Global Veterinary Reference Laboratory Market Analysis By Technology (Clinical Chemistry, Haematology, Immunodiagnostics, Molecular Diagnostics, Others), By Application (Pathology, Bacteriology, Parasitology, Virology, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136570

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

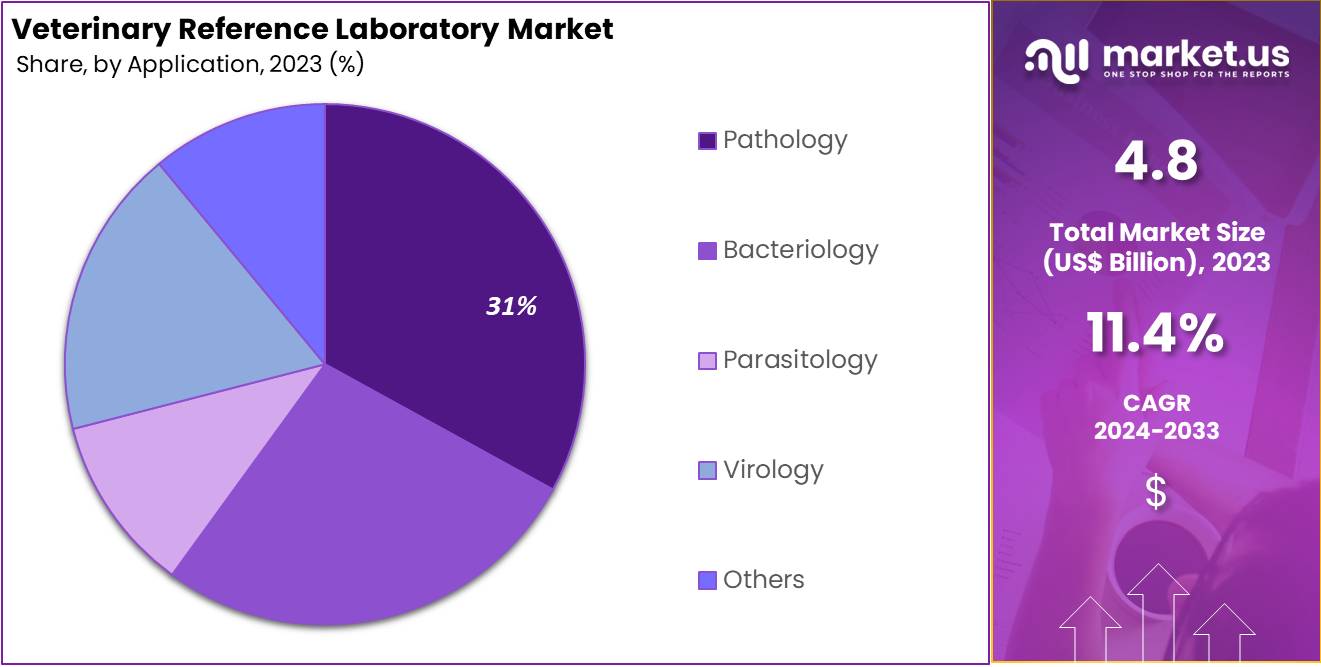

The Global Veterinary Reference Laboratory Market Size is expected to be worth around US$ 14.1 Billion by 2033, from US$ 4.8 Billion in 2023, growing at a CAGR of 11.4% during the forecast period from 2024 to 2033.

The Veterinary Reference Laboratory Market is a vital segment within animal healthcare. These laboratories perform advanced diagnostic testing to detect diseases, monitor health, and ensure the well-being of pets, livestock, and wildlife. By using cutting-edge technologies like PCR, immunoassays, and genomic analysis, these facilities deliver precise results that support veterinary practices and ensure food safety.

The demand for veterinary diagnostics is growing due to factors like the increasing prevalence of zoonotic diseases, higher pet ownership rates, and the rising need for livestock health management. According to market segmentation, these services can be categorized into clinical chemistry, hematology, and immunodiagnostics. Additionally, the market serves diverse animal types, including companion animals and livestock, and caters to end-users like veterinary hospitals and clinics.

