Green Petroleum Coke Market Size, Share, And Business Benefit By Source (Anode, Fuel), By Form (Spongy Coke, Honeycomb Coke, Purge Coke, Shot Coke, Needle Coke), By Application (Aluminum, Graphite Electrode, Cement, Power Station, Calcined Coke, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166877

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

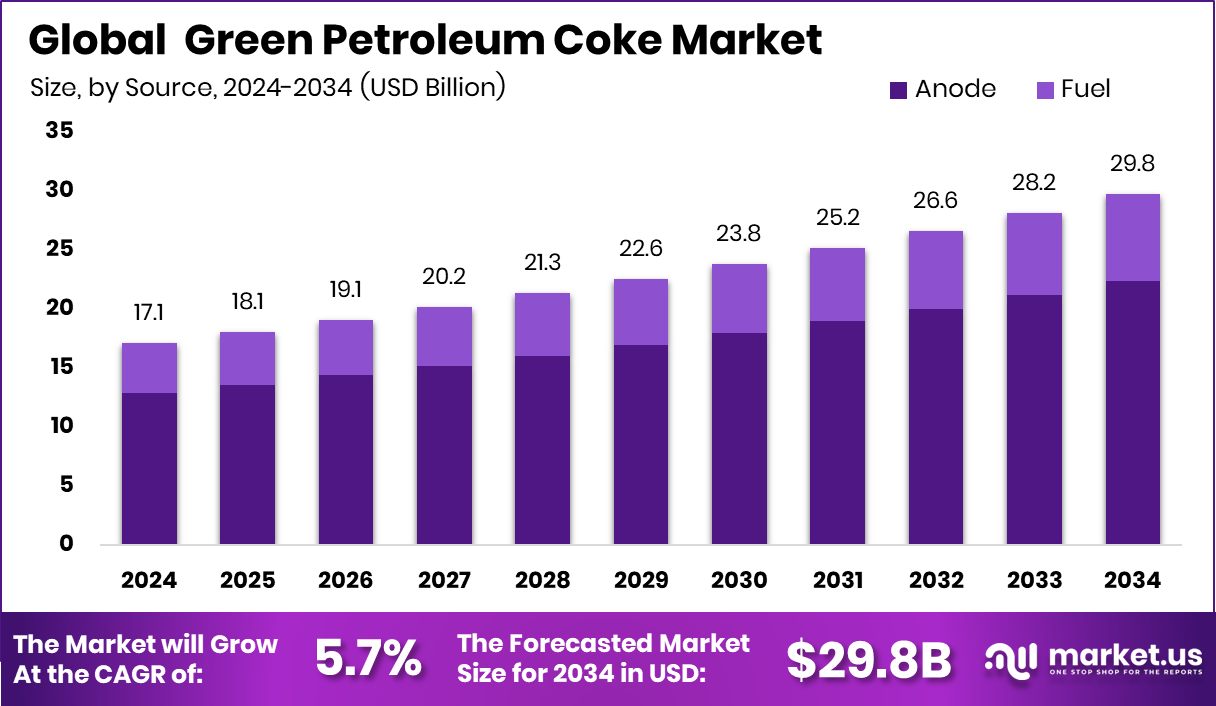

The Global Green Petroleum Coke Market is expected to be worth around USD 29.8 billion by 2034, up from USD 17.1 billion in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034. Asia-Pacific USD 6.7 Bn maintains growth as industrial demand rises across major carbon-using sectors.

Green petroleum coke is an unprocessed, solid carbon-rich material produced during the thermal cracking of heavy oil in refineries. It contains high carbon content with varying sulfur and metal levels, making it useful in fuel applications, anodes, graphite, and industrial heating. Because it is “green,” it has not yet been calcined or upgraded.

The Green Petroleum Coke Market represents the global demand for this raw carbon product across metallurgy, aluminum smelting, cement kilns, power generation, and graphite applications. Its growth is shaped by industrial expansion, rising energy needs, and the shift toward carbon-efficient materials in manufacturing.

