Global Maple Syrup Market By Source (Sugar Maple, Black Maple, Red Maple), By Category (Organic, Conventional), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Sales Channels, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145147

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

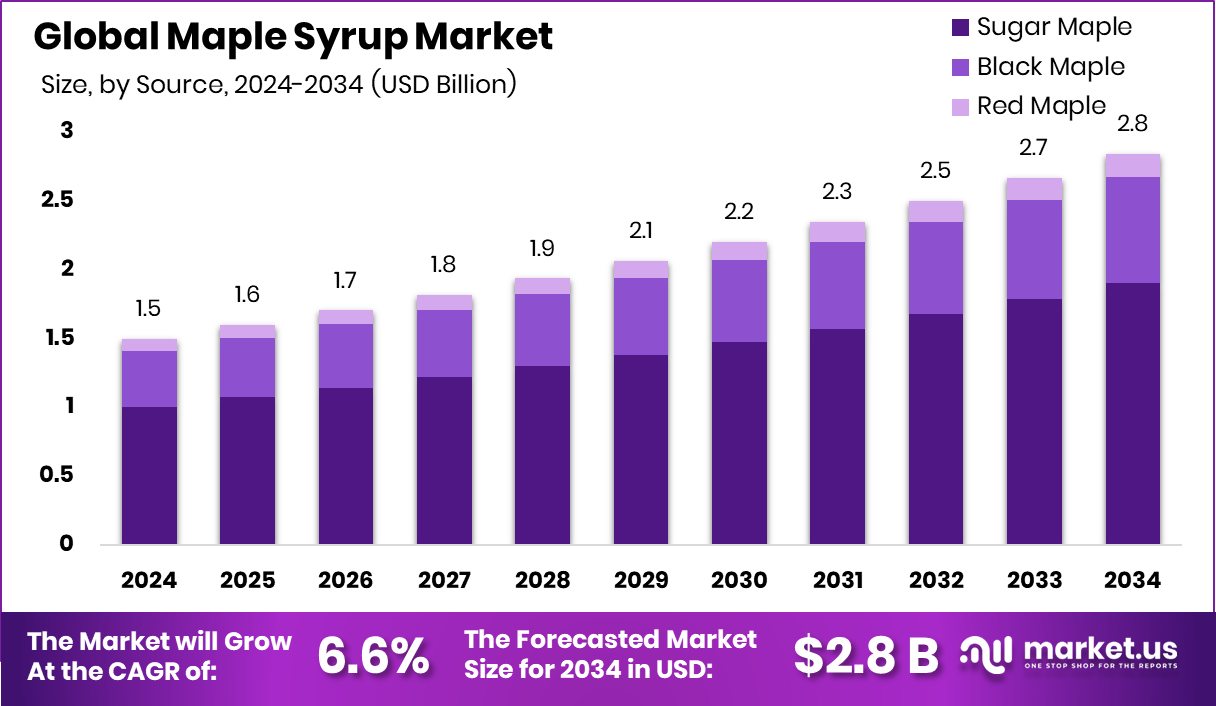

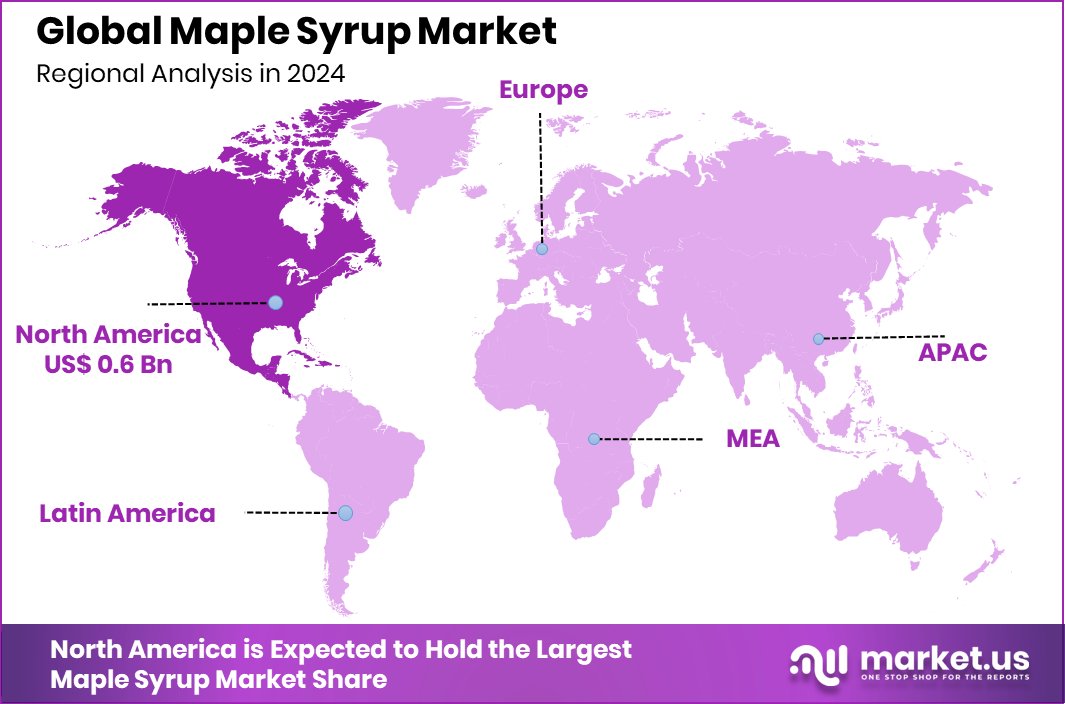

The Global Maple Syrup Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.5 billion in 2024, and grow at a CAGR of 6.6% from 2025 to 2034. Maple Syrup Market in North America achieves USD 0.6 Bn, 46.30% market share.

Maple syrup is a natural sweetener derived from the sap of maple trees, primarily found in the northeastern regions of North America. During the spring, the sap is collected from the trees, then boiled down to produce syrup. It’s known for its distinctive, rich flavor and is commonly used on pancakes and waffles, as well as in baking and cooking.

The Maple Syrup Market refers to the industry that involves the production, distribution, and sale of maple syrup. As a niche but significant market, it caters to a growing consumer base looking for natural and organic sweetener options, differing significantly from artificial sweeteners and other sugar syrups.

Growth factors for the maple syrup market include increasing consumer preference for natural and organic products. As people become more health-conscious, they tend to opt for natural sweeteners over processed ones, boosting the demand for maple syrup. Additionally, the versatility of maple syrup in various culinary applications also contributes to its growing popularity.

Demand for maple syrup is also driven by its use in diverse dietary regimes, including vegan and gluten-free diets. The health benefits, such as being rich in antioxidants and containing nutrients like zinc and manganese, make it a preferred choice among health-aware consumers.

Opportunities in the maple syrup market are vast, with potential for expansion into global markets where natural sweeteners are gaining popularity. Innovative packaging solutions and the introduction of flavor-infused maple syrups offer additional avenues for market growth, appealing to a broader audience looking for gourmet and unique flavor options.

Key Takeaways

- The Global Maple Syrup Market is expected to be worth around USD 2.8 billion by 2034, up from USD 1.5 billion in 2024, and grow at a CAGR of 6.6% from 2025 to 2034.

- Sugar Maple contributes 67.30% to the Maple Syrup Market, dominating the source category.

- Conventional maple syrup holds a 69.30% share, leading in the Maple Syrup Market.

