Global Electrodeionization Modules Market Size, Share, And Business Benefits By Type (Continuous Electrodeionization, Batch Electrodeionization, Hybrid Electrodeionization), By End-use (Power Generation, Pharmaceutical, Semiconductor, Petrochemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143970

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

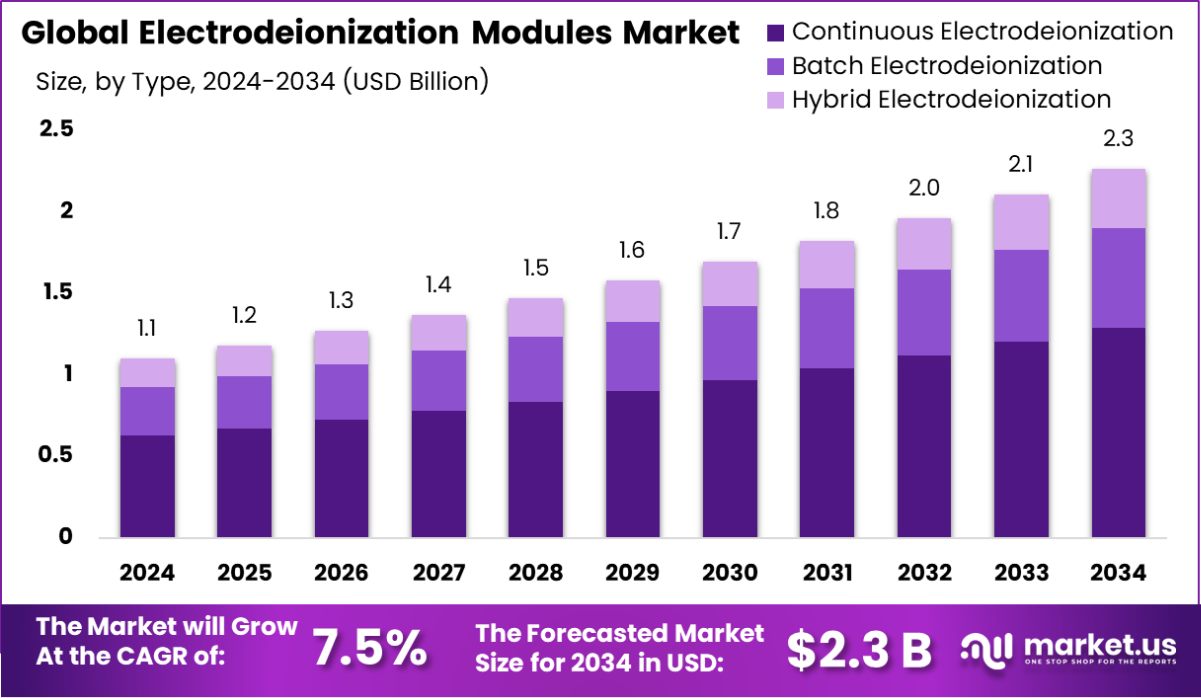

Global Electrodeionization Modules Market is expected to be worth around USD 2.3 billion by 2034, up from USD 1.1 billion in 2024, and grow at a CAGR of 7.5% from 2025 to 2034. North America’s 47.30% market share reflects rising investment in sustainable water purification systems across industrial sectors.

Electrodeionization (EDI) modules are advanced water purification devices used to remove ionizable species from water using electricity, ion exchange membranes, and resins. These modules operate continuously without the need for chemical regeneration, making them more efficient and environmentally friendly than traditional deionization methods. EDI is widely used in industries requiring ultrapure water, such as pharmaceuticals, microelectronics, and power generation.

The demand for electrodeionization modules is rising due to stricter regulations around water quality and the growing need for high-purity water in industrial applications. As manufacturing processes become more sensitive to contaminants, industries are investing in systems that provide consistent water quality, driving adoption. EDI’s chemical-free operation is also aligning with sustainability goals across sectors, encouraging its widespread integration.

