Global Clean Label Mold Inhibitors Market Size, Share, And Business Benefits By Form (Powder, Liquid), By Ingredient (Starch, Vinegar, Fermented Flour, Whey, Others), By End-use (Food and Beverages, Animal Feed, Pharmaceuticals, Personal Care and Cosmetics, Others), By Distribution Channel (Direct Sales, Retail Sales, Online Sales, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140721

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

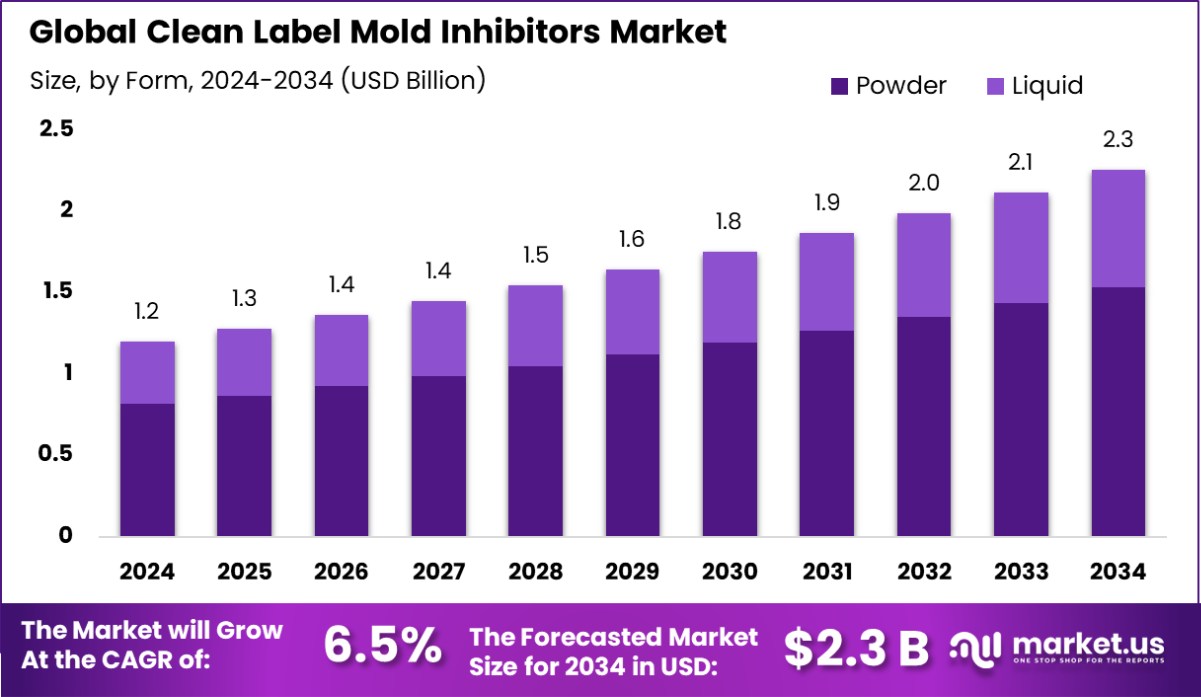

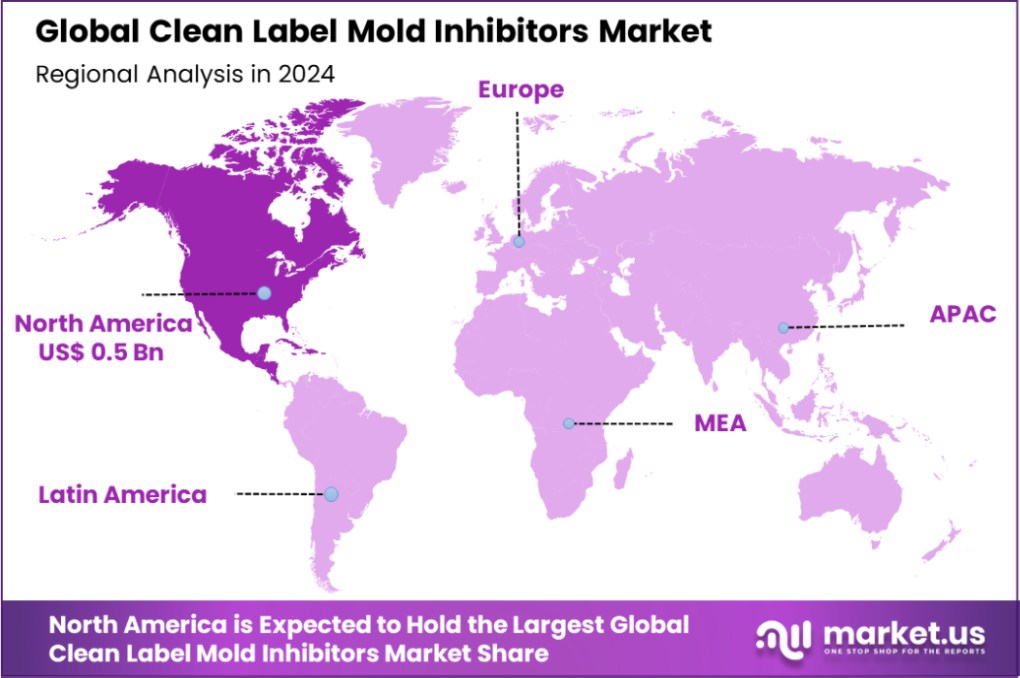

Global Clean Label Mold Inhibitors Market is expected to be worth around USD 2.3 Billion by 2034, up from USD 1.2 Billion in 2024, and grow at a CAGR of 6.5% from 2025 to 2034. North America leads the Clean Label Mold Inhibitors Market with 41.8%, valued at USD 0.5 billion.

Clean Label Mold Inhibitors refer to natural preservatives used in food and beverages to prevent mold growth, offering an alternative to synthetic additives. These mold inhibitors are made from ingredients that are perceived as more natural and healthier by consumers. Clean label products aim to have minimal and recognizable ingredients, making them a popular choice for those seeking transparency in food production.

These inhibitors are derived from natural sources like essential oils, vinegar, and other plant-based compounds, and are typically free from artificial preservatives or chemicals that could compromise the product’s integrity.

The Clean Label Mold Inhibitors Market is seeing robust growth, driven by increasing consumer demand for healthier, more natural food products. With rising awareness of the potential dangers posed by synthetic additives, consumers are actively seeking out clean label options, pushing manufacturers to innovate and include more natural mold inhibitors in their offerings. This trend is particularly noticeable in the bakery, dairy, and convenience food sectors, where mold growth is a significant concern.

Growth Factors for the market include an overall shift towards healthier, minimally processed foods. The increasing preference for transparency and clean ingredients is propelling demand for clean label mold inhibitors, further supported by regulatory pressures around synthetic additives. Additionally, consumer concerns about food safety and long shelf-life products continue to spur the use of natural preservatives.

Demand is primarily driven by the food industry’s effort to meet the growing consumer demand for clean label products. This is especially true in regions with a strong focus on health and wellness trends, such as North America and Europe. Manufacturers are keen on investing in clean label solutions to appeal to health-conscious consumers while maintaining product quality and shelf stability.

Opportunities in the market lie in the development of new, innovative clean label mold inhibitors derived from underexplored natural sources. Companies can focus on creating more effective and versatile mold inhibitors that can be used in a wider range of food products. Additionally, tapping into emerging markets where the demand for natural food products is rising presents a significant opportunity for market expansion.

Key Takeaways

- Global Clean Label Mold Inhibitors Market is expected to be worth around USD 2.3 Billion by 2034, up from USD 1.2 Billion in 2024, and grow at a CAGR of 6.5% from 2025 to 2034.

- Powdered clean label mold inhibitors dominate the market, holding a 67.4% share.

- Starch-based mold inhibitors account for 30.2% of the global market share.

