Global Heat Recovery Steam Generator Market Size, Share And Growth Analysis Report By Design (Horizontal Drum, Vertical Drum), By Mode Of Operation (Cogeneration, Combined Cycle), By Power (Up to 30 MW, 31 to 100 MW, 101 to 200 MW, 201 to 300 MW, Above 300 MW), By Application (Power Generation, Industrial Processes, Desalination Plants, District Heating, Others), By Technology (Horizontal HRSG, Vertical HRSG, Shell and Tube HRSG, Others), By End-use (Refineries, Commercial, Chemical, Utilities, Pulp & Paper, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142718

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

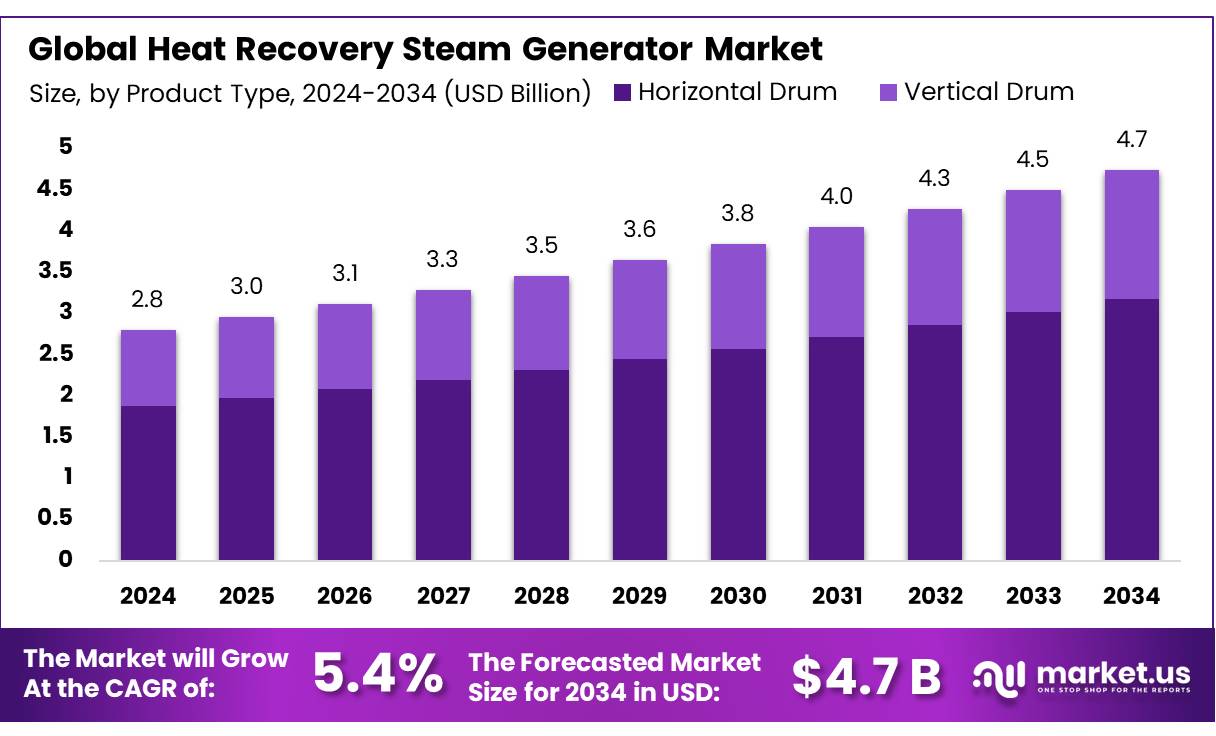

The Global Heat Recovery Steam Generator Market size is expected to be worth around USD 4.7 Billion by 2034, from USD 2.8 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The Heat Recovery Steam Generator (HRSG) Market is poised for significant expansion, driven by increasing energy efficiency requirements and the integration of renewable energy sources. Heat recovery steam generators are critical components in the power generation sector, allowing for the recovery of heat from hot gas streams produced by gas turbines.

This heat is then used to generate steam, which can drive a steam turbine to produce additional electrical power in a combined cycle power plant, enhancing overall efficiency. Heat Recovery Steam Generators are used to recover waste heat from the exhaust of gas turbines, boosting efficiency from a range of 35% to 40% in a simple cycle (also known as open cycle) mode to a range of 55% to 60% in a combined cycle mode.

