Global Medical Equipment Maintenance Market Report By Equipment Type (Imaging Equipment, Electromedical Equipment, Endoscopic Devices, Surgical Instruments, Others), By Service Type (Preventive Maintenance, Corrective Maintenance, Operational Maintenance), By Service Provider (Original Equipment Manufacturers (OEMs), Independent Service Organizations (ISOs), In-House Maintenance), By End-Use (Hospitals, Diagnostic Imaging Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 17931

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

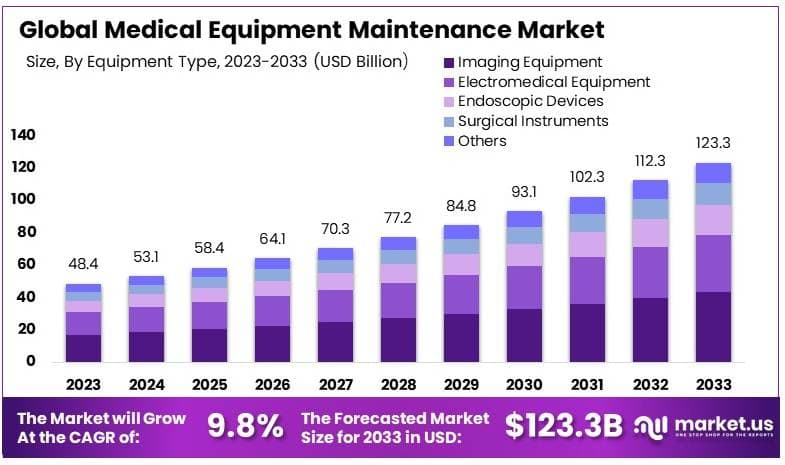

The Global Medical Equipment Maintenance Market size is expected to be worth around USD 123.3 Billion by 2033, from USD 48.4 Billion in 2023, growing at a CAGR of 9.8% during the forecast period from 2024 to 2033.

Medical equipment maintenance refers to the process of ensuring that medical devices and machinery used in healthcare settings function correctly and efficiently. This involves regular inspections, servicing, and repairs to prevent equipment failure and prolong its lifespan. Proper maintenance is critical for patient safety and helps avoid disruptions in medical services.

The medical equipment maintenance market consists of services and solutions that focus on the upkeep, repair, and servicing of medical devices across healthcare institutions. It includes preventive maintenance, corrective maintenance, and software upgrades for devices such as imaging systems, diagnostic machines, and surgical instruments.

Several factors drive the growth of the medical equipment maintenance market. Increasing healthcare expenditure globally, advancements in medical technology, and the rising number of healthcare facilities are key drivers.

Additionally, the growing aging population and prevalence of chronic diseases increase the demand for regular equipment servicing. Preventive maintenance programs, which ensure devices remain functional and reduce breakdown risks, are gaining importance in both developed and developing markets.

The demand for medical equipment maintenance services is rising as healthcare institutions face the need to ensure the continuous operation of critical equipment. With more healthcare facilities adopting advanced technologies, the complexity of maintaining such equipment increases.

According to the Centers for Medicare & Medicaid Services (CMS), healthcare spending in the U.S. is expected to grow at a rate of 5.6% annually between 2023 and 2032. This growing expenditure correlates with higher utilization of healthcare services, increasing the demand for medical equipment and consequently the maintenance services needed to keep them operational.

With 93.1% of the U.S. population insured in 2023, more patients will access medical services, creating higher demand for functional and reliable medical devices.

Opportunities in the medical equipment maintenance market are expanding as healthcare providers outsource maintenance services to third-party vendors to reduce operational costs. Emerging markets in Asia-Pacific and Latin America are witnessing increased investment in healthcare infrastructure, leading to higher demand for maintenance services.

Multinational companies like Siemens, Philips, and GE Healthcare are making significant investments in medical equipment innovation, which directly impacts the maintenance market. For example, GE Healthcare manufactures 70% of its CT equipment in its Beijing factory, while Philips is known for producing advanced MRI and ultrasound systems in China.

