Global Ionic Exchange Based Liquid Nuclear Waste Treatment Market By Type (Low-Level Waste, Intermediate-Level Waste, High-Level Waste), By lonic Exchange Processing (Inorganic Natural lon Exchangers, Organic Natural lon Exchangers, Synthetic Inorganic lon Exchangers, Synthetic Organic lon Exchangers, Modified Natural lon Exchangers), By Water Processing (Pressurized Water Reactors, Boiling Water Reactors, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149513

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

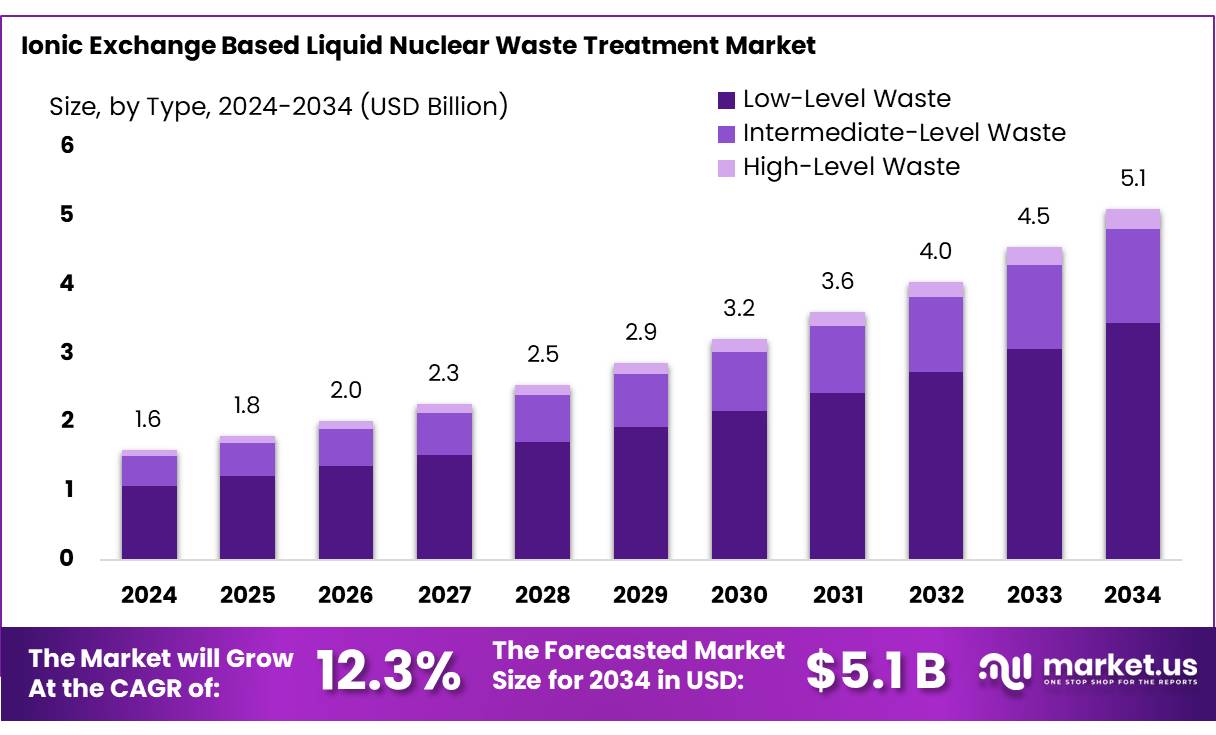

The Global Ionic Exchange Based Liquid Nuclear Waste Treatment Market size is expected to be worth around USD 5.1 Bn by 2034, from USD 1.6 Bn in 2024, growing at a CAGR of 12.3% during the forecast period from 2025 to 2034.

The ionic exchange-based liquid nuclear waste treatment industry plays a pivotal role in the management of radioactive effluents generated from nuclear power plants, research facilities, and medical institutions. This process involves the removal of radioactive ions from liquid waste streams through ion exchange resins, effectively concentrating hazardous radionuclides and facilitating safer disposal. The technique is particularly effective for treating low-level and intermediate-level waste, offering advantages such as high selectivity, operational simplicity, and cost-effectiveness.

