Global Single Phase String Inverters Market Size, Share Report By Connectivity (Standalone, On Grid), By Power Rating (Below 1 kW, 1 kW to 3 kW, 3 kW to 5 kW, Above 5 kW), By Application (Residential, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154531

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

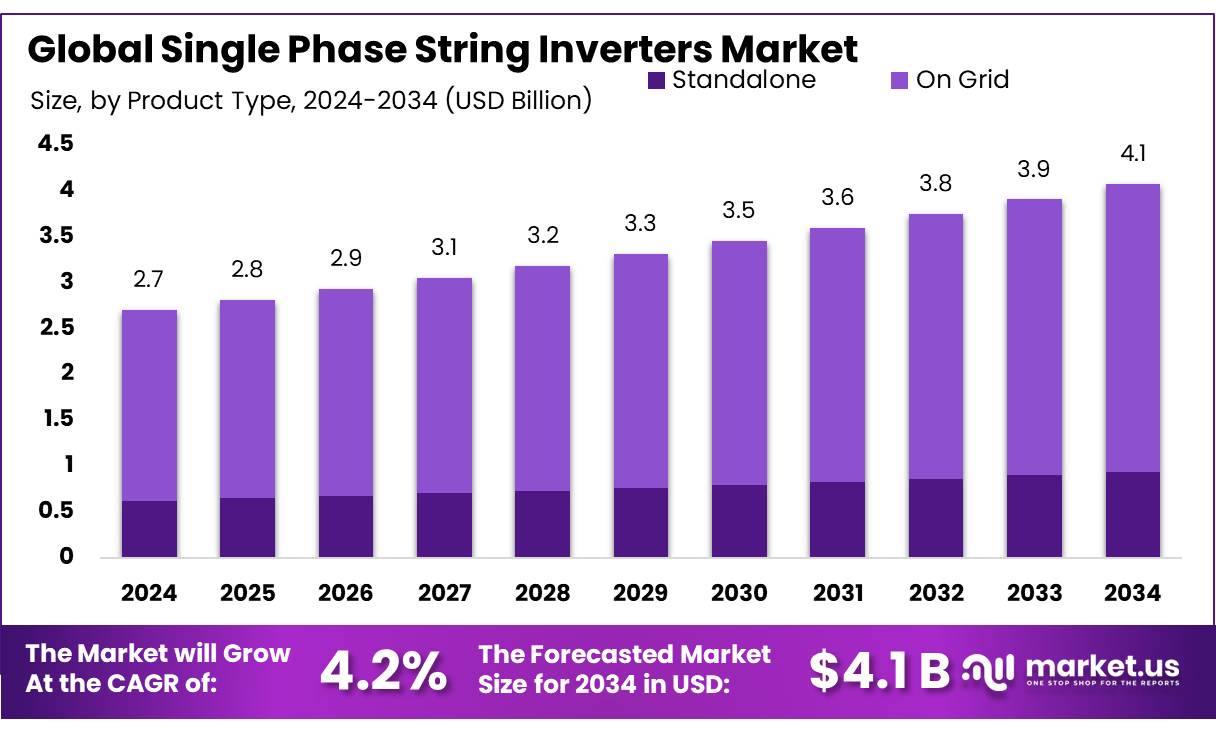

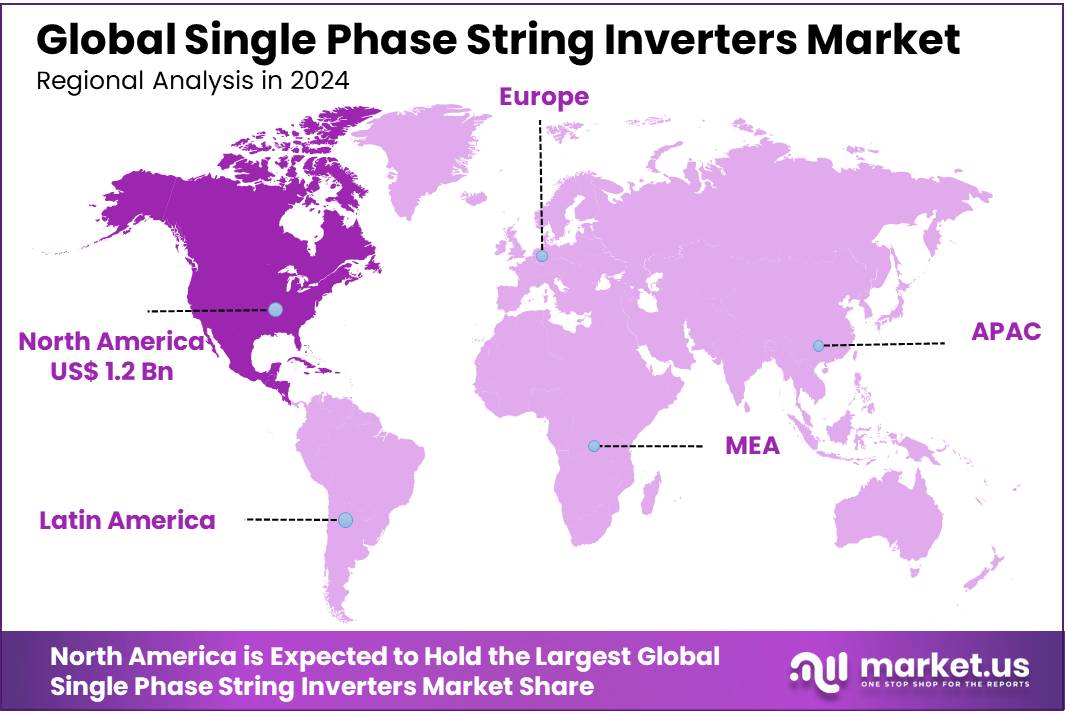

The Global Single Phase String Inverters Market size is expected to be worth around USD 4.1 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 44.7% share, holding USD 1.2 Billion in revenue.

The Single Phase String Inverters market has witnessed significant development in recent years, driven primarily by the expanding adoption of residential and small commercial photovoltaic (PV) systems. Single phase string inverters are essential components in grid-connected solar installations, converting the direct current (DC) generated by solar panels into alternating current (AC) suitable for use in households and light commercial applications. Their efficiency, compact size, and cost-effectiveness make them a preferred choice for decentralized solar power generation, particularly in regions with high residential solar penetration.

According to the International Renewable Energy Agency (IRENA), global solar capacity reached approximately 1,200 gigawatts (GW) by the end of 2023, with residential solar installations accounting for nearly 35% of this capacity. The growing focus on renewable energy integration in distributed energy systems has propelled demand for reliable and efficient inverters. Furthermore, advancements in inverter technology, including higher conversion efficiencies exceeding 98%, improved thermal management, and smart grid compatibility, have enhanced product offerings, thereby encouraging further adoption.

Government initiatives have played a crucial role in shaping the growth trajectory of single phase string inverters. The U.S. Department of Energy (DOE) launched the Solar Energy Technologies Office (SETO) program, allocating over USD 140 million for research and development in solar inverter technology between 2021 and 2024. This investment aims to increase inverter reliability and reduce costs, fostering broader deployment of solar systems.

