Global Alpha Olefin Sulfonate (AOS) Market By Grade (C14-16 AOS, C16-18 AOS, C18-20 AOS, C20-24 AOS), By Application (Detergents and Cleaners, Personal Care Products, Industrial Applications, Oilfield Chemicals, Others), By End-user (Household, Industrial, Institutional, Others), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Online Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139868

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

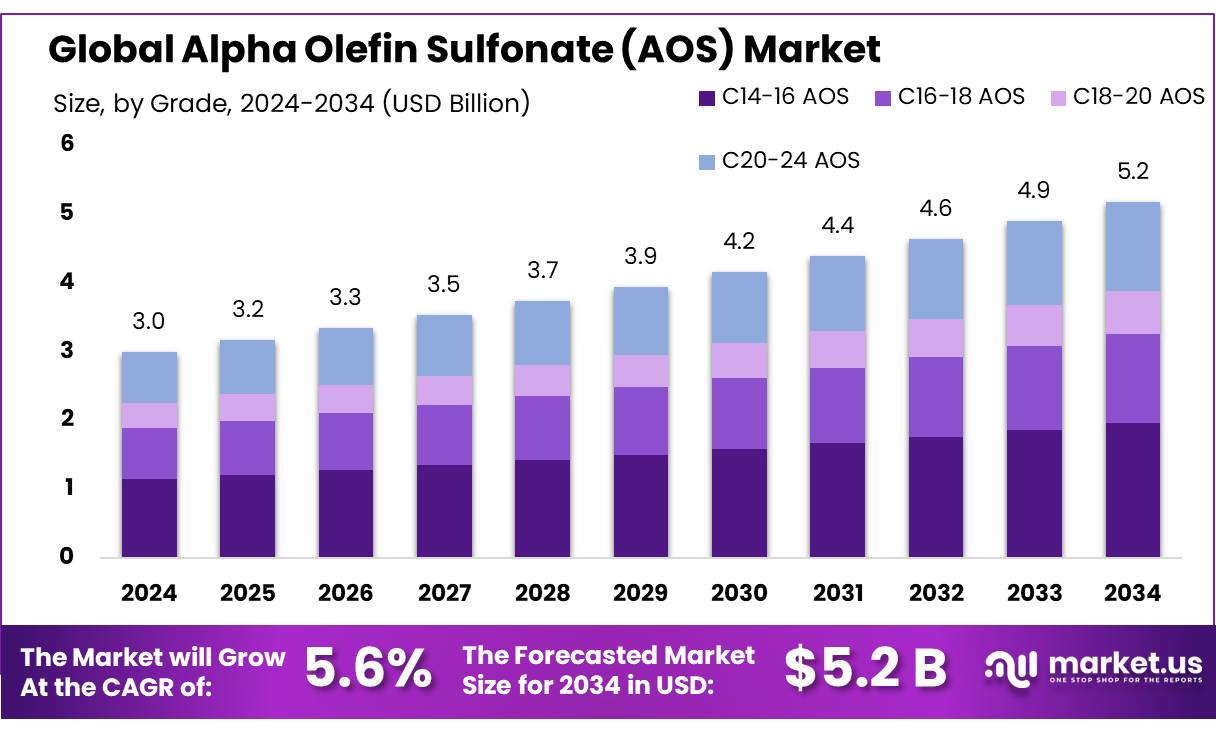

The Global Alpha Olefin Sulfonate (AOS) Market size is expected to be worth around USD 5.2 Bn by 2034, from USD 3.0 Bn in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Alpha Olefin Sulfonate (AOS) is an anionic surfactant primarily used in the formulation of detergents, household cleaners, personal care products, and industrial applications. Derived from long-chain alpha-olefins, AOS is known for its excellent foaming, cleansing, and emulsifying properties, making it highly effective in a wide range of cleaning and personal care applications. As a versatile surfactant, AOS has seen increasing demand in recent years due to its biodegradable nature, mildness to the skin, and effectiveness in both hard and soft water, positioning it as a preferred alternative to other surfactants.

Several key factors are propelling the growth of the AOS market. One of the primary drivers is the increasing demand for sustainable and biodegradable surfactants in personal care and cleaning products. Consumers are becoming more environmentally conscious, favoring products that are gentle on both the skin and the environment. AOS, being biodegradable, aligns with these preferences, which is contributing to its growing market share over traditional surfactants.

