware segment also played a crucial role in the market, constituting an essential component of healthcare information systems. Medical institutions sought advanced hardware solutions to support the robust functioning of their information systems, ranging from servers and storage devices to network infrastructure. In 2023, the Hardware segment showcased steady growth, with healthcare providers prioritizing investments in reliable and high-performance hardware components.

Simultaneously, the Software and Systems segment remained a key player in the healthcare information systems market. This segment included diverse software applications and integrated systems designed to manage and organize healthcare data efficiently. In 2023, the Software and Systems segment experienced notable advancements, driven by the increasing demand for interoperability, data analytics, and electronic health record (EHR) solutions.

As the healthcare industry continued its digital transformation journey, the synergy of Hardware, Software and Systems, and Services became instrumental in creating a comprehensive and interconnected information infrastructure. The interplay between these segments not only facilitated better patient care but also enhanced overall healthcare management.

End-user Analysis

In 2023, the healthcare information systems market showcased a notable landscape, with the Hospitals segment emerging as the frontrunner, securing a robust market position by capturing over 77.4% of the overall market share. Hospitals played a pivotal role in driving the demand for advanced information systems, fostering efficiency, and enhancing patient care.

Diagnostic Centers also contributed significantly, holding a noteworthy share of the market. This segment, though slightly trailing hospitals, demonstrated a considerable presence, harnessing healthcare information systems to streamline diagnostic processes, ensuring swift and accurate results for patients.

Academic and Research Institutes carved out their space in the healthcare information systems landscape, contributing to approximately 12.6% of the market share. These institutions leveraged information systems to propel medical research and educational initiatives, fostering innovation and knowledge dissemination.

The dynamic interplay among these segments underscored the diverse applications and adaptability of healthcare information systems across different healthcare settings. As the market continued to evolve, the collaborative efforts of hospitals, diagnostic centers, and academic and research institutes played a pivotal role in shaping the trajectory of healthcare information systems, ensuring a comprehensive and interconnected approach to healthcare delivery and advancement.

Key Market Segments

Application

- Revenue Cycle Management

- Hospital Information System

- Electronic Health Record

- Electronic Medical Record

- Real-time Healthcare

- Patient Engagement Solution

- Others

Deployment

- Web-based

- On-premises

- Cloud-based

Component

- Hardware

- Software and Systems

- Services

End-user

- Hospitals

- Diagnostic Centers

- Academic and Research Institutes

Drivers

Digital Transformation in Healthcare

The increasing need for digitalization and integration of healthcare processes is a major driver. Healthcare information systems facilitate the transition from paper-based to electronic health records, improving efficiency and accessibility.

Rising Demand for Data Analytics

Growing demand for data-driven insights in healthcare is propelling the adoption of information systems. These systems enable healthcare providers to analyze patient data, optimize treatment plans, and enhance overall healthcare outcomes.

Government Initiatives and Regulations

Supportive government initiatives and regulations promoting the adoption of healthcare information systems are driving market growth. Incentives for implementing electronic health records (EHRs) and ensuring interoperability contribute to increased adoption.

Increasing Focus on Patient-Centric Care

The shift towards patient-centric care is pushing the demand for healthcare information systems. These systems enable better coordination among healthcare professionals, leading to improved patient engagement, satisfaction, and outcomes.

Restraints

High Implementation Costs

One of the predominant obstacles facing the healthcare sector is the substantial upfront costs associated with the implementation of healthcare information systems. Particularly burdensome for smaller healthcare organizations, these financial considerations may impede the adoption of comprehensive information systems.

Data Security Concerns

The increasing digitization of healthcare data brings forth a heightened susceptibility to data breaches and cyber threats. Apprehensions regarding the security of patient information pose a significant deterrent to the widespread adoption of healthcare information systems.

Interoperability Challenges

A critical impediment arises from the lack of standardization and interoperability among diverse healthcare information systems. This deficiency obstructs the seamless exchange of data, leading to complications in sharing patient information across various healthcare entities.

Resistance to Change

A pervasive challenge is the resistance to change exhibited by healthcare professionals. The transition from traditional methodologies to digital systems necessitates training and adaptation. Some healthcare professionals may resist this cultural shift, further complicating the integration of healthcare information systems.

Opportunities

Telehealth Integration

The seamless integration of healthcare information systems with telehealth services represents a significant growth opportunity in the healthcare industry. The escalating demand for remote patient monitoring and virtual consultations is creating avenues for the expansion of these systems.

Emerging Markets and Untapped Regions

Substantial growth potential lies in emerging markets and untapped regions where the adoption of healthcare information systems is still in its nascent stages. Increased awareness and investments in these regions present lucrative growth opportunities for market players.

Advancements in Artificial Intelligence (AI) and Machine Learning (ML)

The integration of AI and ML into healthcare information systems offers opportunities for enhanced decision support, predictive analytics, and personalized medicine, thereby propelling market growth. These advancements contribute to more efficient and intelligent healthcare solutions.

Blockchain Technology in Healthcare

The application of blockchain technology for secure and transparent health data management is a promising avenue for growth. Blockchain has the potential to address data security concerns and ensure the integrity and privacy of healthcare information, bolstering trust in the healthcare ecosystem.

Trends

Cloud-Based Solutions in Healthcare Information Systems

The widespread adoption of cloud-based healthcare information systems stands out as a prevailing trend in the healthcare industry. Cloud solutions bring forth unparalleled scalability, flexibility, and accessibility, empowering healthcare providers to streamline operations and curtail infrastructure costs significantly.

