Global Cellulosic Ethanol Market By Feedstock (Agricultural Residue, Forest Residue, Energy Crops, Municipal Solid Waste (Msw), Others), By Process (Dry Grind, Wet Mill, Others), By Application (Gasoline, Detergent, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147459

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

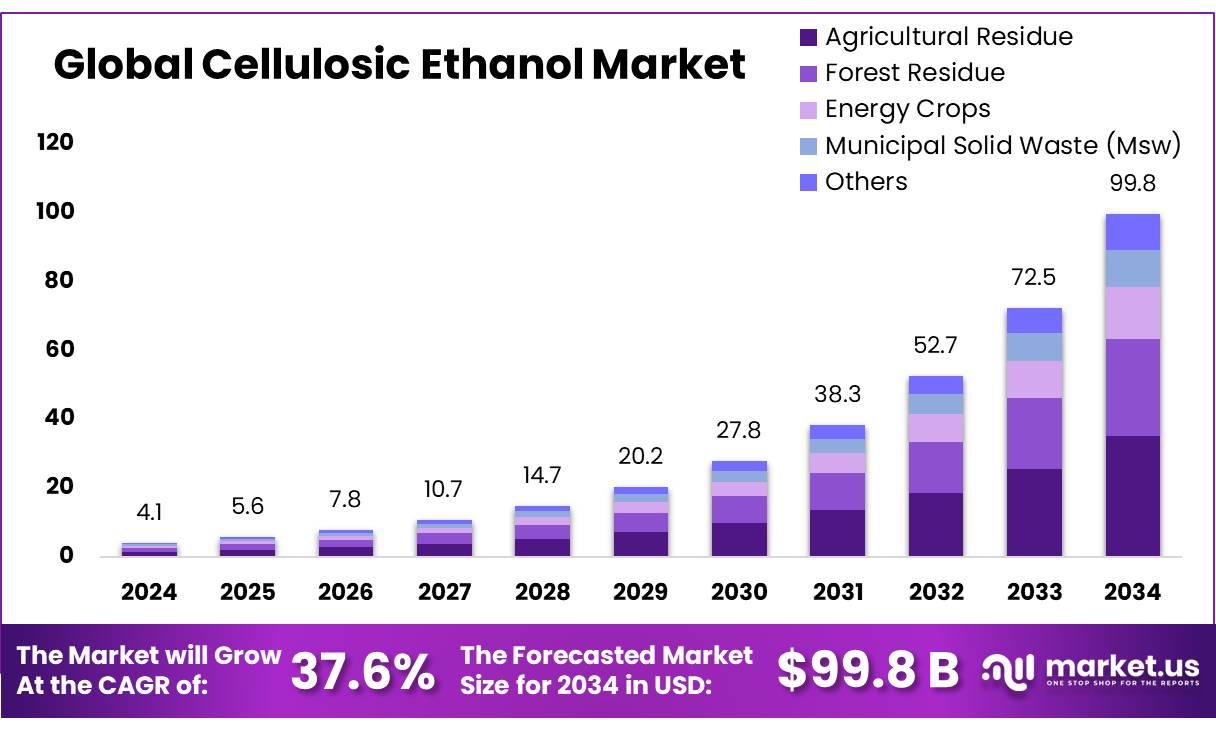

The Global Cellulosic Ethanol Market size is expected to be worth around USD 99.8 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 37.6% during the forecast period from 2025 to 2034.

Cellulosic ethanol, a second-generation biofuel derived from non-food biomass such as agricultural residues, offers a sustainable alternative to conventional ethanol produced from food crops. Unlike first-generation biofuels, which utilize food-based feedstocks like sugarcane and corn, cellulosic ethanol leverages lignocellulosic materials—such as straw, bagasse, and rice husk—thereby mitigating concerns related to food security and land use.

The cellulosic ethanol in India is evolving, with the government actively promoting its development. As of November 2023, India’s total ethanol production capacity reached approximately 1,380 crore liters, with 875 crore liters derived from molasses-based sources and 505 crore liters from grain-based sources . While these figures predominantly reflect first-generation ethanol production, the government’s strategic initiatives aim to diversify feedstock sources, including the incorporation of cellulosic materials. The National Policy on Biofuels (NPB) 2018 categorizes cellulosic ethanol as an advanced biofuel, recognizing its potential to reduce greenhouse gas emissions and dependence on fossil fuels.

