Veterinary Equipment Market By Product Type (Equipment & Accessories (Anesthesia Equipment, Waste Gas Management Systems, Ventilators, Vaporizers, Anesthesia Machines, Anesthesia Accessories, Veterinary Telemetry Systems, Patient Monitors, Patient Monitoring Accessories, Oxygen Concentrator & Accessories, Fluid Management Equipment, Syringe Pumps, Large-Volume Infusion Pumps, Temperature Management Equipment, Patient Warming Systems, and Fluid Warmers), Disposables/Consumables (Airway Management Consumables and Others)), By Animal (Small Animals (Dogs, Cats, and Others), Large Animals), By Application (Surgical, Monitoring, and Diagnostic), By End-user (Veterinary Hospitals & Clinics, Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145394

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

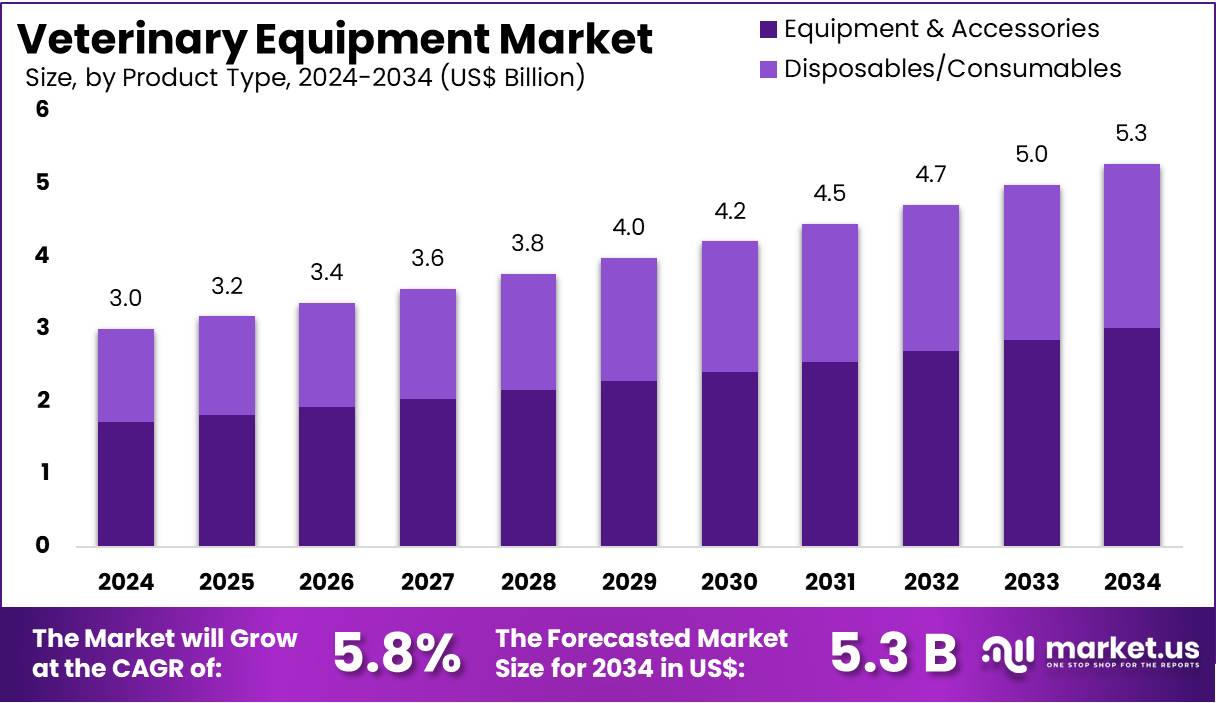

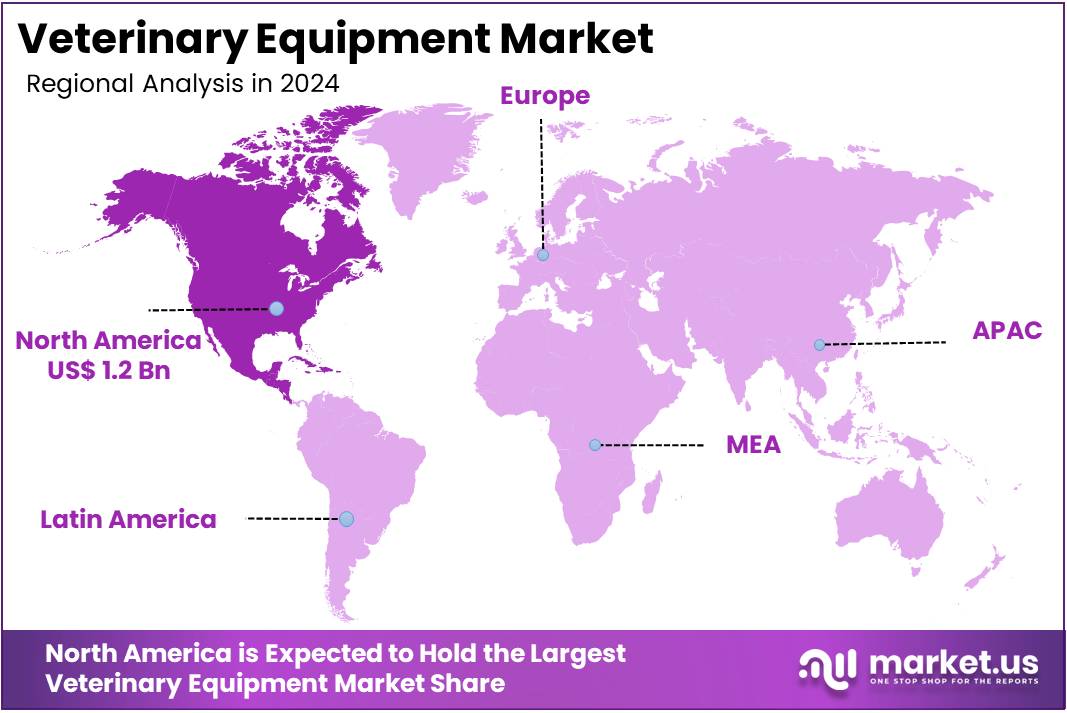

The Global Veterinary Equipment Market size is expected to be worth around US$ 5.3 Billion by 2034, from US$ 3 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.4% share and holds US$ 1.2 Billion market value for the year.

Increasing pet ownership and the growing demand for veterinary services are driving significant growth in the veterinary equipment market. Veterinary equipment is essential for diagnosing, treating, and managing the health of animals, ranging from companion pets to livestock. The market benefits from technological advancements in diagnostic tools, imaging equipment, surgical instruments, and therapeutic devices.

Rising awareness of animal health and wellness, coupled with increasing veterinary care expenditures, further boosts the market. Innovations such as portable diagnostic devices, telemedicine solutions, and minimally invasive surgical tools create new opportunities for veterinary professionals. In April 2021, DRE Veterinary rebranded as Avante Animal Health, marking its transition into a division of Avante Health Solutions.

This reorganization allowed Avante Animal Health to better focus on providing a wide range of veterinary medical equipment, including surgical, imaging, and radiation oncology solutions. These trends indicate a shift toward more advanced, efficient, and comprehensive veterinary care, with a clear emphasis on improving animal health outcomes.

Key Takeaways

- In 2024, the market for veterinary equipment generated a revenue of US$ 3.0 billion, with a CAGR of 5.8%, and is expected to reach US$ 5.3 billion by the year 2034.

- The product type segment is divided into equipment & accessories and disposables/consumables, with equipment & accessories taking the lead in 2024 with a market share of 57.3%.