Government policies and regulations play a crucial role in shaping the medical equipment maintenance sector. In countries like China, initiatives such as the “Made in China 2025” plan have driven the growth of domestic medical equipment manufacturers. This program has increased local production of high-end devices, with their market share rising from 20% to 30% over the past decade.

The U.S. remains a significant exporter of medical devices, representing about 30% of China’s medical device and diagnostics imports. However, trade tensions between the U.S. and China, particularly tariffs on medical devices like surgical tools and X-ray generators, have impacted this market. $860 million worth of Chinese imports to the U.S. and $5 billion in U.S. exports to China have been affected, leading to increased costs for manufacturers and potential disruptions in the supply chain.

Key Takeaways

- The Medical Equipment Maintenance Market was valued at USD 48.4 Billion in 2023, and is expected to reach USD 123.3 Billion by 2033, with a CAGR of 9.8%.

- In 2023, Imaging Equipment dominated the equipment type segment with 34.5%, driven by the increasing usage in diagnostic imaging procedures.

- In 2023, Corrective Maintenance led the service type segment with 58.9%, reflecting the need for timely repair and upkeep of equipment.

- In 2023, Original Equipment Manufacturers (OEMs) dominated the service provider segment with 50.6%, emphasizing their role in equipment maintenance.

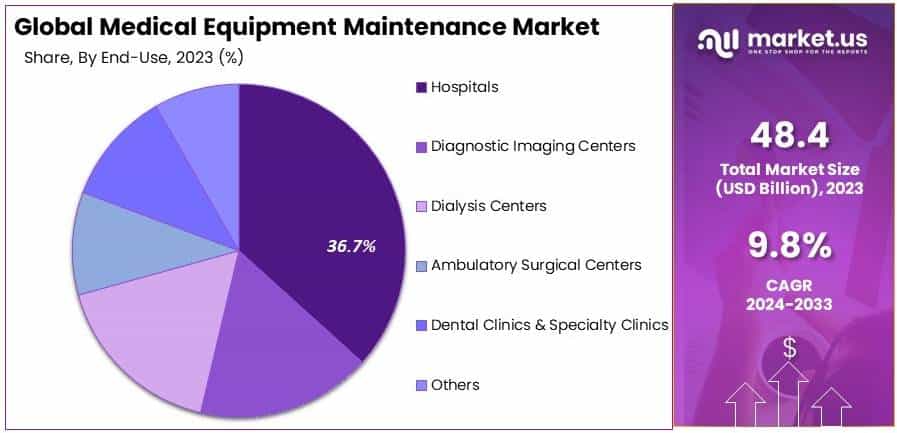

- In 2023, Hospitals accounted for 36.7% of the end-use segment due to their reliance on high-performance medical equipment.

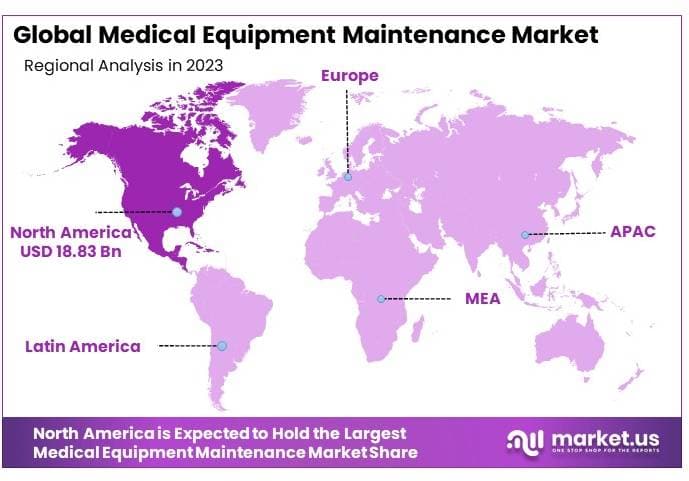

- In 2023, North America led the regional market with 38.9%, driven by advanced healthcare infrastructure.

