Global Chlorine Tablet Market By Type (Upto 60%, 60% to 90%, Above 90%), By Application (Swimming Pools, Water Treatment Plants, Household Cleaning, Others), By End-Use (Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147894

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

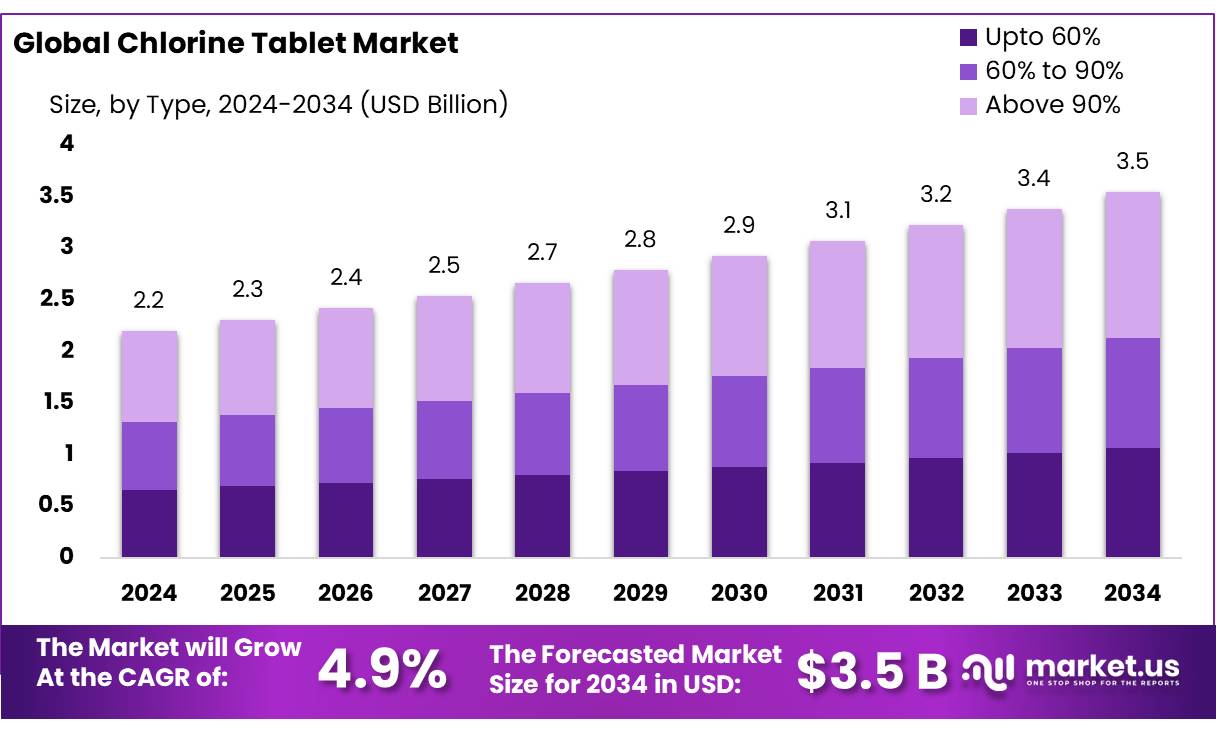

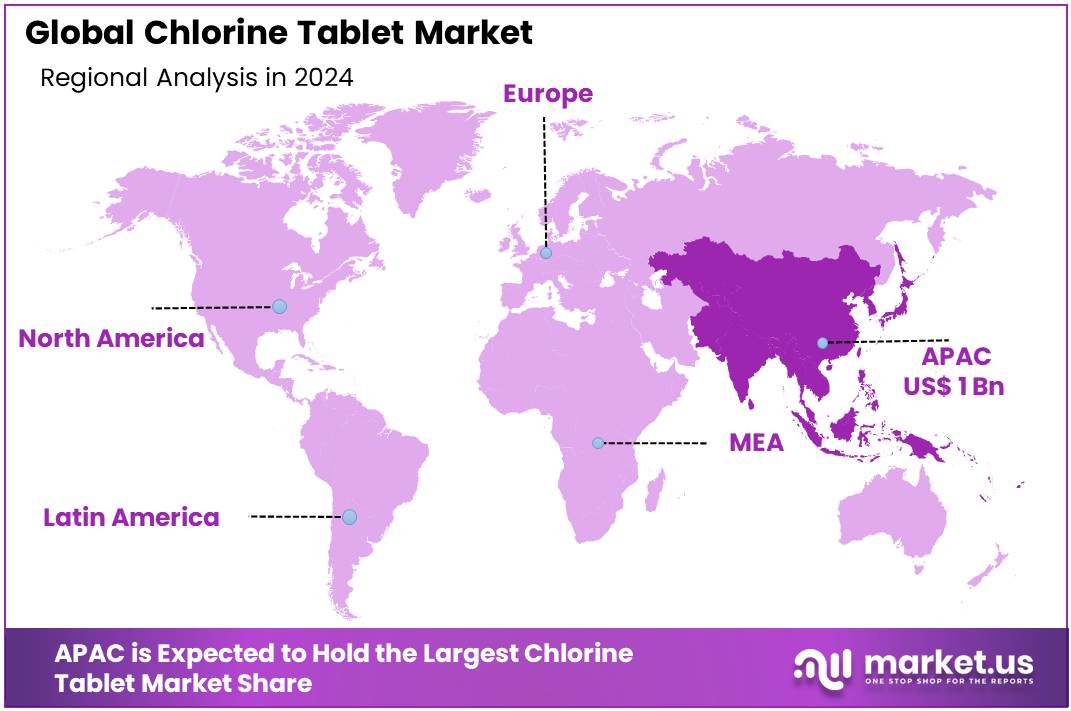

The global Chlorine Tablet market size is projected to reach approximately USD 3.5 billion by 2034, rising from USD 2.2 Billion in 2024. This promising growth reflects a steady compound annual growth rate (CAGR) of 4.9% between 2025 and 2034. In 2024, Asia Pacific remained the leading regional contributor, accounting for more than 47.8% of the global market share, with revenue generation of around USD 1 billion.

Chlorine tablets are a widely used form of disinfectant in various applications, including water treatment, sanitation, and swimming pool maintenance. These tablets are essential for purifying water by eliminating harmful bacteria, viruses, and pathogens. Chlorine is effective in killing microorganisms by disrupting their cellular processes, making it a critical chemical in both residential and industrial water treatment.

Chlorine tablets offer the advantage of being easy to handle, store, and transport, which makes them more popular compared to liquid chlorine or other forms of disinfectants.According to the Centers for Disease Control and Prevention (CDC), chlorine-based products are instrumental in maintaining water quality and public health, particularly in potable water systems and recreational water venues.

Key driving factors behind the growth of the chlorine tablet market is the increasing demand for clean water due to rising populations and urbanization. The World Health Organization (WHO) reports that over 2 billion people globally lack access to safely managed drinking water, which increases the need for water purification technologies such as chlorine tablets. Furthermore, industrial growth, particularly in the agriculture and healthcare sectors, continues to drive demand for sanitation products. Chlorine tablets offer a cost-effective solution for maintaining hygiene standards in industries such as food processing, hospitals, and sanitation services.

