Global Venous Stents Market By Type (Bare Metal Stents, Drugs-Eluting Stents), By Application (Leg, Chest, Abdomen, and, Others), By Disease, By Technology, By End-User, By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 35244

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Application Analysis

- By Disease Analysis

- By Technology Analysis

- By End-User Analysis

- Market Key Segments Analysis

- Drivers

- Restraints

- Opportunities

- Impact of macroeconomic factors / Geopolitical factors

- Latest Trends

- Regional Analysis

- Key Regions

- Key Players Analysis

- Top Key Players

- Recent Developments

- Report Scope

Report Overview

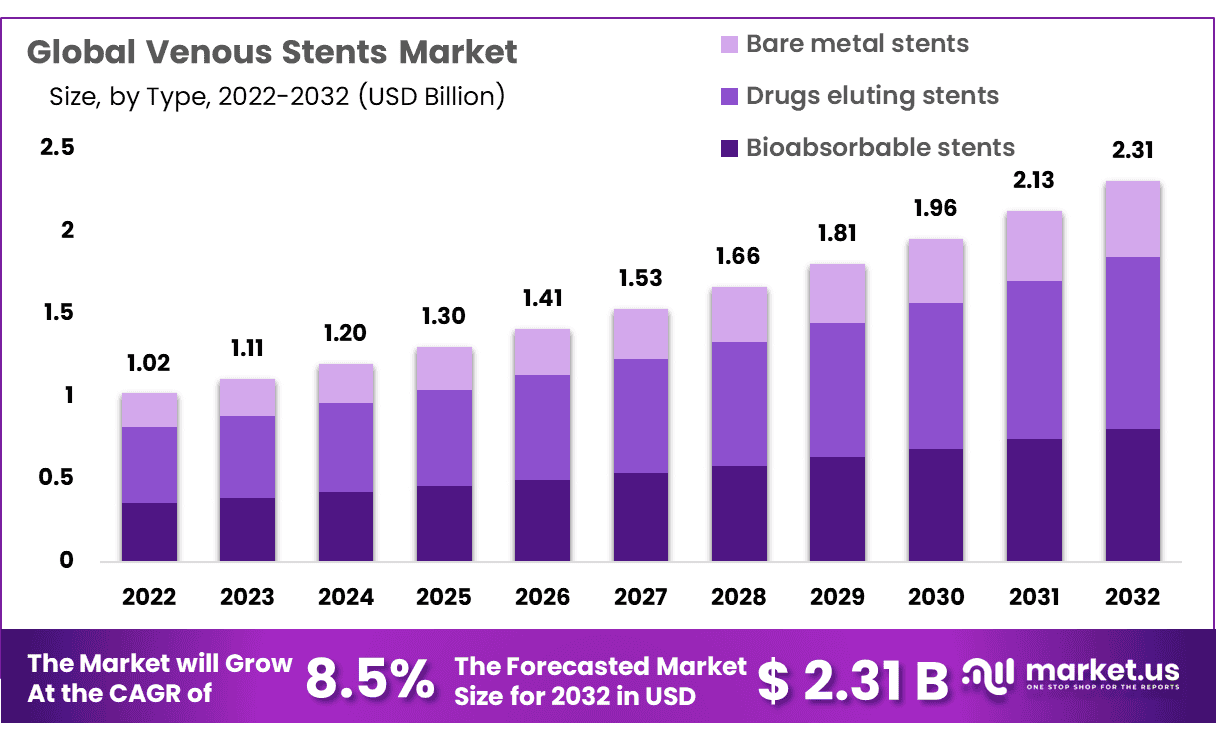

Global Venous Stents Market size is expected to be worth around USD 2.3 Billion by 2032 from USD 1.02 Billion in 2022, growing at a CAGR of 8.5 % during the forecast period from 2023 to 2032.

Venous stenting is a medical procedure carried out to alleviate venous obstruction. This has emerged as a low-risk and minimally invasive alternative to surgery. In this, a mesh tube made of metal is inserted inside the obstructed vein with the help of a catheter, moved to the desired location within the brain, and expanded. A venous stent helps in dilating the vein to ensure uninterrupted blood flow. In a way, a venous stent provides structural support to an incompetent vein. It is most commonly employed to treat Venous Thromboembolism (also referred to as Deep Vein Thrombosis, Pulmonary Embolism), Venous Occlusion, and May-Thurner Syndrome.

