Global Combined Heat and Power Market Size, Share, And Business Benefits By Fuel (Natural Gas, Coal, Biomass, Others), By Capacity (Up to 10 Mw, 11-150 Mw, 151-300 Mw, Above 300 Mw), By Prime Mover (Gas Turbine, Steam Turbine, Reciprocating Engine, Fuel Cell, Microturbine, Others), By End-use (Commercial (office Buildings, Hotels, Hospitals, Institutions, Military Bases, Others), Residential (Multifamily Buildings, co-ops Buildings, Planned Communities, Others), Industrial (Chemicals, Petroleum Refining, Food, Agriculture, Pulp and Paper, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143940

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

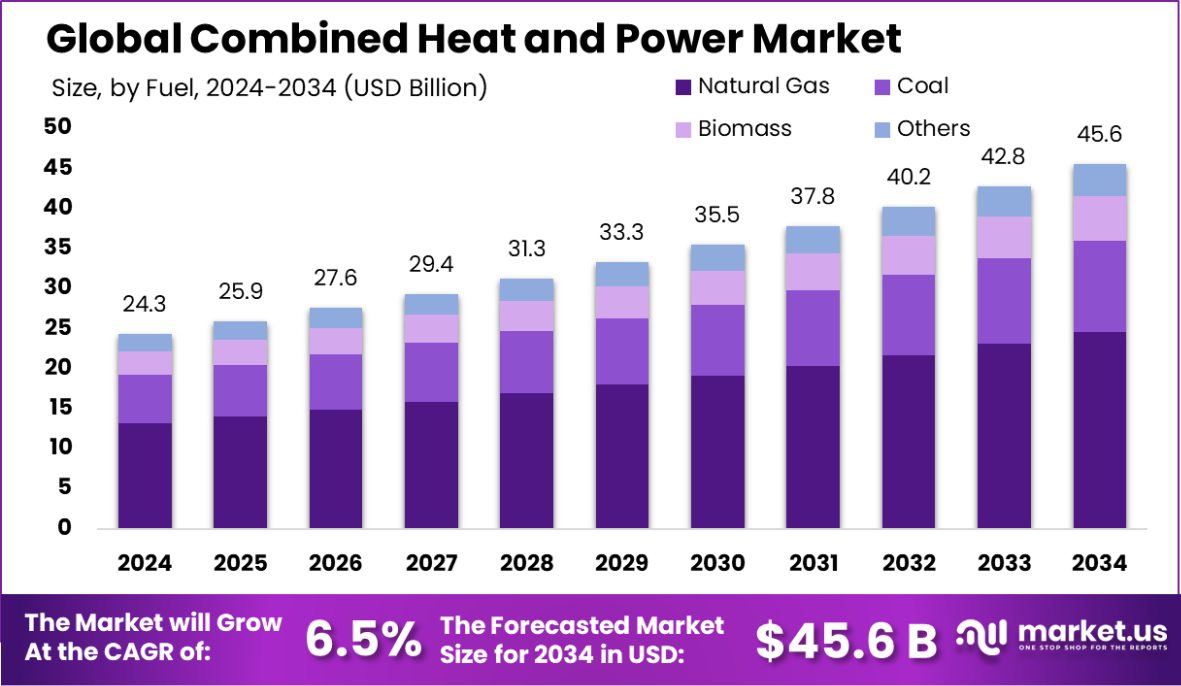

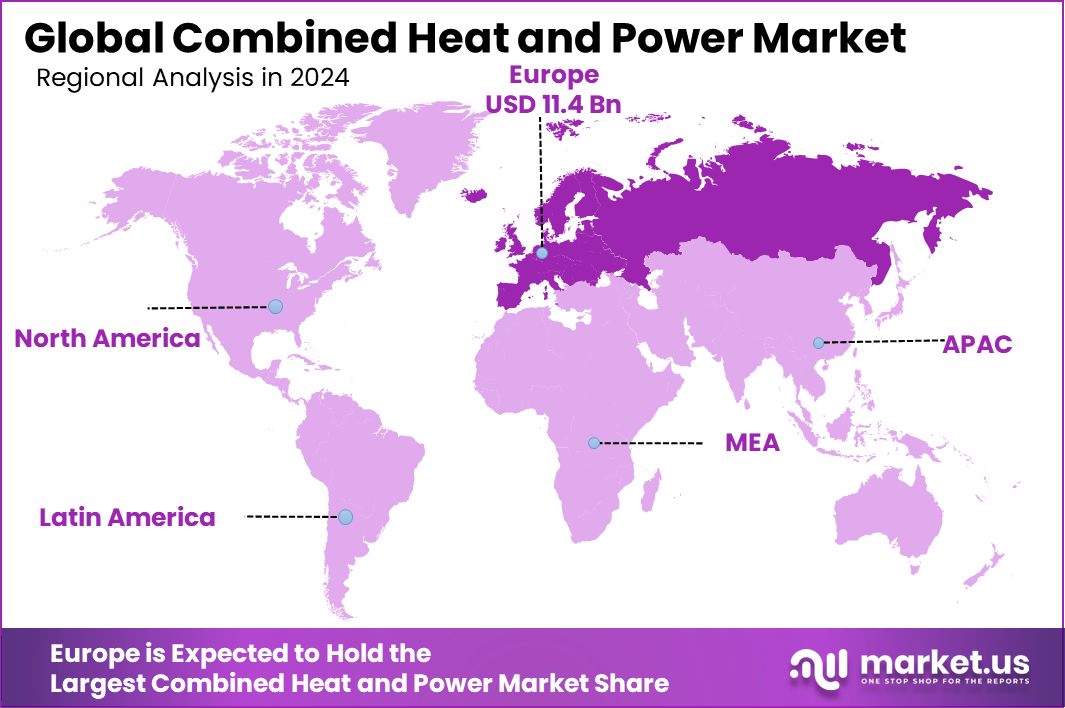

Global Combined Heat and Power Market is expected to be worth around USD 45.6 billion by 2034, up from USD 24.3 billion in 2024, and grow at a CAGR of 6.5% from 2025 to 2034. With a 47.20% market share, Europe leads globally due to the high adoption of advanced CHP technologies.

Combined Heat and Power (CHP), also known as cogeneration, is a highly efficient process that captures and utilizes the heat that is a by-product of the electricity generation process. Typically, in conventional power plants, a significant portion of this heat is wasted.

However, CHP systems make use of this waste heat for heating, cooling, or other thermal energy requirements, significantly enhancing the overall efficiency of the system. This process not only reduces energy costs but also minimizes the environmental impact by lowering greenhouse gas emissions.

