Global Environmental Health and Safety Software Market By Product Type (Software, Services (Project Deployment & Implementation, Certification, Business Consulting & Advisory, Audit, Assessment, & Regulatory Compliance, Analytics, and Others)), By Deployment Mode (Cloud and On-premises), By End-user (Chemical & Petrochemical, Telecom & IT, Healthcare, General Manufacturing, Energy & Mining, Construction, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144822

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

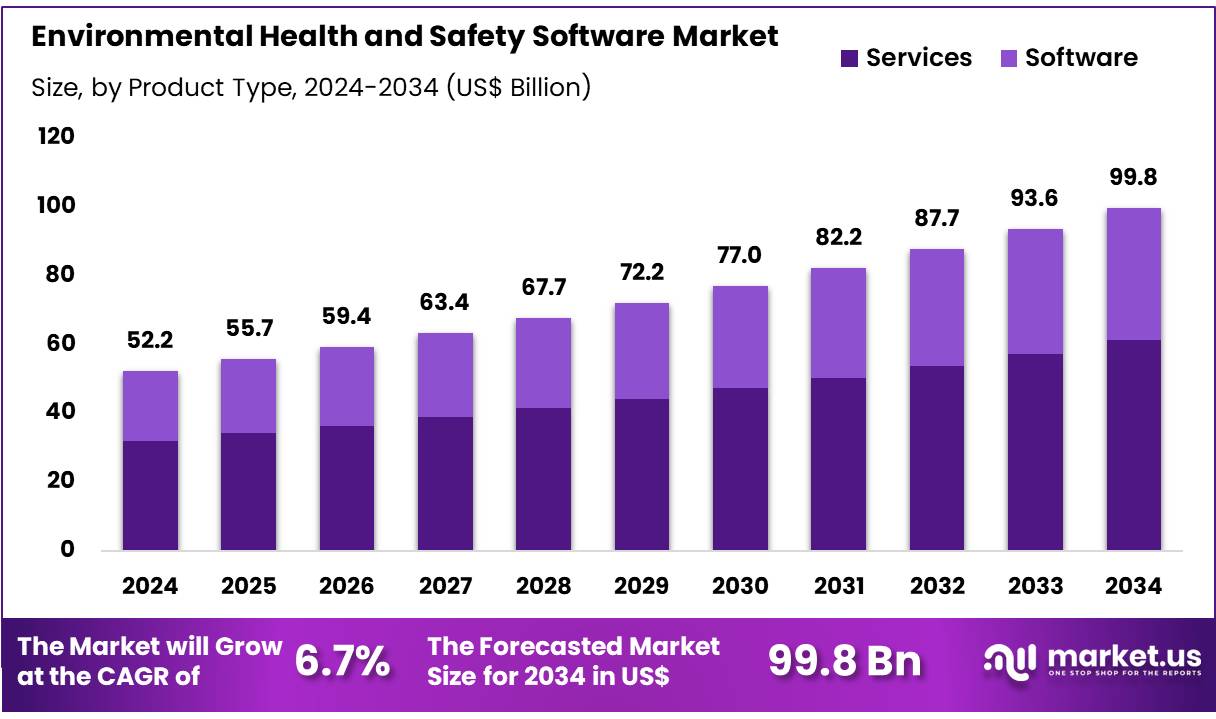

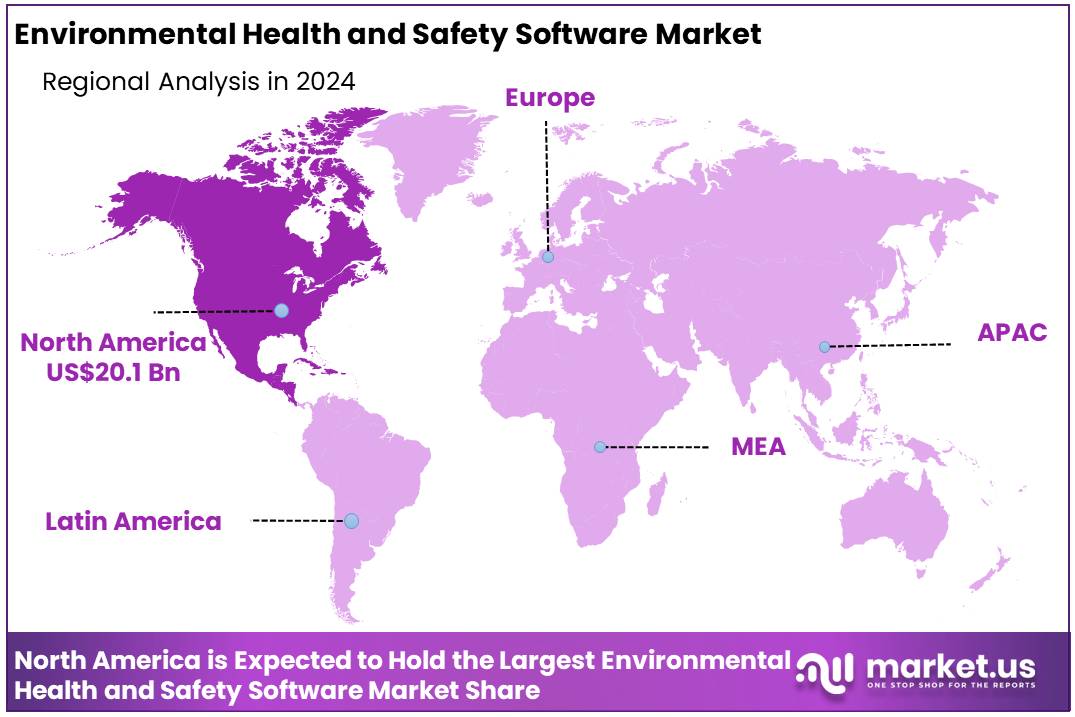

Global Environmental Health and Safety Software Market size is expected to be worth around US$ 99.8 billion by 2034 from US$ 52.2 billion in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.6% share with a revenue of US$ 20.1 Billion.

Increasing awareness of workplace safety, regulatory compliance, and environmental impact is driving the growth of the environmental health and safety (EHS) software market. Organizations across industries are adopting EHS software to streamline their processes, improve regulatory compliance, and enhance the overall safety and well-being of their employees.

As the need to minimize risks related to environmental hazards, occupational health, and safety regulations grows, EHS software has become a critical tool for ensuring businesses meet compliance standards and reduce liabilities. The integration of real-time data monitoring, incident reporting, and environmental impact tracking has created new opportunities for businesses to manage risks more effectively.

Recent trends show a growing emphasis on cloud-based solutions, providing flexibility and scalability for companies of all sizes. As reported by the KPA Survey 2022, users of EHS software experience significant advantages over non-users, with a notably higher satisfaction rate. While only 35% of EHS software users express average satisfaction with data collection and processing, 55% of non-users report similar dissatisfaction, highlighting the improved efficiency and outcomes provided by modern software tools.

These advancements not only support regulatory compliance but also enable companies to take proactive measures in mitigating potential hazards, resulting in safer and more sustainable work environments.

Key Takeaways

- In 2024, the market for environmental health and safety software generated a revenue of US$ 52.2 billion, with a CAGR of 6.7%, and is expected to reach US$ 99.8 billion by the year 2033.

- The product type segment is divided into software and services, with services taking the lead in 2024 with a market share of 61.3%.

