Global Organic Perfume Market By Source (Flowers, Fruits, Spice, Others), By Intensity (Eau de Parfum, Eau de Toilette, Eau de Cologne), By End User (Female, Male, Unisex), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147837

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

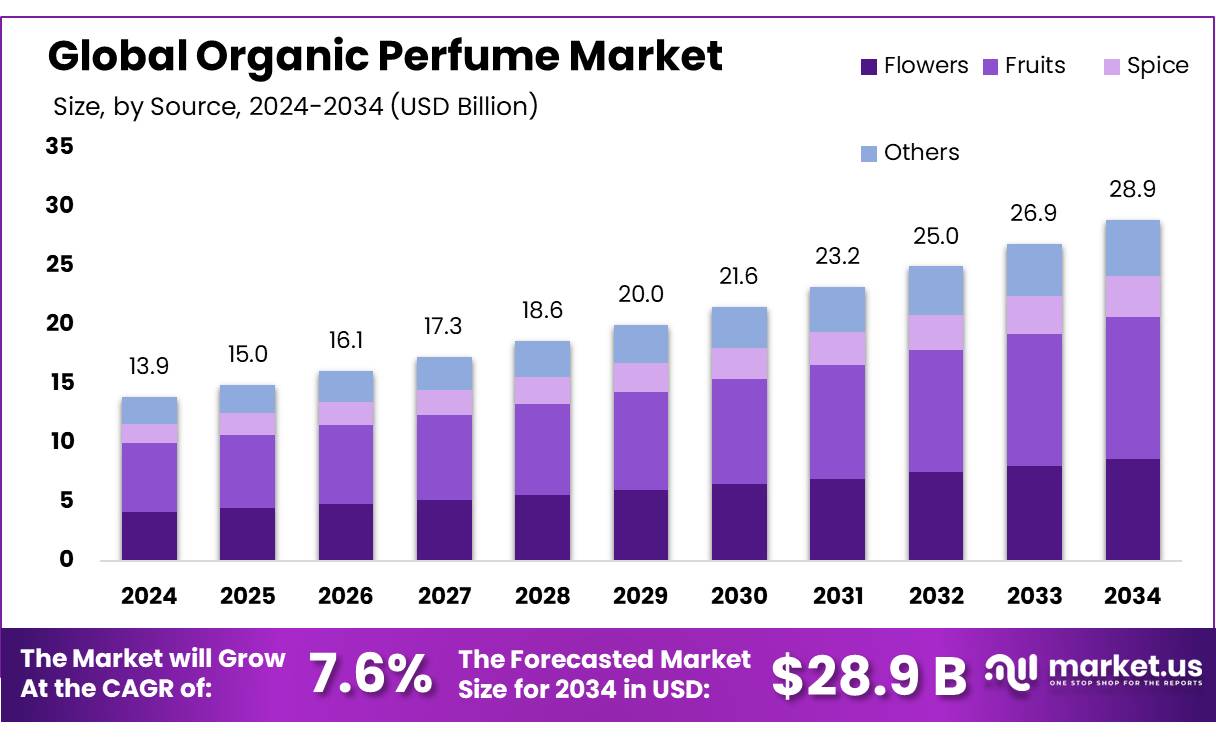

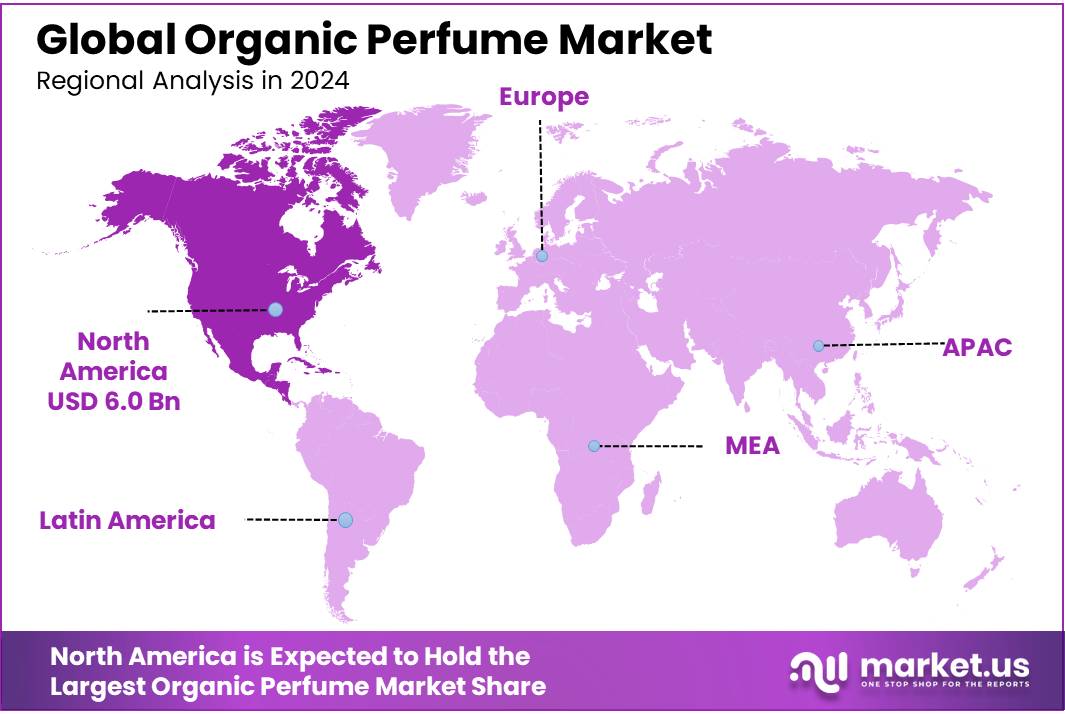

The global Organic Perfume market is undergoing a robust transformation, with its size projected to reach approximately USD 28.9 billion by 2034, rising from USD 13.9 Billion in 2024. This promising growth reflects a steady compound annual growth rate (CAGR) of 7.6% between 2025 and 2034. In 2024, North America remained the leading regional contributor, accounting for more than 43.6% of the global market share, with revenue generation of around USD 6.0 billion.

Organic perfumes, made from natural ingredients such as essential oils, plant extracts, and flower-based compounds, are becoming a popular alternative to conventional synthetic perfumes. This shift is largely attributed to increasing awareness regarding the harmful effects of synthetic chemicals on both health and the environment. According to the European Commission, approximately 40% of consumers in the European Union prefer organic products, including cosmetics and personal care items, reflecting a broader consumer preference for sustainability.

Additionally, the global trend of eco-conscious living, backed by various environmental regulations, is expected to fuel further growth. For example, the EU’s Cosmetics Regulation (EC No 1223/2009) mandates that all cosmetic products, including perfumes, be free from harmful chemicals, encouraging manufacturers to adopt organic practices. This regulation is expected to positively impact the organic perfume market, ensuring consumer safety and environmental protection.

Driving factors behind the growth of the organic perfume market include the rise in environmental awareness, increasing consumer preference for sustainable and cruelty-free products, and the growing trend of clean beauty. According to the Organic Trade Association, the U.S. organic personal care market has grown by over 10% annually, with organic fragrances being a key segment in this expansion.

Furthermore, the increasing demand for vegan and cruelty-free products also plays a pivotal role in driving the organic perfume market forward. A survey by the Vegan Society found that the global vegan beauty market is expected to reach USD 20.8 billion by 2025, signaling a significant opportunity for organic perfume brands to capitalize on the growing demand for vegan beauty products

Government initiatives have played a crucial role in supporting the organic perfume sector. In the United States, the USDA organic certification has encouraged the production and consumption of organic fragrances, leading to a significant increase in sales. Specifically, sales of organic fragrances in the U.S. rose by over 10 million units in 2024 alone. Similarly, international certification bodies like ECOCERT have been instrumental in promoting organic standards across various countries, including France, Germany, and the United States .

Key Takeaways

- Organic Perfume Market size is expected to be worth around USD 28.9 Billion by 2034, from USD 13.9 Billion in 2024, growing at a CAGR of 7.6%.

