Global Hypotaurine (Cas 300-84-5) Market Size, Share, And Business Benefits By Form (Powder, Liquid), By Type (98% Purity, Others), By Application (Pharmaceuticals, Nutraceuticals, Cosmetics, Animal Feed, Others), By Distribution Channel (Online Stores, Specialty Stores, Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140278

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

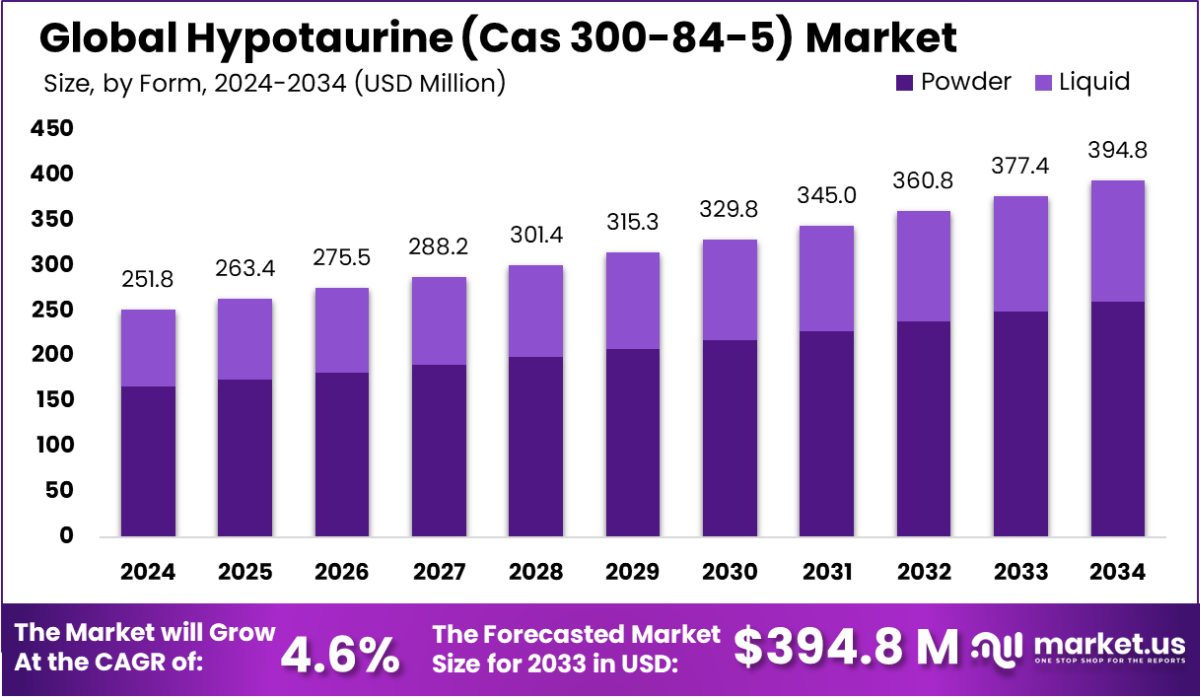

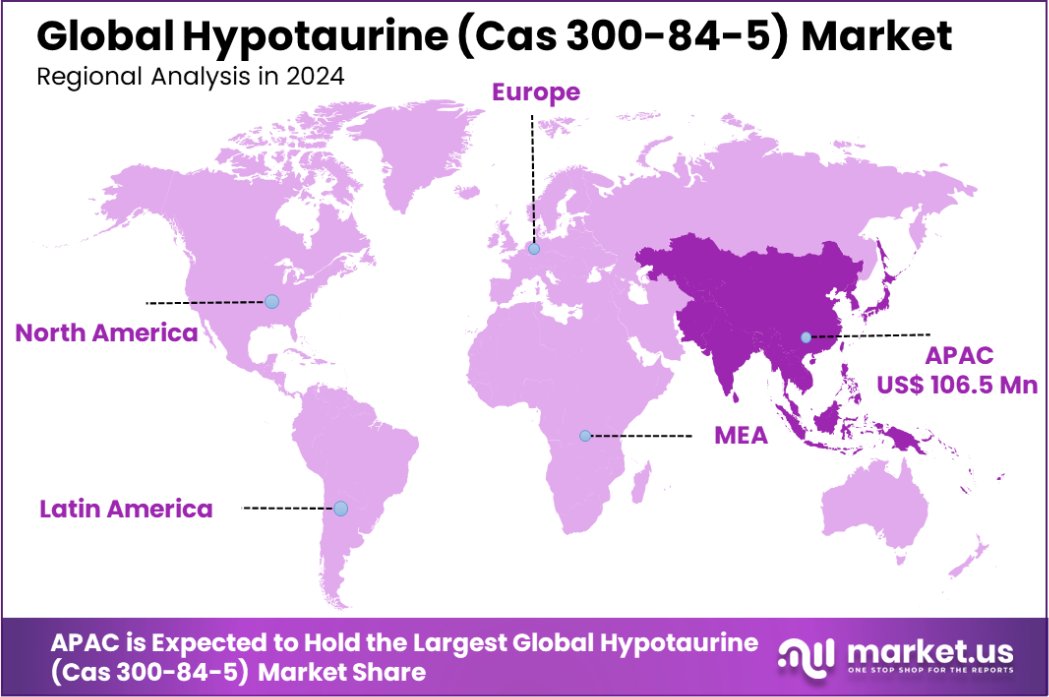

The Global Hypotaurine (Cas 300-84-5) Market is expected to be worth around USD 394.8 million by 2034, up from USD 251.8 million in 2024, and grow at a CAGR of 4.6% from 2025 to 2034. Asia-Pacific dominates the Hypotaurine (CAS 300-84-5) market with 42.3%, USD 106.5 Mn.

Hypotaurine (CAS 300-84-5) is a naturally occurring sulfur-containing compound, chemically similar to taurine. It is often found in various biological systems, including in the brains and livers of animals, and is considered an intermediate in the biosynthesis of taurine.

The compound holds significant potential in various applications, particularly in the health and wellness sector, due to its antioxidant and anti-inflammatory properties. Additionally, it is explored in studies related to the prevention of neurodegenerative diseases and as an active ingredient in functional foods and cosmetics.

The global growth of the hypotaurine market is primarily driven by increasing consumer awareness about the benefits of bioactive compounds. As health consciousness rises, particularly in the areas of brain health and overall wellness, hypotaurine’s demand is expected