Global Precipitated Calcium Carbonate Market By Particle Size (Fine Particle Size, Medium Particle Size, Coarse Particle Size), By Application (Paper, Plastics, Rubber, Paints and Coatings, Pharmaceuticals, Adhesives and Sealants, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147464

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

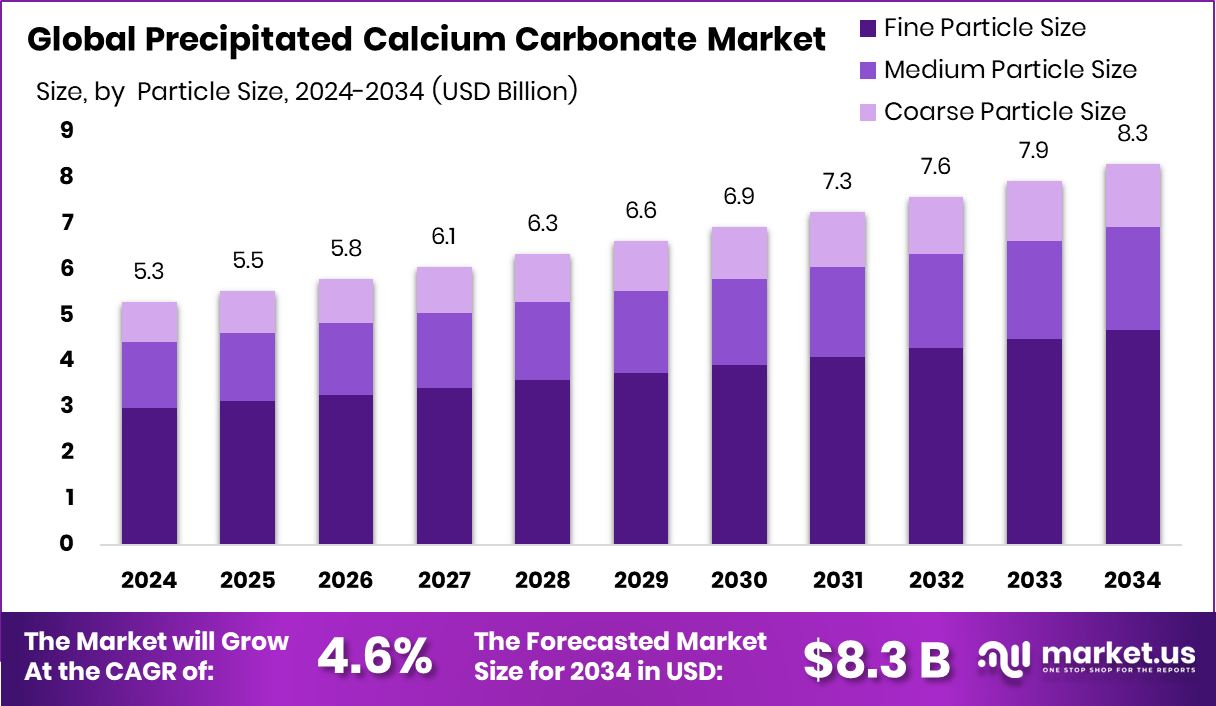

Global Precipitated Calcium Carbonate Market is expected to be worth around USD 8.3 billion by 2034, up from USD 5.3 billion in 2024, and grow at a CAGR of 4.6% from 2025 to 2034. Asia-Pacific dominates global PCC consumption, capturing 47.2% share with increasing industrial use.

Precipitated Calcium Carbonate (PCC) is a refined, synthetic form of calcium carbonate produced by reacting quicklime with carbon dioxide in a controlled environment. It is typically manufactured in fine, white powder form and is valued for its purity, consistent particle size, and high brightness. PCC is widely used as a functional filler in industries such as paper, plastics, paints, coatings, rubber, and pharmaceuticals, where it enhances surface finish, improves strength, and reduces production costs.

The Precipitated Calcium Carbonate market revolves around the supply and consumption of PCC across various industrial applications. Its market is driven by growing demand from sectors that rely on cost-effective, high-performance fillers and pigments. Key end-users include paper manufacturers, construction material producers, and plastic compounders.