The future of the AOS market appears promising, with numerous opportunities for growth. The demand for eco-friendly personal care and cleaning products is expected to continue driving AOS consumption, particularly in emerging markets. Companies that focus on developing innovative, sustainable AOS-based formulations will benefit from this trend. Furthermore, the increasing focus on sustainability and the implementation of stricter environmental regulations globally presents an opportunity for AOS to replace more harmful surfactants in both consumer and industrial applications.

The development of specialized AOS formulations for specific applications, such as hair care products, baby care, and medical disinfectants, could also open new market opportunities. As consumer awareness of product ingredients rises, there is an increasing trend towards personalized, dermatologically tested formulations that include mild, effective ingredients like AOS.

Key Takeaways

- Alpha Olefin Sulfonate (AOS) Market size is expected to be worth around USD 5.2 Bn by 2034, from USD 3.0 Bn in 2024, growing at a CAGR of 5.6%.

- C14-16 AOS held a dominant market position, capturing more than 38.2% of the global market share.

- Detergents and Cleaners held a dominant market position, capturing more than 43.2% of the global Alpha Olefin Sulfonate (AOS) market share.

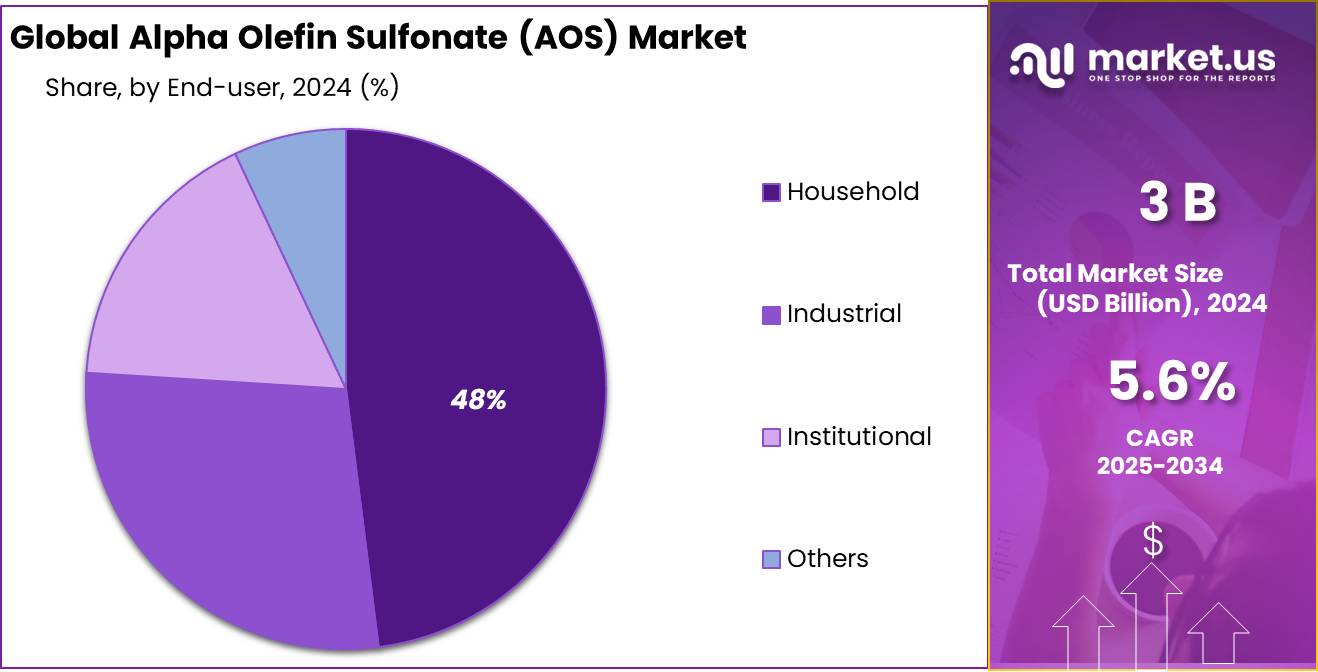

- Household held a dominant market position, capturing more than 48.2% of the global Alpha Olefin Sulfonate (AOS) market share.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than 41.1% of the global Alpha Olefin Sulfonate (AOS) market share.