The Combined Heat and Power market refers to the landscape of industries and sectors that implement CHP systems to meet their energy needs more efficiently and sustainably. This market is driven by the increasing demand for energy efficiency and the reduction of carbon footprints across various industries, including manufacturing, residential complexes, and commercial sectors.

One of the primary growth factors for the CHP market is the rising energy costs that drive businesses and residential consumers to seek more cost-effective solutions. CHP systems offer a way to reduce energy expenditures by making dual use of fuel sources, thus providing significant savings over time. Additionally, the global push for sustainable energy practices encourages more industries to adopt these systems to meet their environmental targets.

The demand for CHP systems is increasing particularly in regions with stringent regulations on energy efficiency and greenhouse gas emissions. Industries that require a constant heat supply, like chemical, paper, and food processing plants, are major contributors to this demand. Moreover, urban areas with high-density populations see a growing trend in implementing CHP solutions in residential and commercial buildings to enhance energy efficiency and reliability.

Key Takeaways

- Global Combined Heat and Power Market is expected to be worth around USD 45.6 billion by 2034, up from USD 24.3 billion in 2024, and grow at a CAGR of 6.5% from 2025 to 2034.

- In the Combined Heat and Power Market, natural gas dominates by fuel, accounting for a 54.20% share.

- The 11-150 MW capacity segment leads in the Combined Heat and Power Market with a 39.20% share.