The steam generated by the HRSG can be used for process heating or generating electricity in a steam turbine. Such units are installed on gas turbines ranging from below 1 MW up to 320 MW. The industrial scenario for HRSGs is currently robust, with widespread adoption across various sectors, including utilities, oil and gas, and manufacturing.

The integration of HRSGs in existing thermal power plants to improve efficiency and reduce carbon emissions is becoming increasingly common. This trend is particularly notable in regions with stringent environmental regulations. For the heat-transfer tubes of an HRSG, finned tubes with excellent heat-transfer performance are employed. By adopting a compact design, the installation footprint of the equipment is reduced.

Key Takeaways

- The Global Heat Recovery Steam Generator (HRSG) Market is projected to grow from USD 2.8 billion in 2024 to USD 4.7 billion by 2034, with a CAGR of 5.4% during the forecast period 2025–2034.

- The Horizontal Drum segment holds a 67.3% share, favored for its operational efficiency and ease of maintenance, particularly in large-scale power plants and industrial facilities.

- Cogeneration systems dominate with a 69.4% share, driven by their ability to simultaneously generate electricity and useful heat, widely used in industries like manufacturing, chemicals, and residential heating.

- Power generation accounts for 58.4% of the market, with HRSGs enhancing efficiency in combined cycle and cogeneration systems by converting exhaust heat into additional electrical power.

- Horizontal HRSGs hold a 57.6% share, preferred for easier maintenance and superior performance in handling high exhaust levels, especially in large power plants and industrial settings.

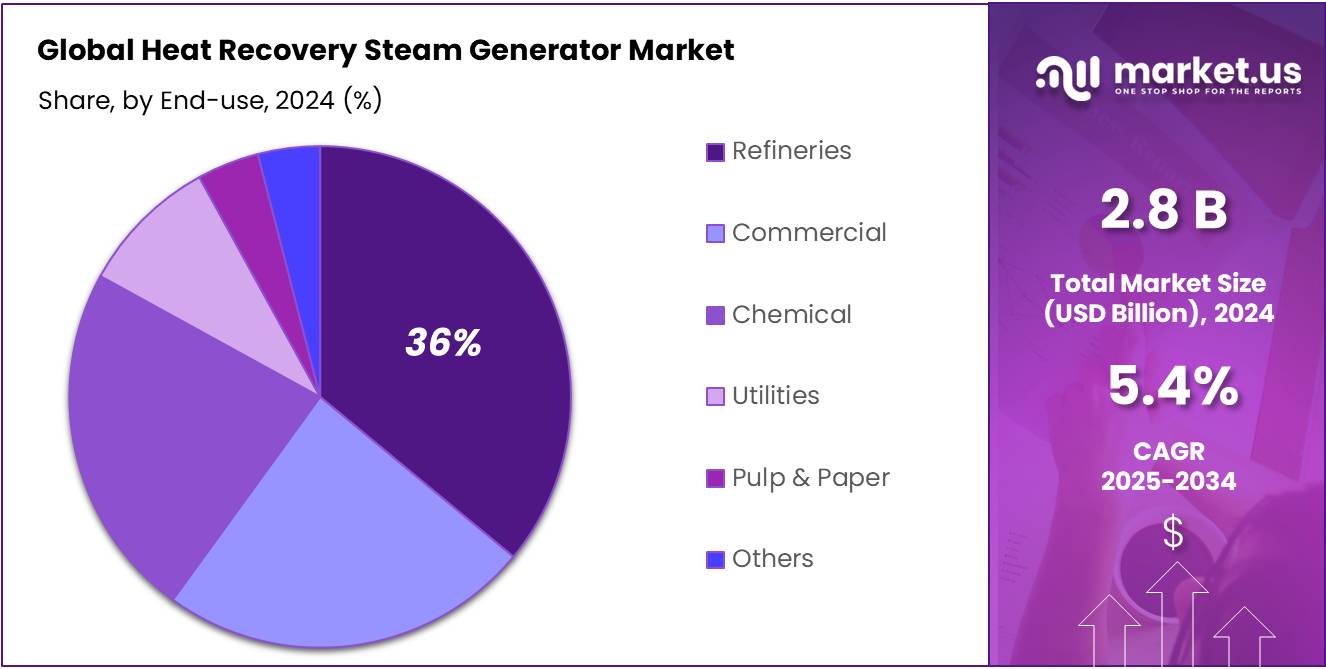

- Refineries hold a 36.3% share, leveraging HRSGs for waste heat recovery to improve thermal efficiency and meet environmental compliance requirements.

