Global 2-Mercaptoethanol Market Size, Share, And Business Benefits By Type (greater than equal to 99%, less than 99%), By Application (PVC production, Polymer and Rubbers, Food Industry, Water Treatment, Agrochemicals, Others), By Distribution Channel (Direct Sales, Distributors and Traders, Online Channels, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140361

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

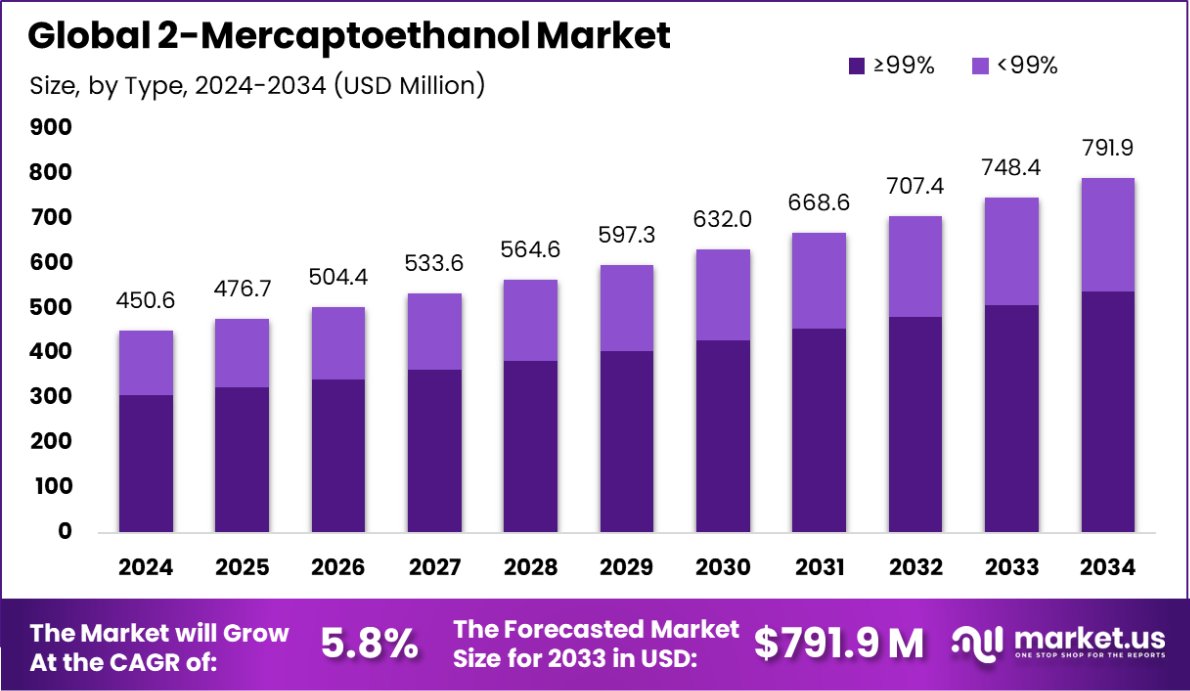

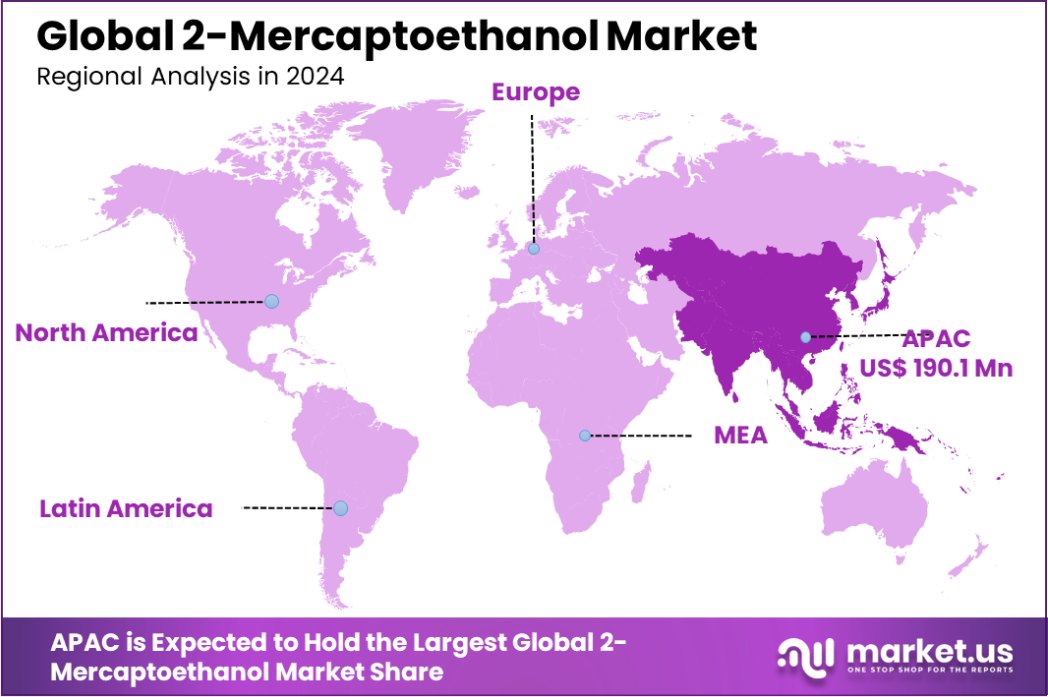

Global 2-Mercaptoethanol Market is expected to be worth around USD 791.9 Million by 2034, up from USD 450.6 Million in 2024, and grow at a CAGR of 5.8% from 2025 to 2034. Asia-Pacific accounted for 42.6% of the 2-Mercaptoethanol market, valued at USD 190.1 Mn.

2-Mercaptoethanol (C2H6OS) is a colorless, water-soluble chemical compound with a strong odor, commonly used as a reducing agent in laboratories and industrial applications. It is often employed in biochemistry, molecular biology, and protein chemistry for its ability to break disulfide bonds in proteins. The compound is also used in the production of various chemicals and in the manufacture of plastics, synthetic fibers, and coatings.

The market for 2-Mercaptoethanol is influenced by its diverse applications in scientific research, the pharmaceutical industry, and manufacturing. Increasing demand from the biotechnology and pharmaceutical sectors, particularly in drug development and diagnostics, is a key driver. The compound’s role in protein analysis and enzyme stabilization further strengthens its position in market growth.