Ethanol is a renewable fuel made from various plant materials collectively known as “biomass.” More than 98% of U.S. gasoline contains ethanol to oxygenate the fuel. Typically, gasoline contains E10 (10% ethanol, 90% gasoline), which reduces air pollution

Several factors drive the push for cellulosic ethanol in India. Firstly, the nation’s substantial agricultural residue availability—estimated at 350 million tonnes annually—provides a ready feedstock base for biofuel production. Secondly, the government’s commitment to achieving a 20% ethanol blending target in petrol by 2025 necessitates the expansion of ethanol production capacities, including the adoption of second-generation biofuels. Additionally, initiatives like the GOBARdhan scheme, which focuses on converting organic waste into biogas, complement the objectives of biofuel production by promoting waste-to-energy solutions.

The future of cellulosic ethanol in India appears promising. The government’s allocation of ₹5,000 crore for the establishment of second-generation biofuel plants underscores its commitment to advancing this sector. Moreover, the recent policy shift allowing the use of cane juice and B-heavy molasses for ethanol production indicates a more flexible approach to feedstock utilization . These developments, coupled with the growing emphasis on sustainable energy solutions, position cellulosic ethanol as a pivotal component in India’s renewable energy strategy, offering both environmental and economic benefits.

Key Takeaways

- Cellulosic Ethanol Market size is expected to be worth around USD 99.8 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 37.6%.

- Agricultural Residue held a dominant market position, capturing more than a 35.1% share of the Cellulosic Ethanol market.

- Dry Grind held a dominant market position, capturing more than a 65.9% share of the Cellulosic Ethanol market.

