Global Aluminum Pigments Market By Туре(Leafing, Non-leafing), By Form(Paste, Pellet, Powder, Others), By Application(Paints and Coatings, Plastics, Personal Care, Printing Inks, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 39081

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

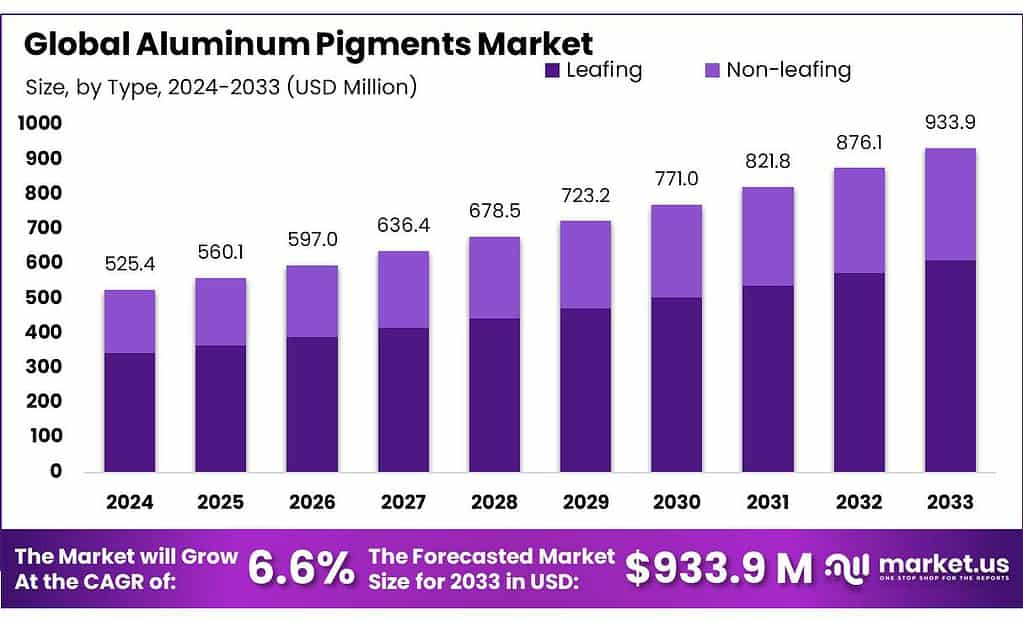

The global Aluminum pigment market size is expected to be worth around USD 933.9 Million by 2033, from USD 524.4 Million in 2023, growing at a CAGR of 6.6% during the forecast period from 2023 to 2033.

The Aluminum Pigments Market encompasses the manufacturing, distribution, and application of finely divided aluminum powders used to enhance materials like coatings, plastics, and inks with a metallic appearance and functional properties. These pigments are prized for their luster and reflectivity, finding widespread use in automotive paints, protective coatings, cosmetics, and various packaging materials.

This market’s growth is propelled by the demand for products that combine aesthetic appeal with protective qualities, making aluminum pigments a favored choice in industries that prioritize both durability and visual attractiveness. The automotive and construction sectors, especially in regions like North America and Asia-Pacific, are significant drivers of demand due to their ongoing expansion and modernization efforts.

However, the market is also subject to stringent environmental regulations which oversee everything from the production processes to the end-use applications of these pigments. For instance, the extraction and processing of aluminum from bauxite are closely monitored for environmental impact. Such regulations can influence manufacturing efficiencies, affect product quality, and lead to higher compliance costs.

Moreover, the aluminum pigments market is affected by global economic conditions and the dynamics of international trade. The export market, particularly in countries like China, plays a crucial role in setting global prices and supply chain dynamics. In the United States, the implementation of specific import licenses for aluminum products helps regulate the market and collect data, which can impact the availability and cost of these pigments.

Key Takeaways

- Market Size: Expected to reach USD 933.9 million by 2033, growing from USD 524.4 million in 2023, at a CAGR of 6.6%.

- Regional Dominance: APAC leads with a 38.5% market share, valued at USD 201.9 million in 2023.

- Types of Pigments: Leafing pigments held a 65.4% market share in 2023 for reflective coatings; and non-leafing for uniform protection.

- Forms: Pellet form dominates with a 35.8% share in 2023, favored for ease of application in industrial settings.