Demand continues to rise as heavy industries look for dependable carbon inputs, especially in aluminum and graphite value chains. Recent investments, such as Golden Aluminum securing $22 million for the Nexcast project and $10 million in Phase 1 funding for a green aluminum smelter, signal increasing consumption of carbon-intensive feedstocks like green coke.

Growth opportunities strengthen with global recycling momentum. Grants enabling 31 million aluminum cans to be captured annually support downstream aluminum demand, which indirectly drives the need for stable carbon sources.

Future prospects also improve with the expansion of graphite capacity. Projects like HEG planning a ₹3,500-crore implementation and Graphite India acquiring a 31% stake in Godi for ₹50 crore indicate stronger long-term carbon material demand, benefiting the green petroleum coke market.

Key Takeaways

- The Global Green Petroleum Coke Market is expected to be worth around USD 29.8 billion by 2034, up from USD 17.1 billion in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034.

- The green petroleum coke market was dominated by the anode source with a 75.2% share.

- The green petroleum coke market was dominated by spongy coke, holding a 39.5% share.

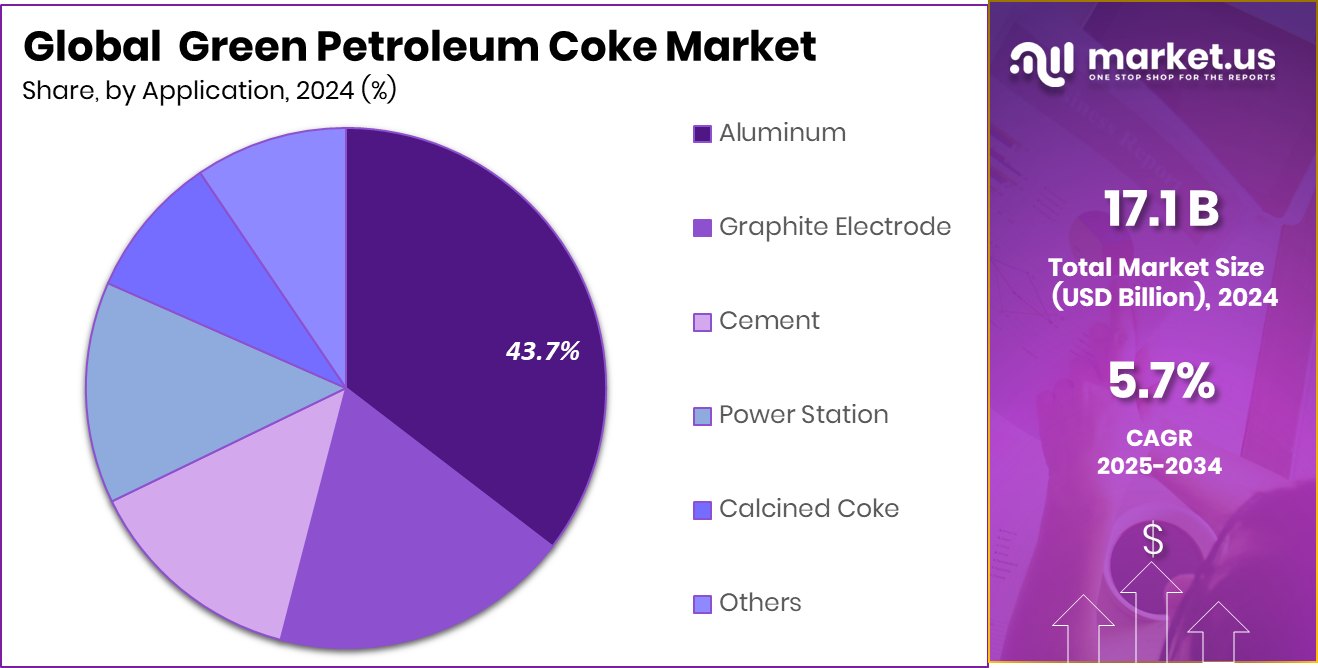

- The green petroleum coke market was dominated by aluminum applications with a 43.7% share.

