Global Sugar Substitutes Market Size, Share, Report Analysis By Origin (Plant-Derived, Synthetic, Biotechnologically Fermented), By Form (Powder, Liquid), By Type ( High-intensity Sweeteners, Low-intensity Sweeteners, High-fructose Syrup), By Application (Food, Beverage, Health and Personal Care) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156185

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

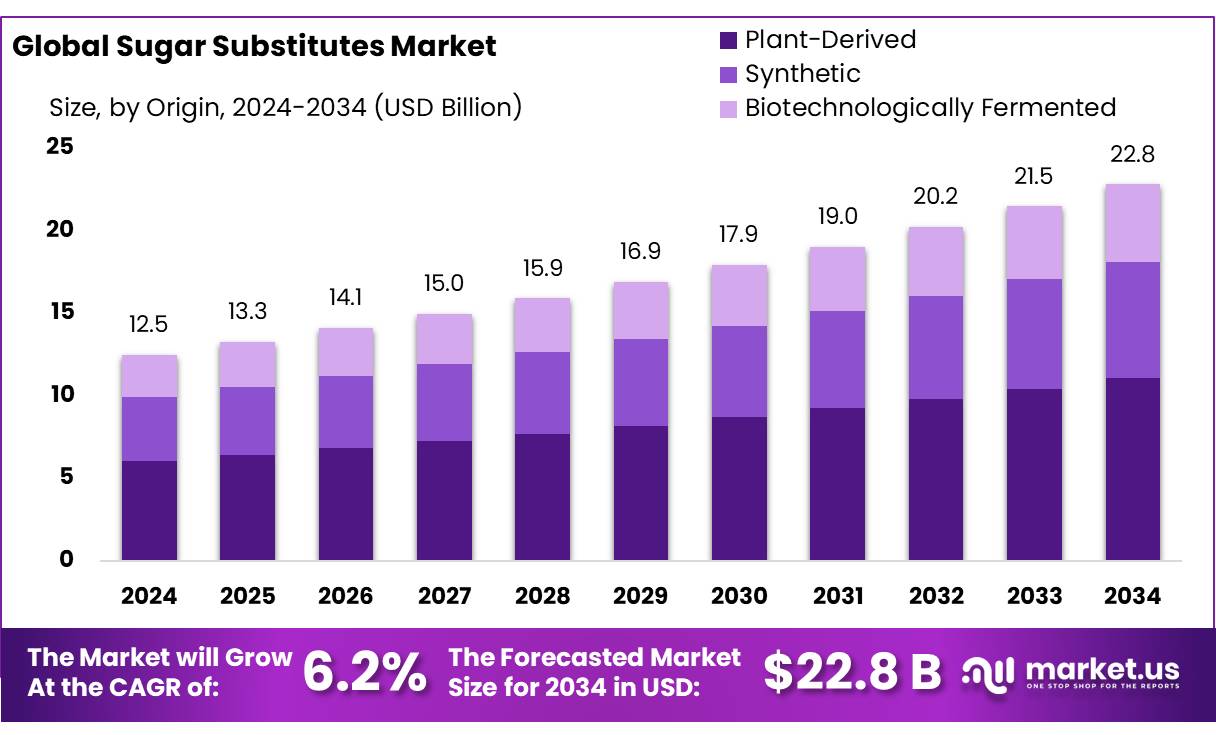

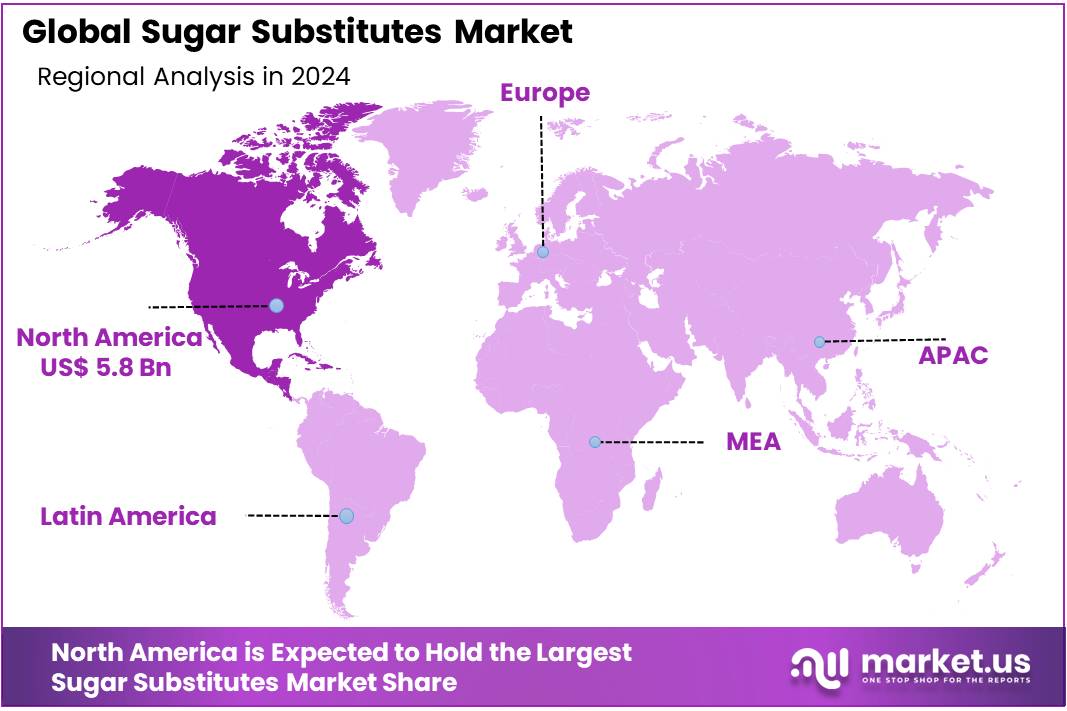

The Global Sugar Substitutes Market size is expected to be worth around USD 22.8 Billion by 2034, from USD 12.5 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.80% share, holding USD 5.8 Billion revenue.

The demand for sugar substitutes is primarily driven by the increasing prevalence of health issues such as obesity and diabetes. For instance, the Centers for Disease Control and Prevention (CDC) reports that over 37 million Americans have diabetes, with an additional 97.6 million adults classified as prediabetic . This has led to a heightened consumer preference for low-calorie, low-glycemic index sweeteners, including high-intensity sweeteners like aspartame, sucralose, and stevia, which are widely used in food and beverages.

High-intensity sweeteners (HIS), such as aspartame, sucralose, and stevia, dominate the market, accounting for over 70% of the segment share in 2023. These sweeteners are widely used in beverages, foods, and health products due to their low-calorie content and high sweetness intensity. The beverage sector is the largest application area, holding a 44.27% share globally in 2023.

Government initiatives play a pivotal role in shaping the industry landscape. India has implemented a Goods and Services Tax (GST) of 40% on sugary sodas to curb excessive sugar consumption. Additionally, the National Biofuel Policy aims to achieve a 20% ethanol blending target by 2025-26, up from the current 13%-14%, promoting the use of sugarcane for ethanol production. These policies not only address health concerns but also encourage the utilization of sugarcane in biofuel production, influencing the dynamics of the sugar substitutes industry.

Key Takeaways

- Sugar Substitutes Market size is expected to be worth around USD 22.8 Billion by 2034, from USD 12.5 Billion in 2024, growing at a CAGR of 6.2%.

- Plant-Derived held a dominant market position, capturing more than a 48.5% share.

- Powder held a dominant market position, capturing more than a 69.2% share.

- High-intensity Sweeteners held a dominant market position, capturing more than a 58.1% share.