- Top Application Sector: The paints & coatings sector accounted for 48.4% of the market share in 2023, crucial for automotive and decorative applications.

By Туре

In 2023, Leafing aluminum pigments held a dominant market position, capturing more than a 65.4% share. This type of pigment is primarily used for its excellent reflective properties, making it a popular choice in applications that require a mirror-like finish to enhance visual appeal. Common uses include protective coatings and decorative paints, where the leafing variety ensures that the aluminum flakes align at the surface to provide a bright, reflective layer.

Conversely, Non-leafing aluminum pigments, which distribute evenly throughout the paint or coating matrix without floating to the surface, are preferred when uniform color and protection are required rather than reflectivity. This type is extensively used in applications where resistance to weathering and corrosion is critical, such as in automotive finishes and industrial coatings.

By Form

In 2023, Pellet form aluminum pigments held a dominant market position, capturing more than a 35.8% share. This form is favored for its ease of handling and consistency in application, making it a preferred choice in industrial processes where precision and uniformity are critical. Pellets are commonly used in automotive paints and plastic coatings, where they contribute to smoother finishes and consistent color qualities.

Powder form pigments are also widely utilized due to their versatility and ease of integration into various solvent and water-based formulations. They are essential in applications requiring fine and homogeneous dispersion of pigments, such as in printing inks and decorative coatings.

Paste form pigments cater to specific needs where higher pigment concentration is required, often used in applications demanding intense coloration and brightness, such as in cosmetic products and specialty coatings.

By Application

In 2023, the Paints & Coatings sector held a dominant market position within the Aluminum Pigments market, capturing more than a 48.4% share. This segment utilizes aluminum pigments extensively to enhance the aesthetic appeal and functional properties of products, such as increasing reflectivity and providing resistance against corrosion, making it essential for automotive finishes and decorative applications.

Plastics is another significant application area, where aluminum pigments are added to plastic products to impart a metallic sheen and improve UV stability. This application is crucial for consumer electronics, automotive components, and decorative items.

In Personal Care, aluminum pigments are valued for their ability to add shimmering effects to cosmetics such as eyeshadows, nail polishes, and lipsticks, enhancing product appeal.

The Printing Inks segment uses aluminum pigments to create metallic and pearlescent effects in printing applications. These pigments are vital for attractive packaging, labeling, and high-end graphic arts.

Key Market Segments

By Туре

- Leafing

- Non-leafing

By Form

- Paste

- Pellet

- Powder

- Others

By Application

- Paints & Coatings

- Plastics

- Personal Care

- Printing Inks

- Others

Drivers

Growth in Automotive and Construction Industries

One major driving factor for the Aluminum Pigments market is the expanding demand in the automotive sector, particularly for applications in automotive coatings. The automotive industry extensively utilizes aluminum pigments for their ability to provide corrosion protection and enhance the aesthetic appeal of vehicles with metallic finishes. This trend is significantly propelled by advancements in automotive technology and the rising production of vehicles, which require high-quality coatings that offer durability and visual appeal.

Additionally, the growth of the construction sector, especially in regions like Asia-Pacific, is another critical driver. The increased construction activities in countries like China and India, supported by government spending and initiatives to improve infrastructure, are boosting the demand for paints and coatings that incorporate aluminum pigments.

These pigments are chosen for their resistance to chemical attacks, harsh temperatures, and weathering, making them ideal for use in construction materials that require long-lasting protection and aesthetic quality.

Moreover, the push towards more environmentally friendly and sustainable manufacturing processes is influencing the market. Innovations in pigment technology, such as the development of products with lower volatile organic compound (VOC) emissions, align with global regulatory standards and market demands for greener products. These technological advancements not only meet environmental regulations but also cater to consumer preferences for sustainable products, further driving market growth.

Restraints

Stringent Environmental Regulations

One of the primary factors restraining the growth of the Aluminum Pigments market is the stringent environmental regulations governing the production and use of metallic pigments, including aluminum pigments. These regulations, aimed at reducing air pollution and minimizing the environmental impact of chemical manufacturing, significantly affect the way aluminum pigments are produced and used.

Regulations focusing on reducing volatile organic compound (VOC) emissions are particularly impactful. Aluminum pigments used in paints and coatings often need to comply with these environmental standards, which can restrict the use of certain solvent-based pigments known for their higher VOC emissions. This has led to a shift towards water-based pigments and those with lower VOC content, posing challenges for manufacturers used to traditional solvent-based products.

