Global DIN Rail Power Supply MarketSize, Share, And Business Benefits By Phase Type (Single-Phase, Two-Phase, Three-Phase), By Power (Upto 480 Watt, 480 Watt to 960 Watt, Above 960 Watt), By Voltage Range (Upto 24 V, 24 V to 48 V, Above 48 V), By End-use (Industrial (Automotive, Power and Energy, Telecommunications and IT Infrastructure, Others), Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143788

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

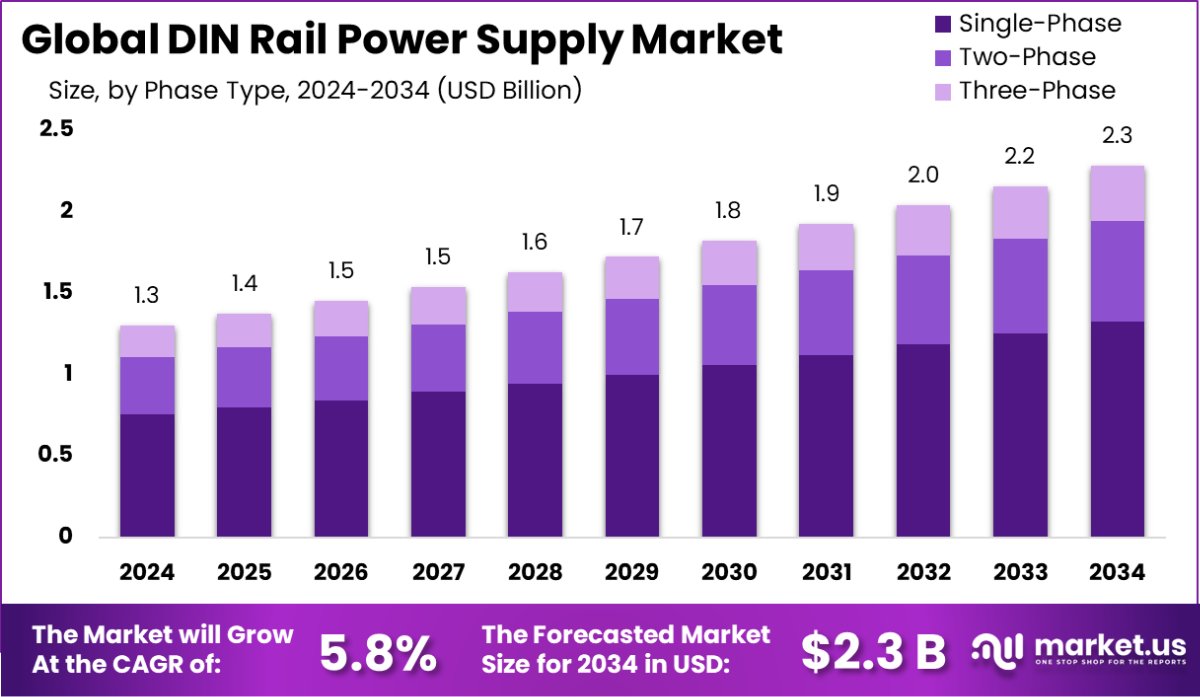

Global DIN Rail Power Supply Market is expected to be worth around USD 2.3 billion by 2034, up from USD 1.3 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034. With a strong 38.20% share, Asia-Pacific leads globally, driven by increased automation and manufacturing expansion.

A DIN rail power supply is a specialized device used to convert input power into a safe voltage and current for operating machinery, control systems, and other industrial equipment. It is designed to be mounted on standard DIN rails, which are commonly used in electrical installations for securely housing various components. This modular setup allows for easy installation, flexibility, and maintenance within industrial environments.

The DIN Rail Power Supply Market refers to the collective manufacturing, distribution, and sales activities associated with DIN rail power supplies. This market caters to industries that require reliable and efficient power distribution for control systems, automated equipment, and assembly lines. The market dynamics are influenced by industrial growth, technological advancements, and the evolving need for power management solutions in various sectors.