Equipment Type Analysis

Imaging Equipment dominates with 34.5% due to its critical role in diagnostic procedures.

In the medical equipment maintenance market, various equipment types require upkeep, but imaging equipment holds the dominant share with 34.5%. This segment includes crucial diagnostic tools such as CT scanners, MRI machines, digital X-rays, and ultrasound devices. The maintenance of these machines is vital because they are extensively used for a wide range of diagnostic purposes, and their operational reliability can directly impact patient care outcomes.

Other significant segments within the equipment category include life support devices, dental equipment, electromedical equipment, endoscopic devices, and surgical equipments. Each of these segments has specific maintenance needs that are essential for safe and effective patient care. Life support devices, for example, must function flawlessly to sustain life in critical situations, while dental and surgical equipment require precision in maintenance to ensure sterility and functionality.

The predominance of the medical imaging devices is driven by the high cost of these devices and their technological sophistication, which necessitates specialized knowledge and skills for maintenance. The ongoing advancements in imaging technology further compound the need for specialized maintenance services.

While imaging equipment leads in market share, the overall growth of the medical equipment maintenance market is also supported by the increasing complexity and regulatory requirements across all medical devices, ensuring safety and efficacy in healthcare settings.

Service Type Analysis

Corrective Maintenance dominates with 58.9% due to the need for repairs and ad-hoc services.

Within the medical equipment maintenance market, service types include preventive, corrective, and operational maintenance. Corrective maintenance is the most dominant, making up 58.9% of the market. This type of service is performed after equipment failure or when problems are detected during use. It is crucial because it addresses immediate repair needs that, if unattended, could lead to equipment downtime or compromised patient safety.

Preventive maintenance involves regular, scheduled service to prevent equipment failure before it occurs, and operational maintenance includes ongoing services to ensure optimal functioning of medical equipment.

While corrective maintenance leads due to the immediate and unplanned nature of repairs, preventive maintenance is growing in importance as healthcare providers aim to reduce downtime and extend the lifespan of expensive medical assets.

The dominance of corrective maintenance underscores the reactive nature of much of the healthcare sector’s approach to equipment management. However, as the cost implications of downtime become more apparent, the market is seeing a gradual shift towards more preventive maintenance to ensure reliability and cost-efficiency in healthcare operations.

Service Provider Analysis

Original Equipment Manufacturers (OEMs) dominate with 50.6% due to their specialized knowledge and proprietary service capabilities.

Service providers in the medical equipment maintenance market include Original Equipment Manufacturers (OEMs), Independent Service Organizations (ISOs), and in-house maintenance teams. OEMs hold the largest market share at 50.6%.

This dominance is attributed to their in-depth, specific knowledge of their equipment, which enables them to provide highly effective and reliable maintenance. Moreover, OEMs often provide maintenance contracts and warranties that are appealing to healthcare providers looking to minimize risks associated with equipment failure.

ISOs offer maintenance services for a variety of brands and types of equipment, often at lower costs than OEMs. In-house maintenance teams are employed directly by healthcare facilities to perform daily maintenance tasks. While OEMs lead the market, ISOs and in-house teams are integral to the maintenance landscape, providing competitive options and specialized services that can be more cost-effective.

The leading position of OEMs in the market is reinforced by the growing complexity of medical technologies, which often requires brand-specific knowledge for effective maintenance. However, the roles of ISOs and in-house maintenance are also expanding as healthcare providers seek more cost-efficient and flexible maintenance solutions.

End-Use Analysis

Hospitals dominate the end-use segment with 36.7% due to their extensive range of medical equipment and high demand for maintenance services.

End-use sectors within the medical equipment maintenance market include hospitals, diagnostic imaging centers, dialysis centers, ambulatory surgical centers, dental clinics, and specialty clinics. Hospitals are the dominant segment, accounting for 36.7% of the market.