to escalate. Research in neurology and mental health continues to support the potential of hypotaurine to mitigate oxidative stress and support cognitive function, further enhancing its appeal as a nutraceutical and therapeutic ingredient.

The demand for hypotaurine is largely fueled by its incorporation into dietary supplements and functional foods, where it is valued for its ability to improve cognitive function and reduce the risk of neurodegenerative diseases. Furthermore, its use in cosmetics and skin care products as an antioxidant agent is also increasing, particularly in formulations aimed at reducing skin aging and inflammation.

As the pharmaceutical and cosmetic industries evolve, there is a growing opportunity for hypotaurine to be developed into targeted treatments for conditions such as Alzheimer’s disease, Parkinson’s, and other cognitive impairments. Additionally, untapped opportunities in emerging markets, where rising disposable incomes and changing lifestyles increase demand for health-oriented products, offer avenues for market expansion.

Key Takeaways

- The Global Hypotaurine (Cas 300-84-5) Market is expected to be worth around USD 394.8 million by 2034, up from USD 251.8 million in 2024, and grow at a CAGR of 4.6% from 2025 to 2034.

- Hypotaurine powder accounts for 65.4% of the total market share globally.

- 98% purity hypotaurine holds a significant 78.5% share in market demand.

- Pharmaceuticals remain the largest application segment, capturing 45.1% of hypotaurine usage.

- Online stores dominate as distribution channels, responsible for 48.2% of sales.

