Global Hot Sauce Market Size, Share, And Business Benefits By Type (Mild Hot Sauce, Medium Hot Sauce, Very Hot Sauce, Others), By Product Type (Tabasco Pepper Sauce, Habanero Pepper Sauce, Jalapeno Sauce, Sweet and Spicy Sauce, Peanut Butter Hot Sauce, Chipotle Hot Sauce, Asian-Style Hot Sauce, Others), By Packaging (Jars, Bottles, Others), By Application (Cooking Sauce, Table Sauce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145107

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

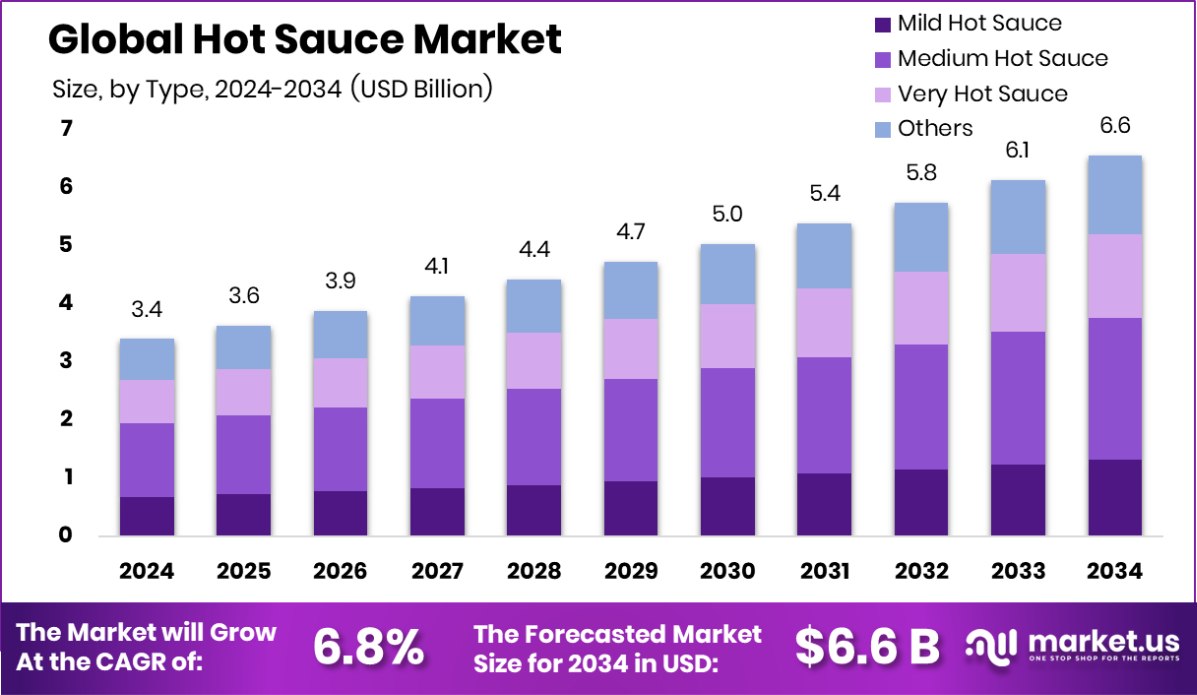

The Global Hot Sauce Market is expected to be worth around USD 6.6 billion by 2034, up from USD 3.4 billion in 2024, and grow at a CAGR of 6.8% from 2025 to 2034. USD 1.5 Bn market value in North America, representing 46.30% of total sales.

Hot sauce is a spicy condiment made primarily from chili peppers mixed with other ingredients such as vinegar, salt, and often fruits or vegetables to enhance the flavor. The intensity and flavor profiles can vary widely, ranging from mild to extremely hot, catering to different taste preferences and culinary uses. Hot sauce is used globally to add heat and depth to dishes.

The hot sauce market comprises the production, distribution, and sale of various types of hot sauces. It caters to a diverse audience who seek to enhance their meals with spiciness. The market has seen growth due to the rising popularity of ethnic cuisines, where hot sauce is a staple, and an increasing consumer preference for bold and spicy food flavors.

The hot sauce market is experiencing growth driven by the global expansion of culinary horizons, with more consumers willing to experiment with new flavors and heat levels. The trend towards ethnic cuisines incorporating spicy elements and a growing interest in gourmet food experiences have significantly contributed to the demand for varied hot sauces.