The ion exchange-based treatment is characterized by its integration into the broader nuclear fuel cycle. India’s commitment to a closed fuel cycle necessitates efficient waste treatment solutions. The Department of Atomic Energy (DAE) has outlined plans to increase nuclear power capacity to 22.5 GWe by 2031, with aspirations of reaching 100 GWe by 2047. This expansion underscores the need for advanced waste management technologies, including ion exchange systems.

Government initiatives and regulatory frameworks are playing a pivotal role in propelling the market forward. For instance, the U.S. Department of Energy’s Hanford Test Bed Initiative demonstrated the effectiveness of ion exchange processes by removing over 98% of radioactivity from 2,000 gallons of tank waste. Such successful implementations underscore the potential of ion exchange technology in addressing complex nuclear waste challenges.

In India, the Department of Atomic Energy (DAE) has implemented ion exchange methods as part of its comprehensive radioactive waste management strategy. The Bhabha Atomic Research Centre (BARC) employs ion exchange, along with filtration, chemical treatment, and evaporation, to pre-treat liquid waste before immobilization, thereby reducing the volume and radioactivity of the waste. This approach aligns with India’s goal to achieve 22.5 GWe of nuclear capacity by 2031, as reaffirmed by the government in 2025.

Key Takeaways

- Ionic Exchange Based Liquid Nuclear Waste Treatment Market size is expected to be worth around USD 5.1 Bn by 2034, from USD 1.6 Bn in 2024, growing at a CAGR of 12.3%.

- Low-Level Waste held a dominant market position, capturing more than a 67.4% share.

- Inorganic Natural Ion Exchangers held a dominant market position, capturing more than a 38.3% share.

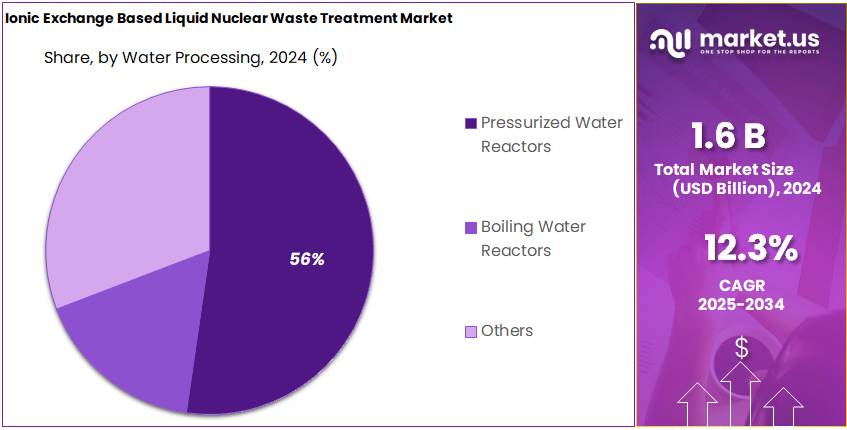

- Pressurized Water Reactors held a dominant market position, capturing more than a 56.6% share.

