Global Silicon Carbide Market By Product (Black Silicon Carbide, Green Silicon Carbide), By Wafer Size (Up to 150 mm, Greater-than 150 mm), By Application ( Automotive, Aerospace, Military and Defense, Electrical And Electronics, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2025-2034

- Published date: Feb 2025

- Report ID: 139102

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

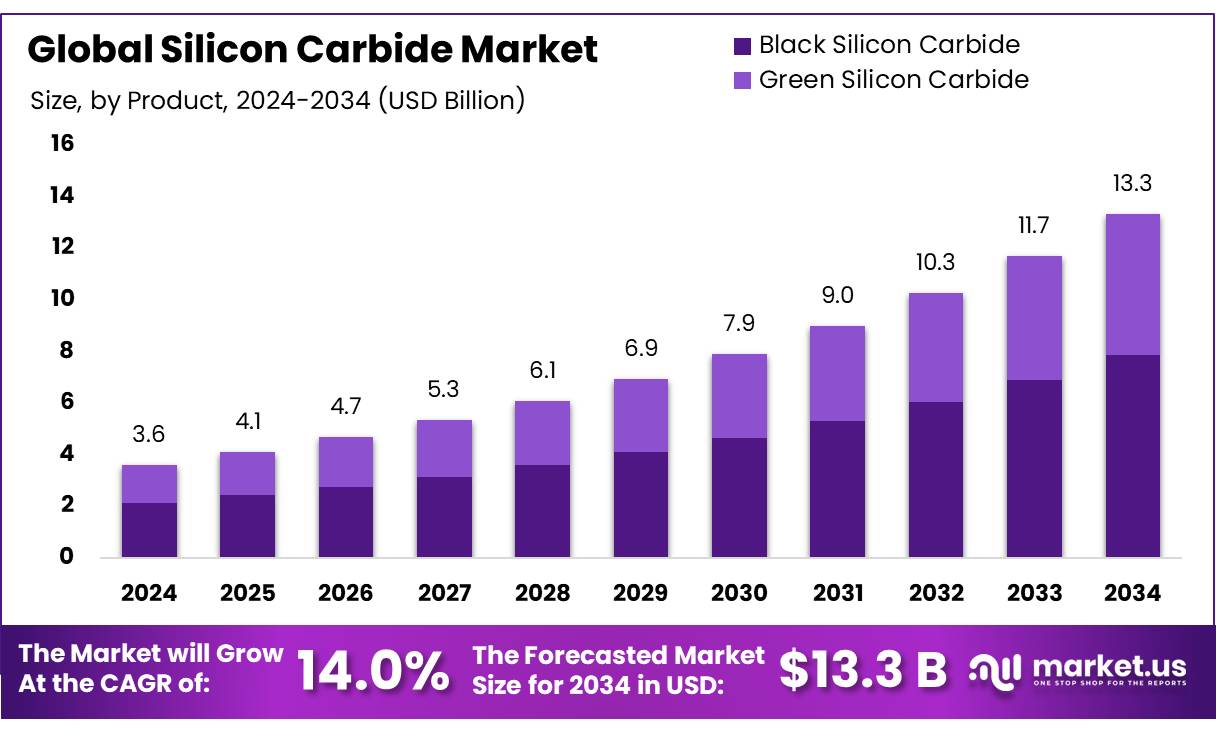

The Global Silicon Carbide Market size is expected to be worth around USD 13.3 Bn by 2034, from USD 3.6 Bn in 2024, growing at a CAGR of 14.0% during the forecast period from 2025 to 2034.

The global Silicon Carbide (SiC) market is experiencing significant growth, driven by increasing demand across sectors like automotive, electronics, and energy. SiC is a semiconductor material known for its high thermal conductivity, resistance to corrosion, and ability to withstand extreme temperatures, making it ideal for power electronics.

The growth of the silicon carbide market is supported by advancements in manufacturing processes and strong investments from both private and public sectors. Silicon carbide is gaining popularity in power devices, especially in energy-efficient applications like electric vehicles (EVs), where high-efficiency power modules are needed for battery management systems and chargers. In 2023, the automotive sector represented over 40% of the silicon carbide market, largely due to the rise in electric vehicle production.