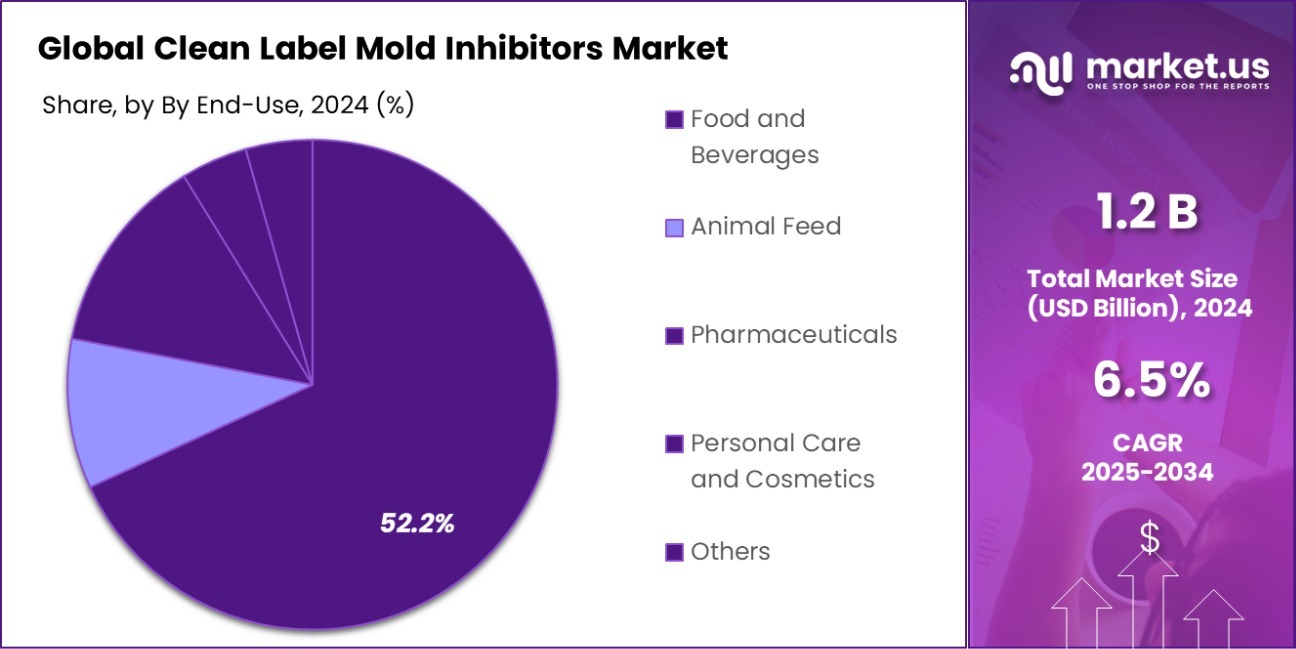

- Food and beverages make up 52.2% of clean label mold inhibitor usage.

- Direct sales channel represents 48.3% of clean label mold inhibitors’ market distribution.

- North America leads the Clean Label Mold Inhibitors Market with 41.8%, valued at USD 0.5 billion.

By Form Analysis

Powder-based clean label mold inhibitors dominate the market, accounting for 67.4% of market share.

In 2024, Powder held a dominant market position in the By Form segment of the Clean Label Mold Inhibitors Market, with a 67.4% share. This strong market presence can be attributed to the growing preference for powder-based mold inhibitors due to their ease of incorporation, long shelf life, and stability in various food products. The powder form allows for precise dosing, which ensures optimal effectiveness without compromising the clean label credentials that consumers increasingly demand.

Powdered mold inhibitors are often used in dry or powdered food products, bakery goods, and seasoning blends, where their functionality is preserved until the point of consumption. Their ability to extend the shelf life of products without the need for synthetic chemicals or additives aligns with the rising consumer trend toward natural and minimally processed ingredients. Additionally, powder forms are easier to store, transport, and handle, making them a practical solution for manufacturers.