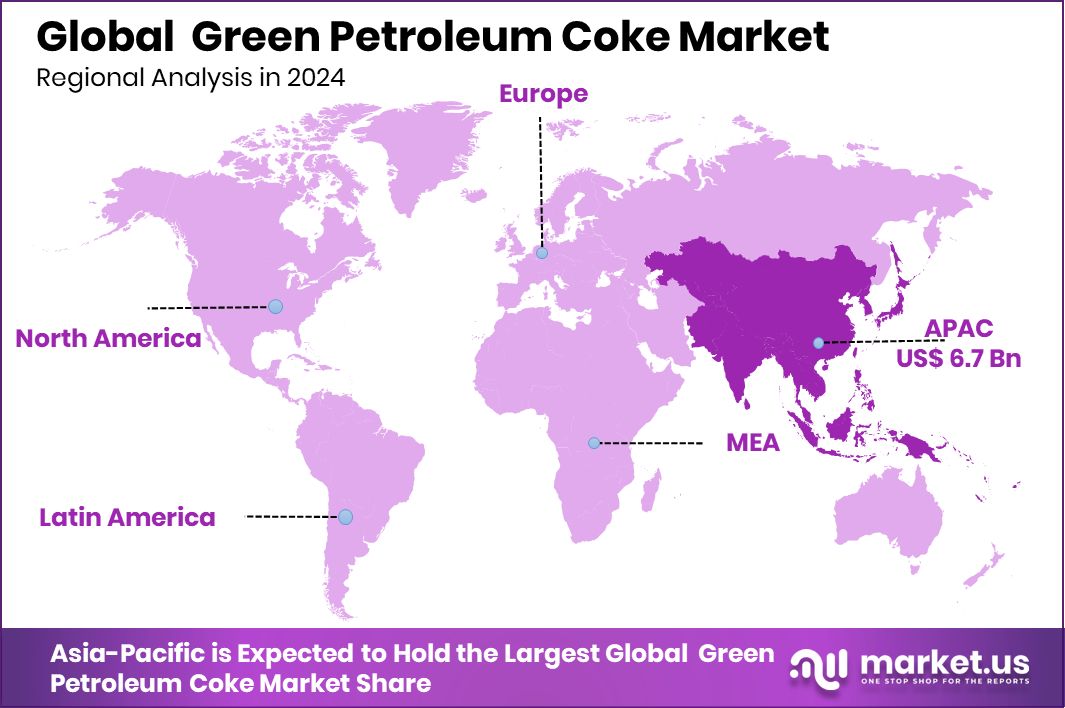

- The Asia-Pacific records a strong market value of USD 6.7 Bn in 2024.

By Source Analysis

The green petroleum coke market is dominated by the anode source with a 75.2% share globally.

In 2024, Anode held a dominant market position in the By Source segment of the Green Petroleum Coke Market, with a 75.2% share. This strong position reflects its essential role as the primary carbon input for industrial anode production, especially in energy-intensive metallurgical processes. The segment benefits from stable demand for carbon blocks, electrodes, and related high-temperature applications where consistent carbon purity is crucial.

Its dominance also indicates how industries continue to rely on anode-grade material for long operating cycles, thermal stability, and predictable performance. With downstream sectors expanding capacity and upgrading technologies, the anode segment maintains its leadership, supported by long-term consumption needs and steady operational demand across processing industries.

By Form Analysis

The green petroleum coke market is dominated by the spongy coke form at 39.5% today.

In 2024, Spongy Coke held a dominant market position in the By Form segment of the Green Petroleum Coke Market, with a 39.5% share. Its leadership comes from its porous structure, which supports efficient carbon utilization in high-temperature industrial operations. The form is widely preferred where strong reactivity and controlled combustion are required, allowing industries to maintain consistent performance and energy output.