In India, the demand for chlorine tablets is bolstered by government initiatives aimed at enhancing water quality and accessibility. The Jal Jeevan Mission, launched by the Indian government, seeks to provide potable water to all rural households. As part of this mission, in-line chlorination systems are being implemented in states like Madhya Pradesh to ensure continuous water disinfection . Additionally, during flood emergencies, state governments have distributed millions of chlorine tablets to prevent waterborne diseases.

Key Takeaways

- Chlorine Tablet Market size is expected to be worth around USD 3.5 Billion by 2034, from USD 2.2 Billion in 2024, growing at a CAGR of 4.9%.

- Above 90% chlorine tablets held a dominant market position, capturing more than a 44.2% share of the global chlorine tablet market.

- Swimming Pools held a dominant market position, capturing more than a 49.6% share of the global chlorine tablet market.

- Residential held a dominant market position, capturing more than a 49.4% share of the chlorine tablet market.

- Asia Pacific (APAC) region emerged as the dominant market for chlorine tablets, capturing a significant 47.8% share, translating to an estimated market value of approximately USD 1 billion.

By Type

Above 90% Chlorine Tablets Capture 44.2% Market Share in 2024

In 2024, Above 90% chlorine tablets held a dominant market position, capturing more than a 44.2% share of the global chlorine tablet market. The segment’s robust performance is primarily driven by its high concentration of active chlorine, making it exceptionally effective in water disinfection and sanitation applications. The increased adoption of Above 90% tablets in municipal water treatment plants, particularly in regions facing significant waterborne disease outbreaks, has fueled demand. Additionally, the segment’s substantial share is also attributed to its extended shelf life and greater disinfection efficacy compared to lower concentration variants. As industries and residential sectors prioritize reliable disinfection solutions, Above 90% chlorine tablets are anticipated to maintain their leading position in 2025, driven by stringent regulatory standards and rising public health concerns.