Venous stenting is employed only in cases of blockages of larger veins. Before administration of a venous stent, certain procedures are to be performed, for example, CT scan, Venoscope, MRI, Fluoroscopy, and Ultrasound. Although this is a less invasive process, venous stents can be difficult to remove and thus, remain in their place after implantation. Risks of venous stenting include bruising or bleeding due to friction against the blood vessel.

- According to the National Center for Biotechnology Information, over 25 million people in the US suffer from chronic venous disease (CVD). The financial strain on the healthcare system is extreme, with an estimated expenditure of US$1 billion.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Venous stenting is an endovascular procedure performed to aid patients suffering from venous obstruction. Such a procedure requires a venous stent, a metal mesh tube that dilates the constricted blood vessel to restore blood flow within the vein.

- In 2022, the market for venous stents was estimated at US$1.08 Billion, with a CAGR reaching 8.5% from 2023 to 2032.

- As far as type is concerned, the venous stents market is dominated by drug eluting stents that claim over a 45% market share.

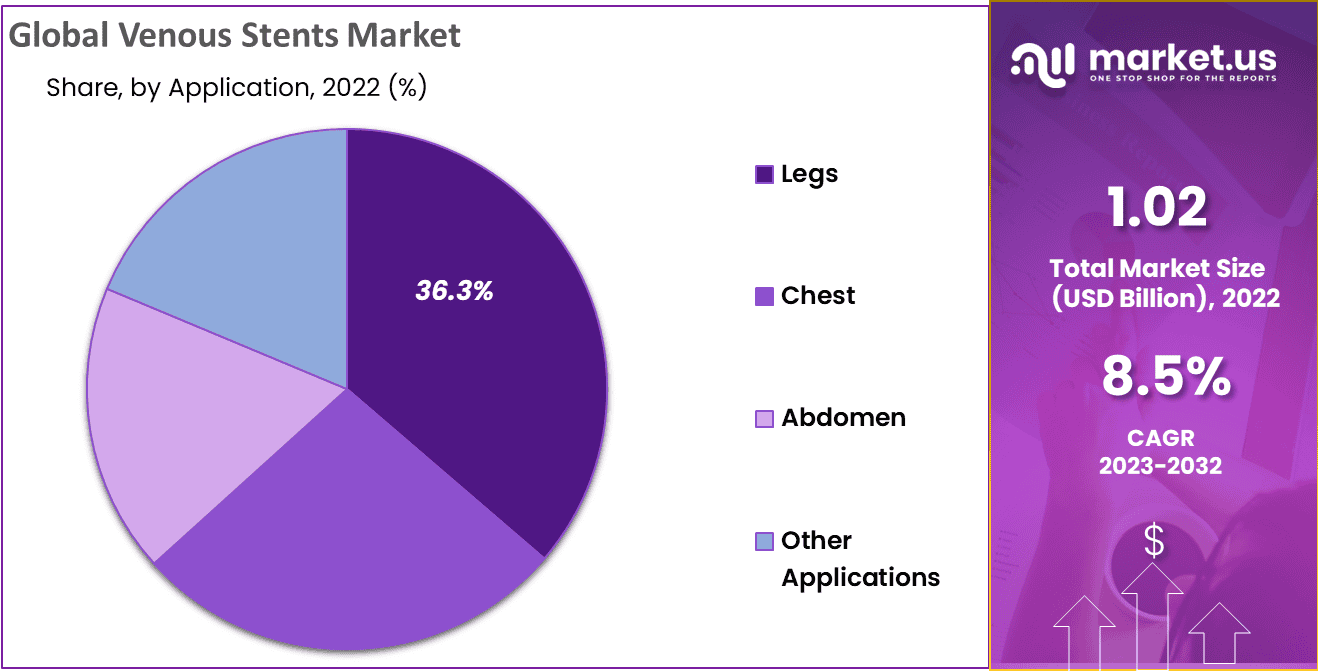

- Based on application, the legs segment remains a leading contributor, with a share of 36.3% in 2022.

- When segmented by disease, the deep vein thrombosis segment generated over 47.1% of revenue.

- The wallstent technologies segment is estimated to acquire maximum CAGR of 8.7%.

- The hospitals & cardiac centers segment accounted for the majority of share in 2022.

