Global Paperboard Tray Market Size, Share, Growth Analysis By Material (Paperboard, Molded Fiber, Kraft Paper), By Product (Multiple Cavity, Single Cavity), By Capacity (Up to 8 oz, 8 oz to 20 oz, 20 oz to 30 oz, Above 30 oz), By Application (Microwave Trays, Conventional Trays), By End Use (Food And Beverages, Cosmetics & Personal Care Product, Pharmaceuticals, Homecare, Electrical And Electronics Product, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144971

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

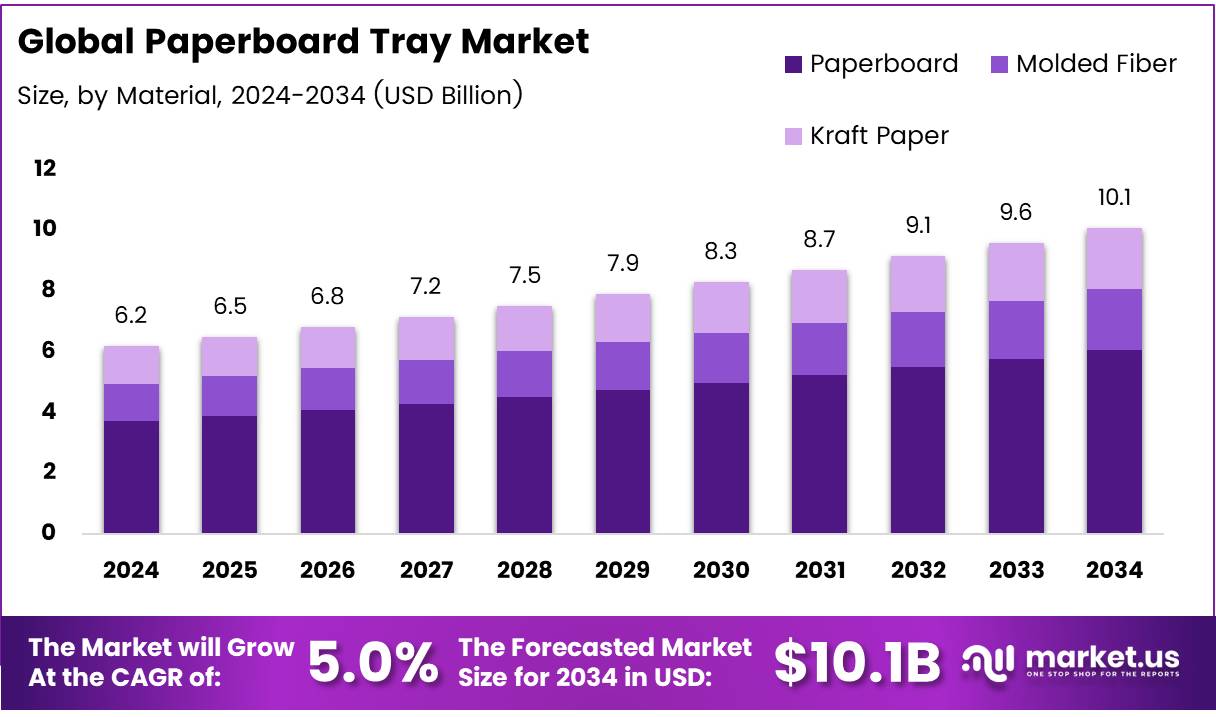

The Global Paperboard Tray Market size is expected to be worth around USD 10.1 Billion by 2034, from USD 6.2 Billion in 2024, growing at a CAGR of 5% during the forecast period from 2025 to 2034.

The Paperboard Tray Market is primarily concerned with the production and distribution of paperboard trays, which are extensively used in packaging applications across various industries, including food and beverage, pharmaceuticals, and consumer electronics.

Paperboard trays offer a sustainable alternative to traditional packaging solutions, mainly due to their biodegradable and recyclable properties. This market segment capitalizes on the growing consumer demand for environmentally friendly packaging solutions.