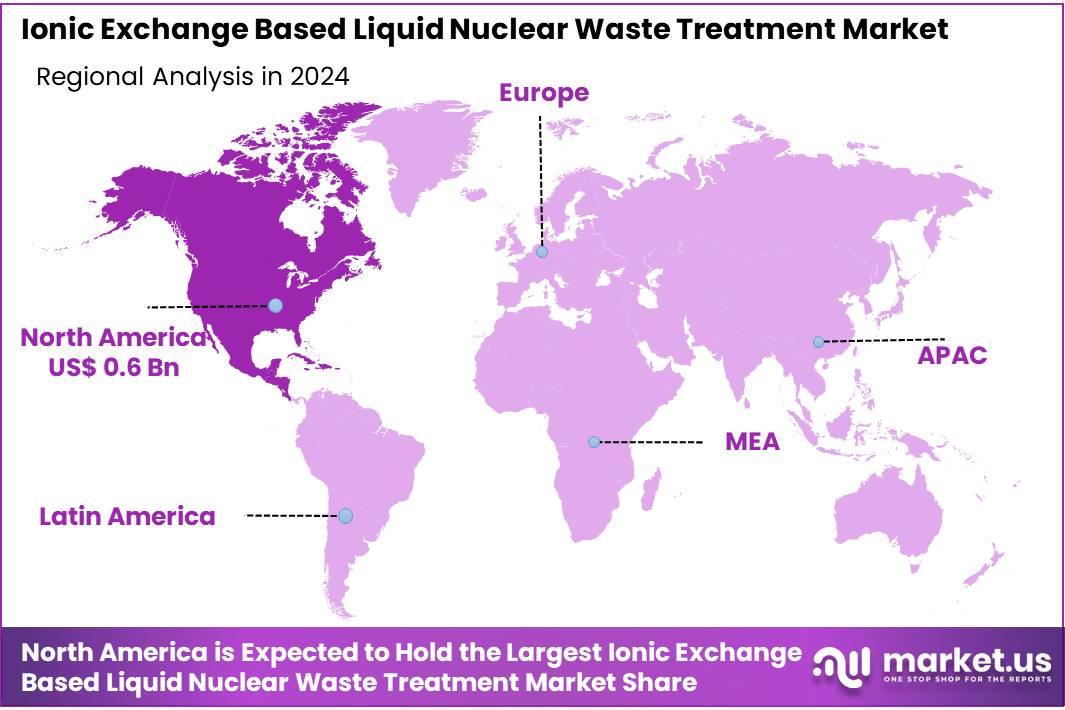

- North America led the Ionic Exchange Based Liquid Nuclear Waste Treatment market, accounting for 38.5% of the global share, valued at approximately USD 0.6 billion.

By Type

Low-Level Waste dominates with 67.4% share due to its high volume generation and easier treatability.

In 2024, Low-Level Waste held a dominant market position, capturing more than a 67.4% share in the global Ionic Exchange Based Liquid Nuclear Waste Treatment market. This segment includes contaminated materials such as protective clothing, cleaning rags, filters, and other items with low levels of radioactivity that result from routine nuclear facility operations, research activities, and medical procedures. The high share is mainly due to the sheer volume of this type of waste generated across nuclear power plants and healthcare institutions globally.

High-level or intermediate-level waste, low-level waste requires less complex processing, making ion exchange an efficient and preferred method for treatment. By 2025, demand for low-level waste treatment is expected to remain strong as regulatory bodies continue to emphasize safe disposal practices and as nuclear power maintains a central role in low-carbon energy strategies. Moreover, ion exchange processes for low-level waste are cost-effective and scalable, which supports their adoption in both developed and emerging nuclear economies.

By lonic Exchange Processing

Inorganic Natural Ion Exchangers lead with 38.3% share due to their cost-efficiency and environmental compatibility.

In 2024, Inorganic Natural Ion Exchangers held a dominant market position, capturing more than a 38.3% share in the Ionic Exchange Based Liquid Nuclear Waste Treatment market. These exchangers, which include naturally occurring minerals such as zeolites and clays, are widely used because of their high selectivity for radioactive ions like cesium and strontium, especially in low- and intermediate-level liquid waste streams. Their strong position in the market is supported by advantages such as low cost, chemical stability, and resistance to radiation damage, which makes them a practical choice for large-scale nuclear facilities.

Additionally, the environmental compatibility of natural ion exchangers has gained attention as more countries push for sustainable waste treatment solutions. By 2025, this segment is expected to see continued use in both existing and new treatment systems, particularly in countries expanding their nuclear power capacity while seeking more natural and eco-friendly processing technologies.

By Water Processing

Pressurized Water Reactors dominate with 56.6% share owing to their global deployment and continuous waste generation.

In 2024, Pressurized Water Reactors held a dominant market position, capturing more than a 56.6% share in the Ionic Exchange Based Liquid Nuclear Waste Treatment market. This leading share is primarily linked to the widespread global adoption of pressurized water reactor (PWR) technology, especially in countries like the United States, France, China, and South Korea. PWRs produce significant volumes of liquid radioactive waste during normal operation, maintenance, and refueling processes, making efficient treatment methods like ion exchange critical for regulatory compliance and environmental safety.

The consistent generation of waste from these reactors has driven ongoing demand for reliable processing systems. By 2025, the segment is projected to maintain its strong market share as more developing nations incorporate PWR technology into their nuclear power strategies, further reinforcing the need for effective liquid waste management solutions.