- In Asia-Pacific, the Hypotaurine (CAS 300-84-5) market holds a 42.3% share, valued at USD 106.5 Mn.

By Form Analysis

Hypotaurine in powder form accounts for 65.4% of the market share, preferred for ease of formulation.

In 2024, Powder held a dominant market position in the By Form segment of the Hypotaurine (CAS 300-84-5) market, with a 65.4% share. This preference can be attributed to powder’s stability, longer shelf life, and ease of use in various applications, including the food, cosmetic, and dietary supplement industries.

The powder form is often preferred for its versatility in formulation and its capacity to retain the active properties of Hypotaurine over extended periods. Additionally, its cost-effectiveness compared to liquid forms contributes to its widespread adoption in bulk manufacturing processes.

On the other hand, the Liquid form, though holding a smaller share, is also gaining traction due to its convenient application in industries where immediate dissolution and quick absorption are critical.

The liquid form is particularly favored in pharmaceutical formulations, where rapid bioavailability is required. However, liquid Hypotaurine typically has a shorter shelf life and may require more careful handling, which limits its market share relative to powder-based forms.

By Type Analysis

The 98% purity variant of hypotaurine dominates, holding 78.5% of market demand due to efficacy.

In 2024, 98% Purity held a dominant market position in the By Type segment of the Hypotaurine (CAS 300-84-5) market, with a 78.5% share. This high-purity form of Hypotaurine is widely preferred due to its superior quality, making it suitable for critical applications in pharmaceuticals, cosmetics, and dietary supplements where potency and consistency are essential.

The 98% purity grade ensures that the active ingredient remains effective, meeting stringent regulatory standards and offering enhanced performance in various formulations.

The demand for 98% purity Hypotaurine is particularly strong in the health and wellness industry, where consumers prioritize products with guaranteed potency and minimal impurities. Additionally, the pharmaceutical sector favors high-purity Hypotaurine for its precise dosages and reliable efficacy in treating specific health conditions.

In contrast, lower purity grades, while occupying a smaller portion of the market, are often used in less demanding applications or where cost-efficiency is a significant factor. These forms are more economical but may not provide the same level of effectiveness or consistency as the 98% purity version.

