Global Immunology Market By Drug Class (Monoclonal Antibody (mAb), Immunosuppressants, and Others), By Application (Psoriatic Arthritis, Rheumatoid Arthritis, Plaque Psoriasis, Inflammatory Bowel Disease, Ankylosing Spondylitis, and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143367

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

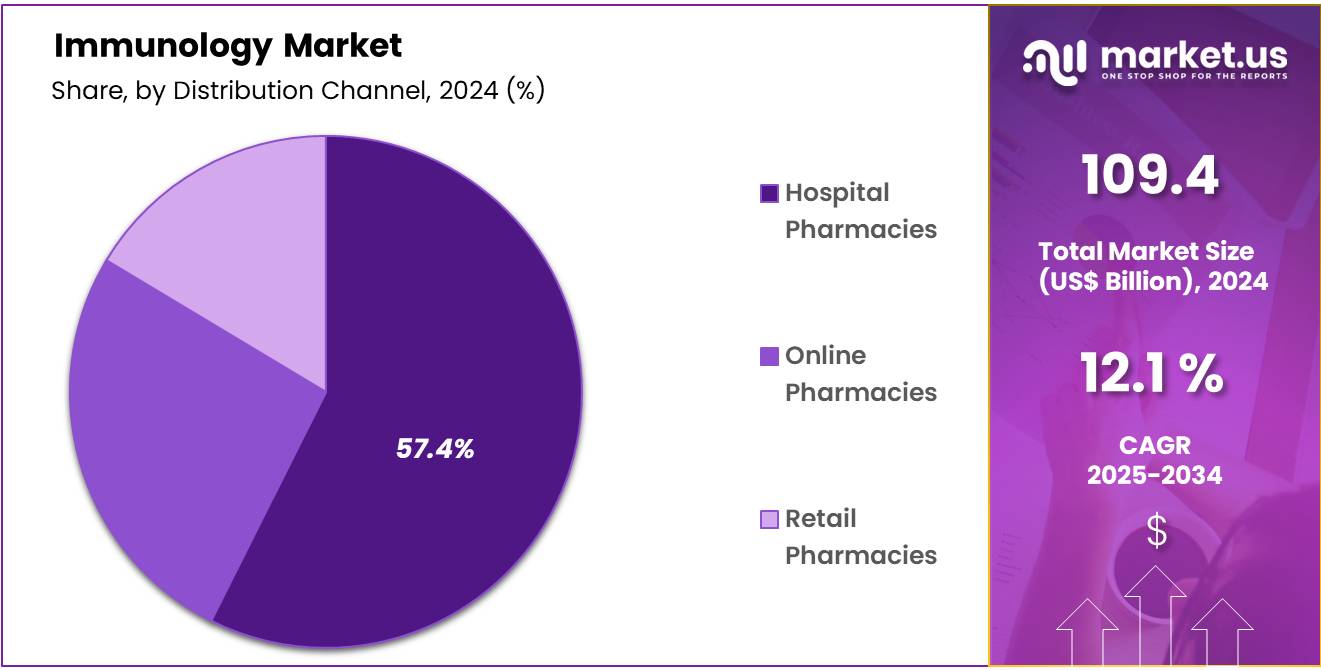

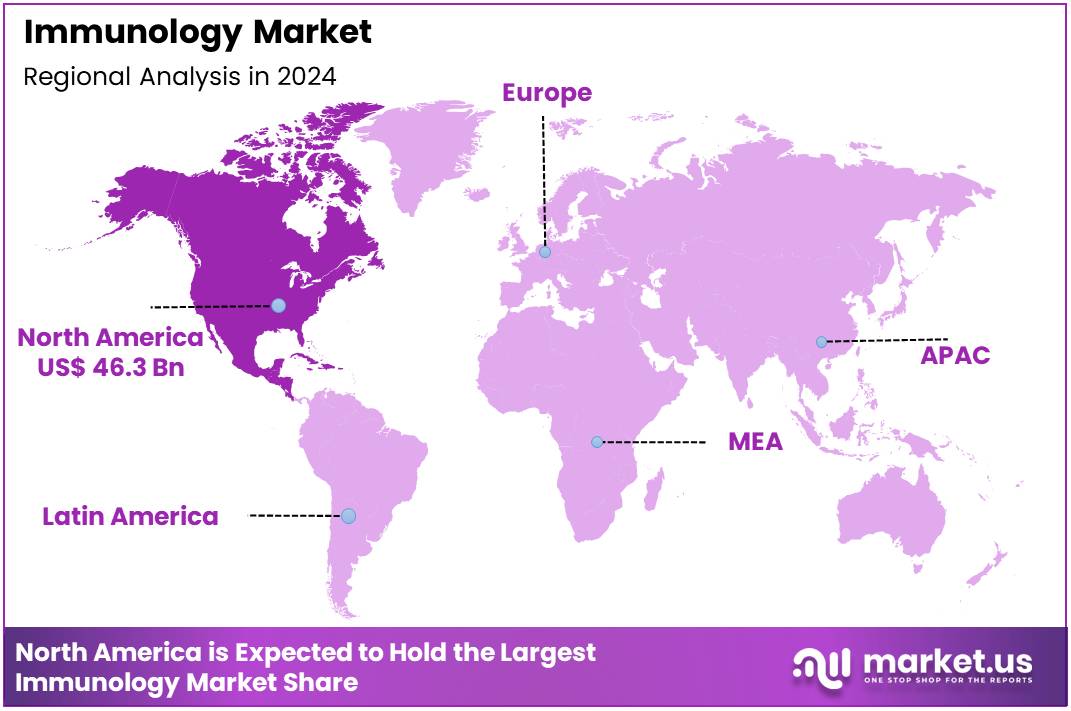

Global Immunology Market size is expected to be worth around US$ 342.8 Billion by 2034 from US$ 109.4 Billion in 2024, growing at a CAGR of 12.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.3% share with a revenue of US$ 46.3 Billion.

Increasing demand for advanced treatments in autoimmune diseases and chronic conditions is propelling the growth of the immunology market. Immunology plays a vital role in understanding and treating a wide range of diseases, including allergies, autoimmune disorders, and chronic inflammatory conditions.

The market is driven by ongoing advancements in immunotherapy, precision medicine, and biotechnology, all aimed at enhancing treatment outcomes and providing more targeted therapies. In recent years, the approval of new biologic drugs has fueled opportunities in the market.

For instance, in October 2023, Novartis AG secured US FDA approval for Cosentyx, making it the first and only authorized treatment for hidradenitis suppurativa (HS), a chronic inflammatory skin condition. Such innovations highlight the increasing shift toward personalized medicine and biologic therapies, especially for rare and complex diseases. The immunology market is expected to continue expanding as pharmaceutical companies invest in developing new treatments that address unmet medical needs, particularly in immuno-oncology and autoimmune disorders.

Key Takeaways

- In 2024, the market for immunology generated a revenue of US$ 109.4 billion, with a CAGR of 12.1%, and is expected to reach US$ 342.8 billion by the year 2033.

- The drug class segment is divided into monoclonal antibody (mAb), immunosuppressants, and others, with monoclonal antibody (mAb) taking the lead in 2024 with a market share of 64.3%.

