Global Acetylacetone Market By Type (Keto, Enol), By Formulation (Liquid, Solid), By Application (Intermediate Chemicals, Biomolecules, Agrochemicals, Pharmaceutical, Dyes and Pigments, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147850

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

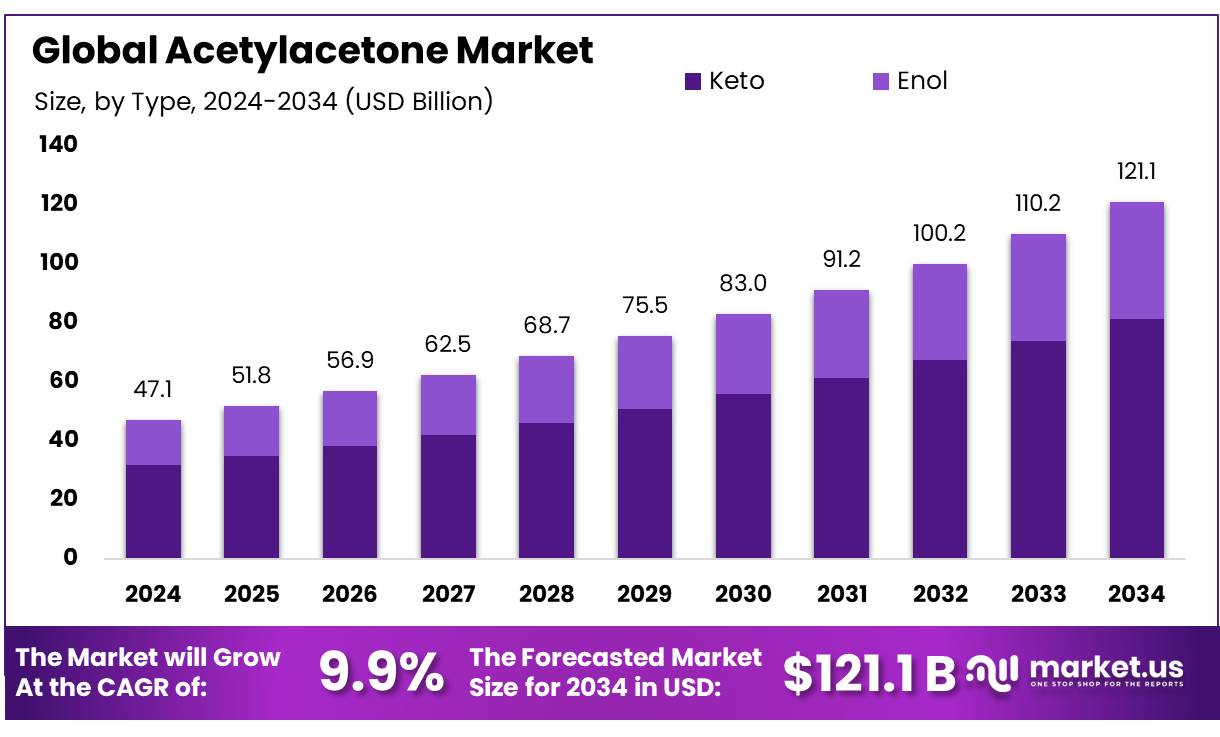

The global Acetylacetone market size is projected to reach approximately USD 121.1 billion by 2034, rising from USD 47.1 Billion in 2024. This promising growth reflects a steady compound annual growth rate (CAGR) of 9.9% between 2025 and 2034. In 2024, North America remained the leading regional contributor, accounting for more than 42.9% of the global market share, with revenue generation of around USD 20.2 billion.

Acetylacetone (2,4-pentanedione) is a versatile β-diketone compound widely utilized as a chelating agent, solvent, and intermediate in various industrial applications. Its chemical properties make it integral to the production of pharmaceuticals, agrochemicals, polymers, and metal catalysts. The compound’s ability to form stable complexes with metal ions underpins its significance in coordination chemistry and catalysis.

In July 2022, LG Chem Ltd. began exporting its first batch of bio-balanced phenol and acetone. An ISCC PLUS certified product makes use of renewable bio-feedstocks such as biomass and waste cooking oil from renewable sources. This is the largest quantity of ISCC PLUS certified product South Korea has ever exported, with 4,000 tons of phenol and 1,200 tons of acetone.