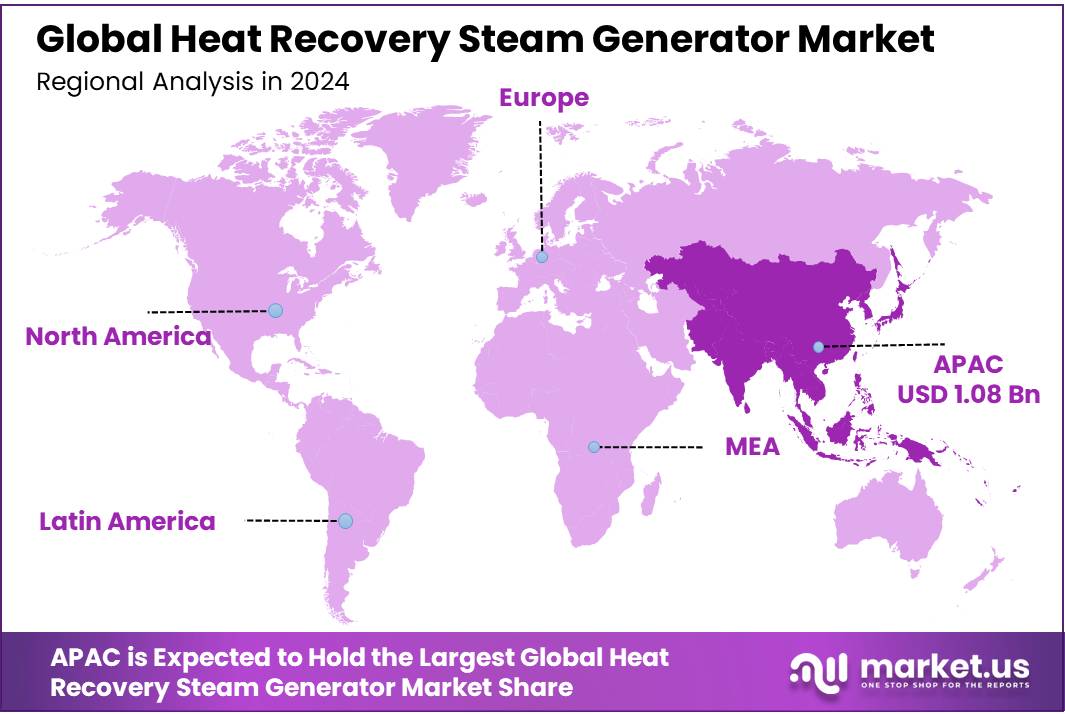

- The Asia-Pacific (APAC) region dominates with a 38.9% share, valued at USD 1.08 billion, fueled by industrial growth, urbanization, and investments in energy infrastructure.

By Design

In 2024, the Horizontal Drum design segment held a dominant position in the heat recovery steam generator market, capturing more than a 67.3% share. This segment’s prominence is attributed to its widespread application in large-scale power plants and industrial facilities where space constraints are less of an issue. Horizontal drum HRSGs are preferred for their operational efficiency and ease of maintenance, which is crucial in high-capacity settings.

The design’s ability to handle higher steam pressures and temperatures makes it ideal for rigorous operations, contributing to its majority stake in the market. Additionally, the horizontal configuration facilitates better water and steam separation, leading to enhanced quality of steam produced, which is a critical factor in power generation and industrial processes.

By Mode Of Operation

In 2024, Cogeneration held a dominant market position in the heat recovery steam generator market, capturing more than a 69.4% share. This significant market share underscores the growing preference for cogeneration systems, which are designed to maximize the efficiency of energy usage by simultaneously generating electricity and useful heat.