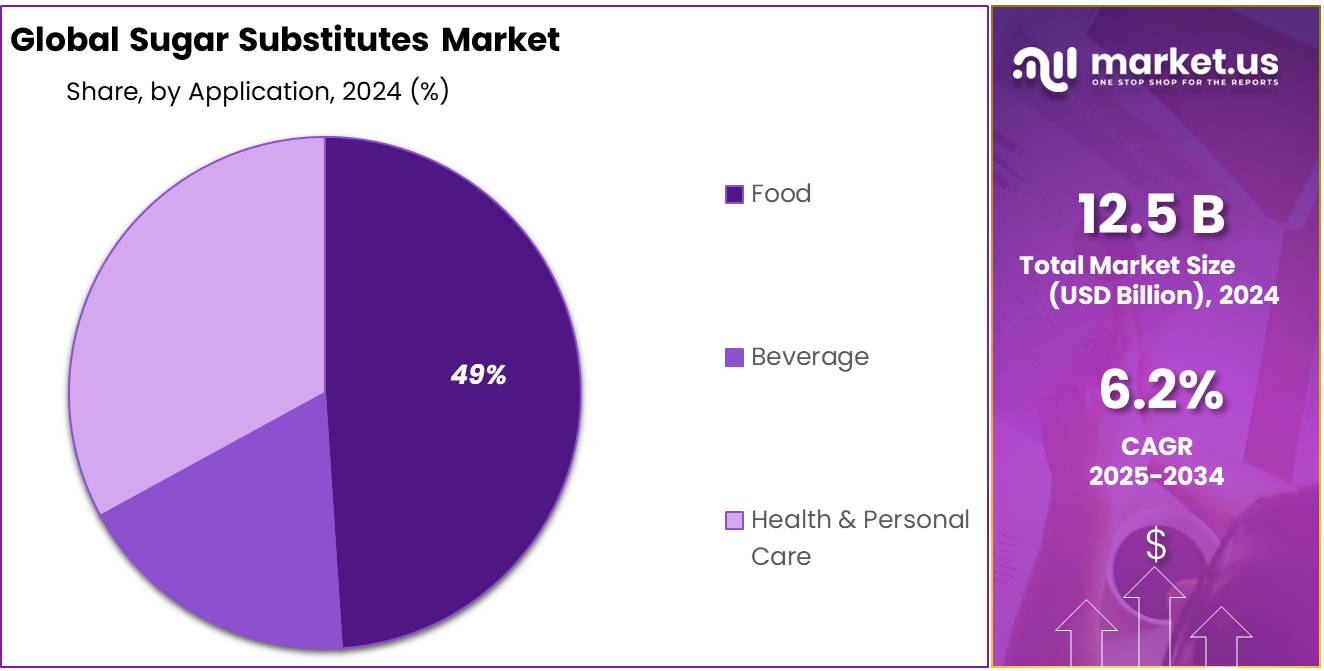

- Food held a dominant market position, capturing more than a 49.8% share.

- North America held a dominant position in the Sugar Substitutes market, capturing more than a 46.9% share with a valuation of around USD 5.8 billion.

By Origin Analysis

Plant-Derived Sugar Substitutes dominate with 48.5% due to rising consumer preference for natural ingredients

In 2024, Plant-Derived held a dominant market position, capturing more than a 48.5% share. This strong presence came as consumers increasingly turned toward natural sweetening options such as stevia, monk fruit, and other plant-based extracts. Their appeal lies in being perceived as safer, healthier, and closer to nature compared to synthetic alternatives. Manufacturers responded by formulating concentrated blends that fit both clean-label demands and regulatory pressure to reduce added sugars in foods and beverages.

By Form Analysis

Powder Form dominates with 69.2% due to its wide application and easy handling

In 2024, Powder held a dominant market position, capturing more than a 69.2% share. The strong uptake of powdered sugar substitutes was driven by their convenience, longer shelf life, and versatility across food and beverage formulations. Powdered forms are easy to blend, dissolve quickly, and allow precise dosing, which makes them the preferred choice for large-scale industrial applications as well as household use.

By Type Analysis

High-intensity Sweeteners dominate with 58.1% due to their strong sweetness and low-calorie benefits

In 2024, High-intensity Sweeteners held a dominant market position, capturing more than a 58.1% share. Their popularity comes from delivering hundreds of times more sweetness than sugar while adding little to no calories. Ingredients like stevia, sucralose, and aspartame are widely used in beverages, dairy products, and tabletop sweeteners, allowing manufacturers to create sugar-free or reduced-calorie products without compromising taste.

By Application Analysis

Food Application dominates with 49.8% due to growing use in everyday diets

In 2024, Food held a dominant market position, capturing more than a 49.8% share. The wide use of sugar substitutes in bakery, confectionery, dairy, and packaged meals fueled this dominance, as consumers looked for healthier options without sacrificing sweetness. Food manufacturers increasingly turned to sugar substitute concentrates to reduce calorie content and meet the growing demand for clean-label and diet-friendly products.

Key Market Segments

By Origin

- Plant-Derived

- Synthetic

- Biotechnologically Fermented

By Form

- Powder

- Liquid

By Type

- High-intensity Sweeteners

- Natural

- Artificial

- Low-intensity Sweeteners

- High-fructose Syrup

By Application

- Food

- Bakery

- Confectionery

- Dairy

- Others

- Beverage

- Juices

- Functional Drinks

- Carbonated Drinks

- Non-Dairy

- Milk and Dairy

- Others

- Health & Personal Care

Emerging Trends

Surge in Natural Sweeteners and Clean-Label Products

In recent years, there has been a notable shift in consumer preferences towards natural sweeteners and clean-label products within the sugar substitutes market. This trend is driven by increasing health consciousness, a desire for transparency in food labeling, and a growing demand for products with minimal processing. Natural sweeteners such as stevia, monk fruit, and agave nectar are gaining popularity as alternatives to traditional sugar and synthetic sweeteners.

