Global Squalene Market Size, Share Analysis Report By Source (Animal, Plants, Synthetic), By Purity (Greater than 95%, 85 to 95%, Less than 85%), By Extraction Method (Molecular Distillation, Supercritical Fluid Extraction (SFE), Counter Current Chromatography (CCC)), By End-use (Personal Care And Cosmetics, Food Supplements, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 146560

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

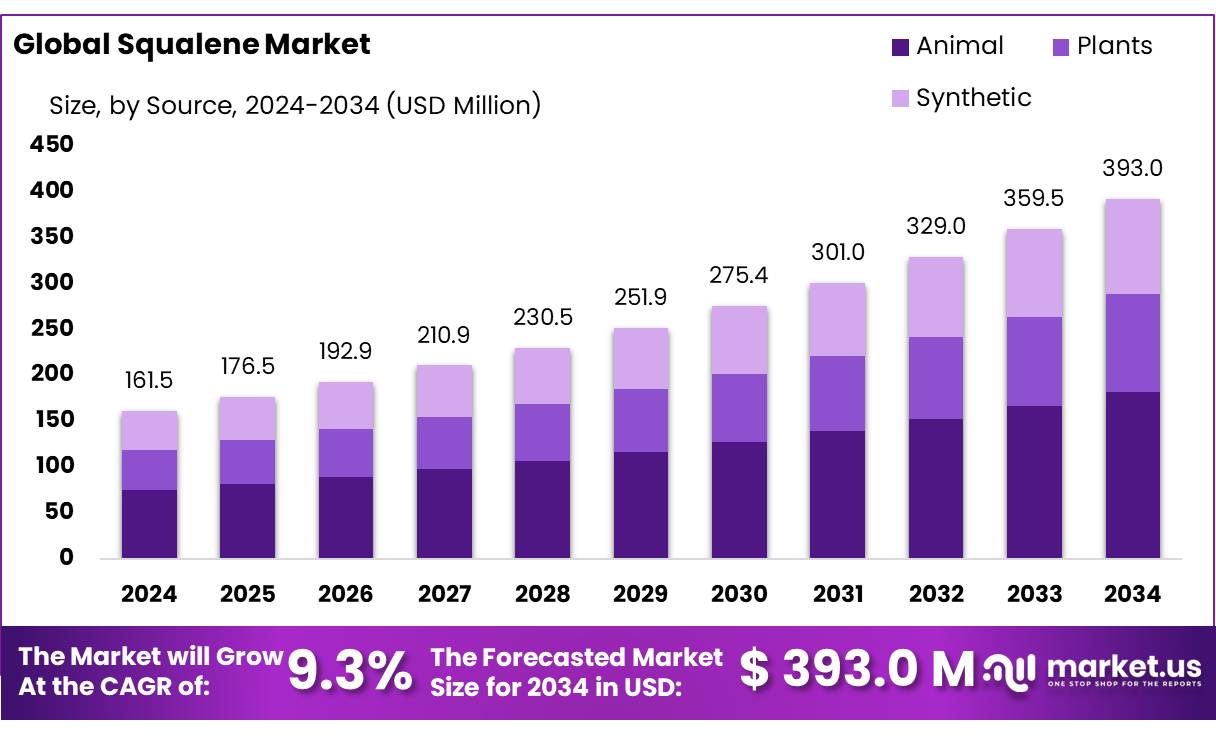

The Global Squalene Market size is expected to be worth around USD 393.0 Million by 2034, from USD 161.5 Million in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034.

Squalene is a naturally occurring unsaturated hydrocarbon classified as a triterpenoid and serves as a biosynthetic precursor of steroids and hopanoids in humans, animals, plants, and microorganisms. Known for its excellent antioxidant, emollient, and immune-boosting properties. Squalene is widely applied across the cosmetic, pharmaceutical, and nutraceutical industries. In cosmetics, it is used in a wide range of products, including moisturizers, creams, sunscreens, and makeup, due to its moisturizing, anti-inflammatory, and anti-aging benefits.

- For instance, in the United States, 1 out of 14 creams contains animal squalene.

- For instance, European Swiss beauty care, 9.4% of the creams (3 out of 32) contain shark squalene.