One of the key growth factors is the shift towards green and sustainable technologies. EDI modules eliminate the use of acid and caustic chemicals, which are traditionally used for resin regeneration. This not only reduces hazardous waste but also lowers operational costs and enhances workplace safety, making it a preferred choice for companies focused on clean technologies.

Opportunities are expanding in emerging economies where industrialization and infrastructure development are accelerating. As these regions develop sectors like electronics, pharmaceuticals, and energy, the need for reliable water purification systems such as EDI will continue to surge.

Key Takeaways

- Global Electrodeionization Modules Market is expected to be worth around USD 2.3 billion by 2034, up from USD 1.1 billion in 2024, and grow at a CAGR of 7.5% from 2025 to 2034.

- Continuous electrodeionization holds a 57.20% share in the Electrodeionization Modules Market due to efficiency.

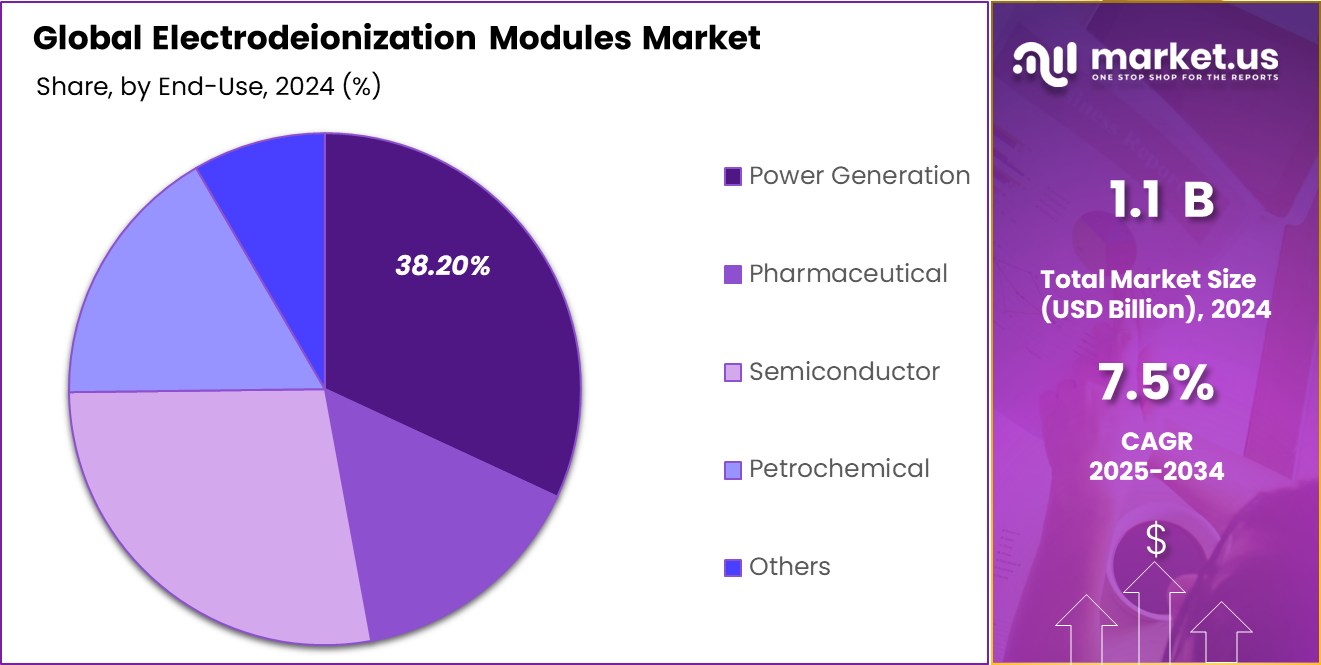

- Power generation leads the Electrodeionization Modules Market with a 38.20% share, demanding ultrapure water consistently.