- Fruits held a dominant market position, capturing more than a 41.6% share in the Organic Perfume Market.

- Eau de Parfum held a dominant market position, capturing more than a 51.4% share in the Organic Perfume Market.

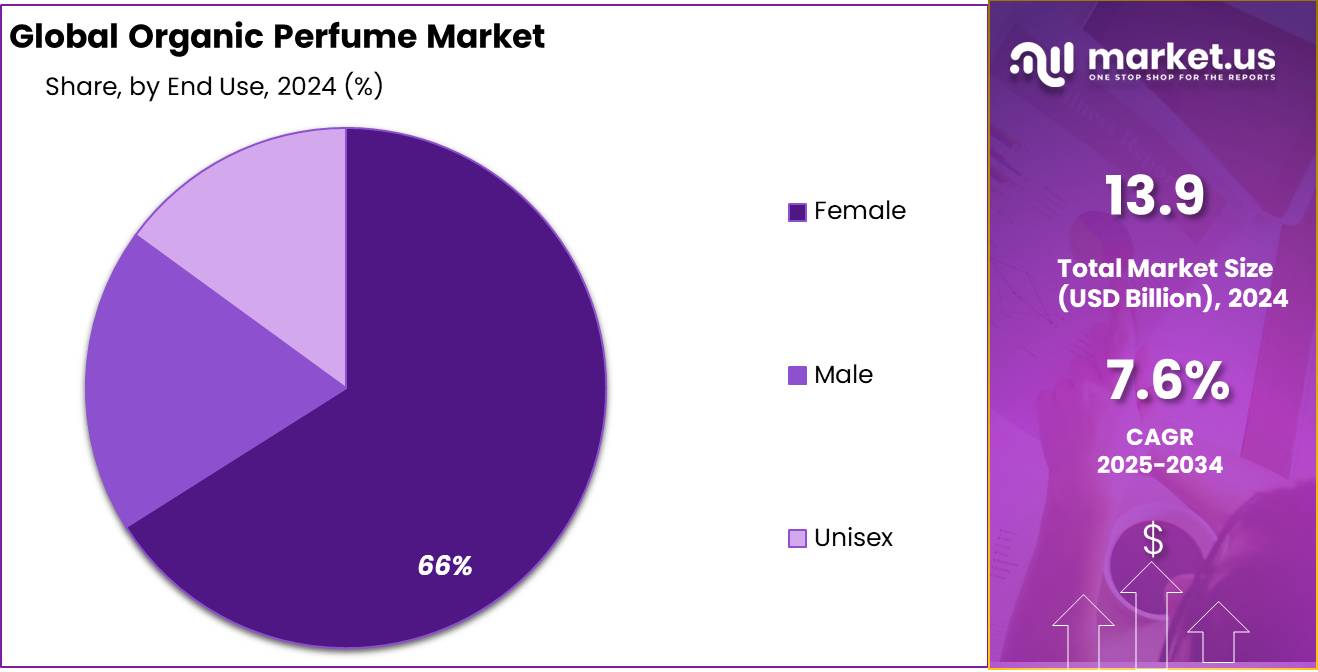

- Female held a dominant market position, capturing more than a 66.1% share in the Organic Perfume Market.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 44.9% share in the Organic Perfume Market.

- North America emerged as the dominant region in the global organic perfume market, holding a substantial 43.6% share and generating a market value of USD 6.0 billion.

Analysts’ Viewpoint

From an investment perspective, the organic perfume sector presents both opportunities and challenges. The industry’s expansion is supported by a growing preference for clean beauty and sustainability, aligning with consumer values. However, investors must be cognizant of potential risks, such as the volatility in raw material costs and the complexities of sustainable supply chain management. Additionally, the market’s fragmentation and the need for coordination among diverse stakeholders can pose challenges in implementing sustainable practices. Despite these hurdles, the sector’s trajectory suggests promising returns for those navigating its dynamics effectively.