Similarly, the European Union’s Renewable Energy Directive mandates that member states achieve at least 40% renewable energy consumption by 2030, spurring subsidies and incentives for residential solar installations where single phase string inverters are extensively used. In India, the Ministry of New and Renewable Energy (MNRE) has set ambitious targets to reach 280 GW of solar capacity by 2030, with accelerated rooftop solar schemes that directly impact the demand for single phase inverters.

According to the International Energy Agency (IEA), solar PV capacity in residential and commercial sectors is projected to grow by an annual rate of 12% through 2030, underscoring sustained demand for single phase string inverters. Furthermore, expanding electrification in rural and off-grid areas will open new markets, particularly in Asia-Pacific and Latin America, where governments are promoting decentralized renewable energy solutions.

Key Takeaways

- Single Phase String Inverters Market size is expected to be worth around USD 4.1 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 4.2%.

- On Grid connectivity held a dominant market position in the Single Phase String Inverters segment, capturing more than 77.3% share.

- 1 kW to 3 kW power rating segment held a dominant position in the Single Phase String Inverters market, capturing more than 44.8% share.

- Residential segment held a dominant position in the Single Phase String Inverters market, capturing more than 78.1% share.

- North America emerged as the dominant region in the Single Phase String Inverter market, capturing a substantial 44.7% share, equivalent to approximately USD 1.2 billion.

By Connectivity Analysis

On Grid connectivity leads Single Phase String Inverters market with 77.3% share in 2024

In 2024, On Grid connectivity held a dominant market position in the Single Phase String Inverters segment, capturing more than 77.3% share. This significant dominance reflects the widespread adoption of grid-tied solar power systems, which are favored for their ability to feed excess electricity back into the main power grid. The preference for On Grid inverters is driven by increasing residential and commercial solar installations, where the integration with the utility grid allows for improved energy management and cost savings.

