Digital Assistants in Healthcare Market By Product Type (AI-based Digital Assistants (User Interface (Voice-activated Assistants and Text-based Assistants), Mode of Delivery (Web-based, Cloud-based, and Mobile-based)), Non-AI-based Digital Assistants), By Application (Clinical Applications (Virtual Health Assistants, Remote Patient Monitoring, Diagnosis Assistance, Prescription Assistance, and Appointment Scheduling), Administrative Applications (Scheduling & Appointment Management, Billing & Claims Assistance, and Healthcare Workflow Automation), Patient Assistance Applications (Medication Reminder Systems, Personalized Health Recommendations, Post-Operative Care, and Chronic Disease Management)), By End-user (Hospitals & Healthcare Providers, Patients, and Healthcare Staff), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143803

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

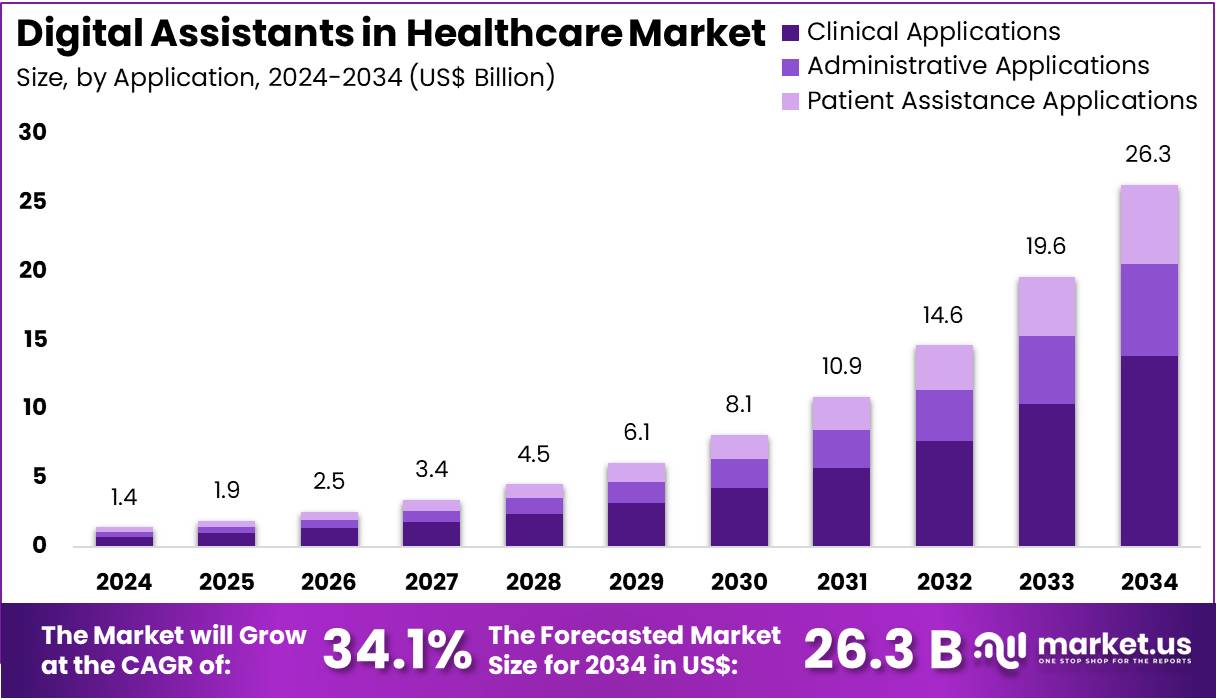

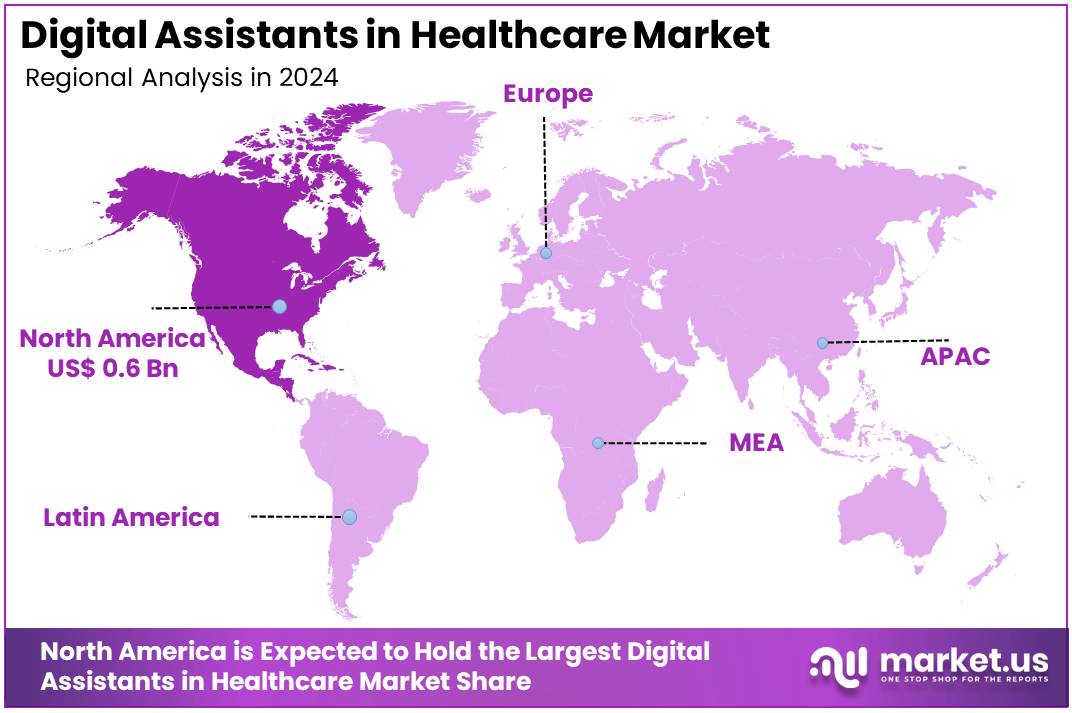

The Global Digital Assistants in Healthcare Market size is expected to be worth around US$ 26.3 Billion by 2034, from US$ 1.4 Billion in 2024, growing at a CAGR of 34.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 42.2% share and holds US$ 0.6 Billion market value for the year.

Increasing adoption of digital health technologies is driving the growth of the digital assistants in healthcare market. Healthcare providers and patients alike are embracing digital assistants for a range of applications, including symptom monitoring, patient education, and administrative support. These tools help streamline patient interactions, reduce wait times, and improve overall care delivery by providing timely assistance and data-driven insights.

As patient-centered care becomes a focal point of healthcare systems, digital assistants are emerging as key enablers in managing chronic conditions, mental health support, and emergency care. Recent innovations in artificial intelligence (AI) and machine learning have enhanced the capabilities of these assistants, allowing for more personalized and efficient healthcare services.

In September 2023, ADA Digital Health introduced a new symptom assessment technology tailored to pregnant women. Integrated into South Africa’s national MomConnect initiative, this service focuses on maternal and infant health, offering valuable information and prioritizing care via mobile phones. With the rise of telemedicine and wearable devices, digital assistants are expected to become integral to future healthcare practices, empowering patients and providers with real-time data and interactive support systems.

Key Takeaways

- In 2024, the market for Digital Assistants in Healthcare generated a revenue of US$ 1.4 billion, with a CAGR of 34.1%, and is expected to reach US$ 26.3 billion by the year 2034.

- The product type segment is divided into AI-based digital assistants and non-AI-based digital assistants, with AI-based digital assistants taking the lead in 2024 with a market share of 61.3%.

