Global Geothermal Power Market By Power Station (Dry Steam Power Stations, Flash Steam Power Stations, Binary Cycle Power Stations), By Power (Upto 5MW, Above 5 MW), By Temperature Type (Low Temperature (Up to 900C), Medium Temperature (900C – 1500C), High Temperature (Above 1500C)), By End-Use (Industrial, Residential, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150112

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

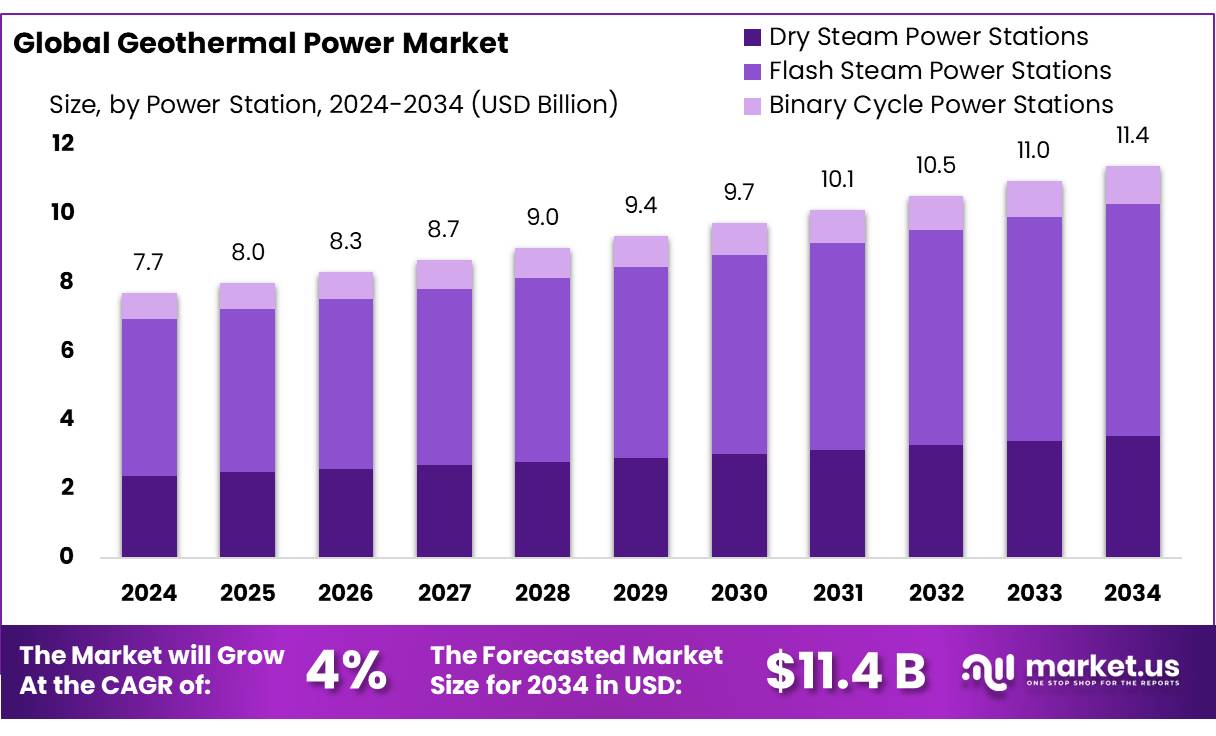

The Global Geothermal Power Market size is expected to be worth around USD 11.4 Billion by 2034, from USD 7.7 Billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034.

The integration of geothermal energy into the processing of cellulose concentrates marks a transformative step in the advancement of sustainable industrial practices. By utilizing geothermal energy’s steady and renewable thermal output, industries involved in the production of food ingredients, pharmaceutical excipients, and advanced biomaterials are achieving greater efficiency in key processes such as hydrolysis, drying, and purification. This synergy not only reduces the dependency on conventional fossil fuels but also enhances process stability and long-term operational sustainability.

Geothermal energy stands out for its low carbon emissions and high availability, making it an ideal energy source for industrial applications requiring continuous heat. In a strategic move to expand its geothermal capabilities, the U.S. Department of Energy launched a $30 million program aimed at unlocking superhot geothermal resources, targeting reliable baseload power generation. Complementing this initiative, the Bureau of Land Management has sanctioned the Fervo Cape Geothermal Power Project in Utah, which is projected to generate up to 2 gigawatts—sufficient to power more than 2 million homes.