Rising demand for high-quality paper and packaging, especially in e-commerce and education, is fueling PCC use in paper mills. Increasing awareness around sustainability is pushing manufacturers to switch from harmful additives to eco-friendly alternatives like PCC. Additionally, the push for lightweight automotive plastics is supporting PCC growth in polymers and composites.

Demand is strong in Asia-Pacific due to expanding manufacturing and infrastructure sectors. Urbanization in countries like India and China is creating a growing need for paints, coatings, and construction materials where PCC is used. The plastics industry is also scaling up the use of PCC for improving thermal properties and lowering raw material costs.

According to indutry report along with partners from four other universities, have secured a $3.5 million grant from the USDA’s National Institute of Food and Agriculture (NIFA). This funding will back their study on applying essential oil-based coatings to improve the shelf life and safety of organic produce.

Key Takeaways

- Global Precipitated Calcium Carbonate Market is expected to be worth around USD 8.3 billion by 2034, up from USD 5.3 billion in 2024, and grow at a CAGR of 4.6% from 2025 to 2034.

- Fine particle size segment holds 56.5% share, driving demand across the paints and polymer industries.

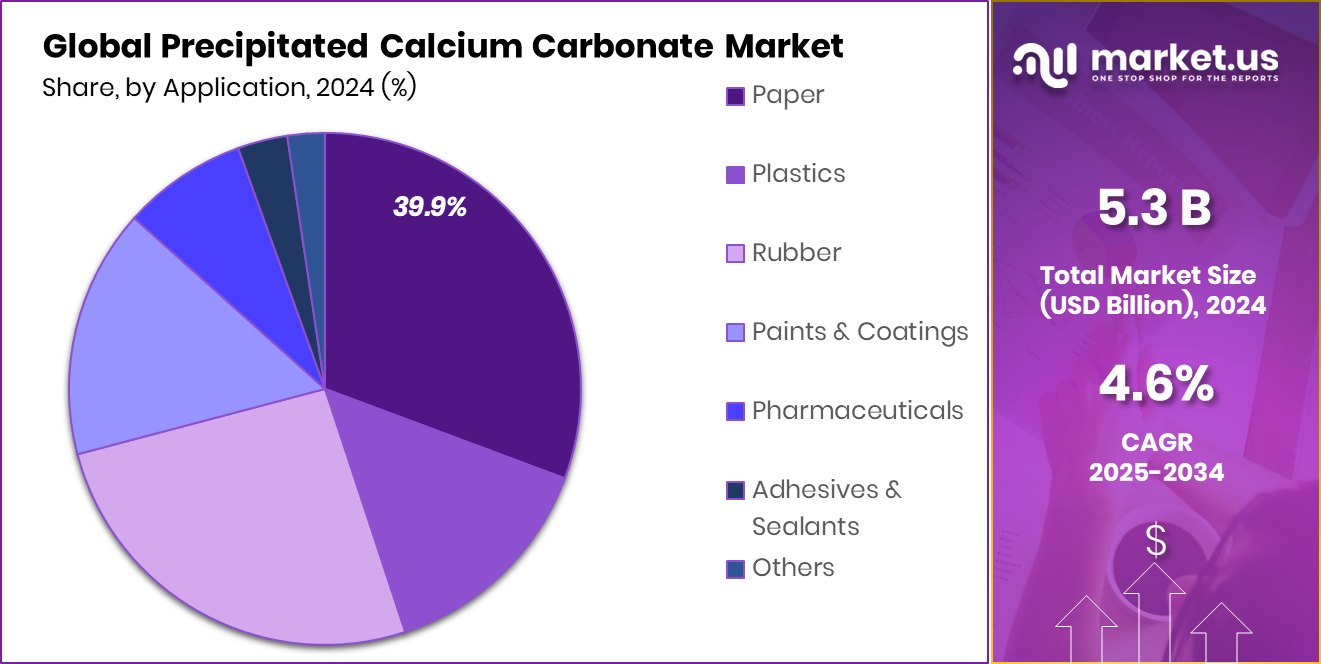

- Paper segment leads application-wise with 39.9% market share due to high consumption in paper coating.

