Global Instant Coffee Market Size, Share, And Business Benefits By Material (Freeze-dried, Spray-dried), By Flavoring (Flavored Instant Coffee, Unflavored Instant Coffee), By Packaging (Jars, Sachets, Pouches, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147230

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

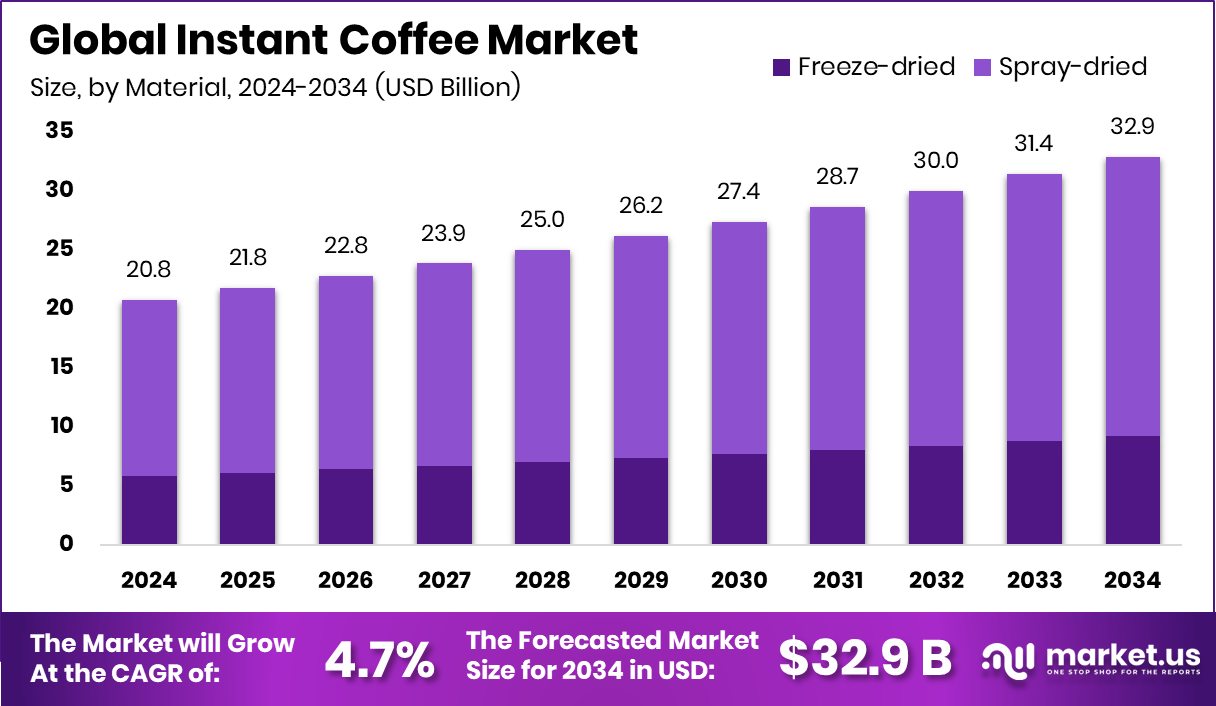

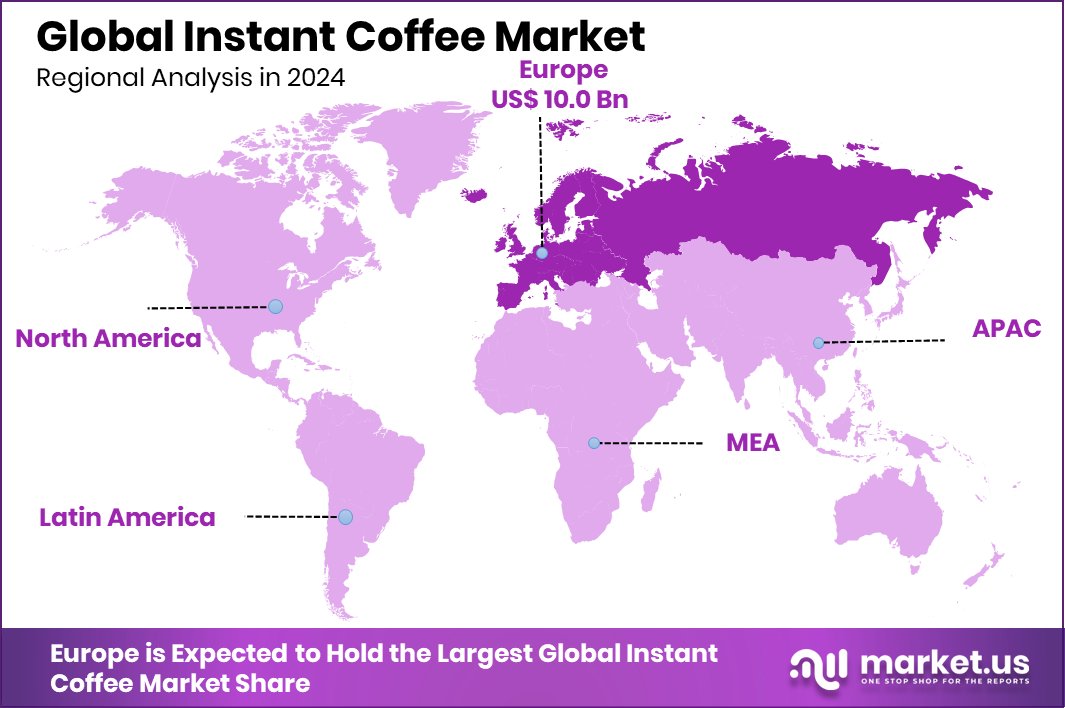

Global Instant Coffee Market is expected to be worth around USD 32.9 billion by 2034, up from USD 20.8 billion in 2024, and grow at a CAGR of 4.7% from 2025 to 2034. Instant coffee sales in Europe totaled USD 10.0 Bn, accounting for 48.1%.

Instant coffee, or soluble coffee, is a beverage derived from brewed coffee beans. It enables users to quickly prepare hot coffee by adding hot water or milk to the powdered or granulated coffee. The convenience and speed of preparation make instant coffee a popular choice among those who seek a quick caffeine fix without the time-consuming process of brewing.

The instant coffee market is experiencing growth due to the increasing demand for convenience foods and beverages driven by the fast-paced lifestyle of consumers worldwide. The development and expansion of the retail sector have also facilitated the easy availability of instant coffee, boosting its market growth. Furthermore, innovations in flavor and packaging are making instant coffee more appealing to a broader consumer base, including younger demographics who value quick and convenient meal options.

