Global Microscopy Market By Product Type (Microscopes (Optical, Stereo, Digital, Confocal, Compound, and Others), Accessories, and Software), By Application (Semiconductors & Electronics, Healthcare & Life Sciences, Clinical Diagnostics, Drug Delivery & Development, and Others), By End-user (Industrial Users, Semiconductor & Electronics industry, Automotive, Food & Beverage, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 28896

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

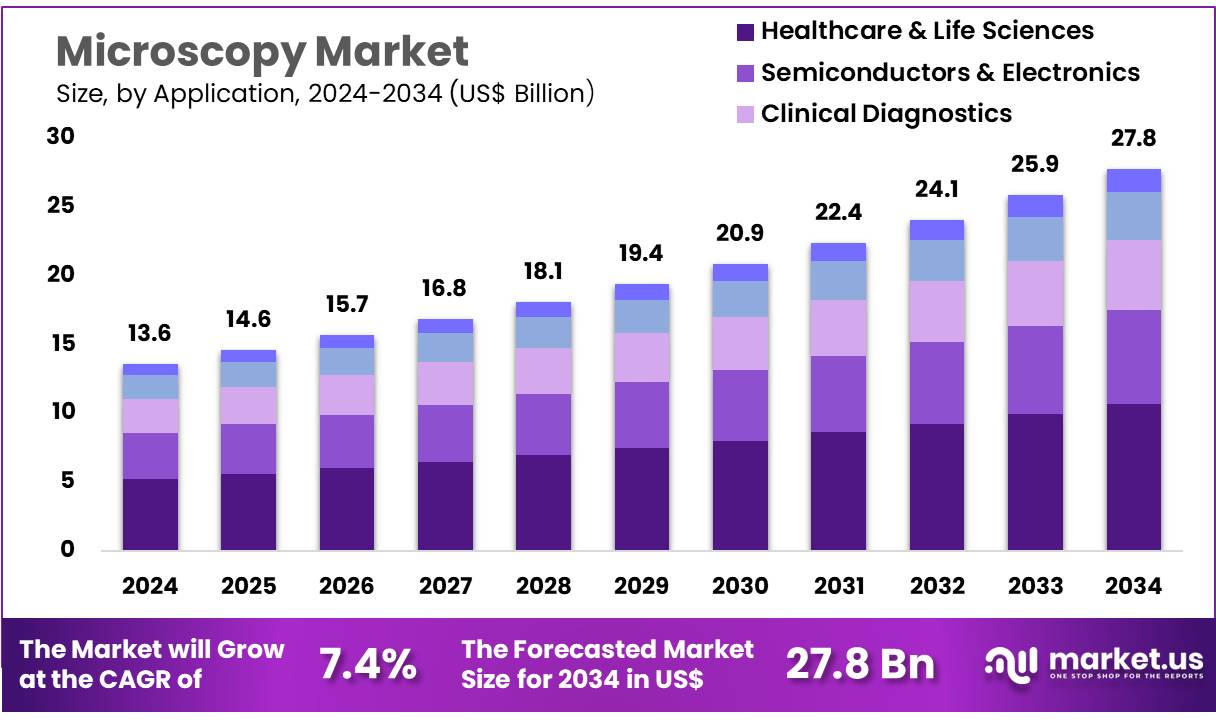

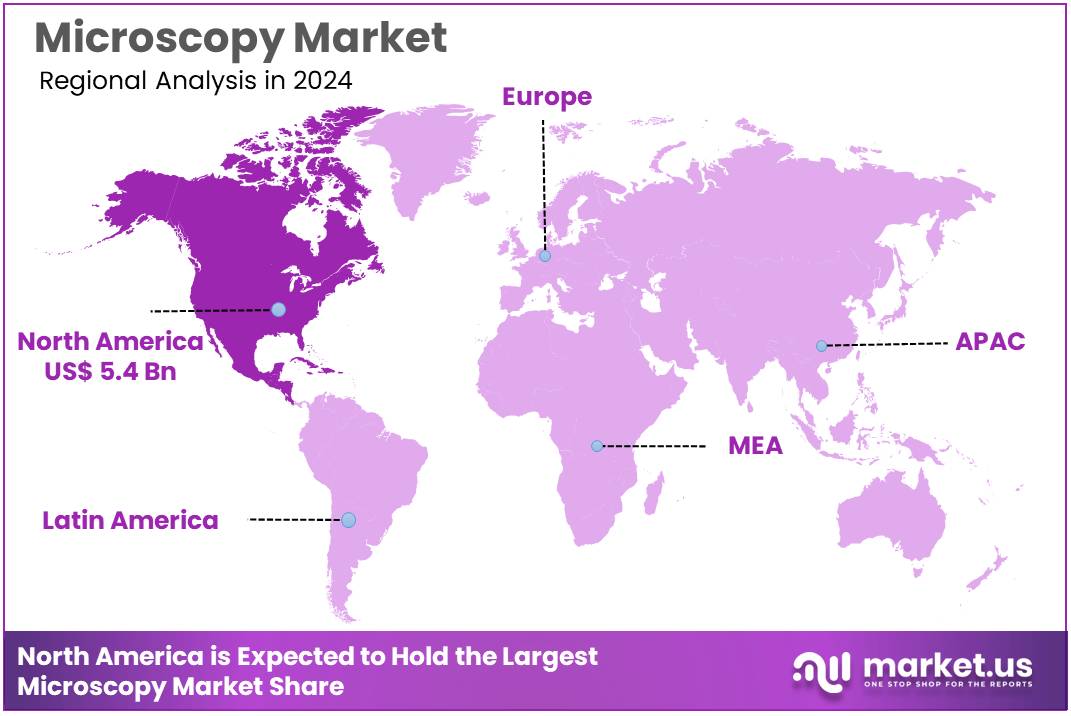

The Global Microscopy Market size is expected to be worth around US$ 27.8 billion by 2034 from US$ 13.6 billion in 2024, growing at a CAGR of 7.4% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 39.4% share with a revenue of US$ 5.4 Billion.

Increasing demand for high-precision imaging and the growing applications of microscopy in research and healthcare are driving the expansion of the microscopy market. Microscopes are essential tools in various fields such as biology, material science, and nanotechnology, enabling scientists to observe objects at a microscopic level, leading to new discoveries in cellular biology, diagnostics, and drug development.

The rising focus on personalized medicine, advanced diagnostics, and the growing need for accurate imaging in scientific research further contribute to the market’s growth. In July 2021, Access Healthcare unveiled Echo, a cutting-edge AI and robotic process automation (RPA) platform designed to optimize revenue cycle management. The platform automates routine administrative tasks, reducing errors and increasing efficiency in healthcare billing and collections, showcasing how automation trends are extending to various sectors, including microscopy.

Recent trends in the microscopy market show increasing integration of artificial intelligence (AI) and machine learning (ML) technologies, enhancing image processing, analysis, and interpretation, making microscopes smarter and more efficient. Additionally, the development of advanced imaging techniques, such as super-resolution microscopy and 3D imaging, opens new opportunities in both academic research and clinical applications. The rising investments in life sciences and biotechnology, along with the growing demand for better healthcare solutions, position the microscopy market for continued growth and innovation.

Key Takeaways

- In 2024, the market for microscopy generated a revenue of US$ 13.6 billion, with a CAGR of 7.4%, and is expected to reach US$ 27.8 billion by the year 2033.

- The product type segment is divided into microscopes, accessories, and software, with microscopes taking the lead in 2023 with a market share of 54.7%.

- Considering application, the market is divided into semiconductors & electronics, healthcare & life sciences, clinical diagnostics, drug delivery & development, and others. Among these, healthcare & life sciences held a significant share of 38.4%.

