Global Enhanced Oil Recovery (EOR) Market Size, Share Analysis Report By Technology (Thermal EOR, Chemical EOR, Gas EOR, Others), By Application (Onshore, Offshore) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164466

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

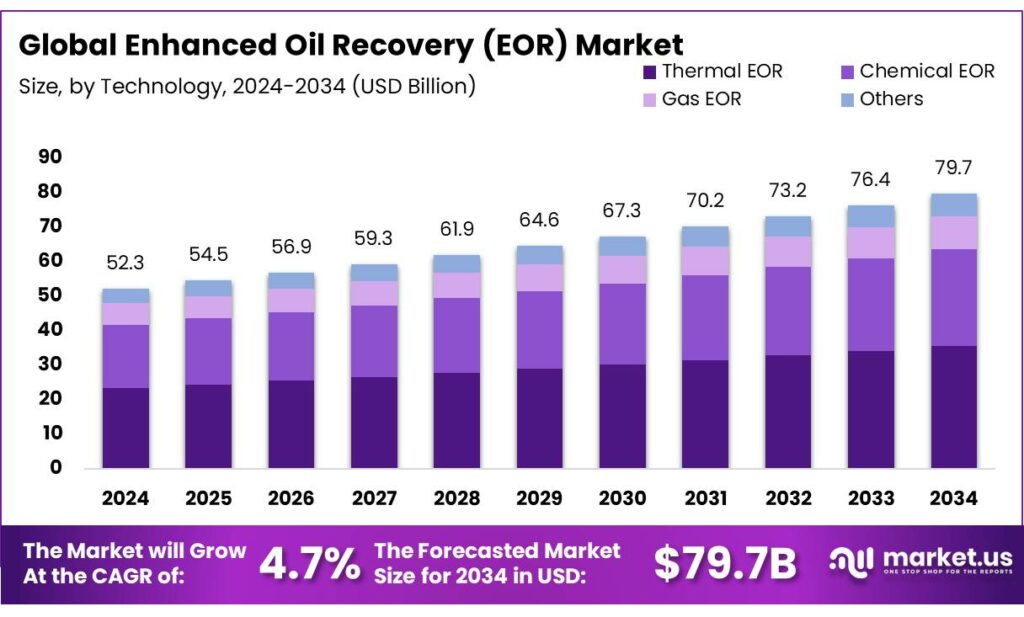

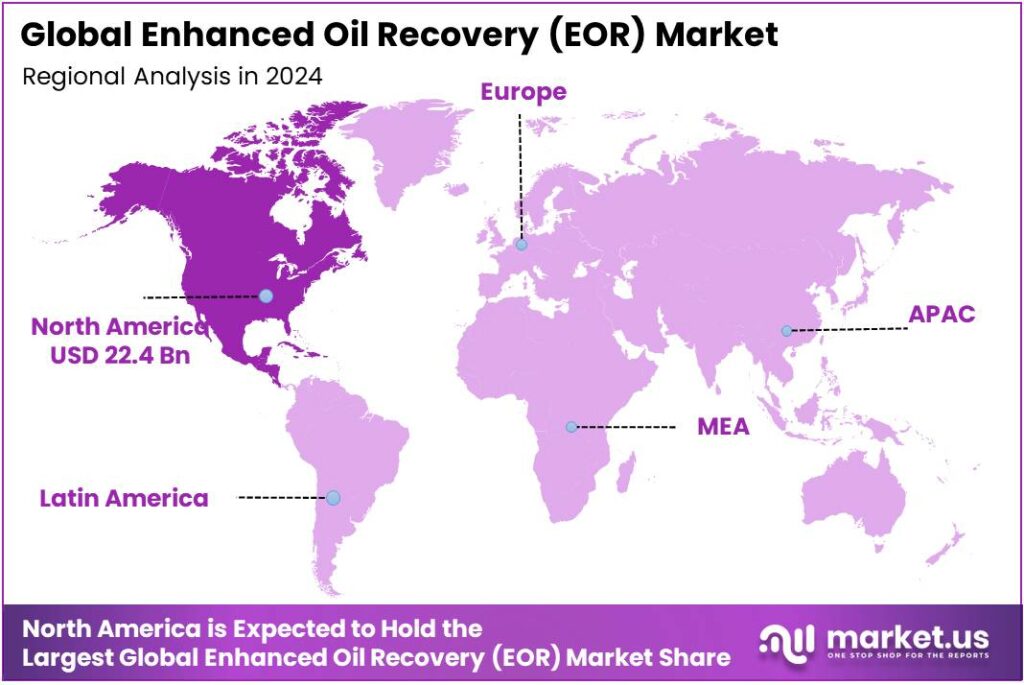

The Global Enhanced Oil Recovery (EOR) Market size is expected to be worth around USD 79.7 Billion by 2034, from USD 52.3 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.9% share, holding USD 22.4 Billion in revenue.