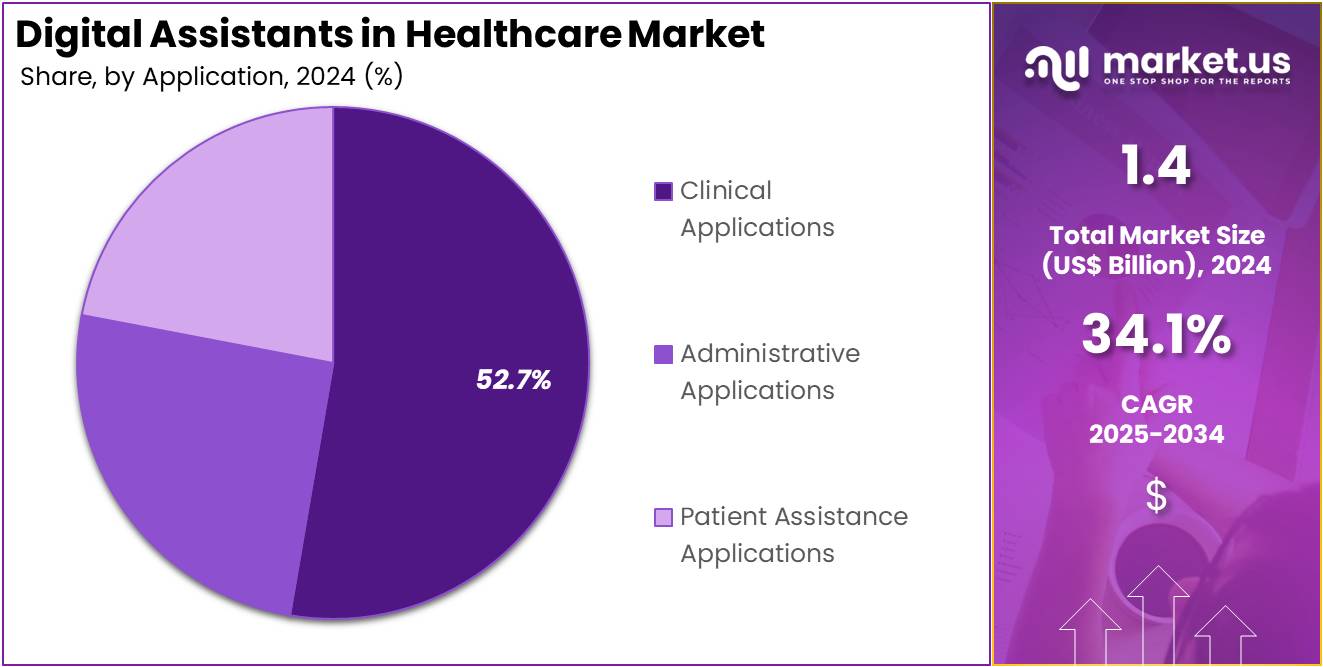

- Furthermore, concerning the application segment, the clinical applications sector stands out as the dominant player, holding the largest revenue share of 52.7% in the Digital Assistants in Healthcare market.

- The end-user segment is segregated into hospitals & healthcare providers, patients, healthcare staff, with the hospitals & healthcare providers segment leading the market, holding a revenue share of 49.3%.

- North America led the market by securing a market share of 42.2% in 2024.

Product Type Analysis

The AI-based digital assistants segment led in 2023, claiming a market share of 61.3% owing to the increasing adoption of AI technologies to improve healthcare outcomes and streamline operations. AI-based assistants are anticipated to offer advanced capabilities such as personalized patient care, real-time diagnostics, and automated decision support, which are likely to enhance the overall efficiency of healthcare systems.

As healthcare providers seek more sophisticated tools to manage patient data and improve clinical decision-making, the demand for AI-based digital assistants is projected to rise. Additionally, the increasing integration of AI with electronic health records (EHR) and patient management systems is expected to drive further growth in this segment as healthcare providers look for solutions that offer automation and data analysis.

Application Analysis

The clinical applications segment had a tremendous growth rate, with a revenue share of 52.7% owing to the rising demand for tools that support clinical decision-making and improve patient care. Digital assistants in clinical applications can assist healthcare providers with tasks such as diagnosis, treatment recommendations, and monitoring patient progress, all of which are anticipated to reduce errors and improve outcomes.

The growing need for real-time access to patient information, along with the rising focus on personalized medicine, is likely to drive demand for clinical applications of digital assistants. Additionally, the increasing use of AI and machine learning in clinical decision support systems is projected to further fuel the growth of this segment as these technologies provide more accurate, data-driven insights.

End-User Analysis

The hospitals & healthcare providers segment grew at a substantial rate, generating a revenue portion of 49.3% as hospitals seek to improve patient care and streamline operational processes. Digital assistants are anticipated to help healthcare providers manage patient interactions, streamline workflows, and enhance clinical decision-making, all of which are crucial for improving the quality of care.

The rising complexity of healthcare administration, coupled with the increasing need for efficient patient management systems, is likely to drive the adoption of digital assistants in hospitals and healthcare facilities. As hospitals and healthcare providers continue to invest in digital solutions to reduce costs and improve patient satisfaction, the demand for digital assistants is projected to grow, making this segment a key area of expansion.