Rising investments in Silicon Carbide technologies have spurred growth, with companies like Cree, Inc. (now Wolfspeed) and STMicroelectronics increasing production capacities. In 2022, global investments in SiC research surpassed USD 1.5 billion. Additionally, government incentives, like those from the U.S. Department of Energy, are boosting Silicon Carbide adoption by supporting clean energy technologies and wide-bandgap semiconductors.

Several factors are fueling Silicon Carbide market growth, including the increasing demand for high-performance power electronics, particularly in electric vehicles. SiC’s efficiency in energy conversion enhances EV performance, contributing to the demand for SiC-based power modules. Furthermore, Silicon Carbide ability to endure high temperatures and voltages makes it a preferred choice for energy applications, including solar inverters, wind turbines, and power grids.

Future Growth Opportunities, the SiC market’s growth prospects are closely linked to the rise of electric vehicles and renewable energy adoption. As governments ramp up decarbonization efforts, Silicon Carbide will be crucial for high-efficiency power modules. Advances in Silicon Carbide wafer production, such as the development of 150mm and 200mm wafers, are expected to lower costs, making Silicon Carbide more accessible for mass-market applications.

Key Takeaways

- Silicon Carbide Market size is expected to be worth around USD 13.3 Bn by 2034, from USD 3.6 Bn in 2024, growing at a CAGR of 14.0%.

- Black Silicon Carbide held a dominant market position, capturing more than a 58.1% share.

- Up to 150 mm held a dominant market position, capturing more than a 58.3% share.

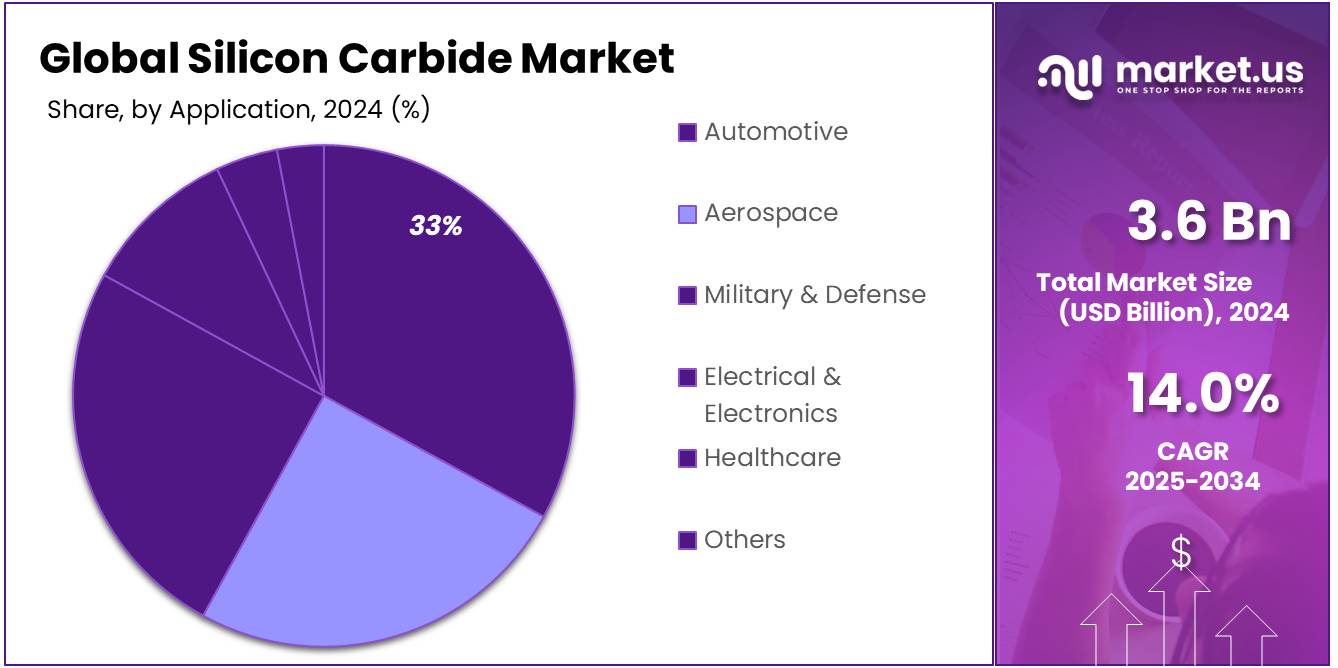

- Automotive held a dominant market position, capturing more than a 33.2% share.