Key Takeaways

- Acetylacetone Market size is expected to be worth around USD 121.1 billion by 2034, from USD 47.1 Billion in 2024, growing at a CAGR of 9.9% from 2025 to 2034.

- Keto held a dominant market position, capturing more than a 67.2% share in the Acetylacetone market.

- Liquid Acetylacetone held a dominant market position, capturing more than an 87.1% share in the global market.

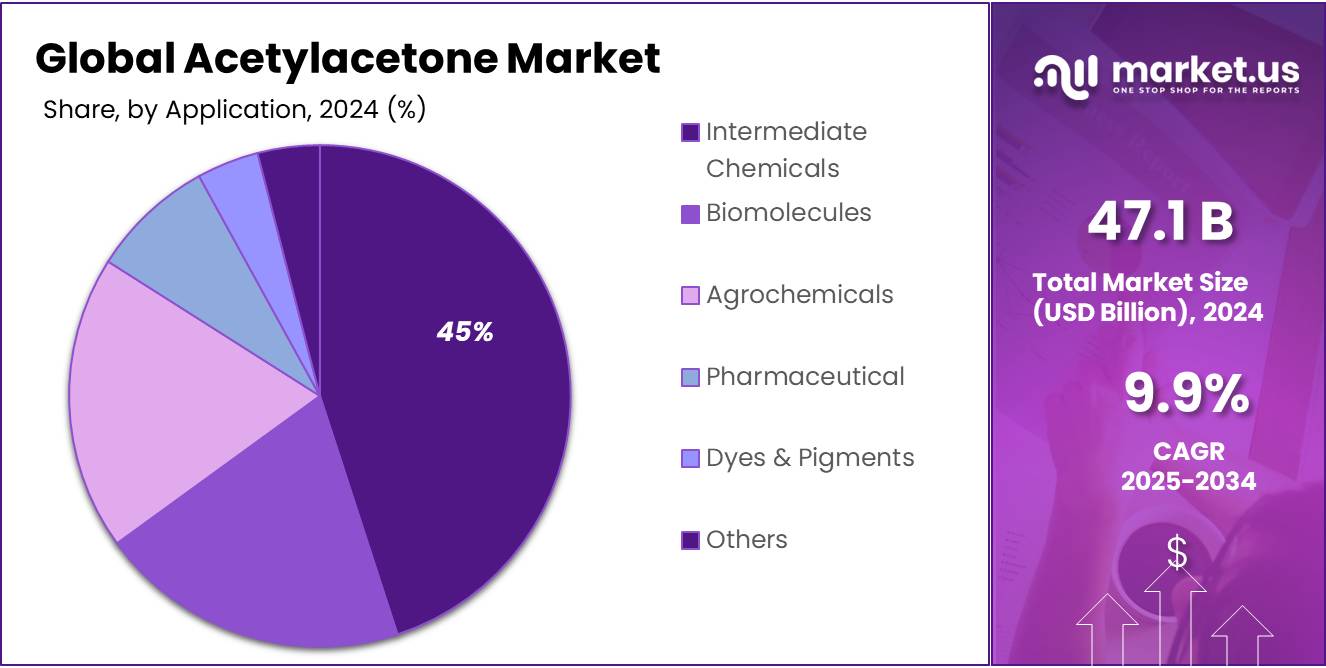

- Intermediate Chemicals held a dominant market position, capturing more than a 45.9% share in the Acetylacetone market.