This is largely due to the vast array of medical equipment used in hospitals and the critical need for such equipment to be operational without fail. Hospitals typically have higher budgets and more comprehensive maintenance needs than other healthcare facilities.

Other end-use segments like diagnostic imaging centers and dialysis centers also rely heavily on specific types of medical equipment, making them significant contributors to the maintenance market. Ambulatory surgical centers and dental clinics, while smaller in scale, require highly specialized equipment maintenance to comply with health and safety regulations.

The dominance of hospitals in the end-use segment is driven by the continuous and comprehensive maintenance required to support a wide range of medical services. As healthcare continues to advance and equipment becomes more specialized, the need for specialized maintenance services across all end-use sectors is expected to grow, further expanding the scope and diversity of the medical equipment maintenance market

Key Market Segments

By Equipment Type

- Imaging Equipment

- CT

- MRI

- Digital X-Ray

- Ultrasound

- Life Support Devices

- Dental Equipment

- Others

- Electromedical Equipment

- Endoscopic Devices

- Surgical Instruments

- Others

By Service Type

- Preventive Maintenance

- Corrective Maintenance

- Operational Maintenance

By Service Provider

- Original Equipment Manufacturers (OEMs)

- Independent Service Organizations (ISOs)

- In-House Maintenance

By End-Use

- Hospitals

- Diagnostic Imaging Centers

- Dialysis Centers

- Ambulatory Surgical Centers

- Dental Clinics & Specialty Clinics

- Others

Driver

Increased Healthcare Spending Drives Market Growth

The medical equipment maintenance market is seeing growth driven by increased healthcare spending worldwide. Governments and private sectors are allocating more funds towards healthcare infrastructure, which includes the purchase and maintenance of advanced medical equipment. This increase in spending allows healthcare facilities to invest in regular maintenance services to prolong the lifespan of their devices.

The rising demand for home healthcare devices is also contributing to this growth, as more patients seek medical care from home, requiring consistent maintenance for their home-based equipment. Government initiatives and investments in healthcare modernization further boost the demand for medical equipment maintenance services.

Additionally, there is a growing focus on preventive maintenance, with healthcare providers aiming to reduce long-term costs by ensuring their equipment is serviced regularly. Preventive maintenance helps avoid breakdowns and ensures patient safety, adding to the overall demand for maintenance services.

Restraint

High Initial Investment Restraints Market Growth

Several factors are restraining the growth of the medical equipment maintenance market, including the high initial investment required for purchasing and maintaining advanced medical equipment. Smaller healthcare facilities and clinics, particularly in developing regions, find it difficult to allocate sufficient funds for regular maintenance.

The limited availability of spare parts also hampers market growth, especially for outdated equipment, where parts may no longer be manufactured or available. In some regions, a lack of awareness about the importance of regular equipment maintenance adds to this challenge, with healthcare providers opting to delay or forgo servicing altogether.

Another significant restraining factor is the dependence on original equipment manufacturers (OEMs) for maintenance services. This reliance can limit the flexibility of service options and lead to higher costs, further slowing market growth.

Opportunity

Expansion of Service Networks Provides Opportunities

There are numerous growth opportunities within the medical equipment maintenance market. One key opportunity is the expansion of service networks by maintenance providers, which can cater to a broader range of healthcare facilities across various regions. Expanding service networks allows companies to meet the growing demand for maintenance services in underserved areas.

The digital transformation of healthcare offers another growth opportunity, as automation and predictive analytics are increasingly being integrated into maintenance processes. These technologies improve efficiency and reduce downtime, offering cost-saving benefits to healthcare providers.

Partnerships with hospitals and clinics are also on the rise, offering mutually beneficial relationships where healthcare providers receive dedicated maintenance services. Lastly, emerging markets present a substantial opportunity, with countries in regions such as Asia-Pacific and Latin America investing heavily in healthcare infrastructure, creating demand for both equipment and maintenance services.