Demand for instant coffee continues to surge as consumers increasingly seek convenience and speed in their routines. The global rise in coffee consumption and the growing awareness of various coffee types among consumers support the market’s expansion. This demand is also spurred by the increasing number of workplaces adopting modern amenities, providing coffee options to employees as a standard benefit.

Several key developments highlight the dynamic nature of the instant coffee market. For instance, Quick-service restaurant chain First Coffee recently secured $1.2 million in a seed funding round led by BEENEXT. Additionally, Blue Tokai Coffee Roasters has successfully raised $35 million in a Series C funding round, underscoring the growing investor interest in specialty coffee brands.

Moreover, GRM Overseas has taken a significant 44% stake in Rage Coffee, reflecting the FMCG sector’s growing focus on the coffee market. Lastly, The Coffee’s progressive funding rounds, culminating in a substantial $10 million Series C round in October 2023, illustrate the sector’s robust investment activity and potential for expansion.

Key Takeaways

- Global Instant Coffee Market is expected to be worth around USD 32.9 billion by 2034, up from USD 20.8 billion in 2024, and grow at a CAGR of 4.7% from 2025 to 2034.

- Spray-dried instant coffee dominates the market, holding a substantial 72.3% material segment share.

- Unflavored instant coffee remains most popular, capturing 76.1% of the market by flavoring preference.

- Sachets are a preferred packaging choice, accounting for 37.4% of instant coffee packaging.

