Global Rubber Vulcanization Market By Type (Vulcanizing Agents, Accelerators, Activators), By Technique (Sulfur Vulcanization, Curing Techniques), By Application (Industrial, Consumer Goods, Automotive and Transportation, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139836

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

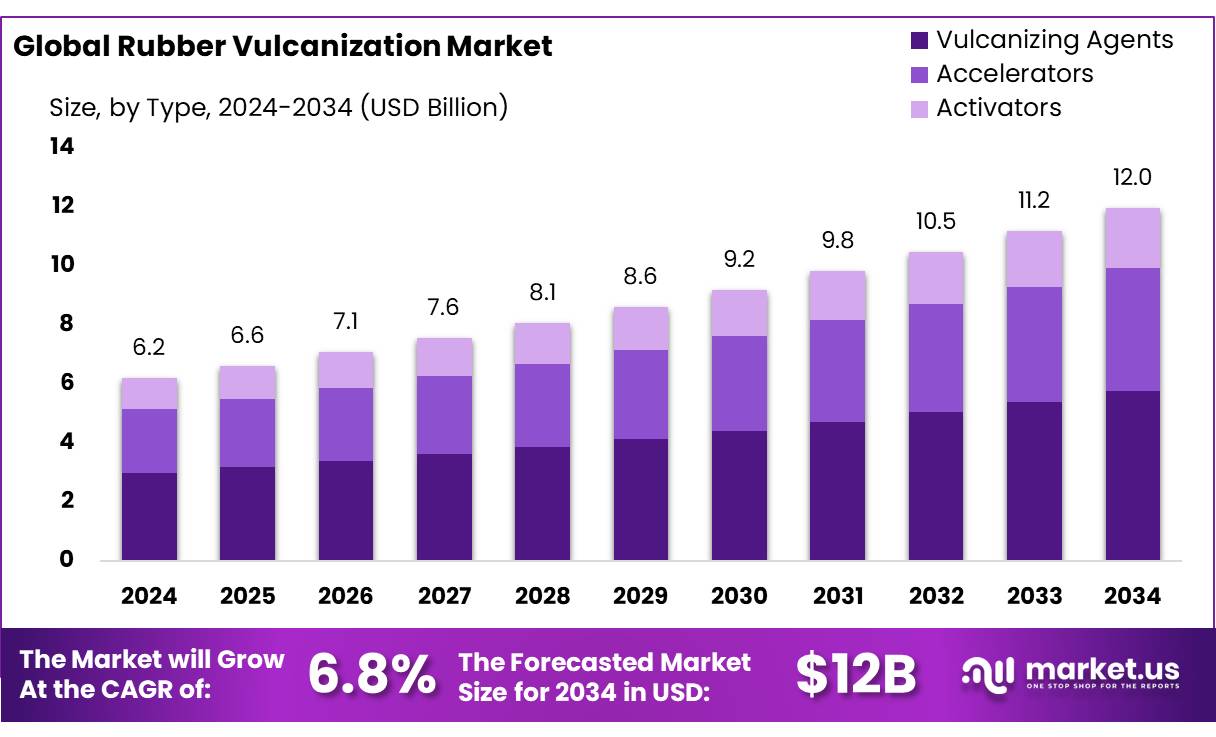

The Global Rubber Vulcanization Market size is expected to be worth around USD 12.0 Bn by 2034, from USD 6.2 Bn in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

Growing demand for rubber products, particularly in comparison to plastic and fiber alternatives, is expected to drive significant growth in the rubber vulcanization market over the forecast period. Rubber vulcanization is a process that enhances the properties of both synthetic and natural rubber, making the material more durable, stronger, and resistant to ozone, heat, and other environmental factors. Key industries such as aerospace and automotive are playing a crucial role in this growing demand for vulcanized rubber, as its superior performance characteristics make it ideal for a wide range of applications.

Rubber vulcanization is a crucial process in the rubber industry that enhances the elasticity, strength, durability, and resistance of natural and synthetic rubber by cross-linking polymer chains with sulfur or other curatives. This process is essential for manufacturing a wide range of rubber products, including tires, industrial seals, hoses, gaskets, footwear, and conveyor belts. The global rubber industry heavily depends on vulcanization technology to produce high-performance rubber materials used across automotive, industrial, medical, and consumer goods applications.