- Gas turbines hold a 37.20% market share in the Combined Heat and Power Market by prime mover.

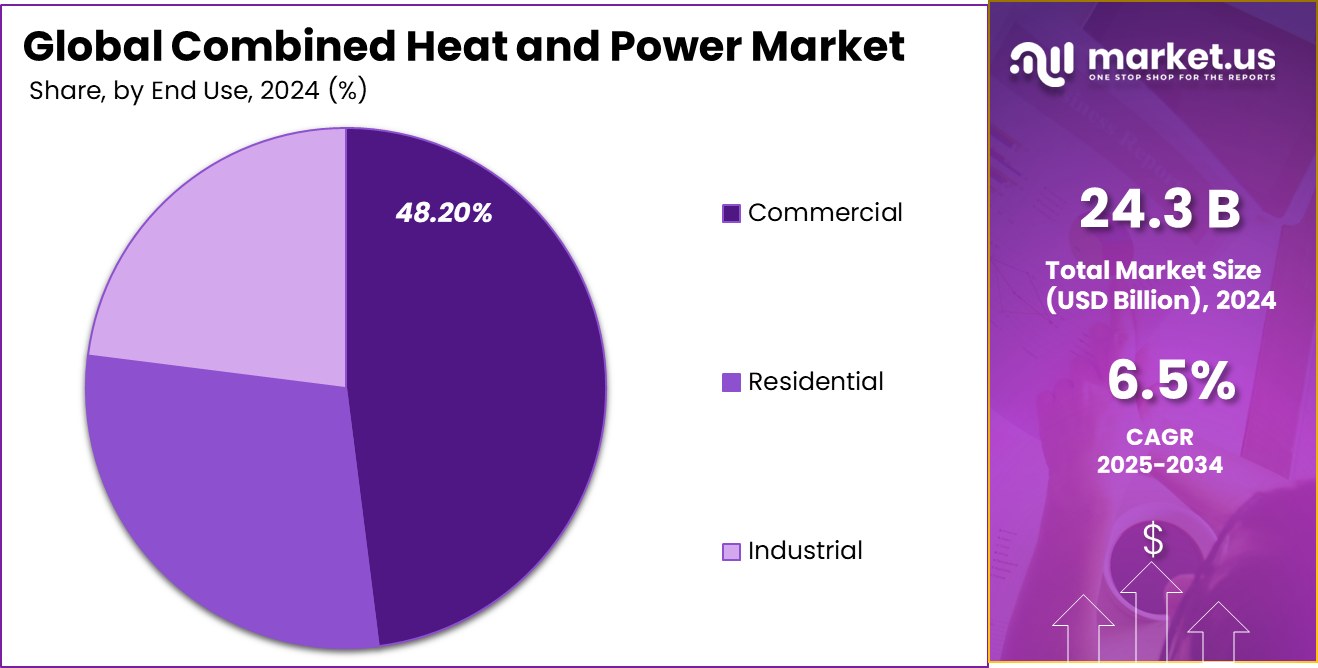

- The commercial sector leads end-use in the Combined Heat and Power Market, holding a 48.20% market share.

- Europe’s market reached USD 11.4 billion driven by strict regulations promoting efficient and greener energy solutions.

By Fuel Analysis

The combined Heat and Power Market sees a 54.20% share dominated by natural gas usage.

In 2024, Natural Gas held a dominant market position in the by-fuel segment of the Combined Heat and Power (CHP) Market, with a 54.20% share. This strong foothold was primarily driven by its cleaner-burning properties compared to coal and oil, along with increasing regulatory pressure to reduce greenhouse gas emissions.

The widespread availability of natural gas infrastructure and its compatibility with both large- and small-scale CHP systems further supported its adoption across industrial, commercial, and residential sectors.

Coal, although gradually declining due to environmental concerns, retained a notable position with significant use in legacy CHP plants, particularly in regions with abundant coal reserves. Biomass followed closely, gaining traction due to government incentives and sustainability mandates, especially in Europe and parts of Asia. Biomass-based CHP systems benefited from their carbon-neutral status and compatibility with circular economy models.