The continued dominance of the powder form is supported by advancements in formulation technology, which have improved the stability and efficacy of powdered clean label mold inhibitors, further strengthening their market share. As the clean label movement grows, powdered mold inhibitors are expected to maintain their position as the preferred form, driven by their practical benefits and alignment with consumer demand for transparency and health-conscious food choices.

By Ingredient Analysis

Starch-based mold inhibitors lead in the market, contributing to 30.2% of the total share.

In 2024, Starch held a dominant market position in the By Ingredient segment of the Clean Label Mold Inhibitors Market, with a 30.2% share. This market leadership can be attributed to the natural, versatile, and widely accepted characteristics of starch as a clean label ingredient.

Starch is commonly used in food products due to its ability to form stable gels, improve texture, and enhance shelf life while maintaining a clean label status. As consumers increasingly demand transparency and natural ingredients, starch-based mold inhibitors meet these expectations by providing effective preservation without the use of synthetic additives.

The use of starch as a mold inhibitor is particularly prevalent in bakery products, snacks, and processed foods, where it functions not only to prevent mold growth but also to enhance the overall product quality. Its natural origin and widespread availability make it a cost-effective and reliable solution for manufacturers looking to appeal to health-conscious consumers.

Furthermore, starch-based mold inhibitors are effective across a variety of formulations, offering flexibility for manufacturers across different product categories. As clean label trends continue to shape the food industry, starch’s dominant position in this segment is likely to persist, with further innovations in starch-based mold inhibitor formulations enhancing its appeal and effectiveness in mold control.

By End-Use Analysis

The food and beverage industry is the largest consumer, utilizing 52.2% of clean label mold inhibitors.

In 2024, Food and Beverages held a dominant market position in the By End-Use segment of the Clean Label Mold Inhibitors Market, with a 52.2% share. This significant market share reflects the growing demand for clean label solutions in the food and beverage industry, driven by increasing consumer awareness about health, sustainability, and ingredient transparency.

Mold inhibitors play a crucial role in extending the shelf life of perishable food products while maintaining the integrity of clean label claims, which is particularly important for brands seeking to meet consumer expectations for natural and minimally processed ingredients.

Within the food and beverage sector, clean label mold inhibitors are commonly used in bakery products, dairy, beverages, and processed foods, where they help prevent mold growth without resorting to synthetic chemicals or artificial preservatives. The rising popularity of clean label foods—products that are free from artificial additives, preservatives, and chemicals—has boosted the demand for mold inhibitors that meet these criteria.

As consumer preferences continue to shift towards healthier and more natural food options, manufacturers in the food and beverage industry are increasingly prioritizing clean label certifications, ensuring that mold inhibitors align with the growing trend of natural, safe, and transparent ingredients. This trend is expected to drive continued growth in the segment, further solidifying its dominant position in the market.

By Distribution Channel Analysis

Direct sales dominate the distribution channel, representing 48.3% of clean label mold inhibitors market share.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel segment of the Clean Label Mold Inhibitors Market, with a 48.3% share. This strong market presence is largely driven by the growing preference for direct, personalized transactions between manufacturers and end-users.

Direct sales provide significant advantages, including greater control over pricing, customization, and customer relationships, all of which are highly valued in the clean label market where transparency and direct communication with consumers are key.

For manufacturers of clean label mold inhibitors, direct sales allow for a more tailored approach, facilitating better alignment with the specific needs of food and beverage producers. Furthermore, direct sales channels enable businesses to more effectively educate customers on the benefits of clean label ingredients and the importance of mold inhibitors in enhancing product shelf life while maintaining natural formulations.

Additionally, the growing trend towards e-commerce platforms and online direct sales has enhanced the accessibility and convenience of purchasing clean label mold inhibitors, further driving the segment’s dominance. With increasing demand for clean label solutions, manufacturers are likely to continue leveraging direct sales strategies to capture a larger share of the market, offering more personalized, direct access to their products while meeting consumer demand for transparency and natural food ingredients.