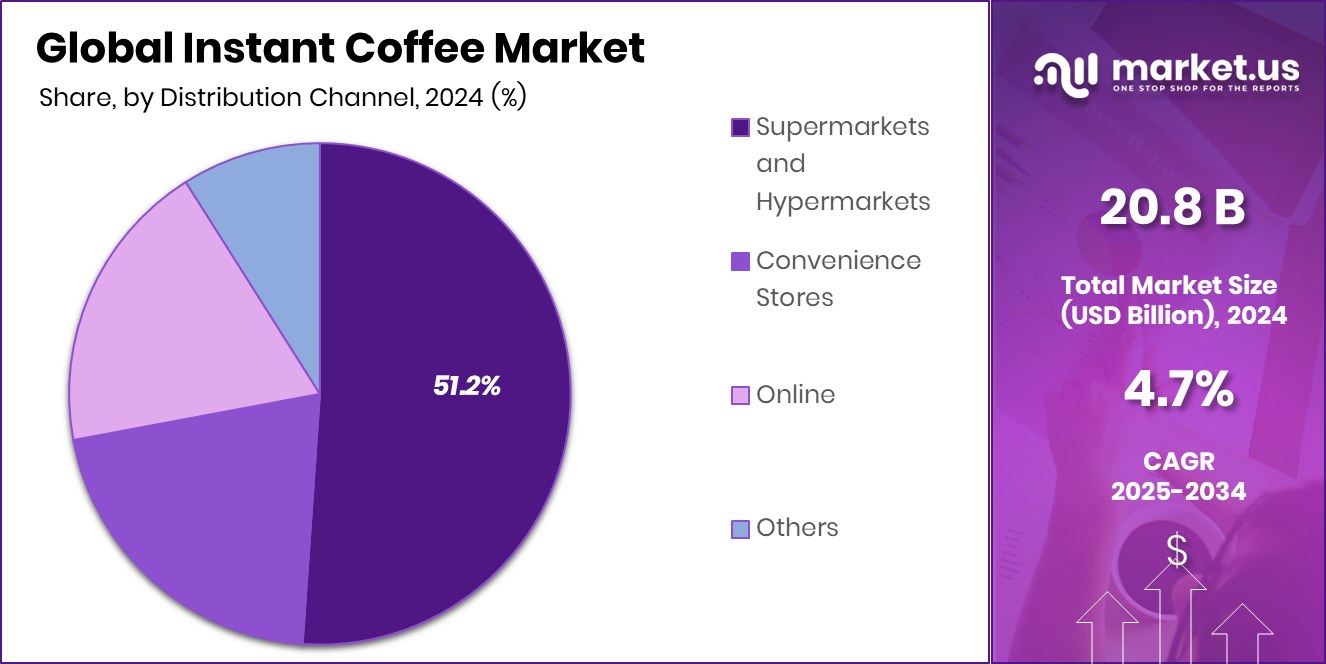

- Supermarkets and hypermarkets are leading distribution channels, with a 51.2% market share.

- Europe dominates global instant coffee demand, holding a strong 48.1% market share value.

By Material Analysis

Spray-dried dominates with 72.3% of the instant coffee market.

In 2024, Spray-dried held a dominant market position in the by-material segment of the instant coffee market, with a 72.3% share. This high share reflects the widespread industrial preference for spray-drying technology, which is cost-effective and enables large-scale production without compromising the basic aroma of coffee. Spray-dried coffee is typically more affordable and has a longer shelf life, making it a popular choice across mass-market brands, institutional buyers, and private-label product lines.

The segment’s dominance also stems from strong consumer demand in price-sensitive markets, especially in emerging economies where affordability outweighs premium flavor retention. Spray-dried coffee granules are also more soluble and convenient for use in sachets and vending machines, aligning with the rising consumption of single-serve instant coffee formats.

Moreover, manufacturers continue to invest in optimizing spray-drying processes to enhance quality while reducing energy consumption, further reinforcing their commercial viability. This material form is also favored in the foodservice sector and by private retailers due to its ease of handling during packaging and transport.

By Flavoring Analysis

Unflavored instant coffee holds a 76.1% share, leading flavor preferences.

In 2024, Unflavored Instant Coffee held a dominant market position in the by-flavoring segment of the instant coffee market, with a 76.1% share. This segment’s strong performance is driven by its wide appeal across both traditional and emerging coffee-drinking populations. Unflavored instant coffee is perceived as a purer form, offering a taste that closely resembles freshly brewed coffee, which attracts consumers who prioritize authenticity and simplicity in their daily beverages.

Its dominance is also influenced by the preference for customizability. Consumers and foodservice providers often prefer unflavored coffee as a base, allowing them to add milk, sugar, spices, or syrups as per their liking. This flexibility supports its large-scale adoption in home kitchens, office pantries, and quick-service restaurants.

The unflavored segment also benefits from higher demand in bulk purchasing across institutional buyers, particularly in emerging regions where flavored options are still considered niche. Additionally, unflavored variants often carry lower production costs and longer shelf life, making them more accessible in rural and cost-sensitive markets.

By Packaging Analysis

Sachets are preferred by 37.4% and are convenient for single-serving use.

In 2024, sachets held a dominant market position in the by-packaging segment of the instant coffee market, with a 37.4% share. This dominance reflects the growing global preference for convenience-driven, portion-controlled packaging formats. Sachets have become especially popular among urban consumers, travelers, office-goers, and younger demographics who seek quick, mess-free coffee preparation without the need for additional equipment.