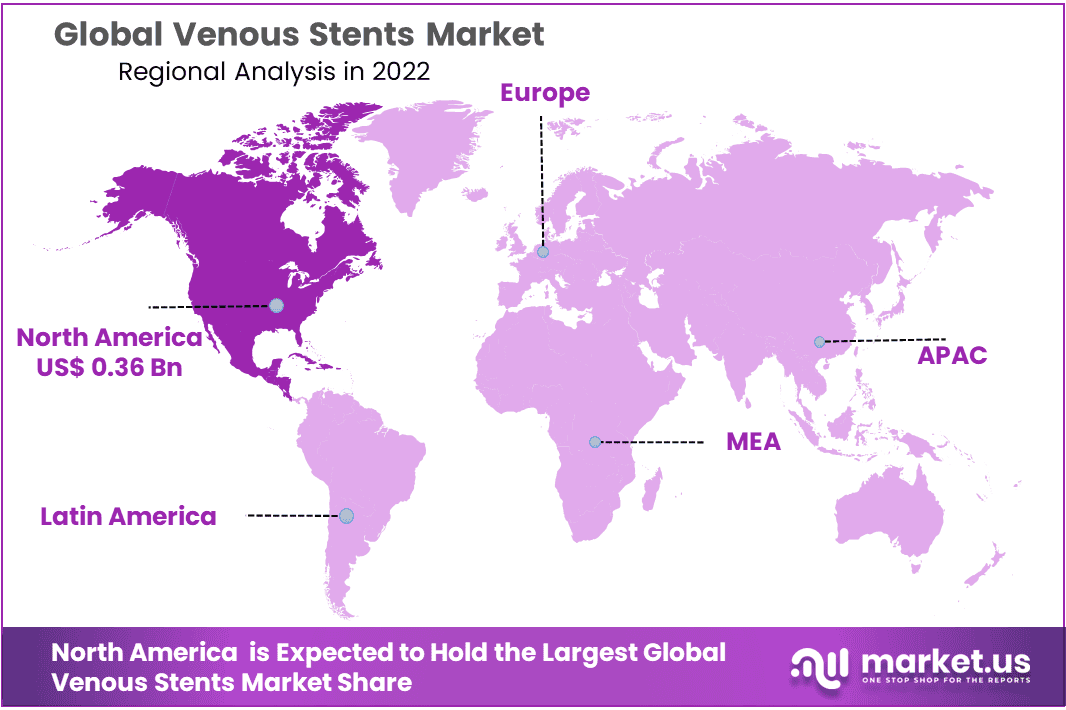

- When geographic distribution of revenue is considered, North America continues to be the largest market share holder, with a share amounting to 36%.

- The Asia Pacific venous stents market will display the highest CAGR during the forecast period.

- The key players operating in the venous stents market include Gore Medical, Cook Medical, Boston Scientific Corporation, Becton, Dickinson and Company, Medtronic Plc, Vesper Medical, Optimized Medinische Instrumente GmbH, Plus medica GmbH & Co., Abbott Laboratories and others.

By Type Analysis

On the basis of type, the type segment is divided into bare metal stents, drugs eluting stents, and bio-absorbable stents. Drugs eluting stents was accounted for the majority of share of 45%. It had a monopoly on the venous stents market since the conception of the venous stenting procedure in the mid-1980s. This trend was discontinued by the emergence of drug-eluting stents. Bare metal stents are made of metal such as steel or metal alloy (nitinol – an alloy of nickel and titanium) and placed directly in a vein.

Conversely drug-eluting stents are metal stents coated with a polymer coating and anti-proliferative drug. These stents allow for gradual elution of the drug into the blood vessel for multiple weeks. Drugs-eluting stents claim the largest market share, which is attributed to their superior clinical performance.

By Application Analysis

As far as application is concerned, the leg application segment is the largest 36.3%, considering that most venous diseases develop due to obstruction of the veins of the legs. This can be credited to the fact that blood clots develop in the lower extremities much more often, thus resulting in interrupted blood flow. This further leads to complications that can only be managed by venous stenting. Alternatively, the market for the chest segment is growing at a rapid pace, due to the soaring numbers of chronic heart and lung disease prevalence.

By Disease Analysis

The deep vein Thrombosis (DVT) segment contributed up to 47.1% of the total revenue, thus claiming the largest share. This is accredited to the high prevalence of the disease, which occurs at an annual incidence of 1 per 1000 adults. Additionally, the risk is elevated if a patient develops Pulmonary Embolism along with DVT, which manifests as Venous Thromboembolism. This condition in particular requires immediate venous stenting. Moreover, the Post Thrombotic segment is growing at a rapid pace. A further contribution is given by May Thurner Syndrome segment and other segments.