Enhanced oil recovery (EOR) remains a strategic lever for extracting additional crude from mature fields while linking upstream operations to carbon-management goals. In the United States, CO₂-EOR alone produced an estimated 310,000–320,000 barrels per day in 2023, underscoring its material role in domestic supply even as base production hit record levels. For context, total U.S. crude output averaged 13.2 million b/d in 2024, a 2% rise year over year, driven mainly by the Permian—demonstrating how EOR barrels complement unconventional growth and help stabilize legacy assets.

The current industrial scenario is shaped by two converging forces: energy security and decarbonization. On one hand, operators seek low-cost barrels from existing reservoirs; on the other, policymakers are expanding carbon capture, utilization and storage (CCUS) to curb emissions. The IEA tracks 700+ CCUS projects in development across the value chain and notes that announced capture capacity for 2030 rose 35% in 2023, with announced storage capacity up 70%—momentum that includes CO₂-EOR storage pathways. Meanwhile, global energy-related CO₂ emissions rose 0.8% in 2024 to 37.8 Gt, keeping pressure on governments and industry to scale capture and secure durable storage.

- Policy signals are increasingly tangible for EOR-linked carbon management. In April 2024, the U.S. Department of Energy’s Office of Fossil Energy and Carbon Management selected $23.2 million in projects to evaluate CO₂-EOR in unconventional reservoirs—explicitly aiming to pair captured CO₂ with incremental oil recovery. In August 2024, DOE announced up to $54.4 million in additional carbon-management funding, broadening the pipeline of capture and storage demonstrations.

Key driving factors include the economics of brownfield barrels and infrastructure readiness. The NETL highlights that U.S. CO₂-EOR production has surpassed 300,000 b/d, and screening studies indicate very large remaining potential in suitable reservoirs—figures that help justify continued investment in CO₂ supply, pipelines and injection facilities. At the same time, the EIA confirms structurally high U.S. production levels, enabling midstream build-outs and cost-sharing for CO₂ networks that EOR projects require.

Policy is a critical catalyst. In the U.S., Section 45Q tax credits under the Inflation Reduction Act provide up to $85/tCO₂ for geologic storage and $60/tCO₂ for CO₂ used in EOR at projects meeting wage and apprenticeship rules (12-year credit period), directly strengthening CO₂ supply economics and EOR project bankability. In the UK, government has committed up to £20 billion to establish a CCUS sector, backing Track-1 clusters and a roadmap that scales capture, transport and storage by 2030—foundational infrastructure that can support CO₂-EOR where appropriate in the North Sea.

Key Takeaways

- Enhanced Oil Recovery (EOR) Market size is expected to be worth around USD 79.7 Billion by 2034, from USD 52.3 Billion in 2024, growing at a CAGR of 4.7%

- Thermal EOR held a dominant market position, capturing more than a 44.8% share of the overall Enhanced Oil Recovery (EOR) market.

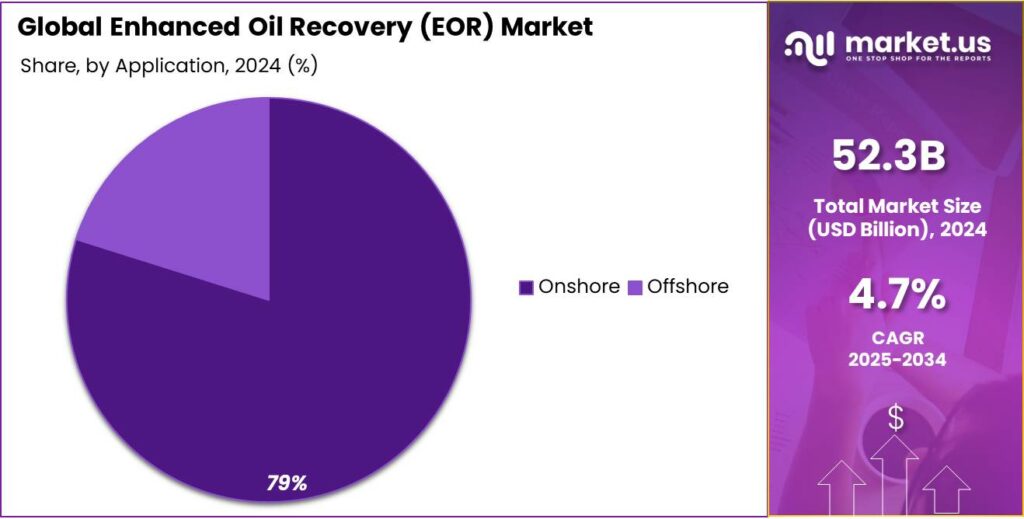

- Onshore held a dominant market position, capturing more than a 79.3% share of the Enhanced Oil Recovery (EOR) market.