Demand for 2-Mercaptoethanol is steadily growing due to advancements in biotechnologies and the rise of molecular biology techniques. The pharmaceutical industry’s focus on genetic research and therapeutic proteins boosts demand, as does the growth in drug testing and diagnostic applications.

Opportunities for the 2-Mercaptoethanol market are evolving with emerging applications in the cosmetic and personal care industries. As its role in formulating anti-aging products and skin-care formulations grows, it presents an untapped market. Furthermore, innovations in the development of new biological drugs and gene therapies open potential avenues for future growth.

The 2-Mercaptoethanol market is poised for steady growth, driven by its critical role in industries such as pharmaceuticals, chemical synthesis, and agricultural applications. The increasing use of pesticides, with total pesticide use in agriculture reaching 3.54 million tonnes in 2021, highlights the growing demand for chemical intermediates.

Additionally, emerging disinfection technologies like ozone, which is 3,000 times faster than chlorination, may further boost the application of 2-Mercaptoethanol in water treatment solutions. These trends suggest continued market expansion, with a rising focus on efficiency and sustainability in product development.

Key Takeaways

- Global 2-Mercaptoethanol Market is expected to be worth around USD 791.9 Million by 2034, up from USD 450.6 Million in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

- The ≥99% purity segment of 2-Mercaptoethanol accounts for 68.2% of the total market share.