The Paperboard Tray Market has witnessed significant growth, driven by increasing awareness among consumers and businesses about sustainable practices. According to Gradeall, the market’s growth is supported by an impressive 68% recycling rate for paper, which not only demonstrates the effectiveness of current recycling systems but also highlights the strong public commitment to recycling practices.

Moreover, according to The Pulp and Paper Times, there has been a 34% increase in paper and paperboard imports in FY24. This surge underscores the growing market demand and the global nature of the supply chain in this industry.

The rise in imports can be attributed to the expanding applications of paperboard trays beyond conventional markets, venturing into luxury packaging and specialized industrial uses, which demand higher quality and customized solutions.

The future growth of the Paperboard Tray Market is promising, with several opportunities emerging from government investments and regulatory frameworks. Governments worldwide are increasingly investing in recycling infrastructure and offering incentives for companies adopting sustainable practices, which directly benefits the market for paperboard trays. These initiatives not only bolster the production capacity of environmentally friendly packaging solutions but also encourage innovation in this sector.

Furthermore, regulatory policies focusing on reducing plastic usage have propelled the demand for paper-based solutions like paperboard trays. This regulatory environment, coupled with the high recycling rates, positions paperboard trays as a front-runner in the shift towards sustainable packaging solutions.

The ongoing development and enhancement of biodegradable and compostable paperboard formulations are set to open new avenues for growth, tapping into sectors that are yet unexplored or are in the early stages of adopting green packaging alternatives.

Key Takeaways

- Global Paperboard Tray Market projected to grow from USD 6.2 Billion in 2024 to USD 10.1 Billion by 2034, with a CAGR of 5%.

- Paperboard materials dominate the market, holding a 55.3% share in 2024 due to their strength, durability, and customization capabilities.

- The Food and Beverages sector is the largest end-user, accounting for 70% of the market share, driven by demand for sustainable packaging.