Demand for hot sauce is bolstered by the rising popularity of fast-casual dining establishments that often feature spicy condiments. Additionally, an increase in home cooking and the consumer shift towards food with perceived health benefits, such as metabolism-boosting from capsaicin in chilies, also play a crucial role.

The market holds opportunities in the form of increasing consumer interest in natural and organic products. Hot sauce producers can capitalize on this trend by offering sauces made from organically grown ingredients without artificial additives. There’s also potential in exploring and introducing global and regional chili varieties to the market, which can attract enthusiasts looking for authentic and novel flavors.

In August 2024, Sauce.vc successfully closed its third fund at INR 365 crore (~$43.6 million), surpassing the target of INR 250 crore. The fund, predominantly backed by domestic investors, plans to initially invest INR 5 crore in 12-15 companies, reserving 75% for follow-on investments into standout performers.

Key Takeaways

- The Global Hot Sauce Market is expected to be worth around USD 6.6 billion by 2034, up from USD 3.4 billion in 2024, and grow at a CAGR of 6.8% from 2025 to 2034.

- The Hot Sauce Market features Medium Hot Sauce as a major category at 37.30%.

- Tabasco Pepper Sauce dominates the product types, holding a 28.30% share of the market.

- Bottles are the preferred packaging for hot sauce, making up 73.40% of the market.

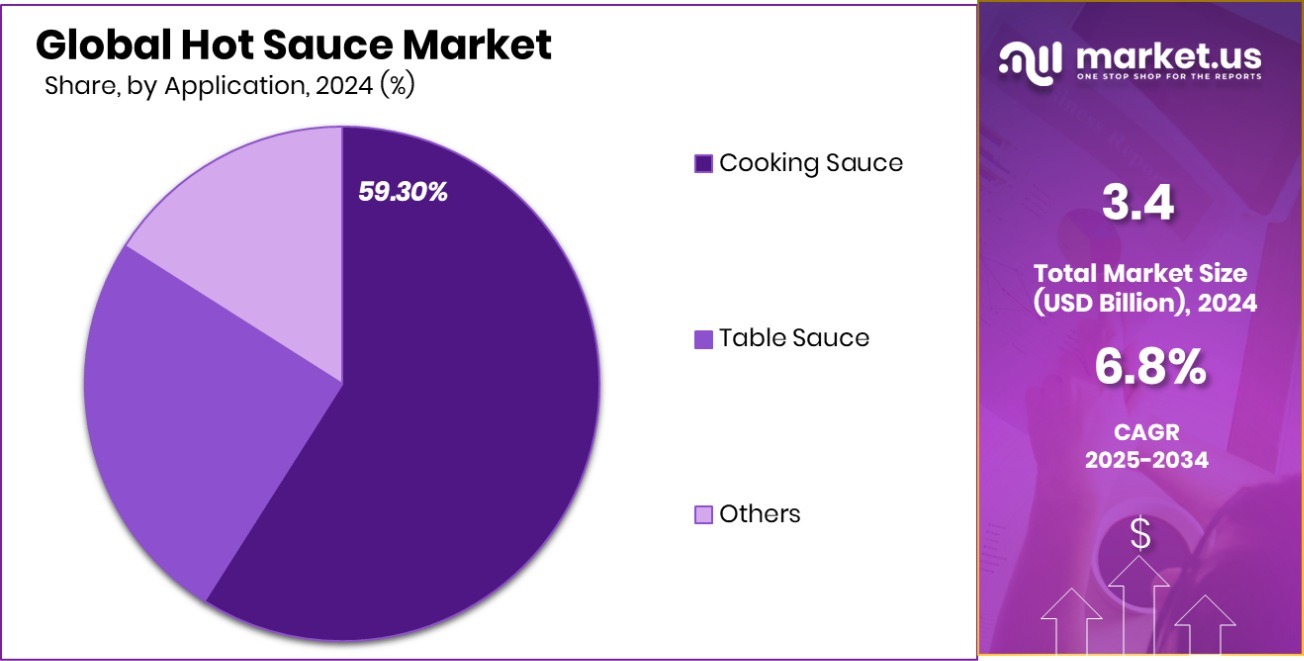

- Cooking Sauce application led the Hot Sauce Market with 59.30% segment share.