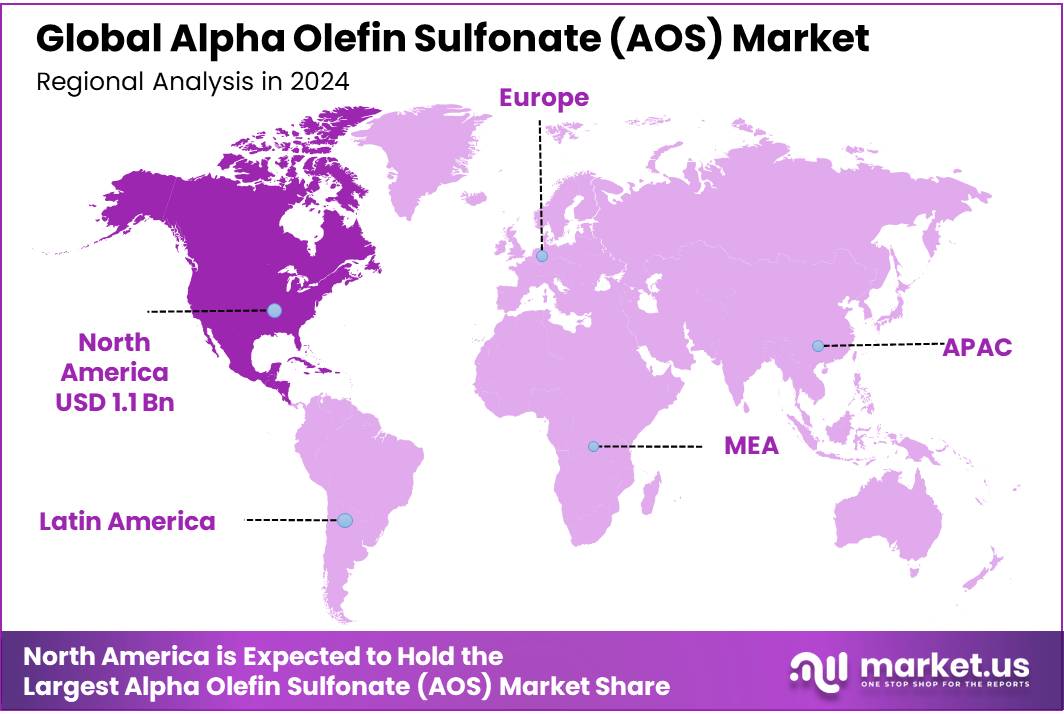

- North America dominated the Alpha Olefin Sulfonate (AOS) market, capturing more than 38.2% of the global market share, valued at approximately USD 1.1 billion.

By Grade

In 2024, C14-16 AOS held a dominant market position, capturing more than 38.2% of the global market share. This grade of Alpha Olefin Sulfonate (AOS) is widely used in a variety of applications, including personal care, home care, and industrial cleaning products. Its popularity stems from its excellent performance in surfactant applications, offering a balanced combination of foaming power, detergency, and mildness to the skin.

In particular, C14-16 AOS is favored in the formulation of shampoos, body washes, and household cleaners, where these properties are essential for consumer satisfaction. The demand for C14-16 AOS is expected to grow steadily through 2025, driven by increasing consumer demand for more eco-friendly and biodegradable ingredients in cleaning and cosmetic products.

C16-18 AOS holds a smaller but significant portion of the market, offering unique benefits in terms of stability and performance in harsher cleaning formulations. This grade accounted for a notable percentage of the market in 2024, with its applications extending to industrial and heavy-duty cleaning products, where its strong cleaning power is most valued.

C18-20 AOS, on the other hand, is more specialized, often used in products that require higher concentrations of surfactants for deep cleansing. Although it captures a smaller share, its growth rate is expected to increase as demand for more targeted, high-performance products grows. Finally, the C20-24 AOS grade, being the least common, is mainly used in niche applications where specific chemical properties are needed for complex formulations.

By Application

In 2024, Detergents and Cleaners held a dominant market position, capturing more than 43.2% of the global Alpha Olefin Sulfonate (AOS) market share. This segment is the largest consumer of AOS, driven by its essential role in cleaning products due to AOS’s strong foaming properties and effective dirt removal capabilities. AOS is commonly used in household detergents, laundry products, and industrial cleaners, making it an integral part of the cleaning industry.

Personal Care Products is another significant application segment, steadily growing and accounting for a sizable portion of the market in 2024. AOS’s mildness and skin compatibility make it an attractive ingredient in shampoos, body washes, facial cleansers, and other personal care items. With the increasing demand for natural and gentle personal care products, AOS is expected to continue playing a crucial role in the formulation of consumer-friendly products.