- Considering application, the market is divided into psoriatic arthritis, rheumatoid arthritis, plaque psoriasis, inflammatory bowel disease, ankylosing spondylitis, and others. Among these, rheumatoid arthritis held a significant share of 44.7%.

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, online pharmacies, and retail pharmacies. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 57.4% in the immunology market.

- North America led the market by securing a market share of 42.3% in 2024.

Drug Class Analysis

The monoclonal antibody (mAb) segment led in 2024, claiming a market share of 64.3% owing to the increasing number of monoclonal antibody therapies being approved for various immunological disorders. mAbs have proven to be highly effective in treating conditions like cancer, autoimmune diseases, and inflammatory disorders, which are expected to drive demand. The growing focus on targeted therapies, which provide more precise treatments with fewer side effects, is likely to further boost the adoption of mAb-based treatments.

As more mAbs are developed for different disease indications, including rheumatoid arthritis, Crohn’s disease, and psoriasis, the market for monoclonal antibodies is anticipated to expand. Additionally, the increasing use of biosimilars is projected to make these therapies more accessible, driving further growth in this segment.

Application Analysis

The rheumatoid arthritis held a significant share of 44.7% as the prevalence of this autoimmune condition increases globally. The rising number of people diagnosed with rheumatoid arthritis (RA), coupled with the growing understanding of its pathophysiology, is expected to drive demand for advanced immunological treatments.

As biologic therapies, such as tumor necrosis factor (TNF) inhibitors and interleukin inhibitors, become more widely adopted, the effectiveness of RA treatments is likely to improve. The continued development of new, more targeted therapies for RA is anticipated to further fuel growth in this segment. Additionally, the aging population and the increasing awareness of early diagnosis and treatment are expected to contribute to the continued expansion of the rheumatoid arthritis market within immunology.