Cogeneration systems, particularly those incorporating HRSGs, are increasingly favored in industries where heat and power are required concurrently, such as manufacturing, chemicals, and residential heating. The appeal of cogeneration lies in its ability to significantly reduce energy wastage compared to separate heat and power generation.

By utilizing waste heat from electricity generation for heating purposes, cogeneration systems achieve higher efficiency levels, which in turn support energy conservation and reduce operational costs. This efficiency is a key driver for the adoption of cogeneration HRSGs in both new installations and upgrades of existing facilities.

By Power

In 2024, the 31 to 100 MW segment of the heat recovery steam generator market held a dominant market position, capturing more than a 34.2% share. This segment caters primarily to medium-scale power generation facilities and industrial applications where the balance between size, efficiency, and cost is critical.

The popularity of HRSGs in this power range is largely due to their versatility and adaptability in a variety of operational environments, including both standalone and integrated settings within larger power plants. HRSGs in this power range are particularly effective for local grids and specific industrial processes that require a moderate amount of power and thermal energy.

Their capacity to efficiently convert exhaust heat into additional electric power or steam enhances plant performance and reduces waste, making them a preferred choice for entities looking to boost operational efficiencies without the extensive capital expenditures associated with larger systems.

By Application

In 2024, Power Generation held a dominant market position in the heat recovery steam generator market, capturing more than a 58.4% share. This substantial market share reflects the critical role of HRSGs in modern power plants, particularly in enhancing the efficiency of combined cycle and cogeneration systems.

HRSGs are adept at capturing exhaust heat from gas turbines and converting it into additional electrical power through steam turbine integration, thereby significantly boosting the overall efficiency of power generation facilities. The reliance on HRSGs in power generation stems from the global drive to increase energy efficiency and reduce greenhouse gas emissions.

The electricity demand continues to grow, especially in developing economies, and the need for efficient, cost-effective, and environmentally friendly power generation technologies becomes more pronounced. HRSGs meet these requirements by enabling more energy to be produced from the same amount of fuel, which is a crucial factor in the economic scaling of power operations.

By Technology

In 2024, Horizontal HRSG held a dominant market position, capturing more than a 57.6% share in the heat recovery steam generator market. This preference for horizontal HRSGs is primarily due to their design benefits, which include easier maintenance and better performance in handling higher levels of exhaust from gas turbines.

The horizontal layout of these HRSGs facilitates the natural flow of water and steam, minimizing pump requirements and improving the thermal efficiency of the steam cycle. This configuration also allows for more expansive heat recovery surfaces, enhancing the energy conversion process and thus contributing to more effective power generation.

By End-Use

In 2024, Refineries held a dominant market position in the heat recovery steam generator market, capturing more than a 36.3% share. This significant stake underscores the essential role HRSGs play in the refining process, where thermal efficiency and waste heat recovery are critical for operational success and environmental compliance.

Refineries utilize HRSGs to harness waste heat from various processes, converting it into steam that can be used either for in-house energy requirements or additional power generation. The integration of HRSGs in refineries not only boosts energy efficiency but also significantly reduces carbon emissions by optimizing the use of fossil fuels. This is particularly important in regions with stringent environmental regulations that mandate reductions in carbon footprints for industrial operations.

Key Market Segments

By Design

- Horizontal Drum

- Vertical Drum

By Mode Of Operation

- Cogeneration

- Combined Cycle

By Power

- Up to 30 MW

- 31 to 100 MW

- 101 to 200 MW

- 201 to 300 MW

- Above 300 MW

By Application

- Power Generation

- Industrial Processes

- Desalination Plants

- District Heating

- Others

By Technology

- Horizontal HRSG

- Vertical HRSG

- Shell and Tube HRSG

- Others

By End-use

- Refineries

- Commercial

- Chemical

- Utilities

- Pulp & Paper

- Others

Drivers

Government Initiatives Supporting HRSG Adoption

One major driving factor for the adoption of heat recovery steam generators (HRSGs) is the global push for energy efficiency backed by government incentives and regulatory frameworks. Governments around the world have been implementing various policies and offering incentives to encourage the integration of energy-efficient technologies like HRSGs into industrial and power generation sectors.