The 37.4% share captured by sachets is also supported by their strong distribution across supermarkets, hypermarkets, and e-commerce platforms. These single-serve units are easy to stock, transport, and sell, making them highly attractive for both retailers and end-users. Moreover, sachets are cost-effective for manufacturers and allow for extended shelf stability, even in humid or tropical environments.

Their popularity is further reinforced in price-sensitive markets where sachets are sold as low-cost daily consumables, often priced to meet the needs of lower- and middle-income households. The portability and affordability of sachets have also fueled their use in institutional setups like airlines, hotels, and healthcare facilities.

By Distribution Channel Analysis

Supermarkets and hypermarkets account for 51.2% of sales, the most popular.

In 2024, supermarkets and hypermarkets held a dominant market position in the direct distribution channel segment of the instant coffee market, with a 51.2% share. This strong presence is largely due to their expansive shelf space, widespread geographic reach, and the trust they enjoy among both urban and semi-urban consumers. These retail formats offer a wide variety of instant coffee brands and packaging options, allowing shoppers to compare prices, flavors, and sizes conveniently under one roof.

The 51.2% share also reflects consumer behavior favoring physical inspection of products before purchase, especially for food and beverages. Instant coffee is often bought in bulk or multipacks in these outlets, driven by promotional pricing and bundle offers. Supermarkets and hypermarkets further benefit from impulse buying, with coffee frequently placed in high-visibility areas to attract spontaneous purchases.

Additionally, these retail channels serve as a key point of entry for new product launches, allowing brands to gain quick consumer exposure. Their established logistics networks and inventory management systems also help maintain steady availability and reduce stockouts, which is crucial for daily-consumption items like instant coffee.

Key Market Segments

By Material

- Freeze-dried

- Spray-dried

By Flavoring

- Flavored Instant Coffee

- Unflavored Instant Coffee

By Packaging

- Jars

- Sachets

- Pouches

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Driving Factors

Rising Urbanization and Fast Lifestyles Boost Demand

One of the top driving factors in the instant coffee market is the fast-paced lifestyle brought on by growing urbanization. As more people move to cities and work longer hours, convenience becomes a priority in daily routines. Instant coffee fits perfectly into this lifestyle because it’s quick to prepare, easy to carry, and requires no brewing equipment.

Busy professionals, students, and travelers all prefer instant coffee for its speed and simplicity. The rise in dual-income households and smaller living spaces has also contributed to the shift toward easy-to-make beverages. As cities grow and schedules tighten, the demand for instant coffee continues to increase, making it a vital product in modern daily consumption habits.

Restraining Factors

Taste and Quality Concerns Limit Consumer Adoption

A major restraining factor in the instant coffee market is consumer concern over taste and quality. Compared to freshly brewed coffee, many people find instant coffee to have a weaker aroma and less rich flavor. Coffee enthusiasts often avoid it because it lacks the depth and freshness they expect. Additionally, certain instant coffee products contain additives or are over-processed, which can affect taste and health perception.

These concerns especially influence premium coffee consumers who prefer using beans or capsules. As more people become aware of coffee origins and brewing techniques, the demand for better-tasting options grows. Unless quality improves, this gap between convenience and flavor may continue to limit the wider appeal of instant coffee.

Growth Opportunity

Expansion in Emerging Markets Offers Huge Potential

A big growth opportunity for the instant coffee market lies in emerging markets like India, Indonesia, and parts of Africa. These regions are seeing rising incomes, rapid urbanization, and changing lifestyles, which are creating strong demand for convenient food and beverage options. Instant coffee, being affordable and easy to prepare, fits perfectly into this growing need.

Younger consumers in these regions are becoming more open to trying new beverages, including coffee, which was once less popular than tea. With increasing exposure through supermarkets, online platforms, and café culture, instant coffee is gaining popularity. Companies that invest in localized flavors, attractive pricing, and small packaging sizes can benefit greatly from this expanding and still under-tapped market segment.

Latest Trends

Premium Instant Coffee Pods Gain Popularity

A notable trend in the instant coffee market is the growing preference for premium instant coffee pods and single-serve formats. These products offer convenience and a consistent, high-quality coffee experience, aligning with the busy lifestyles of modern consumers. The appeal lies in their ability to deliver café-style flavors without the need for brewing equipment, making them ideal for home, office, or travel use.

Manufacturers are responding to this demand by introducing a variety of flavors and blends in pod formats, catering to diverse taste preferences. The innovation in this segment includes the development of gourmet and artisanal options, reflecting a shift towards more sophisticated instant coffee offerings.