Industrial Applications also contribute a significant share to the AOS market, particularly in heavy-duty cleaners and degreasers used in manufacturing and automotive sectors. Although this segment holds a smaller share compared to detergents, its steady demand is expected to increase through 2025 as industries continue to rely on AOS for its high cleaning power and efficiency.

The Oilfield Chemicals segment, while niche, is anticipated to experience growth, especially in oil extraction and drilling operations where AOS is used as a surfactant in oil recovery processes. In addition, there are several smaller segments, such as agricultural and institutional cleaners, which are expected to grow but at a slower pace.

By End-user

In 2024, Household held a dominant market position, capturing more than 48.2% of the global Alpha Olefin Sulfonate (AOS) market share. This segment is the largest end-user of AOS, driven by its widespread use in household cleaning products, laundry detergents, dishwashing liquids, and surface cleaners. AOS is favored for its excellent foaming, cleaning, and dirt removal properties, making it a staple in everyday household cleaning products.

The Industrial segment follows as a significant contributor, using AOS in a range of applications, including heavy-duty cleaning products for manufacturing plants, automotive, and machinery maintenance. While it does not hold as large a share as the Household segment, the demand in this area is steadily growing, with industries increasingly adopting AOS due to its effectiveness in removing grease, oils, and tough stains.

The Institutional segment, which includes commercial establishments such as schools, hospitals, and hotels, represents another important end-user for AOS. Although this segment holds a smaller share compared to Household and Industrial, its demand is increasing as institutions look for effective and eco-friendly cleaning solutions.

By Distribution Channel

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than 41.1% of the global Alpha Olefin Sulfonate (AOS) market share. This distribution channel remains the most preferred for consumers purchasing cleaning and personal care products that contain AOS, such as detergents, dishwashing liquids, and body washes. Supermarkets and hypermarkets offer a wide range of products from well-known brands, providing consumers with easy access to affordable and convenient options.

The Online segment is also seeing significant growth, particularly in the wake of the ongoing shift towards e-commerce. Online platforms are becoming an increasingly popular channel for consumers who prefer the convenience of shopping from home. With the rise of digital marketplaces, more consumers are purchasing AOS-based products, particularly as online retailers offer promotions, discounts, and detailed product information that can influence purchasing decisions.

Specialty Stores, while a smaller channel compared to supermarkets and online platforms, cater to niche markets and high-end consumers looking for specialized products. These stores often focus on organic, natural, or luxury cleaning and personal care items that may contain AOS as a key ingredient.

Key Market Segments

By Grade

- C14-16 AOS

- C16-18 AOS

- C18-20 AOS

- C20-24 AOS

By Application

- Detergents and Cleaners

- Personal Care Products

- Industrial Applications

- Oilfield Chemicals

- Others

By End-user

- Household

- Industrial

- Institutional

- Others

By Distribution Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Online Retailers

- Others

Drivers

Increasing Demand for Eco-friendly and Biodegradable Surfactants

One major driving factor for the growth of the Alpha Olefin Sulfonate (AOS) market is the rising consumer demand for eco-friendly and biodegradable surfactants. As environmental concerns continue to grow, both consumers and industries are increasingly seeking sustainable alternatives to traditional chemical-based surfactants. AOS, known for its biodegradability and lower environmental impact, is becoming a preferred choice in a range of applications, from cleaning products to personal care items.

In 2024, the global shift toward sustainability is evident across various industries, with the personal care and cleaning sectors seeing a notable increase in demand for environmentally friendly products. According to the European Commission’s “EU Ecolabel for cleaning products” initiative, nearly 50% of cleaning products sold in the European Union now meet eco-friendly criteria, reflecting a growing trend toward greener solutions.

In the United States, the demand for sustainable personal care products has surged, with 43% of consumers actively choosing products that are biodegradable or have eco-friendly packaging, as reported by the Environmental Protection Agency (EPA). This growing preference is driving manufacturers to formulate products using AOS, which is biodegradable and derived from renewable resources, thus contributing to its increasing market share.

This demand is supported by various government initiatives, such as the U.S. Environmental Protection Agency’s Green Chemistry Program, which promotes the development of safer, greener chemical alternatives in consumer goods. As more companies align with these sustainability standards, the market for AOS-based products is expected to continue expanding, offering manufacturers a unique opportunity to tap into the growing eco-conscious consumer base.