Moreover, the cost of compliance with these regulations can be high, requiring significant investment in cleaner technologies and processes. This not only affects the operational costs but also influences the pricing and market dynamics for aluminum pigments. Companies must innovate and adapt, which while necessary, can be a barrier to maintaining competitive pricing and market growth.

Opportunity

Expansion in the Construction and Automotive Industries

A significant growth opportunity for the Aluminum Pigments market is identified in its expanding application in the construction and automotive industries. The global market is poised to grow substantially, driven by the increasing use of aluminum pigments in automotive coatings and construction materials due to their corrosion resistance and thermal properties.

Automotive Industry: The demand for aluminum pigments in the automotive sector is growing, with a significant use in coatings that provide corrosion protection and contribute to vehicle lightweighting. This demand is further supported by a surge in vehicle production and sales, particularly in economically booming regions, where rising disposable incomes are enabling higher automobile purchases.

Construction Sector: In construction, aluminum pigments are utilized in paints and coatings for buildings and infrastructure due to their durability and aesthetic properties. The market sees a robust demand for construction materials that can offer enhanced visual appeal and longevity, attributes provided by aluminum pigments.

Technological Innovations: The market is also benefiting from technological advancements in pigment production, such as the development of low-VOC (volatile organic compounds) and water-based pigments, which align with global environmental regulations aiming to reduce air pollution.

The combined effect of these factors is expected to drive substantial growth in the Aluminum Pigments market across various regions, with a particular emphasis on North America and Asia-Pacific. These regions are witnessing rapid industrial and economic growth, further facilitating the demand for advanced materials like aluminum pigments.

Trends

Shift Toward Sustainable and High-Performance Coatings

A significant trend in the Aluminum Pigments market is the shift towards more sustainable and high-performance coatings. This movement is driven by the increasing demand for environmentally friendly and efficient coating solutions across various industries, including automotive and construction.

Sustainability and Low VOC Coatings: The trend towards sustainability is particularly pronounced with a growing preference for coatings that are low in volatile organic compounds (VOCs). These eco-friendly coatings are designed to reduce environmental impact and meet stringent regulatory standards that aim to lower VOC emissions in the atmosphere. The development of water-based aluminum pigments is a response to these environmental concerns, providing options that emit less odor, offer quick drying times, and maintain excellent durability.

Technological Innovations: Innovations in aluminum pigment production are enhancing the functional attributes of these coatings, such as improved light reflectivity and resistance to weather conditions. Advances in pigment technology are enabling the creation of products that not only offer superior aesthetic appeal but also contribute to the longevity and durability of the coatings.

Increasing Demand from Automotive and Construction Industries: The automotive sector continues to be a significant driver for aluminum pigments, used extensively in automotive paints for their brilliant metallic effects and protective properties. Similarly, in the construction industry, aluminum pigments are incorporated into paints and coatings used on buildings and infrastructure to provide both decoration and protection against corrosion and weathering.

These trends are supporting the growth of the Aluminum Pigments market by expanding its application range and enhancing the performance characteristics of pigments, aligning with global shifts towards sustainability and high-performance materials.

Regional Analysis

North America and Europe are mature markets characterized by stringent regulatory frameworks and advanced industrial sectors. In North America, particularly the United States and Canada, the market benefits from established automotive and aerospace industries, driving significant demand for aluminum pigments in coatings and decorative applications.

Europe, led by Germany, France, and the UK, emphasizes sustainability and high-quality standards, boosting the adoption of aluminum pigments in automotive paints and industrial coatings. The market in these regions is valued at approximately USD 150 million collectively.

Asia Pacific (APAC) emerges as the dominant region, holding a substantial 38.5% market share valued at USD 201.9 million. Rapid industrialization, particularly in China, India, and Southeast Asia, fuels robust demand for aluminum pigments in automotive manufacturing, construction, and packaging sectors. Government initiatives supporting infrastructure development and urbanization further bolster market growth in APAC.