Furthermore, in pharmaceuticals and health applications, it functions as a detoxifying agent, a drug delivery carrier, and notably as an adjuvant in vaccines such as those for influenza, malaria, and HPV. Traditionally sourced from shark liver oil, commercial production of squalene is increasingly shifting toward plant-based alternatives such as olive oil, amaranth oil, and rice bran to meet sustainability and ethical sourcing standards. The global squalene market is experiencing strong growth, driven by rising consumer demand for clean-label, vegan, and eco-conscious ingredients, especially in skincare and immunological applications.

Key Takeaways

- Squalene Market size is expected to be worth around USD 393.0 Million by 2034, from USD The

- global squalene market was valued at USD 161.5 million in 2024.

- The global squalene market is projected to grow at a CAGR of 9.3% and is estimated to reach USD 393.0 million by 2034.

- Among the sources, animals accounted for the largest market share of 46.4%.

- Among purity, greater than 95% accounted for the majority of the market share at 58.1%.

- By extraction method, molecular distillation accounted for the largest market share of 48.9%.

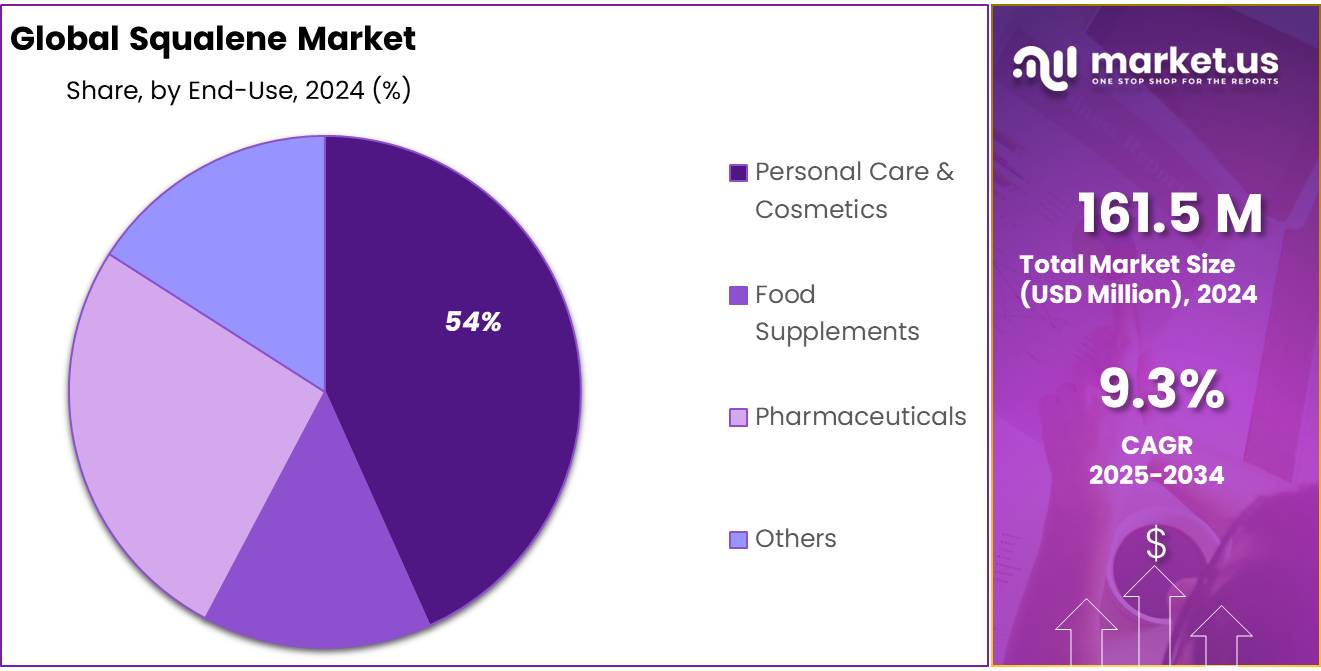

- By end-use, personal care & cosmetics accounted for the majority of the market share at 54.3%.