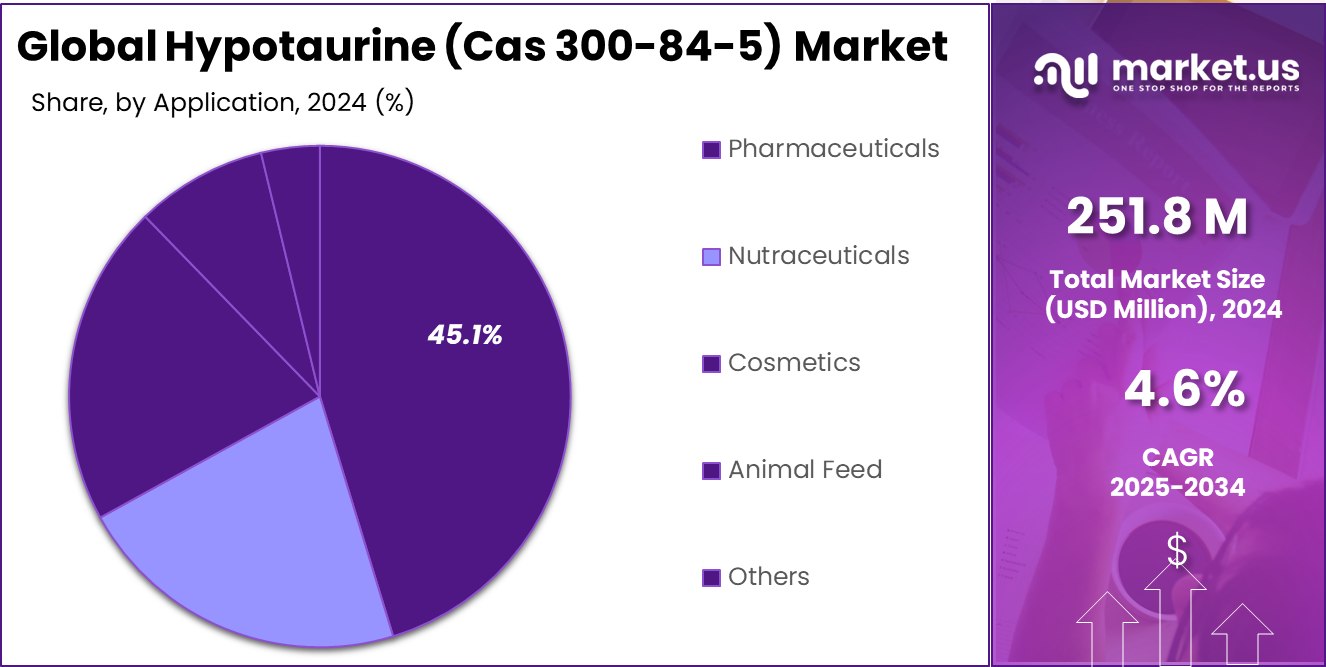

By Application Analysis

Pharmaceutical applications represent 45.1% of hypotaurine’s market, driven by demand for cognitive health supplements.

In 2024, Pharmaceuticals held a dominant market position in the By Application segment of the Hypotaurine (CAS 300-84-5) market, with a 45.1% share. This dominance can be attributed to the growing demand for Hypotaurine in various therapeutic applications, particularly in treatments related to neurological health, anti-aging, and skin conditions.

Hypotaurine’s antioxidant properties make it a key ingredient in pharmaceutical formulations, where efficacy and safety are paramount. The pharmaceutical sector’s stringent regulatory requirements further contribute to the preference for high-quality Hypotaurine, making it a staple in drug development.

Following Pharmaceuticals, Nutraceuticals held a significant share in the market due to the increasing consumer awareness around preventive healthcare and functional foods. Hypotaurine is increasingly being incorporated into dietary supplements for its purported health benefits, including its role in supporting brain function and promoting skin health.

The Cosmetics sector is another key application area, driven by the growing use of Hypotaurine in skincare products for its antioxidant and anti-aging effects. As consumers continue to seek products with natural, effective ingredients, the demand for Hypotaurine in cosmetics is expected to expand.

Finally, Animal Feed applications, while occupying a smaller portion of the market, are growing due to the interest in using Hypotaurine to enhance the health and productivity of livestock.

By Distribution Channel Analysis

Online stores capture 48.2% of hypotaurine market sales, reflecting growing consumer reliance on digital purchasing.

In 2024, Online Stores held a dominant market position in the By Distribution Channel segment of the Hypotaurine (CAS 300-84-5) market, with a 48.2% share. The growth of e-commerce platforms and the increasing consumer preference for convenient shopping options have driven the surge in online sales.

Online stores offer consumers easy access to a wide range of Hypotaurine-based products, often with the added benefits of competitive pricing, fast delivery, and customer reviews to aid purchasing decisions. The flexibility to order from anywhere and at any time has made online stores the preferred choice for many, especially in the nutraceutical and cosmetics sectors.

Specialty Stores followed, catering to specific customer needs, particularly in the health and wellness sector. These stores offer a curated selection of high-quality, specialized products, making them a popular choice for consumers seeking premium or niche Hypotaurine-based products, particularly in the pharmaceutical and nutraceutical segments.

Pharmacies continue to be a key distribution channel, holding a significant share due to their established role in dispensing health-related products. Pharmacies benefit from customer trust, and Hypotaurine products sold through these channels are often associated with medical or therapeutic applications. However, their share in the overall distribution channel landscape is relatively smaller compared to online stores and specialty outlets.

Key Market Segments

By Form

- Powder

- Liquid

By Type

- 98% Purity

- Others

By Application

- Pharmaceuticals

- Nutraceuticals

- Cosmetics

- Animal Feed

- Others

By Distribution Channel

- Online Stores

- Specialty Stores

- Pharmacies

- Others

Driving Factors

Growing Demand for Antioxidant and Anti-Aging Products

One of the key driving factors for the Hypotaurine (CAS 300-84-5) market is the increasing consumer demand for antioxidant and anti-aging products. Hypotaurine is known for its powerful antioxidant properties, which help neutralize harmful free radicals in the body.