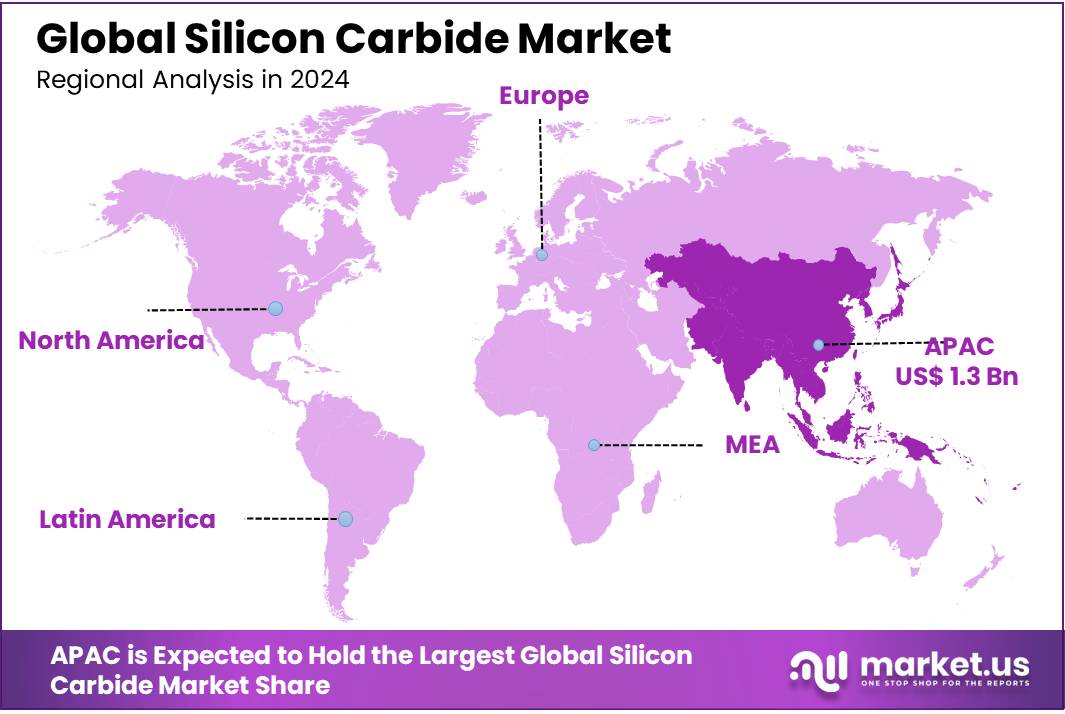

- Asia Pacific (APAC) is the dominating region in the global Silicon Carbide (SiC) market, capturing a significant market share of 36.9%, valued at approximately USD 1.3 billion in 2024.

By Product

In 2024, Black Silicon Carbide held a dominant market position, capturing more than a 58.1% share. This product segment continues to lead the market, primarily due to its widespread application in industries such as abrasives, electronics, and metallurgy. Black Silicon Carbide’s popularity is largely driven by its hardness, high thermal conductivity, and ability to withstand high temperatures, making it an essential material in manufacturing processes like grinding, cutting, and polishing.

Green Silicon Carbide, while holding a smaller share of the market, has steadily gained traction due to its higher purity and sharper crystalline structure. In 2024, Green Silicon Carbide accounted for a significant portion of the overall market, and its growth is projected to continue through 2025. The material’s superior quality makes it a preferred choice in specialized applications like semiconductor manufacturing, advanced ceramics, and high-performance abrasives.

By Wafer Size

In 2024, Up to 150 mm held a dominant silicon carbide market position, capturing more than a 58.3% share. This segment continues to lead the market primarily due to its extensive use in a wide range of applications, including power electronics, automotive, and consumer electronics. Silicon Carbide wafers of this size are widely adopted in the production of devices such as diodes, transistors, and other power devices that require high voltage, high efficiency, and thermal conductivity. The demand for Up to 150 mm wafers is largely driven by the growing need for efficient energy solutions, particularly in electric vehicles (EVs) and renewable energy technologies.

The >150 mm wafer segment has been growing steadily, albeit at a slower pace. In 2024, it accounted for a smaller share of the overall market compared to the Up to 150 mm segment. However, the growing demand for more powerful and efficient devices in sectors like telecommunications, industrial power systems, and electric vehicles is expected to drive the adoption of larger wafers. These larger wafers allow for higher current handling capabilities and are increasingly used in high-performance applications that require larger-scale production.