Integration of Internet of Things (IoT) in Healthcare

The assimilation of IoT devices into healthcare information systems is rapidly becoming a standard practice. This evolving trend facilitates real-time monitoring of patients, tracking of medical assets, and an overall enhancement in healthcare delivery by leveraging the interconnected nature of IoT technologies.

Focus on Interoperability Standards for Seamless Data Exchange

There is a noticeable shift towards prioritizing the establishment of interoperability standards in healthcare. These efforts are aimed at fostering seamless data exchange between diverse healthcare information systems, with the ultimate goal of improving collaboration and ensuring data continuity across the entire healthcare ecosystem.

Patient Engagement Solutions within Healthcare Information Systems

The integration of patient engagement solutions is gaining significant traction within healthcare information systems. This encompasses the incorporation of patient portals, mobile applications, and secure messaging features, all of which contribute to enhancing communication between patients and healthcare providers for a more patient-centric approach.

Regional Analysis

In 2023, North America took the lead in the Healthcare Information Systems Market, holding a strong market position with a whopping 54.8% share. The region’s healthcare information systems market value soared to USD 253.8 billion for the year, showcasing its prominent influence.

This dominance can be attributed to advanced technological adoption, robust healthcare infrastructure, and a strong focus on digitizing medical processes. North America’s commitment to cutting-edge solutions propelled it to the forefront of the global healthcare information systems landscape.

The impressive market share underscores the region’s role as a key region in shaping the future of healthcare technology. As we delve deeper into the regional dynamics, it becomes evident that North America’s proactive approach in embracing innovative information systems plays a pivotal role in its commanding market position. This trend is likely to persist, with the region continuing to drive advancements in healthcare information systems.

The Asia Pacific is the fastest-growing region, with high demand for products in healthcare IT services due to increased government programs spending. The demand for IT-based solutions in healthcare providers is driven by the growth in healthcare expenditures among developing Asian countries, as well as improvements in healthcare infrastructure. These key driving factors can be attributed to the increase in hospital workflow efficiency and lower medical costs.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the expansive realm of Healthcare Information Systems (HIS) Market, several key players play pivotal roles in shaping the industry landscape. Athenahealth Inc., with its innovative solutions, stands out as a frontrunner. Renowned for its user-friendly interfaces and efficient management tools, Athenahealth has become a go-to choice for healthcare providers seeking streamlined information systems.

Another noteworthy player is the Agfa Gevaert Group, recognized for its commitment to imaging and IT solutions in healthcare. The group’s comprehensive approach seamlessly integrates medical imaging and information management, offering a holistic solution to healthcare providers globally.

eClinicalWorks, a key player in the HIS market, specializes in electronic health records (EHR) and practice management. Its focus on enhancing the efficiency of healthcare delivery has garnered attention, making it a significant contributor to the digital transformation of healthcare systems.

Philips Healthcare, a leader in health technology, has made substantial strides in HIS. With a diverse portfolio ranging from diagnostic imaging to patient monitoring, Philips Healthcare contributes to the overall advancement of healthcare information systems.

Market Key Players

- Athenahealth Inc.

- Agfa Gevaert Group

- eClinicalWorks

- Philips Healthcare

- Hewlett Packard

- McKesson Corporation

- Allscripts Healthcare LLC

- GE Healthcare

- Oracle (Cerner Corporation)

- Epic Systems Corporation

Recent Developments

- In October 2024: Product Launch, Athenahealth introduced a new AI-powered solution called “Ambient Notes” designed for ambulatory practices. This technology integrates directly into clinical workflows, significantly simplifying documentation processes, enhancing clinician-patient interactions, and is accessible to practices of all sizes. This development showcases Athenahealth’s commitment to advancing generative AI applications in healthcare.

- In November 2023: Philips received a substantial investment boost from the Bill & Melinda Gates Foundation, totaling USD 60 million, to accelerate the global adoption of AI algorithms in their Philips Lumify Handheld Ultrasound devices. This funding aims to expand access to maternal healthcare by equipping non-expert users with AI-guided ultrasound capabilities, drastically reducing training time from weeks to hours. This innovation is designed to enhance prenatal care, especially in underserved communities worldwide.

- In October 2023: eClinicalWorks announced substantial revenue growth at its 2023 National Conference, projecting a record $900 million in revenue for the year, an increase from $800 million in 2022. The company reported over 180,000 healthcare providers using its systems, with notable enhancements in their V12.0.2 platform, including improvements in specialty modules and patient engagement solutions. These enhancements are aimed at boosting productivity and efficiency across healthcare practices.

Report Scope

Report Features Description Market Value (2023) US$ 463.3 Bn Forecast Revenue (2033) US$ 1658.1 Bn CAGR (2024-2033) 13.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Revenue Cycle Management, Hospital Information System, Electronic Health Record, Electronic Medical Record, Real-time Healthcare, Patient Engagement Solution, Others), By Deployment (Web-based, On-premises, Cloud-based), By Component (Hardware, Software and Systems, Services), By End-user (Hospitals, Diagnostic Centers, Academic and Research Institutes) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Athenahealth Inc., Agfa Gevaert Group, eClinicalWorks, Philips Healthcare, Hewlett Packard, McKesson Corporation, Allscripts Healthcare LLC, GE Healthcare, Oracle (Cerner Corporation), Epic Systems Corporation, and Other Key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Information Systems MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Healthcare Information Systems MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Athenahealth Inc.

- Agfa Gevaert Group

- eClinicalWorks

- Philips Healthcare

- Hewlett Packard

- McKesson Corporation

- Allscripts Healthcare LLC

- GE Healthcare

- Oracle (Cerner Corporation)

- Epic Systems Corporation