As people become more aware of the effects of aging and seek ways to preserve youthful skin and cognitive function, the demand for Hypotaurine-based products in both the pharmaceutical and cosmetic sectors continues to rise. This trend is expected to further accelerate as consumers prioritize health and wellness in their daily routines.

Restraining Factors

High Production Costs of Hypotaurine Impacting Growth

A significant restraining factor in the Hypotaurine (CAS 300-84-5) market is the high production costs associated with its synthesis. The process of extracting and purifying Hypotaurine to achieve high levels of purity requires advanced technology and specialized equipment, which can be costly.

These high production costs translate into higher prices for end consumers, limiting its affordability and accessibility, especially in price-sensitive markets. As a result, the market faces challenges in broadening its customer base, particularly in regions where cost-effective alternatives may be preferred.

Growth Opportunity

Expanding Use in Nutraceutical and Supplement Markets

A key growth opportunity for the Hypotaurine (CAS 300-84-5) market lies in its expanding use within the nutraceutical and dietary supplement industries. As consumers increasingly prioritize preventive healthcare and natural wellness solutions, Hypotaurine’s health benefits—particularly its antioxidant and cognitive support properties—are gaining significant attention.

The rise in demand for functional foods and supplements provides a substantial opportunity for market expansion. Companies can capitalize on this trend by developing innovative Hypotaurine-based products tailored to consumer needs, thereby tapping into the growing health-conscious consumer base.

Latest Trends

Rising Popularity of Plant-Based and Natural Ingredients

A notable trend in the Hypotaurine (CAS 300-84-5) market is the rising preference for plant-based and natural ingredients in health and beauty products. Consumers are becoming more conscious of the ingredients in their supplements, skincare, and wellness products, favoring those derived from natural sources.

Hypotaurine, with its natural antioxidant properties, aligns well with this shift towards cleaner, plant-based formulations. This trend is particularly evident in the cosmetics and nutraceutical sectors, where demand for non-synthetic, environmentally-friendly products continues to grow, offering significant opportunities for market growth.

Regional Analysis

In the Asia-Pacific region, the Hypotaurine (CAS 300-84-5) market accounted for 42.3%, valued at USD 106.5 Mn.

The Hypotaurine (CAS 300-84-5) Market is experiencing significant growth across various regions, driven by increasing demand in pharmaceutical, nutraceutical, and cosmetic applications.

In Asia-Pacific, the market is the largest, holding a dominant share of 42.3%, valued at USD 106.5 million. This region benefits from a growing awareness of health and wellness, particularly in countries like China and India, where there is a rising demand for antioxidant-rich products in both cosmetics and dietary supplements. The expanding middle class and the focus on preventive healthcare are key drivers of this growth.

In North America, the market is driven by the strong demand for high-quality nutraceuticals and functional foods. The U.S. leads the market in terms of consumption and innovation, particularly in the pharmaceutical and dietary supplement sectors. This region continues to grow due to increasing consumer preference for natural and effective ingredients.

In Europe, there is a steady demand for Hypotaurine, especially in the cosmetic and skincare industries, where antioxidant properties are highly valued. Regulations and consumer preferences for high-purity ingredients further support the market’s growth.

Middle East & Africa and Latin America contribute smaller shares to the global market but are expected to see gradual growth due to rising awareness and the adoption of Hypotaurine-based products in health and wellness sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Hypotaurine (CAS 300-84-5) Market continues to witness significant competition, with a range of key players vying for market share across various regions. Companies such as China Grand Pharmaceutical and Henan Tianfu Chemical Co., Ltd. are driving much of the market in Asia-Pacific, particularly due to their strong presence in the pharmaceutical and nutraceutical sectors.