By Application

In 2024, Automotive held a dominant market position, capturing more than a 33.2% share. The automotive sector’s demand for Silicon Carbide (SiC) has surged due to the growing adoption of electric vehicles (EVs) and the shift toward more energy-efficient technologies. SiC’s exceptional ability to handle high temperatures, high voltages, and its excellent thermal conductivity make it ideal for power electronics in EVs, such as inverters, chargers, and motor drives.

The Aerospace and Military & Defense sectors, while smaller in comparison, are also seeing increasing demand for Silicon Carbide due to its superior properties in extreme environments. In 2024, the combined share of Aerospace and Military & Defense applications accounted for a substantial portion of the market, with both industries relying on SiC for components in radar systems, satellites, and high-performance propulsion systems.

In the Electrical & Electronics sector, Silicon Carbide is also becoming increasingly vital, especially in power conversion and semiconductor devices. In 2024, this segment is poised to hold a notable share of the market. With the rise in demand for energy-efficient devices, renewable energy systems, and high-frequency electronics, SiC’s role in power electronics applications is becoming more essential.

The Healthcare segment, while smaller than the others, is expected to experience gradual growth in 2024 and 2025, driven by the increasing need for medical devices that require high-performance semiconductors. Silicon Carbide is becoming more prominent in medical technologies such as imaging systems and diagnostics equipment due to its reliability and durability under demanding conditions.

Key Market Segments

By Product

- Black Silicon Carbide

- Green Silicon Carbide

By Wafer Size

- Up to 150 mm

- >150 mm

By Application

- Automotive

- Aerospace

- Military & Defense

- Electrical & Electronics

- Healthcare

- Others

Drivers

Growth in Demand for Electric Vehicles (EVs)

One of the primary factors fueling the growth of the Silicon Carbide market is the increasing demand for electric vehicles (EVs). The shift towards clean energy, reduced carbon emissions, and sustainable transportation solutions is reshaping the automotive industry. Silicon carbide, known for its superior thermal conductivity, high efficiency, and ability to withstand high voltages, is a critical material in the development of power electronics and energy management systems for electric vehicles.

Performance and Efficiency of Silicon Carbide

Silicon carbide’s ability to perform efficiently at high voltages and temperatures makes it ideal for electric vehicles, particularly in the power electronics systems used for propulsion and charging. SiC’s high efficiency results in reduced energy consumption, allowing EVs to travel longer distances per charge, which is one of the key performance metrics for consumers and manufacturers alike. A recent study by Power Semiconductor Research Group (PSRG) found that SiC-based inverters are up to 40% more efficient than traditional silicon-based inverters in electric vehicles, meaning that vehicles equipped with SiC components benefit from better energy conversion and lower overall power losses.

Market Expansion and Government Support

Governments around the world are increasingly supporting the adoption of electric vehicles through policy initiatives and financial incentives. These initiatives are designed to reduce greenhouse gas emissions, improve air quality, and reduce reliance on fossil fuels. For example, the European Union has implemented policies like the European Green Deal, which targets carbon neutrality by 2050. This includes encouraging the production and adoption of electric vehicles and the infrastructure needed to support them.

Restraints

High Production Costs Limiting Silicon Carbide Adoption

The cost of raw materials is one of the primary drivers of the high price of Silicon Carbide. SiC is produced by a high-temperature, energy-intensive process called chemical vapor deposition (CVD) or through sintering. These processes require specialized equipment and highly controlled environments, which significantly increase production costs compared to silicon. For example, a report by the U.S. Department of Energy indicates that SiC wafers, which are a key component in SiC semiconductors, can cost up to 5 times more than their silicon counterparts.

The Manufacturing Complexity and Scalability Issue

Another significant challenge for SiC adoption is the complexity and scalability of its production process. Unlike silicon, which has been refined and optimized over decades, SiC manufacturing still faces several hurdles in terms of scale. High-quality SiC wafers are difficult to produce consistently, and many manufacturers are still refining the processes to increase yield rates and reduce defects. According to a study by the U.S. Office of Energy Efficiency and Renewable Energy, while SiC-based components have shown a performance advantage in applications like electric vehicles and power electronics, the yield from SiC wafers remains much lower than that of silicon wafers.