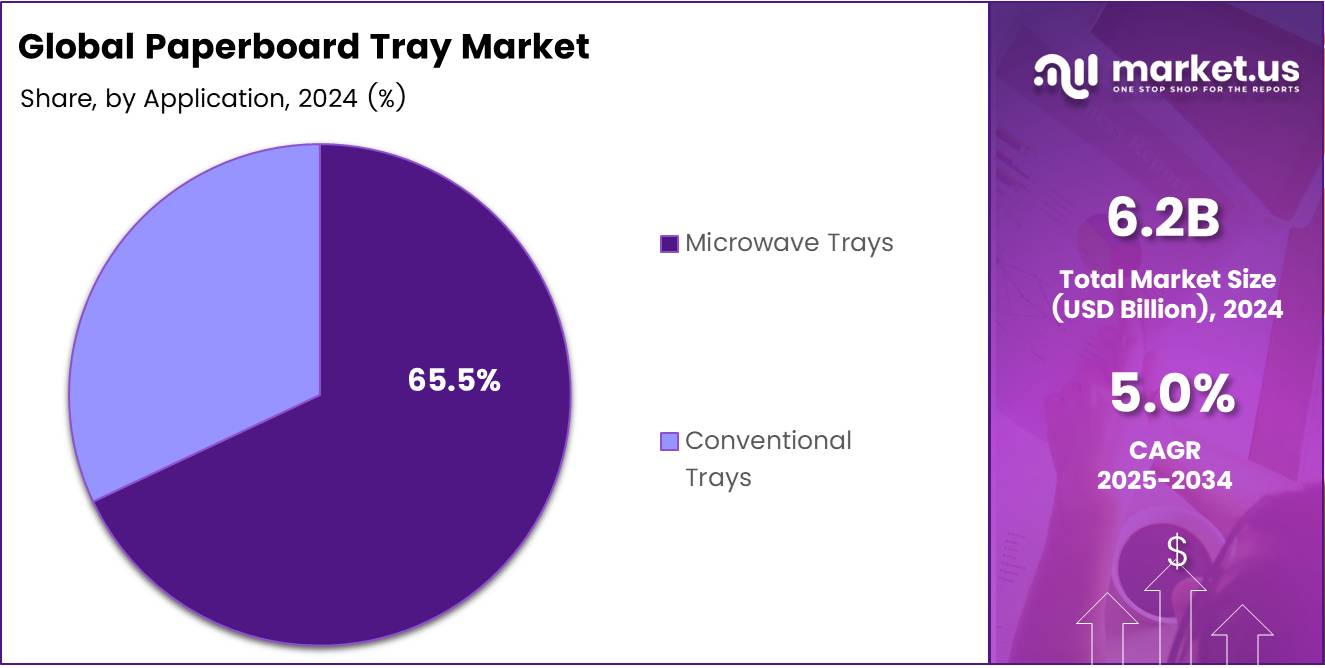

- Microwave Trays lead the application segment with a 65.5% market share, favored for their convenience in preparing food.

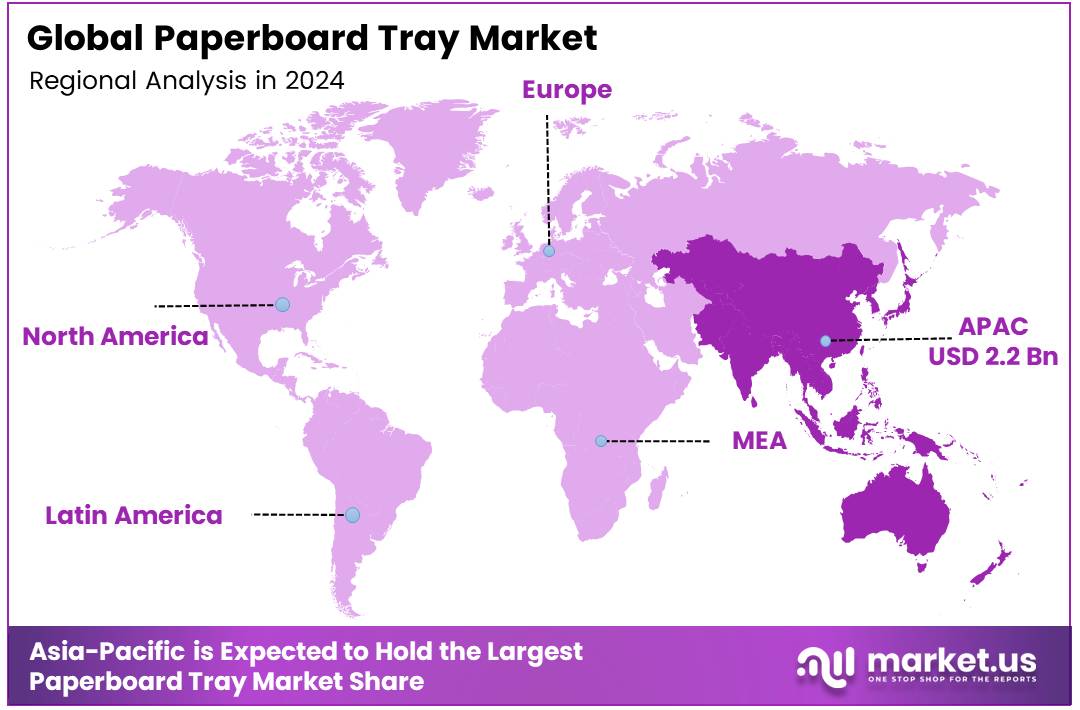

- Asia Pacific is the leading region, contributing 36% of the global market share, spurred by urbanization, rising incomes, and growing retail and food services in China and India.

Material Analysis

Paperboard Leads with 55.3% Share in Material Segment of Paperboard Tray Market

In 2024, the paperboard tray market witnessed a substantial dominance of paperboard material, capturing a significant 55.3% of the market share in the By Material Analysis segment. This predominant position can be attributed to paperboards excellent characteristics such as high strength, durability, and ease of customization, which cater effectively to diverse packaging needs across various industries.

Moreover, paperboard is highly favored for its sustainable properties; it is recyclable and often sourced from managed forestry, aligning with growing global demands for environmentally friendly packaging solutions.