When applied to cellulose concentrate production, geothermal systems offer a highly sustainable and cost-effective thermal energy supply. Globally, direct use of geothermal energy displaces approximately 250 million tons of CO₂ annually, supported by an energy output nearing 1 million terajoules per year, according to data from the International Renewable Energy Agency (IRENA).

At the policy level, the U.S. Department of Energy’s Geothermal Technologies Office (GTO) continues to advance research in enhanced geothermal systems and industrial-scale applications. Under the Biden-Harris administration, 14 geothermal projects have been approved on public lands, contributing to nearly 32 gigawatts of clean energy capacity—a strong signal of governmental commitment to expanding the role of geothermal in industrial decarbonization.

Key Takeaways

- Geothermal Power Market size is expected to be worth around USD 11.4 Billion by 2034, from USD 7.7 Billion in 2024, growing at a CAGR of 4.0%.

- Flash Steam Power Stations held a dominant market position, capturing more than a 59.4% share of the global geothermal power market.

- Upto 5MW held a dominant market position, capturing more than an 87.6% share of the global geothermal power market.

- High Temperature (Above 150°C) held a dominant market position, capturing more than a 74.5% share of the global geothermal power market.

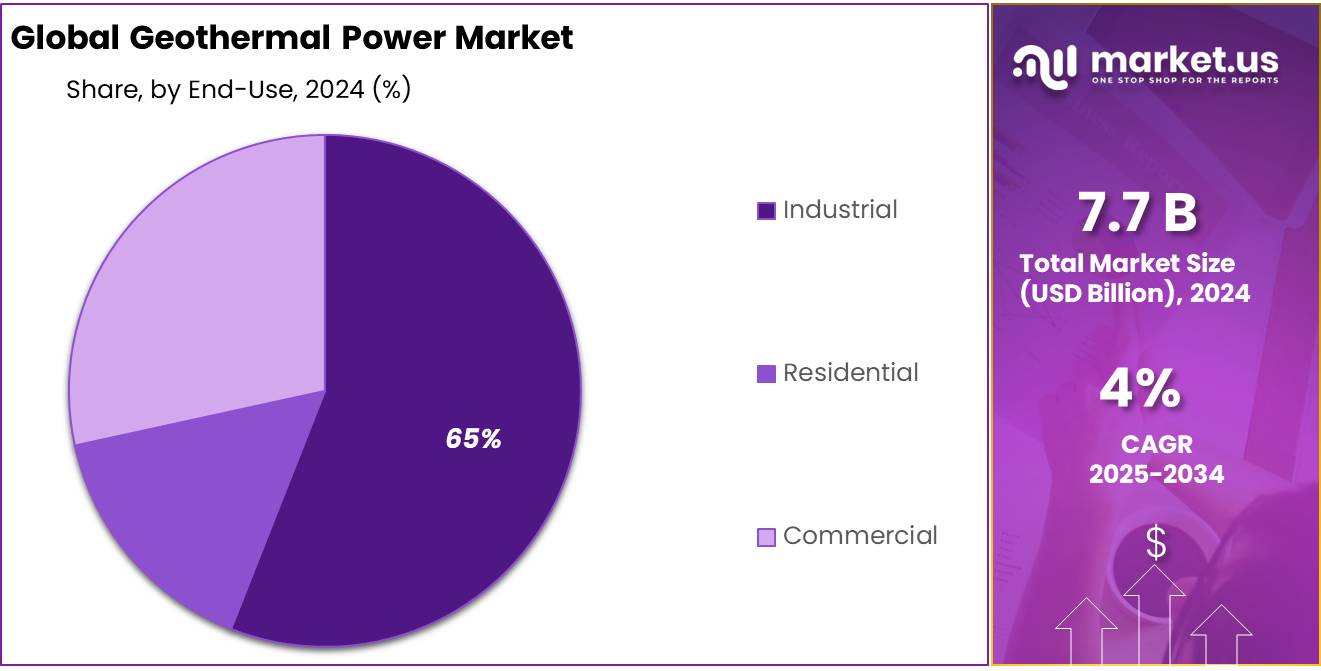

- Industrial held a dominant market position, capturing more than a 65.9% share of the global geothermal power market.