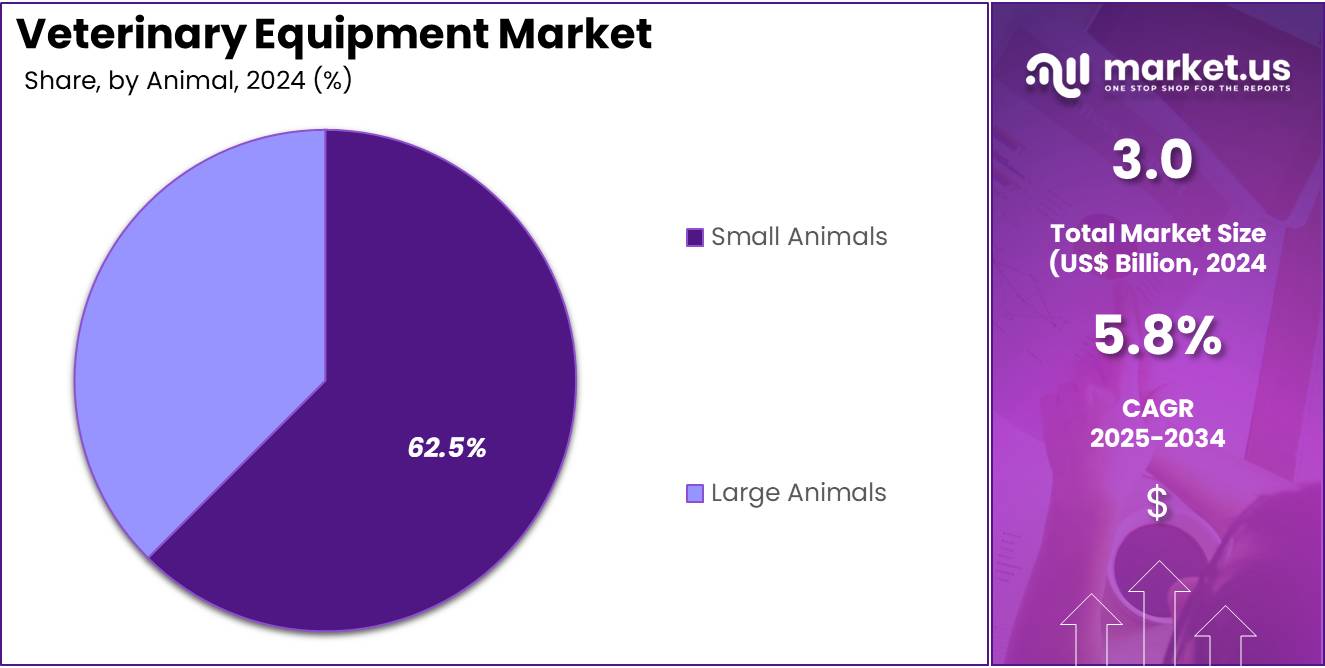

- Considering animal, the market is divided into small animals and large animals. Among these, small animals held a significant share of 62.5%.

- Furthermore, concerning the application segment, the market is segregated into surgical, monitoring, and diagnostic. The surgical sector stands out as the dominant player, holding the largest revenue share of 50.2% in the veterinary equipment market.

- The end-user segment is segregated into veterinary hospitals & clinics, laboratories, and others, with the veterinary hospitals & clinics segment leading the market, holding a revenue share of 54.7%.

- North America led the market by securing a market share of 38.4% in 2024.

Product Type Analysis

The equipment & accessories segment led in 2024, claiming a market share of 57.3% owing to increased demand for advanced veterinary care. As veterinary clinics and hospitals adopt modern diagnostic and surgical technologies, the need for specialized equipment and accessories is rising. Innovations such as telemedicine, robotic-assisted surgery, and advanced diagnostic tools are projected to drive the growth of this segment.

Additionally, the rising focus on animal welfare and the increasing number of pet ownership globally are anticipated to fuel the demand for high-quality veterinary equipment and accessories, contributing to the segment’s expansion.

Animal Analysis

The small animals held a significant share of 62.5% as companion animal ownership continues to rise, particularly in urban areas. Small animals, including cats and dogs, are increasingly viewed as family members, driving greater demand for healthcare services and equipment designed specifically for these animals.

Veterinary care for small animals is expected to increase as pet owners become more proactive about preventive health measures. The availability of specialized veterinary equipment for small animals, including diagnostic and surgical tools tailored to their size and needs, is anticipated to further support the growth of this segment.

Application Analysis

The surgical segment had a tremendous growth rate, with a revenue share of 50.2% owing to advancements in veterinary surgery, including minimally invasive procedures and improved surgical tools. As veterinary clinics and hospitals focus on offering more specialized surgeries, there is an increasing demand for high-quality surgical instruments and equipment.

The rising awareness of animal health, along with advancements in veterinary surgical techniques, is anticipated to drive demand for surgical equipment. This segment’s growth is also supported by the expanding adoption of surgical robots and automated systems for precision, contributing to enhanced recovery and outcomes for animals.

End-User Analysis

The veterinary hospitals & clinics segment grew at a substantial rate, generating a revenue portion of 54.7% due to the increasing demand for comprehensive and specialized veterinary services. With the growing number of pet owners and the rising awareness of animal health, veterinary hospitals and clinics are expected to invest more in modern equipment and infrastructure.