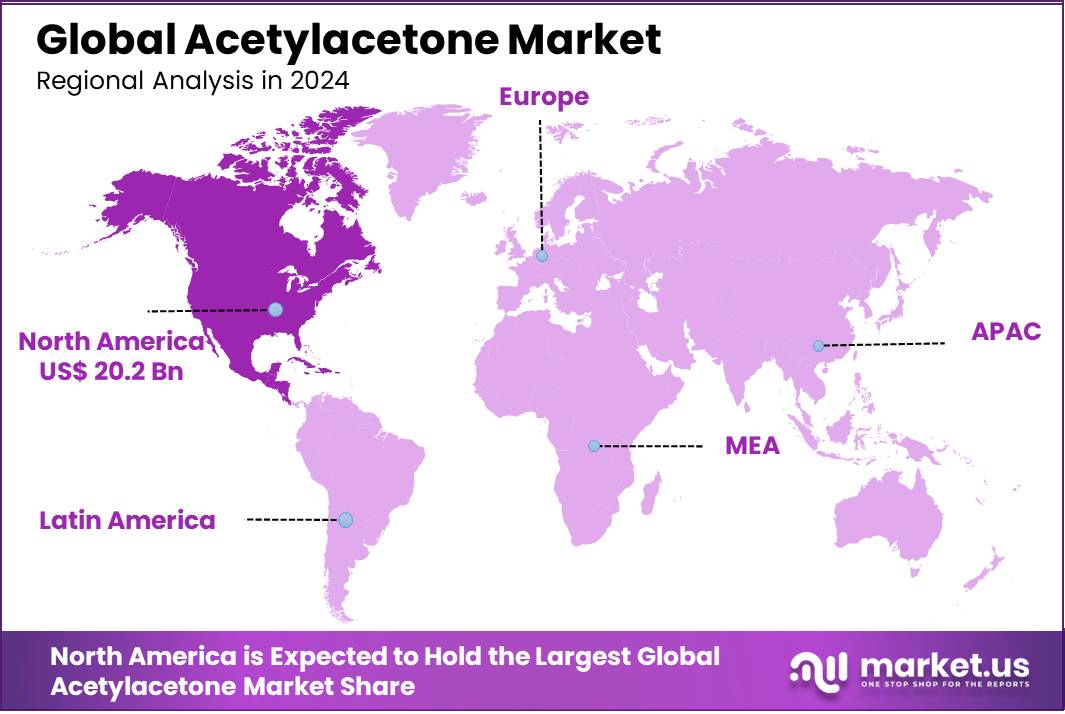

- North America emerged as the dominant region in the global acetylacetone market, capturing a substantial 43.6% share, equivalent to USD 6.0 billion.

Analysts’ Viewpoint

From an investment perspective, in acetylacetone are driven by its diverse applications and the expanding chemical sector. The compound’s role as a chelating agent in metal complex formation and its use in the production of additives, coatings, and pharmaceuticals enhance its application scope across several industries, fostering market growth. However, investors should be aware of potential risks, including price volatility of raw materials like acetone and ketene, which can impact production costs and market stability.

Technological advancements play a significant role in the acetylacetone market. Improvements in chemical production and processing are facilitating safer and more environmentally sound production techniques, which not only reduce production costs but also make the chemical available to an increasing number of industries. Additionally, regulatory frameworks are shaping the development and application of acetylacetone, with environmental regulations influencing formulations and driving the adoption of more sustainable practices in its production and use.

By Type

Keto Acetylacetone Captures 67.2% Share in 2024, Driven by Versatile Applications

In 2024, Keto held a dominant market position, capturing more than a 67.2% share in the Acetylacetone market. This substantial market share is largely attributed to its extensive use as a chemical intermediate in the production of metal chelates and as a stabilizer in resins and polymers. The growing demand for Keto Acetylacetone in the synthesis of pharmaceuticals and agrochemicals has further strengthened its market hold. Additionally, its application in chemical research as a reagent for complexation and catalysis has continued to gain momentum, reinforcing its market dominance. As the demand for specialized chemical intermediates expands in 2025, Keto Acetylacetone is poised to maintain its leading market position, driven by its multi-functional properties and industrial applicability.

By Formulation

Liquid Acetylacetone Commands 87.1% Share in 2024, Boosted by Industrial Usage

In 2024, Liquid Acetylacetone held a dominant market position, capturing more than an 87.1% share in the global market. This extensive market presence is largely driven by its widespread application as a solvent and chelating agent in chemical processing, metal extraction, and paint formulations. The liquid form is preferred due to its superior solubility and ease of handling in industrial applications. Additionally, its usage in synthesizing pharmaceutical intermediates and agrochemical formulations has further propelled demand in 2024. As the chemical sector continues to expand in 2025, Liquid Acetylacetone is expected to maintain its stronghold, driven by its functional versatility and expanding end-use applications.

By Application

Intermediate Chemicals Secure 45.9% Share in 2024, Powered by Industrial Synthesis

In 2024, Intermediate Chemicals held a dominant market position, capturing more than a 45.9% share in the Acetylacetone market. The substantial market share is driven by its extensive use as a precursor in synthesizing specialized compounds across pharmaceuticals, agrochemicals, and polymer industries. The application of Acetylacetone in producing complex metal chelates and stabilizers has further bolstered its demand within the intermediate chemicals segment. Additionally, the growing focus on advanced chemical formulations in 2025 is anticipated to sustain demand, reinforcing its strong market presence and expanding industrial applications.