By Technology Analysis

On the basis of technology, the market is segmented into iliac vein stent technologies & wallstent technologies. The wallstent technologies segment is estimated to acquire the highest CAGR of 8.7%. The aim of this technology is to treat upper pelvic area’s constricted vein that covers the iliofemoral vein. Moreover, the system consists of a catheter device for over-the-wire stent delivery and a stent composed of braided metallic.

By End-User Analysis

The end-user segment includes hospitals & cardiac centers and & ambulatory surgical centers. Among both segments, the hospitals & cardiac centers were accounted for the majority of share owing to the large patient base that are undergoing angioplasty procedures in the hospitals, thus, the demand for the venous stents was maximum in such facility.

Market Key Segments Analysis

By Type

- Bare metal stents

- Drugs eluting stents

- Bioabsorbable stents

By Application

- Legs

- Chest

- Abdomen

- Other Applications

By Disease

- Deep Vein Thrombosis

- Post Thrombotic Syndrome

- May Thurner Syndrome

- Hemodialysis/Arteriovenous Fistulae

- Other Diseases

By Technology

- Iliac Vein Stent Technologies

- Wallstent Technologies

By End-User

- Hospitals & Cardiac Centers

- Ambulatory Surgical Centers

Drivers

Rising healthcare expenditure to aid in market size expansion

According to Centres for Medicare and Medicaid Services, national health expenditure has increased by 2.3%, soaring to a substantial US$4 trillion in 2021, accounting for an 18.35% share of the GDP. Additionally, spending on private health insurance and out-of-pocket expenses both increased by 5.8% and 10.4% respectively. This indicates that there is little resistance to spending on healthcare. This paired with the increasing incidence of chronic vein diseases opens up opportunities for market size expansion.

Increasing chronic venous disease incidence to boost market growth

Cardiovascular disease is one of the leading causes of death worldwide. According to the World Heart Federation, more than 500 million people are suffering from cardiovascular diseases, with fatalities amounting to 20.5 million in 2021. Consequentially, the incidence of Deep Vein Thrombosis is also increasing, with over 900,000 US inhabitants being affected annually, as per the Centers for Disease Control and Prevention. Such patients require venous stenting to lessen the long-term complications. These increasing statistics are indicators of promising market growth, considering that the rates of venous diseases affect the size of the market correspondingly.

Restraints

Arduous nature of the product approval process to discourage market growth

For a venous stent to be made available for purchase, it must meet all the requirements and follow guidelines as dictated by the authorities. Further, the approval process for a medical product is quite burdensome since each product is exposed to rigorous testing. While the testing process is necessary to ensure patient safety, it only adds to the tediousness of the process. Additionally, such harsh testing processes can effectively reduce the shelf life of the products. This can slow down the process of production, thus potentially impeding the market growth.

Opportunities

R&D in the venous stent market experienced increased investment, especially for the development of flexible stents. An interdisciplinary approach to the venous stenting market will facilitate innovative production, which will then aid market growth. An example of this would be the deployment of the Z stent, which was originally developed as a tracheobronchial stent, as secondary support to the primary stent.

Additionally, the development of dedicated nitinol venous stents presents a plethora of opportunities for market expansion. These stents are non-braided, except for Blueflow, self-expanding, and open cell matrix with fortified ends. The BeYond Venous Self-Expanding Stent is one such stent waiting for FDA approval.

Impact of macroeconomic factors / Geopolitical factors

Despite the continued inflation, the venous stents market has experienced growth. This can be attributed to steady demand for venous stents. Additionally, the investment in R&D assists in the growth of the market. Such investments hinge on healthcare expenditure and public spend on healthcare. Healthcare expenditure constitutes up to 11% of global GDP, which the World Health Organisation estimated to be about US$ 9 trillion in 2022. Alternatively, according to an article by the American Medical Association, there was a 2.7% increase in the health spending in the US in 2021. Moreover, the venous stents market is also influenced by taxation policies by regional governments and the national GDP.

Latest Trends

Using two different types of stents in conjunction to ensure longevity and security has become an increasingly popular practice. The use of Z stent along with Wallstent allows for effective bilateral CV stenting while neutralizing the limitation of both types of stents. Additionally, self-expandable stents have experienced a boost in their popularity, which can be attributed to their innovative delivery systems along with higher flexibility and conformity offered. Further, such stents can be positioned without slippage.