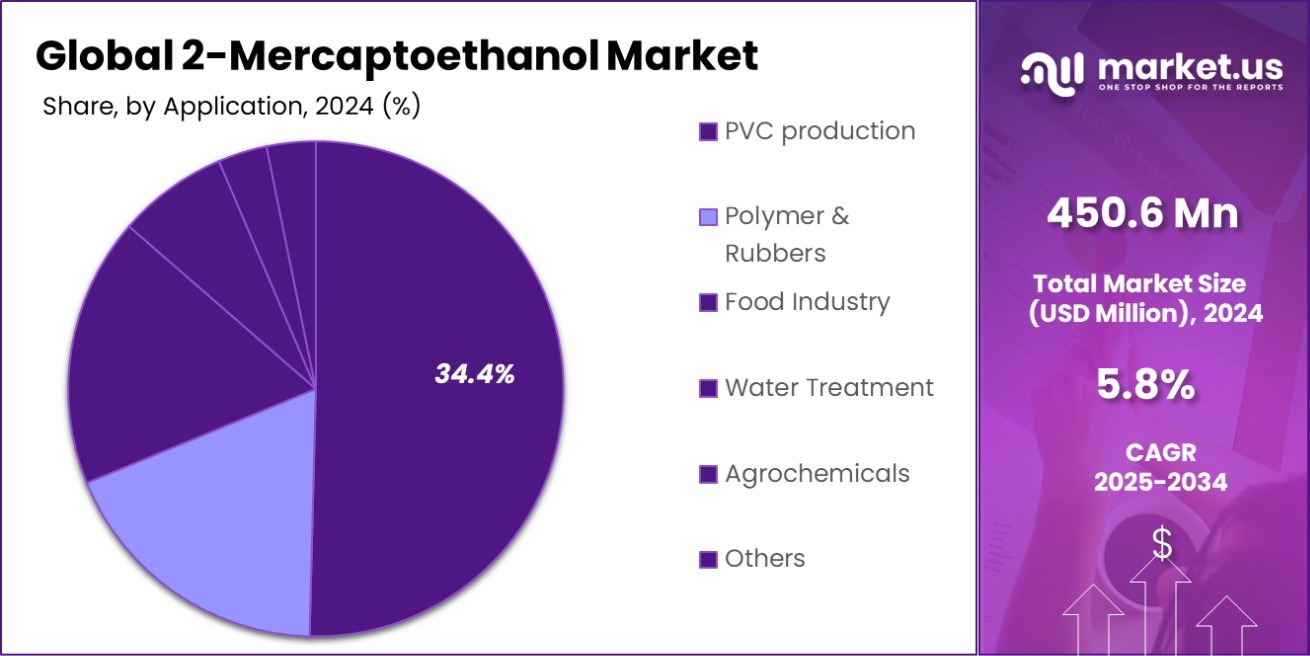

- PVC production drives 34.4% of 2-Mercaptoethanol market demand due to its stabilizing properties.

- Direct sales dominate the 2-Mercaptoethanol market, contributing to 54.2% of overall distribution.

- In Asia-Pacific, the 2-Mercaptoethanol market holds a 42.6% share, valued at USD 190.1 Mn.

By Type Analysis

The 2-Mercaptoethanol market is dominated by ≥99% purity products, accounting for 68.2% of the total market share.

In 2024, ≥99% held a dominant market position in the By Type segment of the 2-Mercaptoethanol Market, with a 68.2% share. This segment’s growth is driven by the increasing demand for high-purity 2-Mercaptoethanol in various industrial applications, including pharmaceuticals, petrochemicals, and electronics. The superior purity level of ≥99% 2-Mercaptoethanol is essential for applications that require high-grade chemicals to maintain product consistency and performance.

The pharmaceutical sector, in particular, has been a key driver of this demand, as ≥99% purity is crucial for the synthesis of active pharmaceutical ingredients (APIs) and intermediates. Additionally, the petrochemical industry uses high-purity 2-Mercaptoethanol in the production of catalysts and as a stabilizing agent, further propelling the demand for ≥99% 2-Mercaptoethanol.

On the supply side, key market players have focused on improving their production processes to meet the stringent purity requirements, which has enhanced the overall market share of ≥99%. Furthermore, with rising advancements in analytical techniques and quality control measures, producers have been able to consistently provide 2-Mercaptoethanol with the required purity levels.

By Application Analysis

PVC production remains a significant application for 2-Mercaptoethanol, contributing 34.4% to the overall market demand and growth.

In 2024, PVC production held a dominant market position in the By Application segment of the 2-Mercaptoethanol market, with a 34.4% share. This significant share can be attributed to the growing demand for PVC in various industries, including the construction, automotive, and electrical sectors. PVC, or polyvinyl chloride, is widely used as a plasticizer and stabilizer, which are essential properties in the production of durable and weather-resistant materials.

The increasing construction activities, particularly in emerging economies, have driven demand for PVC-based products such as pipes, flooring, and insulation materials. Additionally, the automotive industry’s shift towards lightweight, durable materials has further supported PVC’s growth. This trend is expected to continue, driving further consumption of 2-Mercaptoethanol as a key component in PVC production.

Moreover, the rise in electrical and electronics manufacturing, where PVC is used in wiring and cables, also contributes to the robust demand for 2-Mercaptoethanol in this segment. With ongoing technological advancements and a steady rise in infrastructure development, the PVC application in the 2-Mercaptoethanol market is likely to remain dominant, ensuring its continued market leadership in the years to come.

By Distribution Channel Analysis

Direct sales channels lead distribution, with 54.2% of 2-Mercaptoethanol products being sold directly to businesses and research entities.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel segment of the 2-Mercaptoethanol market, accounting for 54.2% of the total market share. This strong position is largely driven by the benefits that direct sales offer to both producers and customers.