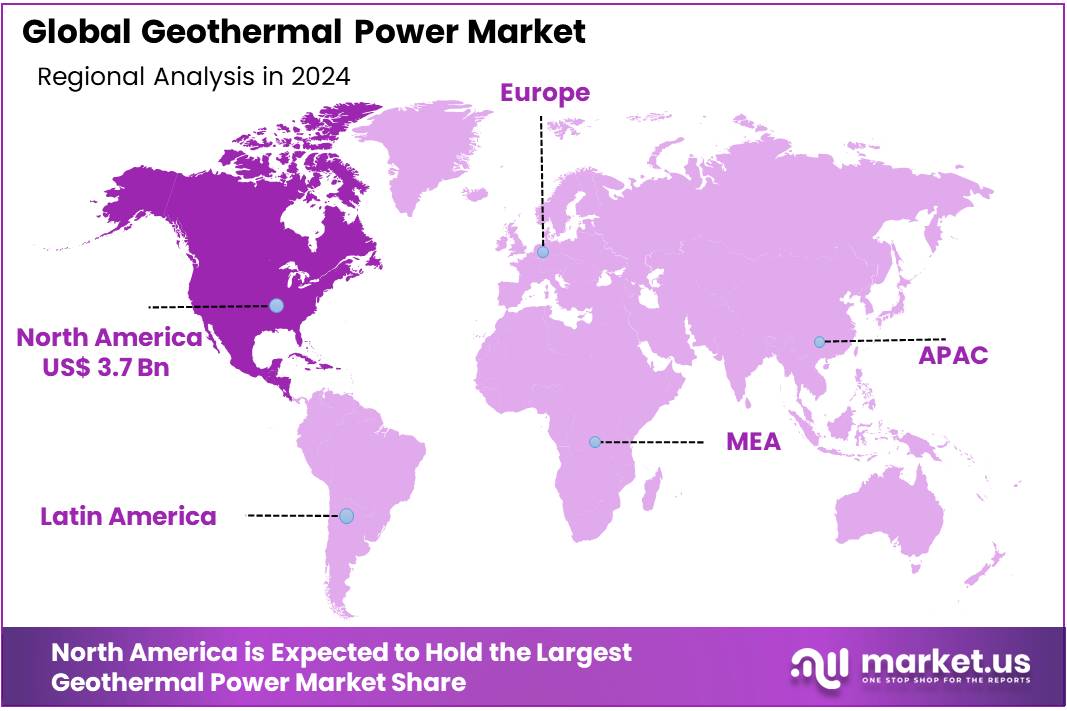

- North America emerged as the leading region in the global geothermal power market, capturing a substantial 48.6% share, equivalent to USD 3.7 billion.

By Power Station

Flash Steam Power Stations dominate with 59.4% in 2024 due to high energy efficiency and wide deployment in geothermal-rich regions.

In 2024, Flash Steam Power Stations held a dominant market position, capturing more than a 59.4% share of the global geothermal power market. This significant share can be linked to the technology’s proven efficiency in harnessing high-temperature geothermal resources, particularly in regions like the United States, Indonesia, and the Philippines where geothermal reservoirs exceed 180°C. Flash steam systems are preferred for large-scale geothermal electricity generation as they offer better energy conversion efficiency compared to dry steam or binary cycle systems.

The technology works by separating steam from hot water under high pressure and then flashing it to produce usable steam to drive turbines, making it highly effective in mature geothermal fields. The strong presence of flash steam installations in North America and Southeast Asia continues to anchor their market lead. This technology is expected to maintain its leadership into 2025, supported by both government-backed renewable energy targets and steady advancements in geothermal drilling methods.

By Power

Upto 5MW leads the market with 87.6% share in 2024, driven by rising adoption of small-scale geothermal systems.

In 2024, Upto 5MW held a dominant market position, capturing more than an 87.6% share of the global geothermal power market by capacity segment. This remarkable dominance is largely due to the increasing use of small-scale geothermal plants for decentralized power generation, especially in remote and rural areas. These compact systems are cost-effective, easier to deploy, and require less infrastructure compared to larger installations, making them ideal for local grids and off-grid applications.