Adjacent to paperboard, molded fiber and kraft paper also held noteworthy positions in the market. Molded fiber, known for its biodegradability and shock absorption capabilities, is increasingly preferred in industries that require protective packaging for fragile items.

Meanwhile, kraft paper, appreciated for its robustness and lightweight nature, continues to be a popular choice for cost-effective and sustainable packaging. Both materials contribute to the dynamic nature of the paperboard tray market, complementing the leading role of paperboard with their unique properties and reinforcing the markets shift towards more sustainable packaging solutions.

End Use Analysis

Paperboard Tray Market Dominated by Food and Beverages Sector with a 70% Share

In 2024, the Food and Beverages sector retained a commanding presence in the By End Use Analysis segment of the Paperboard Tray Market, accounting for 70% of the market share. This predominant position can be primarily attributed to the increasing consumer demand for sustainable packaging solutions coupled with the food and beverage industrys continuous pursuit of eco-friendly and cost-effective packaging alternatives.

Subsequent segments, although smaller in comparison, also exhibited notable market activities. The Cosmetics & Personal Care Products sector leveraged paperboard trays for their biodegradability and premium aesthetic appeal, enhancing brand perception among eco-conscious consumers. Pharmaceuticals, another significant user, valued paperboard trays for their strength and lightweight properties, ensuring drug safety during transportation.

The Homecare sector adopted these trays for similar reasons, prioritizing sustainability in packaging solutions. Meanwhile, the Electrical and Electronics Products sector, driven by the need for static-free and recyclable packaging, progressively integrated paperboard trays to align with environmental directives.

The Other category, encompassing a diverse range of industries, continued to explore the adaptability and benefits of paperboard trays in various applications, further endorsing their versatility across multiple market segments.

Application Analysis

Microwave Trays Lead with 65.5% in Paperboard Tray Market by Application

In 2024, Microwave Trays commanded a dominant position in the By Application Analysis segment of the Paperboard Tray Market, capturing a substantial 65.5% share. This significant market share can be attributed to the increasing consumer preference for convenience foods that are quick and easy to prepare.

Microwave trays, made from paperboard, are especially designed to withstand high temperatures and direct microwave use, making them highly suitable for ready-to-eat meals and frozen products. Their popularity is further bolstered by their eco-friendly attributes, as they are often made from recycled materials and are biodegradable, aligning with growing consumer demand for sustainable packaging solutions.

On the other hand, Conventional Trays, while versatile and widely used across various food sectors, have not matched the specific consumer demands that microwave trays fulfill. These trays typically cater to a broader range of uses, including bakery products, fresh produce, and meats, but lack the specialized features for microwave heating, which has limited their market share growth in comparison to microwave-specific options.

Key Market Segments

By Material

- Paperboard

- Molded Fiber

- Kraft Paper

By Product

- Multiple Cavity

- Single Cavity

By Capacity

- Up to 8 oz

- 8 oz to 20 oz

- 20 oz to 30 oz

- Above 30 oz

By Application

- Microwave Trays

- Conventional Trays

By End Use

- Food And Beverages

- Cosmetics & Personal Care Product

- Pharmaceuticals

- Homecare

- Electrical And Electronics Product

- Other

Drivers

Sustainability and Eco-Friendliness Propel Paperboard Tray Market

The rising demand for eco-friendly packaging solutions is significantly propelling the growth of the paperboard tray market. As consumers increasingly prioritize environmental sustainability, the appeal of paperboard trays is enhanced due to their biodegradable and recyclable nature. This shift is not only driven by consumer awareness but also by stringent regulatory pressures on packaging waste management, prompting businesses to adopt greener alternatives.

Additionally, the convenience offered by paperboard trays aligns well with the fast-paced lifestyle of modern consumers, who favor quick, practical, and disposable packaging options for ready-to-eat meals and takeaways. This convergence of environmental consciousness and convenience needs makes paperboard trays an attractive choice for both manufacturers and consumers, thus driving their market adoption.