Investments in advanced vulcanization technologies, sustainable materials, and automation are shaping the future of the rubber vulcanization market. Companies are increasingly adopting efficient and eco-friendly vulcanization processes that minimize energy consumption and reduce hazardous byproducts. Innovations such as electron beam vulcanization, peroxide curing, and nitrogen-based curing are gaining traction as alternatives to conventional sulfur-based vulcanization. Furthermore, the rise of bio-based and recycled rubber materials is attracting investment in circular economy models, driving sustainable growth in the industry.

The future growth of the rubber vulcanization market will be shaped by technological advancements, environmental regulations, and sustainability efforts. Stringent emission norms and bans on hazardous processing chemicals are pushing manufacturers towards low-emission and solvent-free vulcanization techniques.

Key Takeaways

- Rubber Vulcanization Market size is expected to be worth around USD 12.0 Bn by 2034, from USD 6.2 Bn in 2024, growing at a CAGR of 6.8%.

- Vulcanizing Agents held a dominant market position, capturing more than a 48.1% share.

- Sulfur Vulcanization held a dominant market position, capturing more than a 77.3% share.

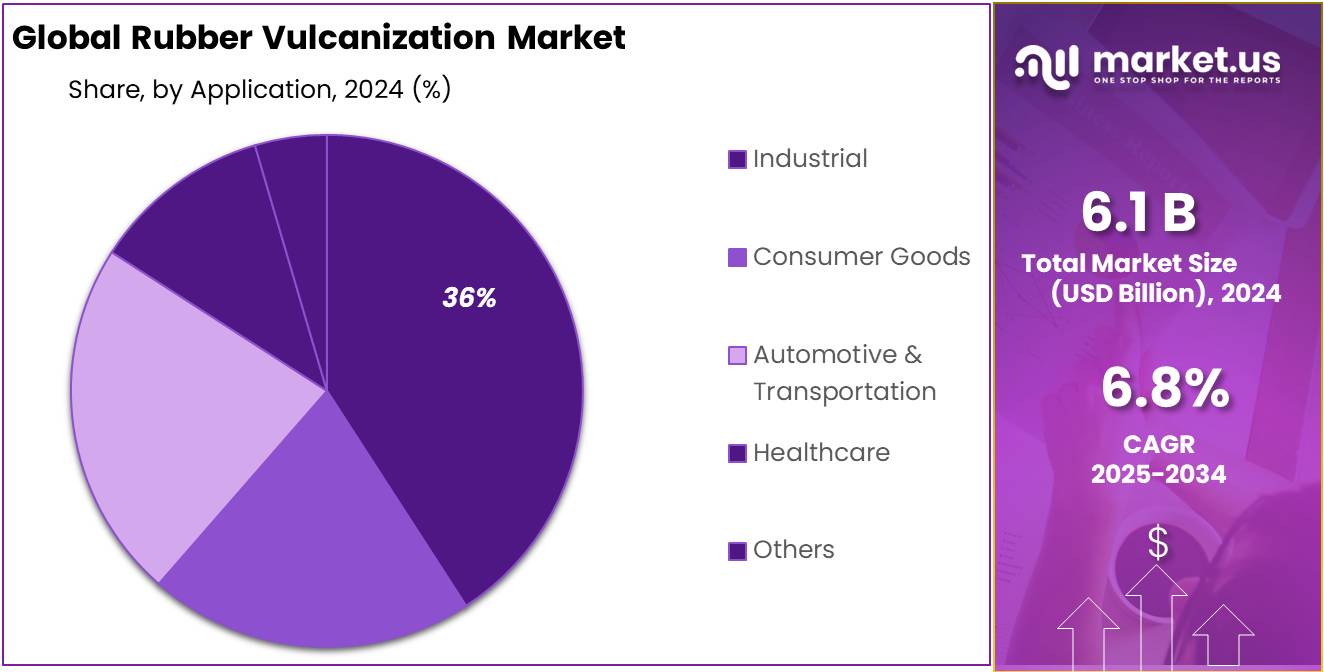

- Industrial held a dominant market position, capturing more than a 36.2% share of the rubber vulcanization market.