Countries with limited access to large power stations, such as Kenya, Turkey, and parts of Southeast Asia, are actively turning to sub-5MW geothermal units to meet local electricity needs sustainably. Additionally, government incentives and policy frameworks in developing nations have encouraged community-level renewable projects, further boosting the demand for this capacity range. The strong performance of this segment is expected to continue into 2025 as clean energy access and rural electrification remain high on the global energy agenda.

By Temperature Type

High Temperature (Above 150°C) leads with 74.5% share in 2024, fueled by its suitability for large-scale electricity generation.

In 2024, High Temperature (Above 150°C) held a dominant market position, capturing more than a 74.5% share of the global geothermal power market by temperature type. This strong lead is attributed to the efficiency and energy yield of high-temperature geothermal reservoirs, which are essential for flash steam and dry steam power generation. These systems are most effective when tapping into geothermal resources with temperatures above 150°C, commonly found in volcanic regions such as the Ring of Fire.

Countries like the United States, Indonesia, and Mexico heavily rely on these high-temperature zones to produce bulk geothermal electricity. The high energy conversion efficiency and ability to support utility-scale plants make this segment highly attractive for both public and private energy projects. In 2025, this trend is expected to continue, supported by expanding exploration activities and improved drilling technologies targeting deep, high-heat geothermal fields.

By End-Use

Industrial sector dominates with 65.9% share in 2024, driven by high energy demand and continuous operations.

In 2024, Industrial held a dominant market position, capturing more than a 65.9% share of the global geothermal power market by end-use. This dominance is mainly due to the sector’s constant need for reliable and cost-effective power to support round-the-clock operations. Industries such as mining, food processing, and manufacturing benefit from geothermal energy’s stable output, especially in areas with rich geothermal resources.

The use of geothermal heat for drying, chemical processing, and steam generation has become increasingly popular as companies look for ways to reduce their carbon emissions and energy costs. In countries like Iceland and the Philippines, geothermal power plays a direct role in powering industrial clusters, offering both electricity and direct heat. By 2025, the demand from the industrial sector is expected to grow further, backed by environmental regulations and the push toward energy transition in heavy industries.

Key Market Segments

By Power Station

- Dry Steam Power Stations

- Flash Steam Power Stations

- Binary Cycle Power Stations

By Power

- Upto 5MW

- Above 5 MW

By Temperature Type

- Low Temperature (Up to 900C)

- Medium Temperature (900C – 1500C)

- High Temperature (Above 1500C)

By End-Use

- Industrial

- Residential

- Commercial

Drivers

Adoption of Geothermal Energy in the Food and Agriculture Sector

The increasing integration of geothermal energy within the food and agriculture sector stands out as a pivotal driver for the global geothermal power market. This trend is propelled by the sector’s substantial energy demands and the pressing need for sustainable, cost-effective energy solutions.

Globally, the food and agriculture industry is a significant energy consumer, accounting for approximately 30% of the world’s total energy consumption and contributing to 20% of global greenhouse gas emissions. Projections by the Food and Agriculture Organization (FAO) indicate that food production must increase by up to 70% by 2050 to meet the demands of a growing population. This anticipated surge underscores the urgency for sustainable energy alternatives in the sector.

Geothermal energy offers a renewable and reliable solution to meet these energy needs. Its applications in the agri-food sector are diverse, encompassing greenhouse heating, aquaculture, soil warming, irrigation, food drying, pasteurization, and sterilization. These processes typically require temperatures ranging from 25°C to over 120°C, which geothermal sources can efficiently provide.

The adoption of geothermal energy in agriculture is not just theoretical but is being actively pursued in various regions. For instance, in Turkey, as of 2022, there are 5,400 decares of geothermally heated greenhouses, with potential expansion to 30,000 decares. These facilities have demonstrated payback periods ranging from 4 to 7 years, highlighting the economic viability of geothermal applications in agriculture.

Government initiatives further bolster this trend. In the United States, the Department of Agriculture and the Department of Energy launched the Rural and Agricultural Income & Savings from Renewable Energy (RAISE) initiative in 2024. This program aims to assist farmers in reducing costs and increasing income through the adoption of underutilized renewable technologies, including geothermal energy. The initiative is part of a broader effort to promote sustainable energy practices in rural communities.