The growth of the DIN rail power supply market is primarily driven by the increasing automation in manufacturing sectors. As industries continue to adopt more sophisticated and automated machinery, the need for reliable power supplies that can be easily integrated and maintained becomes crucial. Furthermore, the shift towards smart factories and the integration of IoT devices in industrial operations stimulate demand for modular and scalable power solutions, which DIN rail power supplies provide.

Demand in the DIN rail power supply market is bolstered by the expansion of renewable energy projects and infrastructure upgrades across the globe. These power supplies are essential in managing power distribution for equipment used in energy production and distribution, including wind turbines and solar panels. Their ability to withstand harsh environments and provide consistent performance makes them ideal for such critical applications.

There is a significant opportunity for growth in the DIN rail power supply market through the development of more energy-efficient and compact models. As businesses increasingly focus on reducing their ecological footprint, the demand for power supplies that consume less energy and reduce operational costs rises. Additionally, emerging markets present new opportunities for the deployment of DIN rail power supplies as they modernize their industrial and infrastructural capabilities.

Key Takeaways

- Global DIN Rail Power Supply Market is expected to be worth around USD 2.3 billion by 2034, up from USD 1.3 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

- Single-phase DIN rail power supplies account for 58.30%, showing strong demand across compact electrical applications.

- Power supplies rated up to 480 watts dominate with 43.20%, ideal for low-to-medium industrial automation tasks.

- Voltage range up to 24 V holds 43.30%, preferred in control systems and compact equipment installations.