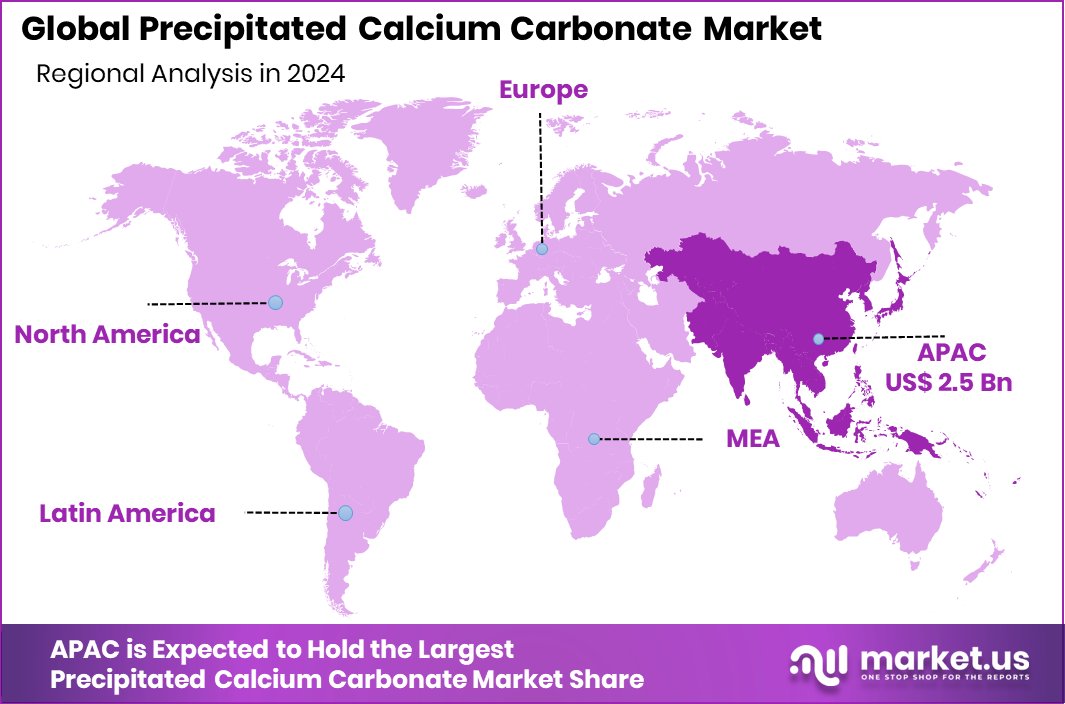

- Strong demand from the paper industry boosts Asia-Pacific’s USD 2.5 Bn PCC market.

By Particle Size Analysis

Fine particle size leads market share with a strong 56.5% dominance globally.

In 2024, Fine Particle Size held a dominant market position in the By Particle Size segment of the Precipitated Calcium Carbonate (PCC) Market, with a 56.5% share. This clear lead reflects the growing preference for fine particles in industries that require superior dispersion, surface finish, and improved mechanical properties in their end products. Fine particle PCC is particularly favored in high-end paper coatings, plastics, and sealants where smooth texture, opacity, and brightness are crucial.

Manufacturers across the globe increasingly opt for fine particle PCC to meet rising quality standards and product performance expectations. Its ability to provide better gloss, tight particle size distribution, and enhanced filler-binder interaction makes it suitable for advanced formulations, especially in the paper and packaging industry. In paints and coatings, fine PCC particles help achieve better coverage and smoothness, thereby reducing pigment costs and increasing efficiency.

By Application Analysis

The paper industry remains the top user of PCC, contributing 39.9% to the application share.

In 2024, Paper held a dominant market position in the By Application segment of the Precipitated Calcium Carbonate (PCC) Market, with a 39.9% share. This dominance is driven by PCC’s critical role in paper manufacturing, where it is extensively used as a coating and filler material. PCC improves brightness, opacity, and smoothness of paper, making it ideal for high-quality printing and writing papers. Moreover, it serves as a cost-effective alternative to wood pulp, helping reduce raw material expenses for manufacturers.