As governments worldwide continue to support grid-connected solar projects through incentives and net metering policies, the demand for On Grid single phase string inverters has seen steady growth. This segment’s leadership is expected to persist in 2025 and beyond, supported by ongoing expansion in rooftop solar capacity and smart grid developments that prioritize grid synchronization and energy export capabilities. The dominance of On Grid connectivity underscores its critical role in enabling efficient, reliable solar energy integration at the consumer level.

By Power Rating Analysis

1 kW to 3 kW power rating leads Single Phase String Inverters market with 44.8% share in 2024

In 2024, the 1 kW to 3 kW power rating segment held a dominant position in the Single Phase String Inverters market, capturing more than 44.8% share. This segment’s prominence is largely attributed to its suitability for residential solar installations, where typical household energy demands fall within this range. The growing adoption of rooftop solar systems in homes has fueled demand for inverters within this power bracket, as they provide an optimal balance between cost and capacity.

Additionally, the increasing emphasis on clean energy solutions for single-family residences and small commercial units has further supported growth in this segment. Looking ahead to 2025, the 1 kW to 3 kW segment is expected to maintain its leadership due to ongoing government incentives promoting small-scale solar projects and the rising interest in self-consumption models that prioritize efficient energy conversion for limited power requirements. This segment’s sustained dominance highlights its vital role in driving decentralized solar energy adoption globally.

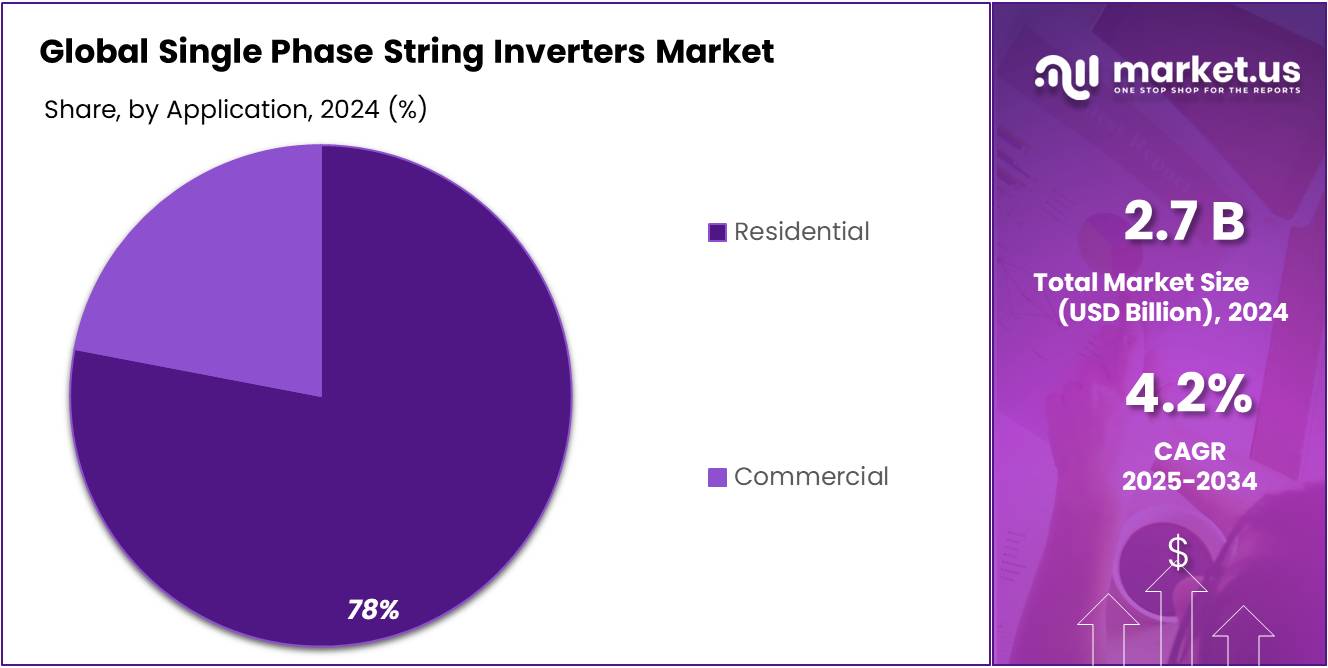

By Application Analysis

Residential application dominates Single Phase String Inverters market with 78.1% share in 2024

In 2024, the residential segment held a dominant position in the Single Phase String Inverters market, capturing more than 78.1% share. This strong leadership is driven by the rapid increase in rooftop solar installations across households worldwide, supported by government incentives and subsidy programs encouraging clean energy adoption at the consumer level. Residential solar systems typically rely on single phase string inverters due to their cost-effectiveness, ease of installation, and compatibility with household power needs.

