Global Vegan Ice Cream Market By Source (Coconut Milk, Soy Milk, Almond Milk, Cashew Milk), By Flavor (Vanilla, Chocolate, Butter Pecan, Strawberry, Neapolitan, Cookies and Cream, Mint Choco Chip, Caramel), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151642

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

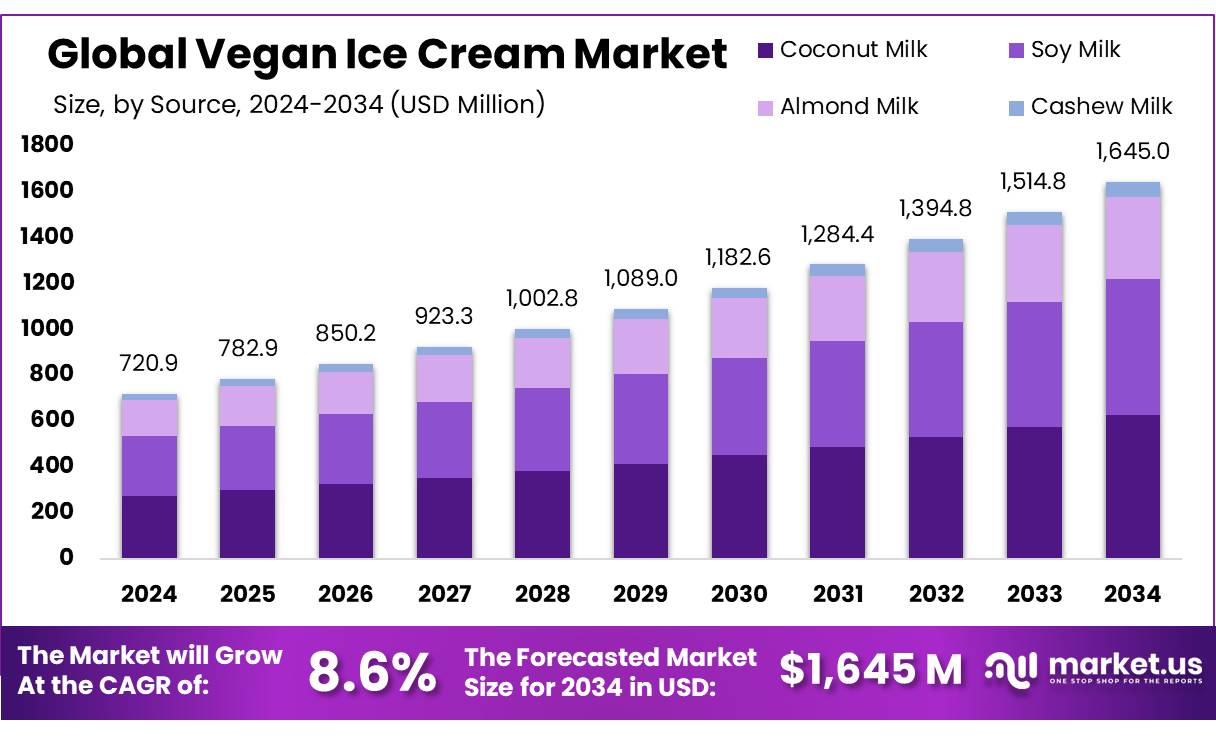

The Global Vegan Ice Cream Market size is expected to be worth around USD 1645.0 Million by 2034, from USD 720.9 Million in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034.

The vegan ice cream concentrates stems from rising consumer demand for plant-based indulgences that offer convenience, dairy-free formulation, and extended shelf life. These concentrates—derived from coconut, almond, soy, or oat bases—are designed for large-scale foodservice and retail use, supporting consistency in taste and texture. They respond directly to dietary shifts influenced by lactose intolerance, plant-forward eating, sustainability awareness, and regulatory recognition.

Government initiatives are increasingly reinforcing this industrial transformation. In India, the Plant Protein Cluster Initiative—operational across 12 states—aims to develop the country as a plant-based ingredient hub via coinvestment in protein processing and infrastructure.

Additionally, Assocham-backed reports assert that India’s plant-based foods sector, valued at INR 300 crore (~USD 36 million) in 2024, has grown 18% over the past three years and remains underpenetrated at under 0.1 % of conventional dairy and meat markets. Parallel Pulse & Legumes programmes under India’s Ministry of Agriculture are advancing supply chain stability for raw materials used in vegan protein and concentrate production.