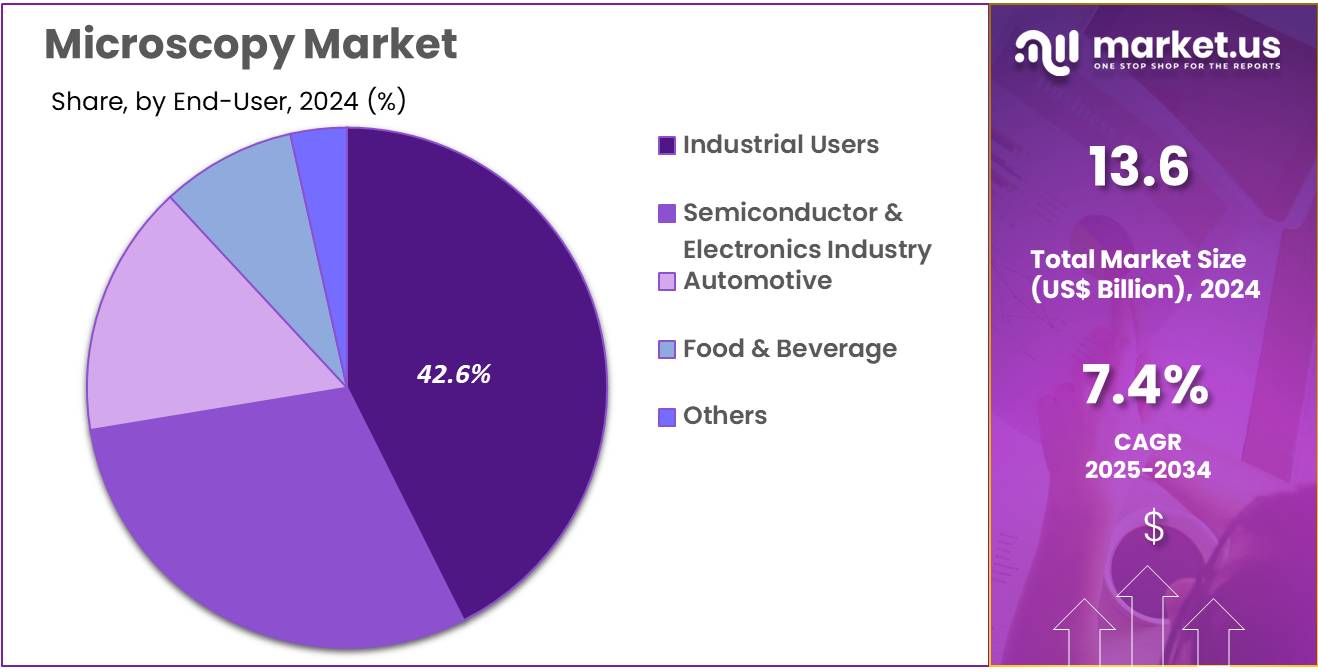

- Furthermore, concerning the end-user segment, the market is segregated into industrial users, semiconductor & electronics industry, automotive, food & beverage, and others. The industrial users sector stands out as the dominant player, holding the largest revenue share of 42.6% in the microscopy market.

- North America led the market by securing a market share of 39.4% in 2023.

Product Type Analysis

The microscopes segment led in 2023, claiming a market share of 54.7% as advancements in technology and an increasing need for high-resolution imaging in various industries drive demand. Microscopes are anticipated to be crucial in research and development in fields like biology, material science, and nanotechnology, where precision and detail are paramount. The need for more sophisticated imaging techniques, such as electron microscopy, confocal microscopy, and super-resolution microscopy, is expected to boost the market for microscopes.

Furthermore, as industries and research institutions continue to seek improved imaging capabilities for product development and quality control, the microscopes segment is projected to expand. The rise in automation and integration of artificial intelligence in microscopy equipment is likely to enhance the demand for these products.

Application Analysis

The healthcare & life sciences held a significant share of 38.4% due to the increasing application of microscopy techniques in the analysis and production of semiconductor materials and electronic components. Microscopes are essential tools for inspecting and measuring the fine structures of semiconductors and electronic devices, enabling precision and quality control in manufacturing processes.

As the demand for smaller, more powerful electronic components continues to rise, microscopy’s role in the research, design, and production of semiconductors is expected to increase. Furthermore, the shift toward nanotechnology in electronics will drive further adoption of high-resolution microscopes for precise imaging at the nanoscale, resulting in sustained growth for this segment.

End-user Analysis

The industrial users segment had a tremendous growth rate, with a revenue share of 42.6% as manufacturing, automotive, and food & beverage industries increasingly rely on advanced microscopy techniques for quality control, product testing, and research. Industrial applications of microscopy are projected to expand as industries require higher levels of precision in inspecting materials, components, and products for defects, structural integrity, and functionality.

As these industries continue to embrace automation, the use of microscopes for process optimization, failure analysis, and product development is expected to grow. The continuous need for innovation, performance improvements, and efficiency across various sectors will likely propel the industrial users segment in the microscopy market.

Key Market Segments

Product Type

- Microscopes

- Optical

- Stereo

- Digital

- Confocal

- Compound

- Others

- Accessories

- Software

Application

- Semiconductors & Electronics

- Healthcare & Life Sciences

- Clinical Diagnostics

- Drug Delivery & Development

- Others

End-user

- Industrial Users

- Semiconductor & Electronics industry

- Automotive

- Food & Beverage

- Others

Drivers

Increasing Innovation Driving the Microscopy Market

Rising advancements in imaging technology are expected to drive the microscopy market by improving resolution, accuracy, and research capabilities across various fields. In July 2023, TELCOR introduced version 21.3 of its TELCOR RCM platform, featuring advanced automation tools, expanded API functionality, and an improved reporting module. The new Executive Module aims to optimize laboratory financial workflows and enhance operational efficiency.