Consumer insights reveal a growing inclination towards personalized and eco-friendly fragrances. The demand for refillable and customizable scent options is on the rise, as consumers seek products that align with their individual preferences and environmental values. Technological advancements, including the use of artificial intelligence in fragrance formulation, are enhancing product development and consumer experience. However, the industry must address regulatory challenges related to ingredient transparency and sustainability to maintain consumer trust and ensure long-term growth .

By Source

Fruits Segment Dominates Organic Perfume Market with 41.6% in 2024

In 2024, Fruits held a dominant market position, capturing more than a 41.6% share in the Organic Perfume Market. The segment’s prevalence is driven by the rising consumer inclination toward natural and eco-friendly fragrance sources, particularly those derived from citrus, berries, and exotic fruits. This shift aligns with the increasing demand for sustainable and chemical-free perfume ingredients, which continue to attract health-conscious consumers. The popularity of fruit-based fragrances is further supported by the growing emphasis on natural sourcing and transparency in ingredient lists, enhancing brand appeal and consumer trust. The segment is anticipated to maintain its leading position through 2025, with ongoing developments in organic farming and extraction techniques expected to bolster the supply of fruit-based essential oils.

By Intensity

Eau de Parfum Leads Organic Perfume Market with 51.4% in 2024

In 2024, Eau de Parfum held a dominant market position, capturing more than a 51.4% share in the Organic Perfume Market. The prominence of this intensity segment is largely attributed to its balanced concentration of essential oils, providing a lasting fragrance without overwhelming the senses. Consumers are increasingly opting for Eau de Parfum formulations due to their longer-lasting scent profiles and perceived value for money, particularly amid rising interest in premium organic fragrances. The segment is expected to sustain its leadership through 2025, as brands continue to introduce sophisticated and sustainable Eau de Parfum blends targeting luxury and eco-conscious consumer demographics.

By End User

Female Segment Dominates Organic Perfume Market with 66.1% in 2024

In 2024, Female held a dominant market position, capturing more than a 66.1% share in the Organic Perfume Market. The substantial share is driven by the increasing preference for organic and natural fragrances among women, who prioritize products free from synthetic chemicals and harsh additives. The segment continues to thrive as major brands expand their offerings to include floral, fruity, and musky notes tailored specifically for the female demographic. Additionally, rising disposable incomes and heightened awareness of eco-friendly and cruelty-free beauty products further reinforce the dominance of the female segment in the organic perfume market. The trend is expected to continue into 2025, as more consumers align their purchasing decisions with sustainable and ethical product choices.

By Distribution Channel

Supermarkets/Hypermarkets Capture 44.9% of Organic Perfume Market in 2024

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 44.9% share in the Organic Perfume Market. This segment’s prominence is driven by the extensive reach and accessibility of large retail chains, which provide a convenient shopping experience for consumers seeking organic fragrances. The availability of a wide range of products under one roof, along with frequent promotional discounts and exclusive deals, has significantly contributed to the robust sales through these channels. Additionally, the strategic placement of organic perfume displays in high-traffic areas of supermarkets and hypermarkets further enhances product visibility and consumer engagement. The segment is expected to maintain its leading position into 2025, as retailers continue to emphasize organic and sustainable product lines to attract environmentally conscious shoppers.

Key Market Segments

By Source

- Flowers

- Fruits

- Spice

- Others

By Intensity

- Eau de Parfum

- Eau de Toilette

- Eau de Cologne

By End User

- Female

- Male

- Unisex

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retailers

- Others

Drivers

Government Support for Organic Farming Boosts Organic Perfume Market

In India, the government has implemented several initiatives to promote organic agriculture. Programs like the Paramparagat Krishi Vikas Yojana (PKVY) and the National Program for Organic Production (NPOP) provide financial assistance and resources to farmers adopting organic methods. These initiatives have led to a significant increase in the area under organic cultivation, ensuring a consistent supply of organic raw materials for various industries, including perfumery.