- North America is projected to dominate the Enhanced Oil Recovery (EOR) market, accounting for 42.90% of the global market share, valued at approximately USD 22.4 billion.

By Technology Analysis

Thermal EOR Dominates with 44.8% Share in 2024

In 2024, Thermal EOR held a dominant market position, capturing more than a 44.8% share of the overall Enhanced Oil Recovery (EOR) market. This technique involves injecting heat into the reservoir, typically through steam injection, to reduce the viscosity of heavy crude oil and improve its flow to the surface. Thermal EOR is widely used in oil fields with heavy or extra-heavy crude, which are difficult to extract using traditional methods. The increasing demand for energy, combined with the need to optimize production from mature fields, has contributed significantly to the adoption of this method.

The thermal EOR market has been steadily growing, with a projected increase in adoption through 2025. Oil-producing regions such as North America and the Middle East are leading the way, with companies in these areas continuing to focus on maximizing output from existing reserves. The U.S., particularly, has seen strong growth in thermal EOR activities, driven by its established oil fields and rising production costs. As oil prices remain relatively high, investments in thermal EOR technologies have continued to rise, further supporting the market’s dominance.

By Application Analysis

Onshore EOR Dominates with 79.3% Share in 2024

In 2024, Onshore held a dominant market position, capturing more than a 79.3% share of the Enhanced Oil Recovery (EOR) market. Onshore EOR applications are particularly significant as most oil reserves are located on land, and the technology has proven effective in enhancing oil extraction from mature and declining reservoirs. Onshore fields typically present lower capital expenditure requirements compared to offshore fields, making them more economically viable for EOR operations, especially in regions with large, established oil reserves like North America, the Middle East, and parts of Asia.

Onshore oil fields, which account for a large portion of global production, have increasingly adopted EOR techniques such as CO2 injection, thermal recovery, and chemical injection to maintain or boost output. This demand is fueled by the need to sustain production from mature fields and extend their operational life. In 2025, the share of onshore applications is expected to remain strong, with companies continuing to focus on enhancing the recovery factor from existing onshore fields due to their established infrastructure and lower operational costs.

Key Market Segments

By Technology

- Thermal EOR

- Steam

- In-situ Combustion

- Others

- Chemical EOR

- Polymer

- Surfactant

- Alkaline Chemical

- Polymer

- Foamers

- Others

- Gas EOR

- CO2

- Others

- Others

By Application

- Onshore

- Offshore

Emerging Trends

EOR Converges With CCUS Hubs and Rules

The clearest recent trend is EOR folding into carbon-management systems—captured CO₂ from industrial sites and power plants is increasingly piped to mature fields, turning EOR into both a production and storage pathway. The International Energy Agency (IEA) counts just over 50 Mt/yr of capture-and-storage capacity operating as of early 2025, with the announced project pipeline implying about ~430 Mt/yr by 2030—a scale jump that materially enlarges the pool of CO₂ available for EOR floods.

Policy design is actively knitting EOR into that hub-and-spoke system. In the United States, the IRS updated procedures in 2024 (Notice 2024-60) for claiming Section 45Q credits, including schedules and certifications tied to disposal and EOR, clarifying how projects document secure geological storage and lifecycle claims—important mechanics for bankable CO₂-EOR deals.

- In January 2025, U.S. pipeline regulators (PHMSA/USDOT) issued a Notice of Proposed Rulemaking that would impose enhanced design, operation, maintenance and emergency-response requirements on CO₂ pipelines. This matters because the U.S. has only ~5,000+ miles of CO₂ pipelines today, mostly serving legacy EOR basins; clearer rules should support prudent expansion as new capture hubs seek reliable offtake into storage and EOR.

The U.S. Department of Energy notes that tertiary methods can raise ultimate recovery from roughly 20–40% to 30–60% of original oil in place—still the fundamental draw for late-life fields. Coupled with hub CO₂ supply and policy incentives, operators can plan multi-year floods with lower volatility in both molecules and margins, aligning production with emissions-management goals.