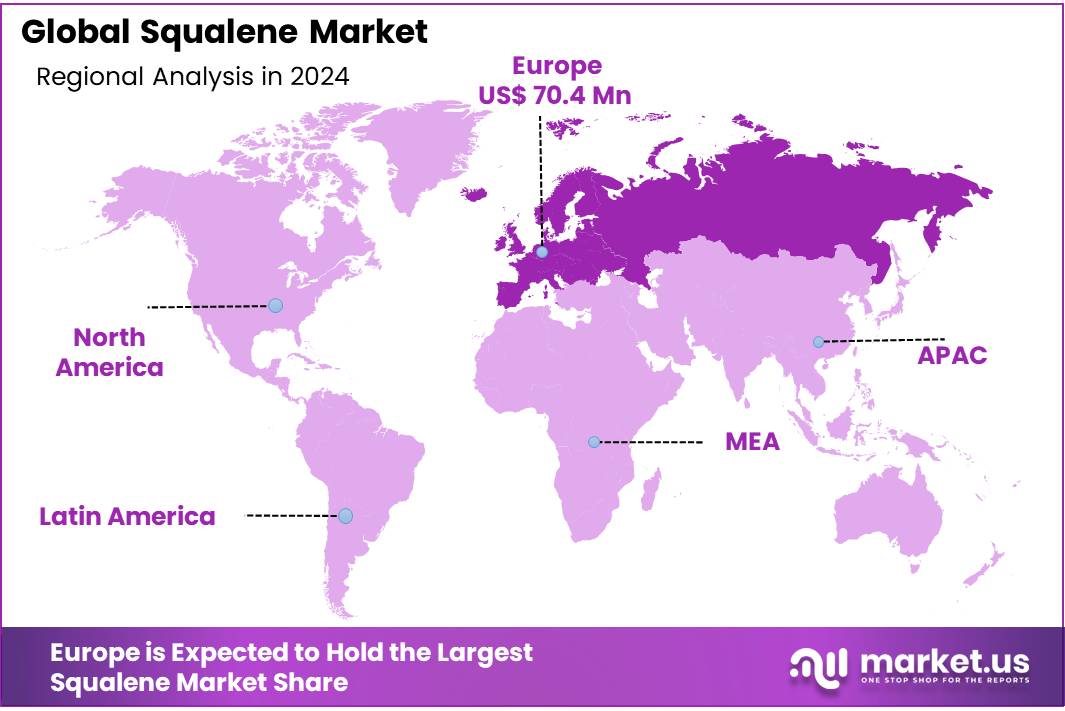

- Europe is estimated as the largest market for Squalenewith a share of 43.6% of the market.

By Source

The Animal Segment Held A Significant Revenue Share

The squalene market is segmented based on source into animal, plant, and synthetic. In 2024, the animal segment held a significant revenue share of 46.4%. Due it their wide availability, especially from shark liver oil, which offers high purity and consistent quality. Its vibrant use in pharmaceutical and cosmetic applications, combined with well-developed extraction and supply processes, has made it the preferred choice for manufacturers. Additionally, regulatory approvals and proven efficacy in vaccines and skincare products have reinforced its dominance.

By Purity

Greater than 95% purity leads the way with 58.1% share in 2024, backed by high demand in cosmetics and pharmaceuticals

Based on purity, the market is further divided into greater than 95%, 85 to 95%, and less than 85%. The predominance of the greater than 95%, commanding a substantial 58.1% market share in 2024. Due to its superior quality, which is essential for pharmaceutical and cosmetic applications requiring high efficacy and safety standards. High-purity squalene ensures better performance as an ingredient in vaccines, skincare products, and drug formulations, driving strong demand from industries prioritizing product effectiveness and regulatory compliance.

By Extraction Method

Molecular Distillation takes the lead with 48.9% share in 2024, thanks to its efficiency and purity output

Among the extraction methods, the squalene market is classified into two molecular distillation, Supercritical Fluid Extraction (SFE), and Counter Current Chromatography (CCC). In 2024, Molecular Distillation held a dominant position with a 48.9% share. Due to its efficiency in producing high-purity squalene while preserving its bioactive properties. This method is cost-effective, scalable for commercial production, and widely adopted in the industry, making it the preferred choice for extracting squalene used in pharmaceutical and cosmetic applications.

By End-Use

The Personal Care & Cosmetics Segment Emerging As The Dominant User

By end-use, the market is categorized into personal care & cosmetics, food supplements, pharmaceuticals, and others. The personal care & cosmetics segment is emerging as the dominant user, holding 54.3% of the total market share in 2024. Due to the growing consumer demand for natural and effective skincare ingredients. Squalene’s moisturizing, antioxidant, and anti-aging properties make it highly valued in beauty products, driving its widespread use. Additionally, the rising trend of clean and sustainable beauty products has further fueled the adoption of squalene in this segment.