Middle East & Africa and Latin America exhibit steady growth trajectories in the aluminum pigments market. In the Middle East & Africa, countries like Saudi Arabia and UAE drive demand through infrastructure projects and construction activities. Latin America, including Brazil and Mexico, sees rising consumption in automotive coatings and consumer goods manufacturing. Both regions benefit from expanding industrial bases and increasing disposable incomes, contributing to a combined market size of USD 90 million.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Aluminum Pigments market is driven by key players who play pivotal roles in shaping industry trends and driving innovation. ALTANA, a prominent player in this sector, is renowned for its advanced pigment technologies tailored for diverse industrial applications. With a strong emphasis on sustainability and innovation, ALTANA has expanded its global footprint, particularly in Europe and North America, solidifying its position as a leader in the market.

Silberline Manufacturing Co. Inc. stands out for its extensive portfolio of aluminum pigments designed for coatings, plastics, and printing inks. Based in North America, Silberline excels in meeting rigorous quality standards and customization requirements across various industries. Its robust manufacturing capabilities and strategic market approach further strengthen its competitiveness in the global arena.

BASF SE, a leading chemical company, offers a comprehensive range of aluminum pigments through its coatings division. Leveraging its global presence and strong research and development capabilities, BASF SE continues to innovate high-performance pigments that enhance aesthetics and durability in automotive, construction, and packaging applications. These efforts underscore BASF SE’s commitment to driving technological advancements and meeting evolving market demands.

Market Key Players

- ALTANA

- Arasan Aluminium Industries (P) Ltd.

- Asahi Kasei Corporation

- BASF SE

- Carl Schlenk AG

- CARLFORS BRUK

- DIC CORPORATION

- FX Pigments Pvt. Ltd

- GEOTECH

- Hefei Sunrise Aluminium Pigments Co. Ltd

- Kolortek Co. Ltd

- Metaflake Ltd

- Nippon Light Metal Holdings Co.

- Silberline Manufacturing Co. Inc.

- Sun Chemical

- Toyal America Inc.

Recent Development

In 2023, ALTANA expanded its market presence with a focus on enhancing product innovations and sustainability initiatives. Their annual production capacity reached 20,000 metric tons of aluminum pigments, supporting their strategic growth in North America, Europe, and Asia Pacific.

In 2023, Arasan Aluminium Industries expanded its market footprint, particularly in Asia Pacific and Middle East regions, bolstering its annual production capacity to 15,000 metric tons.

Report Scope

Report Features Description Market Value (2023) US$ 524.4 Mn Forecast Revenue (2033) US$ 933.9 Mn CAGR (2024-2033) 6.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Туре(Leafing, Non-leafing), By Form(Paste, Pellet, Powder, Others), By Application(Paints and Coatings, Plastics, Personal Care, Printing Inks, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape ALTANA, Arasan Aluminium Industries (P) Ltd., Asahi Kasei Corporation, BASF SE, Carl Schlenk AG, CARLFORS BRUK, DIC CORPORATION, FX Pigments Pvt. Ltd, GEOTECH, Hefei Sunrise Aluminium Pigments Co. Ltd, Kolortek Co. Ltd, Metaflake Ltd, Nippon Light Metal Holdings Co., Silberline Manufacturing Co. Inc., Sun Chemical, Toyal America Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Aluminum pigment Market?Aluminum pigment market size is expected to be worth around USD 933.9 Million by 2033, from USD 524.4 Million in 2023

What CAGR is projected for the Aluminum Pigments Market?The Aluminum Pigments Market is expected to grow at 6.6% CAGR (2024-2033).

List the key industry players of the Global Aluminum Pigments Market?ALTANA, Arasan Aluminium Industries (P) Ltd., Asahi Kasei Corporation, BASF SE, Carl Schlenk AG, CARLFORS BRUK, DIC CORPORATION, FX Pigments Pvt. Ltd, GEOTECH, Hefei Sunrise Aluminium Pigments Co. Ltd, Kolortek Co. Ltd, Metaflake Ltd, Nippon Light Metal Holdings Co., Silberline Manufacturing Co. Inc., Sun Chemical, Toyal America Inc.

-

-

- ALTANA

- Arasan Aluminium Industries (P) Ltd.

- Asahi Kasei Corporation

- BASF SE

- Carl Schlenk AG

- CARLFORS BRUK

- DIC CORPORATION

- FX Pigments Pvt. Ltd

- GEOTECH

- Hefei Sunrise Aluminium Pigments Co. Ltd

- Kolortek Co. Ltd

- Metaflake Ltd

- Nippon Light Metal Holdings Co.

- Silberline Manufacturing Co. Inc.

- Sun Chemical

- Toyal America Inc.