Key Market Segments

By Type

- Keto

- Enol

By Formulation

- Liquid

- Solid

By Application

- Intermediate Chemicals

- Biomolecules

- Agrochemicals

- Pharmaceutical

- Dyes & Pigments

- Others

Drivers

Government Support Spurs Acetylacetone Demand in India’s Chemical Sector

India’s acetylacetone market is experiencing significant growth, largely driven by robust government initiatives aimed at bolstering domestic manufacturing. Recognizing the compound’s vital role in pharmaceuticals, agrochemicals, and coatings, Indian authorities have implemented policies to reduce reliance on imports and encourage local production.

The government’s “Make in India” campaign has been instrumental in this shift, promoting self-sufficiency in chemical manufacturing. As a result, Indian companies are increasingly investing in acetylacetone production facilities to meet the rising domestic demand. This move not only supports the local economy but also ensures a steady supply of this essential chemical for various industries.

In the pharmaceutical sector, acetylacetone serves as a crucial intermediate in drug synthesis. With India’s pharmaceutical industry projected to reach USD 65 billion by 2024, the demand for acetylacetone is expected to rise correspondingly. Similarly, the agrochemical industry, which relies on acetylacetone-based pesticides, is expanding due to the country’s large agricultural base. The coatings industry, particularly in infrastructure and automotive sectors, also contributes to the growing demand for acetylacetone.

To support these developments, the Indian government has introduced favorable policies, including tax incentives and streamlined regulatory processes, to attract investments in chemical manufacturing. These measures aim to enhance production efficiency and environmental sustainability, aligning with global standards.

Restraints

Health and Safety Concerns Limit Acetylacetone’s Industrial Growth

Acetylacetone, also known as 2,4-pentanedione, is widely used in various industries, including pharmaceuticals, agrochemicals, and coatings. However, its hazardous nature poses significant challenges to its widespread adoption.

The Occupational Safety and Health Administration has set a permissible exposure limit (PEL) for acetylacetone at 25 parts per million (ppm) over an 8-hour workday. Exceeding this limit can lead to severe health issues. Short-term exposure may cause irritation to the eyes, skin, and respiratory tract, while prolonged exposure can affect the liver and kidneys.

In addition to health risks, acetylacetone is highly flammable, with a flash point of 93°F (34°C). This necessitates stringent storage and handling protocols, increasing operational costs for industries. Companies must invest in specialized equipment and training to ensure safe usage, which can be a deterrent, especially for small and medium-sized enterprises.

Environmental concerns also play a role in limiting acetylacetone’s market growth. Improper disposal can lead to contamination of water sources, affecting aquatic life. Regulatory bodies worldwide are enforcing stricter environmental guidelines, compelling industries to seek safer and more sustainable alternatives.

Opportunity

Government Support Spurs Acetylacetone Demand in India’s Chemical Sector

India’s acetylacetone market is experiencing significant growth, largely driven by robust government initiatives aimed at bolstering domestic manufacturing. Recognizing the compound’s vital role in pharmaceuticals, agrochemicals, and coatings, Indian authorities have implemented policies to reduce reliance on imports and encourage local production.

The government’s “Make in India” campaign has been instrumental in this shift, promoting self-sufficiency in chemical manufacturing. As a result, Indian companies are increasingly investing in acetylacetone production facilities to meet the rising domestic demand. This move not only supports the local economy but also ensures a steady supply of this essential chemical for various industries.

The demand for acetylacetone is expected to rise correspondingly. Similarly, the agrochemical industry, which relies on acetylacetone-based pesticides, is expanding due to the country’s large agricultural base. The coatings industry, particularly in infrastructure and automotive sectors, also contributes to the growing demand for acetylacetone.

To support these developments, the Indian government has introduced favorable policies, including tax incentives and streamlined regulatory processes, to attract investments in chemical manufacturing. These measures aim to enhance production efficiency and environmental sustainability, aligning with global standards.

Trends

Green Chemistry Drives Acetylacetone Innovation in 2024

In 2024, the acetylacetone market is witnessing a notable shift towards sustainable practices, aligning with the global emphasis on green chemistry. This trend is propelled by increasing environmental concerns and stringent regulations aimed at reducing hazardous chemical usage.

Acetylacetone, traditionally used in various industrial applications, is now being explored for its potential in eco-friendly formulations. Its role as a chelating agent and solvent makes it a candidate for developing biodegradable products and sustainable agrochemicals. This aligns with the broader industry movement towards reducing environmental footprints and adopting renewable resources.