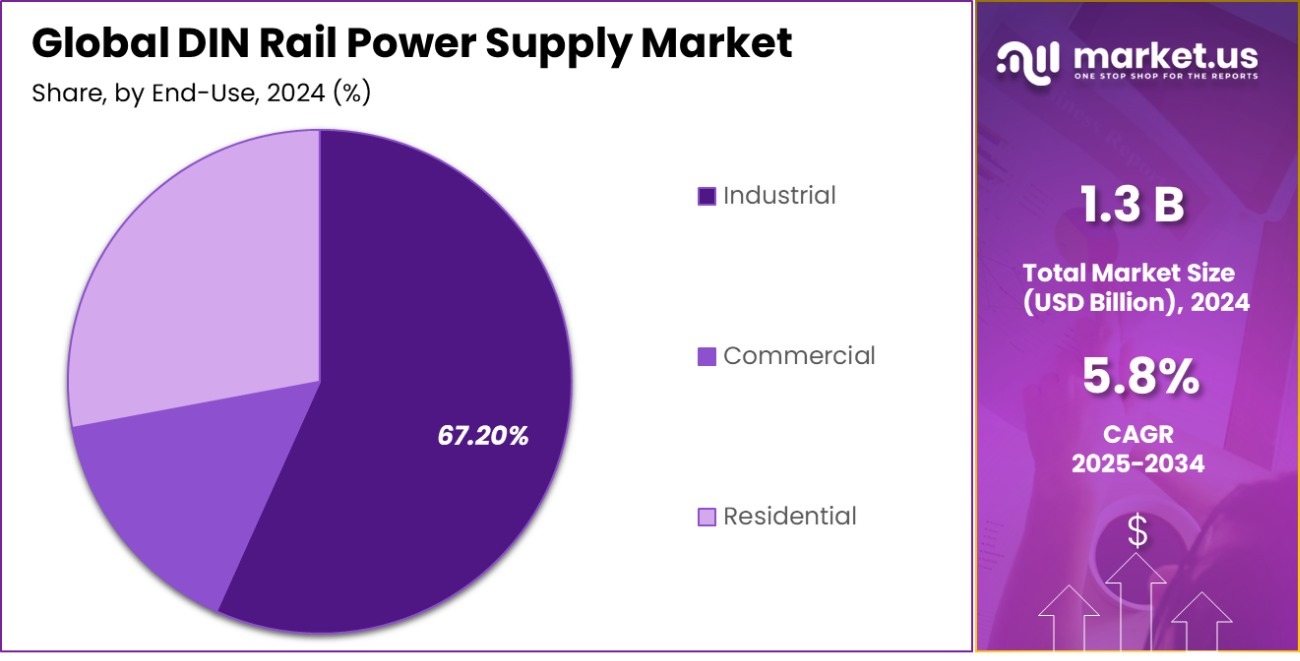

- The industrial sector leads end-use with 67.20%, highlighting the broad adoption of factory automation and process control systems.

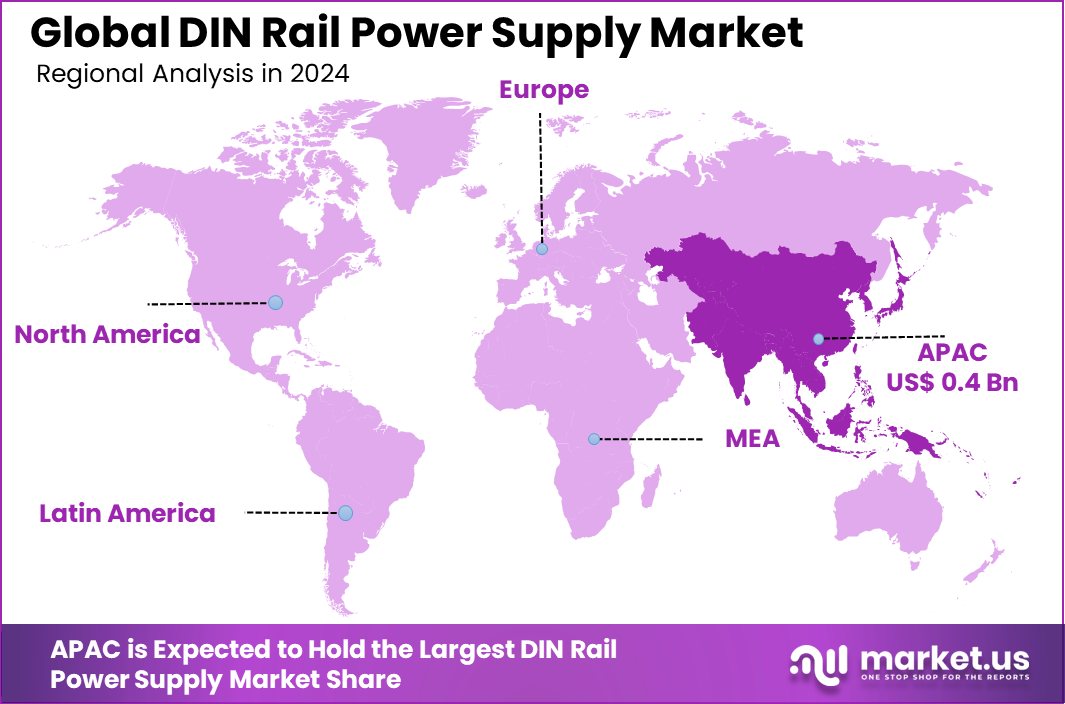

- Rapid industrialization in Asia-Pacific boosts demand, leading DIN Rail Power Supply to a USD 0.4 billion valuation.

By Phase Type Analysis

Single-phase DIN rail power supply holds a 58.30% market share in 2024.

In 2024, Single-Phase held a dominant market position in the Phase Type segment of the DIN Rail Power Supply Market, with a 58.30% share. This significant market share is primarily attributed to its widespread use in residential and light commercial applications, where lower power loads are standard. The ease of installation, compact size, and cost-effectiveness of single-phase DIN rail power supplies continue to drive their preference over three-phase systems, especially among small and medium enterprises (SMEs).