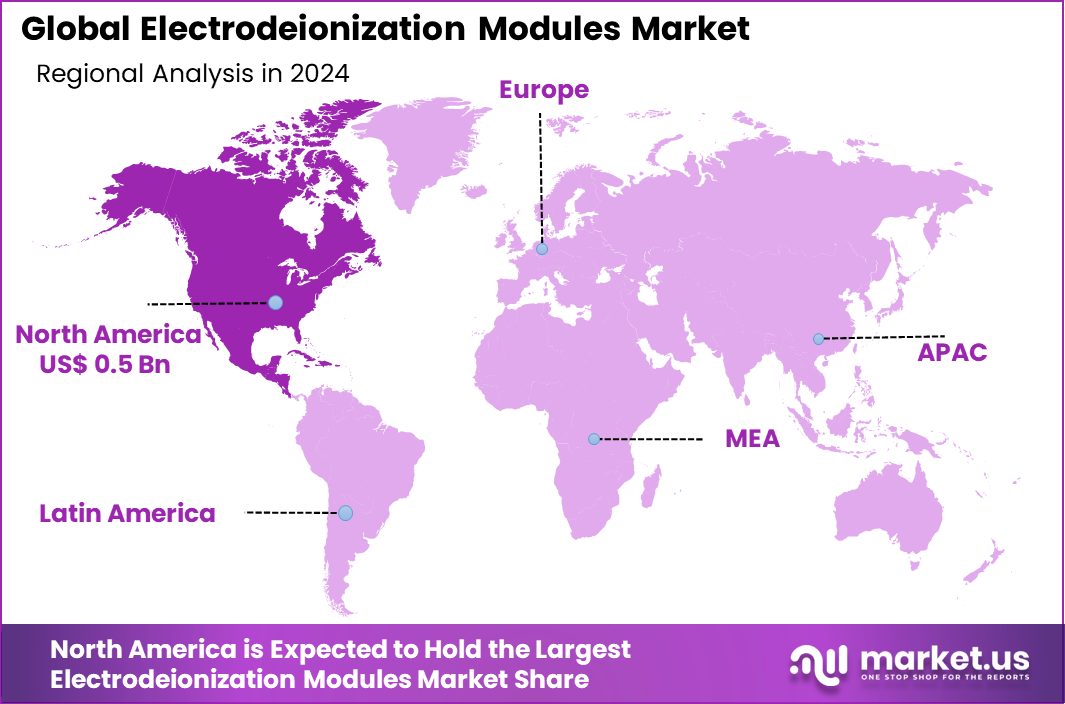

- The strong presence of pharmaceutical and power industries boosted North America’s electrodeionization demand to USD 0.5 billion.

By Type Analysis

Continuous Electrodeionization holds a 57.20% share in the Electrodeionization Modules Market globally.

In 2024, Continuous Electrodeionization held a dominant market position in the By Type segment of the Electrodeionization Modules Market, with a 57.20% share. This dominance is primarily attributed to its ability to provide uninterrupted and consistent purification without the need for chemical regenerants.

Continuous Electrodeionization (CEDI) is widely favored in applications requiring high-purity water, such as in pharmaceutical manufacturing, microelectronics, and power generation. Its chemical-free operation, low maintenance requirements, and operational efficiency make it a more sustainable and cost-effective alternative to traditional deionization processes.

CEDI systems are also capable of delivering stable performance over longer periods, which is crucial for industries operating 24/7 and relying on constant water quality. Additionally, the integration of renewable energy solutions in industrial facilities further supports the adoption of CEDI systems, as they align with low-energy, environmentally conscious operational goals.

The high adoption rate of continuous modules in developed markets and their increasing acceptance in emerging economies highlight their scalability and reliability. With growing environmental awareness and stricter water treatment regulations across various industrial sectors, the demand for continuous electrodeionization is expected to remain strong, securing its leading position in the type-based segmentation of the global electrodeionization modules market.

By End-Use Analysis

The power generation sector accounts for 38.20% of the Electrodeionization Modules Market demand.

In 2024, Power Generation held a dominant market position in the By End-Use segment of the Electrodeionization Modules Market, with a 38.20% share. This strong foothold is driven by the growing demand for ultrapure water in boiler feed applications, turbine maintenance, and other critical power plant processes.