Challenge

Fluctuations in Raw Material Prices Challenges Market Growth

The medical equipment maintenance market faces several challenges that could hinder growth. One significant challenge is the fluctuation in raw material prices, which directly impacts the cost of manufacturing and maintaining medical devices. These fluctuations can make it difficult for service providers to maintain consistent pricing for their clients.

Rapid technological changes also present a challenge, as service providers need to constantly update their skills and knowledge to keep pace with new medical equipment innovations. This requires ongoing investment in training and new tools.

Additionally, the complex regulatory landscape makes it challenging for companies to operate across different regions. Compliance requirements vary and can be difficult to navigate, increasing the cost and complexity of offering maintenance services. Increased competition among service providers further intensifies the challenge, as companies must find ways to differentiate their services while maintaining cost-efficiency and quality.

Growth Factors

Rising Demand for Diagnostic Equipment Is Growth Factor

Several growth factors are contributing to the expansion of the medical equipment maintenance market. The rising demand for diagnostic equipment, including MRI machines and CT scanners, requires consistent maintenance to ensure accurate results and patient safety. As the use of diagnostic equipment grows, so does the need for reliable maintenance services.

Similarly, the increased use of imaging systems in both hospitals and outpatient facilities creates a steady demand for maintenance services. Imaging systems must be kept in optimal condition to avoid malfunctions that could lead to inaccurate diagnoses.

The growth of minimally invasive surgery, which relies heavily on advanced medical devices, further contributes to market growth. These devices must be properly maintained to function optimally during critical procedures. Additionally, the expanding healthcare infrastructure in developing regions is driving demand for both new medical equipment and the maintenance services needed to keep these devices functioning efficiently.

Emerging Trends

Adoption of AI and Machine Learning Is Latest Trending Factor

Several trends are shaping the future of the medical equipment maintenance market. The adoption of artificial intelligence (AI) and machine learning is a major trend, as these technologies are increasingly being used to enhance predictive maintenance capabilities. AI can analyze data from medical devices and predict potential failures, enabling proactive maintenance.

The integration of the Internet of Things (IoT) into medical devices is another significant trend, allowing devices to communicate real-time performance data to maintenance providers. This real-time monitoring helps improve the efficiency and effectiveness of maintenance services.

Subscription-based maintenance models are also becoming more popular, offering healthcare providers flexible payment options while ensuring consistent service. Lastly, the use of big data to analyze maintenance needs and optimize scheduling is a growing trend, helping healthcare facilities improve efficiency and reduce costs.

Regional Analysis

North America Dominates with 38.9% Market Share

North America leads the Medical Equipment Maintenance Market with a 38.9% share, equating to USD 18.83 billion. This dominance is driven by well-established healthcare infrastructure, increased healthcare spending, and a large concentration of hospitals and diagnostic centers. The presence of key industry players further enhances the market’s performance in the region.

The region’s strong healthcare policies and regular advancements in medical technology create an environment conducive to the growth of medical equipment maintenance services. High demand for preventive maintenance and regulatory compliance further boosts the market’s expansion.

North America’s leadership is expected to continue, with technological advancements and a growing focus on healthcare quality likely to increase the demand for medical equipment maintenance. The region’s market share may further expand due to the growing adoption of digital health solutions and aging population trends.

Regional Mentions:

- Europe: Europe holds a steady position in the Medical Equipment Maintenance Market, driven by strict regulatory frameworks and a focus on healthcare quality. The region emphasizes preventive maintenance in hospitals and medical centers, boosting market growth.

- Asia Pacific: Asia Pacific is rapidly growing in the Medical Equipment Maintenance Market, fueled by the expansion of healthcare infrastructure and rising demand for advanced medical devices. Countries like China and India are leading investments in healthcare technologies.

- Middle East & Africa: The Middle East and Africa are emerging players in the market, focusing on enhancing their healthcare infrastructure. Investments in new hospitals and medical facilities are key drivers for the region’s growing market presence.

