Global Pipeline Pigging Systems Market Size, Share, And Business Benefits By Product (Ultrasonic Pigging (UT), Magnetic Flux Leakage (MFL), Others), By Application (Oil and Gas, Chemicals, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154613

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

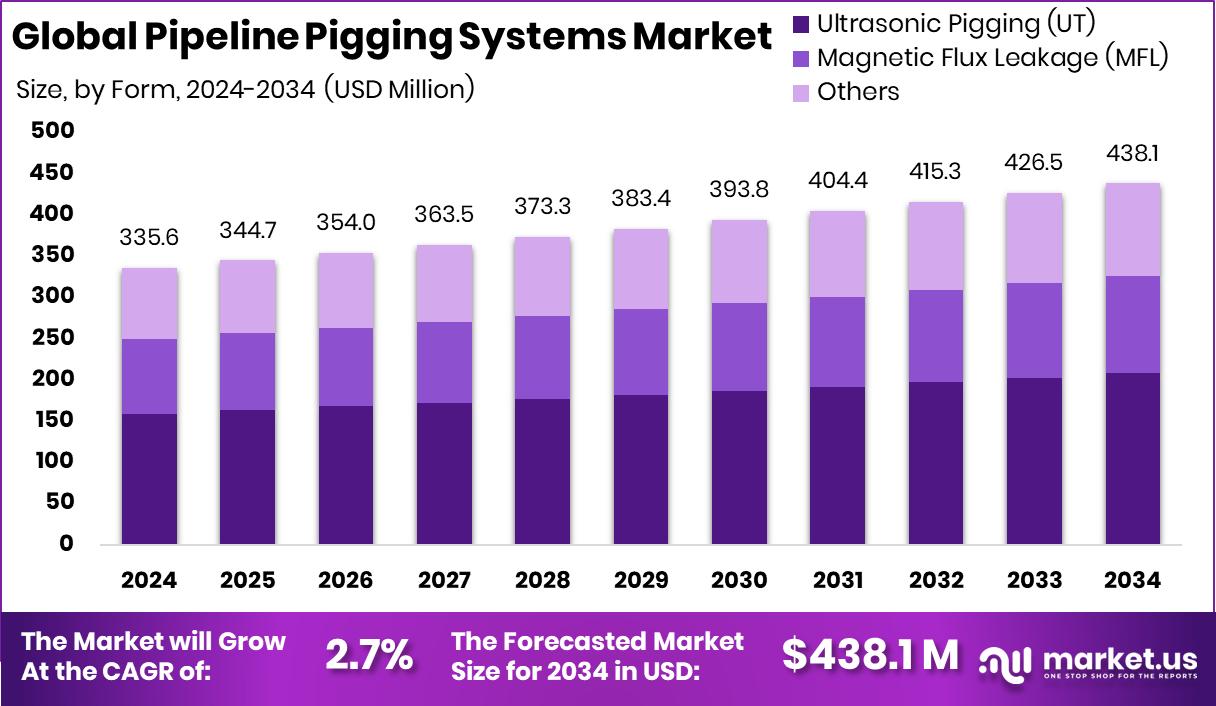

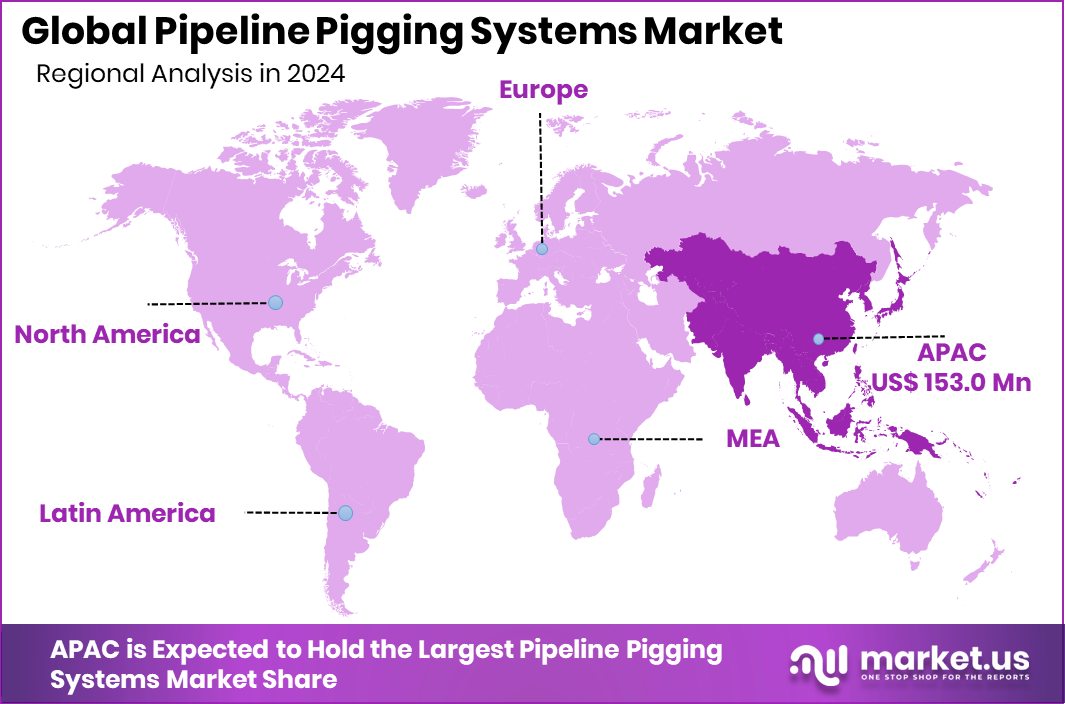

The Global Pipeline Pigging Systems Market is expected to be worth around USD 438.1 million by 2034, up from USD 335.6 million in 2024, and is projected to grow at a CAGR of 2.7% from 2025 to 2034. Strong pipeline infrastructure investments supported Asia-Pacific’s 45.6% market dominance in 2024.

Pipeline pigging systems are mechanical devices used to clean, inspect, and maintain pipelines without interrupting the flow of the product. These systems involve inserting a “pig”—a “tool made from foam, metal, or other materials — into the pipeline to remove debris, prevent corrosion, and ensure efficient flow. Pigging is commonly used in industries such as oil & gas, water treatment, chemicals, and food processing, where maintaining pipeline cleanliness and flow is critical.

The pipeline pigging systems market refers to the global industry involved in designing, manufacturing, and supplying pigging equipment and related technologies. This market is driven by the need for pipeline efficiency, maintenance, and regulatory compliance. It includes products like cleaning pigs, inspection pigs, launchers, receivers, and automation systems. As infrastructure ages and environmental regulations tighten, demand for advanced pigging solutions has been rising across sectors.

The growth of the pipeline pigging systems market is mainly driven by increasing investments in oil, gas, and chemical transportation infrastructure. Aging pipeline networks require frequent maintenance to ensure safety and reduce leaks. Additionally, stricter environmental policies are pushing companies to adopt pigging solutions to minimize contamination and operational risks.

There is growing demand for pipeline pigging systems due to the global rise in energy consumption and the expansion of cross-border pipeline projects. Industries dealing with hazardous or high-value fluids require efficient systems to prevent contamination or blockages. Moreover, frequent cleaning and inspection are now standard practices to comply with safety regulations.

Key Takeaways

- The Global Pipeline Pigging Systems Market is expected to be worth around USD 438.1 million by 2034, up from USD 335.6 million in 2024, and is projected to grow at a CAGR of 2.7% from 2025 to 2034.

- Ultrasonic pigging holds 47.4% of the market share due to its precision in detecting internal pipeline flaws.