- The Indian government’s support for natural sweeteners is evident through various initiatives. For instance, the Food Safety and Standards Authority of India (FSSAI) has approved the use of artificial sweeteners such as saccharin, aspartame, acesulfame-K, and sucralose in 25 food items, including confectioneries and traditional sweets. This regulatory framework facilitates the incorporation of sugar substitutes into a wide range of products, catering to the health-conscious consumer segment .

The growing acceptance of natural sweeteners is also supported by advancements in production technologies. Innovations in extraction and purification processes have improved the taste profiles of natural sweeteners, making them more palatable and suitable for a wider range of applications. These technological developments contribute to the increasing adoption of natural sweeteners in the global market.

Drivers

Rising Health Awareness and Lifestyle Changes

One of the primary drivers propelling the growth of the sugar substitutes concentrate market is the increasing health consciousness among consumers, coupled with significant lifestyle changes. As awareness about the adverse effects of excessive sugar consumption, such as obesity, diabetes, and heart diseases, spreads, individuals are actively seeking healthier alternatives to traditional sugar. This shift in consumer behavior is evident in the growing demand for sugar substitutes that offer sweetness without the associated health risks.

- According to the World Health Organization, India has one of the highest numbers of diabetes cases globally, with over 77 million adults affected. Such statistics have prompted consumers to reconsider their dietary habits, leading to a surge in the adoption of sugar substitutes.

Government initiatives have also played a pivotal role in promoting the use of sugar substitutes. The Food Safety and Standards Authority of India (FSSAI) has introduced regulations encouraging the use of low-calorie sweeteners in food and beverages. These guidelines aim to reduce the overall sugar intake among the population, thereby mitigating the risk of diet-related health issues. Such regulatory support has bolstered consumer confidence in sugar substitutes, further driving their adoption.

Restraints

Health Concerns and Regulatory Cautions

Despite the growing popularity of sugar substitutes, a significant restraint on their widespread adoption stems from emerging health concerns and evolving regulatory guidelines. While these alternatives are often marketed as healthier options, recent studies and expert opinions suggest that their long-term consumption may pose health risks, particularly when consumed in large quantities.

A pivotal development in this regard was the World Health Organization’s (WHO) 2023 guideline, which advised against the use of non-sugar sweeteners (NSS) for weight control or reducing the risk of noncommunicable diseases. This recommendation was based on findings from a systematic review indicating that NSS do not confer any long-term benefit in reducing body fat in adults or children. Moreover, the review suggested potential undesirable effects from long-term use, such as an increased risk of type 2 diabetes, cardiovascular diseases, and mortality in adults.

Specific sweeteners have been under scrutiny for their potential health implications. For instance, erythritol, commonly used in low-calorie and keto products, has been associated with an increased risk of heart attack and stroke. A study presented at the 2025 American Physiology Summit found that consuming a single energy drink or sugar-free soda containing erythritol could harm brain and blood vessel health. The research indicated that even a single dose of approximately 30g—common in one drink—can significantly increase oxidative stress and decrease nitric oxide production in human brain blood vessel cells, potentially impairing circulation and increasing the risk of stroke and cognitive decline.

Similarly, aspartame, a widely used artificial sweetener, has been classified by the International Agency for Research on Cancer (IARC) as possibly carcinogenic to humans (Group 2B), based on limited evidence for cancer in humans, specifically for hepatocellular carcinoma, a type of liver cancer. However, both IARC and the Joint FAO/WHO Expert Committee on Food Additives (JECFA) have reaffirmed the acceptable daily intake of 40 mg/kg body weight for aspartame, suggesting that it is safe for consumption within this limit .

Opportunity

Government Support for Biofuel Initiatives

One significant growth opportunity for the sugar substitutes market in India lies in the government’s robust support for biofuel initiatives, particularly the promotion of ethanol production from sugarcane. This strategic move not only addresses energy sustainability but also creates a synergistic demand for industrial sugar, which is a key feedstock in ethanol production.