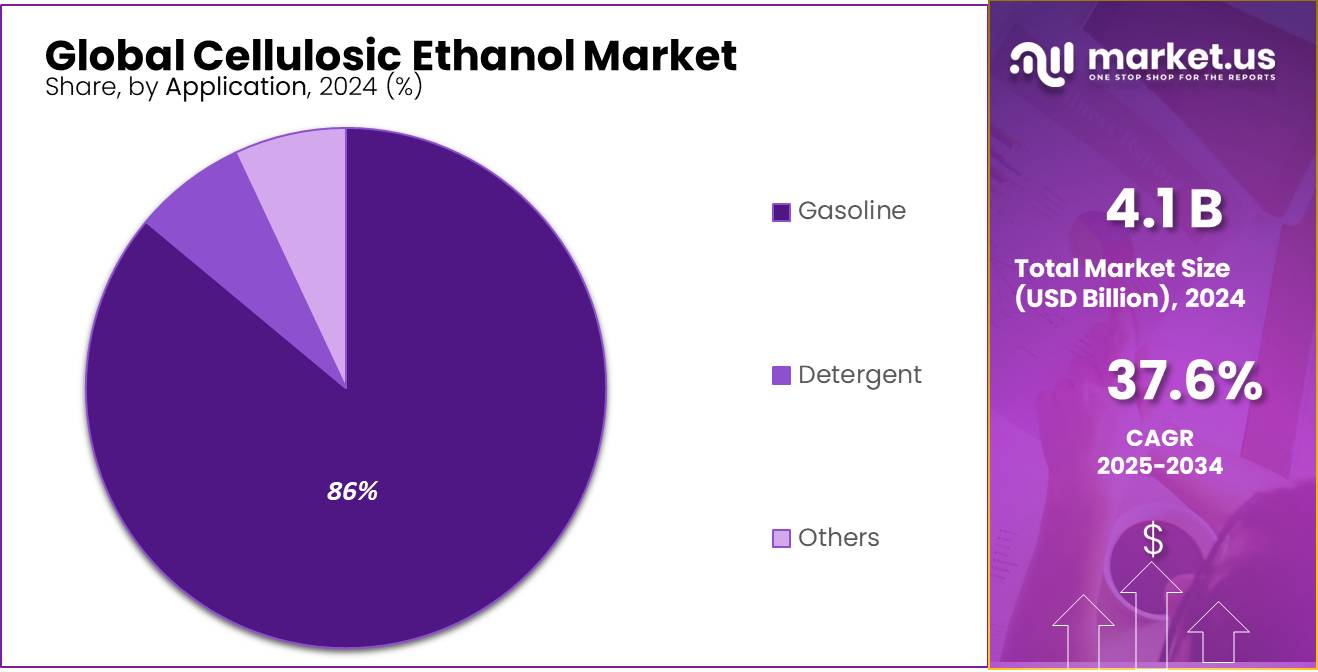

- Gasoline held a dominant market position, capturing more than an 86.3% share of the Cellulosic Ethanol market.

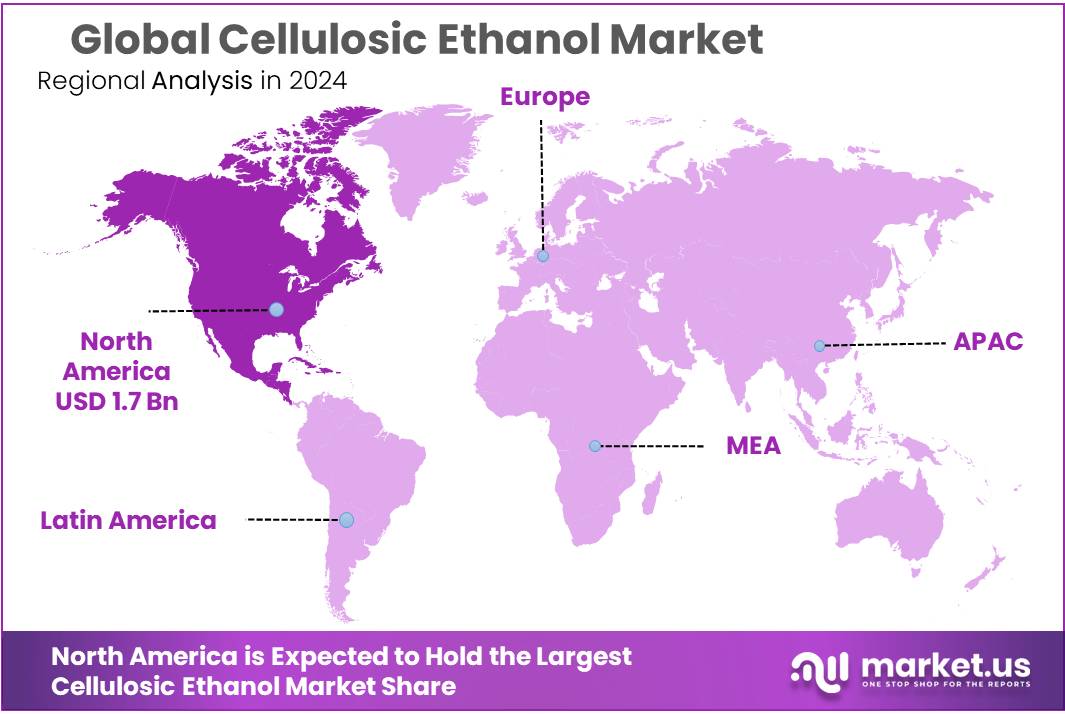

- North America stands as the leading region in the global cellulosic ethanol market, commanding a significant share of approximately 42.3%, translating to a market value of USD 1.7 billion

By Feedstock

Agricultural Residue Dominates with 35.1% Share in 2024, Driven by Abundant Feedstock Availability

In 2024, Agricultural Residue held a dominant market position, capturing more than a 35.1% share of the Cellulosic Ethanol market. This segment’s growth is largely attributed to the vast availability of feedstock, including agricultural by-products such as straw, husks, and corn stover. The abundance of these materials, often considered waste in agricultural operations, presents a sustainable alternative for biofuel production. As farmers and industries increasingly turn to cellulosic ethanol, agricultural residue continues to be a cost-effective and environmentally friendly feedstock.