Key Market Segments

By Type

- Low-Level Waste

- Intermediate-Level Waste

- High-Level Waste

By lonic Exchange Processing

- Inorganic Natural lon Exchangers

- Organic Natural lon Exchangers

- Synthetic Inorganic lon Exchangers

- Synthetic Organic lon Exchangers

- Modified Natural lon Exchangers

By Water Processing

- Pressurized Water Reactors

- Boiling Water Reactors

- Others

Drivers

Government-Led Initiatives Driving Ion Exchange Adoption in Nuclear Waste Treatment

A significant driving factor for the growth of the Ionic Exchange Based Liquid Nuclear Waste Treatment market is the proactive role of governments in advancing nuclear waste management technologies. The United States Department of Energy (DOE) has been at the forefront of implementing ion exchange processes to treat radioactive waste. Notably, the Test Bed Initiative (TBI) at the Hanford Site in Washington State exemplifies this commitment.

In 2024, the TBI successfully treated approximately 2,000 gallons of tank waste using an integrated ion exchange column, effectively removing over 98% of the radioactivity. This treated waste is scheduled for safe disposal in fiscal year 2025, highlighting the DOE’s dedication to innovative waste treatment solutions.

Similarly, at the Savannah River Site in South Carolina, the DOE employs ion exchange processes to remove cesium-137 from high-level waste salt solutions. This method enhances the efficiency and safety of waste treatment, demonstrating the government’s commitment to advancing nuclear waste management technologies.

Restraints

High Costs and Complexities in Managing Spent Ion Exchange Resins

A significant challenge in the Ionic Exchange Based Liquid Nuclear Waste Treatment market is the high cost and complexity associated with managing spent ion exchange resins. These resins, after being used to treat radioactive wastewater, become radioactive themselves and require careful handling, treatment, and disposal.

The International Atomic Energy Agency (IAEA) reports that Pressurized Water Reactors (PWRs) generate between 4 to 7 cubic meters of spent ion exchange resin per unit annually. Boiling Water Reactors (BWRs) produce even more, up to 20 cubic meters per unit each year. Managing this volume of radioactive waste is both technically challenging and costly.

The treatment and disposal of these spent resins involve multiple steps, including stabilization, immobilization, and secure storage. These processes require specialized facilities and technologies, which contribute to the overall cost. For instance, the U.S. Department of Energy’s Hanford Site has faced escalating costs in its waste treatment projects, with estimates reaching $16.8 billion.

Moreover, the lack of standardized global protocols for the disposal of spent ion exchange resins adds to the complexity. Different countries have varying regulations and infrastructure capabilities, leading to inconsistencies in waste management practices. This disparity can hinder international collaboration and the sharing of best practices.

Opportunity

Government-Led Expansion of Nuclear Energy in India Fuels Demand for Ion Exchange Waste Treatment

India’s strategic push to expand its nuclear energy capacity presents a significant growth opportunity for the Ionic Exchange Based Liquid Nuclear Waste Treatment market. The government’s ‘Viksit Bharat’ initiative aims to develop at least 100 GW of nuclear energy by 2047, marking a substantial increase from the current capacity of approximately 22.5 GWe projected by 2031.

This ambitious expansion necessitates the establishment of advanced waste management systems to handle the increased volume of radioactive waste. Ion exchange processes are particularly effective for treating liquid radioactive waste, as they can efficiently remove specific radionuclides from waste streams. The Bhabha Atomic Research Centre (BARC) has been at the forefront of developing and implementing ion exchange technologies for waste treatment. For instance, BARC has established plant-scale ion exchange facilities and has demonstrated the recycling of water recovered from low-level waste, aligning with the “Water Recycle” concept.

Moreover, India’s adoption of a closed fuel cycle, which involves reprocessing and recycling of spent fuel, results in the generation of high-level liquid waste (HLLW). This waste is immobilized into an inert glass matrix through vitrification and stored in Solid Storage Surveillance Facilities for 30-40 years prior to disposal. The treatment of such waste streams further underscores the importance of efficient ion exchange processes.

Trends

Advancements in Ion Exchange Materials Enhance Nuclear Waste Treatment Efficiency

A notable trend in the ionic exchange-based liquid nuclear waste treatment market is the development of advanced ion exchange materials. These innovations aim to improve the selectivity, capacity, and durability of ion exchange resins, which are critical for effectively removing specific radioactive isotopes from waste streams.

Recent advancements have led to the creation of resins with higher affinity for particular radionuclides, enhancing the efficiency of the waste treatment process. For instance, new materials are being designed to target specific radioactive isotopes more effectively, thereby improving the overall effectiveness of waste management systems.