The single-phase configuration is particularly well-suited for applications requiring lower power, such as building automation, industrial control panels, and machine tools. Furthermore, the growing adoption of automation across small industrial setups globally has further supported the demand for single-phase DIN rail power supplies. Their efficiency in energy conversion, safety features, and ability to maintain performance in fluctuating voltage conditions make them an optimal choice for low to moderate power requirements.

While three-phase systems remain crucial for high-power industrial applications, the flexibility and affordability of single-phase units have maintained their lead in this segment. As the demand for compact and efficient power supply solutions increases, particularly in emerging markets and urban infrastructure projects, single-phase DIN rail power supplies are expected to maintain strong market momentum.

By Power Analysis

Upto 480 Watt DIN rail supplies capture 43.20% of the global market.

In 2024, Upto 480 Watt held a dominant market position in the By Power segment of the DIN Rail Power Supply Market, with a 43.20% share. This segment’s strong performance is largely driven by its compatibility with a broad range of industrial and commercial applications that require moderate power levels. These power supplies are widely preferred in control systems, automation equipment, and building management systems, where power efficiency and compact design are critical.

The Upto 480 Watt category is often selected due to its optimal balance between output capacity and cost-efficiency. It supports applications that do not demand high wattage but still require stable and reliable power delivery. In addition, the growing use of programmable logic controllers (PLCs), sensors, and communication devices in smart manufacturing and industrial automation setups has bolstered the need for this specific power range.

Manufacturers continue to innovate within this segment, offering enhanced features such as overload protection, wide input voltage ranges, and improved thermal performance. These features are essential for ensuring operational continuity in sensitive electronic systems. As more industries focus on compact, energy-efficient, and durable power supply systems, the demand for DIN rail power supplies up to 480 Watt is expected to remain strong in the foreseeable future.

By Voltage Range Analysis

Supplies with up to a 24 V voltage range dominate with a 43.30% market share.

In 2024, Upto 24 V held a dominant market position in the By Voltage Range segment of the DIN Rail Power Supply Market, with a 43.30% share. This dominance is primarily due to the widespread use of 24V power supplies in industrial automation, control panels, and building automation systems. The 24V standard is highly compatible with various low-voltage devices such as sensors, relays, actuators, and PLCs, making it the preferred choice for many OEMs and system integrators.

The Upto 24 V range is also favored for its safety, energy efficiency, and ease of integration in compact DIN rail enclosures. It is extensively used in applications where electrical isolation and stable voltage output are critical. Additionally, the growing trend of Industry 4.0 and increased deployment of automation technologies in manufacturing and infrastructure sectors have further fueled the adoption of 24V DIN rail power supplies.

These units are ideal for environments where space-saving, low heat dissipation, and reduced energy consumption are essential. Their ability to ensure consistent performance under fluctuating input conditions and provide reliable output for sensitive components has made them a standard across multiple industries.

By End-use Analysis

Industrial end-use leads the DIN rail power supply market with a 67.20% market share.

In 2024, Industrial held a dominant market position in the By End-use segment of the DIN Rail Power Supply Market, with a 67.20% share. This significant market share is largely driven by the extensive use of DIN rail power supplies in industrial automation, machinery control systems, and factory infrastructure. Industries such as manufacturing, oil & gas, automotive, and packaging heavily rely on these power supplies to support continuous and stable operations across a range of devices and control systems.

The growing emphasis on automation, process efficiency, and equipment reliability has reinforced the demand for DIN rail-mounted power solutions within industrial settings. These power supplies are integral to programmable logic controllers (PLCs), human-machine interfaces (HMIs), sensors, and motor drives, all of which are critical components in modern production environments. Their robust construction, compact form factor, and ability to withstand harsh operating conditions make them especially suitable for industrial use.

Moreover, with the ongoing global shift toward smart factories and digital transformation in the industrial sector, the need for reliable, efficient, and scalable power supply units continues to grow. The industrial segment’s dominance reflects its essential role in supporting these transitions, maintaining the largest share of end-use applications in the DIN Rail Power Supply Market in 2024.