Its dominance also reflects steady consumption in processes that rely on uniform carbon content for reliability and operational stability. As manufacturing activities expand and industries seek dependable carbon materials, Spongy Coke continues to secure its leading role, driven purely by its functional characteristics and suitability for long-cycle industrial usage.

By Application Analysis

The green petroleum coke market is dominated by the aluminum application segment, holding 43.7% overall share.

In 2024, Aluminum held a dominant market position in the By Application segment of the Green Petroleum Coke Market, with a 43.7% share. This leadership reflects the crucial role of green petroleum coke as a core carbon source for producing anodes used in aluminum smelting. The segment benefits from steady operational demand in refineries and smelters, where consistent carbon quality is necessary to maintain high conductivity and stable furnace performance.

Its strong share also shows how aluminum production continues to depend on reliable carbon inputs to support continuous electrolytic processes. As aluminum output remains active across industrial regions, this application secures its dominant position purely due to ongoing consumption needs and functional compatibility with smelting operations.

Key Market Segments

By Source

- Anode

- Fuel

By Form

- Spongy Coke

- Honeycomb Coke

- Purge Coke

- Shot Coke

- Needle Coke

By Application

- Aluminum

- Graphite Electrode

- Cement

- Power Station

- Calcined Coke

- Others

Driving Factors

Growing Use of Carbon-Rich Materials Boosts Market Demand

A major driving factor for the Green Petroleum Coke Market is the rising use of carbon-rich materials in industries that need strong, stable, and affordable carbon sources for high-temperature operations. Green coke remains essential for anode production and heavy industrial heating, especially as manufacturing and metallurgical activities continue to scale up. The push toward cleaner and more efficient carbon processes is also shaping demand.

Recent investments show this momentum clearly. Queens Carbon securing US$10 million in seed funding for low-carbon cement reflects how carbon-intensive sectors are upgrading materials while still relying on dependable carbon inputs. As industries modernize and pursue energy-efficient operations, the need for consistent carbon feedstocks like green petroleum coke strengthens even further.

Restraining Factors

Environmental Limits Reduce Growth Pace for Producers

A key restraining factor for the Green Petroleum Coke Market is the increasing pressure to cut industrial emissions, especially from carbon-heavy materials. Green petroleum coke contains sulfur and heavy metals, making it harder for industries to meet stricter air-quality rules. Many countries are tightening standards for fuel-grade coke use, which creates compliance costs and slows adoption in sensitive sectors.

At the same time, the rise of cleaner alternatives is shaping investment flows. For example, Terra CO₂ securing US$124.5 million in additional Series B funding for sustainable cement production shows how capital is shifting toward low-carbon technologies. As more industries explore these cleaner options, traditional carbon-based materials face greater limitations, reducing growth potential for green petroleum coke.

Growth Opportunity

Rising Industrial Expansion Creates Strong Opportunity Ahead

A major growth opportunity for the Green Petroleum Coke Market comes from the steady expansion of industries that rely on carbon-rich materials for smelting, heating, and high-temperature processing. As more facilities upgrade capacity and add new production lines, the need for stable carbon inputs grows naturally. Green petroleum coke fits these requirements because it offers consistent performance and remains cost-effective for large-scale operations. This opportunity becomes stronger as heavy industries plan new capital investments.

For example, Star Cement’s Board approving a ₹1,500 crore fundraising plan signals continued expansion in energy-intensive sectors. Such industrial growth directly boosts demand for dependable carbon feedstocks, making green petroleum coke well-positioned to benefit from upcoming capacity additions and long-term infrastructure development.

Latest Trends

New Industrial Projects Strengthen Carbon Material Adoption

A key trend in the Green Petroleum Coke Market is the rise of large industrial projects designed to boost carbon processing capacity and support long-term supply stability. Countries and companies are investing heavily in new plants that can handle higher-grade carbon materials and meet growing industrial demand. This shift reflects a broader move toward stronger, more efficient production systems that depend on reliable carbon inputs.