Driving factors for industry growth include rising health consciousness—stemming from concerns over cholesterol, lactose intolerance, and allergen avoidance—alongside ethical and environmental motivations. About 61% of consumers report convenience as a key driver for switching to plant-based options. Moreover, sustainability continues to be a major catalyst, with a shift in dairy alternatives projected by leading industry bodies. For instance, sources estimate that within the coming decade, 20% of global dairy consumption could become plant-based.

Key Takeaways

- Vegan Ice Cream Market size is expected to be worth around USD 1645.0 Billion by 2034, from USD 720.9 Billion in 2024, growing at a CAGR of 8.6%.

- Coconut Milk held a dominant market position in the vegan ice cream market by source, capturing more than a 38.1% share.

- Vanilla held a dominant market position in the vegan ice cream market by flavor, capturing more than a 31.9% share.

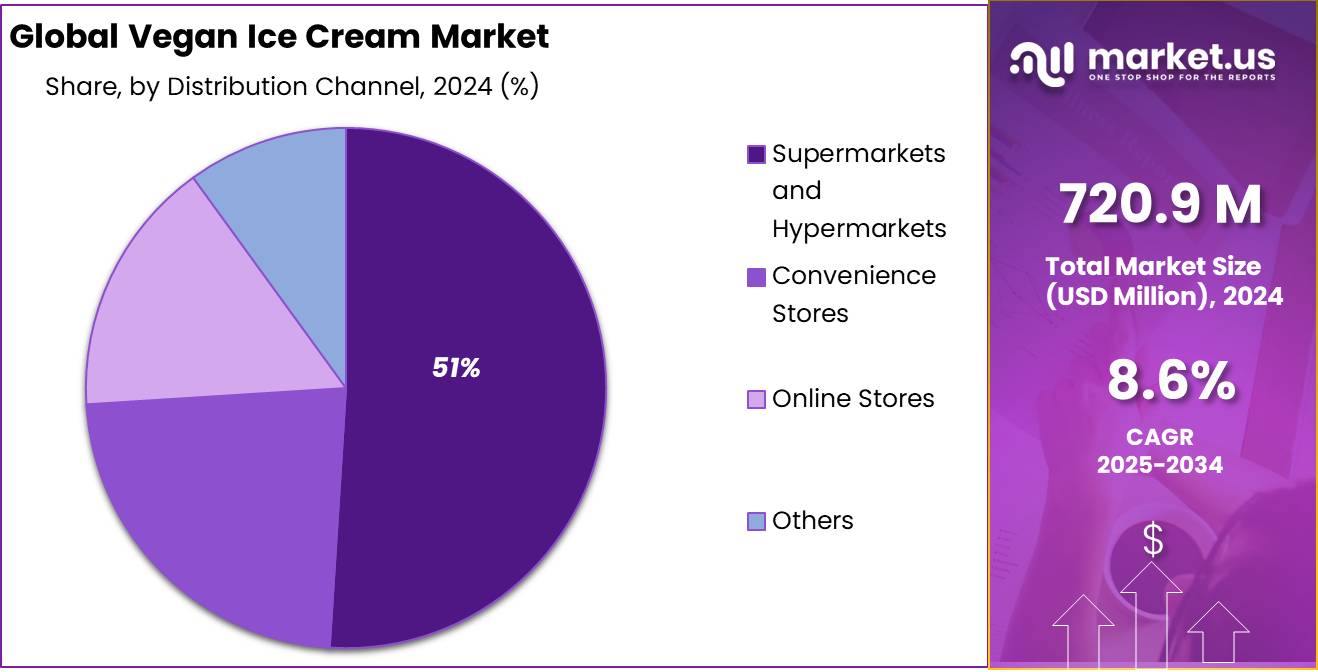

- Supermarkets and Hypermarkets held a dominant market position in the vegan ice cream market by distribution channel, capturing more than a 51% share.