Restraints

High Production Costs and Raw Material Price Fluctuations

One major restraining factor for the growth of the Alpha Olefin Sulfonate (AOS) market is the high production costs and the volatility in raw material prices. AOS is primarily produced from petrochemical derivatives like alpha-olefins, which are sensitive to fluctuations in crude oil prices. As crude oil prices rise, the cost of these raw materials increases, directly impacting the overall cost of AOS production. This creates challenges for manufacturers, as they face higher operational costs, which can eventually be passed down to consumers.

In 2024, the global market has seen an increase in petrochemical prices, driven by fluctuating oil prices and supply chain disruptions. According to the U.S. Energy Information Administration (EIA), global oil prices have experienced significant volatility, with Brent crude prices rising by approximately 30% from 2023 to 2024. This has led to a direct increase in the price of alpha-olefins, which in turn affects the cost structure of AOS production.

Additionally, the production of AOS requires sophisticated chemical processes and investments in specialized equipment, further adding to the overall cost. Smaller manufacturers may find it particularly challenging to remain competitive in this environment, as the cost of production can significantly impact their profit margins.

While government initiatives and regulatory frameworks are increasingly supporting the move toward more sustainable and biodegradable surfactants, the financial burden on manufacturers remains a significant barrier. Companies must balance their sustainability goals with the realities of production costs, which can be difficult to navigate in a market where raw material prices are unpredictable. This high cost of production could limit the broader adoption of AOS, particularly in price-sensitive markets.

Opportunity

Expansion in Emerging Markets and Eco-friendly Product Development

A significant growth opportunity for the Alpha Olefin Sulfonate (AOS) market lies in the increasing demand for eco-friendly and biodegradable products, particularly in emerging markets. As consumers in regions like Asia-Pacific, Latin America, and the Middle East become more aware of environmental issues, the demand for sustainable and safe ingredients in personal care, home care, and industrial cleaning products is on the rise.

In 2024, the Asia-Pacific (APAC) region is expected to see rapid growth in demand for AOS, driven by increasing urbanization and growing disposable income. According to the International Trade Administration (ITA), the Asia-Pacific region accounts for over 60% of global personal care product consumption, and this trend is expected to continue as more consumers seek natural and biodegradable ingredients.

Furthermore, government regulations promoting sustainability are also fueling this growth. The European Union’s Green Deal and similar policies in the U.S. and other regions are pushing for stricter environmental standards, particularly in chemical products used in cleaning and personal care items. These initiatives encourage manufacturers to adopt sustainable practices and use ingredients like AOS, which are biodegradable and have lower environmental impact.

Incorporating AOS into eco-friendly formulations not only meets consumer demand but also aligns with global efforts to reduce chemical waste and pollution. As these markets continue to grow, AOS has significant potential to become the surfactant of choice for companies aiming to offer environmentally responsible products.

Trends

Shift Toward Biodegradable and Sustainable Surfactants

A key trend currently shaping the Alpha Olefin Sulfonate (AOS) market is the growing demand for biodegradable and sustainable surfactants. As consumers become more eco-conscious, industries are under increasing pressure to offer products that are environmentally friendly and reduce the harmful impact of chemicals on ecosystems. AOS, with its biodegradability and renewable sourcing, is well-positioned to meet these needs, especially in the personal care, cleaning, and industrial sectors.

In 2024, there is a significant shift toward natural and sustainable ingredients across various consumer goods. According to the European Commission’s Ecolabel for detergents, the market for biodegradable surfactants in the EU alone is projected to grow by 25% between 2024 and 2026. This aligns with the global push towards sustainability, as both consumers and manufacturers are demanding products that are safer for the environment, such as cleaning agents and personal care products that utilize surfactants like AOS.

Governments are also playing a crucial role in driving this trend. Initiatives such as the U.S. Environmental Protection Agency’s (EPA) Green Chemistry Program are encouraging companies to adopt safer and greener chemical alternatives. As a result, more industries are formulating products that not only perform well but also have a minimal environmental footprint. The EPA has noted that more than 40% of consumer cleaning products in the U.S. now contain biodegradable ingredients, with a significant portion using surfactants like AOS.

This trend is particularly important in the personal care industry, where natural and sustainable products are gaining traction. Consumers are increasingly looking for products that are not only effective but also safe for the environment, a shift that is expected to continue driving the demand for AOS in the coming years. As manufacturers adapt to these consumer preferences and regulatory requirements, the market for AOS is likely to grow, offering significant opportunities for innovation and expansion.