Similarly, in the United States, the USDA Organic certification has become a benchmark for organic products. This certification assures consumers of the authenticity of organic products, including perfumes, and has led to increased consumer trust and demand. According to the Environmental Working Group (EWG), over 80 million U.S. households are now choosing products made from natural ingredients, highlighting the growing preference for organic goods .

The European Union has also been proactive in promoting organic farming. Policies and subsidies have been introduced to encourage farmers to switch to organic methods, resulting in a substantial increase in organic farming acreage across member states. This shift not only supports environmental sustainability but also ensures a robust supply chain for organic product manufacturers.

These government initiatives have a cascading effect on the organic perfume industry. With a reliable supply of organic ingredients, manufacturers can produce high-quality perfumes that meet the growing consumer demand for natural and eco-friendly products. As awareness about the benefits of organic products continues to rise, supported by governmental policies and certifications, the organic perfume market is poised for sustained growth in the coming years.

Restraints

High Production Costs Challenge Growth of Organic Perfume Market

One significant factor restraining the growth of the organic perfume market is the high production cost associated with sourcing and processing natural ingredients. Unlike synthetic fragrances, which are mass-produced and relatively inexpensive, organic perfumes rely on natural extracts that are often scarce and expensive.

For instance, natural sandalwood essential oil can cost up to $770 per kilogram, whereas its synthetic counterpart is significantly cheaper. Similarly, Bulgarian Rose Otto, a prized natural ingredient, is priced at approximately $1,663 for 50 grams, making it over 60 times more expensive than synthetic rose bases.

The extraction processes for these natural ingredients are labor-intensive and yield limited quantities, further driving up costs. Traditional methods like enfleurage and steam distillation require significant time and expertise, contributing to the overall expense.

These high production costs inevitably translate to higher retail prices for organic perfumes, potentially limiting their accessibility to a broader consumer base. While there is a growing demand for natural and eco-friendly products, the premium pricing of organic perfumes may deter price-sensitive customers, thereby restraining market growth.

Opportunity

Government Initiatives Fuel Growth in Organic Perfume Market

One significant opportunity propelling the organic perfume market is the increasing support from governments worldwide for organic agriculture. This backing ensures a steady supply of natural ingredients essential for crafting organic fragrances.

In the United States, the Department of Agriculture (USDA) has launched the Organic Market Development Grant (OMDG) program. This initiative aims to bolster the organic sector by funding projects that expand market opportunities for organic products. By enhancing the infrastructure for organic farming and processing, the program ensures a consistent flow of natural ingredients vital for organic perfume production.

Similarly, in India, the government has introduced schemes like the Paramparagat Krishi Vikas Yojana (PKVY) and the National Program for Organic Production (NPOP). These programs provide financial assistance and resources to farmers adopting organic methods, leading to a significant increase in the area under organic cultivation. This expansion guarantees a reliable supply of organic raw materials for various industries, including perfumery.

These governmental efforts not only promote sustainable farming practices but also ensure that organic perfume manufacturers have access to high-quality, natural ingredients. As consumer demand for eco-friendly and chemical-free products continues to rise, such initiatives play a crucial role in meeting market needs and driving the growth of the organic perfume industry.

Trends

Clean Beauty Movement Drives Demand for Organic Perfumes

A significant trend shaping the organic perfume market is the growing consumer preference for natural and organic ingredients, driven by heightened awareness of potential health risks associated with synthetic chemicals and a commitment to environmental sustainability. This shift aligns with the broader clean beauty movement, which emphasizes the use of non-toxic, eco-friendly, and transparent ingredients in personal care products.

Traditional perfumes often contain synthetic compounds like phthalates and parabens, which some consumers perceive as harmful. In contrast, natural ingredients such as botanical extracts, essential oils, and plant-based alcohols are viewed as healthier alternatives that are gentler on the skin and have a reduced environmental impact. This perception has led to an increased demand for natural perfumes, particularly among eco-conscious consumers who prioritize products with sustainable sourcing practices and minimal environmental footprints.

In response to this demand, brands are reformulating their products to include a higher percentage of natural components, focusing on ethical sourcing, and minimizing the use of chemicals in the production process. Certifications like ECOCERT (organic certification and inspection body), COSMOS (Cosmetic Organic and Natural Standard), and USDA Organic have become increasingly important, assuring consumers that a product meets stringent organic standards.