Key Market Segments

By Phase Type

- Single-Phase

- Two-Phase

- Three-Phase

By Power

- Upto 480 Watt

- 480 Watt to 960 Watt

- Above 960 Watt

By Voltage Range

- Upto 24 V

- 24 V to 48 V

- Above 48 V

By End-use

- Industrial

- Automotive

- Power and Energy

- Telecommunications and IT Infrastructure

- Others

- Commercial

- Residential

Driving Factors

Growing Need for Reliable Industrial Power Supply

The main factor driving the DIN Rail Power Supply market is the growing need for reliable electricity. Industries today depend heavily on continuous and stable electric power to ensure smooth operations. Factories, automation systems, and machines need uninterrupted energy sources to function effectively.

DIN rail power supplies are widely used because they offer a compact, durable, and efficient solution for managing power in tough environments. As more companies use automation and smart technology, the demand for steady and efficient power grows even faster.

These power supplies help businesses minimize downtime, lower maintenance costs, and improve productivity. The increased adoption of automation in factories and rising focus on energy efficiency further strengthen demand for these reliable power solutions.

Restraining Factors

High Initial Cost Limits Small Businesses’ Adoption

The primary factor restraining the DIN Rail Power Supply market growth is the high initial investment cost. DIN rail power supplies offer reliability, safety, and efficiency, but their upfront expenses are often too high for small and medium-sized businesses. Smaller companies, working with limited budgets, find it difficult to justify investing heavily in these advanced power solutions.

Instead, they may choose lower-cost, less efficient alternatives due to immediate budget constraints. This cost-sensitive mindset limits the broader adoption of DIN rail power supplies, especially among businesses in emerging regions. Additionally, many companies hesitate to switch to new power supply equipment, fearing extra hidden costs in training and installation, further reducing the market’s growth potential among smaller industrial end-users.

Growth Opportunity

Rising Demand from Renewable Energy Power Systems

A promising growth opportunity in the DIN Rail Power Supply market is the rising demand for renewable energy systems. Today, many countries are moving towards clean energy solutions like solar and wind power to reduce pollution and dependence on fossil fuels. Renewable power systems require stable and efficient power management solutions to handle fluctuating energy production.

DIN rail power supplies perfectly meet this need by offering compact size, high efficiency, and easy installation. This makes them ideal for renewable energy plants, battery storage systems, and microgrids.

As global investment in renewable energy increases rapidly, the demand for reliable DIN rail power supplies is expected to grow significantly. Companies supplying these units can benefit from this expanding trend by catering specifically to renewable energy markets.

Latest Trends

Growing Popularity of Compact and Smart Solutions

A key latest trend shaping the DIN Rail Power Supply market is the shift towards compact and smart solutions. Customers increasingly prefer power supplies that are smaller, lighter, and easier to install, especially where space is limited. Manufacturers now focus on developing compact DIN rail power units with advanced features like remote monitoring, connectivity, and automated fault detection.

These smart power supplies can communicate real-time data, allowing users to easily track performance and prevent downtime. Industries such as manufacturing, automotive, and renewable energy particularly benefit from these innovations, as smart features improve efficiency and simplify maintenance.

Regional Analysis

The Asia-Pacific DIN Rail Power Supply market currently holds a 38.20% share, valued around USD 0.4 billion.

The DIN Rail Power Supply market shows varying levels of adoption across key global regions, with Asia-Pacific leading the charge. Holding a dominant 38.20% market share and valued at approximately USD 0.4 billion, the Asia-Pacific region benefits from rapid industrial growth, strong adoption of automation, and expanding manufacturing sectors, particularly in countries like China, India, and Japan.

This regional dominance is driven by increasing demand for compact, reliable, and efficient power systems in industrial automation. North America also contributes significantly to market growth, supported by the presence of technologically advanced manufacturing infrastructure and rising investments in smart factories. Europe follows closely, with a strong industrial base and strict energy efficiency regulations encouraging the use of reliable DIN rail power solutions.