The 39.9% share reflects the paper industry’s strong and continued dependence on PCC to meet performance standards and maintain production cost control. As global demand for packaging, printing, and specialty paper products grows, especially in Asia-Pacific and parts of Europe, paper manufacturers are consistently integrating PCC to enhance sheet properties while maintaining sustainability targets.

Fine particle size PCC, in particular, aligns well with the needs of the paper sector by delivering improved coating uniformity and reduced ink absorbency. The substantial market share confirms PCC’s established position in paper applications, underscoring its value in balancing quality enhancement and cost management.

Key Market Segments

By Particle Size

- Fine Particle Size

- Medium Particle Size

- Coarse Particle Size

By Application

- Paper

- Plastics

- Rubber

- Paints and Coatings

- Pharmaceuticals

- Adhesives and Sealants

- Others

Driving Factors

Rising Demand from the Paper Industry Drives Growth

One of the main reasons behind the growing use of Precipitated Calcium Carbonate (PCC) is the rising demand from the paper industry. PCC is widely used as a filler and coating agent in paper manufacturing because it makes paper brighter, smoother, and more cost-effective. It also improves print quality and reduces ink usage, which helps manufacturers lower production costs.

As the demand for better-quality paper and packaging materials grows—especially in Asia-Pacific and Europe—the need for PCC continues to rise. Additionally, with more people shopping online, the packaging sector is booming, further increasing PCC usage. This strong push from the paper and packaging sector is a major factor behind the rapid expansion of the PCC market.

Restraining Factors

Environmental Concerns and Carbon Emissions Limit Growth

One big challenge for the Precipitated Calcium Carbonate (PCC) market is its impact on the environment. Making PCC involves chemical reactions and energy use that often lead to carbon dioxide (CO₂) emissions. As governments around the world get stricter about pollution and carbon footprints, companies using or producing PCC face more pressure to meet environmental rules.

This can lead to higher costs for installing clean technology or managing waste. Smaller manufacturers may struggle to keep up with these changes, slowing down production or growth. Also, industries are now looking for greener alternatives to reduce their environmental impact.

Growth Opportunity

Expanding Use in the Plastics Industry Boosts Market

A significant growth opportunity for the Precipitated Calcium Carbonate (PCC) market lies in its increasing adoption within the plastics industry. PCC serves as a cost-effective filler that enhances the mechanical properties of plastics, such as strength, rigidity, and durability. By incorporating PCC, manufacturers can reduce the amount of expensive polymers needed, leading to cost savings without compromising quality.

Additionally, PCC improves the thermal stability and processability of plastic products, making them more suitable for various applications, including automotive parts, packaging materials, and construction components. The growing demand for lightweight and sustainable materials in these sectors further drives the use of PCC.

Latest Trends

Growing Demand in Pharmaceuticals and Cosmetics

A notable trend in the Precipitated Calcium Carbonate (PCC) market is its increasing use in the pharmaceutical and cosmetics industries. In pharmaceuticals, PCC is valued for its fine particle size and high purity, making it suitable for use in antacids and calcium supplements. Its ability to act as a filler and stabilizer enhances the quality and consistency of medications.

In the cosmetics sector, PCC is used in products like face powders and creams due to its smooth texture and ability to improve product feel. The rising consumer demand for high-quality health and beauty products is driving this trend.

Regional Analysis

Asia-Pacific held 47.2% market share in Precipitated Calcium Carbonate, worth USD 2.5 Bn.

In 2024, Asia-Pacific emerged as the dominant region in the Precipitated Calcium Carbonate (PCC) market, accounting for a substantial 47.2% share, which translated to a market value of USD 2.5 billion. The region’s strong foothold is primarily driven by high consumption in the paper, plastic, and paint industries, especially in countries like China, India, and Japan.

Rapid industrialization, increasing construction activities, and rising packaging demand across the region continue to propel the need for PCC as a cost-effective filler and coating material. In contrast, North America and Europe maintain a steady pace in the market, with stable demand from paper manufacturing and the pharmaceutical sector.