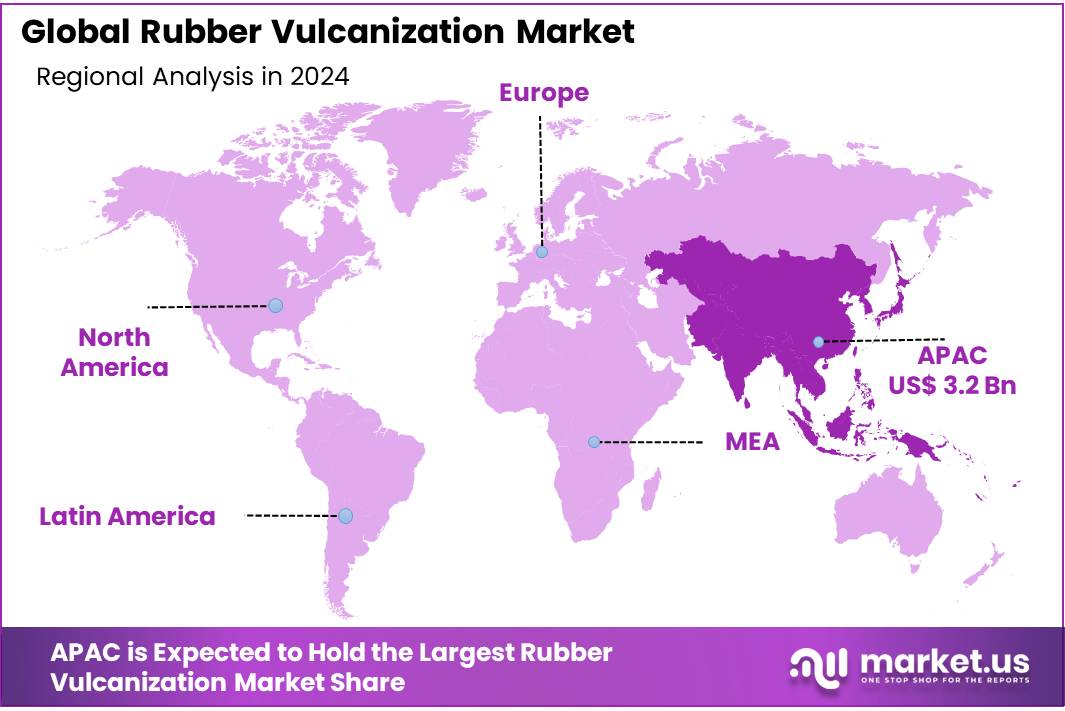

- Asia Pacific (APAC) region emerging as the dominant player, capturing more than 53.2% of the global market share, valued at approximately $3.2 billion.

By Type

In 2024, Vulcanizing Agents held a dominant market position, capturing more than a 48.1% share of the rubber vulcanization market. This segment is expected to maintain its stronghold in the coming years due to its crucial role in the chemical bonding process, which enhances the durability and elasticity of rubber. The growing demand for high-performance rubber in industries like automotive, industrial goods, and consumer products continues to drive the widespread use of vulcanizing agents.

The Accelerators segment, while smaller in comparison, remains significant, accounting for a substantial portion of the market in 2024. Accelerators are essential for improving the speed of the vulcanization process, which makes them vital in industries where time and efficiency are key factors. This segment is projected to grow steadily in the next few years as manufacturers seek faster production cycles without compromising product quality.

Activators, though occupying a smaller share of the market, play a pivotal role in ensuring the effectiveness of vulcanization. They are mainly used in conjunction with accelerators and vulcanizing agents to optimize the chemical reactions involved. Despite their smaller share, the activators market is projected to see gradual growth, with applications in specialty rubber products continuing to rise.

Overall, the rubber vulcanization market is expected to see steady growth across these three segments. The demand for high-quality rubber and the need for improved manufacturing processes will likely continue to propel the market forward through 2025 and beyond.