Key Market Segments

By Form

- Powder

- Liquid

By Ingredient

- Starch

- Vinegar

- Fermented Flour

- Whey

- Others

By End-use

- Food and Beverages

- Animal Feed

- Pharmaceuticals

- Personal Care and Cosmetics

- Others

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Sales

- Others

Driving Factors

Rising Consumer Demand for Natural Ingredients

One of the primary driving factors for the Clean Label Mold Inhibitors Market is the increasing consumer demand for natural and transparent ingredients. As consumers become more health-conscious, they are actively seeking foods that are free from artificial additives and preservatives. This growing preference for clean labels—products with minimal, recognizable ingredients—has prompted manufacturers to develop more natural alternatives for mold inhibition.

Natural mold inhibitors, derived from plant-based sources such as essential oils and vinegar, align with consumer desires for products that are not only healthier but also simpler and more transparent. As a result, the demand for clean label mold inhibitors is rapidly expanding, with manufacturers focusing on meeting these evolving consumer preferences to maintain competitiveness in the market.

Restraining Factors

Higher Cost of Natural Ingredients and Production

A significant restraining factor in the Clean Label Mold Inhibitors Market is the higher cost associated with natural ingredients and their production. Natural mold inhibitors, while preferred by consumers, often require more expensive raw materials and specialized processing methods compared to synthetic alternatives. This results in higher overall production costs for food manufacturers.

As a consequence, clean label products using natural mold inhibitors may be priced higher, making them less accessible to price-sensitive consumers. Additionally, these cost challenges can make it difficult for smaller manufacturers to compete with larger players who have more resources to absorb the premium prices. This cost barrier may limit the widespread adoption of clean label mold inhibitors, particularly in budget-conscious markets.

Growth Opportunity

Innovative Solutions from Underexplored Natural Sources

A significant growth opportunity in the Clean Label Mold Inhibitors Market lies in the exploration and development of innovative solutions from underutilized natural sources. As demand for clean label products increases, there is an opportunity for companies to discover new, effective, and cost-efficient natural mold inhibitors that can be used across a variety of food products.

These natural alternatives could include lesser-known plant extracts, essential oils, or fermentation-derived compounds. By investing in research and development, manufacturers can create more sustainable and versatile mold inhibitors that meet the growing consumer demand for transparency and health-conscious options. This not only offers a chance for differentiation in the market but also opens doors for innovation in clean-label preservation technologies, leading to long-term growth potential.

Latest Trends

Growing Popularity of Plant-Based Mold Inhibitors

One of the latest trends in the Clean Label Mold Inhibitors Market is the growing popularity of plant-based mold inhibitors. With the increasing shift towards vegan and plant-based diets, consumers are looking for natural, plant-derived solutions in their food products. Plant-based ingredients, such as rosemary extract, cinnamon oil, and clove oil, are gaining traction for their effectiveness in preventing mold growth while aligning with clean label standards.

This trend is especially notable in the bakery and dairy sectors, where mold preservation is a critical concern. Manufacturers are increasingly incorporating these plant-based mold inhibitors to meet consumer demand for clean, transparent, and ethical food options. As awareness of the benefits of plant-based ingredients rises, this trend is expected to continue influencing the market.

Regional Analysis

North America leads the Clean Label Mold Inhibitors Market with a 41.8% share, valued at USD 0.5 billion.

The Clean Label Mold Inhibitors Market is experiencing regional growth across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America dominates the market with a share of 41.8%, valued at USD 0.5 billion.

This growth is driven by rising consumer demand for natural, transparent ingredients in food products, along with increasing health consciousness. The region also benefits from stringent food safety regulations, pushing manufacturers to adopt clean label solutions.

In Europe, the market is driven by similar health trends and consumer preference for organic and clean-label products. Growing awareness around food transparency and sustainability is boosting demand for natural preservatives. While the Asia Pacific region is expected to witness significant growth due to expanding economies, changing dietary preferences, and increasing food safety awareness, the market is still emerging and less mature compared to North America and Europe.