Meanwhile, the Middle East & Africa and Latin America represent emerging regions with growing adoption of PCC in industrial and infrastructure applications. However, their market contribution remains comparatively limited. The dominance of Asia-Pacific is supported by both its large-scale production facilities and abundant raw material availability, giving the region a competitive edge in both cost and volume.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CANADA Chemical has established itself as a prominent supplier in the PCC industry, focusing on delivering high-purity calcium carbonate products. Their commitment to quality and consistency has enabled them to cater to various applications, including paper, plastics, and pharmaceuticals. By leveraging advanced production techniques and stringent quality control measures, CANADA Chemical ensures that its PCC products meet the specific requirements of diverse industries.

EZ Chemicals Inc., based in Hangzhou, China, specializes in the development, production, and sales of a comprehensive range of calcium carbonate products, including precipitated, nano, and ground calcium carbonate. Their PCC offerings are tailored for applications in rubber, plastics, and coatings, characterized by high whiteness, uniform particle size distribution, and low oil absorption values. EZ Chemicals’ emphasis on research and development has positioned them as a reliable partner for industries seeking high-performance PCC solutions.

Fujian Sanmu Nano Calcium Carbonate Co., Ltd. is a high-tech enterprise dedicated to the production of nano calcium carbonate. Their products are known for their ultra-fine particle sizes and high purity, making them suitable for specialized applications in plastics, rubber, and coatings. By focusing on innovation and technological advancement, Fujian Sanmu has carved a niche in the PCC market, catering to clients requiring precision-engineered calcium carbonate products.

Top Key Players in the Market

- CANADA Chemical

- EZ Chemicals Inc.

- Fujian Sanmu Nano Calcium Carbonate Co., Ltd.

- GCCP Resources Ltd.

- GLC Minerals

- Guangdong Qiangda New Materials Technology Co.

- Gulshan Polyols Ltd

- ILC Resources

- Imerys S.A.

- J.M. Huber Corporation

- Minerals Technologies Inc.

- Mississippi Lime

- NanoMaterials Technology

- Nanoshel LLC

- Omya International AG

Recent Developments

- In June 2024, J.M. Huber Corporation, through its subsidiary Huber Engineered Materials (HEM), completed the acquisition of Active Minerals International (AMI). With this acquisition, AMI became part of Huber Specialty Minerals, a business unit within HEM.

- In April 2024, Omya invested in seven onsite plants for ground and precipitated calcium carbonate at paper and paperboard mill locations in China and Indonesia. The new plants in China include three ground calcium carbonate (GCC) plants in Guangxi, Guangdong, and Shandong, two PCC plants in Shandong, and one PCC plant in Fujian. The new plant in Indonesia will be for GCC in Sumatra.

Report Scope

Report Features Description Market Value (2024) USD 5.3 Billion Forecast Revenue (2034) USD 8.3 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Particle Size (Fine Particle Size, Medium Particle Size, Coarse Particle Size), By Application (Paper, Plastics, Rubber, Paints and Coatings, Pharmaceuticals, Adhesives and Sealants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape CANADA Chemical, EZ Chemicals Inc., Fujian Sanmu Nano Calcium Carbonate Co., Ltd., GCCP Resources Ltd., GLC Minerals, Guangdong Qiangda New Materials Technology Co., Gulshan Polyols Ltd, ILC Resources, Imerys S.A., J.M. Huber Corporation, Minerals Technologies Inc., Mississippi Lime, NanoMaterials Technology, Nanoshel LLC, Omya International AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Precipitated Calcium Carbonate MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Precipitated Calcium Carbonate MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- CANADA Chemical

- EZ Chemicals Inc.

- Fujian Sanmu Nano Calcium Carbonate Co., Ltd.

- GCCP Resources Ltd.

- GLC Minerals

- Guangdong Qiangda New Materials Technology Co.

- Gulshan Polyols Ltd

- ILC Resources

- Imerys S.A.

- J.M. Huber Corporation

- Minerals Technologies Inc.

- Mississippi Lime

- NanoMaterials Technology

- Nanoshel LLC

- Omya International AG