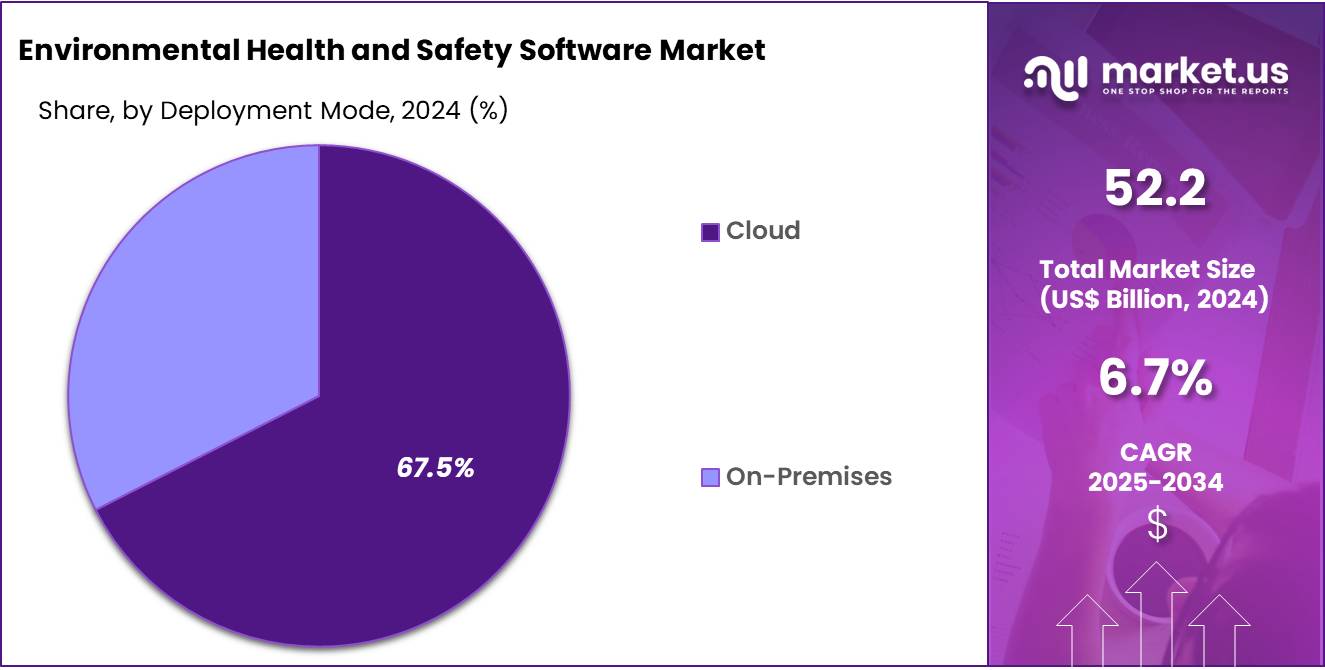

- Considering deployment mode, the market is divided into cloud and on-premises. Among these, cloud held a significant share of 67.5%.

- Furthermore, concerning the end-user segment, the market is segregated into chemical & petrochemical, telecom & IT, healthcare, general manufacturing, energy & mining, construction, and others. The chemical & petrochemical sector stands out as the dominant player, holding the largest revenue share of 27.3% in the environmental health and safety software market.

- North America led the market by securing a market share of 38.6% in 2024.

Product Type Analysis

The services segment led in 2024, claiming a market share of 61.3% as organizations increasingly seek tailored solutions to manage regulatory compliance, risk assessments, and employee safety. The growing complexity of environmental regulations, alongside an increasing emphasis on workplace safety, is likely to drive demand for professional services, such as consulting, training, and support.

These services help companies effectively implement and maintain their environmental health and safety (EHS) software systems. Additionally, as businesses aim to improve their sustainability practices and ensure compliance with evolving regulations, the need for expert services is projected to rise, contributing to the growth of this segment within the market.

Deployment Mode Analysis

The cloud held a significant share of 67.5% due to the increasing adoption of cloud-based solutions that offer flexibility, scalability, and cost-efficiency. Cloud deployment allows organizations to store and access their environmental health and safety data from anywhere, which is expected to drive its demand, especially among multinational companies and smaller businesses looking to reduce IT overhead.

The rising trend of digital transformation in various industries, coupled with the ability of cloud platforms to integrate with other business management tools, makes cloud-based solutions particularly attractive. As companies continue to prioritize remote work and real-time collaboration, the cloud segment is projected to witness substantial growth in the EHS software market.

End-user Analysis

The chemical & petrochemical segment had a tremendous growth rate, with a revenue share of 27.3% as the chemical and petrochemical industries face increasing regulatory scrutiny and environmental concerns. These industries are heavily regulated, and their operations often involve hazardous materials, making effective EHS management essential. Environmental health and safety software is expected to become more widely adopted in these sectors to ensure compliance, mitigate risks, and improve safety protocols.

The growing focus on sustainability, coupled with stricter environmental regulations and a higher emphasis on worker safety, is likely to drive the demand for advanced EHS software solutions in the chemical and petrochemical sector, further contributing to the growth of this segment.

Key Market Segments

Product Type

- Software

- Services

- Project Deployment & Implementation

- Certification

- Business Consulting & Advisory

- Audit, Assessment, & Regulatory Compliance

- Analytics

- Others

Deployment Mode

- Cloud

- On-premises

End-user

- Chemical & Petrochemical

- Telecom & IT

- Healthcare

- General Manufacturing

- Energy & Mining

- Construction

- Others

Drivers

Increasing Regulatory Compliance Requirements is Driving the Market

The growing emphasis on regulatory compliance is a key driver for the environmental health and safety (EHS) software market. Governments and regulatory bodies worldwide are implementing stricter environmental and workplace safety regulations, compelling organizations to adopt advanced software solutions to ensure compliance.