Restraints

High Manufacturing Costs Challenge Paperboard Tray Adoption

In the paperboard tray market, significant restraints are evident, particularly stemming from the high manufacturing costs associated with producing these trays. Paperboard materials, often preferred for their eco-friendly attributes, generally incur higher production expenses compared to their plastic counterparts. This cost disparity can pose a substantial barrier, particularly for businesses operating within highly cost-sensitive sectors, where budget constraints are a primary concern.

Furthermore, paperboard trays tend to offer limited moisture resistance, which can compromise their effectiveness in packaging applications that require robust moisture barriers, such as certain food products.

The susceptibility of paperboard trays to moisture can lead to the degradation of the tray structure and potential leaks, thereby limiting their suitability for a broader range of applications. This combination of higher costs and functional limitations restricts the widespread adoption of paperboard trays, especially among industries that demand cost efficiency and high performance in packaging solutions.

Growth Factors

Rising Popularity of Plant-Based Packaging Drives Market Opportunities

The escalating demand for environmentally sustainable solutions is notably impacting the paperboard tray market, particularly within the food industry. As consumer awareness and regulatory pressures push for more eco-friendly packaging options, plant-based and biodegradable paperboard trays are emerging as key contenders to traditional materials. This trend not only aligns with global sustainability goals but also caters to the growing consumer preference for greener choices.

Additionally, strategic collaborations with companies in the food and beverage sector, which are actively seeking sustainable packaging alternatives, could significantly amplify the market penetration and growth of paperboard trays.

Furthermore, the versatility of paperboard trays is being recognized beyond the food sector, with increased adoption seen in packaging applications for electronics, cosmetics, and other consumer goods. This expansion into non-food industries suggests a broadening market scope and presents substantial growth opportunities for the paperboard tray market.

Emerging Trends

Customization Enhances Appeal of Paperboard Trays

In the evolving landscape of packaging, the paperboard tray market is experiencing significant traction due to key trends that cater to consumer and business needs. A prominent trend is the customization of paperboard trays, where companies are increasingly focusing on tailored designs that resonate with specific brand identities and consumer preferences. This trend not only enhances the visual appeal of products but also serves as a strategic marketing tool, enabling brands to differentiate themselves in a crowded marketplace.

Additionally, the adoption of digital printing on paperboard trays is accelerating, allowing for vibrant, high-quality graphics that improve brand visibility and consumer engagement. Moreover, the introduction of paperboard trays with multiple compartments reflects the market’s response to the growing demand for convenience and portion control in food packaging. These compartments facilitate the separation of different food items, thereby maintaining their integrity and appeal.

Collectively, these trends are shaping the paperboard tray market, making it more responsive to the dynamic needs of both consumers and businesses, while also driving innovation in sustainable packaging solutions.

Regional Analysis

Asia Pacific Leads Paperboard Tray Market with 36% Share, Driven by Urbanization and Sustainable Packaging Demand

Asia Pacific is the dominant region in the Paperboard Tray Market, accounting for approximately 36% of the global market with a valuation of USD 2.2 billion. This region’s market growth is propelled by rapid urbanization, increasing disposable incomes, and the expansion of the retail and food service industries, particularly in China and India. The shift towards convenient and sustainable packaging options significantly contributes to the regional market’s expansion.

Regional Mentions:

North America is witnessing steady growth in the Paperboard Tray Market, primarily driven by the region’s stringent environmental regulations and the increasing demand for sustainable packaging solutions. The U.S. and Canada are significant contributors, with innovations in recyclable and biodegradable materials bolstering market expansion.

Europe holds a substantial share of the market, with a strong emphasis on reducing plastic usage and enhancing recycling processes. Countries like Germany, the UK, and France are leading the way in implementing eco-friendly packaging solutions. The European market is buoyed by governmental policies supporting sustainable packaging, coupled with high consumer awareness about environmental issues, which drives the demand for paperboard trays.