The Middle East & Africa and Latin America markets are seeing slower adoption due to price sensitivity and limited awareness of clean label benefits. However, these regions are anticipated to show gradual growth as consumer preferences evolve. Overall, North America remains the leading market, with other regions following as emerging players in the clean label mold inhibitors space.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Clean Label Mold Inhibitors Market is experiencing significant expansion, driven by the increasing demand for natural, transparent food preservatives. Key players in the market, such as Ara Partners, Archer Daniels Midland Company, BASF SE, BioVeritas, and Cargill, are at the forefront of this growth. These companies are leveraging their established expertise in the food and ingredient sectors to offer innovative, plant-based, and natural mold inhibitors that align with consumer preferences for clean label solutions.

Corbion, E.I. DuPont De Nemours and Company, and Ingredion Incorporated are notable for their investment in research and development, introducing new, effective clean label preservatives sourced from nature. These companies are focusing on improving the efficacy and versatility of their products to cater to a wide range of food applications, from bakery to dairy and processed foods.

Smaller players like J&K Ingredients, Kemin Industries Inc., and Ribus, Inc. are capitalizing on niche opportunities, offering unique mold inhibitors derived from herbs, spices, and other plant-based extracts. These companies provide customized solutions for manufacturers seeking differentiated products to meet evolving consumer demands.

The Kerry Group plc, Koninklijke DSM N.V., and Lesaffre Corporation are expanding their clean label portfolios by acquiring emerging companies and technologies, thus enhancing their product offerings. In a market that increasingly values sustainability, these players are also focusing on environmentally friendly production methods to ensure their clean label mold inhibitors align with both health and ethical considerations.

Top Key Players in the Market

- Ara Partners

- Archer Daniels Midland Company

- BASF SE

- BioVeritas

- Cargill

- Corbion

- E.I. DuPont De Nemours and Company

- Ingredion Incorporated

- J&K Ingredients

- Kemin Industries Inc.

- Kerry Group plc

- Koninklijke DSM N.V.,

- Lesaffre Corporation

- Puratos Group

- Ribus, Inc.

- Tate and Lyle PLCare

Recent Developments

- In February 2024, Ingredion Incorporated introduced NOVATION® Indulge 2940, a non-GMO functional native corn starch that provides a unique gelling texture for dairy and alternative dairy products. This clean label ingredient meets consumer demands for natural and recognizable ingredients

- In 2024, BioVeritas LLC introduced a new clean-label mold inhibitor, developed through the upcycling and fermentation of excess biomass. This innovative product not only offers enhanced cost efficiency but also significantly reduces the carbon footprint when compared to traditional petrochemical-based preservatives, aligning with growing consumer demand for sustainable and environmentally friendly ingredients.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid), By Ingredient (Starch, Vinegar, Fermented Flour, Whey, Others), By End-use (Food and Beverages, Animal Feed, Pharmaceuticals, Personal Care and Cosmetics, Others), By Distribution Channel (Direct Sales, Retail Sales, Online Sales, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ara Partners, Archer Daniels Midland Company, BASF SE, BioVeritas, Cargill, Corbion, E.I. DuPont De Nemours and Company, Ingredion Incorporated, J&K Ingredients, Kemin Industries Inc., Kerry Group plc, Koninklijke DSM N.V.,, Lesaffre Corporation, Puratos Group, Ribus, Inc., Tate and Lyle PLCare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clean Label Mold Inhibitors MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Clean Label Mold Inhibitors MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ara Partners

- Archer Daniels Midland Company

- BASF SE

- BioVeritas

- Cargill

- Corbion

- E.I. DuPont De Nemours and Company

- Ingredion Incorporated

- J&K Ingredients

- Kemin Industries Inc.

- Kerry Group plc

- Koninklijke DSM N.V.,

- Lesaffre Corporation

- Puratos Group

- Ribus, Inc.

- Tate and Lyle PLCare