Other fuels, including oil and renewables like biogas and hydrogen, occupied a smaller market share but showed signs of incremental growth. These alternative fuels are being explored for decentralized energy solutions and off-grid applications. However, high costs and technological barriers currently limit their large-scale deployment.

By Capacity Analysis

The 11-150 MW capacity segment leads the Combined Heat and Power Market with a 39.20% share.

In 2024, 11–150 MW held a dominant market position in the By Capacity segment of the Combined Heat and Power (CHP) Market, with a 39.20% share. This capacity range was widely adopted across large industrial plants, district heating systems, and commercial complexes due to its optimal balance between output efficiency and operational flexibility.

The segment’s strong performance was fueled by increasing energy demands from manufacturing and processing industries, which require continuous and reliable power and heat supply.

The 11–150 MW systems are particularly favored in developed regions where grid stability and carbon reduction are top priorities. These systems allow for the effective integration of fuel-efficient technologies while lowering overall transmission losses. In addition, supportive policies for energy efficiency and government incentives for medium-scale cogeneration systems further encouraged installations in this range.

Smaller capacities, such as below 10 MW, were more common in institutional and small commercial settings, while systems above 150 MW were mostly limited to large-scale industrial users and utility-scale applications. However, they represented a smaller share due to higher capital costs and longer implementation timelines.

By Prime Mover Analysis

Gas turbine prime movers hold a 37.20% share in the Combined Heat and Power Market globally.

In 2024, Gas Turbines held a dominant market position in the Prime Mover segment of the Combined Heat and Power (CHP) Market, with a 37.20% share. This leadership was primarily due to gas turbines’ high power-to-heat ratio, operational efficiency, and suitability for medium to large-scale industrial applications. Their ability to start quickly, operate at high efficiency, and integrate with natural gas—currently the leading CHP fuel—further strengthened their market presence.

Gas turbines are commonly deployed in large commercial facilities, refineries, and district energy systems, where consistent power and thermal energy are essential. Their robust design and lower maintenance requirements compared to reciprocating engines make them a preferred choice for continuous operations. Additionally, advancements in turbine technology have enhanced their fuel flexibility, allowing co-firing with renewable fuels such as biogas.

Other prime movers like steam turbines and reciprocating engines followed, catering to specific niche applications and smaller-scale systems. While steam turbines are favored in coal or biomass-fired CHP systems, reciprocating engines offer benefits for modular and decentralized installations.

By End-use Analysis

The commercial sector drives the Combined Heat and Power Market with a 48.20% end-use application share.

In 2024, Commercial held a dominant market position in the By End-use segment of the Combined Heat and Power (CHP) Market, with a 48.20% share. The segment’s strong performance was largely attributed to the growing energy demands of commercial buildings such as hospitals, hotels, shopping centers, airports, and educational institutions. These facilities require reliable power and continuous heating or cooling, making CHP systems a cost-effective and energy-efficient solution.

The commercial sector increasingly adopted CHP systems to reduce utility costs, enhance energy security, and meet sustainability goals. The ability of CHP to provide both electricity and useful thermal energy from a single fuel source supported operational efficiency and long-term cost savings, which appealed to energy-intensive facilities. Additionally, favorable policy frameworks and utility incentives further supported installations in this segment.

High energy bills and the need for uninterrupted power supply drove investments in on-site generation systems. Many commercial users also pursued CHP to meet building codes and emissions standards aimed at reducing carbon footprints. While the industrial and residential segments also used CHP systems, their share remained comparatively lower.