Restraints

High Upfront Costs and Exploration Risks in Geothermal Energy Development

One of the significant challenges hindering the widespread adoption of geothermal energy is the high initial investment required for exploration and drilling. Unlike other renewable energy sources, geothermal projects necessitate substantial capital before confirming the viability of a site. Drilling a standard geothermal well can cost approximately $10 million, with a failure rate of about 20%, leading to an average cost of $50 million for a successful well.

The complexity of geothermal exploration adds to the financial risk. Geothermal reservoirs are often located in hard-to-penetrate igneous or metamorphic rocks, requiring advanced drilling technologies. The unpredictable nature of subsurface geology means that even with significant investment, there’s no guarantee of finding a viable heat source. This uncertainty makes it challenging to attract private investors, especially in developing countries where financial resources are limited.

Government initiatives have been introduced to mitigate these challenges. For instance, the U.S. Department of Energy has implemented emergency permitting procedures to expedite geothermal projects, aiming to reduce the time and cost associated with regulatory approvals. Similarly, in Turkey, the World Bank provided a $300 million loan to support geothermal energy development, recognizing the high upfront costs as a barrier to entry.

Despite these efforts, the high capital requirements and associated risks continue to be a significant deterrent. To overcome these barriers, increased government support, risk mitigation strategies, and technological advancements in drilling and exploration are essential. By addressing these challenges, geothermal energy can become a more accessible and reliable component of the global renewable energy portfolio.

Opportunity

Expanding Geothermal Energy Use in Agriculture and Food Processing

The integration of geothermal energy into agriculture and food processing presents a significant growth opportunity for the geothermal power market. This renewable energy source offers a reliable and sustainable solution for various agricultural applications, including greenhouse heating, aquaculture, crop drying, and soil warming.

Globally, the use of geothermal energy in agriculture has been steadily increasing. For instance, the area of geothermally heated greenhouses expanded by over 60% between 2000 and 2020, reflecting the growing adoption of this technology in the agri-food sector. This expansion is driven by the need for energy-efficient and environmentally friendly solutions in food production.

In Turkey, as of 2022, there are 5,400 decares of geothermally heated greenhouses, with potential expansion to 30,000 decares. These facilities have demonstrated payback periods ranging from 4 to 7 years, highlighting the economic viability of geothermal applications in agriculture.

Government initiatives further support this growth. In the United States, the Department of Agriculture and the Department of Energy launched the Rural and Agricultural Income & Savings from Renewable Energy (RAISE) initiative in 2024. This program aims to assist farmers in reducing costs and increasing income through the adoption of underutilized renewable technologies, including geothermal energy.

Trends

Integration of Geothermal Energy in Food Processing and Agriculture

A significant trend shaping the geothermal power market is its increasing adoption in the food processing and agriculture sectors. As the global demand for sustainable and energy-efficient solutions rises, geothermal energy offers a reliable and eco-friendly alternative for various applications in these industries.

In food processing, geothermal energy is utilized for drying, pasteurization, and sterilization processes. These applications benefit from the consistent and controllable heat supply that geothermal systems provide, leading to improved product quality and reduced energy costs. For instance, geothermal heat can be effectively used in drying operations, which are essential for preserving fruits, vegetables, and other food products. This not only enhances shelf life but also maintains nutritional value.

The integration of geothermal energy in these sectors aligns with global efforts to reduce greenhouse gas emissions and promote renewable energy sources. By replacing conventional fossil fuels with geothermal systems, the food processing and agriculture industries can significantly lower their carbon footprints. Moreover, the operational cost savings achieved through reduced energy consumption contribute to the economic viability of these applications.

Government initiatives and policies are also playing a pivotal role in encouraging the adoption of geothermal energy in these sectors. Supportive measures, such as subsidies and tax incentives, are being implemented to facilitate the transition towards renewable energy sources. These efforts not only promote environmental sustainability but also enhance energy security and resilience in the food supply chain.

Regional Analysis

North America Leads Geothermal Power Market with 48.6% Share, Valued at USD 3.7 Billion in 2024

In 2024, North America emerged as the leading region in the global geothermal power market, capturing a substantial 48.6% share, equivalent to USD 3.7 billion. This dominance is primarily attributed to the United States, which boasts an installed geothermal capacity of approximately 3,937 MW, maintaining its position as the world’s largest producer of geothermal energy. California plays a pivotal role, housing The Geysers—the world’s largest geothermal field—with an operational capacity of 1,590 MW, contributing significantly to the state’s renewable energy portfolio.