Middle East & Africa are emerging regions in the paperboard tray market, with growth influenced by increasing modern retail sectors and urban development. Although these regions currently hold a smaller market share, the potential for growth is considerable, driven by the expanding food and beverage industries and a growing emphasis on sustainable packaging.

Latin America shows promising growth, driven by the burgeoning food processing and export industries. Countries like Brazil and Argentina are increasingly adopting paperboard trays to enhance food safety and shelf life while focusing on sustainable packaging practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Paperboard Tray Market is marked by the participation of several key players, each contributing distinctively to the competitive landscape. Notably, International Paper Company stands out due to its expansive production capacity and widespread distribution network. This company has been instrumental in driving innovation within the market, particularly through the development of sustainable and recyclable paperboard solutions, catering to the increasing consumer demand for eco-friendly packaging.

Brodrene Hartmann A/S, another prominent player, specializes in the manufacture of molded fiber paperboard trays, which are highly favored in the food and agriculture sectors for their biodegradability and strength. The company’s commitment to sustainability is evident in their continuous improvements in product design to minimize environmental impact.

Pactiv LLC, renowned for its diverse range of packaging solutions, has made significant strides in the paperboard tray market by offering products that are both functional and customizable. Their focus on versatility allows them to serve a broad spectrum of industries, from food service to consumer electronics, thereby enhancing their market reach.

Mondi Group Plc and Stora Enso Oyj are also key contributors, leveraging their expertise in paper and packaging solutions to innovate and expand their paperboard tray offerings. These companies focus on the integration of technology and sustainability, aiming to produce smarter and more environmentally friendly packaging options.

Top Key Players in the Market

- International Paper Company

- Brodrene Hartmann A/S

- Pactiv LLC

- Mondi Group Plc

- Stora Enso Oyj

- DS Smith Plc

- WestRock Company

- Smurfit Kappa Group

- Novolex Holdings

- INDEVCO Paper Containers (IPC)

- Billerud AB

- Graphic Packaging

- Genpak, LLC

- Oliver Packaging

- Cascades Inc.

Recent Developments

- In March 2025, the Saica Group significantly expanded its operations in the United States by investing US$110 million in a new paper factory, aiming to increase its production capacity and market penetration in North America.

- In March 2025, domestic manufacturers expressed concerns as paper and paperboard imports surged to 1.76 million tonnes in the first nine months of the fiscal year 2024-25, potentially impacting the local industry.

- In April 2024, Sappi announced a substantial investment of USD 418 million to convert an existing paper machine in the United States into a board production facility, enhancing its product diversification and market reach.

- In April 2024, a significant investment of 1.78 billion Saudi Riyals was made for the addition of a 5th production line, projected to increase the annual cardboard paper production capacity by 450 thousand tonnes.

Report Scope

Report Features Description Market Value (2024) USD 6.2 Billion Forecast Revenue (2034) USD 10.1 Billion CAGR (2025-2034) 5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Paperboard, Molded Fiber, Kraft Paper), By Product (Multiple Cavity, Single Cavity), By Capacity (Up to 8 oz, 8 oz to 20 oz, 20 oz to 30 oz, Above 30 oz), By Application (Microwave Trays, Conventional Trays), By End Use (Food And Beverages, Cosmetics & Personal Care Product, Pharmaceuticals, Homecare, Electrical And Electronics Product, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape International Paper Company, Brodrene Hartmann A/S, Pactiv LLC, Mondi Group Plc, Stora Enso Oyj, DS Smith Plc, WestRock Company, Smurfit Kappa Group, Novolex Holdings, INDEVCO Paper Containers (IPC), Billerud AB, Graphic Packaging, Genpak, LLC, Oliver Packaging, Cascades Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- International Paper Company

- Brodrene Hartmann A/S

- Pactiv LLC

- Mondi Group Plc

- Stora Enso Oyj

- DS Smith Plc

- WestRock Company

- Smurfit Kappa Group

- Novolex Holdings

- INDEVCO Paper Containers (IPC)

- Billerud AB

- Graphic Packaging

- Genpak, LLC

- Oliver Packaging

- Cascades Inc.