Digital microscopes are gaining popularity due to their ability to capture high-resolution images and provide real-time analysis. The development of super-resolution microscopy techniques is enhancing the study of molecular and cellular structures. Advances in nanotechnology are enabling more precise imaging for biomedical and material science applications.

Researchers are utilizing hybrid microscopes that combine multiple imaging modalities for comprehensive analysis. The expansion of fluorescence and confocal microscopy is improving visualization of live-cell dynamics. Increased investment in research and development is accelerating innovation in microscopy techniques. Government and private sector funding are supporting the integration of AI-driven imaging solutions.

is streamlining workflow efficiency in pathology and clinical diagnostics. Enhanced connectivity features in digital microscopes are enabling remote collaboration in research and diagnostics. With continuous technological progress, the microscopy market is likely to experience significant growth in scientific and industrial applications.

Restraints

High Costs Are Restraining the Microscopy Market

Increasing costs associated with advanced microscopes are limiting accessibility, particularly for academic institutions and small laboratories. High-end microscopy systems, such as electron and super-resolution microscopes, require substantial investment, making affordability a challenge for researchers with limited funding. Maintenance and operational expenses further add to financial burdens, as specialized training is necessary to operate and calibrate complex imaging systems.

Laboratories must allocate additional resources for software updates, imaging accessories, and specimen preparation tools. The requirement for controlled environments, such as vibration-free and temperature-regulated rooms, adds to infrastructure costs. Developing nations face challenges in adopting advanced microscopy due to budget constraints and inadequate research facilities.

Limited availability of skilled professionals trained in handling sophisticated imaging technologies also hinders widespread adoption. Addressing cost-related concerns through government grants, leasing options, and modular microscopy solutions could enhance market accessibility.

Opportunities

Integration of AI as an Opportunity for the Microscopy Market

Growing adoption of artificial intelligence is anticipated to create new opportunities in the microscopy market by improving image analysis and diagnostic accuracy. In June 2022, R1 RCM Inc. completed the acquisition of Cloudmed, a leader in revenue recovery solutions. The integration of Cloudmed’s AI-driven analytics and automation technologies is expected to improve financial performance and streamline billing processes for healthcare providers.

AI-powered microscopy solutions are enabling faster and more precise identification of cellular abnormalities in medical diagnostics. Deep learning algorithms are enhancing image processing, reducing manual workload for researchers and pathologists. Automated detection of disease markers is improving the efficiency of clinical laboratories. AI-driven microscopes are assisting in drug discovery by analyzing molecular interactions at a higher speed and accuracy.

Cloud-based AI integration is allowing real-time collaboration between research teams globally. AI-assisted quality control in industrial microscopy applications is improving defect detection in manufacturing processes. With ongoing advancements in machine learning, AI-powered microscopy solutions are likely to drive innovation across healthcare, material sciences, and life sciences research.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly shape the microscopy market. On the positive side, increasing investments in research and development, particularly in life sciences, biomedical fields, and materials science, drive the demand for advanced microscopy solutions. The global push for improved healthcare services and diagnostic precision has increased the adoption of microscopes for medical and clinical applications.

Additionally, the rising need for high-quality imaging in industries such as pharmaceuticals, nanotechnology, and electronics contributes to the market’s growth. However, economic slowdowns and reduced funding in research sectors could limit spending on high-end imaging equipment. Geopolitical instability, regulatory challenges, and international trade restrictions could disrupt the supply chain, delaying product availability and raising costs.

Furthermore, differences in regulatory standards across regions may complicate the market expansion of microscopy technologies. Despite these challenges, technological advancements in imaging techniques and the growing emphasis on precision medicine provide a positive outlook for the market.

Latest Trends

Surge in Mergers and Acquisitions Driving the Microscopy Market

Rising mergers and acquisitions have become a driving force in the microscopy market. High demand for integrated solutions and the growing complexity of microscopy technologies push companies to consolidate and combine their resources. These strategic mergers enhance operational efficiencies, expand product offerings, and foster innovation, accelerating the development of new imaging techniques.

The increasing need for high-resolution and versatile microscopy systems has prompted companies to collaborate, ensuring that they stay competitive in an evolving market. These mergers also allow for better integration of emerging technologies, such as artificial intelligence and automation, into traditional microscopy. In January 2024, R1 RCM Inc. finalized its acquisition of Acclara, a revenue cycle management firm previously owned by Providence Health.