Distribution Channel Analysis

The hospital pharmacies segment had a tremendous growth rate, with a revenue share of 57.4% as hospitals continue to be the primary setting for the administration of biologic and immunosuppressive therapies. Hospital pharmacies play a crucial role in managing and dispensing these specialized medications, especially for patients with complex immunological conditions like rheumatoid arthritis, lupus, and multiple sclerosis.

The growing adoption of biologics, which often require specialized handling and administration, is likely to drive the demand for hospital pharmacy services. Additionally, the increasing prevalence of chronic diseases and autoimmune disorders is expected to lead to higher prescription volumes in hospital settings. As hospitals focus on improving patient outcomes and managing complex therapies, the hospital pharmacies segment is projected to continue its growth.

Key Market Segments

Drug Class

- Monoclonal Antibody (mAb)

- Immunosuppressants

- Others

Application

- Psoriatic Arthritis

- Rheumatoid Arthritis

- Plaque Psoriasis

- Inflammatory Bowel Disease

- Ankylosing Spondylitis

- Others

Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Drivers

Increasing Prevalence of Autoimmune Diseases is Driving the Market

The rising prevalence of autoimmune diseases, such as rheumatoid arthritis, lupus, and multiple sclerosis, is a significant driver of the immunology market. Approximately 50 million Americans suffer from autoimmune diseases, with the number increasing annually. In 2023, the World Health Organization (WHO) reported a global rise in autoimmune conditions, particularly in developed nations, due to factors like aging populations and environmental triggers.Pharmaceutical companies like AbbVie and Johnson & Johnson have capitalized on this trend, with AbbVie’s immunology portfolio, including Humira, generating US$21.2 billion in 2022. The growing demand for biologics and targeted therapies to manage these chronic conditions is propelling market growth, with the global immunology market projected to reach US$150 billion by 2024.

Restraints

High Cost of Biologic Therapies is Restraining the Market

The high cost of biologic therapies is a major restraint in the immunology market. Biologics, which are often the first line of treatment for autoimmune diseases, can cost patients tens of thousands of dollars annually. For instance, in 2023, the average annual cost of biologic treatments like Humira and Stelara ranged between US$50,000 and US$70,000 per patient in the US.This financial burden limits access, particularly in low- and middle-income countries, where healthcare budgets are constrained. Additionally, biosimilars, while cheaper, face regulatory and adoption challenges, slowing their market penetration. The high R&D costs associated with developing biologics further exacerbate pricing issues, creating barriers for both patients and healthcare systems.

Opportunities

Advancements in Personalized Medicine are Creating Growth Opportunities

The shift toward personalized medicine is creating significant growth opportunities in the immunology market. Advances in genomics, biomarker research, and AI-driven drug discovery are enabling the development of tailored therapies for patients with autoimmune diseases.In 2023, Roche announced a US$1.5 billion investment in personalized immunology treatments, focusing on biomarkers to predict treatment responses. Similarly, Novartis reported a 20% increase in revenue from its precision medicine portfolio in 2022, driven by therapies like Cosentyx. The global personalized medicine market is expected to experience rapid growth, with personalized therapies playing a key role in driving innovation within the immunology sector.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors are significantly influencing the immunology market, creating both challenges and opportunities. Rising inflation and supply chain disruptions have increased production costs for pharmaceutical companies, leading to higher drug prices and strained healthcare budgets. For instance, the COVID-19 pandemic exacerbated supply chain issues, delaying the delivery of critical raw materials for biologic manufacturing.

However, increased government funding for healthcare infrastructure, particularly in emerging markets, is boosting market growth. Geopolitical tensions, such as the US-China trade war, have disrupted global trade, but they have also spurred investments in domestic manufacturing capabilities.

Regulatory harmonization efforts, like the FDA’s Biosimilar Action Plan, are streamlining approvals and fostering innovation. Despite these challenges, the immunology market remains resilient, driven by technological advancements and a growing focus on patient-centric care, ensuring a positive outlook for the future.

Latest Trends

Rising Adoption of Biosimilars is a Recent Trend

The increasing adoption of biosimilars is a notable trend in the immunology market, driven by the need for cost-effective alternatives to expensive biologics. In 2023, the FDA approved several biosimilars, including Amjevita (a Humira biosimilar) and Cyltezo, which are expected to save the US healthcare system US$54 billion over the next decade.Europe has also seen significant uptake, with biosimilars accounting for over US$6 billion in revenue in 2022. This trend is reshaping the competitive landscape, driving down costs, and improving patient access to life-saving treatments.