These companies benefit from well-established distribution networks and robust manufacturing capabilities, making them key suppliers of high-quality Hypotaurine for a wide range of applications.

Hubei Kexing Medical & Chemical Co., Ltd. and Jiangsu Bohan Industry Trade Co., Ltd. are also notable players in the market, focusing on cost-effective production processes and expanding their market reach, particularly in emerging markets where price sensitivity is a key concern. These companies are increasingly emphasizing product purity and regulatory compliance to meet the growing demand for high-quality, standardized Hypotaurine, especially in the pharmaceutical industry.

Kasano Kosan Corporation and Qianjiang Yongan Pharmaceutical Co., Ltd. are expanding their presence globally by focusing on strategic partnerships and international certifications, thus positioning themselves as reliable suppliers in the nutraceutical and cosmetic sectors.

On the other hand, companies like Taisho Pharmaceutical and Shanghai Ruizheng Chemical Technology Co., Ltd. have leveraged their strong research and development capabilities to innovate in Hypotaurine-based products, enhancing their market competitiveness.

Top Key Players in the Market

- China Grand Pharmaceutical

- Henan Tianfu Chemical Co., Ltd.

- Hubei Kexing Medical & Chemical Co., Ltd.

- Jiangsu Bohan Industry Trade Co., Ltd.

- Jiangyin Huachang Food Additive

- Kasano Kosan Corporation.

- Qianjiang Yongan Pharmaceutical Co., Ltd.

- Shanghai Ruizheng Chemical Technology Co., Ltd.

- Taisho Pharmaceutical

- Wuhan Fortuna Chemical Co., Ltd.

- Wuhan Wingroup Pharmaceutical Co., Ltd.

- Zhengzhou Alfa Chemical Co., Ltd.

Recent Developments

- In 2024, China Grand Pharmaceutical expanded its production capacity for Hypotaurine to address the growing demand in the pharmaceutical sector. Additionally, they introduced new formulations aimed at neuroprotective effects, marking a strategic diversification of their product portfolio to target emerging therapeutic markets.

- In 2024, Hubei Kexing achieved notable advancements in sustainable manufacturing processes, enhancing the environmental efficiency of its operations. These developments reflect the company’s ongoing commitment to meeting industry demands and improving product offerings in the Hypotaurine market.

Report Scope

Report Features Description Market Value (2024) USD 251.8 Million Forecast Revenue (2034) USD 394.8 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid), By Type (98% Purity, Others), By Application (Pharmaceuticals, Nutraceuticals, Cosmetics, Animal Feed, Others), By Distribution Channel (Online Stores, Specialty Stores, Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape China Grand Pharmaceutical, Henan Tianfu Chemical Co., Ltd., Hubei Kexing Medical & Chemical Co., Ltd., Jiangsu Bohan Industry Trade Co., Ltd., Jiangyin Huachang Food Additive, Kasano Kosan Corporation., Qianjiang Yongan Pharmaceutical Co., Ltd., Shanghai Ruizheng Chemical Technology Co., Ltd., Taisho Pharmaceutical, Wuhan Fortuna Chemical Co., Ltd., Wuhan Wingroup Pharmaceutical Co., Ltd., Zhengzhou Alfa Chemical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Hypotaurine (Cas 300-84-5) MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Global Hypotaurine (Cas 300-84-5) MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- China Grand Pharmaceutical

- Henan Tianfu Chemical Co., Ltd.

- Hubei Kexing Medical & Chemical Co., Ltd.

- Jiangsu Bohan Industry Trade Co., Ltd.

- Jiangyin Huachang Food Additive

- Kasano Kosan Corporation.

- Qianjiang Yongan Pharmaceutical Co., Ltd.

- Shanghai Ruizheng Chemical Technology Co., Ltd.

- Taisho Pharmaceutical

- Wuhan Fortuna Chemical Co., Ltd.

- Wuhan Wingroup Pharmaceutical Co., Ltd.

- Zhengzhou Alfa Chemical Co., Ltd.