Electrodeionization modules play a vital role in ensuring consistent water quality, reducing the risk of scaling and corrosion in high-pressure systems. Their ability to operate continuously without chemical regeneration adds to operational efficiency and supports environmental compliance within the power generation sector.

The increasing global emphasis on cleaner energy production and more efficient thermal plants has further propelled the need for advanced water treatment technologies. Power plants are increasingly opting for electrodeionization modules as they reduce downtime and maintenance costs while enhancing the reliability of water systems. The shift from traditional ion exchange to continuous, chemical-free systems aligns with broader goals to reduce environmental impact.

Furthermore, expanding infrastructure in emerging markets and upgrades to aging power facilities in developed economies are reinforcing this segment’s growth. As energy demand continues to rise worldwide, the power generation sector is expected to maintain its leadership in the adoption of electrodeionization modules.

Key Market Segments

By Type

- Continuous Electrodeionization

- Batch Electrodeionization

- Hybrid Electrodeionization

By End-use

- Power Generation

- Pharmaceutical

- Semiconductor

- Petrochemical

- Others

Driving Factors

Rising Need for High-Purity Water in Industries

One of the key driving factors for the Electrodeionization Modules Market is the increasing demand for high-purity water across various industries. Sectors like pharmaceuticals, microelectronics, and power generation require water that is free from ions and contaminants to maintain product quality and operational efficiency.

Traditional water purification methods often involve chemicals and create waste, which adds complexity and cost. Electrodeionization offers a cleaner, more consistent solution without using harsh chemicals, making it more attractive to industries focused on sustainability.

As industrial processes become more advanced and sensitive to impurities, the need for ultrapure water continues to grow. This trend is expected to keep pushing demand for electrodeionization modules in both developed and developing regions.

Restraining Factors

High Initial Setup Cost Limits Wider Adoption

A major restraining factor in the Electrodeionization Modules Market is the high initial setup cost. While EDI systems offer long-term savings and reduced chemical use, the upfront investment for equipment, installation, and supporting infrastructure can be significant. This becomes a challenge, especially for small and mid-sized companies with limited capital.

Industries in developing regions may hesitate to adopt EDI systems despite their long-term benefits, due to budget constraints or preference for low-cost traditional methods. Additionally, the need for skilled personnel to manage and maintain these systems adds to the cost burden.

Until costs are reduced through technological advancements or government support, this factor may slow the widespread adoption of electrodeionization modules across certain market segments.

Growth Opportunity

Expansion of Industrial Sector in Emerging Economies

A key growth opportunity for the Electrodeionization Modules Market lies in the rapid expansion of industrial sectors in emerging economies. Countries in Asia-Pacific, Latin America, and parts of Africa are witnessing increased investments in pharmaceuticals, energy, electronics, and manufacturing.

These industries require high-purity water for various processes, and EDI modules provide a chemical-free, low-maintenance solution. As governments in these regions push for industrial development and better environmental standards, demand for modern water purification technologies is expected to grow.

Local industries are also becoming more aware of the long-term benefits of EDI systems. With rising infrastructure and technological adoption, emerging economies present a strong opportunity for companies offering electrodeionization modules in the coming years.

Latest Trends

Integration of EDI with Smart Monitoring Systems

One of the latest trends in the Electrodeionization Modules Market is the integration of EDI systems with smart monitoring technologies. Companies are increasingly using digital tools like IoT sensors, real-time data tracking, and automated alerts to improve system efficiency.

These smart features help monitor water quality, system performance, and maintenance needs without manual checks. This not only saves time and labor but also helps avoid unexpected breakdowns by providing early warnings.

The shift toward automation and smart water treatment solutions is gaining popularity, especially in large industrial facilities. As industries look for more control and reliability in their operations, combining EDI modules with digital monitoring tools is becoming a preferred approach in modern water treatment setups.

Regional Analysis

In 2024, North America held a 47.30% share in the Electrodeionization Modules Market, reaching USD 0.5 billion.