Key Market Segments

Product Type

- AI-based Digital Assistants

- User Interface

- Voice-activated Assistants

- Text-based Assistants

- Mode of Delivery

- Web-based

- Cloud-based

- Mobile-based

- User Interface

- Non-AI-based Digital Assistants

Application

- Clinical Applications

- Virtual Health Assistants

- Remote Patient Monitoring

- Diagnosis Assistance

- Prescription Assistance

- Appointment Scheduling

- Administrative Applications

- Scheduling & Appointment Management

- Billing & Claims Assistance

- Healthcare Workflow Automation

- Patient Assistance Applications

- Medication Reminder Systems

- Personalized Health Recommendations

- Post-Operative Care

- Chronic Disease Management

End-User

- Hospitals & Healthcare Providers

- Patients

- Healthcare Staff

Drivers

Increasing Adoption of AI and Automation is Driving the Market

The growing adoption of artificial intelligence (AI) and automation in healthcare is a key driver of the digital assistants in healthcare market. AI-powered virtual assistants streamline administrative tasks, enhance patient engagement, and improve clinical decision-making. In 2023, Microsoft reported a 25% increase in the adoption of its Azure AI services by healthcare providers, driven by the demand for solutions like chatbots and voice-enabled assistants.

Similarly, Nuance Communications, a subsidiary of Microsoft, saw a 30% rise in the use of its Dragon Medical One platform in 2022, which integrates AI for clinical documentation. The push toward digitization and the need for efficient healthcare delivery are propelling the market forward, with significant investments from both public and private sectors.

Restraints

Data Privacy and Security Concerns are Restraining the Market

Data privacy and security concerns are major restraints in the digital assistants in healthcare market. The sensitive nature of patient data makes it a target for cyberattacks, raising concerns among healthcare providers and patients. In 2022, the US Department of Health and Human Services reported a 45% increase in healthcare data breaches compared to the previous year, affecting over 40 million patient records.

Companies like Amazon and Google have faced scrutiny over the handling of data by their virtual assistant platforms, Alexa and Google Assistant, respectively. These challenges hinder the widespread adoption of digital assistants, as healthcare organizations prioritize compliance with regulations like HIPAA and GDPR.

Opportunities

Expansion of Telemedicine is Creating Growth Opportunities

The rapid expansion of telemedicine is creating significant growth opportunities for digital assistants in healthcare. Virtual assistants play a crucial role in managing patient appointments, providing symptom checks, and offering post-treatment follow-ups. In 2023, Teladoc Health reported a 40% increase in the use of its AI-driven virtual assistant for telemedicine consultations.

Similarly, Amwell integrated Google’s AI tools into its platform, resulting in a 35% improvement in patient engagement. The shift toward remote healthcare delivery, accelerated by the COVID-19 pandemic, is driving demand for these solutions, making telemedicine a key area of opportunity for market players.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the digital assistants in healthcare market, creating both challenges and opportunities. Rising healthcare expenditures and increased government funding for digital health initiatives are boosting market growth. For instance, the US allocated US$3 billion in 2023 to support the adoption of AI and digital health technologies, as reported by the National Institutes of Health. However, inflation and supply chain disruptions, exacerbated by geopolitical tensions, are increasing the costs of developing and deploying these technologies.

The ongoing US-China trade war has impacted the supply of semiconductor chips, essential for AI-powered devices. Despite these challenges, the growing emphasis on healthcare innovation and the need for efficient patient care are driving market resilience. Increased collaboration between governments and private entities is fostering a positive outlook, ensuring sustained growth in the sector.

Latest Trends

Integration of Natural Language Processing is a Recent Trend

The integration of natural language processing (NLP) into digital assistants is a recent trend transforming the healthcare market. NLP enables virtual assistants to understand and respond to complex medical queries, improving their utility in clinical settings. In 2023, IBM Watson Health launched an NLP-enhanced version of its virtual assistant, which saw a 20% adoption rate among healthcare providers within six months.

This innovation is enhancing the accuracy and efficiency of digital assistants, making them more effective in tasks like medical transcription and patient communication. The trend is driving further advancements, with companies like Suki and Orbita leading the way in NLP-based solutions.

Regional Analysis

North America is leading the Digital Assistants in Healthcare Market

North America dominated the market with the highest revenue share of 42.2% owing to the increasing adoption of artificial intelligence (AI) technologies, the need for efficient patient management, and the rise in telehealth services. According to the Centers for Disease Control and Prevention (CDC), the use of telehealth services in the US increased by 38% in 2023 compared to 2022, with digital assistants playing a key role in streamlining virtual consultations.