Competition from Alternative Materials

In addition to the high production costs, SiC faces competition from other materials that offer similar performance characteristics, but at a lower cost. Gallium Nitride (GaN), for example, is another wide bandgap semiconductor material that is often seen as a competitor to SiC. GaN is used in power electronics and is particularly attractive for applications where high efficiency and smaller form factors are essential. Due to its more mature manufacturing processes and lower production costs, GaN is often considered a more affordable alternative, particularly in lower-power applications.

Opportunity

Expansion in Renewable Energy and Power Systems

One of the most significant growth opportunities for Silicon Carbide (SiC) lies in the increasing demand for renewable energy and the modernization of power grids. As the world transitions toward cleaner, more sustainable energy sources, SiC’s properties—such as high efficiency, thermal conductivity, and ability to handle high voltages—make it an ideal material for power electronics used in solar, wind, and energy storage systems.

Energy Storage and Grid Modernization

In addition to renewable energy generation, energy storage and grid modernization are becoming increasingly critical as more intermittent power sources like solar and wind are integrated into national grids. Silicon Carbide is uniquely suited for use in energy storage systems, such as those in large-scale battery storage facilities, where efficiency and reliability are paramount. SiC-based power electronics can help improve the efficiency of battery inverters, making energy storage systems more cost-effective and increasing their capacity to store and release energy when it is needed most.

Government Initiatives and Policies

Government initiatives worldwide are also driving the demand for renewable energy and, by extension, creating significant opportunities for SiC. The European Green Deal aims to make the EU climate-neutral by 2050, and as part of this effort, renewable energy adoption and grid modernization are high priorities. The European Union has set ambitious targets to boost renewable energy production to 40% of its energy mix by 2030, further increasing the need for efficient power electronics like SiC to facilitate this transition.

Trends

Increasing Adoption of Silicon Carbide in Electric Vehicles (EVs)

One of the most notable and exciting trends in the Silicon Carbide market today is the accelerating adoption of SiC in Electric Vehicles (EVs). As the world continues to shift towards more sustainable transportation solutions, SiC is playing an increasingly pivotal role in helping EVs achieve greater efficiency, longer range, and faster charging times. SiC’s superior properties, such as its ability to handle high voltages, operate at high temperatures, and deliver faster switching speeds, make it an ideal material for key components like inverters, power modules, and battery chargers in electric vehicles.

SiC’s Role in Enhancing EV Performance

The adoption of Silicon Carbide in electric vehicles is revolutionizing the automotive industry, especially in the realm of power electronics. SiC inverters, which are used to convert DC power from the battery to AC power for the electric motor, are much more efficient than traditional silicon-based inverters. SiC’s ability to operate at higher frequencies and temperatures allows for smaller, lighter, and more efficient power systems. This not only improves the performance of the vehicle but also contributes to longer driving ranges and shorter charging times—two factors that are critical for enhancing the consumer appeal of EVs.

EV Growth Driven by Government Policies

Government policies and incentives are also a significant driving force behind the adoption of electric vehicles, and by extension, the growing demand for Silicon Carbide. In 2023, the European Union (EU) set ambitious targets under its Green Deal, aiming for net-zero carbon emissions by 2050. As part of this effort, the EU has mandated that all new cars sold must be zero-emission by 2035, further accelerating the shift toward EVs. According to the European Commission, the EU has already set aside €20 billion to promote the development and adoption of green technologies, including EVs and their supporting infrastructure.

Regional Analysis

Asia Pacific (APAC) is the dominating region in the global Silicon Carbide market, capturing a significant market share of 36.9%, valued at approximately USD 1.3 billion in 2024. The region’s dominance is largely driven by the rapid growth of key industries such as automotive, electronics, and renewable energy. In particular, China and Japan are major contributors to the high demand for SiC, with China leading in electric vehicle (EV) production and Japan making significant strides in industrial applications of SiC.

North America holds a considerable share of the market, driven by the presence of major players in the semiconductor and automotive sectors. The U.S., with its strong push for EV adoption under the Inflation Reduction Act and other green energy policies, is expected to continue driving demand for SiC. The region is also seeing growth in its renewable energy sector, further bolstering the adoption of SiC-based technologies in power grids and energy storage.

Europe is another key player, with robust policies aimed at decarbonization and sustainability. The European Union’s commitment to becoming climate-neutral by 2050 has fueled significant investments in electric mobility and renewable energy systems, increasing the demand for SiC-based power devices.