The demand for preventive care, emergency services, and specialized treatments is anticipated to drive the expansion of veterinary hospitals and clinics, leading to increased use of diagnostic, monitoring, and surgical equipment. As veterinary care becomes more sophisticated, veterinary hospitals and clinics are likely to adopt more advanced technologies to enhance patient care, further propelling the segment’s growth

Key Market Segments

By Product Type

- Equipment & Accessories

- Anesthesia Equipment

- Waste Gas Management Systems

- Ventilators

- Vaporizers

- Anesthesia Machines

- Anesthesia Accessories

- Veterinary Telemetry Systems

- Patient Monitors

- Patient Monitoring Accessories

- Oxygen Concentrator & Accessories

- Fluid Management Equipment

- Syringe Pumps

- Large-Volume Infusion Pumps

- Temperature Management Equipment

- Patient Warming Systems

- Fluid Warmers

- Anesthesia Equipment

- Disposables/ Consumables

- Airway Management Consumables

- Others

By Animal

- Small Animals

- Dogs

- Cats

- Others

- Large Animals

By Application

- Surgical

- Monitoring

- Diagnostic

By End-user

- Veterinary Hospitals & Clinics

- Laboratories

- Others

Drivers

Increasing Pet Ownership is Driving the Market

The rising number of pet owners globally is a key driver for the veterinary equipment market. In 2023, US pet ownership increased significantly, indicating sustained demand for pet healthcare services. The American Pet Products Association (APPA) reported that US pet expenditures reached US$136.8 billion in 2022, with veterinary care accounting for US$ 35.9 billion. This trend is reflected in Europe, where data shows 38% of EU households owned at least one pet in 2022.

As more people adopt pets, the need for advanced diagnostic tools, surgical instruments, and monitoring devices grows, prompting manufacturers to innovate and expand their product offerings. Companies such as IDEXX Laboratories and Heska Corporation have reported increased sales in imaging and diagnostic equipment, highlighting the sustained demand for such products. This surge in demand ensures that the market continues to experience steady expansion.

Restraints

High Equipment Costs are Restraining the Market

The high cost of advanced veterinary devices limits market growth, especially in developing regions. Digital radiography systems, for example, can cost between US$20,000 and US$100,000, while MRI machines can exceed US$150,000. Smaller clinics and rural practices often struggle to afford these significant investments. The American Veterinary Medical Association (AVMA) noted that many US veterinary practices have delayed equipment upgrades due to financial constraints.

Similarly, clinics in emerging markets often face barriers to adopting modern diagnostic tools due to limited resources. While financing options and leasing programs exist to help alleviate some of these costs, the high upfront investment remains a barrier, slowing the adoption of modern equipment, particularly in resource-constrained markets.

Opportunities

Telemedicine is Creating Growth Opportunities

The rapid adoption of veterinary telemedicine is opening new revenue streams for equipment providers. In 2023, the number of US veterinarians incorporating telehealth services increased significantly. This shift towards remote care has created a demand for portable and connected devices, such as digital stethoscopes and remote monitoring systems.

As more veterinary practices adopt telemedicine, the need for innovative solutions in remote diagnostics and treatment management continues to rise. Companies like Zoetis and VetNow are investing in cloud-based platforms to meet this growing demand. Emerging markets, where access to in-person care is often limited, present untapped potential for telemedicine-compatible equipment, further fueling market growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic instability and geopolitical tensions are reshaping the veterinary equipment industry. Rising inflation has increased production costs, forcing companies to raise prices, though demand remains resilient due to strong pet care spending. Trade disruptions, such as US-China tariffs, have strained supply chains, causing delays in equipment deliveries.

However, localization efforts are reducing dependencies, as seen with companies expanding their manufacturing capabilities in Europe to shorten lead times. Currency fluctuations also impact emerging markets, where veterinary clinics face higher import costs due to changes in exchange rates.

Despite these challenges, technological advancements and government subsidies, such as grants for rural veterinary infrastructure, continue to foster growth. The industry’s ability to adapt and innovate ensures long-term expansion, with emerging opportunities outweighing short-term disruptions caused by economic and geopolitical factors.

Latest Trends

Sustainability is a Recent Trend

Eco-friendly veterinary equipment is gaining traction as clinics prioritize sustainability. Studies have shown that a large percentage of pet owners prefer brands with strong environmental commitments, encouraging veterinary clinics to adopt more sustainable practices. In response, companies are developing energy-efficient devices and reducing the use of single-use plastics in their products.

For example, Midmark Corporation launched a line of solar-powered anesthesia machines, which reduced energy consumption significantly. The green veterinary equipment market is expected to grow as sustainability becomes a key focus for both manufacturers and consumers. Governments are also incentivizing eco-friendly practices, with grants and initiatives to support eco-friendly medical device innovation. This shift toward sustainability is likely to drive further market development in the coming years.