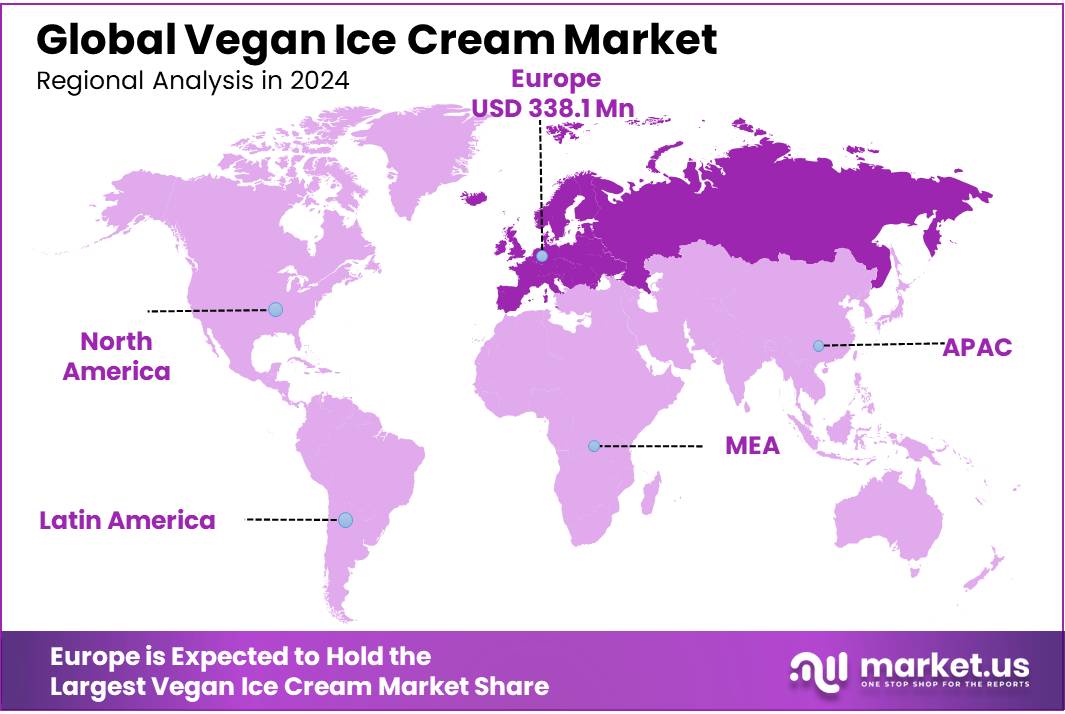

- Europe stands as the dominant region in the global vegan ice cream market, holding a substantial share of 46.9%, equating to approximately USD 338.1 million in 2024.

By Source

Coconut Milk dominates with 38.1% due to its creamy texture and wide consumer preference.

In 2024, Coconut Milk held a dominant market position in the vegan ice cream market by source, capturing more than a 38.1% share. This strong performance can be attributed to its naturally creamy consistency and neutral flavor profile, which make it an ideal base for frozen desserts. Coconut milk has gained significant popularity among both health-conscious and lactose-intolerant consumers, especially in regions where coconut is already a staple ingredient.

Its plant-based origin, combined with its ability to replicate the mouthfeel of traditional dairy, has made it a preferred choice for manufacturers looking to deliver indulgent yet clean-label ice cream alternatives. By 2025, the demand for coconut milk-based vegan ice cream is expected to grow steadily, supported by increasing product launches in both premium and value segments. The growing appeal of tropical flavors, along with consumer interest in allergen-free and gluten-free dessert options, continues to reinforce coconut milk’s leadership in this segment.

By Flavor

Vanilla leads with 31.9% due to its timeless taste and wide consumer appeal.

In 2024, Vanilla held a dominant market position in the vegan ice cream market by flavor, capturing more than a 31.9% share. This strong preference for vanilla is rooted in its universal appeal, subtle sweetness, and compatibility with a variety of toppings and mix-ins. Its familiar taste makes it a popular choice among first-time buyers of plant-based ice cream, especially in regions where vanilla remains a traditional favorite.

Manufacturers often use vanilla as a base flavor to introduce new consumers to the category, capitalizing on its broad acceptance. By 2025, the vanilla segment is expected to maintain steady demand, supported by the rising availability of natural vanilla extracts and sustainable sourcing practices. As vegan ice cream gains popularity in both retail and foodservice sectors, vanilla continues to play a central role due to its versatility and consumer trust.

By Distribution Channel

Supermarkets and Hypermarkets dominate with 51% share due to strong retail visibility and consumer access.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the vegan ice cream market by distribution channel, capturing more than a 51% share. Their broad product offerings, organized cold storage facilities, and high foot traffic have made them the most accessible point of purchase for consumers seeking plant-based dessert options. These retail formats allow brands to reach a wide demographic by offering both premium and economy vegan ice cream varieties under one roof.

The availability of exclusive in-store promotions and discounts further encourages trial and repeat purchases. By 2025, supermarkets and hypermarkets are expected to retain their leading role as more consumers shift toward clean-label and dairy-free alternatives, especially in urban and semi-urban areas. Their ability to offer variety, maintain consistent stock levels, and cater to impulse buying habits continues to support their dominance in this segment.