Regional Analysis

North America is the largest contributor to the Venous Stents Market

North America remains the largest regional segment in the venous stents market with a market share of 36%. This can be attributed to substantial healthcare investments, government initiatives and increasing research partnerships. The local presence of major key players aids North America in maintaining its market share. Further, the well-established medical infrastructure in the region assists in revenue generation.

Asia Pacific achieves the highest CAGR

This particular region is predicted to experience the highest CAGR in the upcoming forecast period. The Asia-Pacific region is rife with development, specifically in the medical field. Due to the help of local governments, the R&D sector has been able to flourish. The presence of highly dynamic economies in the Asia Pacific region also attracts foreign businesses, which assists in market expansion.

Key Regions

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The venous stents market is consolidated in nature with strong presence of established players. Further, the lucrative nature of the industry attracts new players, but the high barriers to entry abate the businesses from entering. Key players compete to either increase or maintain their market share, which keeps the market in a constant state of flux. Businesses seek to cement their positions by strategies like alliances, acquisitions, agreements and product launches. Medtronic is one of the key companies capturing substantial market share.

Top Key Players

- Gore Medical

- Cook Medical

- Boston Scientific Corporation

- Becton, Dickinson and Company

- Medtronic Plc

- Vesper Medical

- Optimized Medinische Instrumente GmbH

- Plus medica GmbH & Co.

- Abbott Laboratories

- Other Key Players

Recent Developments

- In June 2023 saw the initiation of a clinical trial by Gore Medical. The trial aims to compare the effectiveness of VBX Stent Graft with that of bare metal stents. This study, named The Gore VBX Forward, will be carried out on 40 sites and its results will be revealed in 2027.

- In June 2023, the medical technology business Becton, Dickinson and Company signed an agreement to sell its Surgical Instrumentation platform for US$540 million. The platform will be purchased by STERIS, a medical equipment business based in Ireland.

- In July 2023, RevCore, the world’s first minimally invasive catheter was utilized to perform deep venous stent thrombectomies for chronic stent occlusion. All procedures done with the help of RevCore have been successful so far.

Report Scope

Report Features Description Market Value (2022) USD 1.02 Billion Forecast Revenue (2032) USD 2.3 Billion CAGR (2023-2032) 8.5% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bare Metal Stents, Drugs-eluting Stents), By Application (Legs, Chest, Abdomen, and Other Applications), By Disease (Deep Vein Thrombosis, Post Thrombotic Syndrome, May Thurner Syndrome, Hemodialysis/Arteriovenous Fistulae, Other Diseases), By Technology (Iliac Vein Stent Technologies, Wallstent Technologies, By End-User (Hospitals & Cardiac Centers, Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Gore Medical, Cook Medical, Boston Scientific Corporation, Becton, Dickinson and Company, Medtronic Plc, Vesper Medical, Optimized Medinische instrumente GmbH, Plus medica GmbH & Co., Abbott Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Venous Stents Market?The Venous Stents Market refers to the industry that produces and sells medical devices known as venous stents, which are used to treat venous diseases and disorders.

How big is the Venous Stents Market?The global Venous Stents Market size was estimated at USD 1.2 billion in 2022 and is expected to reach USD 2.3 billion in 2032.

What is the Venous Stents Market growth?The global Venous Stents Market is expected to grow at a compound annual growth rate of 8.5%. From 2023 To 2032

Who are the key companies/players in the Venous Stents Market?Some of the key players in the Venous Stents Markets are Gore Medical, Cook Medical, Boston Scientific Corporation, Becton, Dickinson and Company, Medtronic Plc, Vesper Medical, Optimized Medinische Instrumente GmbH, Plus medica GmbH & Co., Abbott Laboratories, Other Key Players

What are venous stents used for?Venous stents are used to treat conditions like deep vein thrombosis (DVT) and chronic venous insufficiency (CVI) by providing structural support to veins.

How do venous stents work?Venous stents are inserted into veins to keep them open, improving blood flow and reducing symptoms of venous diseases.

-

-

- Gore Medical

- Cook Medical

- Boston Scientific Corporation

- Becton, Dickinson and Company

- Medtronic Plc

- Vesper Medical

- Optimized Medinische Instrumente GmbH

- Plus medica GmbH & Co.

- Abbott Laboratories

- Other Key Players