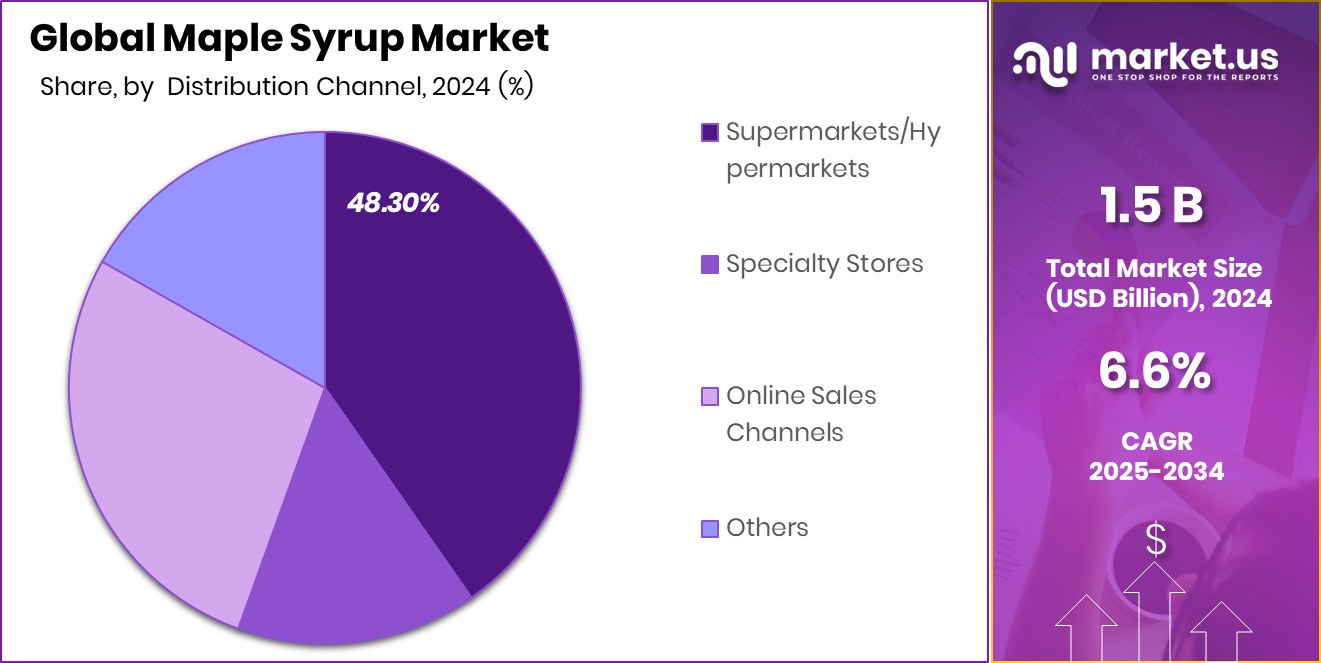

- Supermarkets and hypermarkets distribute 48.30% of maple syrup, being the main sales channel.

- North America dominates with 46.30% of the Maple Syrup Market, reaching USD 0.6 Bn.

By Source Analysis

Sugar Maple accounts for 67.30% of maple syrup sources used globally.

In 2024, Sugar Maple held a dominant market position in the By Source segment of the Maple Syrup Market, commanding a substantial 67.30% share. This significant market share underscores the preference for Sugar Maple sap, known for its superior quality and exceptionally sweet syrup. The majority of maple syrup producers prefer Sugar Maple due to its high sap yield and the robust flavor profile of the syrup it produces, which is highly valued in both domestic and international markets.

This segment’s dominance is further reinforced by traditional syrup-making techniques that are particularly well-suited to Sugar Maple sap. These methods emphasize the natural qualities of the syrup, appealing to consumers seeking authentic, premium-quality natural sweeteners. The enduring popularity of Sugar Maple syrup has encouraged producers to maintain and expand their Sugar Maple tree farms, ensuring a steady production capacity to meet the growing demand.

Moreover, the market segment’s strength is indicative of consumer trends that favor natural and sustainable products. As awareness of health benefits associated with natural sweeteners like maple syrup increases, Sugar Maple’s prominence in the market is expected to continue, supported by both consumer preference and sustainable agricultural practices.

By Source Analysis

Conventional maple syrup leads the market with a 69.30% share.

In 2024, Conventional maple syrup held a dominant market position in the By Category segment of the Maple Syrup Market, with a commanding 69.30% share. This segment’s strong performance is attributed to its widespread availability and generally lower price point compared to organic alternatives. Conventional maple syrup production typically involves more extensive farming practices and the use of certain additives to stabilize the syrup, which makes it accessible to a broader range of consumers.