Key Market Segments

By Source

- Coconut Milk

- Soy Milk

- Almond Milk

- Cashew Milk

By Flavor

- Vanilla

- Chocolate

- Butter Pecan

- Strawberry

- Neapolitan

- Cookies and Cream

- Mint Choco Chip

- Caramel

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Drivers

Growing Health Consciousness and Dietary Shifts Drive Vegan Ice Cream Market Growth

The increasing shift towards healthier and more sustainable eating habits is one of the primary driving factors behind the growth of the vegan ice cream market. As consumers become more health-conscious, many are looking for alternatives to traditional dairy products, which are often linked to health issues such as lactose intolerance, high cholesterol, and obesity. According to the International Dairy Federation, nearly 68% of the global population experiences some form of lactose intolerance, fueling the demand for plant-based alternatives, including ice cream.

In addition, the rising awareness about the environmental impact of dairy farming has prompted many consumers to explore vegan options. Vegan ice cream is considered a more sustainable choice due to its lower carbon footprint compared to dairy production. The United Nations Food and Agriculture Organization has reported that animal agriculture contributes significantly to greenhouse gas emissions, motivating consumers to seek out eco-friendly substitutes. In fact, the market for plant-based food and beverages, which includes vegan ice cream, is expected to reach over $74.2 billion by 2027, driven by these sustainability concerns.

Government initiatives also play a role in this market’s expansion. In several countries, including the U.S. and EU, government programs promoting plant-based diets and reducing environmental impact are encouraging the consumption of vegan products. The European Commission has introduced regulations supporting plant-based alternatives, which further accelerates the growth of the vegan ice cream market.

Restraints

High Production Costs Pose a Challenge for Vegan Ice Cream Market

One of the major challenges facing the vegan ice cream market is the high production costs associated with plant-based ingredients. While the demand for vegan products has grown substantially, the cost of key ingredients like almonds, cashews, and coconut milk is still significantly higher than traditional dairy ingredients. According to the U.S. Department of Agriculture (USDA), plant-based milks are often 2 to 3 times more expensive than cow’s milk, which impacts the overall cost of producing vegan ice cream.

Additionally, the processing of these plant-based ingredients into ice cream involves more complex and often more expensive manufacturing techniques. For instance, the development of creamy textures that resemble dairy-based ice cream often requires the use of stabilizers, emulsifiers, and thickeners, which can increase production costs. These higher costs are typically passed on to consumers, making vegan ice cream less accessible to price-sensitive shoppers. The Plant-Based Foods Association highlights that while plant-based ice cream has seen growth, it still represents only a small percentage of the overall ice cream market due to the price barrier.

Furthermore, the scaling up of production to meet increasing demand requires significant investment in new machinery, infrastructure, and research and development, adding to the financial burden. Companies may struggle to maintain competitive pricing against large, established dairy brands, which benefit from economies of scale.

Opportunity

Rising Demand for Dairy-Free Products Presents Growth Opportunity for Vegan Ice Cream

The growing demand for dairy-free products represents a significant growth opportunity for the vegan ice cream market. As more consumers embrace plant-based lifestyles, including those with lactose intolerance, dairy allergies, and ethical concerns about animal welfare, the vegan food sector has seen rapid expansion. According to the Food and Agriculture Organization (FAO), over 68% of the global population experiences some form of lactose intolerance, which is driving the demand for dairy-free alternatives, including ice cream. This trend has opened up a broader market for vegan ice cream, appealing to those who can’t consume dairy as well as those opting for healthier or more sustainable diets.

A key driver of this opportunity is the increasing variety and availability of plant-based ingredients that enhance the taste and texture of vegan ice cream. Innovations in plant-based milk alternatives, such as oat, soy, and almond milk, have made it easier for producers to replicate the creamy, indulgent qualities of traditional dairy ice cream. As a result, consumers are less likely to feel limited by flavor or texture and are more likely to choose plant-based ice cream options.

Government policies and initiatives are also supporting this shift. In many countries, including the U.S. and EU, plant-based alternatives are gaining traction due to government regulations promoting sustainable food production and consumption. For example, the European Union’s Green Deal aims to reduce carbon emissions and promote plant-based diets, further fueling growth in the vegan ice cream sector.

Trends

Innovative Plant-Based Ingredients Transform Vegan Ice Cream Offerings

A notable trend in the vegan ice cream market is the increasing use of innovative plant-based ingredients, such as oat milk, coconut milk, and cashew cream, to enhance the texture and flavor profile of dairy-free ice cream. These ingredients not only cater to the growing demand for vegan options but also appeal to consumers seeking indulgent yet healthier dessert alternatives. The incorporation of these plant-based ingredients has led to the development of ice creams that closely mimic the creaminess and mouthfeel of traditional dairy ice cream, thereby attracting a broader consumer base.