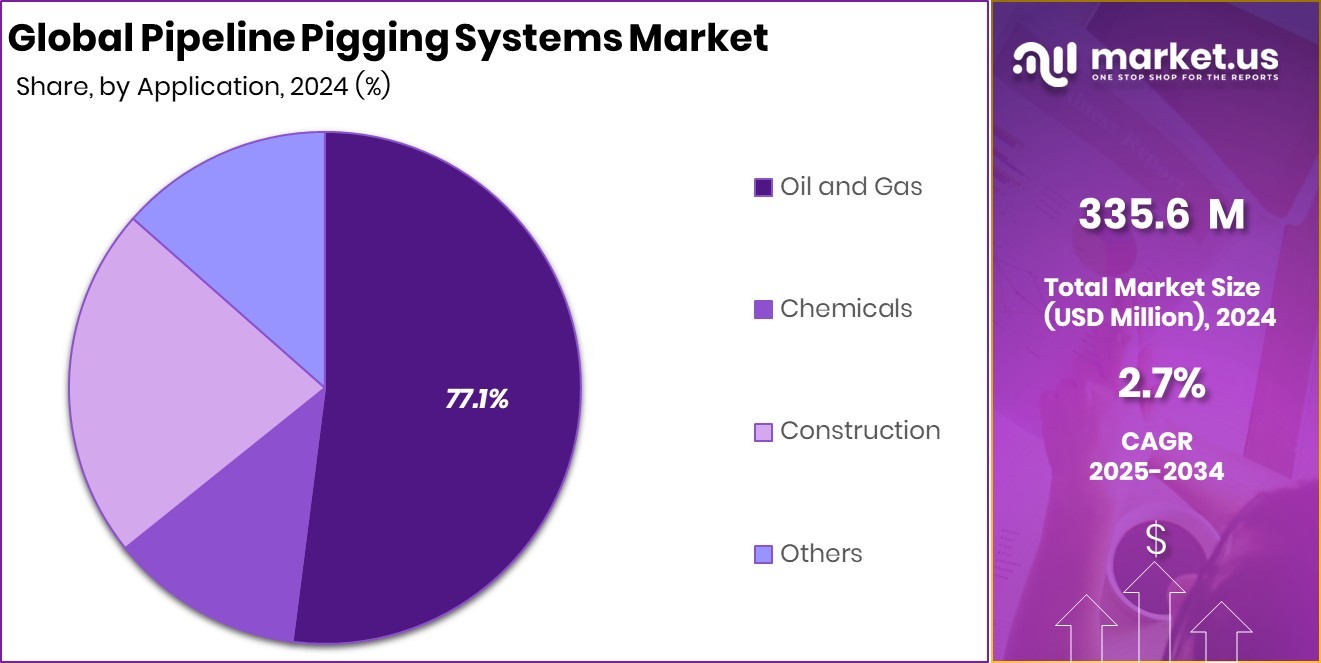

- The oil and gas segment dominates with a 77.1% share, driven by rising global pipeline maintenance activities.

- The Asia-Pacific recorded a total market value of USD 153.0 million in 2024.

By Product Analysis

Ultrasonic pigging holds 47.4% of the pipeline pigging systems market.

In 2024, Ultrasonic Pigging (UT) held a dominant market position in the By-Product segment of the Pipeline Pigging Systems Market, with a 47.4% share. This significant market share can be attributed to the increasing demand for high-precision pipeline inspection and maintenance solutions. Ultrasonic pigging uses high-frequency sound waves to detect corrosion, wall thickness changes, and internal pipeline defects with greater accuracy compared to conventional methods.

Its ability to provide real-time data and support predictive maintenance strategies has positioned it as a preferred choice among end-users seeking to enhance pipeline safety and operational efficiency. The growing emphasis on minimizing downtime and preventing product loss, particularly in high-stakes industries such as oil, gas, and chemicals, has further driven the adoption of ultrasonic pigging systems. Additionally, regulatory bodies are placing greater focus on leak detection and pipeline integrity, prompting industries to invest in advanced inspection tools.

As infrastructure ages and maintenance needs intensify, ultrasonic pigging is increasingly being viewed not only as a compliance tool but also as a cost-effective approach to long-term asset management. With its proven reliability and ability to operate without interrupting the flow, the UT segment is expected to maintain its leading position in the pipeline pigging systems market.