The increasing awareness of sustainable energy solutions and rising electricity costs have further accelerated demand in this segment. Moving into 2025, the residential application is expected to sustain its dominance, fueled by continued expansion of solar rooftops in urban and suburban areas, as well as advancements in inverter technology that enhance energy efficiency and smart home integration. This trend highlights the critical role of the residential sector in driving the growth of single phase string inverters globally.

Key Market Segments

By Connectivity

- Standalone

- On Grid

By Power Rating

- Below 1 kW

- 1 kW to 3 kW

- 3 kW to 5 kW

- Above 5 kW

By Application

- Residential

- Commercial

Emerging Trends

Integration of Smart Technologies

A significant trend shaping the future of single-phase string inverters is their integration with smart technologies, enhancing the efficiency and user-friendliness of residential solar systems. Modern inverters are now equipped with features like remote monitoring, predictive maintenance, and compatibility with home energy management systems.

These advancements enable homeowners to monitor energy production in real-time, receive alerts for maintenance needs, and optimize energy consumption patterns. For instance, inverters with built-in Wi-Fi connectivity allow users to track system performance via smartphone apps, providing greater control and transparency. Such features not only improve the user experience but also contribute to the overall efficiency and longevity of solar installations.

In India, the government’s push towards digitalization and smart grid technologies further supports this trend. Initiatives like the National Smart Grid Mission aim to modernize the electricity grid, incorporating advanced technologies for better demand-side management and integration of renewable energy sources. As the grid becomes smarter, the demand for inverters that can seamlessly integrate with these systems is expected to rise, presenting a growth opportunity for manufacturers of single-phase string inverters.

The integration of smart technologies into single-phase string inverters not only aligns with global trends towards digitalization but also addresses specific needs in the Indian market. With increasing urbanization and a growing middle class, there is a rising demand for energy solutions that offer convenience, efficiency, and cost savings. Smart inverters cater to these demands by providing enhanced control and optimization of solar energy systems, making them an attractive option for residential consumers.

Drivers

Government Incentives and Policies

Government initiatives play a pivotal role in accelerating the adoption of single-phase string inverters, particularly in India. The Indian government has introduced several policies to promote renewable energy, including the Solar Rooftop Scheme under the Ministry of New and Renewable Energy (MNRE).

- This scheme offers subsidies of up to 40% for residential systems up to 3 kW and 20% for systems between 3 and 10 kW, making solar installations more affordable for households. Additionally, the Production Linked Incentive (PLI) Scheme aims to boost domestic manufacturing of solar photovoltaic (PV) modules, with an outlay of Rs. 24,000 crore, thereby reducing dependence on imports and fostering local industry growth.

These policies not only make solar energy more accessible but also encourage the use of efficient inverters like single-phase string inverters, which are well-suited for residential applications due to their cost-effectiveness and ease of installation. As a result, the market for single-phase string inverters is witnessing significant growth, contributing to India’s renewable energy objectives and the global transition towards sustainable energy solutions.

Restraints

Lack of Skilled Workforce

One significant barrier to the widespread adoption of single-phase string inverters in India is the shortage of skilled labor for installation and maintenance. According to a study by Luminous Power Technologies, 90% of respondents agree that specialized skills are necessary for the installation of solar solutions such as rooftop panels. However, nearly half of the respondents (45%) believe that skilled labor for implementing solar energy solutions is unavailable in their vicinity .

This skill gap leads to improper installations, which can affect the efficiency and longevity of solar systems. Additionally, the lack of trained professionals hampers the growth of the solar industry, as consumers may be hesitant to invest in solar solutions due to concerns about quality and reliability.

To address this issue, the Indian government has initiated programs to promote skill development in the renewable energy sector. For instance, the National Institute of Solar Energy (NISE) offers training programs for technicians and engineers to enhance their skills in solar technology. Such initiatives aim to bridge the skill gap and ensure the successful deployment of solar systems, including single-phase string inverters.

Despite these efforts, the demand for skilled labor continues to outpace supply. Therefore, it is crucial for both the government and private sector to collaborate in establishing more training centers and certification programs to equip individuals with the necessary skills to support the growing solar industry.

Opportunity

Government-Backed Subsidies and Schemes

One of the most significant growth opportunities for single-phase string inverters in India arises from government-backed subsidies and schemes aimed at promoting rooftop solar installations. The Pradhan Mantri Surya Ghar Muft Bijli Yojana (PM Surya Ghar) is a notable initiative launched in 2024 with an investment of over ₹75,000 crore.