In practice, this trend creates a two-value stream: barrels from incremental recovery and tonnes from verifiable storage. IEA’s database update—700+ CCUS projects across the chain and sharp increases in announced capture (+35%) and storage capacity (+70%) for 2030—signals that many more emitters will be looking for dependable sinks; properly screened EOR fields can be those sinks when storage integrity is demonstrated.

Drivers

Oil Price Economics and Incremental Barrel Value

One of the most compelling reasons why companies invest in enhanced oil recovery (EOR) is the potential to produce incremental barrels at a cost that becomes economically attractive when oil prices rise. In plain terms, when the price of crude is high enough, the added cost of injecting technologies like CO₂, steam, or chemicals into older fields becomes justified by the extra oil produced.

- According to the U.S. Energy Information Administration (EIA), the injection of CO₂ into older reservoirs adds US $20–30 per barrel of oil produced, due to costs associated with the CO₂ itself and the surface facilities needed for compression and injection.

When crude oil prices are high, more mature fields become viable candidates for EOR. The EIA projected that under a “High Oil Price” scenario (with West Texas Intermediate crude rising to US $202 per barrel in 2012 dollars by 2040), CO₂-EOR production could reach 960,000 barrels per day, about 30% more than the reference projection of 740,000 barrels per day.

This dynamic makes such recovery a financially savvy path: many mature fields face higher marginal operating costs and falling production volumes, so applying EOR gives operators a way to extend field life by producing barrels at a lower incremental cost than new exploration and development. A report from the U.S. Department of Energy (DOE) explains that EOR techniques “offer prospects for ultimately producing 30–60% or more of the reservoir’s original oil in place (OOIP)”—compared to only 20–40% under primary and secondary recovery.

In human terms, think of an older oil field as a factory that once ran well but is now slowing down. Instead of shutting it entirely and building a new factory (which costs a lot), the operator adds a few enhancements—injecting steam, or CO₂—so the existing wells produce more for a relatively modest incremental cost. That added oil sits on top of what’s already being produced, and when oil sells at, say, US $80 or more per barrel, the margin from that extra oil easily absorbs the US $20–30 incremental cost for CO₂.

Restraints

CO2 Supply, Transport And Permitting Bottlenecks

A major brake on Enhanced Oil Recovery (EOR) is the simple inability to get enough affordable, reliable CO₂ to the wellhead—and to secure permits for the pipes that move it. Globally, the IEA counts a little over 50 million tonnes per year of capture-and-storage capacity operating as of Q1 2025—far short of the hundreds of millions of tonnes per year that broad EOR deployment would require this decade. Even if every project in today’s pipeline were built, capture capacity would reach ~430 MtCO₂/yr by 2030, highlighting how tight the near-term CO₂ market still is for EOR buyers.

In the United States—the world’s most mature CO₂-EOR market—the dedicated CO₂ pipeline network remains thin. Federal pipeline data show ~5,331–5,354 miles of CO₂ pipelines in 2023–2022, a tiny fraction of total liquid pipeline mileage and geographically concentrated, which makes it hard and costly to serve new EOR fields outside legacy hubs.

The economics are squeezed by these logistics. DOE/NETL notes that delivered CO₂ can cost up to US $30 per tonne, and that each tonne typically yields 2–3 barrels of incremental oil under CO₂-EOR—attractive on paper, but only if supply is steady, transport is available, and prices don’t spike. NETL also cautions that CO₂ purchase and recycle costs can be 25–50% of the cost per barrel produced in CO₂-EOR, so disruptions to CO₂ sourcing or pipeline access quickly erode margins and deter investments.

In the Midwest, high-profile CO₂ trunkline proposals have been delayed or canceled after permit denials and local-siting disputes—Navigator’s ~1,300-mile Heartland Greenway was withdrawn, and Summit’s ~2,000-mile network has faced state-level setbacks—signaling real execution risk for future EOR-relevant CO₂ corridors.

Opportunity

CCUS Hubs Feeding CO₂-EOR at Scale

A powerful growth opening for EOR is the surge of carbon-capture hubs that can feed steady, lower-risk CO₂ to mature fields. The International Energy Agency (IEA) reports just over 50 Mt/yr of capture-and-storage capacity operating as of Q1-2025, and a pipeline that could lift announced capture capacity to around 430–435 Mt/yr by 2030—a step change versus today’s base. For EOR developers, that means more potential third-party CO₂ suppliers, clearer offtake contracts, and shorter ramp-up times.