Regional Analysis

North America Dominates Organic Perfume Market with 43.6% Share, Valued at USD 6.0 Billion

In 2024, North America emerged as the dominant region in the global organic perfume market, holding a substantial 43.6% share and generating a market value of USD 6.0 billion. The region’s leadership position can be attributed to the rising consumer demand for sustainable and natural personal care products, driven by increasing awareness of synthetic chemical-related health risks. The United States, in particular, plays a pivotal role, accounting for a significant portion of the regional market due to its strong consumer base for luxury and premium organic fragrances. Brands are capitalizing on the growing preference for eco-friendly products, incorporating natural ingredients like sandalwood, lavender, and citrus extracts to attract health-conscious consumers.

Additionally, favorable government policies promoting organic farming and sustainable sourcing practices further support market expansion in North America. Initiatives by the USDA, such as the National Organic Program (NOP), have reinforced regulatory standards, ensuring the authenticity of organic products and enhancing consumer trust. Canada also contributes notably to market growth, with increasing investments in organic farming and heightened consumer inclination toward clean-label and cruelty-free products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Takasago, a leading player in the organic perfume market, leverages its expertise in natural ingredient extraction to create sustainable and eco-friendly fragrances. The company emphasizes ethical sourcing and utilizes advanced distillation techniques to produce premium quality organic scents. With a robust global distribution network, Takasago targets both luxury and mass-market segments, expanding its market presence in North America and Europe. The firm continues to invest in sustainable production practices, aligning with consumer demand for natural and chemical-free fragrances.

Firmenich, a global leader in the fragrance sector, actively participates in the organic perfume market with a focus on sustainable and ethically sourced ingredients. The company collaborates with local farmers to procure high-quality natural extracts, promoting fair trade practices. Firmenich’s investment in green chemistry and biotechnology enables the development of innovative organic scents, positioning it as a pioneer in sustainable fragrance production. The firm’s extensive R&D capabilities drive continuous product innovation, enhancing its competitive edge in the global market.

Primavera Life, a prominent player in the organic perfume market, specializes in natural and aromatherapeutic fragrances. The brand sources raw materials from certified organic farms, adhering to strict quality standards. Primavera’s product line includes essential oil-based perfumes, targeting consumers seeking holistic wellness solutions. The company’s emphasis on sustainability, from sourcing to packaging, resonates with environmentally conscious customers. Its expanding distribution network across Europe and Asia further solidifies its market presence in the organic fragrance sector.

Top Key Players in the Market

- Takasago

- Lavera

- Firmenich

- Weleda

- Primavera Life

- Nature’s

- The Organic Pharmacy

- Givaudan

- Dr. Hauschka

- Avalon Organics

- Neal’s Yard Remedies

- Robertet

- IFF

Recent Developments

In 2024, Takasago International Corporation reported a revenue of approximately USD 1.33 billion, reflecting its strong presence in the global fragrance industry.

In 2024, Weleda achieved a record turnover of €456.2 million, marking an 8.3% increase from the previous year. The Natural Cosmetics division contributed €367.9 million to this figure, reflecting an 8.2% growth.

Report Scope

Report Features Description Market Value (2024) USD 13.9 Bn Forecast Revenue (2034) USD 28.9 Bn CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Flowers, Fruits, Spice, Others), By Intensity (Eau de Parfum, Eau de Toilette, Eau de Cologne), By End User (Female, Male, Unisex), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Takasago, Lavera, Firmenich, Weleda, Primavera Life, Nature’s, The Organic Pharmacy, Givaudan, Dr. Hauschka, Avalon Organics, Neal’s Yard Remedies, Robertet, IFF Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Takasago

- Lavera

- Firmenich

- Weleda

- Primavera Life

- Nature's

- The Organic Pharmacy

- Givaudan

- Dr. Hauschka

- Avalon Organics

- Neal's Yard Remedies

- Robertet

- IFF