Global Water-soluble CBD Market By Type (CBD Isolate, Full-Spectrum CBD, Broad-Spectrum CBD), By Form (Powder, Liquid), By Distribution Channel (Direct Sales/B2B, Indirect Sales/B2C, Supermarkets/Hypermarkets), By End-use (Food And Beverages, Personal Care and Cosmetics, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 147124

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

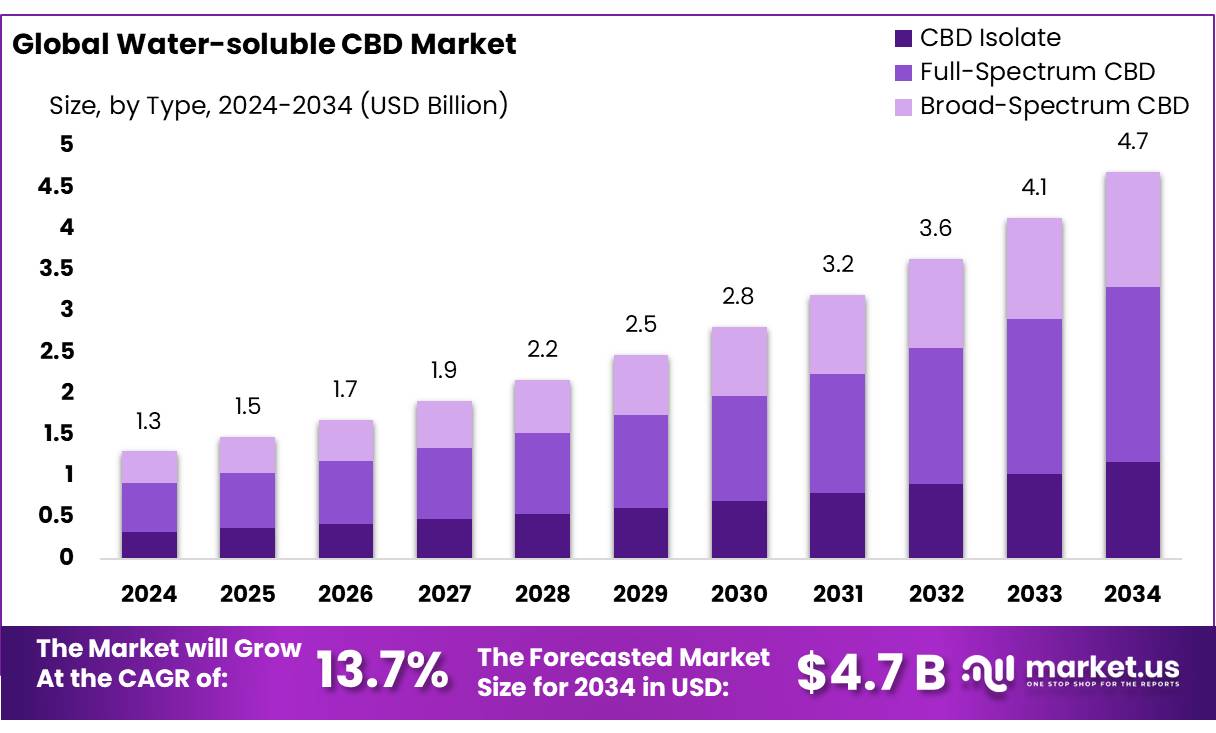

The Global Water-soluble CBD Market size is expected to be worth around USD 4.7 Bn by 2034, from USD 1.3 Bn in 2024, growing at a CAGR of 13.7% during the forecast period from 2025 to 2034.

Water-soluble Cannabidiol (CBD) is a next-generation form of CBD that has been engineered using nanotechnology to break down CBD molecules into tiny, water-dispersible particles, significantly improving their absorption and bioavailability in the body. Unlike traditional oil-based CBD, water-soluble CBD allows for faster onset of effects and more consistent dosing, addressing key challenges such as poor solubility and variable absorption.

This advancement has expanded the application of CBD into a wide range of consumer-friendly formats, including functional beverages, wellness supplements, skincare products, and ready-to-drink (RTD) teas and waters. As global demand for clean-label, plant-based wellness products rises, the water-soluble CBD market is gaining strong momentum across health, beauty, and food & beverage industries, driven by consumer preference for fast-acting, easily integrated solutions and supported by evolving regulatory frameworks in regions such as North America and Europe.