The global push for sustainability has led to innovations in acetylacetone production methods. Companies are investing in research to develop bio-based acetylacetone, utilizing renewable feedstocks and environmentally benign processes. These advancements not only cater to the demand for greener chemicals but also open new avenues in pharmaceuticals, agriculture, and materials science.

Government initiatives worldwide are supporting this transition. Policies promoting green chemistry and providing incentives for sustainable manufacturing practices are encouraging industries to adopt eco-friendly alternatives. This regulatory support is crucial in accelerating the development and commercialization of sustainable acetylacetone products.

Regional Analysis

North America Leads Acetylacetone Market with 43.6% Share, Valued at USD 6.0 Billion

In 2024, North America emerged as the dominant region in the global acetylacetone market, capturing a substantial 43.6% share, equivalent to USD 6.0 billion. The region’s stronghold can be attributed to the extensive application of acetylacetone in the chemical, pharmaceutical, and coatings industries. The United States, being a key contributor, has a well-established chemical manufacturing sector, with leading companies investing in the production of acetylacetone for high-value applications such as metal chelation, catalyst synthesis, and pharmaceutical intermediates.

Canada also plays a vital role in the market, driven by its expanding agrochemical sector, where acetylacetone is employed as a stabilizer and intermediate in pesticide formulations. Additionally, the increasing demand for high-performance coatings in the construction and automotive sectors further propels market growth in North America. According to the U.S. Environmental Protection Agency (EPA), the demand for sustainable and low-VOC chemicals is pushing manufacturers to explore bio-based acetylacetone derivatives, aligning with stringent regulatory frameworks aimed at reducing environmental impact.

Furthermore, government initiatives such as the Inflation Reduction Act in the U.S. provide financial incentives for domestic chemical manufacturing, fostering investments in advanced chemical processing facilities. With a robust industrial base and supportive regulatory environment, North America is expected to maintain its leading position in the acetylacetone market, with continued investments in high-performance chemical applications and sustainable production practices, further consolidating its market dominance in the upcoming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Merck KGaA remains a prominent player in the acetylacetone market, leveraging its extensive expertise in specialty chemicals. The company focuses on producing high-purity acetylacetone for applications in pharmaceutical synthesis and advanced chemical processing. Merck’s innovative approach in developing bio-based acetylacetone aligns with the growing demand for sustainable chemical solutions. Its strategic investments in research facilities across Europe and the U.S. further solidify its market position, driving revenue growth in 2024 and beyond.

Wacker continues to expand its acetylacetone portfolio, targeting the coatings, adhesives, and sealants industries. The company emphasizes sustainable production processes, utilizing advanced chemical synthesis to reduce environmental impact. In 2024, Wacker reported increased demand for acetylacetone as a chelating agent in high-performance coatings, particularly in automotive and construction sectors. The firm’s commitment to research and development supports its ongoing efforts to introduce innovative acetylacetone derivatives tailored to industrial applications.

Weirong has established itself as a significant player in the acetylacetone market by adopting a competitive pricing strategy. The company’s production facilities in China enable cost-effective manufacturing, meeting the rising demand for acetylacetone in agrochemical and pharmaceutical applications. In 2024, Weirong increased its market share by expanding export capabilities to North America and Europe, positioning itself as a key supplier of acetylacetone intermediates for global clients seeking reliable and economical chemical solutions.

Top Key Players in the Market

- Merck KGaA

- Wacker

- Weirong

- XINAOTE

- Daicel

- BASF SE

- Fubore

- Anhui Wotu Chemical

Recent Developments

In 2024, Merck KGaA, a leading science and technology company based in Darmstadt, Germany, reported total net sales of €21.2 billion, with its Life Science segment contributing €8.9 billion.

In 2024, Wacker Chemie AG reported total sales of €5.72 billion, reflecting an 11% decrease from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 47.1 Bn Forecast Revenue (2034) USD 121.1 Bn CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Keto, Enol), By Formulation (Liquid, Solid), By Application (Intermediate Chemicals, Biomolecules, Agrochemicals, Pharmaceutical, Dyes and Pigments, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Merck KGaA, Wacker, Weirong, XINAOTE, Daicel, BASF SE, Fubore, Anhui Wotu Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Merck KGaA

- Wacker

- Weirong

- XINAOTE

- Daicel

- BASF SE

- Fubore

- Anhui Wotu Chemical