By Technique

In 2024, Sulfur Vulcanization held a dominant market position, capturing more than a 77.3% share of the rubber vulcanization market. This technique has remained the preferred method for vulcanizing rubber due to its cost-effectiveness, reliability, and the high-quality products it yields. Sulfur vulcanization is widely used across various industries, including automotive, industrial goods, and consumer products, where it enhances the durability, strength, and heat resistance of rubber. As demand for high-performance rubber products continues to grow, sulfur vulcanization is expected to retain its leading position in the market through 2025 and beyond.

Curing Techniques segment, while considerably smaller in comparison, also contributes to the market. These techniques include methods like peroxide vulcanization, radiation curing, and others, which are used for specialty applications requiring specific properties such as higher temperature resistance or more complex formulations. This segment is expected to see moderate growth as manufacturers look for alternatives to sulfur vulcanization for specialized rubber products. However, it is likely to remain a niche market compared to the dominant sulfur vulcanization technique in the coming years.

By Application

In 2024, Industrial held a dominant market position, capturing more than a 36.2% share of the rubber vulcanization market. This segment leads primarily due to the extensive use of vulcanized rubber in industrial applications such as seals, gaskets, and belts, which require materials that can withstand wear and tear, extreme temperatures, and mechanical stress. The demand for durable and high-performance rubber in manufacturing processes is expected to continue driving growth in this segment through 2025.

The Automotive & Transportation segment follows closely, holding a significant share in 2024. The increasing use of rubber in tires, engine parts, and suspension systems plays a key role in this growth. With the continued development of the automotive industry, including the rise of electric vehicles, the demand for high-quality, durable rubber products is anticipated to rise, fueling further market expansion in this application.

The Consumer Goods sector also contributes to the overall market, though with a smaller share compared to industrial and automotive applications. In 2024, this segment is driven by the need for rubber in various household products, such as footwear, sports equipment, and kitchenware. As consumer preferences for durable, long-lasting products continue to evolve, this market is projected to experience steady growth in the coming years.

The Healthcare sector, while niche, remains an important application for rubber vulcanization, particularly in medical devices, tubing, and gloves. In 2024, this segment is expected to grow due to increasing demand for healthcare products in line with rising health concerns globally. As healthcare standards and hygiene protocols continue to prioritize rubber-based products, this market is likely to expand, although at a slower rate compared to other sectors.

Key Market Segments

By Type

- Vulcanizing Agents

- Accelerators

- Activators

By Technique

- Sulfur Vulcanization

- Curing Techniques

By Application

- Industrial

- Consumer Goods

- Automotive & Transportation

- Healthcare

- Others

Drivers

Increasing Demand for High-Performance Rubber in the Automotive Industry

One of the major driving factors for the growth of the rubber vulcanization market is the rising demand for high-performance rubber in the automotive industry. As vehicles continue to evolve with advancements in design, efficiency, and sustainability, the need for durable, high-quality rubber components has become even more critical. Vulcanized rubber plays a vital role in automotive parts such as tires, seals, belts, and suspension components, all of which must endure extreme conditions, including temperature fluctuations, mechanical stress, and wear over time.

This is largely driven by increased vehicle production, which reached 80 million units globally in 2023, a number expected to rise as electric vehicles (EVs) and other fuel-efficient vehicles become more mainstream. As EV adoption grows, manufacturers are focusing on tires and rubber products that are lighter, more durable, and energy-efficient, further increasing the need for high-performance vulcanized rubber.

Additionally, initiatives from governments and industry leaders are driving advancements in rubber technology to meet these demands. The European Union, for example, has implemented policies to reduce carbon emissions from vehicles, encouraging the development of tires and other automotive rubber products that can help reduce fuel consumption and enhance the overall efficiency of vehicles.

Restraints

Environmental Concerns and the Impact of Toxic Chemicals in Rubber Vulcanization

One of the major restraining factors for the rubber vulcanization market is the environmental impact associated with the use of toxic chemicals during the vulcanization process. Sulfur, accelerators, and other chemical agents used in the vulcanization process can release harmful emissions and contribute to pollution if not managed properly. This has raised concerns within industries and governments, prompting stricter regulations and the development of more sustainable manufacturing practices.

For instance, the rubber industry in the European Union is heavily monitored, with strict guidelines on the usage of chemicals and waste management in rubber manufacturing. According to the European Commission’s 2020 report on industrial emissions, the rubber industry is one of the key sectors that need to adapt to the EU’s Circular Economy Action Plan, which aims to reduce the environmental impact of industrial processes.