This trend is further supported by advancements in packaging technology, ensuring freshness and ease of use. As consumers continue to seek convenient yet premium coffee solutions, the popularity of instant coffee pods and single-serve formats is expected to rise, influencing the overall dynamics of the instant coffee market.

Regional Analysis

In Europe, the instant coffee market reached USD 10.0 Bn with a 48.1% share.

In 2024, Europe emerged as the leading region in the Instant Coffee Market, accounting for a dominant 48.1% share valued at USD 10.0 billion. The region’s established coffee culture, coupled with high consumer preference for convenient beverage options, has sustained strong demand for instant coffee across both Western and Eastern European countries.

Supermarkets and hypermarkets in Europe serve as key distribution points, enhancing product visibility and accessibility to a broad customer base. Meanwhile, North America follows closely, driven by the increasing adoption of on-the-go coffee solutions among working professionals and students.

The Asia Pacific region is witnessing rising consumption due to urbanization and shifting consumer lifestyles, particularly in countries like India and China, although specific data was not disclosed.

In Latin America, cultural affinity toward coffee continues to support steady market expansion, especially in countries with growing middle-class populations. The Middle East & Africa region also presents emerging opportunities as coffee drinking habits spread beyond traditional markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global instant coffee market witnessed significant contributions from key players: Kraft Heinz Company, The Coca-Cola Company, and JAB Holding Company.

Kraft Heinz Company continued to leverage its well-established brand, Maxwell House, to maintain a strong presence in the instant coffee segment. The company’s focus on affordability and widespread distribution channels allowed it to cater effectively to a broad consumer base seeking convenient coffee options. By emphasizing value-driven products, Kraft Heinz sustained its relevance in a competitive market.

The Coca-Cola Company, through its acquisition of Costa Coffee, aimed to diversify its beverage portfolio by entering the coffee market. However, in 2024, Costa Coffee faced challenges, particularly in the UK, where it experienced a 3% decline in sales for the year. Factors such as increased coffee bean prices and cost-of-living pressures impacted consumer spending on coffee, affecting Coca-Cola’s performance in this segment.

JAB Holding Company solidified its position as a dominant force in the coffee industry through its subsidiary, JDE Peet’s. In 2024, JDE Peet’s reported organic sales growth of 3.6% in the first half of the year, maintaining leading positions in 39 markets. JAB’s strategic investments and expansive portfolio underscored its commitment to capturing a significant share of the global instant coffee market.

Top Key Players in the Market

- Kraft Heinz Company

- The Coca-Cola Company

- JAB Holding Company

- Jacobs Douwe Egberts

- Kraft Foods Inc.

- Luigi Lavazza SpA

- Matthew Algie & Company Ltd.

- Nestlé SA

- Starbucks Corporation

- Strauss Group Ltd.

- Tata Consumer Products Limited

- Tchibo Coffee International Ltd.

- Unilever PLC

Recent Developments

- In April 2025, Lavazza introduced Tablì, a new single-serve coffee system unveiled at Milan Design Week. This innovative machine uses a capsule-free “coffee tab” made entirely from compressed coffee, aiming to reduce waste from traditional plastic and aluminum capsules. The Tablì system is set to launch in Italy in September 2025.

- In July 2023, Kraft Heinz introduced a new instant coffee product under its Maxwell House brand called “Iced Latte with Foam.” This product is designed to make it easy for consumers to prepare a café-style iced latte at home. It comes in three flavors: Vanilla, Hazelnut, and Caramel. Each box contains six sachets, and the preparation involves adding cold water and stirring to create a foamy iced latte.

Report Scope

Report Features Description Market Value (2024) USD 20.8 Billion Forecast Revenue (2034) USD 32.9 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Freeze-dried, Spray-dried), By Flavoring (Flavored Instant Coffee, Unflavored Instant Coffee), By Packaging (Jars, Sachets, Pouches, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kraft Heinz Company, The Coca-Cola Company, JAB Holding Company, Jacobs Douwe Egberts, Kraft Foods Inc., Luigi Lavazza SpA, Matthew Algie & Company Ltd., Nestlé SA, Starbucks Corporation, Strauss Group Ltd., Tata Consumer Products Limited, Tchibo Coffee International Ltd., Unilever PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kraft Heinz Company

- The Coca-Cola Company

- JAB Holding Company

- Jacobs Douwe Egberts

- Kraft Foods Inc.

- Luigi Lavazza SpA

- Matthew Algie & Company Ltd.

- Nestlé SA

- Starbucks Corporation

- Strauss Group Ltd.

- Tata Consumer Products Limited

- Tchibo Coffee International Ltd.

- Unilever PLC