The integration of ion exchange processes with other treatment methods, such as chemical precipitation and membrane filtration, is also gaining traction. This combination enhances the overall effectiveness of waste management systems, ensuring more comprehensive removal of contaminants.

The adoption of automated systems and real-time monitoring technologies in ion exchange processes is improving operational efficiency. These advancements reduce human intervention and ensure accurate waste treatment, aligning with the industry’s move towards more sustainable and cost-effective solutions.

Regional Analysis

In 2024, North America led the Ionic Exchange Based Liquid Nuclear Waste Treatment market, accounting for 38.5% of the global share, valued at approximately USD 0.6 billion. This dominance is attributed to the region’s mature nuclear infrastructure, stringent environmental regulations, and significant investments in nuclear waste management technologies.

The United States, in particular, has been proactive in addressing nuclear waste challenges. The Department of Energy (DOE) allocated USD 40 million in May 2021 to enhance nuclear waste treatment processes, emphasizing the importance of advanced technologies like ion exchange systems. Such investments underscore the government’s commitment to ensuring safe and efficient waste management practices.

Moreover, the region’s focus on sustainable energy solutions has led to the resurgence of nuclear power as a viable alternative. As nuclear energy production increases, so does the volume of liquid radioactive waste, necessitating effective treatment methods. Ion exchange processes have become integral in this context, offering efficient removal of radioactive contaminants from liquid waste streams.

Canada also contributes significantly to the regional market, with its robust nuclear sector and emphasis on environmental safety. Collaborative efforts between government bodies and private enterprises have fostered the development and implementation of advanced waste treatment technologies across North America.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Areva SA, a French multinational, has been instrumental in nuclear waste management, particularly through its La Hague reprocessing facility. The company specializes in treating spent nuclear fuel and radioactive waste, employing advanced ion exchange techniques to ensure environmental safety. Despite facing regulatory challenges, Areva continues to innovate in waste treatment solutions, maintaining a significant presence in the global nuclear industry.

Augean Plc, based in the UK, focuses on hazardous waste management, including radioactive materials. The company offers comprehensive services for the treatment and disposal of low-level radioactive waste, utilizing ion exchange processes to meet stringent environmental standards. Augean’s commitment to sustainable waste solutions has solidified its role in the UK’s nuclear waste management sector.

AVANTech, headquartered in the United States, provides specialized water treatment systems for nuclear facilities. The company designs and manufactures ion exchange resins and systems tailored for radioactive waste treatment. Notably, AVANTech contributed to the Fukushima Daiichi nuclear disaster response by implementing advanced water treatment technologies, demonstrating its expertise in emergency nuclear waste management.

Top Key Players in the Market

- Areva SA

- Augean Plc

- AVAN Tech

- Bechtel Corporation

- Chase Environmental Group, Inc.

- Graver Technologies LLC

- Kiewt Corporation

- Orano

Recent Developments

Bechtel’s commitment to excellence was recognized when the U.S. Department of Energy awarded the company nearly 95% of a potential $15 million fee for its 2024 work at the Hanford plant, amounting to $14.2 million.

In 2024, Augean Plc reinforced its position as a key player in the ionic exchange-based liquid nuclear waste treatment sector within the UK. The company specializes in managing hard-to-handle wastes, including radioactive materials, through its network of 22 facilities across the country.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 5.1 Bn CAGR (2025-2034) 12.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Low-Level Waste, Intermediate-Level Waste, High-Level Waste), By lonic Exchange Processing (Inorganic Natural lon Exchangers, Organic Natural lon Exchangers, Synthetic Inorganic lon Exchangers, Synthetic Organic lon Exchangers, Modified Natural lon Exchangers), By Water Processing (Pressurized Water Reactors, Boiling Water Reactors, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Areva SA, Augean Plc, AVAN Tech, Bechtel Corporation, Chase Environmental Group, Inc., Graver Technologies LLC, Kiewt Corporation, Orano Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ionic Exchange Based Liquid Nuclear Waste Treatment MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Ionic Exchange Based Liquid Nuclear Waste Treatment MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Areva SA

- Augean Plc

- AVAN Tech

- Bechtel Corporation

- Chase Environmental Group, Inc.

- Graver Technologies LLC

- Kiewt Corporation

- Orano