In August 2024, the Indian government introduced guidelines permitting sugar mills to produce ethanol from cane juice or syrup, effective from the new marketing year starting November 1, 2024. Additionally, distilleries were authorized to use B-heavy molasses—byproducts with higher sucrose levels—for ethanol production. These policy changes aim to enhance ethanol production capacity and ensure timely payments to sugarcane farmers.

The government’s ethanol blending target is ambitious: a 20% ethanol blend in gasoline by 2025–26, up from the current 13%. This initiative is expected to significantly increase the demand for industrial sugar, thereby benefiting the sugar substitutes sector. The policy also includes provisions for distilleries to purchase up to 2.3 million metric tons of rice from the Food Corporation of India for ethanol production, further bolstering the biofuel supply chain.

Regional Insights

North America dominates with 46.9% share ($5.8 Bn), driven by reformulation and clean-label demand

In 2024, North America held a dominant position in the Sugar Substitutes market, capturing more than a 46.9% share with a valuation of around USD 5.8 billion. This leadership is rooted in the region’s strong consumer shift toward low-calorie, reduced-sugar, and clean-label products, driven by rising health concerns such as obesity and diabetes.

According to the Centers for Disease Control and Prevention (CDC), more than 37 million Americans are living with diabetes, while around 96 million adults are considered pre-diabetic. These figures highlight why demand for sugar alternatives continues to grow, as consumers increasingly replace refined sugar with natural and artificial substitutes in everyday diets.

Food and beverage companies across the U.S. and Canada are responding quickly, reformulating products with stevia, monk fruit, allulose, and sucralose to meet the expectations of health-conscious buyers. The U.S. Food and Drug Administration’s recognition of several low- and no-calorie sweeteners as Generally Recognized as Safe (GRAS) has also supported wider adoption. Moreover, the rising popularity of ketogenic and low-carb diets across North America further boosts demand for substitutes that provide sweetness without spiking blood sugar.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Tate & Lyle strengthened its role in the sugar substitutes market through stevia- and sucralose-based solutions that serve beverage, bakery, and dairy sectors. The company leveraged its global distribution and innovation hubs to meet rising demand for plant-derived and high-intensity sweeteners. With a strong push toward clean-label and reduced-calorie applications, Tate & Lyle expanded partnerships with food producers. By 2025, its focus on natural sweetener innovation and sustainability keeps it a leading global supplier.

Ingredion maintained strong momentum in 2024 with a wide range of sugar substitute solutions, including stevia extracts, polyols, and specialty sweetener systems. Its innovation centers supported manufacturers in creating clean-label, reduced-calorie products tailored to local markets. The company emphasized consumer-friendly ingredients and transparency, enhancing trust among global brands. By 2025, Ingredion’s investment in natural-origin sweeteners and partnerships in plant-based food systems ensure its continued leadership, helping customers meet health, wellness, and regulatory targets for sugar reduction.

ADM played a vital role in the sugar substitutes market in 2024 by advancing stevia, erythritol, and natural sweetener blends. The company’s integrated processing and fermentation capabilities supported scalable, cost-effective production. With rising demand for reduced-sugar formulations, ADM partnered with food and beverage companies to deliver customized solutions that balance taste and functionality. Looking into 2025, ADM is focusing on expanding its natural sweetener footprint, aligning with health-driven consumer trends and growing global demand for sugar alternatives.

Top Key Players Outlook

- Tate & Lyle

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Roquette Freres

- Ajinomoto Co.

- JK Sucralose Inc.

- The NutraSweet Company

- PureCircle

- DuPont De Nemours

Recent Industry Developments

In 2024 Ingredion Incorporated, achieved $7.43 billion in total annual revenue, reflecting its broad offerings in specialty ingredients like stevia-based sweeteners and clean‑label textures.

In 2024, Cargill posted $160 billion in total revenue, a figure that underscores its financial strength and breadth as an agribusiness giant.

Report Scope

Report Features Description Market Value (2024) USD 12.5 Bn Forecast Revenue (2034) USD 22.8 Bn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Origin (Plant-Derived, Synthetic, Biotechnologically Fermented), By Form (Powder, Liquid), By Type ( High-intensity Sweeteners, Low-intensity Sweeteners, High-fructose Syrup), By Application (Food, Beverage, Health and Personal Care) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tate & Lyle, Cargill, Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Roquette Freres, Ajinomoto Co., JK Sucralose Inc., The NutraSweet Company, PureCircle, DuPont De Nemours Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tate & Lyle

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Roquette Freres

- Ajinomoto Co.

- JK Sucralose Inc.

- The NutraSweet Company

- PureCircle

- DuPont De Nemours