Key Market Segments

By Fuel

- Natural Gas

- Coal

- Biomass

- Others

By Capacity

- Up to 10 Mw

- 11-150 Mw

- 151-300 Mw

- Above 300 Mw

By Prime Mover

- Gas Turbine

- Steam Turbine

- Reciprocating Engine

- Fuel Cell

- Microturbine

- Others

By End-use

- Commercial

- Office Buildings

- Hotels

- Hospitals

- Institutions

- Military Bases

- Others

- Residential

- Multifamily Buildings

- co-ops Buildings

- Planned Communities

- Others

- Industrial

- Chemicals

- Petroleum Refining

- Food

- Agriculture

- Pulp and Paper

- Others

Driving Factors

Rising Demand for Efficient Energy-Saving Solutions

One major factor boosting the combined heat and power market growth is the increasing need for efficient energy-saving solutions. Governments and industries around the world want ways to reduce fuel use and lower greenhouse gas emissions. Combined heat and power (CHP) systems can produce both electricity and useful heat at the same time, which saves fuel and makes energy use more efficient.

These systems help reduce overall energy costs for businesses, making them very popular among factories, hospitals, universities, and large buildings. Additionally, strict government regulations related to emission reduction are encouraging more companies to switch to CHP systems. Because of these advantages, CHP systems are gaining popularity quickly, driving steady growth in the global market.

Restraining Factors

High Initial Costs Limit CHP Market Growth

The major challenge holding back the combined heat and power (CHP) market growth is high upfront installation costs. CHP systems need significant initial investment for equipment, installation, and integration with existing infrastructure, making them less affordable, especially for smaller companies or facilities. Many organizations, particularly those with limited budgets, find these large upfront costs a big barrier.

Additionally, ongoing maintenance expenses and the requirement for specialized technical expertise further add to the overall expenses of operating CHP systems. Although long-term savings are possible through reduced energy bills, the high initial investment discourages some potential customers from adopting CHP solutions.

Growth Opportunity

Growing Shift Towards Renewable CHP Energy Sources

A key growth opportunity for the combined heat and power (CHP) market is the increasing shift toward renewable energy sources. Many countries worldwide are now strongly focused on sustainability and reducing their dependence on fossil fuels.

This opens a major opportunity for CHP systems that utilize renewable sources like biomass, biogas, solar, and hydrogen. Using renewable fuels in CHP systems helps industries and communities become greener, significantly lowering carbon footprints.

Moreover, governments globally offer attractive incentives and supportive policies for businesses adopting renewable-based CHP solutions. Companies that quickly adopt these renewable CHP technologies are likely to see long-term savings and improved environmental performance.

Latest Trends

Smart Technology Integration in CHP System Operations

A major latest trend in the combined heat and power (CHP) market is integrating smart technologies into operations. CHP systems are now being combined with advanced digital tools, sensors, and smart monitoring devices that boost efficiency and performance. These smart technologies allow operators to remotely monitor CHP systems, track energy consumption, and quickly detect or predict potential system issues.

Using digital solutions like artificial intelligence and real-time analytics helps optimize performance, minimize downtime, and enhance overall energy management. Many CHP providers now offer solutions equipped with IoT (Internet of Things) technology, enabling seamless connectivity and smart control.

Regional Analysis

Europe holds a 47.20% share of the combined heat and power market, valued at USD 11.4 billion.

The combined heat and power market is segmented regionally into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Europe dominates the global market, holding a major share of 47.20%, valued at USD 11.4 billion. Europe’s leading position is largely driven by strict government regulations, supportive policies, and a strong emphasis on sustainable energy solutions across major economies such as Germany, France, and the UK.

North America is also experiencing steady growth, driven by increased industrial adoption and government incentives for efficient energy use. The Asia Pacific region shows significant potential due to rapid industrialization and urbanization, particularly in countries like China, India, and Japan, boosting market expansion.

The Middle East & Africa region currently holds moderate market activity, with a growing shift toward energy-efficient solutions to meet rising energy demands in commercial and industrial sectors. Latin America shows gradual adoption, with market activity primarily driven by Brazil and Mexico, where industries increasingly focus on energy efficiency and emission control.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BDR Thermea, Bosch Thermotechnology, and Capstone Turbine Corporation are positioned as influential players in the global combined heat and power (CHP) market.

BDR Thermea continues to strengthen its market presence through innovative solutions tailored specifically for residential and commercial applications.