For instance, the European Union’s Corporate Sustainability Reporting Directive (CSRD), effective from 2024, mandates detailed sustainability reporting, pushing companies to invest in EHS platforms. According to a 2023 report by Verdantix, global spending on EHS software reached $1.65 billion in 2022, with a projected CAGR of 9.2% through 2024. This growth is fueled by the need for real-time data tracking, reporting, and analytics to meet evolving regulatory standards.

Key players like Intelex and Enablon are expanding their compliance management modules to cater to this demand. The U.S. Occupational Safety and Health Administration (OSHA) also reported a 15% increase in workplace safety violations in 2022, further highlighting the need for robust EHS solutions.

Restraints

High Implementation Costs are Restraining the Market

Despite the growing demand, the high implementation costs of EHS software act as a significant restraint, particularly for small and medium-sized enterprises (SMEs). Deploying these solutions often requires substantial upfront investment in software licenses, hardware, and employee training.

Additionally, the complexity of integrating these systems with existing enterprise resource planning (ERP) and other operational platforms adds to the financial burden. For example, a 2022 survey by Deloitte revealed that 45% of companies cited cost as the primary barrier to adopting advanced EHS technologies. This financial challenge is particularly pronounced in developing regions, where regulatory pressures are increasing but financial resources remain limited.

Opportunities

Adoption of Cloud-Based Solutions is Creating Growth Opportunities

The shift toward cloud-based EHS solutions is creating significant growth opportunities in the market. Cloud platforms offer scalability, cost-effectiveness, and remote accessibility, making them highly attractive to organizations of all sizes. The cloud deployment segment accounted for over 60% of the EHS software market share in 2022 and is expected to grow at a CAGR of 10.5% through 2024.

Major players like Cority and VelocityEHS are investing heavily in cloud-based offerings to capitalize on this trend. The COVID-19 pandemic accelerated this shift, as remote work environments necessitated flexible and accessible solutions. Furthermore, cloud-based platforms enable seamless updates and compliance with changing regulations, reducing the burden on internal IT teams. This trend is particularly beneficial for SMEs, as it lowers the barrier to entry by eliminating the need for extensive on-premise infrastructure.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the EHS software market, creating both challenges and opportunities. Economic downturns, such as the global inflation surge in 2022-2023, have strained corporate budgets, delaying investments in advanced technologies. However, the increasing focus on sustainability and corporate social responsibility (CSR) has driven demand for EHS solutions, as companies strive to meet stakeholder expectations.

Geopolitical tensions, such as the Russia-Ukraine conflict, have disrupted supply chains, prompting organizations to enhance risk management through EHS platforms. On the positive side, government initiatives like the U.S. Inflation Reduction Act of 2022, which allocates $369 billion for clean energy and sustainability projects, are boosting market growth.

Additionally, the global push for net-zero emissions by 2050 is encouraging industries to adopt EHS software for carbon footprint tracking. While geopolitical instability poses risks, the long-term outlook remains optimistic, as regulatory pressures and technological advancements continue to drive innovation and adoption in the market.

Latest Trends

Integration of AI and IoT is a Recent Trend in the Market

The integration of artificial intelligence (AI) and the Internet of Things (IoT) into EHS software is a prominent recent trend, enhancing predictive analytics and real-time monitoring capabilities. AI-powered tools enable organizations to analyze vast amounts of data to identify potential risks and predict incidents before they occur.

IoT devices, such as wearable sensors and connected equipment, provide real-time data on environmental conditions and worker safety. According to a 2023 study by Accenture, 65% of EHS software users reported improved incident prediction accuracy due to AI integration. Key players like SAP and IBM are incorporating AI and IoT into their EHS platforms to offer advanced features like predictive maintenance and automated compliance reporting.

Regional Analysis

North America is leading the Environmental Health and Safety Software Market

North America dominated the market with the highest revenue share of 38.6% owing to stricter regulatory requirements, increased corporate focus on sustainability, and the need for efficient compliance management. According to the US Environmental Protection Agency (EPA), the number of environmental violations reported in 2023 rose by 18% compared to 2022, prompting organizations to adopt advanced EHS solutions to mitigate risks.