Despite the growing trend toward organic and natural products, conventional maple syrup remains popular due to its established presence in the market and its acceptance in various culinary contexts—from home kitchens to professional food services. The segment benefits from robust distribution channels that make conventional maple syrup available in supermarkets, convenience stores, and online platforms, ensuring it reaches a wide demographic.

The substantial market share of conventional maple syrup also reflects a degree of consumer resistance to the higher prices of organic syrup, despite the latter’s perceived health and environmental benefits. As long as conventional maple syrup continues to offer a balance of quality and affordability, it is likely to maintain its appeal among cost-conscious consumers who do not prioritize organic certification.

By Distribution Channel Analysis

Supermarkets and hypermarkets distribute 48.30% of the maple syrup sold.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Maple Syrup Market, securing a substantial 48.30% share. This prominence is largely due to the convenience and accessibility these outlets offer, allowing consumers to explore a wide range of maple syrup brands and varieties under one roof.

The strength of supermarkets/hypermarkets in this market segment is supported by their strategic location choices, often in high-traffic areas that guarantee a steady flow of consumers. Additionally, the ability to provide competitive pricing and frequent promotions helps maintain customer interest and boosts sales volumes. These retailers also benefit from strong supply chain efficiencies, which ensure that inventory levels are adequate to meet consumer demand without significant overstocking, thus optimizing both cost and shelf space.

Given their scale, supermarkets and hypermarkets are able to leverage their buying power to negotiate better terms with suppliers, which in turn can be passed on to consumers in the form of lower prices or special offers. This segment’s continued dominance in the distribution channel hierarchy underscores its crucial role in the maple syrup market’s dynamics.

Key Market Segments

By Source

- Sugar Maple

- Black Maple

- Red Maple

By Category

- Organic

- Conventional

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Sales Channels

- Others

Driving Factors

Growing Demand for Natural Sweeteners

As consumers become increasingly health-conscious, there is a noticeable shift towards natural and organic food products. This trend is significantly driving the maple syrup market. Maple syrup, known for being a natural sweetener, is gaining popularity as people look for healthier alternatives to refined sugar and artificial sweeteners.

Its rich mineral content and antioxidants not only make it a healthier choice but also add to its appeal as a versatile ingredient in a variety of dishes. As awareness of the benefits of natural sweeteners spreads, the demand for maple syrup continues to rise, influencing production rates and market dynamics.

Restraining Factors

High Production Costs Limit Market Growth

Maple syrup production involves a labor-intensive process that significantly drives up costs, acting as a primary restraining factor in the market. From tapping trees to boiling the sap into syrup, each step requires careful handling and considerable time, contributing to higher final product prices.

Additionally, the seasonal nature of sap collection can lead to variability in production volumes, further influencing costs and market supply. These high production expenses are often passed onto consumers, making maple syrup less competitive against cheaper sweetener alternatives. This pricing barrier can deter budget-conscious consumers, limiting the market’s expansion.

Growth Opportunity

Expansion into International and Emerging Markets

The global expansion of the maple syrup market presents a significant growth opportunity. As maple syrup is primarily produced in North America, its introduction to international markets, especially in regions where natural and organic products are becoming more popular, could lead to substantial growth.

There is a growing curiosity and appreciation for diverse, international flavors among consumers worldwide, which maple syrup can satisfy with its unique taste profile. Tapping into emerging markets with targeted marketing strategies that highlight maple syrup’s natural and healthful properties could open new avenues for sales.

Additionally, establishing partnerships with local distributors can help overcome logistical challenges, making maple syrup more accessible globally and driving further market expansion.

Latest Trends

Flavor Innovation Enhances Maple Syrup Appeal

One of the latest trends in the maple syrup market is the introduction of innovative flavor-infused syrups. Producers are now offering maple syrup combined with a variety of flavors such as vanilla, cinnamon, and even spicy chili. This trend caters to the growing consumer desire for new and unique taste experiences in their food.