Key Market Segments

By Source

- Animal

- Shark Liver Oil

- Other Animals

- Plants

- Amaranth Oil

- Olive Oil

- Rice Bran Oil

- Others

- Synthetic

- Petrochemical

- Biotechnological

By Purity

- Greater than 95%

- 85 to 95%

- Less than 85%

By Extraction Method

- Molecular Distillation

- Supercritical Fluid Extraction (SFE)

- Counter Current Chromatography (CCC)

By End-use

- Personal Care & Cosmetics

- Skin Care

- Hair Care

- Perfumes

- Others

- Food Supplements

- Pharmaceuticals

- Others

Drivers

Government incentive for biobased cosmetics ingredients

Government support and incentives promoting the use of bio-based ingredients in cosmetic products are driving the growth of the global squalene market. As sharks have traditionally been the primary source of squalene, there is a growing need to identify low-cost, environmentally friendly, and sustainable alternatives for commercial production. Squalene, particularly when sourced from plant-based origins such as olives, sugarcane, and amaranth, aligns well with the environmentally friendly and sustainability trends gaining momentum in the personal care industry.

- For instance, according Food & Agriculture Organization of the United Nations to approximately 2,500 to 3,000 are killed to produce just one ton of squalene, To obtain >98% pure squalene from liver oil, a single distillation under a vacuum at a temperature of 200°C–230°C is necessary Highlighting the urgent need for alternatives due to sharks’ slow growth, long reproductive cycles, and unsustainable massive killing of sharks have increased the demand for biobased squalene.

Additionally, increasing consumer demand for clean-label and organic products, along with rising concerns about the negative impact of synthetic chemicals on human health and the environment, is accelerating the shift away from synthetic and animal-derived components. In response to these trends, many governments are introducing

g favorable policies, subsidies, and research funding to encourage the adoption of natural, renewable alternatives, further supporting the market expansion for bio-based squalene. Furthermore, growing consumer awareness around ethical and eco-friendly products is prompting major cosmetic manufacturers to reformulate their product lines with bio-based ingredients. As consumer demand for skincare, anti-aging, and moisturizing products increased, governments from regions such as the European Union, North America, and parts of Asia-Pacific are actively encouraging the cosmetic sector to transition toward greener formulations, thus creating strong demand for plant-derived squalene. Further supporting its expansion across the beauty and personal care industry.

- For instance, Topicrem used animal-based squalene, but in 2023 brand reportedly stopped using animal squalene, shifting towards biobased squalene.

Restraints

The growing regulatory frameworks to protect marine animals

The growing regulatory frameworks to protect marine animals are restraining the growth of the global squalene market. Cosmetics and pharmaceutical sectors major sector, is facing increasing challenges due to growing regulatory frameworks aim`ed at protecting marine life. With shark liver oil historically serving as a primary source of commercial squalene, the sharp decline in global shark populations has raised serious concerns regarding marine biodiversity and animal welfare. In response, governments and environmental agencies are implementing stricter environmental regulations to curb unsustainable fishing practices and safeguard marine ecosystems.

Furthermore, shark overfishing driven by the high demand for squalene has led to severe ecological imbalances. As apex predators, sharks are essential to maintaining healthy ocean ecosystems, and their depletion has triggered cascading effects on marine biodiversity.

- According to the International Union for Conservation of Nature (IUCN), some shark populations have already declined by up to 95%. Also, between three and six million deep-sea sharks are captured and killed each year to meet global squalene demand.

As International fisheries commissions have imposed regulations and bans on shark fishing, reducing the raw material supply for animal-based squalene, further restraining the growth of squalene. Additionally, the extraction methods for shark liver oil often involve inhumane practices, clashing with evolving societal values and industry standards that emphasize ethical sourcing and sustainability. These environmental, ethical, and regulatory challenges are increasingly restraining the growth of shark-derived squalene EU strictly prohibits the use of shark-derived squalene in cosmetics. This is regulated under Annex II of the EU Cosmetics Regulation, which lists forbidden ingredients.

- According to the International Union for Conservation of Nature (IUCN), 26 of the 60 shark species harvested for their liver oil are classified as vulnerable to extinction. Additionally, an estimated 3 million sharks are killed each year to meet the growing demand for squalene in the beauty industry. These figures highlight the significant ecological impact of shark-derived squalene.