The Occupational Safety and Health Administration (OSHA) reported a 22% increase in workplace safety inspections in 2024, further accelerating the demand for software that ensures compliance with safety standards. Additionally, the US Department of Labor highlighted a 15% year-on-year increase in funding for workplace safety programs in 2023, encouraging businesses to invest in digital tools for incident reporting and hazard management.

Major players like Intelex and Cority have expanded their customer base by 25% in 2024, as reported in their annual financial statements, reflecting the growing adoption of EHS platforms. The integration of artificial intelligence and IoT into these solutions has also enhanced their functionality, enabling real-time monitoring and predictive analytics. These factors, combined with heightened awareness of corporate social responsibility, have fueled the market’s robust growth in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rapid industrialization, increasing regulatory enforcement, and rising awareness of workplace safety. The Chinese Ministry of Ecology and Environment reported a 30% increase in environmental compliance audits in 2023, pushing companies to adopt digital solutions for managing emissions and waste.

India’s Ministry of Labour and Employment noted a 20% rise in workplace safety inspections in 2024, emphasizing the need for efficient safety management systems. The Japanese Ministry of Health, Labour, and Welfare announced a 15% increase in funding for occupational health programs in 2023, encouraging the adoption of advanced EHS tools.

Additionally, the Association of Southeast Asian Nations (ASEAN) highlighted a 25% surge in cross-border environmental regulations in 2024, further driving demand for compliance software. Companies like Enablon and Sphera have reported a 30% increase in their regional customer base in 2024, as stated in their corporate updates. These developments, coupled with growing investments in smart manufacturing and sustainable practices, are projected to propel the market’s expansion in the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the environmental health and safety (EHS) software market focus on continuous product innovation, strategic partnerships, and expanding their global footprint to drive growth. They invest in integrating advanced technologies like artificial intelligence (AI) and machine learning to enhance risk management and compliance tracking.

Companies also offer customizable solutions that cater to various industries, including manufacturing, construction, and healthcare, to meet specific regulatory requirements. Strategic collaborations with industry leaders and regulatory bodies help ensure product relevance and broader adoption. Additionally, expanding into emerging markets where industrial growth is rapidly increasing provides new opportunities for market penetration.

SAP SE, headquartered in Walldorf, Germany, is a global leader in enterprise software solutions, including environmental health and safety software. The company’s EHS solutions help organizations manage risks, ensure compliance with regulatory standards, and improve workplace safety. SAP focuses on integrating sustainability and compliance features into its software offerings, enabling businesses to track and report environmental impacts more efficiently. With a global presence and a strong emphasis on innovation, SAP continues to strengthen its position in the EHS software market through continuous product development and strategic partnerships.

Top Key Players

- VelocityEHS

- UL Solutions

- SAP SE

- Jacobs

- Intelex Technologies

- Golder Associates

- Enablon

- AECOM

Recent Developments

- In February 2024, VelocityEHS strengthened its portfolio by acquiring Contractor Compliance, a Canadian company specializing in safety and risk management software. This acquisition enhances VelocityEHS’s Accelerate Platform by adding valuable third-party contractor and vendor compliance features.

- In August 2023, UL Solutions expanded its capabilities by acquiring CERE, a private Spanish company known for its expertise in third-party testing, simulation, and certification. This move enhances UL’s ability to provide comprehensive solutions to meet global safety standards.

Report Scope

Report Features Description Market Value (2024) US$ 52.2 billion Forecast Revenue (2034) US$ 99.8 billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software, Services (Project Deployment & Implementation, Certification, Business Consulting & Advisory, Audit, Assessment, & Regulatory Compliance, Analytics, and Others)), By Deployment Mode (Cloud and On-premises), By End-user (Chemical & Petrochemical, Telecom & IT, Healthcare, General Manufacturing, Energy & Mining, Construction, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape VelocityEHS, UL Solutions, SAP SE, Jacobs, Intelex Technologies, Golder Associates, Enablon, and AECOM. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Environmental Health and Safety Software MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Environmental Health and Safety Software MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- VelocityEHS

- UL Solutions

- SAP SE

- Jacobs

- Intelex Technologies

- Golder Associates

- Enablon

- AECOM