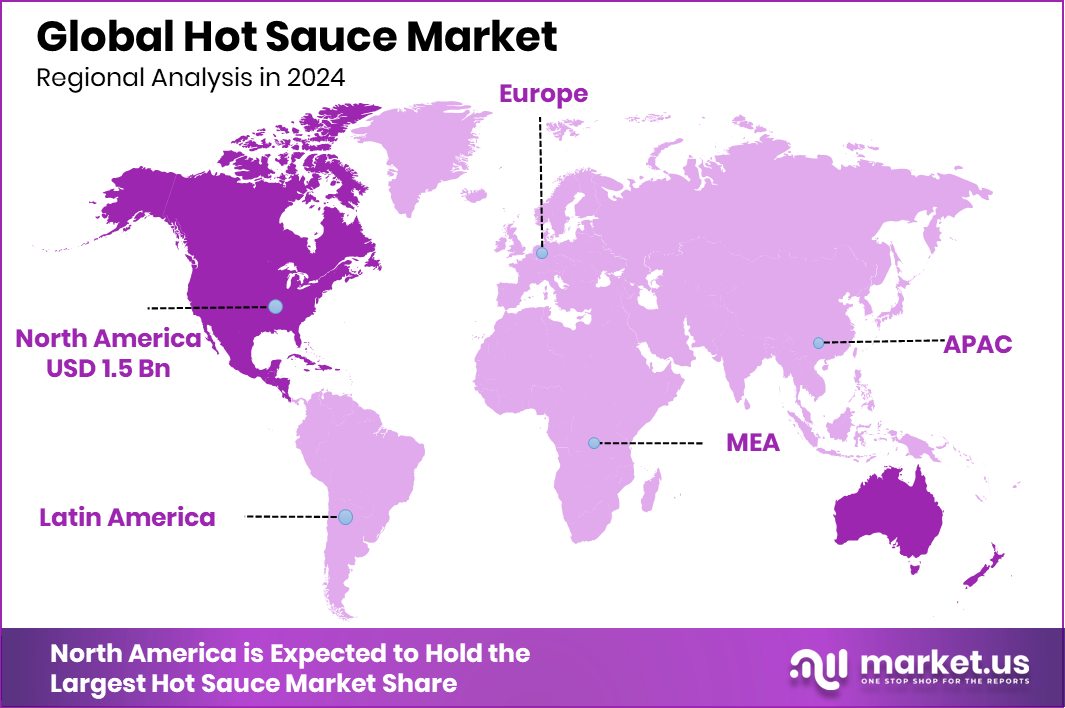

- With a market share of 46.30%, North America dominates, reaching USD 1.5 Bn.

By Type Analysis

Medium Hot Sauce leads the market with a 37.30% share.

In 2024, Medium Hot Sauce held a dominant market position in the “By Type” segment of the Hot Sauce Market, capturing a 37.30% share. This segment’s prominence is attributed to the balanced flavor profile of medium hot sauces, which offer enough heat to satisfy spice lovers without overpowering the dish’s original flavors.

This level of spiciness appeals to a broad audience, making it a staple in many households and restaurants. Medium hot sauces are particularly popular in regions where consumers prefer a moderate level of heat but are keen to explore the nuanced flavors that these sauces bring to different cuisines.

This segment’s strong performance highlights its critical role in the hot sauce market’s overall landscape, where consumer preferences for mild to moderate spice levels drive significant sales volumes. The preference for medium hot sauces underscores a key trend in the market: the desire for flavor complexity coupled with manageable heat levels, which accommodates a wider range of culinary applications and broadens consumer appeal.

By Product Type Analysis

Tabasco Pepper Sauce dominates product types, holding a 28.30% market share.

In 2024, Tabasco Pepper Sauce held a dominant market position in the “By Product Type” segment of the Hot Sauce Market, with a 28.30% share. This iconic sauce, known for its distinctive flavor and moderate heat level, continues to be a favorite among consumers worldwide.

Its success can be attributed to its versatile use across various cuisines and dishes, from breakfast eggs to evening cocktails. Tabasco’s longstanding reputation, coupled with consistent quality, has helped it maintain a strong market presence.

The brand’s strategy to diversify flavor options while keeping the original recipe’s essence has broadened its appeal. Whether used as a cooking ingredient or a tabletop condiment, Tabasco Pepper Sauce enhances meals with just the right amount of heat and acidity. This has cemented its position in kitchens but also in the commercial food service industry.

The market’s affinity for Tabasco Pepper Sauce demonstrates a clear preference for established brands that promise both tradition and innovation. As consumers continue to seek out both familiar and new taste experiences, Tabasco’s steady market share reflects its successful adaptation to evolving culinary trends and consumer preferences.

By Packaging Analysis

Bottles are the preferred packaging, accounting for 73.40% of the market.