- The U.S. Department of Agriculture (USDA) reports that the acreage used for hemp (the primary source of CBD) in the United States increased from 32,464 acres in 2018 to over 146,000 acres in 2021, reflecting the growing demand for CBD-based products, including water-soluble formulations.

Several factors are driving the market’s momentum. Firstly, consumer demand for functional health products is escalating. According to the World Health Organization (WHO), 70% of adults globally are actively seeking preventive healthcare solutions, such as wellness supplements and fortified beverages.

Key Takeaways

- The global water-soluble CBD market was valued at USD 1.3 billion in 2024.

- The global water-soluble CBD market is projected to grow at a CAGR of 13.7 % and is estimated to reach USD 4.7 billion by 2034.

- Among types, full-spectrum CBD accounted for the largest market share of 45.3%.

- Among forms, powder accounted for the majority of the market share at 67.9%.

- By distribution channel, indirect sales/B2C accounted for the majority of the market share at 57.4%.

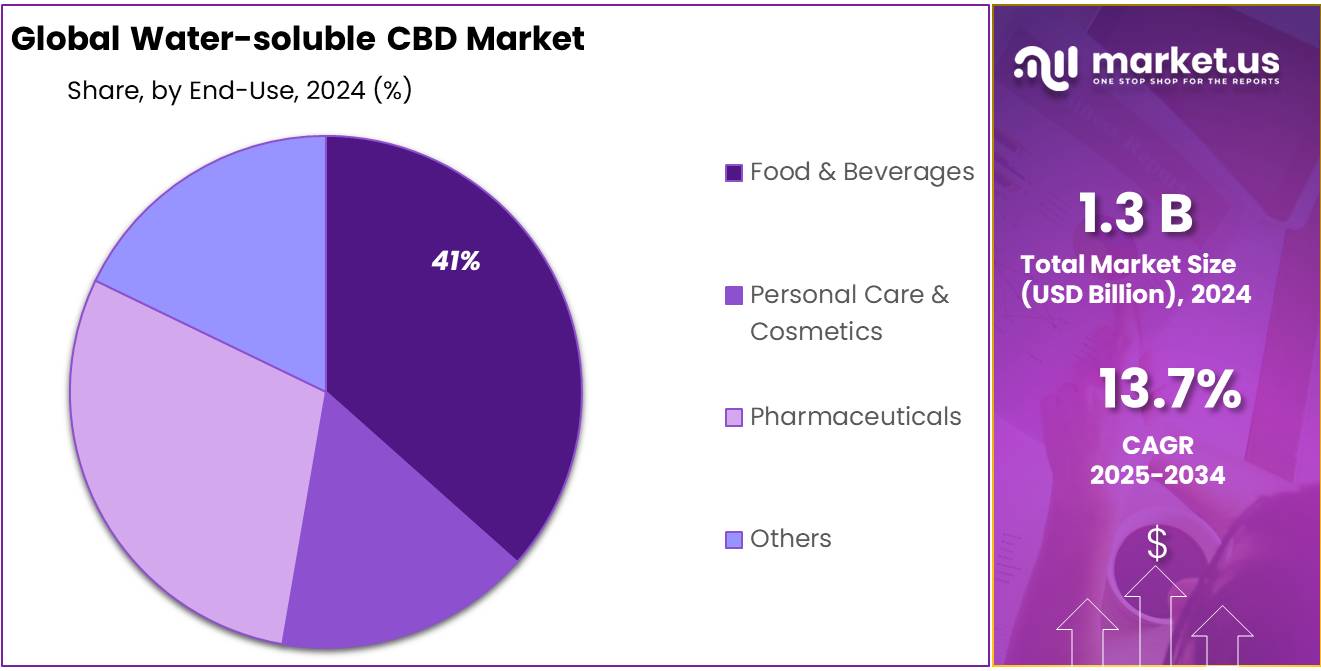

- Among end-use, food & beverages accounted for the largest market share of 41.8%