This scheme targets empowering 1 crore residential households by providing them with rooftop solar systems and offering up to 300 units of free electricity monthly. Beneficiaries receive direct subsidies ranging from ₹30,000 to ₹78,000, depending on their average monthly power consumption, making solar energy more accessible to a broader population.

In parallel, the Indian government continues to support the solar sector through various policies and financial incentives. For instance, the Production Linked Incentive (PLI) Scheme for High Efficiency Solar PV Modules aims to enhance domestic manufacturing capabilities, with a total capacity of 39,600 MW allocated to 11 companies under this initiative. This move is expected to reduce dependence on imports and bolster the local economy.

These government initiatives not only make rooftop solar systems more affordable but also create a conducive environment for the adoption of single-phase string inverters. As more households opt for solar energy solutions, the demand for efficient and cost-effective inverters is set to rise, presenting a significant growth opportunity for the industry.

Regional Insights

North America leads Single Phase String Inverter market with 44.7% share in 2024

In 2024, North America emerged as the dominant region in the Single Phase String Inverter market, capturing a substantial 44.7% share, equivalent to approximately USD 1.2 billion in market value. This leadership is primarily attributed to the United States, which accounted for 76.3% of the North American market share, driven by robust solar adoption policies and incentives.

The growth trajectory in 2024 was propelled by several key factors. The Inflation Reduction Act (IRA) played a pivotal role by extending the Investment Tax Credit (ITC), thereby providing long-term certainty for developers and investors. This policy framework stimulated investment in renewable energy and grid modernization, fostering an environment conducive to the expansion of solar photovoltaic (PV) installations.

Residential solar installations were particularly significant, with over 4 million U.S. homes equipped with solar PV systems by mid-2024. This surge is indicative of the increasing consumer preference for clean energy solutions and energy independence. The widespread adoption of single phase string inverters in these residential applications underscores their cost-effectiveness and compatibility with household energy needs.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

APsystems is a leading manufacturer specializing in advanced single phase string inverters, known for their microinverter technology that maximizes solar energy harvest at the module level. The company focuses on delivering high-efficiency, reliable solutions for residential and small commercial solar systems worldwide. Their inverters are designed for easy installation and real-time monitoring, supporting grid compatibility and smart energy management. APsystems’ commitment to innovation and quality has helped it secure a strong position in the growing distributed solar energy market.

Canadian Solar is a major global solar energy company offering a comprehensive range of single phase string inverters tailored for residential and commercial use. Renowned for their high efficiency and robust performance, Canadian Solar’s inverter solutions complement their photovoltaic modules, enabling optimized energy conversion and system reliability. The company invests significantly in research and development, focusing on smart inverter features and grid integration, which supports expanding solar markets across North America, Europe, and Asia.

Enphase Energy specializes in single phase microinverter technology, transforming solar energy production with module-level power electronics. Their microinverters offer enhanced energy yield, safety, and system monitoring capabilities for residential solar installations. Enphase’s ecosystem includes energy storage and management solutions, creating integrated smart energy systems. The company’s focus on innovation and ease of use has made it a key player in the residential solar inverter market, driving growth in decentralized renewable energy adoption globally.

Top Key Players Outlook

- APsystems

- Canadian Solar

- Enphase Energy

- Fronius International

- Huawei Technologies

- INVTSolar

- NingBo Deye Inverter Technology

- Solaredge Technologies

- SUNGROW

- UTL Solar

Recent Industry Developments

In 2024, APsystems’ microinverters maintained a significant market share, with the single-phase category holding approximately 57.4% of the global solar microinverter market. This dominance is attributed to the widespread adoption of single-phase microinverters in residential solar systems, where they are favored for their simplicity and cost-effectiveness.

In 2024 Canadian Solar, the company reported total module shipments of 8.2 gigawatts (GW) in the fourth quarter, contributing to an annual total of over 30 GW for the year. This performance underscores Canadian Solar’s robust manufacturing capabilities and its commitment to meeting the growing demand for renewable energy solutions.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Bn Forecast Revenue (2034) USD 4.1 Bn CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Connectivity (Standalone, On Grid), By Power Rating (Below 1 kW, 1 kW to 3 kW, 3 kW to 5 kW, Above 5 kW), By Application (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape APsystems, Canadian Solar, Enphase Energy, Fronius International, Huawei Technologies, INVTSolar, NingBo Deye Inverter Technology, Solaredge Technologies, SUNGROW, UTL Solar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Single Phase String Inverters MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Single Phase String Inverters MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- APsystems

- Canadian Solar

- Enphase Energy

- Fronius International

- Huawei Technologies

- INVTSolar

- NingBo Deye Inverter Technology

- Solaredge Technologies

- SUNGROW

- UTL Solar