Manufacturers can establish closer relationships with end-users, providing personalized services and customized solutions to meet specific application requirements, particularly in industries such as pharmaceuticals, plastics, and agriculture. This level of customization and direct communication is essential in ensuring the high quality and precise performance needed in chemical applications.

Additionally, direct sales allow for better control over pricing, eliminating the need for third-party distributors and enabling manufacturers to offer more competitive prices, particularly for bulk orders. The direct transaction model also enhances efficiency, reducing lead times and enabling faster response to customer demands.

The increasing trend toward digital transformation has further bolstered the effectiveness of direct sales. Online platforms and B2B e-commerce channels are making it easier for businesses to place orders, track shipments, and access customer support, all of which contribute to greater customer satisfaction. As demand for 2-Mercaptoethanol continues to grow, particularly in PVC production, the direct sales channel is expected to remain the preferred distribution method, maintaining its dominant share in the market.

Key Market Segments

By Type

- ≥99%

- <99%

By Application

- PVC production

- Polymer and Rubbers

- Food Industry

- Water Treatment

- Agrochemicals

- Others

By Distribution Channel

- Direct Sales

- Distributors and Traders

- Online Channels

- Others

Driving Factors

Rising Demand for PVC and Plastic Products

One of the key driving factors in the 2-Mercaptoethanol market is the increasing demand for PVC (polyvinyl chloride) and plastic products. PVC is widely used in industries such as construction, automotive, and electrical, where its durability, flexibility, and cost-effectiveness make it an ideal material for a variety of applications.

Since 2-Mercaptoethanol is a vital component in PVC production, its growing demand directly boosts the need for 2-Mercaptoethanol. The expansion of infrastructure and rising manufacturing activities, particularly in emerging markets, further accelerates this demand, ensuring sustained market growth.

Restraining Factors

Environmental Concerns and Regulatory Challenges

A major restraining factor in the 2-Mercaptoethanol market is the increasing focus on environmental regulations and concerns about the toxicity of certain chemicals. As industries are under pressure to reduce their environmental footprint, chemicals like 2-Mercaptoethanol, which can be hazardous if not handled properly, face stricter regulations.

This has led to higher compliance costs and limitations on production. Additionally, stringent environmental standards are pushing companies to explore more eco-friendly alternatives, which may slow down the growth of the 2-Mercaptoethanol market in the long term.

Growth Opportunity

Expansion in Emerging Markets and Industries

A significant growth opportunity for the 2-Mercaptoethanol market lies in the expansion of emerging markets, particularly in Asia-Pacific and Latin America. As these regions experience rapid industrialization, the demand for chemicals in industries like construction, automotive, and agriculture is increasing.

This growth is driving the need for materials like PVC, where 2-mercaptoethanol plays a crucial role in production. Additionally, the rising focus on developing infrastructure and manufacturing in these regions opens up new avenues for market players to expand their presence and meet the growing demand for 2-Mercaptoethanol.

Latest Trends

Shift Toward Sustainable and Green Chemicals

A key trend in the 2-Mercaptoethanol market is the growing emphasis on sustainability and the development of green chemicals. With increasing environmental awareness, both consumers and industries are pushing for more eco-friendly alternatives to traditional chemicals.

As a result, manufacturers are exploring bio-based or less toxic versions of 2-Mercaptoethanol. This shift towards sustainability not only aligns with global environmental goals but also helps businesses comply with stricter regulations. Companies investing in green chemistry are likely to gain a competitive edge as the demand for sustainable products continues to rise.

Regional Analysis

In 2024, Asia-Pacific held 42.6% of the 2-Mercaptoethanol market, valued at USD 190.1 million.

In 2024, the 2-Mercaptoethanol market was geographically dominated by the Asia-Pacific region, which held a substantial share of 42.6%, valued at USD 190.1 million. This dominance is largely driven by the rapid industrialization and growing demand for PVC in countries such as China, India, and Japan. The region’s expanding infrastructure, automotive, and electronics industries fuel the need for chemicals like 2-Mercaptoethanol, essential in PVC production.

North America accounted for a significant portion of the market, driven primarily by the U.S. and Mexico. The region’s strong chemical manufacturing base and the demand for high-quality plastic products contribute to market growth. Europe, while slightly smaller in comparison, maintains a steady demand for 2-Mercaptoethanol, especially in the chemical and pharmaceutical sectors. The increasing shift towards sustainability and eco-friendly solutions is influencing production practices in this region.