One of the main challenges highlighted in the report is the high consumption of raw materials and energy, as well as the release of chemical by-products that can harm both workers and the environment. As of 2023, it was estimated that more than 60% of the rubber used in the EU was not recycled or reused, contributing to environmental concerns around rubber waste.

Additionally, the global push for sustainability has led to pressure on manufacturers to reduce their carbon footprints. The International Labour Organization (ILO) has emphasized the need for safer working environments in industries using hazardous chemicals, including rubber production.

As more countries implement regulations to minimize the use of harmful chemicals, the rubber vulcanization market faces increased pressure to find safer, more eco-friendly alternatives to traditional vulcanization methods.

Opportunity

Growing Demand for Eco-Friendly Rubber in the Automotive Sector

One of the major growth opportunities for the rubber vulcanization market lies in the increasing demand for eco-friendly and sustainable rubber products, particularly in the automotive sector. With growing awareness about climate change and the environmental impact of traditional manufacturing processes, there has been a shift toward more sustainable materials and production methods in the automotive industry.

This shift presents an opportunity for the rubber vulcanization market to adopt greener technologies, particularly through the use of bio-based rubbers and environmentally friendly curing agents.

According to a report from the European Tyre and Rubber Manufacturers’ Association (ETRMA), the demand for environmentally friendly tires has been growing rapidly. As electric vehicle (EV) adoption accelerates, so does the need for tires that are both durable and energy-efficient, pushing the demand for innovative vulcanization methods that reduce the carbon footprint.

Governments around the world are also supporting this transition through various initiatives. For example, the European Union’s Green Deal aims to make the continent carbon-neutral by 2050. The automotive sector is a significant focus of this plan, with regulations in place to push manufacturers to adopt more sustainable practices. This includes the use of eco-friendly tires and rubber components, which aligns with the growing need for greener vulcanization solutions.

Furthermore, initiatives like the U.S. Environmental Protection Agency’s (EPA) Clean Energy Program are providing financial incentives for companies to adopt greener production methods. As a result, there is a significant opportunity for manufacturers of rubber vulcanization products to innovate and offer more sustainable solutions, tapping into the growing demand for eco-friendly automotive components.

Trends

Increasing Adoption of Bio-Based and Recycled Materials in Rubber Vulcanization

A major trend shaping the rubber vulcanization market is the growing adoption of bio-based and recycled materials to replace traditional petroleum-based rubber. This shift is being driven by a global push towards sustainability, with industries aiming to reduce their carbon footprints and reliance on non-renewable resources. Bio-based rubbers, such as those derived from natural sources like dandelion and guayule plants, are gaining traction as alternatives to synthetic rubbers. These materials not only help in reducing environmental impact but also offer unique properties such as improved resilience and biodegradability.

According to a report from the European Tyre and Rubber Manufacturers’ Association (ETRMA), the European tire market alone saw a 15% increase in the use of sustainable materials in tire production from 2020 to 2023. This includes an increase in the incorporation of recycled rubber and bio-based alternatives. This shift is particularly prominent in the production of tires for electric vehicles (EVs), where lightweight and energy-efficient materials are in high demand. By 2025, it’s estimated that up to 30% of the materials used in tire manufacturing could be derived from sustainable sources.

Governments worldwide are also pushing for these changes through stricter regulations and incentives. In 2020, the U.S. Environmental Protection Agency (EPA) launched the Sustainable Materials Management Program, which encourages industries to adopt environmentally friendly production practices, including the use of recycled and bio-based materials. Similarly, the European Union’s Circular Economy Action Plan aims to promote the use of recycled materials in various industries, including rubber, with specific goals for increasing material recovery and recycling rates.

Regional Analysis

In 2024, the rubber vulcanization market is heavily influenced by regional dynamics, with the Asia Pacific (APAC) region emerging as the dominant player, capturing more than 53.2% of the global market share, valued at approximately $3.2 billion. This growth is largely driven by the region’s robust automotive, industrial, and consumer goods sectors. Countries like China, India, and Japan are key contributors, benefiting from rapid industrialization, significant automotive production, and a growing demand for durable rubber products. As the automotive industry in APAC continues to expand, particularly with the rise of electric vehicles (EVs), the need for high-performance rubber materials remains strong.