Additionally, the National Institutes of Health (NIH) allocated US$ 1.2 billion in 2023 for AI-driven healthcare innovations, including the development of advanced digital assistants for clinical and administrative tasks. These tools have been widely adopted to reduce administrative burdens, improve patient engagement, and enhance diagnostic accuracy.

The growing emphasis on personalized medicine and the integration of AI into electronic health records (EHRs) have further fueled market expansion. With strong support from government initiatives and healthcare providers, North America has emerged as a leader in the adoption of digital assistants in healthcare.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing investments in healthcare technology and the rising demand for efficient patient care solutions. The World Health Organization (WHO) reported a 25% increase in the adoption of telehealth services in Southeast Asia in 2023, with digital assistants being integral to these platforms. India’s Ministry of Health and Family Welfare allocated US$ 500 million in 2022 to modernize healthcare infrastructure, including the deployment of AI-powered tools for patient management.

China’s National Health Commission announced a US$ 800 million investment in 2022 to modernize healthcare infrastructure, with a focus on developing intelligent systems for diagnostics and patient care. These initiatives, combined with the region’s growing population and increasing healthcare needs, are expected to drive significant growth in the adoption of digital assistants in healthcare across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the digital assistants in healthcare market focus on integrating advanced technologies, such as artificial intelligence (AI) and machine learning, to drive growth. They invest in developing intelligent virtual assistants that enhance patient engagement, streamline workflows, and provide personalized care. Companies also form strategic partnerships with healthcare providers and institutions to improve the adoption of these digital tools across hospitals and clinics.

Targeting emerging markets with expanding healthcare infrastructures and increasing awareness of digital health solutions supports further expansion. Additionally, compliance with healthcare regulations and continuous innovation ensures that digital assistants meet the evolving needs of both healthcare professionals and patients.

IBM Watson Health, based in Cambridge, Massachusetts, is a leading provider of AI-powered solutions in healthcare. The company’s Watson Assistant for Health enables healthcare organizations to offer personalized patient interactions, streamline administrative tasks, and improve clinical decision-making. IBM Watson Health leverages its expertise in AI and data analytics to develop cutting-edge digital tools that enhance healthcare delivery.

The company focuses on expanding its reach through collaborations with healthcare providers, payers, and life sciences organizations to drive efficiency and improve outcomes. By continuing to innovate and integrate AI into healthcare practices, IBM Watson Health maintains a strong position in the market.

Top Key Players in the Digital Assistants in Healthcare Market

- Microsoft Corporation

- IBM Corporation

- Baidu Inc.

- Babylon Healthcare

- Apple Inc

- Alphabet Inc

- Ada Health

Recent Developments

- In February 2023, Ada Health partnered with Pfizer to launch a digital healthcare journey aimed at helping individuals assess their risk of severe COVID-19 progression. The tool allows users to evaluate their symptoms and connect with healthcare providers for appropriate treatment options.

- In October 2022, Babylon Healthcare expanded its services to Vietnam, launching a digital health platform to assist underserved populations in Bac Ninh and Hanoi. This platform integrates AI-powered symptom checking with a health provider locator, providing free 24/7 healthcare access to over 9 million people in the region.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 billion Forecast Revenue (2034) US$ 26.3 billion CAGR (2025-2034) 34.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (AI-based Digital Assistants (User Interface (Voice-activated Assistants and Text-based Assistants), Mode of Delivery (Web-based, Cloud-based, and Mobile-based)), Non-AI-based Digital Assistants), By Application (Clinical Applications (Virtual Health Assistants, Remote Patient Monitoring, Diagnosis Assistance, Prescription Assistance, and Appointment Scheduling), Administrative Applications (Scheduling & Appointment Management, Billing & Claims Assistance, and Healthcare Workflow Automation), Patient Assistance Applications (Medication Reminder Systems, Personalized Health Recommendations, Post-Operative Care, and Chronic Disease Management)), By End-user (Hospitals & Healthcare Providers, Patients, and Healthcare Staff) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, IBM Corporation, Baidu Inc., Babylon Healthcare, Apple Inc, Alphabet Inc, and Ada Health. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Assistants in Healthcare MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Assistants in Healthcare MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- IBM Corporation

- Baidu Inc.

- Babylon Healthcare

- Apple Inc

- Alphabet Inc

- Ada Health