In 2024, North America emerged as the dominating region in the Electrodeionization Modules Market, holding a substantial 47.30% market share, valued at USD 0.5 billion. The region’s leadership is driven by high demand from industries such as power generation, pharmaceuticals, and microelectronics, where consistent water purity is essential.

The United States, in particular, continues to invest heavily in sustainable and chemical-free water purification technologies, further boosting the regional market. Europe followed, supported by strict environmental regulations and a growing preference for green technologies in industrial operations. The Asia Pacific region is witnessing steady growth, backed by rapid industrial expansion in countries like China and India.

Although currently holding a smaller share, Asia Pacific’s adoption rate is expected to rise due to increased manufacturing activity and infrastructure projects. The Middle East & Africa region, while still developing in terms of industrial scale, is gradually exploring EDI technologies to meet clean water demands in the energy and desalination sectors.

Latin America shows moderate growth, with rising interest in eco-efficient water treatment systems across select manufacturing hubs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, AES Arabia, Aguapuro Equipment, and Applied Membranes emerged as notable contributors to the global Electrodeionization Modules Market, each bringing distinct strengths to the table.

AES Arabia has continued to strengthen its presence in the Middle East and surrounding regions through a combination of localized production and custom-built water treatment systems. The company’s focus on energy-efficient and chemical-free purification aligns well with the rising demand for sustainable industrial solutions. AES’s strategic emphasis on turnkey water treatment projects, especially in oil and gas, positions it well for long-term growth.

Aguapuro Equipment, with its strong foothold in South Asia and parts of Africa, has carved a niche by offering modular, cost-effective EDI systems. The company’s focus on compact designs, catering to small and mid-sized industries, has helped it penetrate developing markets with limited access to advanced infrastructure. Its adaptability across multiple end-use industries, including food & beverage and healthcare, supports its expansion efforts.

Applied Membranes stands out for its robust engineering expertise and global supply capabilities. Known for its strong product quality and technical support, the company has attracted clients from electronics, pharmaceuticals, and laboratories. Its investments in innovation and standardization have made its EDI modules competitive in developed markets.

Top Key Players in the Market

- AES Arabia

- Aguapuro Equipment

- Applied Membranes

- DowDuPont Inc.

- ELGA LabWater

- Evoqua Water Technologies LLC

- Lenntech

- Mega a.s.

- new terra ltd

- Ovivo Inc.

- Pure Aqua Inc.

- Qua Group

- Snowpure LLC

- Veolia Environnement S.A.

Recent Developments

- In February 2024, Ovivo enhanced its capabilities by acquiring E2metrix Inc., a leader in electrochemical oxidation technology that effectively eliminates perfluoroalkyl and polyfluoroalkyl substances (PFAS) from water and wastewater. This acquisition strengthens Ovivo’s solutions for PFAS removal, tackling environmental concerns related to these persistent chemicals.

- In 2022, Newterra Ltd specializes in Electrodeionization (EDI) systems, providing continuous, electrically driven membrane and resin ion separation technology to achieve ultra-pure water with conductivity levels as low as 10 µS/cm.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Continuous Electrodeionization, Batch Electrodeionization, Hybrid Electrodeionization), By End-use (Power Generation, Pharmaceutical, Semiconductor, Petrochemical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AES Arabia, Aguapuro Equipment, Applied Membranes, DowDuPont Inc., ELGA LabWater, Evoqua Water Technologies LLC, Lenntech, Mega a.s., newterra ltd, Ovivo Inc., Pure Aqua Inc., Qua Group, Snowpure LLC, Veolia Environnement S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Electrodeionization Modules MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global Electrodeionization Modules MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AES Arabia

- Aguapuro Equipment

- Applied Membranes

- DowDuPont Inc.

- ELGA LabWater

- Evoqua Water Technologies LLC

- Lenntech

- Mega a.s.

- new terra ltd

- Ovivo Inc.

- Pure Aqua Inc.

- Qua Group

- Snowpure LLC

- Veolia Environnement S.A.