The company’s emphasis on energy efficiency, sustainability, and customized CHP offerings will likely bolster its competitive advantage, particularly across European markets, where regulatory support remains strong.

Bosch Thermotechnology, leveraging its robust technological capabilities and extensive distribution networks, is anticipated to maintain steady market growth. Bosch’s strategy is focused on enhancing system reliability, performance, and connectivity through digital and smart control integration.

The company’s well-established global footprint enables rapid market penetration and allows it to effectively capitalize on increasing global demand for advanced CHP solutions, especially in North America and Europe.

Capstone Turbine Corporation, known for its expertise in microturbine technology, is expected to capitalize on growing industrial and commercial applications. The company’s unique advantage lies in compact CHP systems that offer higher flexibility, efficiency, and scalability, meeting diverse energy demands.

Capstone’s continued investment in renewable fuel integration—such as biogas and hydrogen-compatible turbines—further positions it well for future growth, notably within emerging markets of Asia Pacific and Latin America.

Top Key Players in the Market

- 2G Energy Services

- ABB

- Aegis Energy Services Inc.

- BDR Thermia

- Bosch Thermotechnology

- Capstone Turbine Corporation

- Caterpillar

- CENTRAX Gas Turbines (U.K.)

- Centrica

- Clarke Energy

- Cummins Inc.

- Doosan Fuel Cell

- E.ON SE

- FuelCell Energy

- General Electric

- Kawasaki Heavy Industries, Ltd.

- MAN Diesel & Turbo

- Mitsubishi Hitachi Power Systems, Ltd.

- Siemens

- Tecogen Inc.

- Veolia

- Viessmann

- Wartsila

Recent Developments

- In 2024, 2G Energy expanded its global reach, with international CHP system sales overtaking domestic. Service revenues climbed, and a strong €189 million order backlog suggests momentum. The company will see €450 million in revenue in 2025, reinforcing its commitment to clean energy growth.

- In 2024, ABB introduced over 20 innovative products to support the energy transition across various segments. Notably, ABB unveiled the SACE Infinitus solid-state circuit breaker, designed to enhance the safety and efficiency of DC power systems.

Report Scope

Report Features Description Market Value (2024) USD 24.3 Billion Forecast Revenue (2034) USD 45.6 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel (Natural Gas, Coal, Biomass, Others), By Capacity (Up to 10 Mw, 11-150 Mw, 151-300 Mw, Above 300 Mw), By Prime Mover (Gas Turbine, Steam Turbine, Reciprocating Engine, Fuel Cell, Microturbine, Others), By End-use (Commercial (office Buildings, Hotels, Hospitals, Institutions, Military Bases, Others), Residential (Multifamily Buildings, co-ops Buildings, Planned Communities, Others), Industrial (Chemicals, Petroleum Refining, Food, Agriculture, Pulp and Paper, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 2G Energy Services, ABB, Aegis Energy Services Inc., BDR Thermia, Bosch Thermotechnology, Capstone Turbine Corporation, Caterpillar, CENTRAX Gas Turbines (U.K.), Centrica, Clarke Energy, Cummins Inc., Doosan Fuel Cell, E.ON SE, FuelCell Energy, General Electric, Kawasaki Heavy Industries, Ltd., MAN Diesel & Turbo, Mitsubishi Hitachi Power Systems, Ltd., Siemens, Tecogen Inc., Veolia, Viessmann, Wartsila Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Combined Heat and Power MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global Combined Heat and Power MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 2G Energy Services

- ABB

- Aegis Energy Services Inc.

- BDR Thermia

- Bosch Thermotechnology

- Capstone Turbine Corporation

- Caterpillar

- CENTRAX Gas Turbines (U.K.)

- Centrica

- Clarke Energy

- Cummins Inc.

- Doosan Fuel Cell

- E.ON SE

- FuelCell Energy

- General Electric

- Kawasaki Heavy Industries, Ltd.

- MAN Diesel & Turbo

- Mitsubishi Hitachi Power Systems, Ltd.

- Siemens

- Tecogen Inc.

- Veolia

- Viessmann

- Wartsila