For example, the MU Veterinary Medical Diagnostic Laboratory reported a significant performance increase in 2023. The lab handled 64,924 accessions and conducted 207,026 tests, marking a 10.67% rise in accessions and a 17.54% growth in tests compared to the previous year. This highlights the growing reliance on veterinary diagnostic services.

Regulatory bodies play a critical role in maintaining standards in this market. In the United States, the USDA APHIS conducted 10,595 site inspections in 2022, assessing the care and treatment of over 1.4 million animals. Remarkably, 96% of licensees and registrants were found to be in substantial compliance with the Animal Welfare Act. Similarly, in the United Kingdom, the Food Standards Agency reported that over 1 billion animals were processed in slaughterhouses in 2022/23, with over 99.9% meeting welfare compliance standards.

Innovation drives the market, as seen in the expansion of breed-specific genetic testing. For instance, Embark introduced over 50 new genetic health condition tests in 2023, including a breed-specific test for Stargardt Disease in Labrador Retrievers. The test revealed that only 79.7% of tested Labradors were clear of this genetic risk. Such advancements underline the growing focus on personalized animal health.

Veterinary forensic science is also gaining prominence. A study by the ASPCA revealed that their Forensic Science Center supported nearly 450 cruelty cases involving over 1,100 animals in 2023. Collaborations with agencies like the NYPD resulted in assistance for over 350 suspected cruelty cases. Their expert court testimonies further demonstrate the vital role of forensic science in animal welfare.

Similarly, the University of Florida’s Veterinary Forensic Pathology Program reported a 136% surge in casework between 2022 and 2023. This increase is attributed to growing awareness and training initiatives, reflecting the rising importance of veterinary forensic services in addressing animal cruelty.

The Veterinary Reference Laboratory Market continues to grow, driven by innovation, regulatory oversight, and the increasing need for reliable diagnostics. These facilities not only enhance animal health but also contribute to food safety, public health, and animal welfare.

Key Takeaways

- The global Veterinary Reference Laboratory Market is projected to grow from US$ 4.8 billion in 2023 to US$ 14.1 billion by 2033, a CAGR of 11.4%.

- In 2023, Clinical Chemistry led the technology segment, holding over 28% of the Veterinary Reference Laboratory Market share.

- The Pathology segment was the leading application in the Veterinary Reference Laboratory Market in 2023, securing more than 31% of the market.