This acquisition enhances R1 RCM’s technological capabilities and expands its service offerings, improving financial operations for healthcare providers and patient billing experiences. As mergers and acquisitions continue to rise, the microscopy market will likely benefit from innovations, streamlined operations, and a broader range of cutting-edge products, driving continued growth.

Regional Analysis

North America is leading the Microscopy Market

North America dominated the market with the highest revenue share of 39.4% owing to advancements in imaging technology and increasing investments in life sciences research. The growing demand for high-resolution imaging in biomedical applications, including cancer research and neuroscience, contributed to the widespread adoption of cutting-edge microscopy solutions. Expanding biotechnology and pharmaceutical industries further fueled the need for sophisticated imaging techniques in drug discovery and cellular analysis.

The presence of leading research institutions and collaborations between universities and industry players strengthened innovation in this sector. Rising adoption of digital microscopy, integrated with artificial intelligence for automated analysis, improved diagnostic accuracy and workflow efficiency. Government funding for research in nanotechnology and material sciences also supported market expansion. Additionally, the integration of digital platforms and remote-access imaging solutions enabled seamless data sharing, enhancing collaborative research efforts.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing investments in scientific research and expanding healthcare infrastructure. The launch of the ECLIPSE Ui by Nikon Corporation in April 2023 underscored the region’s commitment to advancing digital imaging solutions. Rising demand for high-precision imaging in medical diagnostics and semiconductor manufacturing is likely to fuel adoption. Expanding biotechnology and nanotechnology sectors in countries like China, Japan, and India are anticipated to support market growth.

Government initiatives promoting research and development in life sciences and materials engineering are expected to encourage investment in advanced imaging technologies. Collaborations between global manufacturers and regional research institutions are projected to enhance accessibility and affordability of cutting-edge equipment.

The increasing adoption of AI-powered imaging tools for pathology and disease diagnostics is likely to improve efficiency in clinical applications. Growing awareness of the importance of high-quality imaging in scientific advancements is expected to further drive market expansion across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the microscopy market focus on advancing imaging technologies such as super-resolution, digital, and electron microscopy to enhance research and diagnostics. Companies invest in artificial intelligence and automation to improve image analysis, streamline workflows, and increase precision in biological and material sciences.

Strategic collaborations with research institutions and pharmaceutical companies drive innovation and expand application areas. Geographic expansion into emerging markets with rising demand for scientific research supports further growth. Many players also prioritize affordability and user-friendly designs to encourage widespread adoption in academia and healthcare.

Carl Zeiss Microscopy is a leading company in this market, offering cutting-edge imaging solutions such as the LSM 980 confocal microscope for high-resolution research. The company focuses on continuous technological advancements and strong partnerships with scientific communities. Carl Zeiss Microscopy’s commitment to precision optics and innovation solidifies its position as a key player in the industry.

Top Key Players

- Zeiss Group

- Thermo Fisher Scientific

- Olympus Corporation

- NT-MDT SI

- Nikon Corporation

- Hitachi High-Tech Corporation

- CAMECA

- Bruker Corporation

Recent Developments

- In July 2023, ZEISS Microscopy showcased its latest microscopy technologies at the Microscopy and Microanalysis (M&M) 2023 Conference. The exhibition featured interactive displays, new product launches, and insights from emerging researchers in the field.

- In November 2022, Bruker Corporation expanded its microscopy portfolio with the acquisition of Inscopix, Inc., a company specializing in miniaturized microscopes for neuroscience applications. This acquisition strengthens Bruker’s position in advanced imaging solutions, particularly in brain research and neural activity mapping.

Report Scope

Report Features Description Market Value (2024) US$ 13.6 billion Forecast Revenue (2034) US$ 27.8 billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Microscopes (Optical, Stereo, Digital, Confocal, Compound, and Others), Accessories, and Software), By Application (Semiconductors & Electronics, Healthcare & Life Sciences, Clinical Diagnostics, Drug Delivery & Development, and Others), By End-user (Industrial Users, Semiconductor & Electronics industry, Automotive, Food & Beverage, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zeiss Group, Thermo Fisher Scientific, Olympus Corporation, NT-MDT SI, Nikon Corporation, Hitachi High-Tech Corporation, CAMECA, and Bruker Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zeiss Group

- Thermo Fisher Scientific

- Olympus Corporation

- NT-MDT SI

- Nikon Corporation

- Hitachi High-Tech Corporation

- CAMECA

- Bruker Corporation