The U.S. Department of Energy underscores why this matters commercially: EOR techniques can ultimately move recovery from roughly 20–40% (primary+secondary) to 30–60% of original oil in place, turning stranded barrels into booked production when reliable CO₂ is available.

Policy is turning these hubs into bankable infrastructure. In the United States, the IRS confirms Section 45Q provides a 12-year, inflation-indexed tax credit per tonne of qualified CO₂ captured and either geologically stored or used as a tertiary injectant in EOR with secure storage—directly improving EOR netbacks when paired with anthropogenic CO₂ supply.

The United Kingdom is building similar momentum: government policy has committed up to £20 billion for early CCUS deployment and designated “Track-1” clusters—HyNet and the East Coast Cluster—with ongoing expansion steps to 2030. Those clusters anchor capture, transport, and storage networks that could also serve North Sea EOR where geology and economics align.

The physical network is expanding too, though unevenly—an opportunity for first movers. U.S. pipeline data show ~5,331–5,345 miles of CO₂ pipelines in 2023–2024, a specialized grid that today concentrates around legacy EOR basins, but which will need to grow as new capture hubs connect to sinks and EOR targets. Developers that co-site capture projects with trunklines and storage/EOR offtake will be best positioned to lock in long-term molecules and pricing.

Regional Insights

North America Dominates the EOR Market with 42.90% Share and USD 22.4 Billion in 2024

In 2024, North America is projected to dominate the Enhanced Oil Recovery (EOR) market, accounting for 42.90% of the global market share, valued at approximately USD 22.4 billion. The region’s stronghold in the EOR market can be attributed to its extensive oil reserves, particularly in the U.S. and Canada, where mature oil fields are being increasingly optimized through advanced recovery techniques.

The adoption of CO2 injection, thermal recovery methods, and chemical flooding technologies in these fields has contributed to maintaining or increasing production rates from aging oil fields. For example, CO2 EOR is widely used in the Permian Basin, one of the most active regions for EOR in North America, where it is estimated that up to 30% of oil production is derived from CO2 injection.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BP plc: BP is deploying advanced EOR methods globally, including its LoSal® low-salinity waterflood technology at the Clair Ridge project, which BP estimates could add around 42 million barrels of incremental oil from that one development. The company’s approach emphasises boosting recovery from existing reservoirs by injecting lower-salinity water to mobilise more oil. BP calls this “step-change” technology and integrates it into offshore as well as onshore operations.

Cenovus Energy, Inc.: This Canadian producer actively uses EOR techniques in its oil sands and heavy oil operations in Alberta, including steam-assisted gravity drainage (SAGD) and other enhanced recovery approaches. In particular, Cenovus notes that its Weyburn-Midale field, a major conventional EOR project, is paired with CO₂ storage of roughly 30 million tonnes, underscoring its dual role in recovery and carbon management.

LUKOIL: LUKOIL, Russia’s large private oil-producer, emphasises enhanced recovery at its mature fields as a strategic objective. Company disclosures note that new projects include “increasing recovery at mature fields through the use of advanced technologies, increased production drilling, and a higher number of EOR operations.” While public numbers are less prominent in the open English literature, LUKOIL’s direction reinforces a global emphasis on EOR as a productivity lever.

Top Key Players Outlook

- BP plc

- Cenovus Energy, Inc.

- Chevron Corporation

- Equinor ASA

- ExxonMobil Corporation

- LUKOIL

- Total SA

Recent Industry Developments

In 2024 Chevron Corporation, reported a net unrisked resource base of 71 billion barrels of oil-equivalent (BOE) at year-end, down 5% from the prior year, which underlines the need for more efficient recovery from existing reservoirs.

In 2024, ExxonMobil posted US $25.4 billion in upstream earnings, up US $4.1 billion from 2023. Achieved total production of ~4.3 million barrels of oil equivalent per day—its highest in over a decade.

Report Scope

Report Features Description Market Value (2024) USD 52.3 Bn Forecast Revenue (2034) USD 79.7 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Thermal EOR, Chemical EOR, Gas EOR, Others), By Application (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BP plc, Cenovus Energy, Inc., Chevron Corporation, Equinor ASA, ExxonMobil Corporation, LUKOIL, Total SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enhanced Oil Recovery (EOR) MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Enhanced Oil Recovery (EOR) MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BP plc

- Cenovus Energy, Inc.

- Chevron Corporation

- Equinor ASA

- ExxonMobil Corporation

- LUKOIL

- Total SA