Regional Analysis

In 2024, North America dominated the Alpha Olefin Sulfonate (AOS) market, capturing more than 38.2% of the global market share, valued at approximately USD 1.1 billion. The region’s strong market position can be attributed to the high demand for AOS in the cleaning and personal care industries, driven by the increasing consumer preference for eco-friendly and biodegradable products. North America’s established industrial infrastructure, along with growing regulatory support for sustainable chemicals, further bolsters the demand for AOS in both household and commercial applications.

The Asia Pacific (APAC) region is also a significant player, accounting for a large portion of the global market, and is expected to see robust growth through 2025. The rapid urbanization, rising disposable incomes, and a large population base in countries like China and India are contributing to the increased demand for consumer goods, including AOS-based detergents and personal care products. The expansion of the personal care industry and the increasing focus on biodegradable ingredients in the region will likely drive the AOS market forward.

Europe, with its growing emphasis on sustainability and eco-conscious products, also represents a substantial market for AOS. The region is witnessing a shift towards natural and biodegradable surfactants, in line with EU regulations promoting environmentally friendly formulations in cleaning and personal care items. The Middle East & Africa, while a smaller market, is gradually increasing its share as industrial and household cleaning applications expand, and the demand for AOS grows. Latin America, although still emerging in terms of market share, is expected to see steady growth as awareness of sustainable product options increases in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Alpha Olefin Sulfonate (AOS) market is highly competitive, with several major players leading the industry in product innovation and market share. Companies such as BASF, Dow Chemical Company, and ExxonMobil Chemical Company dominate the market with their extensive product portfolios and global reach.

Other prominent players like Chevron Phillips Chemical Company, Clariant, and Evonik Industries are also significant contributors, leveraging their extensive chemical expertise to offer a range of AOS products with varied chain lengths for different applications. Clariant, for instance, focuses on developing high-quality AOS for personal care and industrial cleaning products, while Evonik emphasizes the development of sustainable surfactants that align with global environmental standards.

Companies such as Kao Corporation, Mitsui Chemicals, and Sasol are also noteworthy players, with strong regional presence and a focus on Asia-Pacific and Latin American markets. Kao is particularly strong in personal care applications, using AOS to meet the rising demand for biodegradable surfactants in Asia. On the other hand, Sasol and Mitsui have been expanding their production capabilities, tapping into growing demand in emerging markets.

Top Key Players

- Air Products and Chemicals

- BASF

- Chevron Phillips Chemical Company

- Clariant

- Croda International Plc

- Dow Chemical Company

- Evonik Industries

- ExxonMobil Chemical Company

- Huntsman Corporation

- Ineos Group

- Kao Corporation

- Mitsui Chemicals

- Sanyo Chemical Industries

- Sasol

- Shell Chemicals

- Stepan Company

Recent Developments

In 2024, Air Products is set to expand its presence in the North American and European markets, where there is a notable shift towards green chemicals.

In 2024, BASF’s AOS products are expected to see increased demand in regions like Europe and North America, where environmental regulations are becoming more stringent.

In 2024, Chevron Phillips is also focusing on strengthening its partnerships with key industries such as oilfield chemicals and personal care, aiming for a projected growth rate of around 5-6% in AOS sales by 2025.

Report Scope

Report Features Description Market Value (2024) USD 3.0 Bn Forecast Revenue (2034) USD 5.2 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (C14-16 AOS, C16-18 AOS, C18-20 AOS, C20-24 AOS), By Application (Detergents and Cleaners, Personal Care Products, Industrial Applications, Oilfield Chemicals, Others), By End-user (Household, Industrial, Institutional, Others), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air Products and Chemicals, BASF, Chevron Phillips Chemical Company, Clariant, Croda International Plc, Dow Chemical Company, Evonik Industries, ExxonMobil Chemical Company, Huntsman Corporation, Ineos Group, Kao Corporation, Mitsui Chemicals, Sanyo Chemical Industries, Sasol, Shell Chemicals, Stepan Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alpha Olefin Sulfonate (AOS) MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Alpha Olefin Sulfonate (AOS) MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Air Products and Chemicals

- BASF

- Chevron Phillips Chemical Company

- Clariant

- Croda International Plc

- Dow Chemical Company

- Evonik Industries

- ExxonMobil Chemical Company

- Huntsman Corporation

- Ineos Group

- Kao Corporation

- Mitsui Chemicals

- Sanyo Chemical Industries

- Sasol

- Shell Chemicals

- Stepan Company