Flavor-infused maple syrups are especially popular among younger demographics who are eager to experiment with different culinary combinations. These new products are not only revitalizing traditional uses of maple syrup in breakfast foods but are also expanding its application in desserts, beverages, and even savory dishes.

Regional Analysis

In North America, the Maple Syrup Market holds 46.30%, valued at USD 0.6 Bn.

The Maple Syrup Market showcases significant regional diversity, with North America leading as the dominant region, holding a substantial 46.30% market share and valued at USD 0.6 billion. This is largely due to the extensive maple tree forests in Canada and the northeastern United States, making it a central hub for production and consumption.

In Europe, the market is growing steadily, driven by increasing consumer interest in natural and organic food products. European consumers are incorporating maple syrup into traditional dishes, expanding beyond typical breakfast applications. The Asia Pacific region is witnessing a burgeoning market for maple syrup, facilitated by rising health awareness and the incorporation of Western dietary habits.

Meanwhile, in the Middle East & Africa, and Latin America, the market is still in its nascent stages. However, these regions present untapped opportunities due to growing urbanization and the rising middle class, which are gradually developing a taste for diverse and international flavors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the global maple syrup market, B & G Foods, Inc., The J.M. Smucker Co., and the Federation of Quebec Maple Syrup Producers stand as pivotal players as of 2024. Each company brings unique strengths and strategies to the table, shaping the industry’s dynamics.

B & G Foods, Inc. has consistently demonstrated robust distribution capabilities, leveraging its extensive network to enhance maple syrup accessibility across diverse markets. This strategy not only fortifies its market position but also enables it to respond swiftly to shifting consumer preferences, a critical advantage in adapting to the increasing demand for organic and natural food products.

The J.M. Smucker Co., renowned for its strong brand portfolio, continues to invest in brand development and marketing initiatives that resonate well with consumers. Its focus on sustainability and ethical sourcing appeals to the environmentally conscious consumer, thereby strengthening its brand loyalty and expanding its consumer base. The company’s strategic acquisitions have also broadened its reach, making it a formidable competitor in the maple syrup segment.

The Federation of Quebec Maple Syrup Producers, which plays a crucial role in regulating the supply of maple syrup, has been instrumental in stabilizing prices and ensuring quality control. Their efforts in promoting maple syrup globally have not only benefited Quebec’s producers but have also positioned the region as a leader in quality maple syrup production.

Top Key Players in the Market

- B & G Foods, Inc.

- The J.M. Smucker Co.

- Federation of Quebec Maple Syrup Producers

- Les Industries Bernard et Fils Ltee

- LB Maple Treat

- Bascom Maple Farms Inc

- Butternut Mountain Farm

- Ferguson Farm Vermont Maple Syrup

- Conagra Brands Inc.

- Coombs Family Farms

Recent Developments

- In February 2025, Pure Maple launched a rebrand featuring modern packaging and introduced organic maple syrups, responding to increasing consumer demand for organic products.

- In September 2024, QMSP reported a record-breaking harvest of 239 million pounds of maple syrup, significantly surpassing previous years. This achievement was attributed to favorable weather conditions and the addition of new taps to meet growing demand.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Sugar Maple, Black Maple, Red Maple), By Category (Organic, Conventional), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Sales Channels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape B & G Foods, Inc., The J.M. Smucker Co., Federation of Quebec Maple Syrup Producers, Les Industries Bernard et Fils Ltee, LB Maple Treat, Bascom Maple Farms Inc, Butternut Mountain Farm, Ferguson Farm Vermont Maple Syrup, Conagra Brands Inc., Coombs Family Farm Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- B & G Foods, Inc.

- The J.M. Smucker Co.

- Federation of Quebec Maple Syrup Producers

- Les Industries Bernard et Fils Ltee

- LB Maple Treat

- Bascom Maple Farms Inc

- Butternut Mountain Farm

- Ferguson Farm Vermont Maple Syrup

- Conagra Brands Inc.

- Coombs Family Farms