By Application

Swimming Pools Lead with 49.6% Market Share in 2024

In 2024, Swimming Pools held a dominant market position, capturing more than a 49.6% share of the global chlorine tablet market. The extensive usage of chlorine tablets in public and private swimming pools for effective disinfection and algae control has driven the segment’s growth. With increasing recreational and leisure activities, the demand for maintaining pool hygiene has surged, particularly in residential complexes and commercial facilities. Furthermore, heightened public awareness about waterborne diseases has propelled the adoption of chlorine tablets, particularly in regions with strict water quality regulations. As the trend towards health and wellness continues, the Swimming Pools segment is expected to sustain its leadership in 2025, driven by rising investments in infrastructure and recreational facilities.

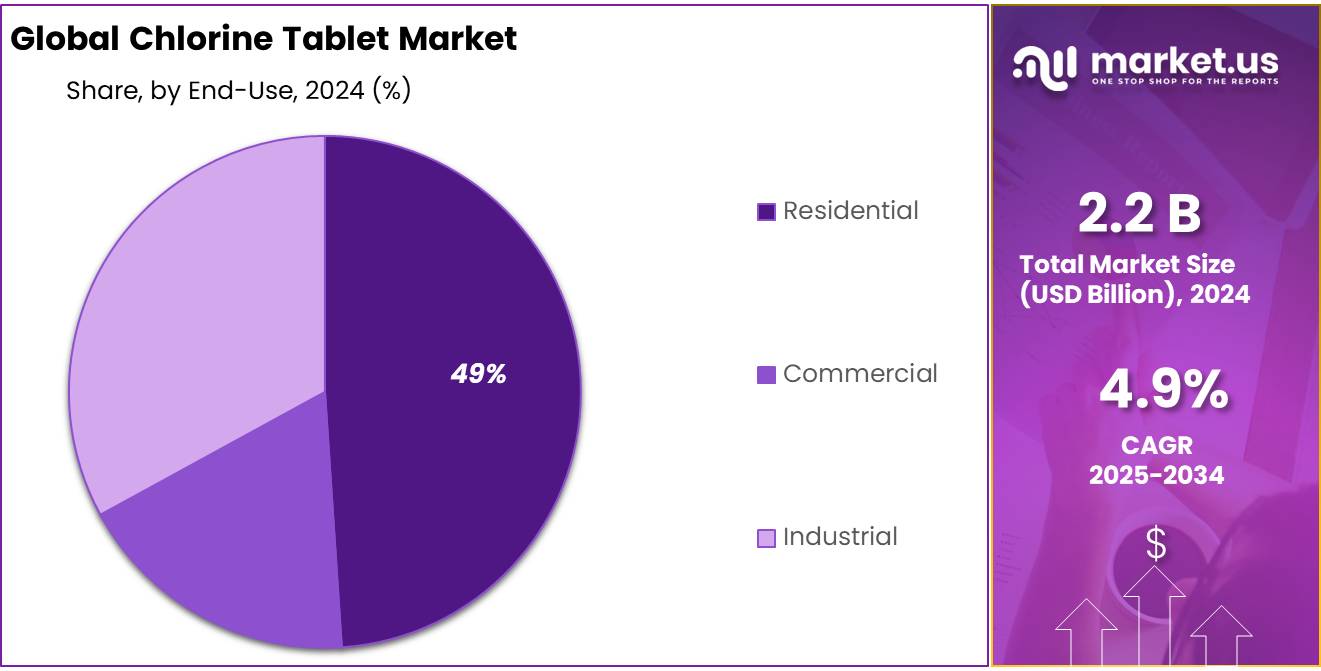

By End-Use

Residential Sector Commands 49.4% Market Share in 2024

In 2024, Residential held a dominant market position, capturing more than a 49.4% share of the chlorine tablet market. The increasing focus on maintaining household water hygiene, particularly in urban and semi-urban areas, has driven the segment’s prominence. Rising concerns over waterborne diseases and the need for effective disinfection solutions have accelerated the adoption of chlorine tablets in residential settings. Additionally, the growing number of swimming pools in private homes and the emphasis on safe drinking water have further bolstered demand. Looking ahead to 2025, the Residential segment is expected to retain its stronghold, supported by ongoing public health initiatives and heightened consumer awareness about water sanitation practices.