North America and Europe also hold notable shares of the rubber vulcanization market, though at a comparatively smaller scale. North America is expected to account for around 20% of the global market, driven by advancements in automotive technology and a focus on sustainable rubber solutions. The European market, with its stringent environmental regulations, is also witnessing a shift towards greener vulcanization techniques, which has spurred innovation in bio-based and recycled rubber materials. These regions are also home to a growing emphasis on high-quality rubber for industrial and healthcare applications.

The Middle East & Africa (MEA) and Latin America are relatively smaller markets but continue to show steady growth. In MEA, the demand for rubber products is linked to infrastructure development and the expansion of manufacturing sectors. Latin America, with its emerging automotive market, particularly in Brazil, is seeing gradual adoption of advanced rubber vulcanization processes. However, these regions’ shares remain limited compared to APAC’s dominant position in the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The rubber vulcanization market is highly competitive, with several key players shaping its growth and technological advancements. Arkema SA, BASF SE, and Eastman Chemical Company are among the leading companies, offering a wide range of innovative vulcanizing agents and accelerators to meet the growing demand for high-performance rubber.

Arkema, known for its expertise in specialty chemicals, provides sustainable and high-quality solutions, focusing on the development of eco-friendly vulcanization technologies. BASF SE, a global leader in chemicals, continues to innovate in the field with advanced rubber additives and environmentally friendly products aimed at improving the performance of rubber materials in automotive and industrial applications.

Other significant players like LANXESS, Sumitomo Chemical Co. Ltd., and Kumho Petrochemical are also key contributors, providing cutting-edge solutions for rubber vulcanization. LANXESS, with its strong portfolio of rubber chemicals, plays a crucial role in the automotive and tire industries, while Sumitomo Chemical focuses on developing high-performance rubber materials that meet the evolving demands for energy-efficient and durable products.

In addition, companies like Shandong Stair Chemical & Technology Co., Ltd., and Willing New Materials Technology Co. Ltd., based in China, are driving growth in the APAC region, where demand for rubber vulcanization is surging. These regional players are focusing on expanding production capabilities and providing cost-effective solutions to meet local market needs.

Top Key Players

- Arkema SA

- BASF SE

- Duslo, a.s.

- Eastman Chemical Company

- King Industries Inc.

- Kumho Petrochemical

- LANXESS

- Shandong Stair Chemical & Technology Co., Ltd

- Sumitomo Chemical Co. Ltd.

- Willing New Materials Technology Co. Ltd.

- Emerald Performance Materials

- Stair Chemical & Technology Co. Ltd.

Recent Developments

In 2024, Arkema’s AOS segment contributed significantly to its Specialty Materials division, with a reported revenue increase of 6% year-over-year.

In 2024, Duslo focused on expanding its Rubber vulcanization product range by enhancing production processes to meet the growing demand for biodegradable surfactants. The company has seen a steady increase in sales, with a reported 5% growth in its surfactant division in 2024.

Report Scope

Report Features Description Market Value (2024) USD 6.2 Bn Forecast Revenue (2034) USD 12.0 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Vulcanizing Agents, Accelerators, Activators), By Technique (Sulfur Vulcanization, Curing Techniques), By Application (Industrial, Consumer Goods, Automotive and Transportation, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema SA, BASF SE, Duslo, a.s., Eastman Chemical Company, King Industries Inc., Kumho Petrochemical, LANXESS, Shandong Stair Chemical & Technology Co., Ltd, Sumitomo Chemical Co. Ltd., Willing New Materials Technology Co. Ltd., Emerald Performance Materials, Stair Chemical & Technology Co. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Rubber Vulcanization MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Rubber Vulcanization MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arkema SA

- BASF SE

- Duslo, a.s.

- Eastman Chemical Company

- King Industries Inc.

- Kumho Petrochemical

- LANXESS

- Shandong Stair Chemical & Technology Co., Ltd

- Sumitomo Chemical Co. Ltd.

- Willing New Materials Technology Co. Ltd.

- Emerald Performance Materials

- Stair Chemical & Technology Co. Ltd.