Regional Analysis

North America is leading the Veterinary Equipment Market

North America dominated the market with the highest revenue share of 38.4% owing to rising pet ownership, increased spending on animal healthcare, and advancements in veterinary technology. According to the American Pet Products Association (APPA), US pet expenditures reached US$147 billion in 2023, with veterinary care accounting for US$ 38.3 billion, a 10.5% increase from 2022. The growing demand for advanced diagnostic tools, such as digital radiography and ultrasound systems, has further fueled market expansion.

The US Bureau of Labor Statistics reported a 19% increase in veterinary employment from 2022 to 2024, reflecting the need for more clinics and equipment. Additionally, government initiatives, such as the USDA’s US$ 120 million investment in veterinary infrastructure in 2023, have supported market growth by improving access to advanced medical devices in rural areas. The rise in livestock health monitoring systems, driven by the US Food and Drug Administration’s stricter regulations on livestock welfare, has also contributed to higher equipment demand.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding pet care awareness, rising disposable incomes, and government-led animal health initiatives. The Food and Agriculture Organization (FAO) reported a 15% increase in livestock production investments across Southeast Asia from 2022 to 2024, driving demand for diagnostic and monitoring tools. In India, the Department of Animal Husbandry allocated ₹4,000 crore (US$ 480 million) in 2023 to modernize veterinary facilities, emphasizing digital imaging and surgical equipment.

China’s Ministry of Agriculture noted a 22% surge in pet clinic registrations in 2023, indicating higher equipment procurement. Japan’s growing geriatric pet population has led to a rise in veterinary visits, boosting sales of advanced monitoring devices. With Australia’s livestock exports increasing in 2023, the need for portable ultrasound and vaccination devices has grown. These trends suggest sustained market expansion across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the veterinary equipment market focus on technological innovation, strategic partnerships, and expanding their global presence to drive growth. They invest in developing advanced diagnostic tools, surgical instruments, and consumables to enhance veterinary care. Collaborations with veterinary clinics, research institutions, and distributors facilitate the integration of new technologies and broaden market reach. Additionally, targeting emerging markets with increasing demand for veterinary services presents significant growth opportunities.

IDEXX Laboratories, headquartered in Westbrook, Maine, is a leading provider of diagnostic products and services for the veterinary market. The company offers a comprehensive range of diagnostic equipment, including in-clinic analyzers and laboratory services, to support veterinary practices globally. IDEXX emphasizes research and development to deliver innovative solutions that improve animal health and streamline veterinary workflows. With a presence in over 175 countries, IDEXX continues to expand its influence in the veterinary diagnostics sector through strategic partnerships and continuous innovation.

Top Key Players in the Veterinary Equipment Market

- SunTech Medical, Inc

- Nonin

- Medtronic

- Masimo

- Dispomed Ltd

- Covetrus

- Braun Vet Care GmbH

- Avante Animal Health

Recent Developments

- In January 2024, SunTech Medical, Inc. introduced the Vet40, a new surgical vital signs monitor designed specifically for pets. This launch further extends the company’s product line, providing veterinary professionals with advanced tools to monitor vital signs during surgery, enhancing patient care and safety.

- In April 2022, Dispomed expanded its capabilities with the acquisition of ARVS, a move aimed at improving the company’s ability to offer high-quality medical equipment and technical services to veterinary clinics, reinforcing its position in the veterinary market.

Report Scope

Report Features Description Market Value (2024) US$ 3.0 Billion Forecast Revenue (2034) US$ 5.3 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Equipment & Accessories (Anesthesia Equipment, Waste Gas Management Systems, Ventilators, Vaporizers, Anesthesia Machines, Anesthesia Accessories, Veterinary Telemetry Systems, Patient Monitors, Patient Monitoring Accessories, Oxygen Concentrator & Accessories, Fluid Management Equipment, Syringe Pumps, Large-Volume Infusion Pumps, Temperature Management Equipment, Patient Warming Systems, and Fluid Warmers), Disposables/Consumables (Airway Management Consumables and Others)), By Animal (Small Animals (Dogs, Cats, and Others), Large Animals), By Application (Surgical, Monitoring, and Diagnostic), By End-user (Veterinary Hospitals & Clinics, Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SunTech Medical, Inc, Nonin, Medtronic, Masimo, Dispomed Ltd, Covetrus, B. Braun Vet Care GmbH, and Avante Animal Health. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Equipment MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Equipment MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SunTech Medical, Inc

- Nonin

- Medtronic

- Masimo

- Dispomed Ltd

- Covetrus

- Braun Vet Care GmbH

- Avante Animal Health