In the Middle East & Africa, the market is relatively smaller but is growing due to expanding manufacturing capacities in the UAE and Saudi Arabia, where the demand for chemicals in industrial applications is rising. Latin America’s 2-Mercaptoethanol market is also gaining traction, driven by infrastructure development and industrial growth, particularly in Brazil and Argentina.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global 2-Mercaptoethanol market is highly competitive, with several key players driving growth and innovation. BASF SE, a global leader in chemicals, is strategically positioned with its extensive product portfolio and strong distribution networks across key markets, including North America, Europe, and Asia-Pacific. Their focus on sustainable solutions and high-quality production processes helps them maintain a leading market share.

Chevron Phillips Chemical stands out due to its strong foothold in the petrochemical sector, with its reliable supply chain and robust manufacturing capabilities. The company’s vast experience in chemical production positions it well to cater to the growing demand for 2-Mercaptoethanol, particularly in PVC and specialty chemicals.

Shanghai Polymet Commodities Ltd. and Hefei TNJ Chemical Industry Co. Ltd. are key players from China, which is the largest consumer of 2-Mercaptoethanol globally. These companies benefit from China’s industrial boom and the demand for PVC, where 2-Mercaptoethanol is a critical component.

VWR, Merck Schuchardt OHG, and Sigma-Aldrich International GmbH, recognized for their extensive product ranges in the chemicals and life sciences sectors, are also significant contributors to the market. Their emphasis on research and development ensures consistent product quality and innovation.

Emerging players like Sunion Chemical & Plastic Co. Ltd., LabdhiChem, and Triveni Chemicals bring regional diversity, offering specialized products tailored to local market needs. As the demand for high-performance, sustainable chemicals continues to grow, these companies are poised for expansion.

Top Key Players in the Market

- BASF SE

- Chevron Philips Chemical

- Shanghai Polymet Commodities Ltd

- Hefei TNJ Chemical Industry Co. Ltd.

- VWR

- Sunion Chemical & Plastic Co. Ltd.

- LabdhiChem

- ULTIMA CHEMICALS

- OttOChemiePvt Ltd.

- Triveni Chemicals

- Century Multech, Inc.

- Hangzhou ZhongqiChem Co. Ltd

- Xiamen Equation Chemical Co. Ltd

- Merck Schuchardt OHG

- Sigma-Aldrich International GmbH

Recent Developments

- In 2024, Chevron Phillips introduced innovative processing techniques to enhance product purity and sustainability, with an emphasis on reducing environmental impact. This shift aligns with the growing need for more eco-friendly manufacturing practices. Their investments in research and development also bolstered market positioning, making significant strides toward meeting evolving customer demands.

- In 2024, Shanghai Polymet is expected to improve product quality and customer reach, aiming for growth in the global market by leveraging advanced manufacturing processes. The company continues to strengthen its market position with strategic partnerships and innovations in 2-Mercaptoethanol applications.

Report Scope

Report Features Description Market Value (2024) USD 450.6 Million Forecast Revenue (2034) USD 791.9 Million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (≥99%, <99%), By Application (PVC production, Polymer and Rubbers, Food Industry, Water Treatment, Agrochemicals, Others), By Distribution Channel (Direct Sales, Distributors and Traders, Online Channels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Chevron Philips Chemical, Shanghai Polymet Commodities Ltd, Hefei TNJ Chemical Industry Co. Ltd., VWR, Sunion Chemical & Plastic Co. Ltd., LabdhiChem, ULTIMA CHEMICALS, OttOChemiePvt Ltd., Triveni Chemicals, Century Multech, Inc., Hangzhou ZhongqiChem Co. Ltd, Xiamen Equation Chemical Co. Ltd, Merck Schuchardt OHG, Sigma-Aldrich International GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global 2-Mercaptoethanol MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Global 2-Mercaptoethanol MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Chevron Philips Chemical

- Shanghai Polymet Commodities Ltd

- Hefei TNJ Chemical Industry Co. Ltd.

- VWR

- Sunion Chemical & Plastic Co. Ltd.

- LabdhiChem

- ULTIMA CHEMICALS

- OttOChemiePvt Ltd.

- Triveni Chemicals

- Century Multech, Inc.

- Hangzhou ZhongqiChem Co. Ltd

- Xiamen Equation Chemical Co. Ltd

- Merck Schuchardt OHG

- Sigma-Aldrich International GmbH