These initiatives are designed to reduce greenhouse gas emissions and increase the overall energy efficiency of industrial operations. For instance, the European Union’s energy efficiency directives and the United States Department of Energy’s (DOE) policies provide substantial support for technologies that enhance energy efficiency.

The DOE, through its Combined Heat and Power (CHP) Deployment Program, actively promotes the use of systems like HRSGs, which are integral to CHP systems. The program highlights that CHP, including HRSG technology, can achieve efficiencies of over 80%, significantly higher than the traditional methods of electricity generation and separate heat production, which might only reach efficiency levels of 50%.

Restraints

High Initial Investment Costs as a Major Restraint

One significant restraint impacting the broader adoption of heat recovery steam generators (HRSGs) is the high initial investment required for their installation and integration. Setting up an HRSG system involves substantial capital outlay, which can be a deterrent for small and medium-sized enterprises (SMEs) and in regions with financial constraints.

The complexity and scale of these systems demand advanced technological components and skilled labor for installation, both of which contribute to the initial costs. The cost of deploying a standard HRSG can vary significantly, depending largely on the capacity and specific application requirements.

For instance, in power generation applications, the integration of HRSG technology in combined cycle plants can increase initial project expenses by 20-30%. This figure is critical as it reflects the additional financial burden that can influence decision-making, especially under tight budget constraints.

Opportunity

Enhanced Focus on Sustainability and Efficiency

A major growth factor for the heat recovery steam generator (HRSG) market is the increasing global emphasis on sustainability and energy efficiency in power generation and industrial processes. As governments worldwide tighten environmental regulations and set ambitious carbon reduction targets, the demand for HRSGs, which significantly enhance energy efficiency, is poised to grow.

HRSGs play a pivotal role in reducing the carbon footprint of power plants by capturing waste heat from exhaust gases and converting it into additional electricity, thereby increasing overall plant efficiency. For instance, reports from the International Energy Agency (IEA) suggest that enhancing the efficiency of power plants through technologies like HRSGs could reduce global CO2 emissions by millions of tons annually.

The IEA has highlighted combined cycle power plants, which utilize HRSGs, as being capable of achieving efficiency rates of up to 60%, compared to conventional coal-fired power plants, which operate at about 35-45% efficiency.

Trends

Integration with Renewable Energy Systems

A significant emerging factor for the heat recovery steam generator (HRSG) market is their integration with renewable energy systems, particularly solar and biomass energy operations. As the global energy landscape shifts toward more sustainable sources, HRSGs are being adapted to work in tandem with these technologies, enhancing the overall efficiency and stability of the power supply.

Renewable energy systems often face challenges related to the intermittent nature of power sources like solar and wind. HRSGs can mitigate this by capturing waste heat from biomass combustion or from concentrated solar power systems to produce steam, which in turn can generate additional electricity during periods of low sunlight or wind activity.

In solar thermal power plants, HRSGs are used to convert heat from solar collectors into steam, which can then drive turbines to produce electricity. The International Renewable Energy Agency (IRENA) has noted that such integrated approaches can enhance plant efficiencies by up to 20%, making renewable energy more competitive with traditional fossil fuel sources.

Regional Analysis

The Asia-Pacific (APAC) region holds a dominant position in the global Heat Recovery Steam Generator (HRSG) Market, with a market share of 38.9% and a value of approximately USD 1.08 billion. This strong market presence is driven by the region’s extensive industrial growth, rapid urbanization, and substantial investments in new energy infrastructure.

Countries such as China, India, and South Korea are at the forefront, with their governments actively promoting energy efficiency through stringent policies and incentives. For instance, China’s focus on reducing its carbon footprint and enhancing energy efficiency in power generation has led to the increased adoption of HRSGs in both new and existing thermal power plants.

India’s national energy policy emphasizes sustainable growth through cleaner energy technologies, providing a substantial push for HRSG integration in its expanding industrial sector. The region’s shift toward cleaner energy sources and the modernization of aging power plants further contribute to the demand for HRSGs.

APAC countries are retrofitting old power generation facilities with state-of-the-art HRSG systems to meet rising energy needs while adhering to stricter environmental regulations. This retrofitting trend is complemented by the construction of new combined cycle and cogeneration power plants, where HRSGs are essential for maximizing efficiency and minimizing waste.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- ABB is a global leader in power and automation technologies, offering advanced HRSG solutions that enhance energy efficiency and reduce emissions. The company focuses on integrating digital technologies to optimize performance and provide predictive maintenance, ensuring reliable and sustainable operations across various industries.