The agricultural residue is expected to maintain its leading market share, as governments globally continue to support the utilization of non-food feedstocks for ethanol production. This trend is particularly notable in regions with large agricultural sectors, where the efficient use of residues aligns with sustainability goals and waste reduction initiatives. Additionally, the advancements in enzyme technology and fermentation processes are making it easier to convert these residues into fermentable sugars, further boosting the segment’s appeal.

By Process

Dry Grind Leads with 65.9% Market Share in 2024, Supported by Cost-Effectiveness and Efficiency

In 2024, Dry Grind held a dominant market position, capturing more than a 65.9% share of the Cellulosic Ethanol market. The dry grind process, widely used in biofuel production, involves milling the feedstock into smaller particles, which are then fermented to produce ethanol. This method is particularly favored for its cost-effectiveness, simplicity, and scalability, making it the preferred choice for large-scale ethanol production facilities.

As cellulosic ethanol production evolves, the dry grind method is anticipated to maintain its strong position due to ongoing improvements in enzyme technologies, which increase fermentation rates and yield. These advancements are likely to enhance the overall economic feasibility of dry grind processes, solidifying its role as the dominant process in the cellulosic ethanol market.

By Application

Gasoline Application Dominates with 86.3% Share in 2024, Fueled by Growing Demand for Clean Energy

In 2024, Gasoline held a dominant market position, capturing more than an 86.3% share of the Cellulosic Ethanol market. This segment’s leading role is driven by the increasing adoption of ethanol-blended gasoline as a cleaner, more sustainable alternative to traditional fossil fuels. Governments across the world, especially in regions like North America and Europe, have pushed for higher ethanol blending targets, bolstering the demand for cellulosic ethanol in gasoline applications.

The gasoline application is expected to maintain its strong market position due to continued regulatory support for ethanol-blended fuels and the rising consumer preference for environmentally friendly options. With more vehicles being designed to run on ethanol-blended gasoline, the sector’s growth is further supported by expanding infrastructure for fuel distribution and blending.

As fuel standards tighten and renewable energy initiatives gain momentum, gasoline will remain the largest application for cellulosic ethanol, representing a key component in the global transition to greener energy solutions.

Key Market Segments

By Feedstock

- Agricultural Residue

- Forest Residue

- Energy Crops

- Municipal Solid Waste (Msw)

- Others

By Process

- Dry Grind

- Wet Mill

- Others

By Application

- Gasoline

- Detergent

- Others

Drivers

Government Initiatives and Renewable Energy Policies

One of the key driving factors for the growth of the cellulosic ethanol market is the continued support from government initiatives and policies aimed at promoting renewable energy sources. Governments around the world are increasingly turning to biofuels like cellulosic ethanol as a sustainable solution to reduce greenhouse gas emissions, improve energy security, and decrease reliance on fossil fuels. This is particularly important as nations work toward meeting climate goals and reducing carbon footprints.

In the United States, the government’s support for biofuels, including cellulosic ethanol, is evident through programs like the Renewable Fuel Standard (RFS) set by the Environmental Protection Agency (EPA). The RFS mandates the blending of renewable fuels into the transportation fuel supply, with specific targets set for biofuels like cellulosic ethanol. According to the U.S. Department of Energy (DOE), the U.S. government set a target of producing 16 billion gallons of cellulosic ethanol annually by 2022. Although the production figures have not yet reached these targets, the initiative remains a strong motivator for industry growth.

In the European Union, the Renewable Energy Directive (RED II) has also established ambitious targets for renewable energy use in transportation, with biofuels playing a significant role in achieving these goals. As of 2020, the EU’s renewable energy share in transport was about 9.6%, and the EU aims to achieve a 14% renewable energy share by 2030. This push for sustainable energy sources is further spurring the demand for biofuels, including cellulosic ethanol.

Restraints

High Production Costs

One of the significant challenges facing the growth of the cellulosic ethanol market is the high production cost associated with its manufacturing process. Unlike traditional ethanol made from food crops like corn or sugarcane, cellulosic ethanol is derived from non-food biomass such as wood, agricultural waste, and grasses. While the feedstocks are abundant and renewable, the cost of converting these materials into ethanol is considerably higher due to the complex and energy-intensive processes involved.