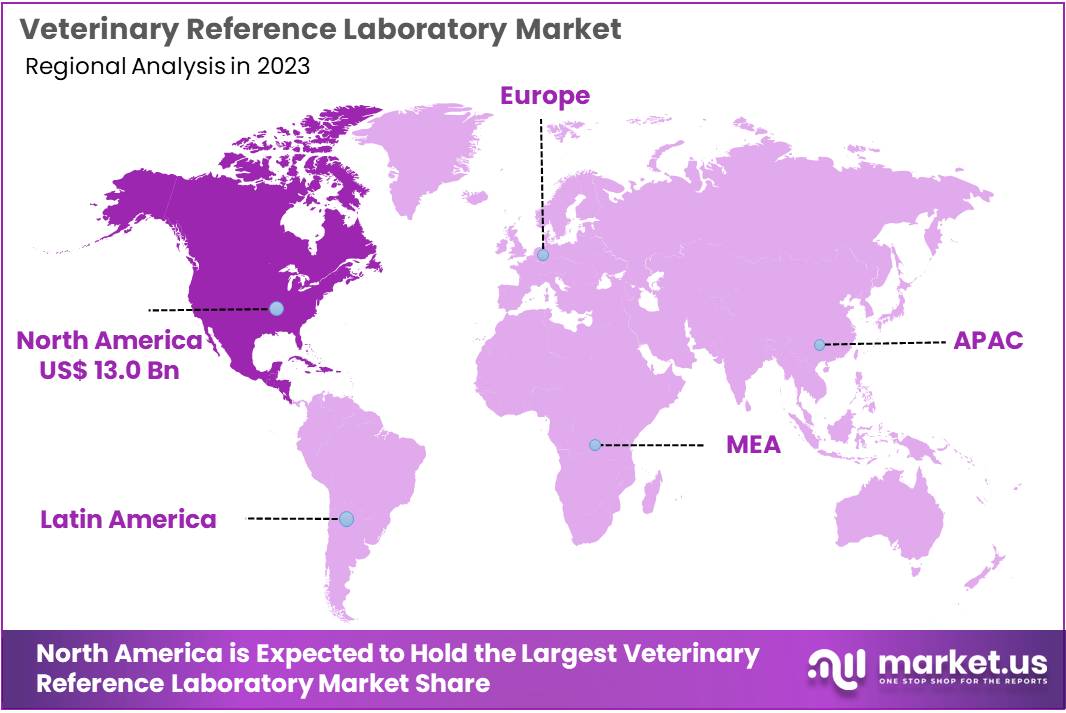

- North America dominated the veterinary reference laboratory market in 2023, with a 34% share, valued at US$ 13 billion.

Technology Analysis

In 2023, Clinical Chemistry held a dominant market position in the Technology Segment of the Veterinary Reference Laboratory Market, capturing more than a 28% share. This segment is pivotal because it facilitates basic and advanced biochemical testing. These tests provide essential data for assessing the health of animals, including kidney and liver function and electrolyte balance.

Hematology represents a significant portion of the market. It involves analyzing blood samples to detect conditions such as anemia and infections. Regular health checks and disease screenings frequently rely on hematology. It plays a crucial role in routine veterinary diagnostics.

Immunodiagnostics is vital for identifying specific antigens or antibodies. This technology includes methods like ELISA, which are critical for diagnosing viral diseases in animals. The precision and speed of immunodiagnostics make it a cornerstone in preventive veterinary care and controlling outbreaks.

Molecular Diagnostics is growing rapidly within the veterinary sector. It identifies pathogens using advanced techniques like PCR, which are essential for pinpointing diseases that traditional methods cannot detect. Other important technologies include urinalysis and microbiology, crucial for a full health assessment and effective treatment planning.

Application Analysis

In 2023, the Pathology segment led the Veterinary Reference Laboratory Market’s application analysis, capturing over 31% of the market. This segment is pivotal for diagnosing diseases through detailed tissue sample examinations. Its significant market share is attributed to its crucial role in accurate disease identification, which is essential for effective treatment and animal health management.

Bacteriology is another crucial component, focusing on identifying bacterial infections in animals. This segment’s growth is driven by the need for precise bacterial identification and antibiotic sensitivity testing. Bacteriology is essential for addressing antimicrobial resistance and ensuring targeted treatments, thus safeguarding animal health.

The Parasitology segment deals with detecting parasites that impact animal health. Its importance spans companion and livestock sectors, where accurate parasite detection is crucial for preventing disease outbreaks and maintaining animal health. The segment supports global efforts to develop effective parasite control strategies.

Lastly, Virology and other specialized tests like endocrinology and immunology are integral to the market. Virology’s importance escalates with emerging animal viruses, highlighting the need for advanced virological testing. The Others segment, which includes genetic testing, is expanding, offering advanced disease screening and enhancing veterinary care capabilities.

Key Market Segments

By Technology

- Clinical Chemistry

- Haematology

- Immunodiagnostics

- Molecular Diagnostics

- Others

By Application

- Pathology

- Bacteriology

- Parasitology

- Virology

- Others

Drivers

Increasing Pet Ownership and Demand for Advanced Veterinary Care

Pet ownership is increasing rapidly worldwide. This growth is particularly evident in urban areas where pets are considered part of the family. As more people adopt pets, the need for veterinary care also rises. Pet owners seek high-quality and comprehensive healthcare for their animals. This trend significantly impacts the demand for veterinary reference laboratories. These facilities offer precise diagnostic services, ensuring effective treatments. Their specialized tests are crucial in maintaining animal health and addressing various medical concerns.

Veterinary reference laboratories provide advanced diagnostic capabilities. These labs perform specialized tests that are not available in regular clinics. Examples include genetic testing, disease detection, and biochemical analysis. These services help veterinarians deliver accurate diagnoses and tailored treatments. The growing awareness of such specialized care among pet owners drives the demand for these labs. As pets’ medical needs become more complex, laboratories play a vital role in ensuring effective treatment outcomes.