Middle East & Africa and Latin America represent smaller but growing markets, with interest rising in EVs and renewable energy solutions, though they are expected to grow at a slower pace compared to APAC, North America, and Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Silicon Carbide (SiC) market is highly competitive, with numerous established players driving innovation and expansion in various segments, including automotive, electronics, energy, and industrial applications. Leading companies such as Wolfspeed, Inc., Infineon Technologies AG, STMicroelectronics N.V., and ROHM Co., Ltd. are at the forefront, with significant investments in research and development to advance SiC technology.

Wolfspeed, in particular, has emerged as a market leader, specializing in SiC power devices and modules for applications like electric vehicles and renewable energy systems. Similarly, Infineon Technologies and STMicroelectronics are leveraging their deep expertise in semiconductor solutions to expand their SiC product portfolios, focusing on power electronics and automotive solutions.

Companies such as Carborundum Universal Limited, Grindwell Norton Ltd., and Washington Mills are focused on SiC abrasives and ceramics, serving industrial sectors that demand durable materials for cutting, grinding, and polishing applications. Meanwhile, Entegris, Inc. and SK Siltron Co., Ltd. provide high-purity SiC wafers and materials for semiconductor manufacturing, supporting the growing demand for SiC in power electronics.

Additionally, firms like Semiconductor Components Industries (a subsidiary of ON Semiconductor) and Gaddis Engineered Materials are contributing to the development of advanced SiC technologies. These companies are working to capitalize on emerging opportunities in electric vehicles, renewable energy, and high-performance computing. With continued technological advancements and increased investments in SiC production capacity, these players are well-positioned to drive the market forward in the coming years.

Top Key Players

- AGSCO Corporation

- Carborundum Universal Limited

- Coherent Corp.

- Coorstek

- Entegris, Inc.

- ESD-SIC b.v.

- Fuji Electric Co., Ltd.

- Gaddis Engineered Materials

- Grindwell Norton Ltd.

- Infineon Technologies AG

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- ROHM Co., Ltd.

- Semiconductor Components Industries, LLC

- SK siltron Co.,Ltd.

- Snam Abrasives Pvt. Ltd.

- STMicroelectronics N.V.

- TOSHIBA CORPORATION

- Washington Mills

- WOLFSPEED, INC.

Recent Developments

In 2024, AGSCO’s focus has been on expanding its presence in the global SiC market, with a special emphasis on increasing production capacity to meet the growing demand for SiC-based products, particularly as industries like electric vehicles and renewable energy continue to thrive.

In 2024, Carborundum Universal’s SiC segment is expected to contribute around 18% to its total revenue, reflecting its significant role in the global SiC market. CUMI continues to invest in R&D to improve the performance and cost-effectiveness of its SiC products, positioning itself for long-term growth in an increasingly competitive market.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 13.0 Bn CAGR (2025-2034) 14.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Black Silicon Carbide, Green Silicon Carbide), By Wafer Size (Up to 150 mm, >150 mm), By Application ( Automotive, Aerospace, Military and Defense, Electrical And Electronics, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AGSCO Corporation, Carborundum Universal Limited, Coherent Corp., Coorstek, Entegris, Inc., ESD-SIC b.v., Fuji Electric Co., Ltd., Gaddis Engineered Materials, Grindwell Norton Ltd., Infineon Technologies AG, Microchip Technology Inc., Mitsubishi Electric Corporation, ROHM Co., Ltd., Semiconductor Components Industries, LLC, SK siltron Co.,Ltd., Snam Abrasives Pvt. Ltd., STMicroelectronics N.V., TOSHIBA CORPORATION, Washington Mills, WOLFSPEED, INC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AGSCO Corporation

- Carborundum Universal Limited

- Coherent Corp.

- Coorstek

- Entegris, Inc.

- ESD-SIC b.v.

- Fuji Electric Co., Ltd.

- Gaddis Engineered Materials

- Grindwell Norton Ltd.

- Infineon Technologies AG

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- ROHM Co., Ltd.

- Semiconductor Components Industries, LLC

- SK siltron Co.,Ltd.

- Snam Abrasives Pvt. Ltd.

- STMicroelectronics N.V.

- TOSHIBA CORPORATION

- Washington Mills

- WOLFSPEED, INC.