- Alstom specializes in integrated power generation systems, including HRSGs, designed for combined cycle and cogeneration plants. The company emphasizes innovation, sustainability, and energy efficiency, providing customized solutions to meet diverse industrial needs while adhering to stringent environmental regulations.

- Amec Foster Wheeler, now part of Wood PLC, is renowned for its engineering expertise in HRSG design and manufacturing. The company delivers high-efficiency, low-emission solutions tailored for power generation and industrial applications, leveraging advanced technologies to maximize energy recovery and operational performance.

Top Key Players in the Market

- ABB

- Alstom

- Amec Foster Wheeler

- Babcock & Wilcox

- Bharat Heavy Electricals Limited

- Bhi Co., Ltd.

- Cleaver-Brooks

- Cn Co., Ltd.

- Coepro

- Ge Power

- Ge Vernova And/Or Its Affiliates.

- Isgec Heavy Engineering Ltd.

- John Cockerill.

- Kawasaki Heavy Industries, Ltd.

- Larsen & Toubro Limited.

- Mitsubishi Heavy Industries, Ltd.

- Mutares Se & Co. Kgaa

- Nooter/Eriksen, Inc.

- Rentech Boiler Systems, Inc.

- Siemens

- Sofinter

- Technology Transfer Services

- Thermax Limited.

Recent Developments

- In 2024, ABB partnered with a European utility provider to enhance energy efficiency in combined-cycle power plants, which often utilize HRSGs. The partnership focuses on integrating ABB’s digital solutions, such as advanced process control systems, to optimize steam generation and reduce emissions.

- In 2024, BHEL is set to commission a record 9 GW of thermal power generation capacity in the fiscal year 2024-25, the highest-ever thermal power capacity addition for India in a single fiscal year. BHEL, in collaboration with NTPC, is developing an 800 MW coal power plant using advanced ultra-supercritical (AUSC) technology, which includes HRSGs to achieve higher efficiency and lower emissions.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Billion Forecast Revenue (2034) USD 4.7 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Design (Horizontal Drum, Vertical Drum), By Mode Of Operation (Cogeneration, Combined Cycle), By Power (Up to 30 MW, 31 to 100 MW, 101 to 200 MW, 201 to 300 MW, Above 300 MW), By Application (Power Generation, Industrial Processes, Desalination Plants, District Heating, Others), By Technology (Horizontal HRSG, Vertical HRSG, Shell and Tube HRSG, Others), By End-use (Refineries, Commercial, Chemical, Utilities, Pulp & Paper, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Abb, Alstom, Amec Foster Wheeler, Babcock & Wilcox, Bharat Heavy Electricals Limited, Bhi Co., Ltd., Cleaver-Brooks, Cn Co., Ltd., Coepro, Ge Power, Ge Vernova And/Or Its Affiliates., Isgec Heavy Engineering Ltd., John Cockerill., Kawasaki Heavy Industries, Ltd., Larsen & Toubro Limited., Mitsubishi Heavy Industries, Ltd., Mutares Se & Co. Kgaa, Nooter/Eriksen, Inc., Rentech Boiler Systems, Inc., Siemens, Sofinter, Technology Transfer Services, Thermax Limited. Customization Scope Customization for segments, regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)  Heat Recovery Steam Generator MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Heat Recovery Steam Generator MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Alstom

- Amec Foster Wheeler

- Babcock & Wilcox

- Bharat Heavy Electricals Limited

- Bhi Co., Ltd.

- Cleaver-Brooks

- Cn Co., Ltd.

- Coepro

- Ge Power

- Ge Vernova And/Or Its Affiliates.

- Isgec Heavy Engineering Ltd.

- John Cockerill.

- Kawasaki Heavy Industries, Ltd.

- Larsen & Toubro Limited.

- Mitsubishi Heavy Industries, Ltd.

- Mutares Se & Co. Kgaa

- Nooter/Eriksen, Inc.

- Rentech Boiler Systems, Inc.

- Siemens

- Sofinter

- Technology Transfer Services

- Thermax Limited.