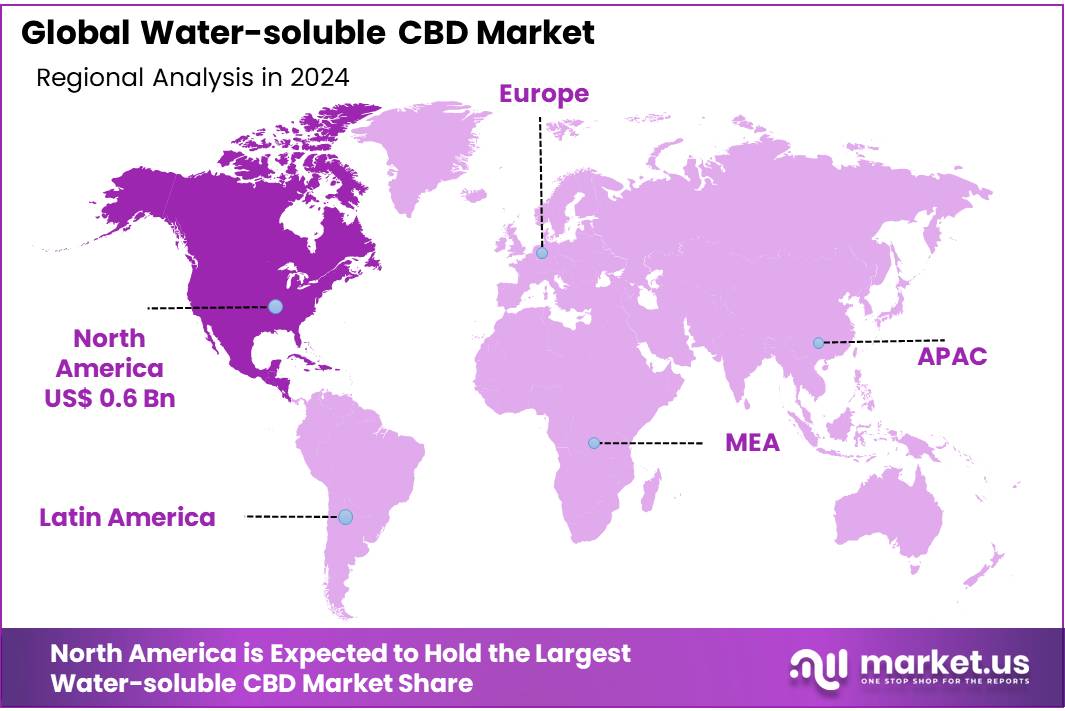

- North America is estimated as the largest market for Water-soluble CBDwith a share of 51.50% of the market share.

- Water-soluble cannabinoids provide higher bioavailability and more consistent effects than conventional oil-based CBD products.

- Advanced technologies such as nanoemulsions and liposomal encapsulation are used to improve cannabinoid solubility in water-based formulations.

- Enhanced absorption allows for quicker onset and more precise dosing, making water-soluble CBD ideal for functional food, beverage, and supplement applications.

By Type

Full-Spectrum CBD Holding Major Share In Water-Soluble CBD Market

The water-soluble CBD market is segmented based on type into CBD isolate, full-spectrum CBD, and broad-spectrum CBD. In 2024, the full-spectrum CBD segment held a significant revenue share of 45.3%. Due to its enhanced therapeutic potential and compatibility with a wide range of health and wellness applications. Full-spectrum CBD is a type of cannabidiol extract that contains all the naturally occurring compounds found in the cannabis plant, including cannabinoids, terpenes, flavonoids, and trace THC.

Water-soluble full-spectrum CBD delivers the benefits of the “entourage effect” with improved bioavailability and faster absorption. This makes it especially attractive for functional beverages, dietary supplements, and clinical nutrition products where quick onset and consistent dosing are required. As demand rises for natural, multi-functional ingredients in stress relief, pain management, and sleep support, water-soluble full-spectrum CBD is increasingly preferred by both manufacturers and health-conscious consumers seeking effective and convenient wellness solutions.

By Form

Powder Form Dominates Water-Soluble CBD Market

Based on form, the market is further divided into powder and liquid. The predominance of the powder, commanding a substantial 67.9% market share in 2024. Due to its convenience, versatility, and extended shelf life compared to liquid formulations. This format allows for precise dosage control and can be easily incorporated into a wide range of products, including supplements, clinical nutrition items, baked goods, tinctures, tablets, and especially ready-to-make beverages like stick-packs.

Its rapid dissolution in liquids makes it ideal for health-conscious consumers seeking stress relief, immune support, and overall wellness. Powdered water-soluble CBD is particularly well-suited for markets prioritizing clean-label, easy-to-use solutions in both everyday and specialized nutrition applications.