The need for precise and reliable veterinary care contributes to the market growth. Pet owners prioritize the health and well-being of their animals, increasing the demand for advanced testing. This trend also aligns with a growing focus on preventive healthcare. Veterinary reference laboratories enable early detection of diseases, improving treatment success rates. The continuous rise in pet adoption and awareness about animal health underscores the importance of these facilities. As a result, the market for veterinary diagnostic services continues to expand globally.

Restraints

High Cost of Veterinary Diagnostic Services

The high cost of advanced veterinary diagnostic services poses a significant barrier for many pet owners. Diagnostic tests often require sophisticated equipment and cutting-edge technology, driving up expenses. This is especially true for procedures like imaging scans, molecular tests, and genetic screenings. Such costs can be prohibitive for individuals in lower-income brackets, making these services inaccessible to a large portion of the population. Affordability challenges often limit early detection and treatment of diseases, which may further impact pet health outcomes.

Another contributing factor is the need for highly skilled personnel to operate advanced diagnostic equipment. Veterinary professionals with specialized expertise are essential for accurate test administration and result interpretation. However, their expertise comes at a premium, which adds to the overall cost of services. These costs are particularly challenging in less developed regions, where access to specialized care is already limited. Consequently, this disparity restricts market growth in emerging economies, where affordability remains a key issue.

In developed regions, pet owners may still face financial strain despite better access to diagnostic services. Routine check-ups and advanced diagnostics can lead to cumulative expenses over time. Additionally, rising pet healthcare costs are not always covered by insurance or subsidies, leaving pet owners to shoulder the burden. This limits the adoption of advanced veterinary diagnostics, despite growing awareness of their importance. Addressing these affordability issues is crucial for expanding access and driving growth in the veterinary diagnostics market.

Opportunities

Expansion into Emerging Markets

Emerging markets offer a promising growth opportunity for veterinary reference laboratories. These regions are witnessing a growing awareness of animal health and welfare among pet owners and livestock managers. Increased education and outreach efforts are encouraging routine veterinary checkups and preventive care. This shift in mindset is creating a demand for advanced diagnostic and reference laboratory services. Laboratories entering these markets can position themselves as trusted partners for animal care, addressing unmet needs with reliable, high-quality services.

Rising disposable incomes in emerging economies further enhance the potential for market expansion. Pet ownership and livestock investments are increasing as households and businesses allocate more resources toward animal care. This trend is driving the demand for specialized diagnostic services to support both pet wellness and livestock productivity. Veterinary reference laboratories can capitalize on this growth by offering tailored solutions that meet the specific needs of these markets, including rapid diagnostics and comprehensive testing panels.

Establishing operations in emerging markets allows veterinary reference laboratories to access a growing customer base. These regions represent an untapped market where regular veterinary care is gaining importance. By localizing services and creating partnerships with local veterinary clinics, laboratories can build trust and foster long-term relationships. Strategic entry into these markets also enables laboratories to stay ahead of competitors while contributing to improved animal health outcomes, thus ensuring sustained growth and market relevance.

Trends

Integration of Advanced Technologies

The veterinary reference laboratory market is embracing advanced technologies like artificial intelligence (AI) and machine learning. These technologies significantly enhance diagnostic accuracy by analyzing complex data faster and more precisely. They support veterinarians in identifying health issues early, ensuring better treatment outcomes. AI-powered tools also reduce the time required for manual diagnostics, improving workflow efficiency. The growing adoption of these innovations reflects the increasing demand for quicker and more reliable diagnostic processes, making AI and machine learning essential components in modern veterinary practices.

Telemedicine is another key trend reshaping the veterinary reference laboratory market. This technology allows veterinarians to consult with specialists remotely, providing timely and expert input on complex cases. Telemedicine platforms also enable pet owners to access veterinary advice without needing in-person visits, saving time and reducing stress for pets. The convenience offered by telemedicine is driving its popularity, particularly among busy pet owners. It also improves access to veterinary care in rural or underserved areas, expanding healthcare availability to a broader population.