The adoption of these innovative ingredients is supported by various industry reports and market analyses. For instance, the OECD-FAO Agricultural Outlook 2023-2032 highlights the increasing consumer preference for plant-based dairy alternatives, noting a significant rise in the consumption of plant-based beverages and products. This shift is attributed to factors such as health consciousness, lactose intolerance, and ethical considerations regarding animal welfare. The report indicates that the demand for plant-based dairy products is expected to continue growing, presenting opportunities for innovation in the vegan ice cream sector.

Furthermore, government initiatives and policies are playing a crucial role in promoting plant-based diets. In several countries, including the United States and members of the European Union, subsidies and incentives are being offered to producers of plant-based products. These policies aim to encourage sustainable agricultural practices and reduce the environmental impact of food production. Such support not only makes plant-based ingredients more accessible and affordable but also fosters innovation in product development.

Regional Analysis

Europe stands as the dominant region in the global vegan ice cream market, holding a substantial share of 46.9%, equating to approximately USD 338.1 million in 2024. This leadership is underpinned by a confluence of consumer preferences, regulatory support, and market dynamics.

The European market’s prominence is largely attributed to the increasing consumer inclination towards plant-based diets, driven by health considerations, ethical concerns, and environmental awareness. Countries like Germany, the United Kingdom, and France are at the forefront of this shift, with Germany leading in per capita expenditure on plant-based foods, reaching €19.92 in 2024 . This trend is mirrored across other European nations, reflecting a broader regional movement towards plant-based alternatives.

gfieurope.orgGovernment initiatives further bolster this transition. The European Union’s Green Deal and Farm to Fork Strategy emphasize sustainability and the promotion of plant-based diets, creating a conducive environment for the growth of vegan products, including ice cream. These policies not only encourage consumer adoption but also support the development of plant-based food sectors through research funding and infrastructure development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arctic Zero, founded in 2009, is a U.S.-based brand renowned for its low-calorie, non-dairy frozen desserts. Initially launched as a protein shake in ice cream form, it has evolved to offer a variety of flavors sweetened with organic cane sugar and monk fruit. The company emphasizes clean ingredients, ensuring their products are free from sugar alcohols and artificial additives. In 2018, Arctic Zero introduced a vegan line made with faba bean protein, catering to health-conscious consumers seeking indulgent yet nutritious options.

HappyCow is a Hong Kong-based company known for its dairy-free, handcrafted ice creams. Their offerings, such as flavors like Salted Caramel and Cherry Almond Fudge, are made with coconut milk, catering to vegan and lactose-intolerant consumers. The brand has expanded its presence with multiple locations, including a notable shop on the University of Hong Kong campus, and is recognized for its commitment to quality and flavor innovation.

Morrisons, a leading UK supermarket chain, has significantly expanded its plant-based offerings in recent years. Under its V Taste range, the retailer provides a variety of vegan ice creams, including options like Salted Caramel Swirl and Chocolate Brownie. These products are crafted to offer indulgent flavors while adhering to vegan dietary standards. Morrisons’ commitment to inclusivity is evident in their extensive selection of plant-based desserts, making vegan options accessible to a broader audience.

Top Key Players in the Market

- Arctic Zero

- Booja-Booja

- HappyCow

- Morrisons

- NadaMoo!

- Over The MOO

- SorBabes

- Tofutti Brands Inc.

- Unilever PLC

- Van Leeuwen Ice Cream.

Recent Developments

In 2024 Arctic Zero, reported annual revenues of approximately $25.8 million, reflecting its growing presence in the plant-based ice cream sector.

In 2024, Happy Cow expanded its product line to include innovative flavors such as Golden Pillow Durian, Strawberry, Pineapple Coconut, and Banana Caramel Swirl, all crafted from fresh, natural ingredients without artificial additives.

Report Scope

Report Features Description Market Value (2024) USD 720.9 Mn Forecast Revenue (2034) USD 1645.0 Mn CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Coconut Milk, Soy Milk, Almond Milk, Cashew Milk), By Flavor (Vanilla, Chocolate, Butter Pecan, Strawberry, Neapolitan, Cookies and Cream, Mint Choco Chip, Caramel), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arctic Zero, Booja-Booja, HappyCow, Morrisons, NadaMoo, Over The MOO, SorBabes, Tofutti Brands Inc., Unilever PLC, Van Leeuwen Ice Cream Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arctic Zero

- Booja-Booja

- HappyCow

- Morrisons

- NadaMoo!

- Over The MOO

- SorBabes

- Tofutti Brands Inc.

- Unilever PLC

- Van Leeuwen Ice Cream.