By Distribution Channel

Indirect Sales/B2C Segment Emerging As The Dominant Channel In Water-Soluble CBD Market

By distribution channel, the market is categorized into direct sales/B2B and indirect sales/B2C, with the Indirect Sales/B2C segment emerging as the dominant channel, holding 57.4 % of the total market share in 2024. Due to its scalability, wider reach, and cost-effectiveness for manufacturers. In this model, products are sold through third-party retailers, distributors, e-commerce platforms, health stores, and wholesalers rather than directly from the producer to the consumer.

This approach provides an opportunity for CBD brands to access established retail channels and leverage the marketing infrastructure of large distributors or online platforms, increasing visibility and consumer access across various regions. Moreover, indirect sales are particularly effective in navigating the complex and varied legal frameworks governing CBD around the world. By partnering with regional distributors familiar with local regulations and consumer preferences, brands can enter new markets more efficiently.

This strategy also reduces the logistical and compliance burden on manufacturers, allowing them to focus on product innovation and brand development. Making indirect distribution continues to be the dominant channel in markets where CBD regulation, consumer education, and retail integration are still evolving.

By End-use

Food & Beverages sector leads the market, Water-soluble CBD Market

In terms of end-use, the water-soluble CBD market comprises food & beverages, personal care & cosmetics, pharmaceuticals, and others. In 2024, food & beverages led the market, accounting for a dominant 41.8% share. Due to its enhanced bioavailability and versatility, water-soluble CBD can be easily incorporated into a wide range of products, including beverages such as sparkling water, teas, and cocktails, as well as edibles like baked goods, salad dressings, and everyday meals.

Oil-based CBD, water-soluble CBD mixes seamlessly with foods and drinks, allowing consumers to add it to their morning coffee, smoothies, or even soups without affecting taste or texture. This flexibility makes it an ideal choice for manufacturers and consumers seeking convenient, effective ways to include CBD in their daily routines.

Key Market Segments

By Type

- CBD Isolate

- Full-Spectrum CBD

- Broad-Spectrum CBD

By Form

- Powder

- Liquid

By Distribution Channel

- Direct Sales/B2B

- Indirect Sales/B2C

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

By End-use

- Food & Beverages

- Bakery & Confectionery

- Nutraceuticals

- Beverages

- Others

- Personal Care & Cosmetics

- Skin Care Products

- Hair Care Products

- Lip Care Products

- Others

- Pharmaceuticals

- Others

Drivers

Increasing demand for functional food and beverages.

The increasing demand for functional foods and beverages is a major factor driving the growth of the global water-soluble CBD market. As consumers prioritize health and wellness, they are seeking products that offer more than just flavor, demanding beverages that support relaxation, recovery, sleep, and overall well-being. Water-soluble CBD formulations align with this trend by offering enhanced bioavailability and seamless integration into everyday drinks such as tea, coffee, smoothies, and sports beverages. The versatility of CBD allows consumers to incorporate it into their daily routines.

- For instance, according to the National Institutes of Health (NIH) survey reports state that nearly 14% of U.S. adults had tried CBD products by 2022, with a significant portion preferring beverages and edibles for their convenience and perceived health benefits.

Moreover, growing acceptance of cannabis-derived products is increasing, and many people are becoming more aware of CBD’s potential health benefits. These include pain relief, reduced anxiety, better sleep, and anti-inflammatory effects. CBD-infused drinks are also becoming popular among adults as a natural alternative to alcohol, providing a calming effect without the unwanted side effects. In response, brands are rapidly investing in research and development to innovate a variety of creative and functional CBD beverages, further expanding water-soluble CBD demand in the food and beverages sector.

Restraints

Competition from other wellness ingredients

Competition from other wellness ingredients is emerging as a key factor restraining the growth of the global water-soluble CBD market. Novel cannabinoids such as CBG (cannabigerol), CBN (cannabinol), and CBC (cannabichromene) are gaining momentum in the wellness space due to their distinct therapeutic benefits, drawing consumer interest and investment away from CBD-focused formulations. As scientific research and product development around these lesser-known cannabinoids expand, they are increasingly positioned as differentiated alternatives to CBD.