Opportunity

The growing prevalence of seasonal and infectious diseases

The increasing prevalence of seasonal and infectious diseases is emerging as a key opportunity for the global squalene market growth. Driven by factors such as climate change, environmental disruptions, and evolving human behavior, which significantly influence pathogen survival, transmission dynamics, and host vulnerability. These factors are contributing to notable changes in global disease patterns, intensifying the need for effective prevention and treatment strategies.

Additionally, squalene plays a critical role as an immunologic adjuvant in modern vaccine formulations. It is increasingly being utilized in vaccines designed to combat both seasonal infections and newly emerging viral strains, such as novel influenza A. As global healthcare systems prioritize the development of advanced immunization solutions, significantly boost the demand for squalene in the global pharmaceutical and biotechnology sectors.

Moreover, the rising incidence of a broad spectrum of infectious diseases—including childhood illnesses such as measles, diphtheria, and chickenpox; fecal-oral infections such as cholera and rotavirus; vector-borne diseases such as malaria; and sexually transmitted infections including gonorrhoea—is contributing to an escalating global health burden.

In response, vaccine manufacturers are adopting squalene as a key ingredient to enhance vaccine efficacy and support broader immunization efforts. In addition to its immunological benefits, squalene offers notable antioxidant and anti-inflammatory properties. Which provides additional health benefits such as protection against age-related physiological decline and chronic inflammatory conditions.

These versatile characteristics of squalene are increasingly recognized as a multifunctional bioactive compound with growing applications in both pharmaceutical and nutraceutical products, creating robust market opportunities for squalene.

Trends

Development of hybrid cosmetics products

Hybrid cosmetics have emerged as a significant trend in the beauty industry, characterized by the integration of active pharmaceutical ingredients into makeup formulations to deliver both skincare benefits and aesthetic enhancement.

This innovation allows products such as foundations, lipsticks, and eyeshadows to offer moisturizing, antioxidant, and anti-aging properties alongside their traditional cosmetic functions. The rising consumer demand for multifunctional and clean beauty products has driven the incorporation of squalene—known for its superior emollient and skin-nourishing qualities—into hybrid cosmetics.

In addition, the global squalene market has witnessed notable growth, supported by a shift toward sustainable, plant-derived sources and increased applications in both personal care and pharmaceutical sectors. This trend is expected to continue fueling market expansion, with squalene playing a pivotal role in the development of innovative, multifunctional beauty products.

Geopolitical Impact Analysis

Geopolitical factors, such as sanctions, trade barriers, conflicts, and environmental policies, impact the Squalene market by disrupting supply, affecting prices.

The squalene market is significantly influenced by geopolitical factors such as sanctions, trade barriers, and regional conflicts. The ongoing tensions between Israel and Iran have impacted trade, as Iran is a major oil-producing region, and the conflict has disrupted squalene-related exports, leading to supply chain disruptions and rising prices in key markets like the EU and North America.

Additionally, changes in global trade agreements or tariffs, particularly those imposed by the European Union, can affect market access and pricing. In addition, the implementation of free trade agreements may reduce costs and expand market access, potentially reshaping the global dynamics of the squalene trade.

Furthermore, Environmental policies, such as the CITES convention, also play an important role in shaping the market, as they impose restrictions on shark hunting to protect endangered species. These regulations limit the availability of wild-caught sharks and drive the demand for biobased squalene. Geopolitical decisions related to sustainable fishing practices are key to maintaining the long-term viability of both the squalene industry and marine ecosystems.

Moreover, shifting consumer demand for more ethical and environmentally sustainable products is reshaping the Squalene market. As awareness about environmental issues rises, there is a growing trend toward plant-based alternatives, such as biobased Squalene made from sugarcane.

This demand for cruelty-free, eco-friendly products reflects changing attitudes toward sustainability, driving the development and popularity of biobased Squalene alternatives that cater to the increasing preference for more ethical cosmetics, pharmaceutical, and nutraceutical products in the global market.

Regional Analysis

Europe Held the Largest Share of the Global Squalene Market

In 2024, Europe dominated the global squalene market, accounting for 43.6% of the total market share, driven by rising demand for nutraceutical, cosmetics, and pharmaceutical products, supported by increasing awareness of squalene’s benefits for skin and overall health.