Key Market Segments

By Type

- Upto 60%

- 60% to 90%

- Above 90%

By Application

- Swimming Pools

- Water Treatment Plants

- Household Cleaning

- Others

By End-Use

- Residential

- Commercial

- Industrial

Drivers

Rising Global Demand for Safe Drinking Water

One of the primary factors driving the chlorine tablet market is the increasing global demand for safe and clean drinking water. According to the World Health Organization (WHO), approximately 2 billion people worldwide still lack access to safely managed drinking water services. This significant gap underscores the urgent need for effective water purification solutions, such as chlorine tablets, which are widely recognized for their efficiency in disinfecting water and eliminating harmful pathogens.

Governments and municipalities are actively investing in water treatment infrastructure to address this issue. For instance, the United States Environmental Protection Agency (EPA) has set maximum allowable levels for chlorine in drinking water to ensure its safety while maintaining its effectiveness as a disinfectant. Such regulatory measures not only emphasize the importance of water quality but also drive the demand for chlorine-based disinfectants in public water systems.

In addition to regulatory efforts, public awareness about the importance of water sanitation has been on the rise, especially in developing nations. This heightened awareness has led to increased adoption of chlorine tablets in various settings, including households, healthcare facilities, and emergency relief operations. The convenience, affordability, and effectiveness of chlorine tablets make them a preferred choice for ensuring water safety in diverse environments.

Furthermore, the ongoing challenges posed by waterborne diseases have highlighted the critical role of chlorine tablets in public health. By providing a reliable means to disinfect water, these tablets help prevent the spread of illnesses, thereby contributing to improved health outcomes in communities lacking access to advanced water treatment facilities.

Restraints

Health and Environmental Concerns Limit Chlorine Tablet Adoption

While chlorine tablets are effective for water disinfection, their strong taste and odor can deter usage. Studies have shown that even at low concentrations, the taste and smell of chlorine can be off-putting, leading individuals to reject treated water in favor of potentially unsafe sources. This aversion has, in some cases, contributed to outbreaks of waterborne diseases when communities opted for untreated water due to the unpleasant sensory attributes of chlorinated water.

Additionally, the environmental impact of chlorine tablet usage is a growing concern. Excessive use can lead to the formation of harmful byproducts, such as trihalomethanes and haloacetic acids, which are known carcinogens. These compounds can contaminate water bodies, posing risks to aquatic life and potentially entering the human food chain.

Furthermore, the production and disposal of chlorine tablets contribute to environmental degradation. The manufacturing process can release pollutants, and improper disposal of unused tablets or packaging can lead to soil and water contamination.

These health and environmental concerns underscore the need for careful consideration in the use of chlorine tablets. While they play a crucial role in ensuring water safety, it’s essential to address these challenges through improved formulations, public education on proper usage, and the development of alternative disinfection methods that minimize adverse effects.

Opportunity

Expansion of Safe Drinking Water Initiatives Presents Growth Opportunities for Chlorine Tablet Market

One of the most significant growth opportunities for the chlorine tablet market lies in the global expansion of safe drinking water initiatives. According to the World Health Organization (WHO), approximately 2 billion people worldwide still lack access to safely managed drinking water services. This underscores the urgent need for effective and accessible water purification solutions, such as chlorine tablets, to ensure safe drinking water for all.

Government initiatives play a pivotal role in addressing this challenge. For instance, the U.S. Environmental Protection Agency (EPA) provides financial resources, including grants, to support public water systems in enhancing the quality of drinking water and improving public health. These programs aim to ensure that all communities have access to safe and clean drinking water, thereby driving the demand for effective water treatment solutions like chlorine tablets.

Furthermore, organizations such as the Chlorine Chemistry Foundation (CCF) are actively engaged in promoting chlorine-based water treatment methods. The CCF works through partnerships to increase access to safe, chlorinated drinking water and chlorine-based surface disinfectants. Their efforts contribute to improving public health and safety by advocating for the use of chlorine in water purification.

In developing countries, programs like the Safe Water System (SWS), developed by the Centers for Disease Control and Prevention (CDC) and the Pan American Health Organization, have been implemented to reduce waterborne diseases. These programs involve the use of chlorine-based disinfectants to treat water at the point of use, significantly improving water quality and reducing the incidence of diarrheal diseases.