Additionally, the functional foods and beverages sector is already saturated with a range of established wellness ingredients such as adaptogens (e.g., ashwagandha), probiotics, nootropics, and botanical extracts that compete directly with CBD. These ingredients often come with clearer regulatory pathways and more consumer familiarity, making them attractive to both brands and consumers. This heightened competition makes it more challenging for water-soluble CBD products to stand out, especially in categories where functional claims and consumer trust are critical.

Opportunity

CBD-infused cosmetics and healthcare products

The CBD-infused cosmetics and healthcare products, creating significant opportunities for the growth of the global water-soluble CBD market. Nowadays, consumer interest is growing in natural and plant-based products, especially in the cosmetics and personal care sectors. More consumers are seeking alternatives to synthetic chemicals in their skincare and beauty routines, natural ingredients such as CBD for their potential anti-inflammatory, pain-relieving, hydrating, and anti-aging benefits, making CBD an emerging key component in meeting those expectations. Manufacturers from these sectors, Water-soluble CBD, widely used in topical products such as creams, gels, lotions, and serums, are fueling its role in the expanding natural beauty and personal care market.

- For instance, according to NSF, a leading global public health and safety organization, reports state that 74% of consumers consider organic ingredients important when choosing personal care products. Additionally, 65% of consumers prefer products with clear ingredient lists, enabling them to identify and avoid potentially harmful substances. This trend reflects a growing consumer demand for transparency and clean, natural formulations in the beauty and personal care industry.

This shift is encouraging brands to innovate and diversify their product lines with CBD-infused skincare and healthcare items that cater to a wide range of needs and preferences. Water-soluble CBD, with its enhanced absorption and flexibility in formulation, allows manufacturers to develop more effective and appealing cosmetic products.

Its improved absorption and ease of formulation make it ideal for delivering targeted relief for conditions like joint pain, muscle soreness, acne, and dry skin. This expanding use of CBD in cosmetics and healthcare is not only broadening its consumer base but also opening new opportunities for growth in the wellness and beauty industries, further contributing to its global market demand.

Trends

Rapid development in Nano-CBD technologies

The rapid advancement of nano-CBD technologies is significantly transforming the growth of the global water-soluble CBD market. As consumer demand rises, the cannabis industry is facing challenges in overcoming the limitations of traditional cannabinoid delivery methods. CBD, due to its lipophilic nature, dissolves easily in fats but poorly in water, limiting its compatibility with water-based formulations and significantly reducing their bioavailability, especially when consumed orally, due to slow absorption and breakdown in the liver.

Nanoemulsion technology is emerging as a key innovation, addressing these limitations and unlocking new growth opportunities within the water-soluble CBD market. By encapsulating cannabinoids in nanoscale droplets, nanoemulsions improve solubility, enhance bioavailability, and provide greater formulation stability.

This technology not only elevates product performance but also enhances user experience across various applications, from oral consumption to topical use. In skincare and wellness products, nanoemulsions enable deeper skin penetration and more efficient receptor interaction, improving outcomes for localized pain relief and inflammation.

Furthermore, nanoemulsion systems offer the potential for targeted delivery and controlled release, making them highly attractive for pharmaceutical development. These advancements are driving a new wave of cannabinoid product innovation and shaping emerging trends in both consumer and medical markets globally.

Geopolitical Impact Analysis

The geopolitical landscape significantly impacts the water-soluble CBD market by influencing trade policies, international relations, and supply chain dynamics.

The geopolitical landscape exerts a significant influence on the dynamics of the water-soluble CBD market. This encompasses aspects such as trade policies, international relations, and global supply chain dynamics, which collectively shape market operations, investment flows, and technological advancements within this burgeoning sector. Especially, trade policies and tariffs play a critical role.

The imposition of tariffs on Countries that rely on exports of essential ingredients, including cannabidiol, may face challenges if their key trading partners impose tariffs or trade barriers. For example, tensions between major producers of raw ingredients, such as China, the United States, and Europe, can lead to disruptions in the supply of key cannabidiol and hemp.

Furthermore, trade agreements and international regulations play a crucial role in shaping the water-soluble CBD markets. As free trade agreements between countries can ease the flow of raw materials and finished products, making water-soluble CBD more affordable and accessible to consumers.

Conversely, protectionist policies, such as tariffs on imported water-soluble CBD or raw ingredients, can increase production costs, leading to higher prices for end consumers. Regulatory standards and safety concerns related to supplements vary by country, and governments with strict regulations can influence market entry, product formulations, and labeling requirements for international brands.