A clear example is the announcement of a US$430 million petroleum coke plant coming up in Oman, which highlights how regions are preparing for future carbon needs by expanding local manufacturing. Such large-scale developments show a strong commitment to strengthening supply chains, and they keep green petroleum coke firmly aligned with modern industrial growth.

Regional Analysis

Asia-Pacific leads the Green Petroleum Coke Market with 39.30% regional share.

Asia-Pacific dominated the Green Petroleum Coke Market in 2024, holding a 39.30% share valued at USD 6.7 Bn, reflecting its strong industrial base and continuous demand from heavy manufacturing. The region’s large refining capacity and growing carbon-based processing activities reinforce its leadership, supported by steady consumption from sectors that rely on stable high-carbon feedstocks.

North America follows with consistent uptake driven by established industrial operations and ongoing upgrades in high-temperature processing systems. The region benefits from mature refining infrastructure, which supports a stable supply for domestic applications.

Europe shows steady market participation, shaped by its long industrial tradition and demand for carbon materials in specialized manufacturing. Although environmental pressures influence usage, the region continues to rely on carbon inputs for several essential processes.

The Middle East & Africa region leverages expanding energy and industrial activities, progressively increasing usage as new facilities and processing units come online. Latin America contributes through growing industrial operations that continue to adopt carbon-rich materials to support core manufacturing needs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Rain Carbon Inc. continues to play an influential role in the Green Petroleum Coke Market through its strong focus on carbon-based raw materials used in high-temperature industrial processes. The company benefits from its long-standing expertise in handling and upgrading coke products, allowing it to serve complex metallurgical and energy-related applications. Its operational scale and deep understanding of carbon conversion help maintain consistent supply quality, which is essential for industries that rely on reliable carbon feedstocks.

Oxbow Corporation remains a key participant due to its established presence in sourcing, processing, and delivering carbon materials across global industrial networks. The company’s strength lies in its ability to manage large volumes and maintain dependable logistics, supporting customers who require timely and stable deliveries. Its role in handling green coke positions it well within markets where carbon density, fuel performance, and process stability are crucial.

AMINCO RESOURCES LLC. adds strategic value through its active involvement in trading and distributing carbon products to diverse industrial segments. The company focuses on matching supply with operational needs across smelting, heating, and refining environments, where green petroleum coke remains an important raw material. Its market contribution reflects an understanding of quality requirements and the ability to supply materials that align with evolving industrial demands.

Top Key Players in the Market

- Rain Carbon Inc.

- Oxbow Corporation

- AMINCO RESOURCES LLC.

- Weifang Lianxing New Material Technology Co., Ltd.

- Atha Group

- Asbury Carbons

- Aluminium Bahrain (Alba)

Recent Developments

- In January 2025, Rain Carbon disclosed plans to build a new coal-tar distillation and pitch processing facility in the Andhra Pradesh Special Economic Zone, India. The facility is aimed at upgrading pitch and other carbon feedstocks for downstream use.

- In December 2024, Asbury Carbons commercially launched its novel Edge-Oxidized Graphene (EOG) product. This new graphene form, made through a patented process, complements the company’s carbon and coke materials portfolio.

Report Scope

Report Features Description Market Value (2024) USD 17.1 Billion Forecast Revenue (2034) USD 29.8 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Anode, Fuel), By Form (Spongy Coke, Honeycomb Coke, Purge Coke, Shot Coke, Needle Coke), By Application (Aluminum, Graphite Electrode, Cement, Power Station, Calcined Coke, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Rain Carbon Inc., Oxbow Corporation, AMINCO RESOURCES LLC., Weifang Lianxing New Material Technology Co., Ltd., Atha Group, Asbury Carbons, Aluminium Bahrain (Alba) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Green Petroleum Coke MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Green Petroleum Coke MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rain Carbon Inc.

- Oxbow Corporation

- AMINCO RESOURCES LLC.

- Weifang Lianxing New Material Technology Co., Ltd.

- Atha Group

- Asbury Carbons

- Aluminium Bahrain (Alba)