By Application Analysis

The oil and gas segment leads with 77.1% market share.

In 2024, Oil and Gas held a dominant market position in the By Application segment of the pipeline pigging systems market, with a 77.1% share. This strong dominance reflects the critical role pigging systems play in ensuring uninterrupted operations, safety, and efficiency within oil and gas pipelines. Given the long distances and large volumes involved in transporting crude oil, refined products, and natural gas, regular cleaning and inspection through pigging is essential to maintain flow efficiency and prevent blockages or corrosion.

The oil and gas sector continues to face stringent safety and environmental regulations, which have increased the reliance on pigging systems for leak detection, pressure monitoring, and internal assessments. Additionally, the aging pipeline infrastructure across several key markets requires frequent maintenance, further contributing to the segment’s growth.

The high operational risk and financial implications of pipeline failure in the oil and gas industry make pigging systems a fundamental component of the sector’s maintenance strategy. Moreover, with the push toward higher productivity and cost optimization, oil and gas operators are investing more in advanced pigging technologies to reduce downtime and ensure pipeline longevity.

Key Market Segments

By Product

- Ultrasonic Pigging (UT)

- Magnetic Flux Leakage (MFL)

- Others

By Application

- Oil and Gas

- Chemicals

- Construction

- Others

Driving Factors

Aging Pipelines Driving High Maintenance Demand

One of the main factors driving the growth of the pipeline pigging systems market is the rising number of aging pipeline infrastructures worldwide. Many pipelines used for transporting oil, gas, water, and chemicals were installed decades ago and are now approaching the end of their operational life. These old pipelines are more likely to develop corrosion, leaks, or internal buildup, which can disrupt flow and cause safety issues.

To prevent failures and costly downtime, companies are investing more in pigging systems for regular cleaning and inspection. Pigging not only helps extend the lifespan of aging pipelines but also ensures safer and more efficient operations. This growing need for ongoing pipeline maintenance is increasing the demand for advanced pigging solutions globally.

Restraining Factors

High Initial Cost Limits Wider Technology Adoption

One key factor holding back the growth of the pipeline pigging systems market is the high initial cost of installation and equipment. Setting up a pigging system requires special launchers, receivers, and sometimes automation tools, which can be expensive for smaller companies or those in developing regions. Additionally, intelligent or smart pigging tools that use sensors and data systems cost even more.

For some pipeline operators, especially in non-oil and gas industries, the upfront investment may seem too high compared to traditional maintenance methods. This cost concern makes it harder for businesses to shift to modern pigging technologies, slowing down market expansion, especially in cost-sensitive applications or regions with limited infrastructure budgets.

Growth Opportunity

Expanding Pipeline Networks in Emerging Economies

A major growth opportunity for the pipeline pigging systems market lies in the rapid expansion of pipeline infrastructure in emerging economies. Countries across Asia, Africa, and Latin America are investing heavily in new oil, gas, and water pipelines to support industrial growth, energy access, and urban development. As these regions build new networks, there is a rising need for reliable and efficient maintenance tools to ensure smooth operations.

Pigging systems are becoming an important part of project planning, as governments and private firms aim to reduce long-term maintenance costs and meet global safety standards. This growing infrastructure rollout presents a strong opportunity for pigging technology providers to tap into new markets with large-scale future demand.

Latest Trends

Smart Sensors Enhance Real-Time Pipeline Monitoring

A leading trend in the pipeline pigging systems market is the growing use of smart sensors for direct, real-time pipeline monitoring during pigging operations. These intelligent sensors measure parameters such as wall thickness, corrosion levels, and internal defects while the pig travels through the pipeline. By integrating digital data collection and analytics, pipeline operators can review inspection results immediately, enabling quick decisions for maintenance or repair.

This level of insight improves predictive maintenance strategies and reduces unexpected downtime. The combination of traditional cleaning functions with data-driven inspection makes pigging operations more efficient and reliable. As industries seek greater transparency and operational control, the adoption of smart pigging systems is increasing. This trend is driving innovation, leading to pigging tools that not only clean but also deliver valuable diagnostic information for safer, smarter pipeline management.