The Middle East & Africa region is witnessing gradual adoption, primarily in oil & gas, infrastructure, and utilities, where consistent and safe power delivery is essential. Latin America, though a smaller market, is showing steady progress with rising investments in automation and energy projects.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global DIN Rail Power Supply market is witnessing competitive dynamics shaped by innovation, efficiency, and application-specific offerings. Among the key players, ABB stands out with its strong global footprint and broad portfolio tailored for industrial automation and energy systems.

ABB’s products are known for high reliability, safety compliance, and integration capabilities, making them a top choice for mission-critical operations across various industries. The company’s continued investments in digital power solutions have strengthened its positioning in the high-efficiency DIN rail segment.

CUI Inc., a Bel group company, is rapidly gaining attention with its focus on compact, cost-effective power solutions. Its DIN rail power supplies are well-suited for space-constrained environments and offer flexibility in industrial and telecom applications. CUI’s ability to scale and offer modular solutions makes it a competitive mid-tier player.

Mean Well Enterprises Co. Ltd., based in Taiwan, remains one of the most recognized global manufacturers in the standard power supply market. With a strong catalog of reliable and price-competitive DIN rail units, it continues to serve a wide range of industries from automation to security systems. Mean Well’s global distribution network also strengthens its accessibility in both developed and emerging markets.

Moxa Inc., known for industrial networking, is integrating its expertise into power solutions. Its DIN rail power supplies are tailored for harsh environments and mission-critical systems. Moxa leverages industrial IoT integration, offering intelligent power management, which differentiates it in industrial automation and smart grid applications.

Top Key Players in the Market

- ABB

- CUI Inc

- Mean Well Enterprises Co. Ltd.

- Moxa Inc

- Omron Corporation

- P-DUKE Technology Co., Ltd.

- Pepperl+Fuchs

- Phoenix Contact Gmbh & Co. Kg

- Puls Gmbh

- RECOM Power GmbH

- Rockwell Automation

- Schneider Electric

- Siemens

- Tdk Lambda Corporation

- Traco Power

Recent Developments

- In 2024, RECOM expanded its operations by acquiring a majority stake in LECO Power Supplies in Vienna, Austria, and launching a manufacturing setup and after-sales support facility in Bangkok, Thailand. The company employs approximately 201 people and, as of April 2024, reported annual revenues of around $1 million.

- In 2023, MEAN WELL reported revenues of NTD 32.81 billion (approximately USD 1.058 billion), reflecting a 26.4% decrease from the previous year. Despite this decline, the company remains optimistic, anticipating a gradual market improvement starting in the first quarter of 2024.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Phase Type (Single-Phase, Two-Phase, Three-Phase), By Power (Upto 480 Watt, 480 Watt to 960 Watt, Above 960 Watt), By Voltage Range (Upto 24 V, 24 V to 48 V, Above 48 V), By End-use (Industrial (Automotive, Power and Energy, Telecommunications and IT Infrastructure, Others), Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, CUI Inc, Mean Well Enterprises Co. Ltd., Moxa Inc, Omron Corporation, P-DUKE Technology Co., Ltd., Pepperl+Fuchs, Phoenix Contact Gmbh & Co. Kg, Puls Gmbh, RECOM Power GmbH, Rockwell Automation, Schneider Electric, Siemens, Tdk Lambda Corporation, Traco Power Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global DIN Rail Power Supply MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global DIN Rail Power Supply MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- CUI Inc

- Mean Well Enterprises Co. Ltd.

- Moxa Inc

- Omron Corporation

- P-DUKE Technology Co., Ltd.

- Pepperl+Fuchs

- Phoenix Contact Gmbh & Co. Kg

- Puls Gmbh

- RECOM Power GmbH

- Rockwell Automation

- Schneider Electric

- Siemens

- Tdk Lambda Corporation

- Traco Power