Regional Analysis

North America is leading the Immunology Market

North America dominated the market with the highest revenue share of 42.3% owing to advancements in biologics, increased prevalence of autoimmune diseases, and robust healthcare infrastructure. According to the Centers for Disease Control and Prevention (CDC), autoimmune diseases such as rheumatoid arthritis and lupus affect approximately 23.5 million Americans, with rising diagnoses fueling demand for innovative therapies.

The US Food and Drug Administration (FDA) approved 12 new immunology-related drugs in 2023 alone, including biologics targeting interleukin inhibitors and JAK inhibitors, reflecting accelerated innovation in the sector. Additionally, the National Institutes of Health (NIH) reported a 15% increase in funding for immunology research in 2023, reaching 21.2 billion in global sales in 2022, despite biosimilar competition.

The Canadian government’s investment of US$1.2 billion in life sciences and biotechnology in 2023 further bolstered regional growth. These factors, combined with increased patient awareness and access to advanced therapies, have solidified North America’s position as a leader in the immunology market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising healthcare expenditure, an increasing prevalence of chronic diseases, and expanding access to biologics. The World Health Organization (WHO) reported a 20% increase in autoimmune disease cases in countries like India and China between 2022 and 2024, which is attributed to urbanization and lifestyle changes.

Governments in the region have prioritized healthcare reforms, with China allocating US$125 billion to its healthcare sector in 2023, along with a US$10.5 billion investment in biotechnology research, focusing on autoimmune and inflammatory diseases.

Pharmaceutical companies in the region, such as Takeda and Daiichi Sankyo, are projected to expand their immunology portfolios, with Takeda reporting a 12% increase in revenue from its immunology segment in 2023. These developments, combined with increasing patient awareness and improving healthcare infrastructure, are expected to drive significant growth in the Asia Pacific immunology market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the immunology market employ diverse strategies to drive growth, including heavy investment in R&D, strategic partnerships, and expanding their biosimilar portfolios. Companies like AbbVie, Johnson & Johnson, and Novartis focus on developing innovative biologics and personalized therapies to address unmet medical needs.

They also engage in mergers and acquisitions to strengthen their market position and leverage advanced technologies like AI for drug discovery. Additionally, these firms prioritize geographic expansion, particularly in emerging markets, to increase accessibility and market penetration. A strong emphasis on regulatory compliance and patient-centric solutions further enhances their competitive edge.

AbbVie, a global biopharmaceutical company, specializes in developing advanced therapies for autoimmune diseases, oncology, and neuroscience. Founded in 2013 as a spin-off from Abbott Laboratories, AbbVie has established itself as a leader in the immunology market, with blockbuster drugs like Humira generating US$21.2 billion in revenue in 2022. With a commitment to improving patient outcomes, AbbVie continues to lead in delivering cutting-edge treatments for complex diseases.

Top Key Players

- Sandoz

- Novartis AG

- Janssen Global Services, LLC

- Eli Lilly and Company

- Amgen Inc

- ALLERGAN

- AbbVie Inc

Recent Developments

- In June 2023, Sandoz introduced Hyrimoz, a high-concentration formulation designed for the treatment of autoimmune conditions such as rheumatoid arthritis, psoriatic arthritis, and juvenile idiopathic arthritis, expanding therapeutic options for patients.

- In March 2023, Eli Lilly and Company obtained regulatory clearance from India’s Directorate General of Commercial Intelligence and Statistics (DGCI) to launch Copellor. This medication is approved for addressing moderate-to-severe plaque psoriasis as well as psoriatic arthritis, offering a new treatment avenue for individuals with these conditions.

Report Scope

Report Features Description Market Value (2024) US$ 109.4 Billion Forecast Revenue (2034) US$ 342.8 Billion CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Monoclonal Antibody (mAb), Immunosuppressants, and Others), By Application (Psoriatic Arthritis, Rheumatoid Arthritis, Plaque Psoriasis, Inflammatory Bowel Disease, Ankylosing Spondylitis, and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Sandoz, Novartis AG, Janssen Global Services, LLC, Eli Lilly and Company, Amgen Inc, ALLERGAN, and AbbVie Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sandoz

- Novartis AG

- Janssen Global Services, LLC

- Eli Lilly and Company

- Amgen Inc

- ALLERGAN

- AbbVie Inc