The production process of cellulosic ethanol requires advanced technologies like enzymatic hydrolysis and fermentation, which are not yet as cost-effective as traditional ethanol production methods. According to the U.S. Department of Energy’s Bioenergy Technologies Office, the cost of producing cellulosic ethanol in 2020 was estimated to be between $3.00 to $5.00 per gallon, which is significantly higher than the cost of conventional ethanol, which averages around $1.50 to $2.00 per gallon. This price gap makes it challenging for cellulosic ethanol to compete with conventional ethanol, especially in markets where price sensitivity is a key factor.

Government initiatives, such as the U.S. Renewable Fuel Standard (RFS), provide support for the development of advanced biofuels, including cellulosic ethanol, but the lack of economic viability at large scale remains a significant hurdle. As a result, additional investment in research and technological advancements is needed to bring down production costs and make cellulosic ethanol a more feasible alternative to traditional fuels.

Opportunity

Expansion of Government Incentives for Renewable Energy

A significant growth opportunity for the cellulosic ethanol market lies in the continued expansion of government incentives for renewable energy. As countries seek to meet climate targets and reduce their reliance on fossil fuels, policies supporting the development and use of renewable biofuels like cellulosic ethanol are becoming more favorable. These government-driven incentives are paving the way for the growth of the cellulosic ethanol industry.

In the United States, the Renewable Fuel Standard (RFS), established by the Environmental Protection Agency (EPA), is a key driver for the demand for cellulosic ethanol. This program requires a certain amount of renewable fuel, including cellulosic ethanol, to be blended into transportation fuel. In 2020, the U.S. government aimed for a target of 16 billion gallons of advanced biofuels, with a significant portion expected to come from cellulosic ethanol. This mandate has created a stable market for cellulosic ethanol producers, providing both regulatory certainty and financial incentives to expand production capacity.

In addition, the U.S. government’s support for biofuel research through agencies like the U.S. Department of Energy (DOE) has helped reduce the technological barriers to producing cellulosic ethanol. According to the DOE, in 2020, $300 million was allocated to support the commercialization of advanced biofuels, including cellulosic ethanol. This funding is aimed at improving the efficiency of cellulosic ethanol production technologies, which can ultimately reduce production costs and make the biofuel more competitive with traditional fuels.

Globally, the European Union’s Renewable Energy Directive (RED II) also sets ambitious targets for renewable energy use in the transport sector, providing additional market opportunities for cellulosic ethanol. The EU aims to have 14% renewable energy in transport by 2030, further boosting the demand for biofuels like cellulosic ethanol.

Trends

Technological Advancements in Production Processes

A significant trend shaping the cellulosic ethanol market is the ongoing technological advancements aimed at enhancing the efficiency and scalability of production processes. These innovations are crucial for reducing production costs and improving the economic viability of cellulosic ethanol as a sustainable alternative to traditional fossil fuels.

In March 2024, Blue Biofuels, a U.S.-based company, announced the successful production of its first batch of cellulosic ethanol using its proprietary Cellulose-to-Sugar (CTS) technology. This breakthrough highlights the potential of novel technologies to streamline the conversion of lignocellulosic biomass into fermentable sugars, a critical step in ethanol production. The company has also acquired land in Florida to construct a pilot-scale plant, with plans to scale up to a 100 million gallon per year commercial facility, demonstrating a commitment to advancing production capabilities .

Similarly, in India, the government has introduced policies to support the use of agricultural residues and other non-food biomass for ethanol production. These initiatives aim to reduce dependence on food crops and promote the utilization of waste materials, aligning with the global shift towards more sustainable feedstock sources. By encouraging the development of technologies that can efficiently process these alternative feedstocks, India is positioning itself to enhance its biofuel production capacity .

Regional Analysis

North America: Dominant Force in the Cellulosic Ethanol Market

North America stands as the leading region in the global cellulosic ethanol market, commanding a significant share of approximately 42.3%, translating to a market value of USD 1.7 billion. The United States, in particular, plays a pivotal role, driven by robust government policies, substantial investments in research and development, and a well-established infrastructure supporting biofuel production.