- Latin America: Latin America is progressively expanding in the Medical Equipment Maintenance Market. The region’s healthcare modernization and increasing number of private hospitals contribute to the demand for reliable maintenance services.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Medical Equipment Maintenance Market, GE Healthcare, Siemens Healthineers, and Koninklijke Philips are the top three players driving significant influence and shaping market trends. These companies hold strategic positions through their extensive portfolios, innovative services, and global reach.

GE Healthcare is a dominant player, leveraging its broad service offerings across various medical technologies, including diagnostic imaging and life sciences equipment. GE Healthcare’s strong global footprint and its focus on predictive maintenance solutions using advanced data analytics solidify its leadership. The company is well-positioned to cater to healthcare facilities looking to enhance equipment uptime and operational efficiency, making it a vital partner for healthcare providers.

Siemens Healthineers holds a competitive edge with its innovative approach to service contracts and integrated digital platforms. Siemens’ strong reputation in diagnostic imaging maintenance and its use of artificial intelligence to predict equipment failures set it apart from competitors. Siemens Healthineers’ service solutions focus on maximizing the lifespan of equipment while minimizing downtime, which strengthens its strategic positioning in the market.

Koninklijke Philips also plays a key role in the market, offering end-to-end maintenance services. Philips’ focus on customer-centric solutions and value-based maintenance models enhances its market influence. With a strong emphasis on connected care and digital technologies, Philips ensures that medical equipment remains fully operational while delivering high-quality care. Its global service network allows the company to meet the diverse needs of healthcare providers worldwide.

Together, these three companies drive innovation, elevate service standards, and set benchmarks in the medical equipment maintenance space. Their global influence and investments in predictive and data-driven maintenance solutions are expected to drive market growth in the coming years.

Top Key Players in the Market

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips

- Stryker

- Canon

- Fujifilm

- Hitachi

- Shimadzu

- Alliance Medical Group

- Althea Group

- Other Key Players

Recent Developments

- On January 2024, The U.S. Army Medical Materiel Agency (USAMMA) has updated its operating procedures to consolidate all maintenance activities under the Global Combat Support System-Army (GCSS-A) to enhance visibility and transparency of work orders at the unit level.

- On March 2023, GE HealthCare and Advantus Health Partners have entered into a significant 10-year agreement worth up to $760 million. This partnership aims to provide GE HealthCare’s healthcare technology management services to Advantus’ clients, offering a comprehensive program beyond traditional medical device maintenance approaches.

- On July 2022, B. Braun has launched a Technical Service Center in Thailand to offer medical equipment repair and maintenance services supporting the Thai public health system. The center provides technical expertise and resources to ensure that medical devices are functioning properly, helping doctors and nurses deliver effective healthcare solutions.

Report Scope

Report Features Description Market Value (2023) USD 48.4 Billion Forecast Revenue (2033) USD 123.3 Billion CAGR (2024-2033) 9.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment Type (Imaging Equipment, CT, MRI, Digital X-Ray, Ultrasound, Life Support Devices, Dental Equipment, Others, Electromedical Equipment, Endoscopic Devices, Surgical Instruments, Others), By Service Type (Preventive Maintenance, Corrective Maintenance, Operational Maintenance), By Service Provider (Original Equipment Manufacturers (OEMs), Independent Service Organizations (ISOs), In-House Maintenance), By End-Use (Hospitals, Diagnostic Imaging Centers, Dialysis Centers, Ambulatory Surgical Centers, Dental Clinics & Specialty Clinics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GE Healthcare, Siemens Healthineers, Koninklijke Philips, Stryker, Canon, Fujifilm, Hitachi, Shimadzu, Alliance Medical Group, Althea Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Equipment Maintenance MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Equipment Maintenance MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips N.V.

- Drägerwerk AG & Co. KGaA

- Shimadzu Corporation

- Canon Inc.

- Agiliti Health Inc.

- Medtronic

- Braun Melsungen AG

- Aramark

- BC Technical Inc.

- Alliance Medical Group

- Althea Group

- Other Key Players