The market is experiencing significant growth. The increasing preference for natural, sustainable ingredients, along with greater awareness of skin health and anti-aging benefits and advancements in pharmaceutical applications, are key factors fueling this trend. With the continued rise of clean-label, sustainable, and vegan formulations, squalene is set to play a crucial role in shaping the future of the cosmetics, pharmaceutical, and nutraceutical industries.

The cosmetics and personal care industry, one of the primary consumers of squalene, is particularly well-established in countries such as France, Germany, Italy, and the UK. These nations host leading beauty brands that are actively adopting bio-based squalene from sources like olives and sugarcane to meet consumer demand for clean-label and eco-friendly products. In addition to cosmetics, the pharmaceutical and nutraceutical sectors in Europe are contributing to market growth by incorporating squalene for its proven immunomodulatory, antioxidant, and anti-inflammatory properties.

Government incentives for green chemistry and sustainable raw materials further support innovation and investment in alternative squalene production technologies across the region. Overall, Europe’s commitment to sustainability, combined with a mature consumer base and a supportive regulatory environment, continues to position the region as a key driver in the global transition toward ethical and renewable squalene sources.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the squalene market dominate the market through strategic innovation, premium positioning, and global reach.

Major Key players involved in the global squalene market, such as Amyris, Inc., Evonik Industries AG, Sophim, Kuraray Co., and Arista Industries, maintain their dominance through sustainable innovation, diversified applications, global supply networks, and strong regulatory compliance.

- For instance, Amyris, Inc. produces sustainable, sugarcane-derived squalene and has established significant partnerships and licensing agreements to expand its reach in both cosmetics and pharmaceuticals.

- In addition, Evonik Industries AG’s plant-based squalene (PhytoSquene), derived from amaranth oil, focuses on providing non-animal-derived squalene for pharmaceutical and cosmetic applications.

While small players involve Kishimoto Special Liver Oil Co., Ltd., Nucelis, Oleicfat, Arbee, Gracefruit Ltd, Vestan, and Empresa Figueirense de Pesca, focus on niche markets, regional distribution, and specialized sourcing, often offering marine- or plant-based squalene to cosmetic, nutraceutical, and local healthcare sectors.

- For instance, Nucelis focuses on biotechnology and fermentation-based production of specialty ingredients, including squalene, for personal care and cosmetic applications.

Top Key Players in the Market

- Amyris, Inc.

- KISHIMOTO SPECIAL LIVER OIL CO., LTD.

- SOPHIM

- Nucelis

- Oleicfat

- Arbee

- Evonik Industries AG

- Gracefruit Ltd

- VESTAN

- Empresa Figueirense de Pesca

- Arista Industries

- Kuraray Co., Ltd

- Other Key Players

Recent Developments

- In May 2023, Amyris, Inc. entered an exclusive license agreement with Croda International Plc for the supply and commercialization of its sugarcane-derived, sustainable squalene. Croda will market and distribute the ingredient for pharmaceutical applications, including vaccines. The deal includes upfront and milestone payments totaling $8 million, along with profit-sharing on future sales.

- In October 2023, Evonik launched PhytoSquene, the first GMP-compliant, plant-based squalene derived from amaranth oil, for clinical and commercial use in parenteral drug delivery. The innovation offers a sustainable, high-purity alternative to shark-derived squalene, supporting Evonik’s goal to convert over 70% of its portfolio to Next Generation Solutions by 2032.

Report Scope

Report Features Description Market Value (2024) USD 161.5 Mn Forecast Revenue (2034) USD 393.0 Mn CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Animal, Plants, Synthetic), By Purity (Greater than 95%, 85 to 95%, Less than 85%), By Extraction Method (Molecular Distillation, Supercritical Fluid Extraction (SFE), Counter Current Chromatography (CCC)), By End-use (Personal Care And Cosmetics, Food Supplements, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amyris, Inc., KISHIMOTO SPECIAL LIVER OIL CO., LTD., SOPHIM, Nucelis, Oleicfat, Arbee, Evonik Industries AG, Gracefruit Ltd, VESTAN, Empresa Figueirense de Pesca, Arista Industries, Kuraray Co., Ltd, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amyris, Inc.

- KISHIMOTO SPECIAL LIVER OIL CO., LTD.

- SOPHIM

- Nucelis

- Oleicfat

- Arbee

- Evonik Industries AG

- Gracefruit Ltd

- VESTAN

- Empresa Figueirense de Pesca

- Arista Industries

- Kuraray Co., Ltd

- Other Key Players