The U.S. government’s commitment to renewable energy is evident through initiatives like the Renewable Fuel Standard (RFS), which mandates the blending of renewable fuels, including cellulosic ethanol, into the national fuel supply. This policy framework has spurred the development of advanced biofuel technologies and facilitated the establishment of pilot and commercial-scale production facilities across the country.

In Canada, the emphasis on sustainable energy solutions has led to increased utilization of forestry residues and agricultural waste for ethanol production. The Canadian government’s support through grants and incentives has further accelerated the adoption of cellulosic ethanol technologies, contributing to the region’s market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BlueFire Renewables Inc. is a leading player in the cellulosic ethanol market, focusing on developing and commercializing biofuel production from non-food biomass. The company uses its proprietary technology to convert cellulosic materials into renewable ethanol. BlueFire’s projects include biorefineries utilizing agricultural residues and urban waste as feedstocks, contributing to environmental sustainability. Their innovative approach positions BlueFire as a key player in the renewable energy space, with a growing portfolio of strategic partnerships and collaborations.

Borregaard ASA is a global leader in sustainable bio-based products, including cellulosic ethanol. The company produces advanced biofuels using lignocellulosic biomass, positioning itself as a pioneer in biofuel production. Borregaard’s proprietary technology allows for the efficient conversion of waste biomass into high-value products, including ethanol. With a focus on environmental sustainability, Borregaard continues to enhance its market position through innovation and increased capacity in the biofuels sector.

Clariant International Ltd. is a prominent player in the cellulosic ethanol market, providing chemical solutions for biofuel production. The company’s Sunliquid® technology is designed to efficiently convert agricultural residues into cellulosic ethanol. Clariant’s involvement in sustainable energy solutions positions it as a leader in renewable biofuel innovation. The company is expanding its global footprint by increasing its production capacity and collaborating with other industry leaders to drive the adoption of cellulosic ethanol worldwide.

Top Key Players

- BlueFire Renewables Inc.

- Borregaard ASA

- Clariant International Ltd.

- COFCO Corp.

- DuPont de Nemours Inc.

- ENERKEM Inc.

- Eni SpA

- Fiberight LLC

- GranBio Investimentos SA

- Green Plains Inc.

- INEOS AG

- Iogen Corp.

- Novonesis Group

- Orsted AS

- POET LLC

Recent Developments

In 2024, BlueFire is fully permitted plant is designed to produce approximately 3.9 million gallons of fuel-grade ethanol annually by processing post-sorted municipal solid waste diverted from local landfills. Additionally, the company is progressing with its second facility in Fulton, Mississippi, which is expected to produce around 19 million gallons per year from woody biomass and mill residues. These projects are anticipated to create over 1,000 construction jobs and more than 100 full-time operational positions upon completion.

December 2023, Clariant announced the closure of the Podari facility due to sustained operational challenges and financial losses. The company reported asset impairments of approximately CHF 110 million and provisions related to the closure of around CHF 60–90 million in the fourth quarter of 2023 .

Report Scope

Report Features Description Market Value (2024) USD 4.1 Bn Forecast Revenue (2034) USD 99.8 Bn CAGR (2025-2034) 37.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Feedstock (Agricultural Residue, Forest Residue, Energy Crops, Municipal Solid Waste (Msw), Others), By Process (Dry Grind, Wet Mill, Others), By Application (Gasoline, Detergent, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BlueFire Renewables Inc., Borregaard ASA, Clariant International Ltd., COFCO Corp., DuPont de Nemours Inc., ENERKEM Inc., Eni SpA, Fiberight LLC, GranBio Investimentos SA, Green Plains Inc., INEOS AG, Iogen Corp., Novonesis Group, Orsted AS, POET LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cellulosic Ethanol MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Cellulosic Ethanol MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BlueFire Renewables Inc.

- Borregaard ASA

- Clariant International Ltd.

- COFCO Corp.

- DuPont de Nemours Inc.

- ENERKEM Inc.

- Eni SpA

- Fiberight LLC

- GranBio Investimentos SA

- Green Plains Inc.

- INEOS AG

- Iogen Corp.

- Novonesis Group

- Orsted AS

- POET LLC