Regional Analysis

North America Held the Largest Share of the Global Water-Soluble CBD Market

In 2024, North America dominated the global water-soluble CBD market, accounting for 51.5 % of the total market share, Driven by increasing consumer awareness of the health benefits associated with water-soluble CBD, countries such as USA, Mexico, and Canada are witnessing a rising demand for water-soluble CBD in Food & Beverages, personal care and pharmaceutical sectors.

Consumers from these regions focus on preventative health and wellness. Seeking functional beverages that support health goals such as relaxation, pain relief, sleep improvement, and mood enhancement. Water-soluble CBD is ideal for this trend, as it mixes well into drinks such as tea, coffee, flavored water, and sports beverages while maintaining high bioavailability.

Furthermore, regions with growing favorable government regulations and strong consumer demand for clean-label, natural products are significantly driving the water-soluble CBD market. In North America, governments have taken important steps to legalize and regulate CBD, creating a supportive environment for innovation and commercialization.

- For instance, in the United States, the 2018 Farm Bill legalized the cultivation and sale of hemp-derived CBD products containing less than 0.3% THC, providing a clear legal framework for manufacturers. This has encouraged the development of a wide range of CBD-infused products, including beverages, supplements, and topicals.

- In addition, Canada’s full cannabis legalization under the Cannabis Act allows for both the production and sale of CBD products, further promoting industry growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players In The Water-Soluble CBD Market Dominate The Market Through Strategic Innovation, Premium Positioning, And Global Reach.

Key players in the global water-soluble CBD market include companies like Isodiol International Inc., Prinova Group LLC, and CBD Hemp Experts, all of which specialize in nano-technology and microencapsulation to enhance bioavailability and product stability. OROCAN GmbH and Le Herbe, Inc. are also leading the way with premium hemp-derived products and growing consumer trust in North America and Europe. Beverage-focused brands such as Chilco River Holdings, Nuleaf Naturals LLC, and Arvanna LLC are expanding the market through innovative ready-to-drink CBD beverages. These companies are driving market growth by leveraging advanced formulation technologies and tapping into wellness-focused consumer trends.

Top Key Players in the Market

- Isodiol International Inc

- Prinova Group LLC

- CBD Hemp Experts

- OROCAN GmbH

- Le Herbe, Inc.

- International CBD Supply

- Simply Soluble CBD

- Hanma Investment Group Co., Ltd. (HMI Group)

- Elixinol LLC

- Nuleaf Naturals LLC

- BIOTA Biosciences LLC

- Arvanna LLC

- Isan Global

- Beneficial Blends

- Chilco River Holdings

- Other Key Players

Recent Development

- In November 2023 – Chilco River Holdings, Inc. acquired Colorado-based American Hemp Brands, Inc., a producer of nano-emulsified, water-soluble cannabinoid formulations designed to enhance bioavailability and absorption in edibles, beverages, and topicals. This strategic acquisition positions Chilco to expand its footprint in the high-margin cannabinoid sector with scalable, customizable nano-emulsion technology.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 4.7 Bn CAGR (2025-2034) 13.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (CBD Isolate, Full-Spectrum CBD, Broad-Spectrum CBD), By Form (Powder, Liquid), By Distribution Channel (Direct Sales/B2B, Indirect Sales/B2C, Supermarkets/Hypermarkets), By End-use (Food And Beverages, Personal Care and Cosmetics, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Isodiol International Inc, Prinova Group LLC, CBD Hemp Experts, OROCAN GmbH, Le Herbe, Inc., International CBD Supply, Simply Soluble CBD, Hanma Investment Group Co., Ltd. (HMI Group), Elixinol LLC, Nuleaf Naturals LLC, BIOTA Biosciences LLC, Arvanna LLC, Isan Global, Beneficial Blends, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Isodiol International Inc

- Prinova Group LLC

- CBD Hemp Experts

- OROCAN GmbH

- Le Herbe, Inc.

- International CBD Supply

- Simply Soluble CBD

- Hanma Investment Group Co., Ltd. (HMI Group)

- Elixinol LLC

- Nuleaf Naturals LLC

- BIOTA Biosciences LLC

- Arvanna LLC

- Isan Global

- Beneficial Blends

- Other Key Players