Regional Analysis

In Asia-Pacific, Pipeline Pigging Systems reached 45.6% market share in 2024.

In the Pipeline Pigging Systems Market by region, Asia‑Pacific emerges as the dominating region, capturing a 45.6% market share and generating USD 153.0 Mn in 2024. This dominant position reflects the significant investments made in pipeline expansion and maintenance across Asia‑Pacific economies. The high deployment of pigging systems has been supported by growing infrastructure developments and stringent regulatory requirements that necessitate pipeline integrity and operational reliability.

The region’s leadership, with nearly half of the market share, underscores its importance in the global pipeline pigging landscape. While other regions such as North America, Europe, the Middle East & Africa, and Latin America are integral parts of the overall market, the data indicates that Asia‑Pacific holds the preeminent role, both in terms of market share and monetary value.

The strong presence in Asia‑Pacific highlights substantial opportunities for pigging system providers and reflects the region’s increasing reliance on reliable pipeline inspection and maintenance methods. Consequently, pigging technology investments are most pronounced in Asia‑Pacific, reinforcing its status as the top regional market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Pigtek Ltd. continued to innovate with its modular pigging solutions, catering to both inspection and cleaning requirements. Emphasis was placed on design flexibility and ease of deployment, which helped position Pigtek favorably among pipeline operators seeking versatile and rapid-to-install systems.

NDT Global Corporate Limited strengthened its presence through cutting‑edge inline inspection technology, integrating high‑resolution sensors with advanced data-analysis platforms. This focus on precision diagnostics reinforced its role as a provider of intelligent pigging solutions, especially in sectors where defect detection accuracy and data quality were critical.

3P Services GmbH & Co KG has maintained a strong reputation for comprehensive pigging services, including pig deployment, retrieval, and system consulting. Its operational support model, especially in project-critical environments, continued to be valued by clients requiring tailored, end‑to‑end pigging capabilities on complex pipeline networks.

T.D. Williamson leveraged its global service network and longstanding expertise in pigging infrastructure to offer robust launcher/receiver systems and maintenance support. Its holistic approach to pigging system deployment, including safety protocols and regulatory compliance, contributed to its sustained influence in large-scale, heavy‑duty pipeline operations.

Top Key Players in the Market

- Pigtek Ltd.

- NDT Global Corporate Limited

- 3P Services GmbH & Co KG

- T.D. Williamson

- Enduro Pipeline Services

- Dacon Inspection Services Co. Ltd.

- Alpha Pipeline Integrity Services

Recent Developments

- In July 2025, Enduro introduced Dynamic Speed Control (DSC 2.0), an advanced tool for managing cleaning pig speed in high-flow pipeline operations. This enhancement supports smarter cleaning runs by helping operators adjust pig velocity to improve cleaning effectiveness, especially in pipelines facing heavy debris challenges.

- In January 2025, TDW published a new performance specification for Circumferential Stress Corrosion Cracking (CSCC) detection in pipelines. The document outlines usage of the MDS™ Pro system, combining multiple magnetic flux leakage and geometry datasets to accurately identify and prioritize CSCC anomalies.

Report Scope

Report Features Description Market Value (2024) USD 335.6 Million Forecast Revenue (2034) USD 438.1 Million CAGR (2025-2034) 2.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Ultrasonic Pigging (UT), Magnetic Flux Leakage (MFL), Others), By Application (Oil and Gas, Chemicals, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Pigtek Ltd., NDT Global Corporate Limited, 3P Services GmbH & Co KG, T.D. Williamson, Enduro Pipeline Services, Dacon Inspection Services Co. Ltd., Alpha Pipeline Integrity Services Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pipeline Pigging Systems MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Pipeline Pigging Systems MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pigtek Ltd.

- NDT Global Corporate Limited

- 3P Services GmbH & Co KG

- T.D. Williamson

- Enduro Pipeline Services

- Dacon Inspection Services Co. Ltd.

- Alpha Pipeline Integrity Services