In 2024, Bottles held a dominant market position in the “By Packaging” segment of the Hot Sauce Market, with a 73.40% share. This preference for bottled packaging can be attributed to several factors that resonate with both manufacturers and consumers.

Bottles, typically made from glass or plastic, offer a practical and durable solution for preserving the flavor and extending the shelf life of hot sauces. Their transparent nature allows consumers to see the product within, which can be a decisive factor in purchase decisions.

Furthermore, the convenience of bottles with easy-to-use caps or droppers enhances the user experience by allowing precise control over the amount of sauce dispensed, reducing waste and mess. This feature is particularly valued in both household and commercial settings, where efficiency and cleanliness are priorities.

The dominance of bottles in the packaging sector of the hot sauce market also reflects consumer preferences for sustainability and quality. Glass bottles, in particular, are often perceived as more premium and eco-friendly compared to other packaging forms, aligning with the growing consumer trend toward environmentally conscious purchasing decisions.

By Application Analysis

Cooking Sauce held a 59.30% share in the Hot Sauce Market by application in 2024.

In 2024, Cooking Sauce held a dominant market position in the “By Application” segment of the Hot Sauce Market, with a 59.30% share. This leading position reflects the widespread use of hot sauce as a cooking ingredient rather than just a tabletop condiment. Consumers are increasingly incorporating hot sauces directly into their recipes, from marinades and stir-fries to stews and baked dishes, to enhance overall flavor and depth.

The appeal of using hot sauce in cooking lies in its ability to deliver heat, tang, and complexity in a single ingredient, making it an easy and efficient choice for home cooks and professional chefs alike. This trend is particularly noticeable in households that prepare spicy meals regularly or follow global cuisines where cooking sauces are essential.

The dominance of the cooking sauce application also points to a broader culinary shift, where people prefer bold and adventurous flavors even in everyday meals. As consumers experiment more in their kitchens, cooking sauces that incorporate hot sauce have become a pantry staple. This usage supports repeat purchases and larger packaging sizes, which in turn boosts volume sales.

Key Market Segments

By Type

- Mild Hot Sauce

- Medium Hot Sauce

- Very Hot Sauce

- Others

By Product Type

- Tabasco Pepper Sauce

- Habanero Pepper Sauce

- Jalapeno Sauce

- Sweet and Spicy Sauce

- Peanut Butter Hot Sauce

- Chipotle Hot Sauce

- Asian-Style Hot Sauce

- Others

By Packaging

- Jars

- Bottles

- Others

By Application

- Cooking Sauce

- Table Sauce

- Others

Driving Factors

Increasing Demand for Ethnic Cuisines Globally

One of the primary driving factors in the hot sauce market is the increasing consumer interest in ethnic cuisines worldwide. As more people explore diverse food cultures, especially Latin American and Asian, the demand for authentic and flavorful ingredients such as hot sauce is on the rise.

This trend is amplified by the growing popularity of cooking shows and food blogs that showcase international recipes, encouraging home cooks to experiment with new flavors and spicy condiments.

Additionally, the rise in immigration rates has brought a more diverse range of culinary traditions and tastes to various parts of the world, further bolstering the demand for hot sauces as essential components of many traditional dishes.

Restraining Factors

Health Concerns Over Excessive Capsaicin Consumption

A significant restraining factor for the hot sauce market is the health concerns associated with excessive consumption of capsaicin, the active component that gives chili peppers their heat. While many enjoy the zest and flavor enhancement that hot sauces provide, overconsumption can lead to gastrointestinal issues, such as heartburn and stomach ulcers.

Health-conscious consumers are becoming more aware of the potential adverse effects, which can dampen their enthusiasm for high-capacity hot sauces. Additionally, there is a growing trend toward milder flavors among certain demographics, particularly in regions where highly spicy foods are not a traditional part of the local cuisine. This shift in consumer preference can limit the market’s growth in these areas.

Growth Opportunity

Expanding Market in Emerging Economies Worldwide

A key growth opportunity in the hot sauce market lies in the expanding consumer bases within emerging economies. As countries like India, China, and Brazil experience economic growth, their middle-class populations are increasing, leading to greater disposable income and a heightened interest in global cuisine.

This demographic shift presents a significant opportunity for hot sauce brands to introduce their products to new markets where consumers are eager to explore different flavors and culinary traditions.

Moreover, urbanization in these regions is contributing to the availability and popularity of international dining options, further driving demand for diverse condiments like hot sauce. Capitalizing on this trend, companies can achieve substantial growth by catering to the evolving tastes and preferences of these emerging consumer segments.