Trends

Government Initiatives Fueling Chlorine Tablet Market Growth

One of the most significant growth drivers for the chlorine tablet market is the increasing global emphasis on water sanitation and safety. Governments worldwide are implementing stringent regulations and investing in infrastructure to ensure access to clean and safe drinking water, thereby propelling the demand for effective disinfection solutions like chlorine tablets.

In the United States, the Environmental Protection Agency (EPA) has established rigorous standards for water quality, with chlorine being one of the most widely used disinfectants in municipal water treatment. As of 2022, over 60% of municipal water treatment facilities in the U.S. employed chlorine in various forms, underscoring its critical role in safeguarding public health.

Similarly, the Centers for Disease Control and Prevention (CDC) reports that approximately 7 million people in the U.S. fall ill each year due to waterborne pathogens, highlighting the importance of effective water purification methods. This statistic underscores the necessity for chlorine-based disinfectants to mitigate health risks associated with contaminated water.

Internationally, organizations such as the World Health Organization (WHO) and the United Nations Children’s Fund (UNICEF) are actively promoting the use of chlorine tablets as part of their initiatives to improve water quality in developing regions. These organizations provide technical assistance and funding to support the distribution and use of chlorine-based disinfectants, aiming to reduce the prevalence of waterborne diseases in underserved communities.

Regional Analysis

Asia Pacific (APAC) Region Dominates the Chlorine Tablet Market with 47.8% Share in 2024

In 2024, the Asia Pacific (APAC) region emerged as the dominant market for chlorine tablets, capturing a significant 47.8% share, translating to an estimated market value of approximately USD 1 billion. This commanding position is attributed to several key factors, including rapid industrialization, urbanization, and a heightened focus on public health and sanitation.

Government initiatives across APAC countries have also played a pivotal role in this growth. In India, the Ministry of Jal Shakti’s ‘Jal Jeevan Mission’ aims to provide safe drinking water to all rural households by 2024, thereby escalating the need for effective water disinfection methods like chlorine tablets. Similarly, China’s ‘Water Ten Plan’ enforces stringent water quality standards, compelling industries to adopt advanced water treatment technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

B&V Chemicals is a prominent player in the chlorine tablet market, specializing in the production of high-quality disinfectants and water treatment chemicals. The company offers chlorine tablets that are widely used in water purification, swimming pool maintenance, and industrial water treatment applications. With a commitment to quality and safety, B&V Chemicals is known for its efficient supply chain and adherence to global regulatory standards, making it a trusted supplier for various sectors across the globe.

R X Chemicals is a leading manufacturer of chlorine-based products, including chlorine tablets for water treatment applications. The company focuses on delivering reliable and cost-effective solutions for municipal and industrial water disinfection. Their chlorine tablets are known for their stability and effectiveness in killing bacteria and pathogens. R X Chemicals’ emphasis on research and development allows it to innovate and meet the growing demand for water purification products globally.

Hydrachem Limited is a key player in the chlorine tablet market, providing a range of products for water treatment. The company specializes in high-quality chlorine tablets for municipal and industrial water disinfection. Known for its customer-centric approach, Hydrachem Limited has developed a strong reputation for providing reliable, effective, and safe chlorine solutions. Its products are used extensively in drinking water sanitation, wastewater treatment, and swimming pool maintenance across various industries.

Top Key Players in the Market

- B&V Chemicals

- R X Chemicals

- Hydrachem Limited

- ACURO ORGANICS LIMITED

- Maclin Group

- Medentech

- Westlake Chemical

- Hind Pharma

Recent Developments

In 2023, Acuro Organics Limited reported a notable 11.02% growth in revenue. However, despite this increase, the company experienced a significant decline in profitability, with a 32.81% decrease in profit. On a positive note, Acuro’s net worth saw a remarkable rise, soaring by 15.37%.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Bn Forecast Revenue (2034) USD 3.5 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Upto 60%, 60% to 90%, Above 90%), By Application (Swimming Pools, Water Treatment Plants, Household Cleaning, Others), By End-Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape B&V Chemicals, R X Chemicals, Hydrachem Limited, ACURO ORGANICS LIMITED, Maclin Group, Medentech, Westlake Chemical, Hind Pharma Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- B&V Chemicals

- R X Chemicals

- Hydrachem Limited

- ACURO ORGANICS LIMITED

- Maclin Group

- Medentech

- Westlake Chemical

- Hind Pharma