The integration of these technologies is transforming the way veterinarians and pet owners interact with diagnostic services. Real-time data capabilities offered by AI, machine learning, and telemedicine improve decision-making during critical situations. These advancements make it easier to track a pet’s health over time, ensuring early intervention for potential issues. The seamless connectivity between laboratories and clinics enhances collaboration, delivering faster results and better care. The rising adoption of these technologies highlights their role in improving veterinary diagnostics and meeting the growing expectations of pet owners.

Regional Analysis

In 2023, North America maintained a dominant position in the veterinary reference laboratory market, capturing over a 34% share with a market value of US$ 13 Billion. This leadership stems from a robust healthcare infrastructure tailored to both human and veterinary needs. High standards in veterinary services, backed by rigorous regulatory frameworks in the U.S. and Canada, significantly bolster the region’s market share.

The high rate of pet ownership in North America significantly fuels demand for veterinary diagnostics. This demographic trend ensures a steady flow of clients to reference laboratories. Additionally, the region hosts some of the foremost companies in this sector. These enterprises drive innovation and service quality, continuously enhancing the region’s market position.

Awareness of animal health is on the rise among pet owners and livestock managers, increasing the demand for veterinary services. This trend, coupled with advances in diagnostic technologies, predicts a sustained, if not increased, dominance of North America in the veterinary reference laboratory market. Moving forward, ongoing developments and a growing pet humanization movement are likely to further solidify North America’s leading role.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

IDEXX Laboratories Inc. is a prominent player in the Veterinary Reference Laboratory Market, known for its innovative diagnostic solutions that enhance veterinary care globally. Similarly, VCA Inc. contributes significantly with its comprehensive network of laboratories, offering a range of diagnostic services that improve treatment accuracy and animal health outcomes. Both companies integrate modern technologies to advance veterinary practices.

GD Animal Health is distinguished by its commitment to animal health through extensive diagnostic services, focusing on disease control and prevention. Boehringer Ingelheim enhances the market with its strong emphasis on research and development in the animal health division. This focus supports the creation of effective animal health therapies, reinforcing their market leadership.

Zoetis Inc. leads with innovative products and customer-centric solutions, supporting diverse animal species. Their efforts in improving diagnostic predictability are essential for effective treatment strategies. Additionally, other key players in the market provide specialized expertise and innovative technologies, essential for the sector’s growth and the enhancement of veterinary diagnostics worldwide.

Market Key Players

- IDEXX Laboratories Inc.

- VCA Inc.

- GD Animal Health

- Boehringer Ingelheim

- Zoetis Inc.

- NEOGEN Corporation

- SYNLAB International GmbH

- Thermo Fischer Scientific Inc.

- Heska Corporation

- Virbac

Recent Developments

- In October 2023: NEOGEN Corporation hosted a significant industry seminar, showcasing the X-SEPA™ technology at the Indian Battery Show. This event marked the inception of a strategic partnership with noco-noco, focusing on exploring new battery formulations for the Indian market. This collaboration aims to meet the growing energy storage demands in India, driven by NEOGEN’s expertise in electrolytes.

- In June 2022: Zoetis completed its acquisition of Basepaws, a petcare genetics company. Basepaws offers genetic testing for pets which can aid early disease detection and treatment. This acquisition enhances Zoetis’s portfolio in the precision animal health sector, although the financial details were not disclosed.

Report Scope

Report Features Description Market Value (2023) US$ 4.8 Billion Forecast Revenue (2033) US$ 14.1 Billion CAGR (2024-2033) 11.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Clinical Chemistry, Haematology, Immunodiagnostics, Molecular Diagnostics, Others), By Application (Pathology, Bacteriology, Parasitology, Virology, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IDEXX Laboratories Inc., VCA Inc., GD Animal Health, Boehringer Ingelheim, Zoetis Inc., NEOGEN Corporation, SYNLAB International GmbH, Thermo Fischer Scientific Inc., Heska Corporation, Virbac Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Reference Laboratory MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Veterinary Reference Laboratory MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IDEXX Laboratories Inc.

- VCA Inc.

- GD Animal Health

- Boehringer Ingelheim

- Zoetis Inc.

- NEOGEN Corporation

- SYNLAB International GmbH

- Thermo Fischer Scientific Inc.

- Heska Corporation

- Virbac