Latest Trends

Rising Popularity of Artisanal and Craft Sauces

In the hot sauce market, there is a growing trend toward artisanal and craft hot sauces. These products are typically made in smaller batches and boast unique flavor profiles, often using locally sourced or specialty ingredients.

Consumers are increasingly drawn to these authentic, high-quality sauces as they seek out more personalized and distinct food experiences. This trend is supported by a surge in gourmet food shops and online platforms that make it easier for small-scale producers to reach a wider audience.

Additionally, the rise of food festivals and farmer’s markets has provided a platform for these niche producers to showcase their creations directly to consumers, further driving the popularity of craft hot sauce varieties.

Regional Analysis

North America holds 46.30% of the Hot Sauce Market, valued at USD 1.5 Bn.

The global hot sauce market is segmented into five key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America emerges as the dominant region, commanding a substantial 46.30% market share with a market valuation of USD 1.5 billion. This prominence is attributed to a strong consumer preference for spicy foods and the presence of a diverse population that has incorporated hot sauce into their culinary practices.

In Europe, the market is driven by an increasing interest in ethnic cuisines, where hot sauces are being used to enhance traditional dishes. The Asia Pacific region shows promising growth due to rising urbanization and the popularity of spicy condiments in local cuisines. Meanwhile, the Middle East & Africa region is slowly adopting more diverse condiments, including hot sauces, as international trade and culinary cross-pollination increase.

Latin America, with its rich history of chili-based sauces, continues to explore innovative flavors and varieties, contributing to the overall growth of the market in the region. Each region’s unique demographic trends and culinary preferences play a crucial role in shaping the dynamics of the hot sauce market, making it a vibrant and diverse industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the competitive landscape of the global hot sauce market, key players such as Baumer Foods Inc., Campbell Soup Company, and Conagra Brands Inc. are positioned to capitalize significantly on market trends in 2024.

Baumer Foods Inc., renowned for its Crystal Hot Sauce, leverages its long-standing brand reputation to maintain a loyal customer base while expanding its reach through strategic marketing and product diversification. The company focuses on authenticity and regional flavor profiles, which resonate well with consumers seeking traditional, spicy experiences.

Campbell Soup Company, with its broader portfolio of food products, integrates hot sauces into its array of offerings to enhance its cross-category appeal. The company’s focus on quality and innovation, coupled with its robust distribution network, allows it to tap into new segments and reinforce its presence in the hot sauce market.

Conagra Brands Inc., known for its diverse range of food products, including hot sauces under brands like Frank’s RedHot, strategically positions itself through aggressive marketing and consumer engagement strategies. The company capitalizes on the trend toward bold and spicy flavors, particularly among younger demographics.

Top Key Players in the Market

- Baumer Foods Inc.

- Campbell Soup Company

- Conagra Brands Inc.

- Hormel Foods Corporation

- McCormick & Company, Inc.

- McIlhenny Company

- Southeastern Mills, Inc.

- T.W. Garner Food Company

- The Kraft Heinz Company

- Unilever PLC

Recent Developments

- In August 2024, Campbell’s Foodservice introduced three new global soup flavors—Cuban-Style Black Bean, Italian-Style Wedding, and Spicy Harissa White Bean—to its Culinary Reserve line, catering to diverse consumer tastes.

- In October 2023, Conagra Brands’ Vlasic partnered with Frank’s RedHot to introduce spicy Kosher Dill Pickles, blending Frank’s cayenne pepper heat with Vlasic’s dill flavor.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Billion Forecast Revenue (2034) USD 6.6 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mild Hot Sauce, Medium Hot Sauce, Very Hot Sauce, Others), By Product Type (Tabasco Pepper Sauce, Habanero Pepper Sauce, Jalapeno Sauce, Sweet and Spicy Sauce, Peanut Butter Hot Sauce, Chipotle Hot Sauce, Asian-Style Hot Sauce, Others), By Packaging (Jars, Bottles, Others), By Application (Cooking Sauce, Table Sauce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Baumer Foods Inc., Campbell Soup Company, Conagra Brands Inc., Hormel Foods Corporation, McCormick & Company, Inc., McIlhenny Company, Southeastern Mills, Inc., T.W. Garner Food Company, The Kraft Heinz Company, Unilever PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Baumer Foods Inc.

- Campbell Soup Company

- Conagra Brands Inc.

- Hormel Foods Corporation

- McCormick & Company, Inc.

- McIlhenny Company

- Southeastern Mills, Inc.

- T.W. Garner Food Company

- The Kraft Heinz Company

- Unilever PLC