The region’s growth is further bolstered by technological advancements and supportive government policies. Innovations in enhanced geothermal systems (EGS) and horizontal drilling techniques have improved the efficiency and feasibility of geothermal projects. Notably, Fervo Energy’s successful demonstration of a 3.5 MW EGS plant in Nevada showcases the potential of these technologies to expand geothermal capacity. Additionally, federal and state incentives, including tax credits and research grants, have played a crucial role in attracting investments and accelerating project development across the United States and Canada.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB plays a significant role in the geothermal power market by providing advanced electrical and automation solutions for geothermal plants. The company’s expertise in grid integration, switchgear systems, and digital monitoring helps enhance efficiency and stability in power generation. ABB supports geothermal operations in countries such as the U.S. and Indonesia, where demand for reliable, renewable electricity is growing. Its scalable and modular technologies are designed to optimize operational costs while maintaining consistent power output in high-temperature environments.

Ansaldo Energia is actively involved in supplying steam turbines and power plant solutions tailored for geothermal energy projects. The company has delivered systems for geothermal power stations in Italy and Southeast Asia, contributing to clean energy targets. Ansaldo’s high-efficiency turbine systems are designed to withstand corrosive geothermal conditions, offering long-term performance with reduced maintenance. The firm also participates in geothermal R&D, advancing next-generation thermal cycle technologies and collaborating with local utilities on plant upgrades and retrofits.

Atlas Copco Group contributes to the geothermal sector through its specialized drilling equipment, compressors, and power tools. Its rigs and accessories are widely used in deep well drilling, a critical phase in geothermal exploration. Known for durability and energy efficiency, Atlas Copco’s technologies help reduce environmental impact while enhancing operational precision. The company’s equipment is present in various geothermal-rich regions, including East Africa and Central America, supporting both exploratory and commercial-scale geothermal projects.

Top Key Players in the Market

- ABB

- Ansaldo Energia

- Atlas Copco Group

- Calpine

- EDF

- Enel SPA (Enel)

- EthosEnergy

- Exergy

- GEG Power

- General Electric (GE)

- Mitsubishi Hitachi Power Systems Inc.

- Ormat Technologies Inc.

- Siemens AG

- TAS Energy

- The Tata Power Company Limited

- Toshiba Corporation

Recent Developments

In 2024, Calpine Corporation reinforced its position as the leading geothermal energy producer in the United States, primarily through its operations at The Geysers in Northern California. Operating 13 geothermal power plants, Calpine maintained a steady capacity of 725 megawatts (MW), supplying clean electricity to approximately 725,000 homes.

In 2024, Atlas Copco made significant strides in the geothermal power sector by introducing advanced drilling technologies tailored for sustainable energy projects. A notable innovation was the launch of the X-Air⁺ 750-25 portable compressor, designed to enhance medium-depth geothermal drilling efficiency.

Report Scope

Report Features Description Market Value (2024) USD 7.7 Bn Forecast Revenue (2034) USD 11.4 Bn CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Station (Dry Steam Power Stations, Flash Steam Power Stations, Binary Cycle Power Stations), By Power (Upto 5MW, Above 5 MW), By Temperature Type (Low Temperature (Up to 900C), Medium Temperature (900C – 1500C), High Temperature (Above 1500C)), By End-Use (Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Ansaldo Energia, Atlas Copco Group, Calpine, EDF, Enel SPA (Enel), EthosEnergy, Exergy, GEG Power, General Electric (GE), Mitsubishi Hitachi Power Systems Inc., Ormat Technologies Inc., Siemens AG, TAS Energy, The Tata Power Company Limited, Toshiba Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB

- Ansaldo Energia

- Atlas Copco Group

- Calpine

- EDF

- Enel SPA (Enel)

- EthosEnergy

- Exergy

- GEG Power

- General Electric (GE)

- Mitsubishi Hitachi Power Systems Inc.

- Ormat Technologies Inc.

- Siemens AG

- TAS Energy

- The Tata Power Company Limited

- Toshiba Corporation